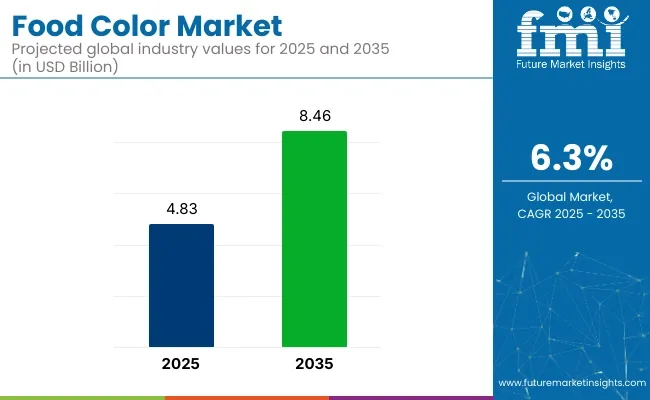

The global food color market is projected to grow from USD 4.83 billion in 2025 to USD 8.46 billion by 2035, registering a compound annual growth rate (CAGR) of 6.3% during the forecast period. This growth is driven by the increasing demand for clean-label products, the rising consumer preference for natural ingredients, and the expanding application of food colorants in various food and beverage products.

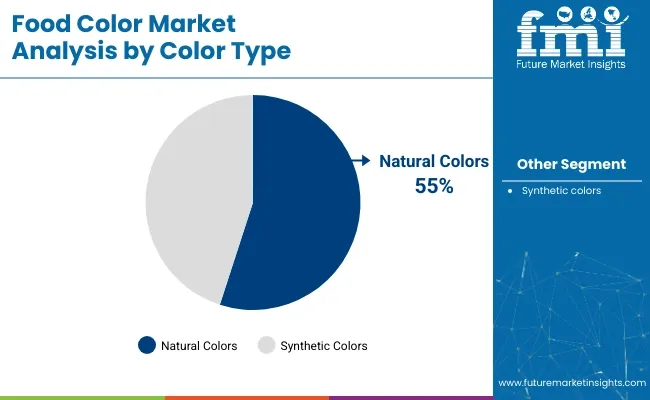

The global food color market is set to expand at a CAGR of 6.3% from 2025 to 2035, with the market size increasing from USD 4.83 billion in 2025 to USD 8.46 billion by 2035. Natural food colors are anticipated to dominate, capturing 55% of the market share by 2025.

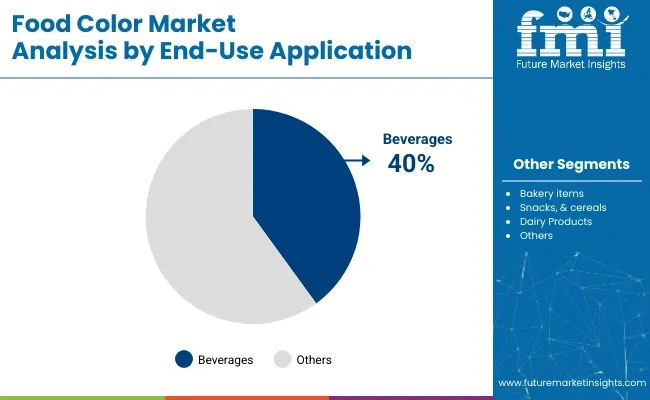

Beverages will represent 40% of the market share, fueled by rising consumer demand for clean-label ingredients. The USA food color market is expected to lead global growth, with a 5.6% CAGR. Sensient Colors LLC will remain the market leader, holding a 15% share of the global food color market.

Leading dyemakers like Sensient Technologies Corp. are pioneering the shift from artificial to natural food colorants. Dave Gebhardt, Senior Technical Director at Sensient, emphasized in 2024, “Most of our customers have decided that this is finally the time when they’re going to make that switch to a natural color.”

Sensient is advancing sustainable solutions, leveraging beet juice and black carrot to replace synthetic dyes in a wide range of food products. “We’re in the race to provide cleaner, safer color solutions for food manufacturers,” Gebhardt added. R&D efforts focus on enhancing color stability and meeting consumer demand for cleaner ingredients.

Natural colors will dominate with a 55% market share, while beverages will lead end-use applications with a 40% market share in 2025, driven by increasing consumer preference for clean-label products and natural ingredients.

Natural colors are projected to capture 55% of the global food color market share by 2025.

The beverages segment is expected to hold 40% of the end-use market share in 2025.

The food color market is shifting towards natural alternatives, driven by growing consumer demand for clean-label products and sustainability. This transition is reshaping the industry, with manufacturers seeking innovative solutions to meet evolving demands.

Recent Trends in the Food Color Industry

Challenges in the Food Color Industry

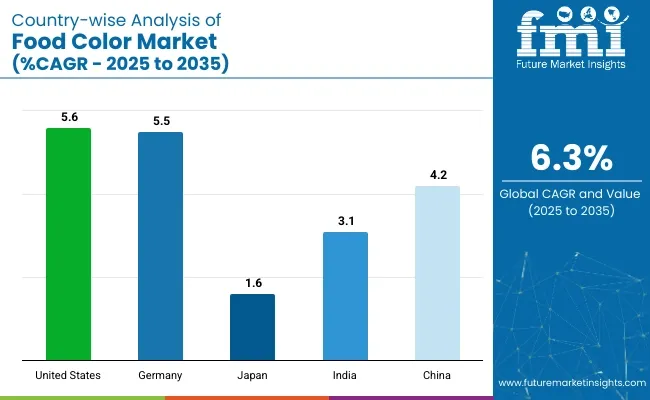

The global food color market is expanding, driven by increasing demand for vibrant food products and innovations in colorant technologies. Countries like the United States, Germany, China, the United Kingdom, and India are contributing significantly to market growth.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

| Germany | 5.5% |

| Japan | 1.6% |

| India | 3.1% |

| China | 4.2% |

The USA food color market is expected to grow at a CAGR of 5.6% from 2025 to 2035, driven by the increasing preference for visually appealing and health-conscious food products.

Germany’s food color market is projected to grow at a CAGR of 5.5% from 2025 to 2035, supported by the country’s strong food and beverage industry.

Japan’s food color market is expected to grow at a slower pace, with a projected CAGR of 1.6% from 2025 to 2035, shaped by consumer preferences for traditional food colors and high-quality ingredients.

India’s food color market is projected to grow at a CAGR of 3.1% from 2025 to 2035, supported by the increasing demand for processed foods, beverages, and packaged snacks.

China’s food color market is expected to grow at a CAGR of 4.2% through 2035, driven by the country’s rapidly expanding food and beverage sector.

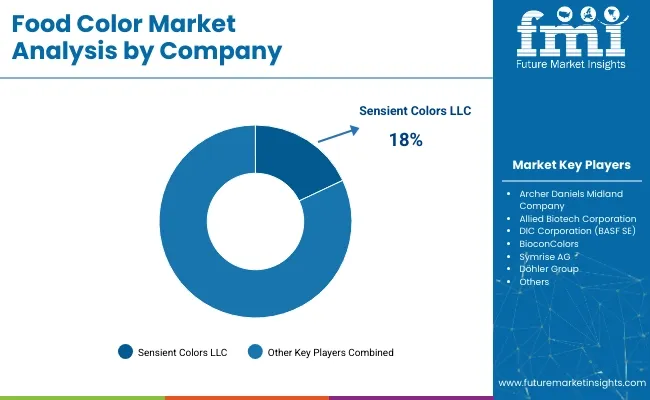

Market Leader : Sensient Colors LLC- 18%

The global food color market is shaped by key players across different tiers. Tier 1 players like Archer Daniels Midland (ADM), DIC Corporation, and Symrise AG dominate with vast production capabilities and global presence. Their strategies include product innovation, such as Symrise's natural food colors and DSM's bio-based alternatives, along with strategic acquisitions like DIC's purchase of BASF SE's food ingredients division.

Mid-tier players, such as Kalsec Inc. and GNT International B.V., focus on niche markets and sustainability. GNT leads with its EXBERRY line of plant-based colors, while Kalsec offers customized color solutions for specific applications.

Smaller players, like BioconColors and Naturex S.A., cater to regional markets and emphasize natural, customized solutions. The market features high entry barriers due to capital intensity and regulatory hurdles. While larger players consolidate, smaller firms focus on innovation and sustainable, clean-label products.

Recent Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 4.83 billion |

| Projected Market Size (2035) | USD 8.46 billion |

| CAGR (2025 to 2035) | 6.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Color Type Segments Analyzed | Natural Colors (Beta Carotene, Carmine, Black Carrot Concentrated Juice, Grape Skin Red/Anthocyanidin, Lutein, Turmeric, Red Beet, Malt Extract, Spirulina), Synthetic Colors |

| End-Use Application Segments Analyzed | Beverage (milk drinks & milk alternatives, alcoholic beverages, carbonates, sports drinks, coffee & cocoa, tea, energy drinks), Bakery, Snacks, & Cereal (breakfast cereal, bread, cakes & pastries, cookies, biscuits & cones), Dairy, Fruit Preparations & Fillings, Meat, Poultry, Fish & Eggs, Sauces, Soups & Dressings, Seasonings, Pet Food |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, UAE, South Africa |

| Key Players Influencing the Market | Archer Daniels Midland Company, Allied Biotech Corporation, DIC Corporation (BASF SE), BioconColors, Symrise AG, Döhler Group, GNT International B.V., Kalsec Inc., DSM, Naturex S.A., Sensient Colors LLC |

| Additional Attributes | Dollar sales growth by color type (natural vs. synthetic), application-specific demand trends, regional adoption rates, key player market shares, emerging consumer preferences for natural colors, regulatory trends, and product innovation. |

The market is divided into natural colors (Beta Carotene, Carmine, Black Carrot Concentrated Juice, Grape Skin Red/Anthocyanidin, Lutein, Turmeric, Red Beet, Malt Extract, Spirulina) and synthetic colors.

The market is categorized into beverages (milk drinks & milk alternatives, alcoholic beverages, carbonates, sports drinks, coffee & cocoa, tea, energy drinks), bakery items, snacks, & cereals (breakfast cereals, bread, cakes & pastries, cookies, biscuits & cones), dairy products, fruit preparations & fillings, meat, poultry, fish & eggs, sauces, soups & dressings, seasonings, and pet food.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia and the Pacific, East Asia, and the Middle East & Africa.

The global food color market is expected to grow from USD 4.83 billion in 2025 to USD 8.46 billion by 2035, with a CAGR of 6.3%.

Natural colors are projected to capture 55% of the market share, while beverages will dominate end-use applications, holding a 40% share by 2035.

The United States is expected to experience the fastest growth in the food color market, with a CAGR of 5.6%.

Sensient Colors LLC is the market leader, holding a 18% share of the global food color market.

The growth of the food color market is driven by the increasing demand for natural colors, the expansion of the beverage sector, and innovations in colorant technology.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food and Beverages Color Fixing Agents Market Analysis by Product Type, Application and Region through 2035

Natural Food Colors Market Analysis - Size, Share, and Forecast 2025 to 2035

Caramel Food Colors Market Growth - Applications & Demand 2025 to 2035

Betanin Food Color Market Insights - Natural Pigments & Industry Demand 2024 to 2034

Coloring Foodstuffs Market Insights – Natural Pigments & Growth 2025 to 2035

Curcumin Food Color Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Lycopene Food Colors Market Growth Share Trends 2025 to 2035

Synthetic Food Color Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

GCC Natural Food Color Market Growth – Trends, Demand & Innovations 2025–2035

Anthocyanin Food Colors Market Analysis by Source, Form, and End Use Industry

Plant-Based Food Colors Market Growth - Types & Solubility Trends

ASEAN Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

Japan Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

Titanium-Free Food Color Market Analysis - Size, Share & Forecast 2025 to 2035

Titanium-Free Food Color Alternatives Market

Germany Natural Food Color Market Growth – Trends, Demand & Innovations 2025–2035

Aluminum-free Natural Food Color Market Size and Share Forecast Outlook 2025 to 2035

United States Natural Food Color Market Trends – Growth, Demand & Forecast 2025–2035

United Kingdom Natural Food Color Market Outlook – Share, Growth & Forecast 2025–2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA