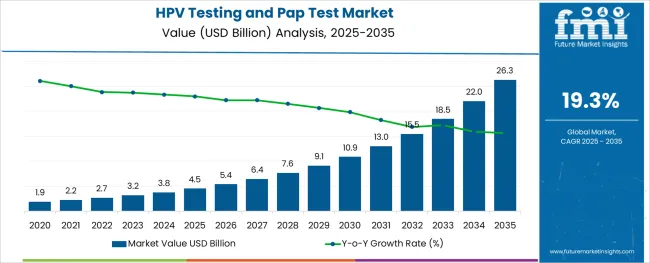

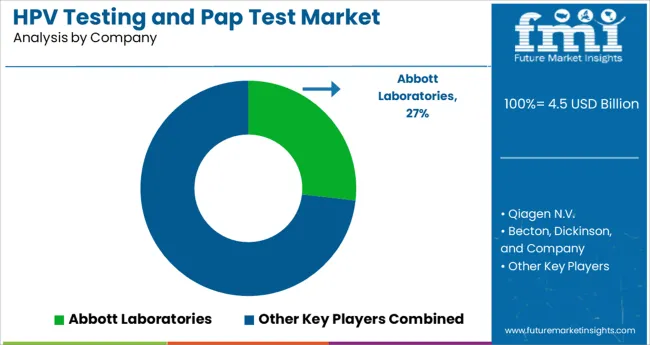

The HPV Testing and Pap Test Market is estimated to be valued at USD 4.5 billion in 2025 and is projected to reach USD 26.3 billion by 2035, registering a compound annual growth rate (CAGR) of 19.3% over the forecast period.

The alginic acid market is undergoing consistent growth, propelled by rising demand from food processing, pharmaceutical formulations, and cosmetic applications. A growing focus on natural and sustainable ingredients in manufacturing processes has positioned alginic acid as a preferred biopolymer across industries.

The market is further supported by its diverse functional benefits, including water retention, gelling, and stabilizing properties, which make it indispensable in high-performance formulations. Increased regulatory acceptance of alginates as safe additives and the push towards cleaner labeling in food and personal care products have reinforced their adoption.

Ongoing innovation in extraction technologies and the utilization of algae as a renewable resource are paving the way for cost-effective production and expanded applications, ensuring sustained market expansion in the coming years.

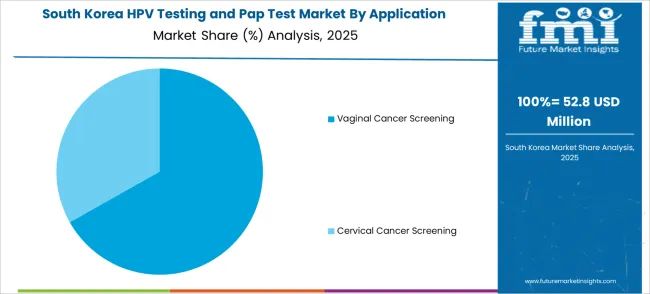

The market is segmented by Test Type, Application, Product Type, and Technology and region. By Test Type, the market is divided into HPV Testing and Pap Test. In terms of Application, the market is classified into Vaginal Cancer Screening and Cervical Cancer Screening. Based on Product Type, the market is segmented into Instruments, Consumables, and Services. By Technology, the market is divided into PCR (Polymerase Chain Reaction), Immunodiagnostics, and Other Technologies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The market is segmented by Test Type, Application, Product Type, and Technology and region. By Test Type, the market is divided into HPV Testing and Pap Test. In terms of Application, the market is classified into Vaginal Cancer Screening and Cervical Cancer Screening. Based on Product Type, the market is segmented into Instruments, Consumables, and Services.

By Technology, the market is divided into PCR (Polymerase Chain Reaction), Immunodiagnostics, and Other Technologies. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

When segmented by salts, sodium alginate is expected to command 27.5 % of the market revenue in 2025, marking it as the leading subsegment in this category. This leadership has been driven by its superior solubility, ease of incorporation into formulations, and versatility in a wide range of applications.

Its ability to form stable gels and maintain viscosity under varying conditions has made it highly sought after in both food and pharmaceutical sectors. Manufacturers have prioritized sodium alginate due to its consistent performance, cost-effectiveness, and regulatory acceptance, which have collectively strengthened its position.

The segment’s prominence has also been enhanced by its adaptability to evolving consumer preferences for plant-derived and sustainable ingredients, reinforcing its market share.

Segmented by end user industry, the food industry is projected to hold 33.0 % of the market revenue in 2025, positioning it as the most prominent sector. This dominance has been shaped by the industry’s increasing reliance on alginic acid and its derivatives to deliver desirable textures, stabilize emulsions, and improve shelf life of processed foods.

As consumer demand for clean label and natural additives has intensified, the food sector has responded by integrating alginates into bakery, dairy, and confectionery products. Enhanced production efficiency and compliance with food safety standards have further encouraged widespread use.

The segment’s leadership has also been supported by product differentiation strategies where alginates contribute to premium quality and innovation, securing their role in modern food formulations.

When analyzed by functionality, thickening agents are forecast to account for 29.0 % of the market revenue in 2025, establishing themselves as the dominant functional category. This preeminence has been underpinned by the growing need for consistent texture and viscosity in a wide array of end products.

Alginic acid’s natural origin and high efficiency in creating uniform, stable thickness without altering taste or color have solidified its appeal. The demand for thickeners in both edible and topical applications has expanded, with manufacturers leveraging its rheological properties to meet performance and regulatory requirements.

The functionality’s leading share has also been reinforced by the ability to deliver cost savings through lower dosages and its compatibility with other ingredients, securing its position as an indispensable component in formulation strategies.

The global HPV Testing and Pap Test market expanded at a CAGR of 17.2% from 2020 to 2024. The global market is predicted to surge ahead at a CAGR of 19.3% and record sales worth USD 26.3 Billion by the end of 2035, registering an absolute dollar opportunity of USD 4.5 Billion from 2025 to 2035.

Cervical cancer is the 4th most common form of cancer amongst women worldwide. In 2024, there were an estimated 604,000 new cases and 342,000 related deaths. Cervical cancer is most treatable and curable if vaccinations are effective and the cancer is detected at an early stage and proper treatment is given promptly.

If detected at an early stage, the 5-year survival rate is very high at around 92%. Even cancers at later stages can be managed with proper treatment and care. The global strategy for cervical cancer elimination, endorsed by the WHO in 2024, aims for 70% of women globally to have undergone testing at regular intervals by 2035.

The policy is based on the idea that implementing this, along with other policies regarding treatment and vaccination could eliminate cervical cancer deaths in a century. According to the WHO, this could prevent around 62 million deaths.

Pap testing, which tests for cell changes that could potentially be or become cervical cancer, and HPV testing, which looks for high-risk HPV are globally recommended. In recent years, demand is increasing due to increased awareness, developments in reducing costs, and government policies and programs.

There have been a number of government programs and policies that are boosting the global demand for testing. In the USA, the CDC recommends a Pap test or cytology test once every 3 years for 21-29-year-olds and a pap test every 3 years or an HPV test every 5 years, or a cotest of both Pap and HPV tests every 5 years for those over 30 years.

In China, the All-China Women's Federation and the Ministry of Health launched a dual program for screening cervical and breast cancer in rural women, at 3-year intervals. In Japan, the National Cancer Center recommends screening every 2 years.

Most cities offer free or subsidized options for women of eligible age groups. In South Korea, which has a single-payer public health insurance system, eligible women over 20 years of age are provided a free screening once every 2 years.

Nearly 90% of HPV deaths occurring in 2024, occurred in low and middle-income countries; largely owing to the fact that low-resource areas often do not have the ability to provide regular screening. A commonly used method is Visual Inspection with Acetic Acid or VIA testing which involves a health worker applying dilute acetic acid to the cervix and inspecting it for visual signs of whitening with the naked eye.

This method is used despite lower accuracy in low-resource areas since it has lower cost-per-test and is convenient. Another developing technology that has the potential to raise demand in low-resource areas is the use of AI in diagnosis.

A team of researchers from the National Cancer Institute (NCI) and Global Good trained an ML algorithm to use Automated Visual Evaluation (AVE) to analyze images of a cervix and identify changes that could lead to cancer. The images can be taken with even a simple camera. New developments such as training the algorithm with a more global set of images to account for geographic variations are expected to eventually raise demand.

Cervical Cancer Screening is the top application for HPV testing and Pap Testing, with a CAGR of 16.7% from 2020 to 2024. The forecasted CAGR for this category is 18.4% for the period 2025 to 2035.

Neither HPV testing nor the Pap test can detect vaginal cancer on its own, but they do detect cervical cancer and pre-cancerous conditions- which are often precursors to vaginal cancer, and HPV, which increases the risk of developing vaginal cancer.

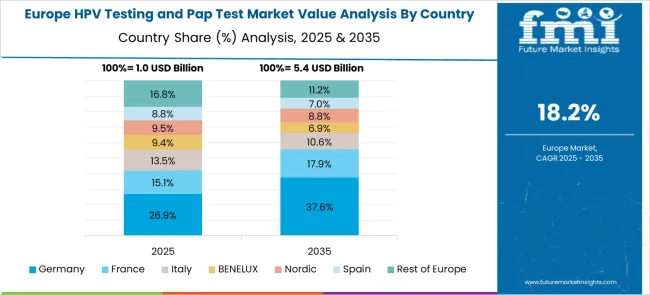

Europe is an emerging HPV Testing and Pap Test market for HPV and Pap tests. According to the European Centre for Disease Prevention and Control or the ECDC, 2.5% of all cancers in Europe are caused by HPV, and Cervical cancer is the second most common type of cancer in women of the 15 to 55 age group, after only breast cancer.

Awareness drives and official programs are driving demand. For example, in the United Kingdom, the NHS provides free tests to women every 3 years if in the 25 to 29 age category and every 5 years to women over 50 years of age. The program uses an initial HPV test and an additional Pap Test for cells that test positive.

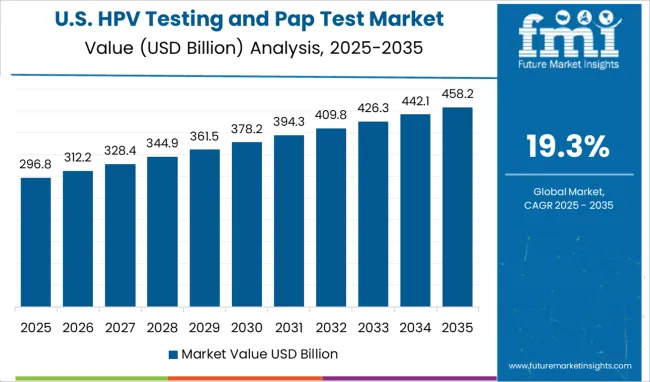

The USA contributes significantly to the HPV and Pap Tests market, with a forecasted market size of USD 26.3 Billion by 2035. The American cancer society recommends screening with an HPV test or HPV/Pap cotest every 1.9 years from 21.9 years of age to 61.9 years, or a Pap Test every 3 years.

The Centers for Disease Control provides free or low-cost screenings to women who qualify based on factors like income levels and insurance coverage under their National Breast and Cervical Cancer Early Detection Program (NBCCEDP). The HPV Testing and Pap Test market in the country is expected to garner an absolute dollar opportunity of USD 1.9 Billion. The HPV Testing and Pap Test market in the USA witnessed a CAGR of 18.2% from 2020 to 2024 and is expected to continue growing, with a forecasted CAGR growing at 20.4%.

The HPV Testing and Pap Test market in the United Kingdom is expected to reach a valuation of USD 672.7 Million by 2035. With a projected CAGR of 20.2% from 2025 to 2035, the market is expected to garner an absolute dollar opportunity of USD 1.967 Million.

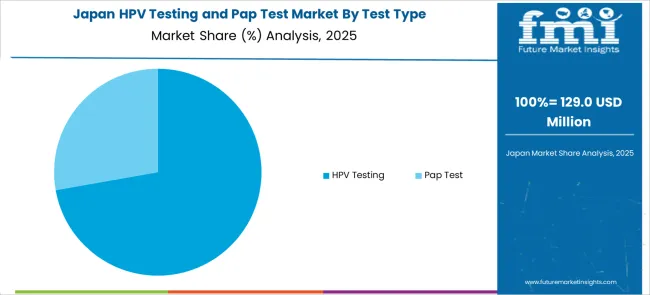

The HPV Testing and Pap Test market in Japan is expected to account for USD 791.9 Million by 2035. Growing at a CAGR of 22.4% from 2025 to 2035, the market is likely to gross an absolute dollar opportunity of USD 689 Million.

The HPV Testing and Pap Test market in South Korea is expected to reach a valuation of USD 241 Million by 2035. The market from 2025 to 2035 is expected to grow at a CAGR to garner an absolute dollar opportunity of USD 194 Million.

PAP tests are the largest contributor to HPV Testing and Pap Test market revenue, having witnessed a CAGR of 16.8% with a forecasted CAGR of 17.5% for the next decade. Their use has led to a significant decrease in Cervical Cancer deaths. However, new WHO guidelines shift to the HPV DNA-based test as preferred over the currently prevalent VIA or Pap Tests.

Despite this, Pap tests, which are the historical method in use, are still useful and common. There are concerns that additional HPV testing would mean an increase in invasive procedures. A combination of both tests is now recommended, with healthcare providers and global programs choosing whether to administer one of the two or both depending on patient age, history, and availability of resources.

HPV Testing and Pap Test providers are focused on increasing the efficiency, accuracy, and affordability of their tests and harnessing new technology. The key companies operating include Abbott Laboratories, Qiagen N.V., Becton, Dickinson and Company, Quest Diagnostics, Inc., Hologic, Inc., F. Hoffmann-La Roche, Femasys, Inc., Arbor Vita Corporation, NURX, Inc., Seegene, Inc., Thermo Fisher Scientific. Inc., and bioMérieux SA

Some of the recent developments in HPV Testing and Pap Tests are as follows:

Similarly, recent developments related to companies manufacturing HPV Testing and Pap Tests have been tracked by the team at Future Market Insights, which is available in the full report.

The global hpv testing and pap test market is estimated to be valued at USD 4.5 billion in 2025.

It is projected to reach USD 26.3 billion by 2035.

The market is expected to grow at a 19.3% CAGR between 2025 and 2035.

The key product types are hpv testing and pap test.

vaginal cancer screening segment is expected to dominate with a 42.3% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Self-sampling HPV Test Kits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

HSV Testing Market Size and Share Forecast Outlook 2025 to 2035

IoT Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

LTE Testing Equipment Market Growth – Trends & Forecast 2019-2027

Drug Testing Systems Market Size and Share Forecast Outlook 2025 to 2035

Tire Testing Machine Market Size and Share Forecast Outlook 2025 to 2035

Self-Testing Market Analysis - Size, Share, and Forecast 2025 to 2035

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

Bend Testing Machine Market Growth - Trends & Forecast 2025 to 2035

An Analysis of the Leak testing Machine Market by Detectors and Sensors Hardware Type through 2035

Soil Testing Market Growth - Trends & Forecast 2025 to 2035

Examining Food Testing Services Market Share & Industry Outlook

Market Share Distribution Among Leak Testing Machine Providers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA