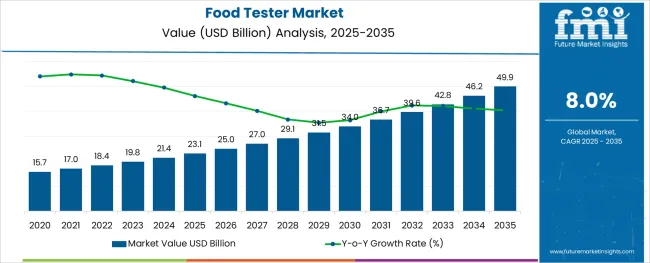

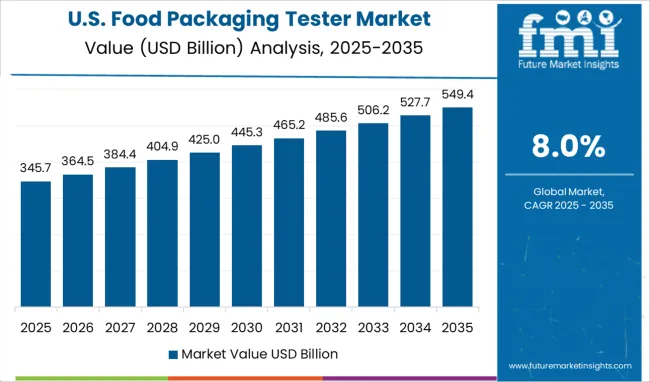

The Food Tester Market is estimated to be valued at USD 23.1 billion in 2025 and is projected to reach USD 49.9 billion by 2035, registering a compound annual growth rate (CAGR) of 8.0% over the forecast period.

The webbing cutting machine market is witnessing notable growth as industries including automotive, apparel, military, and packaging increasingly depend on precision fabric cutting technologies to improve productivity and reduce material waste. Automation has become central to the evolution of these machines, as manufacturers seek to enhance output consistency, minimize human error, and meet diverse order specifications with minimal downtime.

The demand for faster changeovers, smart control systems, and digitally calibrated feed mechanisms is accelerating, particularly in high-mix production environments. Additionally, integration with vision systems and programmable logic controls is enabling manufacturers to achieve tighter tolerances across various textile and synthetic materials.

Emerging application areas such as wearable technology and smart textiles are also encouraging investment in highly adaptable cutting equipment. As global supply chains become more reliant on efficiency and precision, future growth will be shaped by machines that offer high throughput, minimal material degradation, and compatibility with sustainable production practices.

The market is segmented by End Use and Device Type and region. By End Use, the market is divided into Food Testers for the Food Manufacturing Sector, Food Testers for the Agricultural Sector, and Food Testers for Other End Use. In terms of Device Type, the market is classified into Food Spectrometers, Food Refractometers, Food Titrators, Food Moisture Analyzers, and Other Food Tester Devices. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

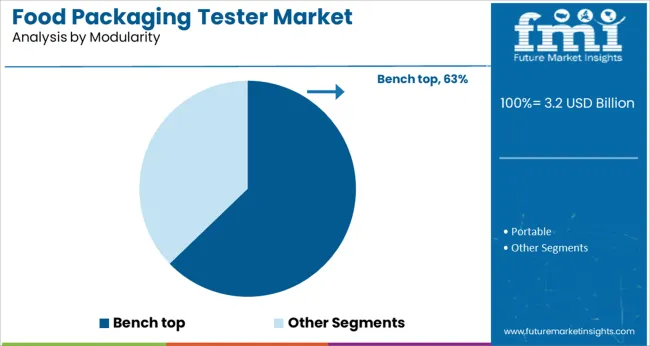

The automatic segment is projected to command 63.50% of the total market revenue in 2025, establishing it as the dominant category within the automation segment. This leadership is driven by increasing demand for machines that offer continuous operation with minimal manual intervention.

Automatic webbing cutting machines are equipped with features such as digital length setting, heat sealing, and tension control, which enhance cutting accuracy and reduce edge fraying. These machines are particularly valued for their role in streamlining operations in mass production environments, where high repeatability and reduced setup time are critical.

With rising labor costs and the need for lean manufacturing, adoption of automatic systems has accelerated across both established and emerging economies. Furthermore, their ability to integrate into larger production lines and support smart factory initiatives has reinforced their position as the preferred automation type in the webbing cutting machine market.

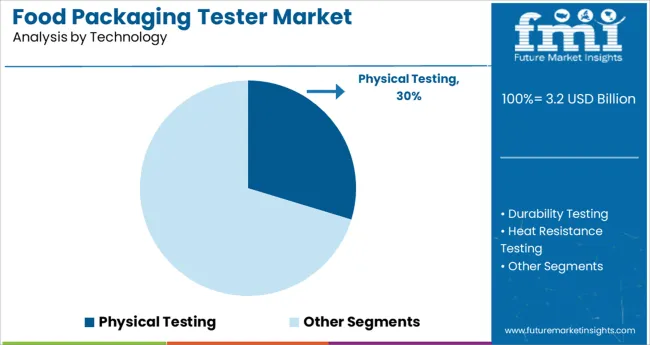

The Phyical Testing per minute capacity range is anticipated to hold 30% of market revenue in 2025, making it the leading segment by capacity. This range has emerged as the optimal balance between operational speed and control, particularly in industries requiring mid-volume production with high dimensional accuracy.

Machines in this capacity bracket are favored for their versatility, enabling manufacturers to process a wide variety of webbings such as nylon, polyester, and cotton with consistent quality. Their compatibility with both manual and automated feeding systems has further expanded their utility across small and medium-sized enterprises.

Additionally, lower energy consumption and compact machine footprints make them suitable for space-constrained production floors. These characteristics have led to widespread adoption, particularly in textile and accessories manufacturing, positioning this capacity range as the most commercially viable in the segment.

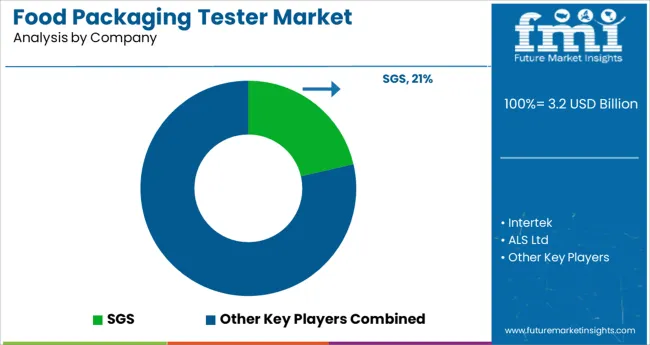

The global market for food safety testing is somewhat fragmented, with both regional and international firms competing against each other to capture as much client base as possible. Among the major players in the sector, some have managed to earn recognition as significant businesses in terms of their geographic reach.

Over the past few years investment in research and development activities to come up with novel technologies with better accuracy and easier-to-use equipment design has become the prominent strategy by manufacturers for their food tester market growth. For instance, in December 2020, ALS Limited introduced Check and Trace, as a novel technology that can identify Salmonella isolates as sensitively as conventional serological techniques. Additionally, Asurequality expanded its line of food safety testing services in June of the year 2024 by adding a new brand called "Kaitiaki Kai" to its existing product portfolio in the market.

On the basis of equipment type, the market for food tester equipment with rapid inspection technology is anticipated to grow at a rate of about 8.3% through 2035. For this reason, PCR and immunoassay methods are the maximum utilized in the construction of food tester machines and other products and account for a sizable portion of fast technologies. These equipment types particularly are attracting more focus from the stakeholders as most of the clients prefer quality over price.

Traditional methods are still widely employed in poor nations in Asia, Latin America, and Europe, and they dominate the worldwide market for food safety testing. So the food tester market players have started extending their production units to these countries in lieu of more lucrative opportunities.

Food tester plays a key role in the food industry. Food analyzers are mostly used by manufacturers to ensure quality control and safety. The agricultural sector uses mass spectrometry/ chromatography to detect the amount of pesticides present in the food.

Food tester is also used to count bacterial colonies in the food sample. Food tester also determines the content of protein, fat, oil, flavor and others. Various parameters need to be considered before buying food testers are the use of food testers based on application, i.e. quality control or amount of contamination in food. Other factors are ease of use, the speed of analysis, type of analysis, sample size, and others.

Food chemistry analysis includes testing of fat, protein, moisture, salt, minerals, contamination, sugar, pH, and others. Food microbiology analysis includes salmonella, lactobacillus, staphylococcus aureus, yeast, E. coli, pseudomonas, mold, Listeria, and others.

Food allergen analysis includes the test for the presence of egg, peanut, soy, and others. Natural food toxin analysis includes testing of fumonisin, histamine, and others. Food quality control determination includes wheat adulteration, GMO analysis.

The food tester market is expected to grow at a significant CAGR during the forecast period due to the strict regulations and standards set by the regulatory bodies of various countries. The other factors creating the demand for food testers are increasing adulteration, use of preservatives, use of pesticides, a rising concern for organic food, and others. All the factors are expected to have a positive impact on the growth of the global food tester market.

In addition to this, regulatory compliance plays a key driver for the growth of the food tester market. Food testing compliance are Food and Drug Administration/Bacteriological Analytical Manual (FDA/BAM), Food Safety and Inspection Service (FSIS), USA Department of Agriculture (USDA), International Organization for Standardization (ISO), Association of Official Agricultural Chemists (AOAC), United States Pharmacopeial Convention (USP), American Public Health Association's Compendium of Methods for the Microbiological Examination of Food (CMMEF), and others. With the increasing regulation and continuous advancements in food testers, the market for food testers is expected to grow at a significant rate during the forecast period.

The challenges associated with the growth of the global food tester market are variation in regulatory standards for different regions or countries. However, food tester manufacturers are continuously focused on manufacturing food testers based on regional standards and are expected to overcome this challenge by the end of the forecast period.

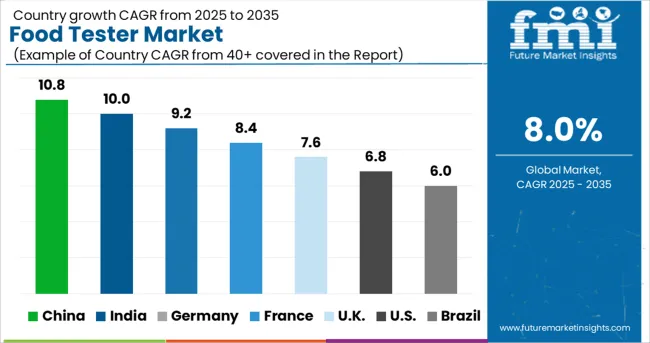

As per the FMI analysis, Europe dominates the market, accounting for 36% of the market revenue share. The growth is owed to the high prevalence of food-related allergies among the population which further increases the demand for safety testing procedures. Furthermore, enforcement of stringent regulatory norms in the region is projected to lead to a large market size in the region.

According to Future Market Insights, North America is expected to have the prominent market share of food testers during the forecast period. The strict regulations for maintaining food standards and the massive demand for packaged food is driving the food tester market in the USA and Canada. In addition, allergen testing in North America for food safety testing mandated by the Food and Drug Administration (FDA) has significantly added to the growth.

Some of the key participants present in the global food tester market include Labcompare, LabX, Presto Group, Progen Scientific, Thwing Albert, Boekel Scientific, Thermo Fisher Scientific, Amaze Instruments, and others. Attributed to the presence of such a high number of participants, the market is highly competitive.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 8% from 2025 to 2035 |

| Market Value in 2025 | USD 19.86 Billion |

| Market Value in 2035 | USD 42.81 Billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in million, Volume in Kilotons and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends and Pricing Analysis |

| Segments Covered | Device, End-Use, Region |

| Regions Covered | North America; Latin America; Europe; Asia Pacific; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, UK, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC, South Africa |

| Key Companies Profiled | Labcompare; LabX; Presto Group; Progen Scientific; Thwing Albert; Boekel Scientific; Thermo Fisher Scientific; Amaze Instruments |

| Customization | Available Upon Request |

The global food tester market is estimated to be valued at USD 23.1 billion in 2025.

It is projected to reach USD 49.9 billion by 2035.

The market is expected to grow at a 8.0% CAGR between 2025 and 2035.

The key product types are food testers for the food manufacturing sector, food testers for the agricultural sector and food testers for other end use.

food spectrometers segment is expected to dominate with a 36.0% industry share in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food Packaging Tester Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA