The competitive structure of the global food testing services market is occupied by multinational corporations (MNCs), regional leaders, start-ups, and niche players. MNCs have a leading market share of about 55% due to their advanced technology, global reach, and following international standards. These include SGS SA, Eurofins Scientific, and Intertek Group, among others.

Regional players, including AsureQuality Limited in New Zealand and Mitra S.K. Private Limited in India, hold around 25% of the market share as they cater to localized requirements and regulations. Startups and niche players, who focus on innovative solutions such as plant-based and novel food testing, hold 15%.

The remaining 5% is held by small-scale laboratories and independent service providers. The top five players hold around 40% of the market. While the global players dominate the market, it is still moderately fragmented, with many regional and niche players catering for specialized services.

Global Market Share by Key Players

| Global Market Share, 2025 | Industry Share% |

|---|---|

| Top 5 Players (SGS SA, Eurofins Scientific, Intertek Group, Bureau Veritas, ALS Limited) | 40% |

| Rest of Top 10 Players (TÜV SÜD, TÜV Rheinland, Neotron, QIMA, Microbac Laboratories) | 20% |

| Regional Players (AsureQuality, Mitra S.K., Symbio Laboratories, R J Hill Laboratories) | 25% |

| Startups & Niche Players (Tentamus Group, EMSL Analytical, Romer Labs, FOSS Analytical) | 15% |

The market is moderately concentrated, with the top five holding a significant share. However, regional and niche players also play a critical role in the market.

Food Testing Methods segment accounts for the largest share of 35.3% of the market. This segment grows because of high demand for the compliance of tight food safety regulations, particularly in North America and Europe where food safety standards are very stringent. Companies like Eurofins Scientific and SGS SA have their stronghold here through services such as microbiological testing, allergen detection, and nutritional analysis.

Meat Testing Analysis is key at 14.5% because of high concerns over the presence of pathogens such as Salmonella and E. coli, especially in processed meat and poultry products. Dairy Products Testing Methods account for 20.2%, driven by growing consumer demand for lactose-free, organic, and fortified dairy products.

Plant-Based and Novel Food Testing Methods (12.3%) are emerging as a high-growth area, driven by the worldwide adoption of plant-based diets. This includes testing alternative proteins and novel ingredients.

In-House Testing holds 58.6% of the market due to the large-scale food and beverage manufacturers that are heavily investing in internal testing facilities for the betterment of streamlined functioning and safety standards. Companies like Nestlé and Unilever are diligently working and developing advanced in-house capabilities.

Third-Party/Independent Testing Services account for 41.4% of this market, primarily for small manufacturers, new producers, or even for large companies seeking specialized expertise. Service providers include Intertek Group and ALS Limited, who provide complete solutions, including regulatory compliance and high-end testing technologies like DNA-based pathogen detection.

The year had significant developments and strategic moves within the global food testing services market. Multinational companies enhanced their technological capabilities. Regional players consolidated their position through selective expansion. Companies such as SGS SA and Eurofins Scientific led the charge by introducing artificial intelligence-based testing and accelerated microbiological testing.

The companies, Intertek Group and Bureau Veritas, adopted blockchain technology for tracking traceability in organic food supply chain systems. The above innovations and regional initiatives of Mitra S.K. and FOSS Analytical significantly represent the fast evolving pace in this industry. Sustainability, precision, and regional adaptation were the underlying themes fueling growth and innovation.

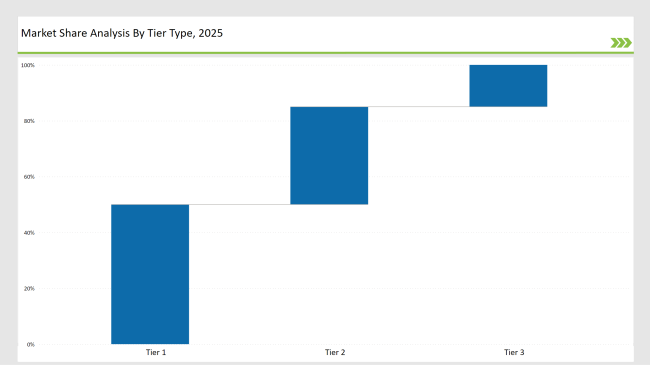

| By Tier Type | Tier 1 |

|---|---|

| Market Share % | 50% |

| Example of Key Players | SGS SA, Eurofins Scientific, Intertek Group, Bureau Veritas, ALS Limited |

| By Tier Type | Tier 2 |

|---|---|

| Market Share % | 30% |

| Example of Key Players | TÜV SÜD, TÜV Rheinland, QIMA, Neotron, Tentamus Group |

| By Tier Type | Tier 3 |

|---|---|

| Market Share % | 20% |

| Example of Key Players | Regional and niche players like Mitra S.K., Symbio Laboratories |

| Brand | Key Focus |

|---|---|

| SGS SA | Investing in AI-powered rapid testing technologies to reduce turnaround time. |

| Eurofins Scientific | Expanding facilities in emerging markets for novel food and allergen testing. |

| Intertek Group | Strengthening Latin American operations through regional partnerships. |

| Bureau Veritas | Launching blockchain-based traceability solutions for organic and clean-label foods. |

| ALS Limited | Enhancing capabilities for pesticide residue testing in plant-based foods. |

| Tentamus Group | Focusing on halal and kosher certification testing for global markets. |

| Mitra S.K. Private Limited | Expanding dairy testing capabilities in rural India. |

| FOSS Analytical | Introducing portable testing kits for small-scale feed producers. |

| TÜV SÜD | Partnering with governments to develop food safety testing frameworks. |

| Romer Labs | Innovating in mycotoxin detection technology for feed safety. |

Alternative proteins and new foods like lab-grown meat will experience huge and sustainable growth soon. Manufacturers can use this growing opportunity by strategically investing in specific testing methods and dedicated, state-of-the-art facilities to remain at the forefront.

These revolutionary cutting-edge technologies-including AI, IoT, and blockchain-will seamlessly revolutionize the landscape of food safety and traceability, provide real-time insights, and guarantee secure data management. The widespread adoption of such transformational solutions will be spearheaded by the United States and Germany as they raise new industry standards.

Testing services demand in Southeast Asia and Latin America will be significant due to the increasing focus on food exports and regulatory compliance. The companies will gain an increased market presence and drive healthy growth by focusing on these regions with their services and solutions that are customized for the fast-growing regions.

Demand for direct-to-consumer testing kits will continue to be highly buoyant and accelerated in the case of small businesses and startups, which would enable manufacturers to reach out to the burgeoning SME segment effectively and fulfil their evolving needs.

As per testing type, the industry has been categorized into Microbiological Testing (e.g., Salmonella, E. coli, Listeria), Chemical Testing (e.g., Pesticide, Heavy Metals, Mycotoxin), Allergen Testing (e.g., Gluten, Diary, Nuts, Soy), and Molecular Testing (e.g., GMO).

As per technology, the industry has been categorized into Traditional Methods (Culture-Based Techniques, and Chemical Titration), Advanced Methods [Rapid Testing, PCR (Polymerase Chain Reaction), Chromatography (HPLC, GC-MS), Spectroscopy (NMR, FTIR), Immunoassays (ELISA), Next-Generation Sequencing (NGS), Biosensors, and Atomic Absorption Spectroscopy].

This segment is further categorized into Dairy Products, Meat and Seafood, Fruits and Vegetables, Cereals and Grains, Beverages, Processed and Packaged Foods, Infant and Baby Food, Animal Feed and Pet Food.

Industry analysis has been carried out in key countries of North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Central Asia, Russia & Belarus, Balkans & Baltic Countries and the Middle East & Africa.

SGS SA, Eurofins Scientific, and Intertek Group collectively hold approximately 40% of the market, driven by advanced technology and global reach.

Food Testing Methods lead with 35.3% market share, driven by stringent safety regulations in North America and Europe.

In-house testing accounts for 58.6%, while third-party testing holds 41.4%, catering to startups and cost-sensitive manufacturers.

AI, IoT, and blockchain are transforming food safety by improving efficiency, transparency, and real-time monitoring capabilities.

Regional players cater to local regulations and preferences, holding 25% of the market. Examples include AsureQuality in New Zealand.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Testing Services Market Size, Growth, and Forecast for 2025–2035

UK Food Testing Services Market Report – Trends, Demand & Industry Forecast 2025–2035

USA Food Testing Services Market Outlook – Share, Growth & Forecast 2025–2035

Food Safety Testing Services Market Analysis – Size, Share, and Forecast Outlook 2025 to 2035

ASEAN Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

Europe Food Testing Services Market Analysis – Size, Share & Forecast 2025–2035

Food Authenticity Testing Services Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Australia Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Latin America Food Testing Services Market Growth – Trends, Demand & Innovations 2025–2035

Key Players & Market Share in Packaging Testing Services Industry

Evaluating Market Share in Restaurants & Mobile Food Services

Market Leaders & Share in the Preclinical Medical Device Testing Services Industry

Food Allergen Testing Market - Size, Share, and Forecast Outlook 2025-2035

Food Pathogen Testing Market Analysis by Contaminant Type, Technology, Application, and Region through 2035

GMO Testing Services Market Insights – Food Safety & Regulatory Compliance 2024 to 2034

GMP Testing Services Market

Food Diagnostics Services Market Size, Growth, and Forecast for 2025–2035

Key Companies & Market Share in the Food Trays Sector

Seed Testing Services Market Growth – Trends & Forecast 2018-2028

Mobile Food Services Market Analysis - Growth & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA