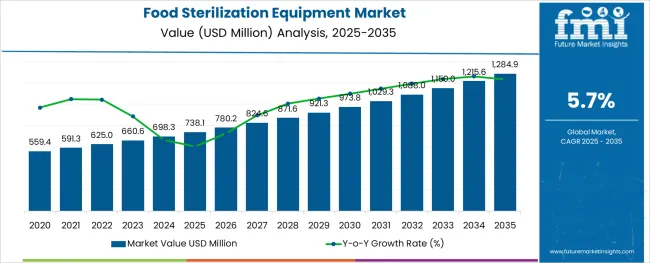

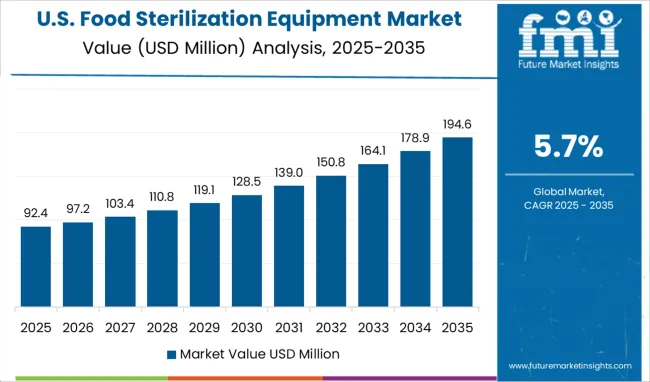

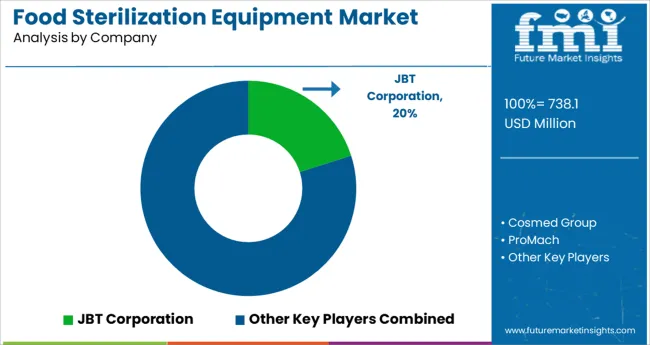

The Food Sterilization Equipment Market is estimated to be valued at USD 738.1 million in 2025 and is projected to reach USD 1284.9 million by 2035, registering a compound annual growth rate (CAGR) of 5.7% over the forecast period.

The food sterilization equipment market has experienced steady growth in recent years, primarily driven by rising concerns over food safety, increasing demand for shelf-stable products, and strict regulatory standards on microbial content in consumables.

As global food supply chains grow increasingly complex, manufacturers have intensified their focus on adopting reliable sterilization technologies to extend product shelf life while preserving nutritional quality. Industry players are responding by investing in equipment that balances efficiency, product integrity, and operational safety, which has notably reshaped product development pipelines and procurement strategies in the food processing sector.

Looking ahead, the market is expected to maintain positive momentum as the processed and packaged food industries expand across emerging economies, fueled by rising disposable incomes and urbanization trends. Additionally, the escalating prevalence of foodborne illnesses and heightened consumer awareness regarding contamination risks are poised to reinforce equipment demand in the coming years. Technological innovations aimed at enhancing energy efficiency and reducing environmental footprints are anticipated to further shape the competitive landscape, offering manufacturers an avenue to meet sustainability targets while maintaining high sterilization standards.

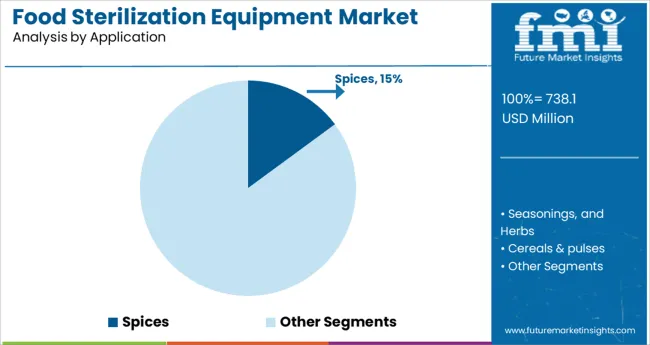

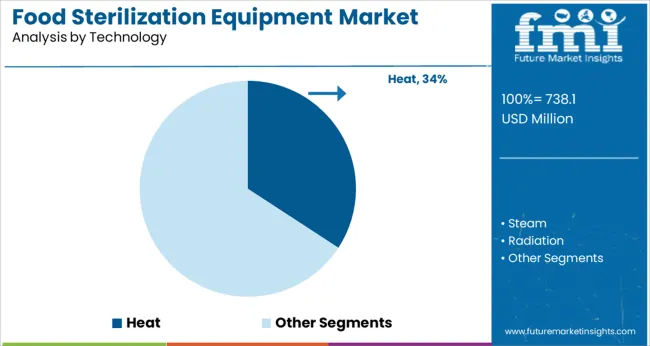

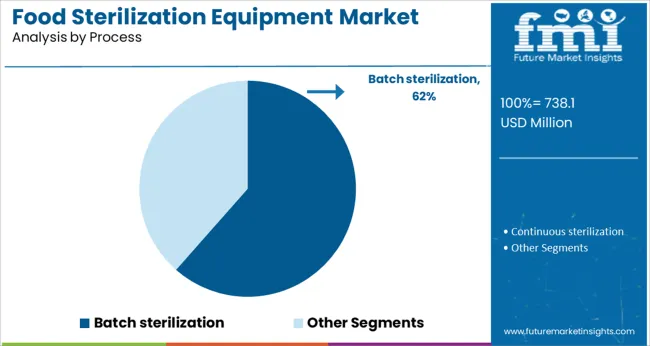

The market is segmented by Application, Technology, Process, Type, and Equipment and region. By Application, the market is divided into Spices, Seasonings, and Herbs, Cereals & pulses, Meat, Poultry & seafood, Dairy products, Fruits & vegetables, Dried fruits & nuts, Beverages, Bottled food sterilization, Canned food & beverages, and Others (edible seed, gums, starch, jelly, & other ingredients). In terms of Technology, the market is classified into Heat, Steam, Radiation, Chemical, Filtration, and Others (HPP and ultrasound technologies). Based on Process, the market is segmented into Batch sterilization and Continuous sterilization.

By Type, the market is divided into High Voltage Electric Field Sterilization Equipment, Inductive Electronic Sterilization Equipment, High-Temperature Sterilization, Chemical Sterilization, Ultraviolet Sterilization Equipment, and Microwave Sterilization Machine. By Equipment, the market is segmented into Milk pasteurization machine, Industrial jam vacuum cooker, Small-scale industrial jam cooker, Processing system for marmalade, Sterilizer for ready meals, Vegan sauce processing system, Craft beer pasteurizer, Autoclave sterilizer for canned tuna, High-pressure processing machine for juice, Industrial bottle sterilizer, Steam sterilizer for food pouches, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Within the application category, the spices segment captured approximately 14.9% of the food sterilization equipment market share, reflecting the critical need for microbial control in spice processing operations.

Given that spices often originate from diverse geographic regions with variable cultivation and storage practices, they present heightened risks of bacterial and fungal contamination. This reality has necessitated the widespread adoption of sterilization solutions to comply with international food safety standards, particularly in export-driven markets.

The growing preference for natural and organic spice variants has further intensified the demand for equipment that ensures effective microbial reduction while preserving essential oils, aroma, and color integrity. Market participants have responded by developing specialized systems tailored to the thermal sensitivities of spices, minimizing quality degradation during treatment. Additionally, the surge in processed food consumption, where spices play a pivotal role as flavor enhancers, has sustained consistent equipment demand from food manufacturers. The segment's long-term growth trajectory is expected to remain robust as stricter import regulations and consumer expectations for hygienically processed food products continue to evolve.

The heat technology segment accounted for a commanding 34.2% share of the food sterilization equipment market, maintaining its position as the preferred method for microbial deactivation across various food categories.

This dominance is attributed to the proven efficacy, cost-effectiveness, and scalability of thermal sterilization processes in commercial food production. Heat-based systems, including steam and hot water sterilizers, are widely adopted for their versatility and capacity to handle a broad spectrum of food products, ranging from dairy and beverages to ready meals and condiments.

Recent technological advancements have enhanced the operational efficiency of heat sterilizers, reducing energy consumption and processing times while maintaining stringent safety standards. The segment's enduring popularity also stems from its ability to integrate seamlessly into existing production lines, offering food manufacturers operational flexibility. Future growth prospects remain favorable as industry players introduce advanced models equipped with automated control systems and energy recovery mechanisms, enabling producers to optimize resource utilization and meet evolving regulatory benchmarks without compromising product quality.

Among process types, the batch sterilization segment led with a substantial 61.5% market share, driven by its operational simplicity, adaptability, and suitability for handling diverse product volumes and formulations.

This process remains the preferred choice for small to mid-sized food processing units and specialty product lines where continuous sterilization systems may be impractical or cost-prohibitive. Batch systems offer distinct advantages in terms of product traceability, flexibility in processing varied packaging formats, and ease of validation, which have made them a reliable option for manufacturers prioritizing safety assurance.

Additionally, the segment has benefitted from its compatibility with a wide range of sterilization technologies, including heat, steam, and chemical-based treatments, enhancing its application scope across multiple food categories. Market demand has been further supported by the rise of artisanal and premium packaged food segments, where smaller production runs and tailored processing parameters are commonplace. Looking ahead, continued investment in automation and digital monitoring capabilities is expected to enhance the operational efficiency of batch sterilizers, ensuring their sustained relevance in the modern food processing environment.

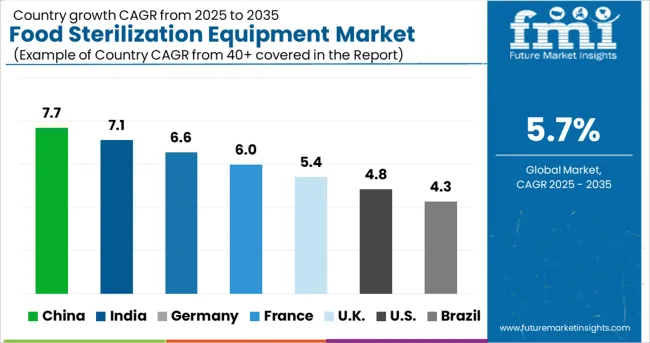

Sales of food sterilization equipment are projected to grow at a 5.7% CAGR over the forecast period, in comparison to the 4.1% CAGR registered between 2020 to 2024.

Increasing focus on food safety, along with sustainable production of food ingredients are spurring demand for food sterilization equipment. Food processing companies are investing in sterilizing equipment to extend the shelf life of these items while adhering to severe regulatory standards, which are expected to boost sales in the market in the forthcoming years.

Ongoing technological advancements in the production of non-thermal food preservation technologies will augment the growth in the market. Nonthermal technologies such as ultraviolet light, pulsed electric fields, ultrasound, and high hydrostatic pressure (HPP) are widely adopted.

This equipment maintains the nutrient values of food in a short dispensing time and at lower temperatures and is used to improve food safety and extend the shelf life of food products.

Expansion of the Foodservice Sector in Australia is Driving Sales of Food Sterilization Equipment

Sales in the Australian market are expected to increase at a 6.5% CAGR over the forecast period, accounting for a dominant share of the Oceania food sterilization equipment market. Increasing expenditure on packaged food products and ready-to-eat meals, along with the growing popularity of cloud kitchens and quick service restaurants in the country will continue fueling sales in the market.

Rapid Adoption of Technologically Advanced Equipment in the Hospitality Sector Will Fuel Sales

According to FMI, demand in the USA market is forecast to increase at a robust 8.2% CAGR, emerging as a lucrative pocket in the North American food sterilization equipment market. Rising preference for online food delivery among consumers, coupled with the presence of stringent food regulatory bodies and restrictions in the country will contribute to the growth in the market over the forecast period.

Growing Preference for Online Food Delivery In India Will Spur Demand

Demand in the Indian market is forecast to grow at a robust 8.2% CAGR, accounting for 31% of the South Asia food sterilization equipment market over the forecast period. The growing establishment of cloud kitchens and fast-food chains in the country, along with increasing government-led initiatives to promote effective sterilization in public and commercial sectors will create prospects for growth for market players.

Stringent Regulations regarding Food Safety Will Propel Sales of Food Sterilization Equipment

China is anticipated to emerge as an attractive market owing to the presence of stringent government laws determining the food safety and quality standards across the food & beverage and food service sector in the country. As per the report, sales in the China market are forecast to grow at a 9.1% CAGR, holding 65% of the East Asia food sterilization equipment market through 2035.

Sales of Continuous Sterilization Equipment in Restaurants Will Gain Traction

In terms of process, demand in the continuous sterilization equipment segment is poised to increase at a 6.6% CAGR over the forecast period. These equipment employ steam or direct heat for shorter heating and cooling times, reducing sterilization time and cost.

They are also used to sterilize soups, pasta, nutritious drinks, milk, cream, vegetables, newborn formula, mushrooms, meats, liquids, and ready meals. They provide uniformity and improved reproducibility at a reduced cost per unit.

Adoption of Food Sterilization Equipment for Seasoning and Herbs to Remain High

Based on application, sales in the seasoning and herbs segment will continue gaining traction over the forecast period. The need for food sterilizing equipment is high since most food companies utilize spices and herbs as significant elements in their products. Manufacturers are enhancing the sterilization process to deliver high-quality food items including spices, herbs, and seasonings, which in turn is boosting the demand for this equipment.

Increasing Sales of Heat Food Sterilization Equipment Will Augment Growth

By technology, the heat food sterilization equipment segment will remain lucrative over the assessment period. Because of its ease of use and inexpensive capital commitment, heat sterilization is one of the most extensively used sterilizing procedures.

During the forecast period, the widespread use of heat sterilization technology in the food and beverage processing industry is expected to fuel growth in the market. For a wide range of high-moisture food goods and ingredients, heat sterilization technology is utilized to guarantee long-term shelf stability.

Key players are investing in mergers and acquisitions to expand their production facilities and global footprint. Furthermore, numerous firms are working on new product launches and development to gain a competitive edge in the market.

For instance:

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | million for Value and Units for Volume |

| Key Regions Covered | North America; Latin America; Europe; East Asia; South Asia; Oceania; Middle East and Africa (MEA) |

| Key Countries Covered | USA, Canada, Mexico, Germany, UK, France, Italy, Spain, China, Japan, India, South Korea, Australia, Brazil, Argentina, South Africa, UAE |

| Key Segments Covered | Process, Technology, Type, Equipment, Application, Region |

| Key Companies Profiled | JBT; Buhler AG; Cosmed Group; STERIFLOW Company; DELAMA S.P.A.; Raphanel System; Industrial Sonomechanics LLC.; Ventilex; Surdry S.L.; Allpax Products LLC.; HISAKA LTD.; Sun Sterifaab Pvt. Ltd.; 3M; Belimed; Boekel Scientific,; Getinge AB,; LTE Scientific Ltd.; Others |

| Report Coverage | Market Forecast, Company Share Analysis, Competitive Landscape, Drivers, Restraints, Opportunities and Threats Analysis, Market Dynamics and Challenges, and Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global food sterilization equipment market is estimated to be valued at USD 738.1 million in 2025.

It is projected to reach USD 1,284.9 million by 2035.

The market is expected to grow at a 5.7% CAGR between 2025 and 2035.

The key product types are spices, seasonings, and herbs, cereals & pulses, meat, poultry & seafood, dairy products, fruits & vegetables, dried fruits & nuts, beverages, bottled food sterilization, canned food & beverages and others (edible seed, gums, starch, jelly, & other ingredients).

heat segment is expected to dominate with a 34.2% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Food and Beverage Industry Software Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA