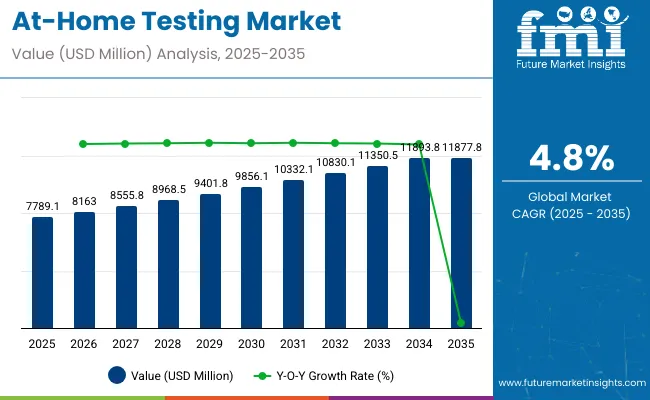

The global sales of at-home testing products are estimated to be worth USD 7,789.1 million in 2025 and are anticipated to reach a value of USD 11,877.8 million by 2035. Sales are projected to rise at a CAGR of 4.8% over the forecast period between 2025 and 2035. The revenue generated by at-home testing in 2024 was USD 7,432.3 million.

The at-home testing market is witnessing substantial growth, largely driven by the rising consumer preference for self-diagnostic tools. According to a CDC report, between August 23, 2021, and March 12, 2022, United States adults increasingly utilized at-home tests to determine their COVID-19 status, particularly among those experiencing COVID-19-like symptoms.

This increase in at-home test use shows an increasing need for easy, quick, and accessible health monitoring solutions. As consumers prioritize personal health management, the market continues to grow, with advances in diagnostic technology improving the accuracy and reliability of at-home testing solutions.

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 7,432.3 million |

| Estimated Size, 2025 | USD 7,789.1 million |

| Projected Size, 2035 | USD 11,877.8 million |

| Value-based CAGR (2025 to 2035) | 4.8% |

The market for at-home testing has gained popularity recently due to the numerous new alternatives it has provided for patients. They aid in the continuous monitoring of health issues, such as blood sugar and cholesterol levels, as well as the diagnosis and treatment of new patients who test positive for specific indications.

With at-home testing kits being well accepted in the market, manufacturers have detained the opportunity to offer novel kits for the well-being of patients suffering from chronic disorders, as well as in the management of several ailments.

One of the primary reasons for the market's predicted opportunistic expansion is the flexibility it affords to the self-testing audience. Because of the rising usage of opioids and drug of abuse testing, has opened up new opportunities in the pain management area.

With so many brands of at-home testing kits available in the market, the FDA has set up certain regulations, including warning of not using pre-used test strips, on 21 June 2022. It has also set up a website enlisting all the approved home tests.

Leading companies in the at-home testing market are increasingly incorporating smart technologies to improve test accuracy, convenience, and user engagement. By integrating connected devices, digital apps, and AI-driven analytics, these manufacturers enable users to access quick and reliable health insights from the comfort of their homes. From COVID-19 diagnostics to genetic testing and hormone monitoring, smart at-home tests provide personalized health data and seamless communication with healthcare professionals, driving innovation and expanding accessibility in healthcare diagnostics.

At-home testing products are governed by strict regulatory frameworks to ensure accuracy, safety, and reliability for consumers. Regulatory agencies such as the U.S. Food and Drug Administration (FDA) and the European Medicines Agency (EMA) oversee the approval and monitoring of these products, requiring rigorous clinical validation and quality control. Emergency Use Authorizations (EUAs) have facilitated quicker access during public health crises, while ongoing post-market surveillance ensures continued safety. Additionally, regulations mandate clear labeling, data privacy compliance, and usability standards to protect consumer health and information.

A comparative analysis of fluctuations in compound annual growth rate (CAGR) for the at-home testing market between 2024 and 2025 on a six-month basis is shown below. By this examination, major variations in the performance of these markets are brought to light, and also trends of revenue generation are captured hence offering stakeholders useful ideas on how to carry on with the market’s growth path in any other given year. January through June covers the first part of the year called half1 (H1), while half2 (H2) represents July to December.

The table below compares the compound annual growth rate (CAGR) for the global at-home testing industry analysis from 2024 to 2025 during the first half of the year. This overview highlights key changes and trends in revenue growth, offering valuable insights into market dynamics. H1 covers January to June, while H2 spans July to December.

In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 5.7%, followed by a slightly lower growth rate of 5.2% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 | 5.7% (2024 to 2034) |

| H2 | 5.2% (2024 to 2034) |

| H1 | 4.8% (2025 to 2035) |

| H2 | 4.3% (2025 to 2035) |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.8% in the first half and projected to lower at 4.3% in the second half. In the first half (H1) the market witnessed a decrease of 90 BPS while in the second half (H2), the market witnessed a decrease of 90 BPS.

The at-home testing market is expanding rapidly. It is driven by investments along with strategic research initiatives to advance diagnostic capabilities. The International Agency for Research on Cancer (IARC) is one of the example. It secured funding from the European Union's Horizon Europe program for its ColoMARK project launched in November 2022.

The project focuses on discovering new biomarkers for the early detection of colorectal cancer. It also aims at risk prediction through liquid biopsy approaches. In addition to biomarker development, the project also offers interdisciplinary training to researchers. This training further advances personalized medicine.

Everlywell’s investment is another example and who is a leader in the at-home testing industry. The company raised USD 175 million in Series D funding in 2021. This investment allowed the company to scale up its production capabilities.

It also helped expand its range of at-home testing products and acquire key companies such as PWNHealth and Home Access Health Corporation. These acquisitions strengthened Everlywell's telehealth services and lab testing infrastructure. They enabled the company to offer more comprehensive testing solutions to consumers.

The continued influx of investments and research initiatives is driving innovation within the market. It is also enhancing accessibility to health monitoring tools. As result the market is on the rise. It benefits from technological developments, partnerships, and product line expansions.

The at-home testing market is experiencing significant expansion as manufacturers focus on launching innovative self-testing devices and kits to drive sales and tap into previously underserved markets. One of the trends in this area is the development of diagnostics monitoring tools that provide health-tracking capabilities.

For example, Abbott Laboratories, on June 3, 2022, disclosed its intentions to develop a continuous glucose-ketone monitoring system that would help individuals track both glucose and ketone levels. This product epitomizes the increased interest for multi-functional products that enable instant health monitoring.

The need for user-friendly, accurate, and portable solutions for self-testing in the context of health conditions cuts across chronic diseases to infectious disease screening. Such development meets the customer's preference for convenience and reliance on oneself as well as lessens the strain on clinical facilities' health care system. Such development also marks an upward trend to decentralized health care by having increased availability of diagnostic technologies leading to broader global market scope.

The at-home testing market holds an immense opportunity especially in older adults. According to The Regents of the University of Michigan study 2022, the vast majority of adults, aged 50-80 perceive at-home tests as more convenient; 74% claim that these tests are more convenient than the lab testing.

This demographic strongly believes in the value of these tests, especially for cancer screening (87%), non-COVID-19 infections (79%), and DNA/genetic testing (77%). This indicates an emerging market segment with a rising demand for reliable, accessible, and easy-to-use testing solutions. In addition, 62% view these tests as a good value. These positive perceptions suggest a market eager for affordable, effective, and convenient health monitoring options.

Moreover, 53% of seniors think that home tests are regulated by the government, which indicates an increased willingness to embrace tests that meet regulatory standards. This trend offers an opportunity for manufacturers to tap into this growing consumer base by developing targeted, user-friendly at-home testing solutions that meet both convenience and regulatory expectations.

Laboratory-based biomarker testing has always been the gold standard for accuracy and reliability in diagnosis. The traditional methods that require patients to visit healthcare facilities to collect samples such as blood or saliva have been perfected over the years, incorporating advanced laboratory equipment, highly trained technicians, and strict protocols. Laboratory-based testing, therefore, offers unmatched precision and comprehensiveness, a high benchmark for diagnostic results.

This strong infrastructure, however, acts as a major constraint for the growing at-home biomarker testing market. The at-home testing solutions, although convenient, cannot be as reliable and accurate as laboratory-based tests. Maintaining the same level of precision with consumer-grade devices and the accuracy of self-collected samples is always an issue. At-home testing usually lacks the complex technology and expert oversight that can be seen in a laboratory setting.

Growing demand for in-home testing calls for the removal of these barriers and opportunities for expansion. There are innovative ways for companies in the at-home biomarker testing industry to bridge the gap that has been created by the existence of traditional lab testing and consumer-level diagnostics. In the meantime, the infrastructure and credibility of laboratory-based tests create a greater barrier to the widespread acceptance of at-home biomarker tests.

The global at-home testing industry recorded a CAGR of 4.2% during the historical period between 2020 and 2024. The growth of the at-home testing diagnostics industry was positive as it reached a value of USD 11,877.8 million in 2035 from USD 7,789.1 million in 2025.

The at-home testing industry has grown rapidly in recent years, particularly between 2020 and 2024, as a result of the COVID-19 pandemic. During this time, COVID-19 home tests were widely popular. The demand for testing solutions was so pressing that many diagnostic kits, from antigen tests to PCR home testing solutions, were developed and approved. It paved for innovations in user-friendly devices, as companies integrated more advanced features like enhanced interpretation guides and mobile applications for greater accuracy and ease of use.

Telemedicine's emergence has helped to the increase of at-home testing. Mobile health applications and telemedicine services allowed patients to consult with doctors remotely, making at-home testing more convenient.

Everlywell, for example, witnessed quick development and expanded its product line to include tests for a variety of health concerns, including pregnancy and diabetes monitoring, as well as at-home STI and DNA testing. Furthermore, health systems such as Geisinger used home testing as part of its more extensive telemedicine programs. The organization offered chronic services for patients that suffer with diabetes and heart failure.

Looking forward, at-home testing looks bright and promises continued innovation in integrating the advanced technologies of today. Wearable health devices are another prominent trend that is going to come into focus soon. People have already been wearing step trackers; soon, the advanced smartwatches and wearables will measure hydration levels, anemia, and other vital signs. It is going to become the central tool for remote health monitoring because users can measure a number of biomarkers in real time.

Telemedicine and at-home sample collection will increase with the progress of mobile health solutions and artificial intelligence. By 2030, home-based testing will be expected to advance to become more complex for diagnostics, including liquid biopsy and multi-analyte tests. This will be through wearable health devices that can collect, process, and analyze samples, thus making less use of traditional labs.

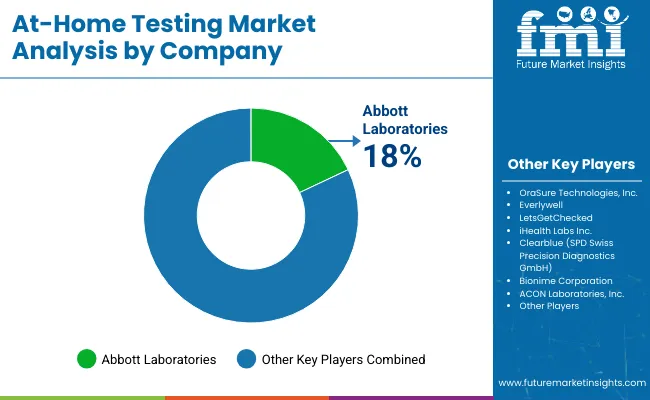

Tier 1 companies are the major companies as they hold a 36.1% share worldwide. Tier 1 companies benefit from large-scale production facilities, significant investments in research and development, and extensive distribution networks, positioning them as leaders in innovation and market leadership.

Their ability to scale production and meet high consumer demand has solidified their position in the market. Prominent companies within tier 1 include Abbott Laboratories, Everlywell, ACON Laboratories, Inc. and Siemens Healthineers

Tier 2 companies are relatively smaller as compared with tier 1 players. The tier 2 companies hold a share of 28.1% worldwide. Tier 2 companies, while smaller in scale compared to Tier 1, continue to play a crucial role in the at-home testing industry. These companies focus on specific or emerging market niches, providing specialized products or solutions targeted toward regional markets or specialized consumer needs.

Their strength lies in their agility and ability to develop innovative solutions for underserved or niche segments of the market. Key Companies under this category include OraSure Technologies, Inc., LetsGetChecked, iHealth Labs Inc., Clearblue (SPD Swiss Precision Diagnostics GmbH), Bionime Corporation and others.

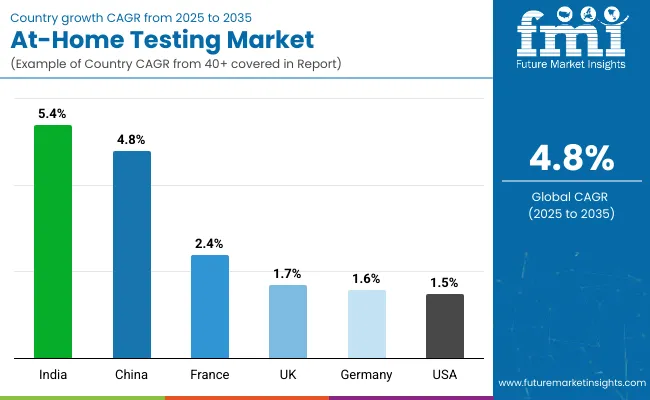

The section below covers the industry analysis for the at-home testing sales for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East & Africa is provided. The United States is anticipated to remain at the forefront in North America, with a CAGR of 1.5% through 2035. In South Asia & Pacific, India is projected to witness the highest CAGR in the market of 5.4% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| United States | 1.5% |

| Germany | 1.6% |

| France | 2.4% |

| UK | 1.7% |

| India | 5.4% |

| China | 4.8% |

The United States dominates the global market with high share in 2024. The United States is expected to exhibit a CAGR of 1.5% throughout the forecast period (2025 to 2035).

The at-home testing sales in the United States is driven by the emphasis on preventive healthcare and the aging population. Cholesterol testing, thyroid testing, and blood glucose monitoring are being adopted more frequently among the aging populace who seek home-based solutions for health monitoring. With continually rising healthcare costs, consumers seek services that may be more affordable than the traditional clinical setting.

Furthermore, well-developed healthcare infrastructure supports the United States market, making it possible to offer a whole variety of tests, from cancer screenings through drug abuse testing. The country's emphasis on individual health empowerment and continuous technological advancements contribute to the drive in innovation in the at-home testing sector. Additionally, FDA and other regulatory agencies provide rules on quality and accuracy of products which boost the consumer's confidence to use these home tests for multiple health-related issues.

In 2024, Germany held a dominant revenue in the Western Europe market and is expected to grow with a CAGR of 1.6%.

The driving factors for the market of at-home testing in Germany include a highly developed health care system in the country and increased awareness towards preventive health care. Demand for cholesterol test, thyroid tests, and other cancer test applications is growing with an active attitude towards the management of health issues in Germany. Another is the aging demographics of Germany that generally require easier, more convenient ways of monitoring chronic conditions like diabetes and heart disease.

Also, a strong regulatory framework in Germany makes sure that the at-home testing products meet high standards of accuracy and safety, which builds confidence among consumers about such products. With a healthcare system that places emphasis on both in-clinic and home-based testing solutions, the market is getting a combination of modern technology and public health awareness. Increasing acceptance of digital health solutions and mobile health apps is also expanding the adoption of at-home tests for various medical conditions.

India occupies a leading value share in South Asia & Pacific market in 2024 and is expected to grow with a CAGR of 5.4% during the forecasted period.

The at-home testing industry is growing rapidly in India, motivated by the ever-increasing requirement for accessible healthcare, as well as a growing self-testing culture. At-home tests, such as pregnancy and fertility testing, blood glucose monitoring, and STD/STI testing, are gaining prominence with the hike in healthcare cost and limited availability of healthcare facilities, especially in rural areas. The younger age group is relatively more likely to use these tests, as the culture of using them is easily accepted due to convenience and affordability.

E-commerce portals are acting as a strong base for distributing such tests to each corner of the country beyond big cities. In India, people are now much more aware about non-communicable diseases such as diabetes and hypertension, thus also increasing demand for regular monitoring tools like cholesterol and blood glucose tests. Moreover, the health and wellness consciousness of the country and the government's efforts to make healthcare accessible are creating a robust market for innovative and affordable at-home testing solutions.

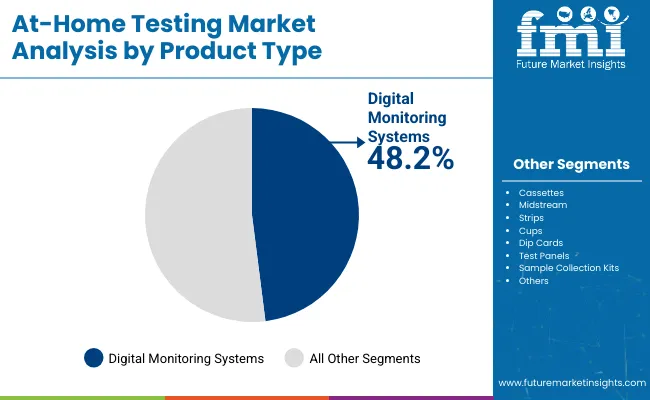

The section contains information about the leading segments in the industry. Based on product type, digital monitoring systems are expected to account 48.2% of the global share in 2025.

| Product Type | Digital monitoring systems |

|---|---|

| Value Share (2025) | 48.2% |

By product type, digital monitoring systems are leading the at-home testing market with a share of 48.2% in 2025 driven by their cost efficiency and ease of use. These systems utilize sensors that provide precise data for regular and emergency monitoring. The integration of sensors with automatic data storage ensures accurate record keeping and strong compliance, as all medical data is stored securely in the system.

This eliminates the need for manual tracking and reduces human error. The systems also offer predictive capabilities, improving maintenance and operational efficiency, which helps reduce overall costs. As digital health solutions continue to grow in popularity, digital monitoring systems are expected to remain the preferred choice due to their convenience, data accuracy, and cost savings, contributing to the expansion of the market.

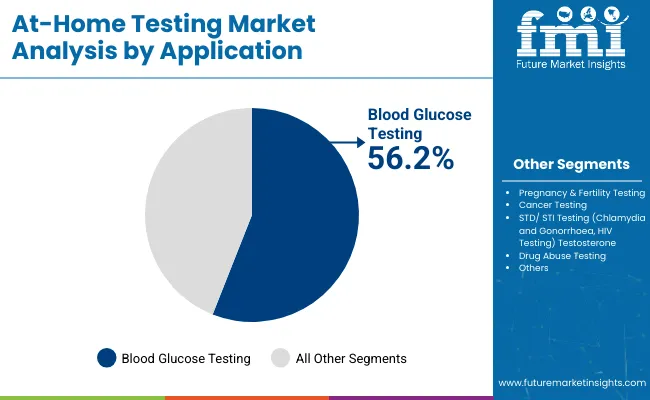

| By Application | Blood Glucose Testing |

|---|---|

| Value Share (2025) | 56.2% |

Blood glucose testing will account for 56.2% of the indication segment in 2025, and exhibit the highest CAGR in the forecast period.

Blood glucose testing is the best application in at-home testing for the moment; it is majorly because the testing is essential to manage diabetes, maintain a lifestyle, and it helps people track their blood sugar levels. In short, glucose monitors give instant, accurate, and timely tests of blood sugar levels, which users can use for decisions on food, exercise, and medication.

This application is highly important for diabetes patients, as they need monitoring for diabetes control and prevention of complications. The advantage of these devices lies in their convenience, portability, and ease of usage, which are to be preferred for home testing. Blood glucose monitors are made for long-term use by patients. This can regularly track their health without having to often visit healthcare facilities. As awareness is rising for diabetes and increasing focus on self-care, the market for blood glucose monitors continues to grow.

The at-home testing market is highly competitive, with both established leaders and new players constantly vying for market share. Leading companies focus on offering cutting-edge solutions by collaborating with the established players that combine advanced technology with user-friendly features. Many of these competitors incorporate smart technology into their products, ensuring seamless integration with mobile apps and cloud-based platforms for real-time data monitoring.

In terms of service, the industry is divided into digital monitoring instruments, cassettes, midstream, strips, cups, dip cards, test panels, sample collection kits and others.

In terms of application, the industry is divided into blood glucose testing, pregnancy & fertility testing, cancer testing, STD/ STI testing (chlamydia and gonorrhoea, HIV testing) testosterone, drug abuse testing, cholesterol testing, thyroid testing and others.

In terms of sample, the industry is divided into urine, blood, saliva, stool, vaginal swab, and semen.

In terms of distribution channel, the industry is segregated into drug stores, hospital pharmacies and online channels

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and Middle East and Africa (MEA) have been covered in the report.

The global at-home testing industry is projected to witness CAGR of 4.8% between 2025 and 2035.

The global at-home testing industry stood at USD 7,432.3 million in 2024.

The global at-home testing industry is anticipated to reach USD 11,877.8 million by 2035 end.

China is expected to show a CAGR of 4.8% in the assessment period.

The key players operating in the global at-home testing industry include Abbott Laboratories, OraSure Technologies, Inc., Everlywell, LetsGetChecked, iHealth Labs Inc., Clearblue (SPD Swiss Precision Diagnostics GmbH), Bionime Corporation, ACON Laboratories, Inc., Siemens Healthineers, Lucira Health and Others

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

At-home Ulcer Testing Market Size and Share Forecast Outlook 2025 to 2035

At-Home Cancer Testing Market - Growth & Forecast 2025 to 2035

At-home Molecular Testing Market Size and Share Forecast Outlook 2025 to 2035

At-Home Pregnancy Testing Market Size and Share Forecast Outlook 2025 to 2035

At-Home Micronutrient Testing Industry Share, Size, and Forecast 2025 to 2035

Global Advanced At-home Biomarker Testing Market Analysis – Size, Share & Forecast 2024-2034

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA