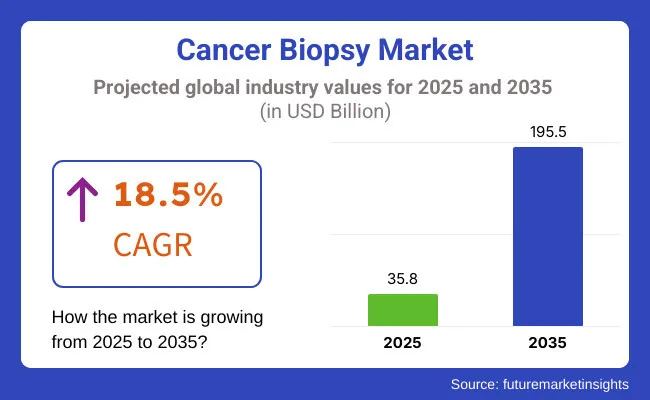

The global cancer biopsy market is estimated to be valued at USD 35.8 billion in 2025 and is projected to reach USD 195.5 billion by 2035, registering a CAGR of 18.5% over the forecast period.

The cancer biopsy market has been evolving rapidly as oncology care continues to shift toward precision medicine and early detection. The market for Cancer biopsies has been reinforced by rising cancer incidence, expanded screening programs, and the increasing importance of molecular profiling in treatment selection. Advances in minimally invasive techniques and next-generation sequencing have improved diagnostic accuracy and enabled more comprehensive tumor characterization.

Regulatory approvals for liquid biopsy assays and targeted companion diagnostics have further strengthened market adoption. Hospitals and specialized cancer research institutes have prioritized investments in biopsy capabilities to support personalized therapy decisions and monitor disease progression. Reimbursement policies in many developed markets have endorsed advanced biopsy technologies to improve outcomes and reduce unnecessary treatments.

Consumables accounts for 60.5% revenue share which has been attributed to kits and consumables, highlighting their essential role in consistent, high-quality cancer biopsy workflows. The market is driven by recurring demand for reagents, collection devices, and assay components required to process and analyze biopsy samples accurately. Laboratories and cancer research institutes have prioritized validated consumables to ensure reproducibility and compliance with regulatory standards.

Advances in pre-analytical processing kits have improved nucleic acid preservation and minimized sample degradation, supporting downstream molecular testing. Manufacturers have invested in expanding product portfolios to address a broad range of cancer types and specimen sources. Reimbursement structures often bundle consumable costs with diagnostic procedures, further reinforcing steady procurement.

Tissue Biopsies is the leading segment with 63.5% revenue share has been attributed to tissue due to rising demand for tissue biopsies, reflecting their continued role as the gold standard for definitive cancer diagnosis and staging. Advances in imaging-guided sampling and minimally invasive procedures have improved tissue yield and reduced procedural risks.

Tissue biopsies have remained critical for comprehensive molecular profiling, enabling targeted therapy selection and resistance monitoring. Hospitals and cancer research institutes have invested in training and infrastructure to standardize tissue sampling workflows.

Breast Cancer holds a revenue share of 15.8% due to their prominence in biopsy procedure volumes globally. The market is driven by widespread screening programs that identify suspicious lesions requiring biopsy confirmation. Clinical guidelines have mandated tissue sampling for accurate histological subtyping and biomarker assessment before therapy initiation. Advances in image-guided core needle biopsies and vacuum-assisted techniques have improved diagnostic yield and patient comfort.

Reimbursement support in developed markets has ensured broad access to breast biopsy procedures across public and private care settings. Hospitals and oncology clinics have prioritized integrated workflows to streamline diagnosis and treatment planning. These has led to continued growth in this segment which is expected as awareness and screening uptake increase worldwide.

Challenge: Regulatory and Reimbursement Hurdles

Overcoming the onerous regulatory landscape and complicated reimbursement models is one of the major barriers in the cancer biopsy landscape. Prior to gaining regulatory clearances, biopsy technologies, in particular liquid biopsies and molecular diagnostic technologies, require substantial clinical validation. In addition, many advanced biopsy procedures are not cheap, limiting access in some regions and also because insurers and health providers have not adapted to cover the new diagnostic tests. The need for standardization in biopsy procedure and diagnostic accuracy also makes large-scale adoption difficult.

Opportunity: Advancements in Liquid Biopsy and Precision Oncology

The unparalleled opportunity in the cancer biopsy market is the growing adoption of liquid biopsies. Liquid biopsies allow for less invasive and more convenient real-time monitoring of the evolution of a tumor based on a simple blood draw that could supplement conventional tissue biopsies. Emerging technologies such as circulating tumor DNA (ctDNA) analysis and exosome-based diagnostics improve early cancer detection and treatment planning.

Additionally, AI-based biopsy interpretation is revolutionizing oncology through improved diagnostic accuracy and precision medicine. As the field of precision medicine continues to accelerate, there will be an army of stakeholders seeking for new tools and effective methods of biopsy, and therefore the demand within this sector is likely to continue to grow.

Market of cancer biopsy shows significant growth in the United States, due to an increased incidence of cancer in the populace, rising requirement for rapid and accurate diagnostic tests and the development in liquid biopsy technology. Market growth is also accelerated by government endorsements to facilitate improved cancer screening programs and access to well-established healthcare infrastructure and oncological studies on large scales.

The growing adoption of minimally invasive biopsy procedures, such as liquid biopsy and fine needle aspiration (FNA), is reducing pain for patients and improving diagnostic accuracy. Additionally, advancements in next-generation sequencing (NGS) and artificial intelligence (AI)-based diagnostics are fueling the potential for the early-stage detection of cancer. Market growth is also being propelled by the significant spending on healthcare and the dominance of large biotechnology and pharmaceutical companies in the USA.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 18.2% |

The growth of the UK cancer biopsy market is driven by government-sponsored cancer research initiatives, increasing utilization of personalized medicine, and increasing awareness toward early cancer detection. Several programs under the National Health Service (NHS) for the early diagnosis of cancer have emerged, giving added incentive for the development of advanced biopsy techniques.

Rising application of liquid biopsy in precision oncology is driving the market growth, as this technology allow non-invasive cancer detection with real-time monitoring. In addition, the growing investments in AI-based diagnostic tools are improving the precision and speed of cancer biopsies. The increasing elderly population, along with the high prevalence of cancer, are also driving the growing demand for biopsy procedures.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 17.9% |

The cancer biopsy global market is expanding aggressively due to high regulatory support, increased spending in cancer research and advancement in molecular diagnostics technology in the European Union region. It is in Germany, France, and Italy where precision oncology and biomarker-directed biopsy methods that are transforming the diagnosis of, and treatment planning for, cancer are leaders. One of the key trends being witnessed in the region is the rising use of liquid biopsy for detection of circulating tumor DNA (ctDNA) and exosome biomarkers.

At the same time, the European Cancer Plan (introduced to help reduce the number of deaths due to cancer) helps drive the founding and usage of new biopsy techniques. By making biopsy technology more accessible and efficient, some factors such as the growing number of top-notch biotech companies and research centers also drive innovation in this area.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 18.8% |

The rapidly growing cancer biopsy market in Japan is mainly driven by the rising ageing population people, increase in the incidence of cancer and the government's strong support for the early diagnosis of cancer. The availability of advanced healthcare facilities and focus on state-of-the-art biotechnology within the country has led to significant development in non-invasive biopsy modalities such as liquid biopsy and fluorescence in situ hybridization (FISH). Japan is investing heavily in AI and robotics to enhance the biopsy and optimise diagnostics as well.

Genomic profiling in the diagnosis of cancer is above all driving demand for biopsy technologies based on NGS. The market is anticipated to grow steadily during the forecast period, due to supportive government initiatives toward national cancer screening programs.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 18.0% |

South Korea cancer biopsy market has a rapid progression owing to the advancements in diagnostic imaging technology, the increasing number of cancer cases, and the surge in investment in precision medicine. The strong biotechnology landscape in the country is driving the progress of liquid biopsy and molecular diagnostics technologies of cancer detection with less accuracy and affordable when compared you need. Market growth is also powered by government-sponsored programs in South Korea for cancer screening and early detection initiatives. More widespread use of AI-based diagnostic tools in leading hospitals is streamlining and improving biopsy, as well. Hallyu is also helping drive the development of new cancer biopsy technologies, including next-generation sequencing of cancer cells and tracking of tumor growth in real time through the collaboration of South Korean biotechs with international drugmakers..

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 18.4% |

The competitive landscape has been shaped by companies investing in next-generation biopsy devices, liquid biopsy platforms, and molecular diagnostic assays to drive differentiation. Leading manufacturers have pursued regulatory clearances for minimally invasive and automated sampling systems.

Strategic collaborations with oncology networks have been established to validate clinical performance and support adoption. Investments in digital pathology integration and training programs have strengthened market penetration. Global expansion initiatives have focused on improving access to advanced biopsy technologies in emerging markets.

Key Development:

The market is estimated to reach a value of USD 35.8 billion by the end of 2025.

The market is projected to exhibit a CAGR of 18.5% over the assessment period.

The market is expected to clock revenue of USD 195.5 billion by end of 2035.

Key companies in the Cancer Biopsy Market include Qiagen N.V., Illumina, Inc., ANGLE Plc, Becton, Dickinson, and Company, Myriad Genetics.

On the basis of product type, instruments to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Cancer Gene Therapy Market Overview – Trends & Future Outlook 2024-2034

Cancer-focused Genetic Testing Service Market Analysis – Growth & Industry Insights 2024-2034

Cancer Tissue Diagnostic Market Trends – Growth & Industry Forecast 2024-2034

Global Cancer Registry Software Market Insights – Trends & Forecast 2024-2034

Cancer Supportive Care Products Market Trends – Growth & Forecast 2020-2030

Cancer Antigens Market

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Surgery Market - Size, Share, and Forecast 2025 to 2035

Lung Cancer Therapeutics Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

Lung Cancer PCR Panel Market Trends, Growth, Demand & Forecast 2025 to 2035

Brain Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Liver Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Blood Cancer Treatment Market Growth – Trends & Forecast 2025 to 2035

Breast Cancer Grading Tools Market Size and Share Forecast Outlook 2025 to 2035

Breast Cancer Screening Tests Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA