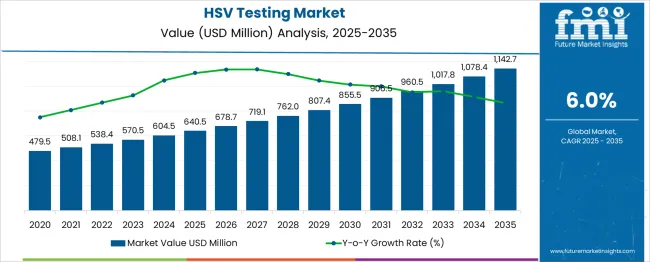

The global HSV testing market is projected to grow from USD 640.5 million in 2025 to approximately USD 1,142.7 million by 2035, recording an absolute increase of USD 502.2 million over the forecast period. This translates into a total growth of 78.4%, with the market forecast to expand at a CAGR of 6% between 2025 and 2035. The market size is expected to grow by nearly 1.78X during the same period, supported by increasing prevalence of herpes simplex virus infections, rising awareness about sexually transmitted diseases, and increasing demand for rapid diagnostic testing solutions in clinical and home-care settings.

Between 2025 and 2030, the HSV testing market is projected to expand from USD 640.5 million to USD 866.9 million, resulting in a value increase of USD 226.4 million, which represents 45.1% of the total forecast growth for the decade. This phase of development will be shaped by rising awareness about HSV infections, increasing adoption of point-of-care testing solutions, and growing penetration of molecular diagnostic technologies in clinical laboratories. Diagnostic companies are expanding their HSV testing product portfolios to address the growing demand for accurate and rapid viral detection solutions.

| Metric | Value |

|---|---|

| Estimated Value in (2025E) | USD 640.5 million |

| Forecast Value in (2035F) | USD 1,142.7 million |

| Forecast CAGR (2025 to 2035) | 6% |

From 2030 to 2035, the market is forecast to grow from USD 866.9 million to USD 1,142.7 million, adding another USD 275.8 million, which constitutes 54.9% of the ten-year expansion. This period is expected to be characterized by the expansion of home-based testing solutions, the integration of digital health platforms with diagnostic testing, and the development of next-generation molecular diagnostic technologies. The growing adoption of personalized medicine and preventive healthcare approaches will drive demand for HSV testing with enhanced sensitivity and specificity characteristics.

Between 2020 and 2025, the HSV testing market experienced steady expansion, driven by increasing awareness about sexually transmitted diseases and growing focus on early diagnosis and treatment. The market developed as healthcare providers recognized the importance of accurate HSV detection for patient management and infection control. Public health initiatives and sexual health education programs began emphasizing the necessity of regular STD screening, including HSV testing, in maintaining reproductive health.

Market expansion is being supported by the increasing prevalence of herpes simplex virus infections globally and the corresponding demand for accurate diagnostic testing solutions. Modern healthcare systems are increasingly focused on early detection and management of sexually transmitted diseases to prevent complications and reduce transmission rates. HSV testing's proven effectiveness in confirming infection status and guiding treatment decisions makes it an essential component of comprehensive sexual health screening programs.

The growing focus on point-of-care testing and home-based diagnostic solutions is driving demand for HSV testing products that can provide rapid results outside traditional laboratory settings. Healthcare providers' preference for testing solutions that combine accuracy with convenience is creating opportunities for innovative diagnostic implementations. The rising influence of telemedicine and digital health platforms is also contributing to increased adoption of HSV testing solutions that can integrate with remote patient monitoring and consultation services.

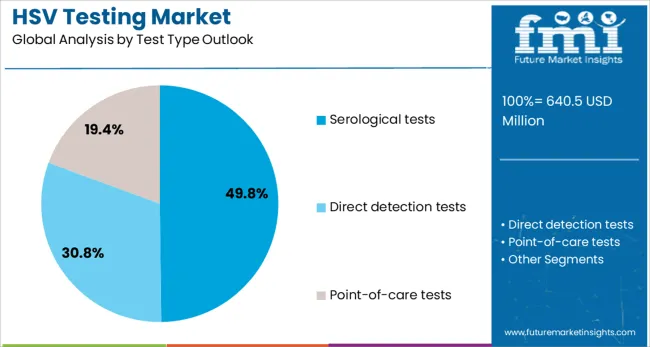

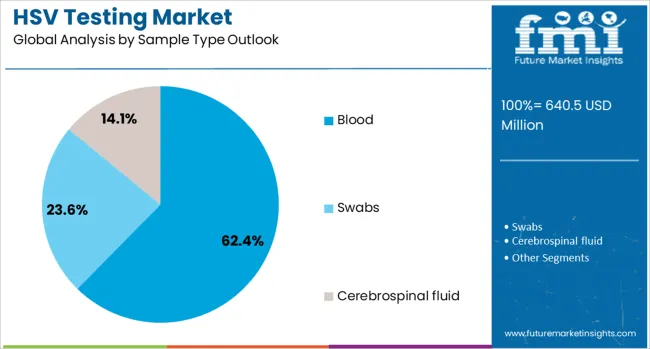

The market is segmented by type, test type, sample type, end-use, and region. By type, the market is divided into HSV-1/HSV-2 combined, HSV-1, and HSV-2. Based on test type, the market is categorized into serological tests, direct detection tests (PCR, viral culture), and point-of-care tests. In terms of sample type, the market is segmented into blood, swabs, and cerebrospinal fluid. By end-use, the market is classified into hospitals, diagnostic laboratories, clinics, sexual health centers, and home care/self-testing. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and the Middle East & Africa.

The HSV-1/HSV-2 combined testing segment is projected to account for 48.9% of the HSV testing market in 2025, reaffirming its position as the dominant testing approach. Healthcare providers increasingly prefer combined testing for its comprehensive diagnostic capability and efficiency in identifying both HSV-1 and HSV-2 infections in a single test procedure. Combined testing's ability to provide a complete herpes status assessment directly addresses clinical needs for thorough patient evaluation and appropriate treatment planning.

This testing approach forms the foundation of most HSV screening protocols, as it represents the most comprehensive and cost-effective method for herpes diagnosis across multiple clinical scenarios. Healthcare provider investments in combined testing platforms and ongoing development of multiplex assays continue to strengthen market adoption. With clinical laboratories prioritizing workflow efficiency and comprehensive diagnostic coverage, combined HSV-1/HSV-2 testing aligns with both operational requirements and clinical best practices, making it the central component of HSV diagnostic strategies.

Serological tests are projected to represent 49.8% of HSV testing demand in 2025, underscoring their critical role in HSV diagnosis and epidemiological studies. Healthcare providers prefer serological testing for its ability to detect antibodies and determine infection history, including asymptomatic infections that may not be detected through direct viral detection methods. Positioned as essential tools for comprehensive HSV screening, serological tests offer both diagnostic accuracy and the ability to assess immune status in various clinical contexts.

The segment is supported by advances in immunoassay technology and the availability of type-specific serological tests that can differentiate between HSV-1 and HSV-2 antibodies. Healthcare providers are increasingly utilizing serological testing for partner notification programs and epidemiological surveillance activities. As clinical practices prioritize comprehensive infection assessment and population health monitoring, serological HSV tests will continue to dominate the market while supporting evidence-based clinical decision-making.

The blood sample type is forecasted to contribute 62.4% of the HSV testing market in 2025, reflecting the widespread use of serum and plasma samples for HSV antibody detection and molecular testing. Healthcare providers increasingly prefer blood-based testing for its reliability, standardized collection procedures, and suitability for both serological and molecular diagnostic approaches. This aligns with clinical laboratory preferences for sample types that provide consistent results and support multiple testing methodologies.

The segment benefits from established phlebotomy procedures and healthcare provider familiarity with blood sample collection and handling protocols. With established quality control measures and standardized testing procedures, blood-based HSV testing serves as a reliable foundation for accurate diagnosis, making it a critical component of comprehensive HSV testing strategies and clinical laboratory operations.

The hospitals' end-use segment is forecasted to contribute 34.1% of the HSV testing market in 2025, reflecting the critical role of hospital laboratories in HSV diagnosis and patient care. Hospital healthcare providers increasingly utilize HSV testing for emergency department evaluations, inpatient care management, and specialized clinical services, including obstetrics and infectious disease consultations. This aligns with hospital-based care delivery models that emphasize comprehensive diagnostic capabilities and rapid turnaround times for critical test results.

The segment benefits from hospital laboratory infrastructure and healthcare provider expertise in managing complex diagnostic testing requirements. With established quality assurance programs and specialized clinical laboratory services, hospital-based HSV testing serves as an essential component of acute care delivery, making it a critical foundation for patient diagnosis and treatment decision-making in healthcare facilities.

The HSV testing market is advancing steadily due to increasing awareness about sexually transmitted infections and growing demand for accurate diagnostic testing solutions. However, the market faces challenges including reimbursement limitations, stigma associated with HSV testing, and competition from alternative diagnostic approaches. Innovation in molecular diagnostics and point-of-care testing continues to influence product development and market expansion patterns.

The growing adoption of point-of-care testing platforms is enabling healthcare providers to deliver rapid HSV test results in clinical settings without laboratory infrastructure requirements. Point-of-care HSV tests offer immediate diagnostic capability and improved patient management through same-visit results and treatment initiation. Healthcare providers are increasingly recognizing the clinical and operational advantages of rapid diagnostic testing for sexually transmitted infections.

Modern diagnostic companies are incorporating advanced molecular testing technologies, including PCR, isothermal amplification, and next-generation sequencing, to improve HSV detection sensitivity and specificity. These technologies enhance diagnostic accuracy while providing comprehensive viral characterization and resistance testing capabilities. Advanced diagnostic platforms also enable integration with electronic health records and digital health management systems for improved patient care coordination.

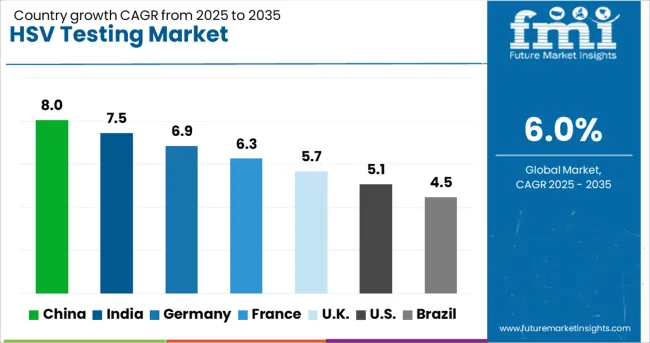

| Countries | CAGR (2025-2035) |

| China | 8% |

| India | 7.5% |

| Germany | 6.9% |

| France | 6.3% |

| UK | 5.7% |

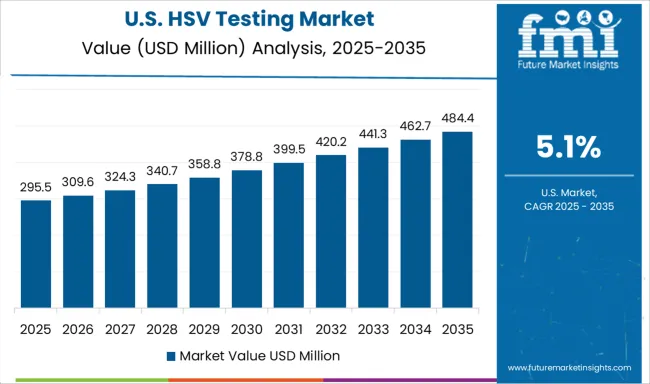

| USA | 5.1% |

| Brazil | 4.5% |

The HSV testing market is experiencing solid growth globally, with China leading at an 8% CAGR through 2035, driven by expanding healthcare infrastructure, increasing awareness about sexually transmitted diseases, and growing adoption of advanced diagnostic technologies. India follows closely at 7.5%, supported by rising healthcare investment, expanding diagnostic laboratory networks, and increasing focus on infectious disease management. Germany shows strong growth at 6.9%, emphasizing advanced molecular diagnostics and comprehensive healthcare delivery. France records 6.3%, focusing on public health initiatives and diagnostic technology integration. The UK shows 5.7% growth, prioritizing evidence-based healthcare and sexual health services.

The report covers an in-depth analysis of 40+ countries; seven top-performing countries are highlighted below.

Revenue from HSV testing in China is projected to exhibit strong growth with a CAGR of 8% through 2035, driven by massive healthcare infrastructure development and increasing awareness about sexually transmitted disease prevention and management. The country's expanding healthcare system and growing focus on infectious disease control are creating significant demand for comprehensive HSV diagnostic solutions. Major international diagnostic companies and domestic manufacturers are establishing production facilities and distribution networks to serve the growing healthcare market.

Revenue from HSV testing in India is expanding at a CAGR of 7.5%, supported by rapidly growing healthcare infrastructure, increasing government investment in infectious disease management, and rising awareness about sexually transmitted disease prevention. The country's developing healthcare system and expanding diagnostic capabilities are driving demand for reliable HSV testing solutions. International diagnostic companies and domestic manufacturers are establishing comprehensive service networks to address the growing demand for infectious disease diagnostics.

Demand for HSV testing in Germany is projected to grow at a CAGR of 6.9%, supported by the country's leadership in healthcare technology and strong focus on evidence-based diagnostic solutions. German healthcare providers consistently demand high-performance HSV testing systems that meet stringent quality requirements and provide reliable results for clinical decision-making and patient management.

Revenue from HSV testing in France is projected to grow at a CAGR of 6.3% through 2035, driven by the country's comprehensive public health system and focus on infectious disease surveillance and management. French healthcare providers consistently demand high-quality HSV diagnostic solutions that deliver superior performance while supporting public health initiatives and patient care objectives.

Revenue from HSV testing in the UK is projected to grow at a CAGR of 5.7% through 2035, supported by strong focus on evidence-based healthcare delivery and comprehensive sexual health services. British healthcare providers value diagnostic accuracy, clinical utility, and proven performance, positioning HSV testing as an essential component of modern healthcare delivery and sexual health management.

Revenue from HSV testing in the USA is estimated to grow at a CAGR of 5.1% through 2035, supported by the country's leadership in healthcare innovation, advanced diagnostic technologies, and preference for high-performance testing solutions. American healthcare providers prioritize diagnostic accuracy, workflow efficiency, and technological advancement, making advanced HSV testing systems a preferred choice in clinical laboratory and point-of-care applications.

Revenue from HSV testing in Brazil is projected to grow at a CAGR of 4.5% through 2035, supported by expanding healthcare access, raising awareness about sexually transmitted diseases, and increasing adoption of diagnostic technologies in healthcare delivery. The country's developing healthcare infrastructure and rising focus on infectious disease management are creating significant opportunities for HSV testing deployment. International diagnostic companies and domestic distributors are establishing comprehensive service networks to serve the growing demand for reliable infectious disease diagnostic solutions.

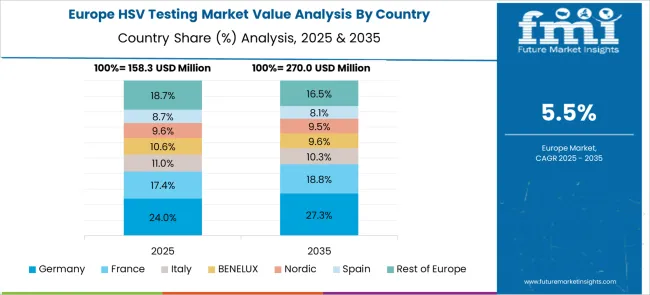

The HSV testing market in Europe demonstrates mature development across major economies, with Germany showing a strong presence through its advanced healthcare infrastructure and comprehensive sexually transmitted disease screening programs, supported by healthcare providers leveraging diagnostic expertise to implement high-quality HSV testing solutions that emphasize clinical accuracy and patient care integration.

France represents a significant market driven by its public health system and sophisticated understanding of infectious disease management, with healthcare providers focusing on comprehensive HSV testing approaches that combine French medical expertise with advanced diagnostic technologies for enhanced patient care and epidemiological surveillance benefits in clinical and public health settings.

The UK exhibits considerable growth through its embrace of evidence-based healthcare and sexual health service integration, with strong adoption of HSV testing in sexual health clinics, general practice settings, and specialized healthcare services. Germany and France show expanding interest in molecular diagnostic applications, particularly in hospital laboratories and specialized infectious disease centers. BENELUX countries contribute through their focus on healthcare quality and advanced diagnostic technologies. At the same time, Eastern Europe and Nordic regions display growing potential driven by increasing healthcare investment and expanding access to comprehensive sexually transmitted disease testing services.

The HSV testing market is characterized by competition among established diagnostic companies, specialized infectious disease testing manufacturers, and emerging molecular diagnostic players. Companies are investing in advanced testing technologies, product development, regulatory compliance, and comprehensive distribution networks to deliver accurate, reliable, and accessible HSV diagnostic solutions. Innovation in molecular diagnostics, point-of-care testing, and digital health integration is central to strengthening market position and clinical utility.

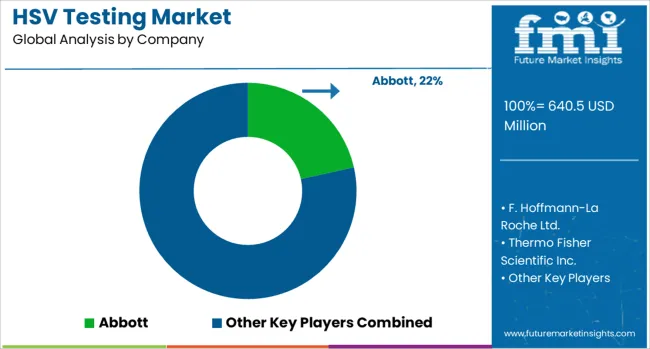

Abbott leads the market with significant global market share, offering comprehensive HSV testing solutions with a focus on molecular diagnostics and point-of-care testing capabilities. F. Hoffmann-La Roche Ltd. provides advanced diagnostic technologies with focus on laboratory automation and molecular testing platforms. Thermo Fisher Scientific Inc. delivers specialized HSV diagnostic solutions with a focus on research and clinical laboratory applications. BD focuses on diagnostic systems and sample collection solutions for infectious disease testing.

Bio-Rad Laboratories Inc. provides quality control and diagnostic testing solutions with focus on laboratory quality assurance. bioMérieux SA offers comprehensive infectious disease testing with a focus on automated laboratory systems and molecular diagnostics. DiaSorin S.p.A. specializes in immunodiagnostics and molecular testing for infectious diseases. Hologic Inc. delivers women's health and infectious disease testing solutions. Cepheid focuses on molecular diagnostic systems for rapid testing applications. QuidelOrtho Corporation provides point-of-care and laboratory diagnostic solutions for infectious disease management.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 640.5 million |

| Type | HSV-1/HSV-2 Combined, HSV-1, HSV-2 |

| Test Type | Serological tests, Direct detection tests (PCR, Viral culture), Point-of-care tests |

| Sample Type | Blood, Swabs, Cerebrospinal fluid |

| End-use | Hospitals, Diagnostic Laboratories, Clinics, and Sexual Health Centers, Home care/Self-testing |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, India, Brazil, Australia, and 40+ countries |

| Key Companies Profiled | Abbott, F. Hoffmann-La Roche Ltd., Thermo Fisher Scientific Inc., BD, Bio-Rad Laboratories Inc., bioMérieux SA, DiaSorin S.p.A., Hologic Inc., Cepheid, and QuidelOrtho Corporation |

| Additional Attributes | Dollar sales by test type and sample type category, regional demand trends, competitive landscape, buyer preferences for laboratory versus point-of-care testing, integration with digital health platforms, innovations in molecular diagnostics, rapid testing technology, and home-based testing solution development |

Region: North America

Europe

East Asia

South Asia & Pacific

Latin America

Middle East & Africa

The global HSV testing market is estimated to be valued at USD 640.5 million in 2025.

The market size for the HSV testing market is projected to reach USD 1,142.7 million by 2035.

The HSV testing market is expected to grow at a 6.0% CAGR between 2025 and 2035.

The key product types in HSV testing market are hsv-1/hsv-2 combines, hsv-1 and hsv-2.

In terms of test type outlook, serological tests segment to command 49.8% share in the HSV testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HPV Testing and Pap Test Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Sand Testing Equipments Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Examining Food Testing Services Market Share & Industry Outlook

Market Share Distribution Among Leak Testing Machine Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA