The global at-home cancer testing market is anticipated to grow at a robust CAGR of 12% from home healhcare indsutry. As such, the at-home cancer-testing market presents a unique growth opportunity for any company that specializes in cancer testing.

Strategic initiatives aimed at enhancing customer relations and expanding market penetration further, the global at-home cancer testing market is estimated to be a relatively untapped space at present. Description: At-home cancer testing kits offer a user-friendly solution for the early identification of cancer, enabling individuals to execute testing from the comfort of their homes and reducing the need for recurrent, invasive clinic visits.

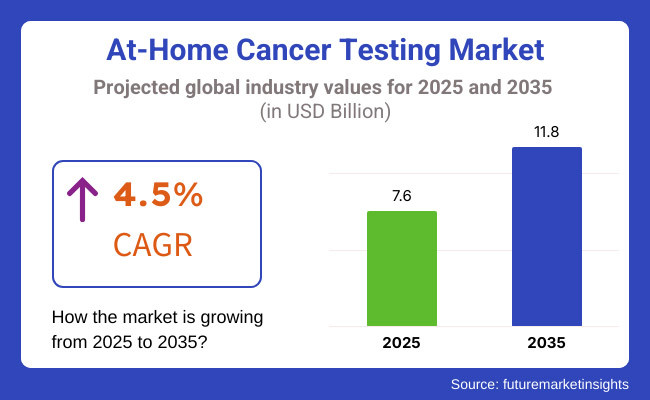

The market is anticipated to reach around USD 11.8 Billion by 2035, at a CAGR of 4.5% during the forecast period. Market growth is primarily driven by the adoption of liquid biopsy technology, genetic screening and AI-powered diagnostic tools. Moreover, increasing awareness regarding preventive healthcare along with the rising prevalence of cancer across the world is expected to boost the demand for at-home cancer screening solutions.

North America held the largest share of the at-home cancer testing market while Asia-Pacific is projected to register the highest CAGR during the forecast period. Despite growing healthcare costs, rising cancer incidence rate, and personalized medicine expected growth, USA has the highest market share. Further market growth is facilitated by laudable regulatory support of direct-to-consumer (DTC) testing.

Government initiatives to promote early cancer detection and preventive health care have also been beneficial in Europe, which constitutes a significant share of the market. The rise in the digitization of healthcare coupled with patients' desire for remote in-vitro diagnostic devices helps further fuel high ownership of at-home cancer testing solutions in Germany, the UK, and France. An invested system of regulation in the region guarantees the safety and validity of exams.

Asia-pacific is the fastest growing country because of the rising prevalence of cancer, better accessibility around the corner and the growing acceptance of international digital health approaches. In China, India and Japan a myriad of government initiatives for early cancer detection and Project Management to promote adoption of telemedicine further propels market expansion. This is enabled thanks to a growing awareness of the virus and due to the relatively low cost of testing kits.

At-home cancer testing is new in this region - boosted by higher investments in the health care and demand for cancer prevention and expanding telehealth services. The ongoing healthcare reforms and partnerships with global diagnostic corporations also help sustain the growth irrespective of income or bureaucratic hindrances.

Challenge

Regulatory and Accuracy Concerns

At-Home Cancer Testing Market are used to adhere to strict regulations are some of the challenges faced by this market along with inaccurate test results. Impulse home testing should be tightly regulated, and the sensitivity and specificity of these tests should ensure that they meet the standards of the respective healthcare law. In addition, false positives or false negatives may cause stress, misdiagnosis and a delay in seeking healthcare, which may adversely impact user confidence and acceptance.

Limited Awareness and Accessibility

At-home cancer testing has gotten more sophisticated, but few people know it exists. Limited access to testing kits in low-income geographic areas, as well as disparities in digital health literacy, is a hurdle for widespread uptake. This can only happen with education initiatives, improved channels of distribution, and affordable pricing models.

Opportunity

Advancements in AI and Biomarker-Based Testing

These advancements will accelerate the expansion of At-Home Cancer Testing Market, furthermore the introduction of artificial intelligence (AI) and biomarker-based diagnosis will create profitable prospects. AI-driven algorithms can enhance the accuracy of testing, automate the interpretation of the results, and provide personalized risk profiles. Hence, you are still learning the latest data until October 2023.

Expansion of Telehealth and Personalized Medicine

These advancements will accelerate the expansion of At-Home Cancer Testing Market, furthermore the introduction of artificial intelligence (AI) and biomarker-based diagnosis will create profitable prospects. AI-driven algorithms can enhance the accuracy of testing, automate the interpretation of the results, and provide personalized risk profiles. Hence, you are still learning the latest data until October 2023.

The At-Home Cancer Testing Market has reached a steady growth between 2020 and 2024, following the rising consciousness regarding early detection of cancer as well as advancements in the diagnostic technology. The COVID-19 pandemic drastically increased users’ willingness to accept at-home medical testing, with convenient and non-invasive test kits now becoming commonplace.

In response, the companies worked to improve test sensitivity and specificity, experimented with distribution via pharmacy and other nonclinical sites, and attempted to collaborate with telehealth providers to integrate guidance into the testing process.

In next 2025 to 2035, market would experience rapid innovations in AI-driven diagnostics, liquid biopsy technology, and wearable cancer screening devices. This growth will be driven by expanded regulatory clearances for at-home testing and partnerships between biotech companies and digital health platforms.

In the future, there will also be an increased focus on preventive health care by assessing an individual’s genetic risk and the companies will also target low cost, easy access, and higher data security which will lead to improved customer trust in their services.

Market Shifts: A Comparative Analysis 2020 to 2024 vs. 2025 to 2035

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Upcoming telehealth and diagnostic regulations compliance |

| Technological Growth | Increasing non-invasive screening and identification of stage 1/2 biomarkers |

| Industry Adoption | Consumer interest grew, thanks to COVID-19-driven telehealth adoption |

| Supply Chain and Distribution | Dependence on its direct-to-consumer sales and online pharmacy collaborations |

| Market Competition | New biotech start-ups and digital health companies are coming onto the scene |

| Market Growth Drivers | The Temptation to Rest on Our Laurels: Awareness of Early Cancer Detection |

| Data Security and Privacy | Early worries about the privacy of consumer data and the security of test results |

| Integration of Digital Health Tools | Early worries about the privacy of consumer data and the security of test results |

| Future of Cancer Testing | Underusing digital health records and remote patient monitoring |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Streamlined FDA and global regulatory approvals, standardized testing protocols |

| Technological Growth | AI-driven diagnostics, liquid biopsy advancements, and integration with wearable health devices |

| Industry Adoption | Widespread adoption of genetic and personalized cancer screening tools |

| Supply Chain and Distribution | Expansion into traditional healthcare channels, insurance-covered at-home cancer testing |

| Market Competition | Growth of established healthcare companies and pharmaceutical firms investing in at-home diagnostics |

| Market Growth Drivers | Advancements in AI-based risk assessments, affordability, and integration with digital health ecosystems |

| Data Security and Privacy | Implementation of block chain and secure cloud storage for test result confidentiality |

| Integration of Digital Health Tools | AI-powered test interpretation, seamless integration with electronic health records (EHRs) |

| Future of Cancer Testing | Evolution of real-time cancer screening through smart sensors and connected health devices |

The USA at-home cancer testing business is expanding progressively, led by developments in diagnostic technology, increased consumer awareness, and a growing demand for early cancer detection. Telehealth services and AI-enabled diagnostics are adding to the growth of the market

| Region | CAGR (2025 to 2035) |

|---|---|

| United States | 4.7% |

The UK market is expanding as increasing numbers of consumers are choosing convenient non-invasive testing solutions. Government programs encouraging early cancer screening coupled with advancements in technology in genetic assays are significant drivers of market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 4.3% |

A Rising Consumer Demand for At-Home Cancer-Testing Due to Healthcare Costs and Enhanced Patient Awareness Increasing focus on personalized medicine & preventive healthcare is supporting market growth.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.4% |

South Korea’s market for at-home cancer testing is expanding due to rapid advancements in biotechnology, increasing government support for early detection programs, and growing consumer preference for accessible cancer screening solutions.

| Region | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.6% |

The home cancer detection industry is expanding internationally, with increasing awareness of early cancer identification, driving technological breakthroughs and innovative shift toward personalized and convenient healthcare alternatives.

Global CAGR (2025 to 2035): 4.5%

At-Home Cancer Testing Market Increasing demand for early detection, ease, and convenience and advances in diagnostic technology are advancing the at-home cancer testing market. As these cancers become more common, including colon, breast, and prostate, this has only stimulated efforts to monitor health more proactively. These screening tests allow individuals to undergo testing in the comfort of their own homes while maintaining privacy and reduce the reliance on frequent visits to the hospital.

Emerging technologies, like Aimed diagnostics and biomarker identification techniques, are increasing the precision and dependability of home cancer tests. Tests based on blood and stool have come into vogue, especially for the detection of colon and breast cancer. In addition, increased access to regulatory-approved testing kits has been coupled with consumer confidence and leads to the penetration of testing market.

The growing number of online pharmacies and telehealth services are putting at-home cancer tests within reach. Given ongoing transitions in healthcare toward digitized and remote solutions, the market is set for continued expansive growth.

Colon and breast cancer tests account for the highest share of the home use cancer testing market across various cancer types. The increasing incidence of colorectal cancer and breast cancer, in addition to the rising awareness regarding early diagnosis, has led to the adoption of non-invasive at-home test kits.

They include stool-based DNA tests for colon cancer and blood-based biomarker tests for breast cancer, both of which have gained traction, enabling users to obtain cancer-risk screenings without having to go to health-care facilities. Not only do these tests provide convenience, they dramatically improve detection rates and, as a result, the prospects for successful treatment.

The availability of advanced home-based diagnostic kits is being expanded by regulatory approvals and increased investment in research and development. Moreover, partnerships between healthcare providers and diagnostic companies are guaranteeing users receive holistic support, from sample collection to interpretation of test results. Biotechnological progress will continue to create tools for the demand of such at-home colon and breast cancer testing, making screening more accessible, affordable, and effective.

Blood and stool-based tests are dominating the at-home cancer testing space by sample type. Blood tests are already used to monitor more than one type of cancer, such as prostate and breast cancer, by measuring markers that are elevated in tumours, as well as genetic mutations.

Due to their high sensitivity and specificity, these tests are a strong option for the early detection of cancer. Stool DNA tests, primarily for colon cancer, detect abnormal DNA and hidden blood, which are precursors to colorectal cancer. By minimizing the need for traditional colonoscopies, these non-invasive tools make screening more readily available and less ominous for patients.

By incorporating advanced biomarkers, fluid and tissue samples can be analysed, with AI algorithms to enhance reliability and reduce testing time, allowing for more accurate testing results and earlier identification of disease. As diagnostic technology continues to evolve, blood and stool-based tests will likely become more widely adopted, serving an essential role across the continuum of preventive cancer screening and driving improved health outcomes.

In terms of distribution channel, online pharmacies is expected to remain a disruptive force in the at-home cancer testing market. The segment keeps growing because of the ability to order at ease, a discreet purchasing experience, and home delivery options. Retail and hospital pharmacies matter for improving access to these tests, too, including ensuring the availability of appropriate guidance and medical consultation, as necessary.

The home-based cancers testing market is expanding as healthcare innovation, consumer awareness and digital healthcare solutions reshape cancer diagnostics. Advances in technology and collaborations between diagnostic companies will continue to influence the landscape of home-based cancer screening going forward.

The at-home cancer testing market is experiencing significant growth due to rising awareness about early cancer detection, advancements in genomic testing, and the increasing demand for personalized healthcare solutions. Key drivers include improvements in biomarker detection technologies, AI-driven diagnostic tools, and the growing adoption of direct-to-consumer (DTC) genetic testing services.

Market Share Analysis by Key Players & Service Providers

| Company/Organization Name | Estimated Market Share (%) |

|---|---|

| Exact Sciences Corporation | 20-25% |

| Guardant Health | 15-20% |

| Grail, Inc. | 12-16% |

| Everlywell | 8-12% |

| Natera | 5-9% |

| Other Service Providers | 30-40% |

| Company/Organization Name | Key Offerings/Activities |

|---|---|

| Exact Sciences Corporation | Non-invasive multi-cancer early detection tests and liquid biopsy solutions. |

| Guardant Health | Advanced blood-based cancer screening and genomic profiling solutions. |

| Grail, Inc. | AI-powered early cancer detection with multi-cancer blood test innovations. |

| Everlywell | Direct-to-consumer at-home cancer screening kits with digital health integration. |

| Natera | Personalized genetic testing for hereditary cancer risk assessment. |

Key Market Insights

Exact Sciences Corporation (20-25%)

Absolute Healthcare is the market leader in blood and stool-based cancer screening for early detection with a fully integrated product pipeline.

Guardant Health (15-20%)

Guardant Health is a precision oncology company with a focus in blood-based cancer diagnostics.

Grail, Inc. (12-16%)

Grail leads multi-cancer early detection via AI-enabled liquid biopsy tech.

Everlywell (8-12%)

Everlywell offers at-home cancer screening kits that are accessible and user friendly with digital health analytics.

Natera (5-9%)

Natera, Inc. is a pioneer of genetic testing solutions to assess hereditary cancer risk and early-stage detection.

Other Key Players (30-40% Combined)

The at-home cancer testing market is ever-growing with innovation from several healthcare disruptors, genetic testing firms and diagnostic providers, including:

The overall market size for At-Home Cancer Testing market was USD 7.6 Billion in 2025.

The At-Home Cancer Testing market is expected to reach USD 11.8 Billion in 2035.

The At-Home Cancer Testing market is set to grow due to increasing demand for early cancer detection, convenience, and advancements in diagnostic technology. By cancer type, colon, breast, prostate, blood, and bladder cancer testing will witness growth due to rising awareness and prevalence. By sample type, blood, urine, cell, and stool-based tests will gain traction for their accuracy and non-invasiveness. In terms of distribution, hospital, retail, and online pharmacies will drive accessibility, with online channels expanding due to digital health trends. The shift toward personalized, cost-effective, and remote diagnostics will further propel market expansion.

The top 5 countries which drives the development of At-Home Cancer Testing market are USA, European Union, Japan, South Korea and UK.

Colon and Breast Cancer Testing demand supplier to command significant share over the assessment period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

At-Home Testing Market Analysis - Growth, Demand & Forecast 2025 to 2035

At-home Ulcer Testing Market Size and Share Forecast Outlook 2025 to 2035

At-home Molecular Testing Market Size and Share Forecast Outlook 2025 to 2035

At-Home Pregnancy Testing Market Size and Share Forecast Outlook 2025 to 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Global Advanced At-home Biomarker Testing Market Analysis – Size, Share & Forecast 2024-2034

Cancer Registry Software Market Size and Share Forecast Outlook 2025 to 2035

Cancer Biological Therapy Market Size and Share Forecast Outlook 2025 to 2035

Cancer Diagnostics Market Analysis - Size, Share and Forecast 2025 to 2035

Cancer Biopsy Market - Growth & Technological Innovations 2025 to 2035

Cancer Vaccines Market Analysis by Technology, Treatment Method, Application and Region from 2025 to 2035

Cancer Gene Therapy Market Overview – Trends & Future Outlook 2024-2034

Cancer Tissue Diagnostic Market Trends – Growth & Industry Forecast 2024-2034

Cancer Supportive Care Products Market Trends – Growth & Forecast 2020-2030

Cancer Antigens Market

Cancer-focused Genetic Testing Service Market Analysis – Growth & Industry Insights 2024-2034

Pet Cancer Therapeutics Market Insights - Growth & Forecast 2024 to 2034

Skin Cancer Detection Devices Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

Lung Cancer Surgery Market - Size, Share, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA