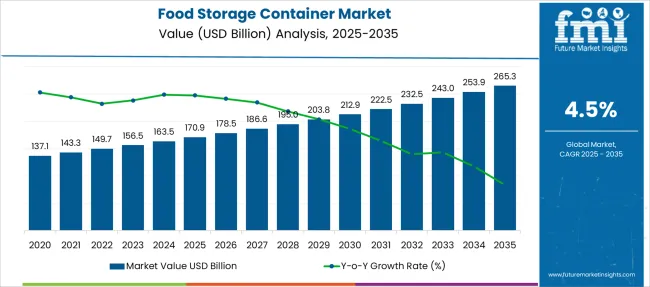

The Food Storage Container Market is estimated to be valued at USD 170.9 billion in 2025 and is projected to reach USD 265.3 billion by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

| Metric | Value |

|---|---|

| Food Storage Container Market Estimated Value in (2025 E) | USD 170.9 billion |

| Food Storage Container Market Forecast Value in (2035 F) | USD 265.3 billion |

| Forecast CAGR (2025 to 2035) | 4.5% |

The food storage container market is experiencing sustained growth, supported by increasing consumer demand for food preservation, portion control, and convenience in both household and commercial settings. Lifestyle shifts toward meal prepping, reduced food waste, and sustainable living have driven demand for containers that offer durability, reusability, and space efficiency.

The surge in at-home cooking, along with the rising preference for organized kitchen solutions, has further intensified market momentum. Innovations in material design, including leak-proof, microwave-safe, and BPA-free containers, are attracting health-conscious consumers seeking both functionality and safety.

The market is also benefiting from expansion in cold chain logistics and growth in packaged food distribution. Looking forward, market expansion is expected to be fueled by eco-friendly product innovations, customized container solutions, and increasing investments in smart kitchen storage technologies that align with modern food storage habits.

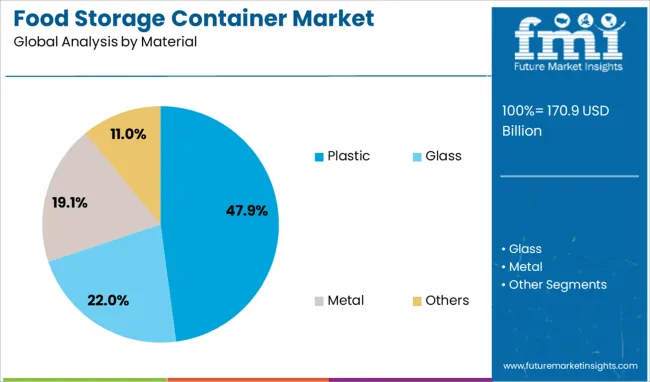

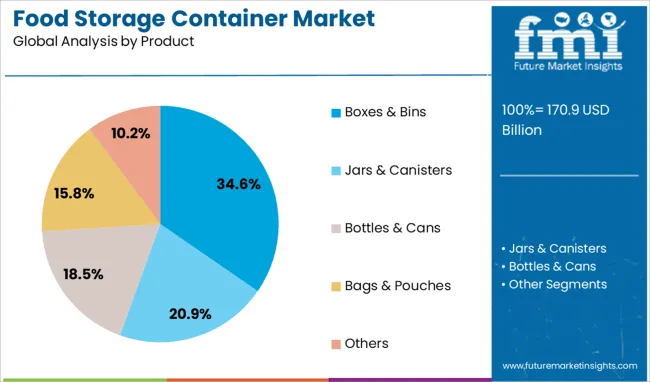

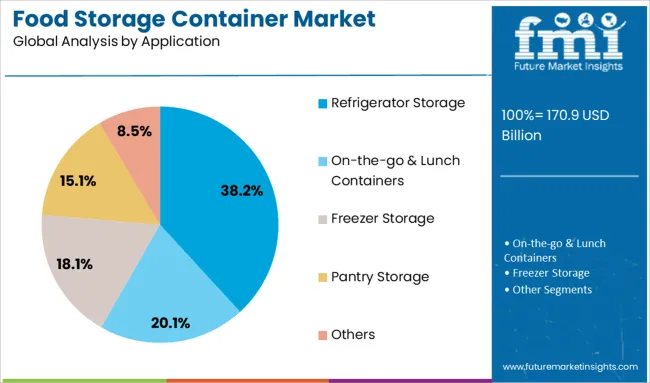

The food storage container market is segmented by material, product, application, and geographic regions. The market for food storage containers is divided into Plastic, Glass, Metal, and Others. In terms of the product, the food storage container market is classified into Boxes & Bins, Jars & Canisters, Bottles & Cans, Bags & Pouches, and Others. Based on the application, the food storage container market is segmented into Refrigerator Storage, On-the-go & Lunch Containers, Freezer Storage, Pantry Storage, and Others. Regionally, the food storage container industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment dominates the material category with a 47.9% market share, owing to its lightweight nature, cost-efficiency, and versatile usage across a range of food storage applications. Plastic containers are widely favored for their durability, flexibility in design, and compatibility with microwave and dishwasher use.

This segment has seen robust demand in both retail and foodservice sectors, particularly with the availability of stackable and seal-tight plastic solutions that enhance convenience and food longevity. Advances in recyclable and BPA-free plastic materials have also helped alleviate environmental concerns, encouraging sustained consumer adoption.

As single-use plastics face regulatory pressures, manufacturers are shifting toward reusable and eco-conscious variants, ensuring continued relevance of plastic in the evolving market landscape. The plastic segment is expected to maintain a strong position due to its adaptability, mass-market appeal, and continuous improvements in safety and sustainability standards.

Boxes and bins hold a 34.6% share of the product category, highlighting their broad acceptance as essential kitchen and pantry organizers. These products are increasingly favored for their ability to provide airtight sealing, modular storage, and stackable configurations, which support efficient space management and food freshness.

Their adaptability for dry goods, leftovers, and bulk storage solutions makes them a go-to option for consumers seeking multipurpose storage. This segment has also benefitted from aesthetic innovations and material diversity, including clear view designs and ergonomic lids that enhance functionality and visual appeal.

Growth is further driven by the rising popularity of minimalist kitchen setups and the growing role of social media in promoting food storage hacks and home organization trends. The boxes and bins segment is projected to witness continued momentum as consumers prioritize smart and compact storage tools tailored to modern lifestyle needs.

The refrigerator storage application leads with a 38.2% share, emphasizing the increasing consumer emphasis on freshness, hygiene, and waste reduction in refrigerated food items. Containers designed for refrigerator use are engineered to resist temperature shifts, minimize odor absorption, and prevent moisture accumulation, making them highly valuable for preserving perishable items.

This segment has gained traction amid rising household awareness about organized refrigeration and prolonged shelf-life of fruits, vegetables, dairy, and leftovers. Manufacturers have responded with containers tailored for specific fridge zones and compatible with stacking and compartmentalization.

The trend toward meal planning and batch cooking has further fueled segment growth, especially in urban areas with busy lifestyles. As energy-efficient refrigerators and smart storage solutions gain popularity, the refrigerator storage segment is expected to strengthen its position as a core driver in the food storage container market.

The food storage container market is expanding through demand for durable, multifunctional designs, meal-prep convenience, and e-commerce-driven accessibility. Competitive differentiation relies on modular innovations, digital engagement, and premium positioning to attract both residential and commercial buyers.

The food storage container market is witnessing strong demand for products made from glass, stainless steel, and high-grade plastics. Consumers prefer options that ensure safety, durability, and compatibility with microwaves and dishwashers. Glass containers have gained traction for their non-reactive properties, while BPA-free plastic containers continue to appeal to price-sensitive segments.

Stainless steel options are popular among households prioritizing long-term use. This demand is amplified by lifestyle shifts that encourage bulk cooking and organized storage. Manufacturers are emphasizing material safety certifications and multi-utility features to meet consumer expectations, positioning premium-quality products as a key differentiator in both residential and commercial markets.

A growing interest in home meal preparation and portable food solutions has driven demand for compact, leak-proof storage containers. Busy professionals and health-conscious consumers are adopting compartmentalized containers for portion control and convenience. The trend of carrying home-cooked meals has increased, supported by flexible work arrangements and cost-conscious behaviors.

Foodservice businesses, including cloud kitchens and catering services, are also expanding bulk container usage to manage pre-portioned ingredients efficiently. This shift has opened opportunities for brands to innovate in space-saving designs and ergonomic solutions tailored to mobile lifestyles. The surge in reusable container adoption reinforces market growth in both household and commercial sectors.

Digital retail has become a vital growth driver for the food storage container market. E-commerce platforms provide consumers with access to a wide variety of designs, price ranges, and bundled offers, influencing buying decisions significantly. Subscription-based delivery models for premium kitchenware have emerged, targeting urban households seeking convenience and curated product selections.

Online channels allow manufacturers to showcase innovative designs and offer personalization, which traditional offline channels often lack. Seasonal promotions and influencer-led campaigns further boost product visibility, making e-commerce an indispensable sales channel. This shift has encouraged traditional brands and new entrants to invest heavily in digital marketing and logistics.

Continuous innovation and branding strategies shape the competitive landscape in the food storage container market focused on functionality and aesthetics. Companies are launching modular, stackable, and air-tight systems with specialized features such as freshness indicators and easy-lock mechanisms. Private-label brands are capturing value-driven consumers, while premium players emphasize durability and design sophistication.

Strategic collaborations with online retailers and lifestyle influencers have become common to strengthen market presence. Brands are also leveraging customer engagement through digital platforms to gather feedback for product improvements. These initiatives position manufacturers to maintain relevance in a category where design and convenience heavily influence purchase behavior.

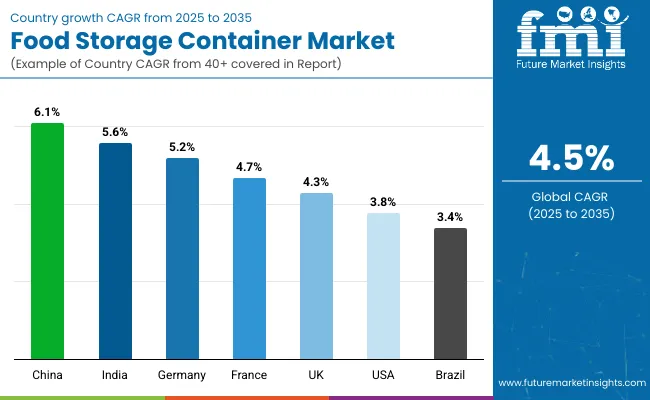

| Country | CAGR |

|---|---|

| China | 6.1% |

| India | 5.6% |

| Germany | 5.2% |

| France | 4.7% |

| UK | 4.3% |

| USA | 3.8% |

| Brazil | 3.4% |

The food storage container industry, projected to expand at a global CAGR of 4.5% from 2025 to 2035, shows notable performance variations across leading regions. China leads with a CAGR of 6.1%, supported by strong urban household demand, e-commerce penetration, and rising interest in premium airtight solutions. India follows at 5.6%, driven by growing middle-class adoption of modular storage, coupled with the popularity of reusable materials for organized kitchen systems. Germany, posting 5.2% CAGR, benefits from higher preference for glass containers and sustainable alternatives in households and foodservice settings, ensuring steady market expansion.

France records 4.7% CAGR with consistent demand from commercial kitchens and meal-prep trends, while the United Kingdom stands at 4.3%, fueled by the rise in on-the-go consumption and compact storage solutions for small kitchens. The United States, at 3.8% CAGR, reflects a mature market where innovation and design aesthetics dominate buying decisions, with premium offerings performing better than traditional plastic-based options. These trends confirm that Asia-Pacific countries are shaping the future of food storage innovation, whereas Europe and North America sustain growth through design-focused and premium products. The report features an in-depth study across 40+ countries, with these top five representing critical benchmarks for global strategy development.

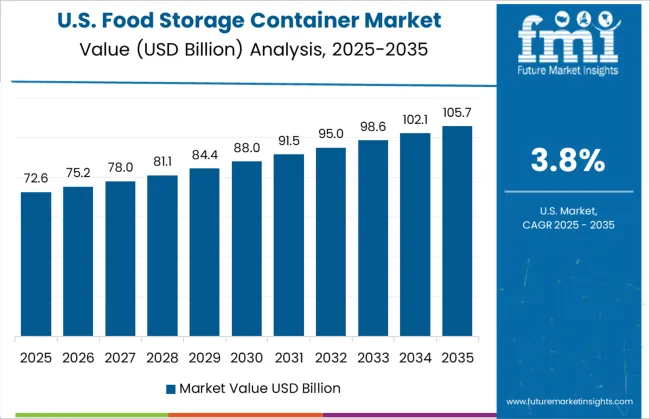

The CAGR of the food storage container market in the United States moved from about 3.2% during 2020–2024 to 3.8% for the 2025–2035 period, indicating steady progress in a mature market. This increase is attributed to heightened consumer focus on premium and multifunctional products that blend durability and aesthetics. Growth was influenced by strong e-commerce penetration and consumer demand for innovative airtight containers designed for modern kitchens. Modular storage and easy-stack formats are gaining traction among households seeking efficient organization. Meal-prep culture and the popularity of portion-controlled systems have reinforced adoption, while commercial foodservice relies on heavy-duty storage formats for compliance and waste reduction goals.

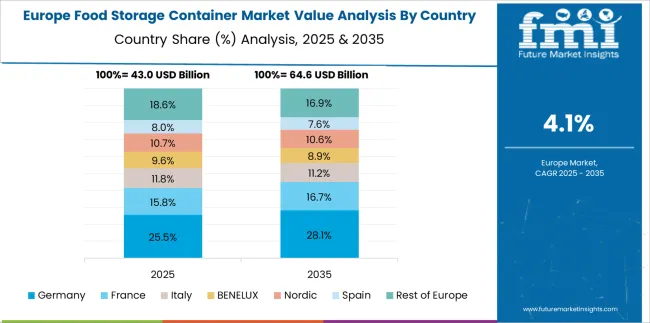

The CAGR in Germany advanced from nearly 4.6% in 2020–2024 to 5.2% during 2025–2035, supported by consumer preference for eco-conscious glass-based storage and efficient modular systems. German households prioritize minimalistic and space-saving designs, driving premiumization trends in both offline and online channels. The professional foodservice segment further drives demand for durable bulk storage solutions with airtight features to meet hygiene standards. Innovations, such as freshness-indicator lids and lock-tight systems, have encouraged household adoption. Leading manufacturers are expanding partnerships with retailers and direct-to-consumer platforms to capture value-driven segments. While growth remains moderate, design and functionality upgrades steady expansion across residential and institutional applications.

The CAGR in the United Kingdom rose from approximately 3.6% during 2020–2024 to 4.3% in the 2025–2035 timeframe, propelled by consumer demand for space-efficient solutions in smaller urban kitchens. High adoption of stackable and compartmentalized containers aligns with increased meal-prep practices among working households. Growth in reusable and microwave-safe categories has further boosted household demand, while catering and cloud kitchens rely on standardized containers for delivery and storage optimization. The surge in e-commerce platforms and quick commerce has enabled brands to scale personalized container kits for niche preferences. Continued innovation in materials and design is expected to elevate premium offerings across retail formats.

China’s CAGR increased from 5.1% in 2020–2024 to 6.1% during 2025–2035, reflecting rising urban household demand and the widespread popularity of organized storage systems. Rapid e-commerce penetration, combined with higher disposable income, has accelerated adoption of premium airtight containers for refrigerators and pantries. Manufacturers are emphasizing glass and stainless steel containers for durability and perceived health benefits. The country also sees growing usage in commercial kitchens and meal delivery platforms, where standardized containers improve operational efficiency. Local players are leveraging innovative packaging technologies, while global brands are expanding localized designs tailored for smaller living spaces common in Chinese metros.

India posted a CAGR shift from about 4.8% in 2020–2024 to 5.6% for the 2025–2035 period, driven by middle-class adoption of modular and reusable containers for improved kitchen organization. Tier 1 and Tier 2 cities are seeing robust growth in premium glass storage products alongside value-priced airtight plastic alternatives for bulk household use. The meal-prep trend, growing health awareness, and expansion of organized retail and e-commerce platforms continue to enhance accessibility. Foodservice operators, including cloud kitchens and catering businesses, represent a significant growth driver for large-capacity storage systems. Domestic manufacturers are focusing on durability, stackability, and affordability to cater to diverse consumer segments.

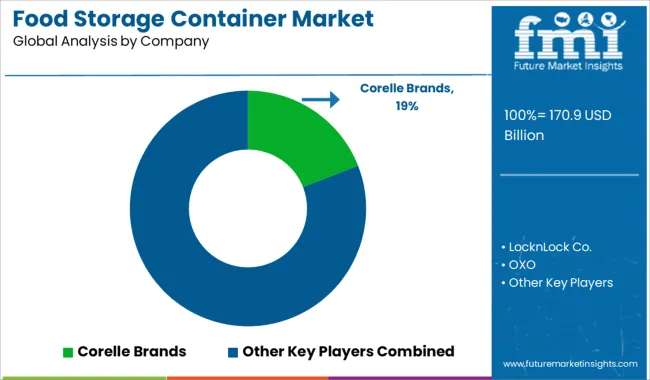

In the food storage container market, leading players are adopting advanced material innovation, functional design, and convenience-focused features to meet changing consumer needs across residential and commercial sectors. Corelle Brands is recognized for premium glass storage systems that combine durability with modern aesthetics, targeting consumers who value long-lasting solutions for organized kitchens.

LocknLock Co. emphasizes airtight and leak-proof containers with modular stacking capabilities, catering to households seeking efficient space management and food freshness. OXO focuses on ergonomic designs and easy-lock mechanisms, introducing smart features for quick sealing and ease of use, making them a preferred choice for premium segments. Rubbermaid Commercial Products has established dominance in the institutional and foodservice sectors with bulk storage systems that comply with hygiene and safety standards, ensuring durability under heavy use.

Tupperware continues to innovate in lifestyle-oriented containers through stylish, portable designs and multifunctional options, including microwave-safe and freezer-friendly solutions. These companies are increasingly leveraging digital sales channels, introducing subscription-based models, and launching eco-conscious materials to capture evolving consumer demand.

Competitive differentiation revolves around innovation in materials, stackable formats, and personalized container sets designed for modern, compact kitchens. Strategic collaborations with e-commerce platforms and retail chains remain central to strengthening their global presence and customer loyalty across diverse market segments.

Key strategies for 2024 and 2025 in the food storage container market include focusing on premiumization through glass and stainless-steel designs, expanding eco-friendly and BPA-free product lines, and leveraging eCommerce with subscription models for recurring sales.

Brands are emphasizing stackable and space-saving solutions to cater to compact kitchens and rising meal-prep trends. Collaborations with retail chains and influencer-driven digital marketing campaigns are becoming critical to enhance visibility.

| Item | Value |

|---|---|

| Quantitative Units | USD 170.9 Billion |

| Material | Plastic, Glass, Metal, and Others |

| Product | Boxes & Bins, Jars & Canisters, Bottles & Cans, Bags & Pouches, and Others |

| Application | Refrigerator Storage, On-the-go & Lunch Containers, Freezer Storage, Pantry Storage, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Corelle Brands, LocknLock Co., OXO, Rubbermaid Commercial Products, and Tupperware |

| Additional Attributes | Dollar sales, share, regional demand outlook, material preferences (glass, plastic, stainless steel), competitive positioning, pricing analysis, e-commerce impact, channel performance, innovation trends, consumer behavior, and forecasted CAGR for key markets. |

The global food storage container market is estimated to be valued at USD 170.9 billion in 2025.

The market size for the food storage container market is projected to reach USD 265.3 billion by 2035.

The food storage container market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in food storage container market are plastic, glass, metal and others.

In terms of product, boxes & bins segment to command 34.6% share in the food storage container market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA