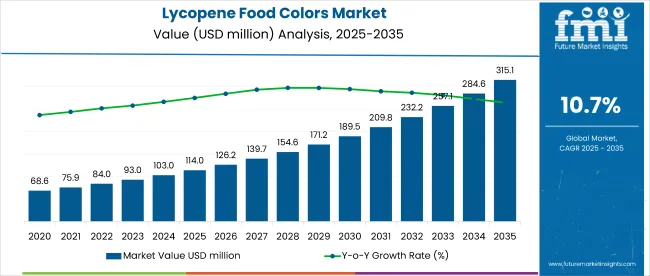

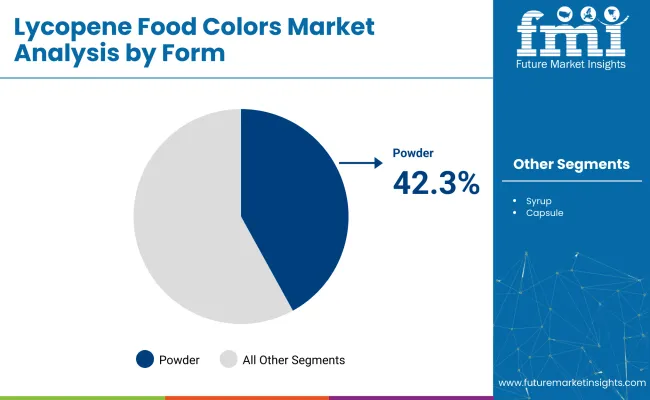

The global Lycopene Food Colors Market is valued at USD 114 million in 2025 and is projected to reach USD 314.9 million by 2035, registering a CAGR of 10.7%. In 2025, lycopene accounted for 2.4% of the USD 4.83 billion global food-colors market. Powder form holds the largest share at 42.3%, dairy food products led applications with 17.3%, and North America was the most lucrative market with a 38.6% revenue share.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 114 million |

| Market Value (2035) | USD 314.9 million |

| CAGR (2025 to 2035) | 10.7% |

Lycopene’s unit economics are shaped by a few high-impact cost centers. Raw material, typically tomato pomace accounts for just 10-15% of COGS, especially when secured through long-term contracts during seasonal gluts. The bulk of expenses lie in solvents and utilities (30-35%), where supercritical CO₂ offers greener extraction but demands high capex, while hybrid ethanol/hexane remains the cost-effective standard.

Purification and formulation contribute another 25-30%, with trade-offs between inline crystallization and column chromatography. QA and compliance (5-8%) add further pressure due to 24-month shelf-life testing. Gross margins vary widely commodity players hover around 25-30%.

The push for cleaner, label-friendly alternatives in food coloring is accelerating, especially as California’s ban on Red-3 and Red-40 takes effect in 2027. This regulatory shift, alongside FDA’s renewed scrutiny of synthetic dyes, has prompted brands to urgently seek replacements that don’t trigger consumer alarm. Lycopene, derived from tomatoes, has emerged as a go-to red colorant.

Unlike carmine, which is insect-derived and often flagged by health-conscious or vegan consumers, lycopene enables brands to label their products with more familiar, plant-based terms like “tomato lycopene,” aligning with the clean-label trend. In a 2025 USA survey done by Future Market Insights as part of its consumer trends report, 60% of shoppers expressed a clear preference for natural colors, and similar consumer expectations are growing across Europe.

Beyond its visual appeal, lycopene offers a marketing edge with its antioxidant halo. Backed by clinical studies supporting cardiovascular and skin health, lycopene fits perfectly into the “color plus function” positioning that many wellness brands are adopting. In the USA, claiming antioxidant benefits can quickly cross into legally risky territory. While structure/function claims are allowed, implying disease prevention (e.g., “reduces cancer risk”) requires robust human data and is tightly regulated by the FDA. Brands walking this line must ensure airtight compliance to avoid regulatory blowback.

Lycopene may ride the clean-label wave today, but its competitive landscape is shifting fast. Beetroot and black-carrot anthocyanins offer cost advantages, though their muted tones and instability in dairy limit broad adoption. Carmine delivers vibrancy and performance, but faces mounting pressure due to its insect origin and rising prices, especially from vegan and natural-product segments. Corn-derived anthocyanins like Amaize® are emerging as a middle ground, offering better stability and avoiding the supply-chain volatility tied to tomato-derived pigments.

The real disruption is brewing elsewhere. Precision-fermented red pigments, like those engineered from Yarrowia yeast are advancing rapidly. These biotech innovations are designed to replicate Red-40’s bold hue with clean-label credentials and far greater efficiency, using half the dosage to achieve the same effect.

The segmentation has been segmented into Nature; Organic; Conventional; by Application; Confectionery and Bakery Products; Beverages; Packaged Food/Frozen Products; Dairy Food Products; Cosmetics; Dietary Supplements; Others; by Form; Powder; Capsule; Syrup; and by Region; North America; Latin America; Western Europe; Eastern Europe; Balkans & Baltic; Russia & Belarus; Central Asia; East Asia; South Asia & Pacific; Middle East & Africa.

The conventional segment is expected to lead the Lycopene Food Colors Market in 2025, capturing 55% of total revenues, while organic accounts for the remaining 45%. This dominance has been driven by growing consumer preference for clean-label ingredients and tighter regulatory scrutiny of artificial dyes, which has reinforced lycopene’s positioning as a naturally derived pigment.

Market entry barriers have been lowered for Natural formulations through more streamlined approval pathways in key regions, whereas Synthetic variants are increasingly viewed as subject to potential future restrictions. Accordingly, investments have been steered toward scaling up organic extraction and refining techniques, ensuring that natural-color offerings remain both cost-competitive and compliant with evolving food-safety mandates.

Beverages are projected to command the largest share of the Lycopene Food Colors Market in 2025, accounting for 40% of total revenues. This leadership has been underpinned by the surge in demand for visually appealing, health-oriented drinks, where lycopene’s antioxidant properties dovetail with consumer clean-label expectations.

Natural formulations have secured 38.8% of the beverage subsegment, reflecting regulatory encouragement of plant-derived colorants, while synthetic variants hold 28.0%, constrained by potential future restrictions. Investments have therefore been focused on optimizing extraction and stabilization methods tailored to beverage applications, ensuring color consistency and shelf-life stability in high-volume production environments.

Powder format is set to dominate the Lycopene Food Colors Market in 2025, securing a 42.3% share of total revenues, while other forms such as capsule and syrup remain secondary. This preference has been driven by powder’s superior stability, ease of handling and dosage precision, which align with large-scale production and clean-label requirements.

Investments have been prioritized toward improving powder microencapsulation and flow properties to enhance solubility and color consistency across diverse applications, whereas liquid and capsule formats continue to face challenges related to shelf-life and formulation complexity.

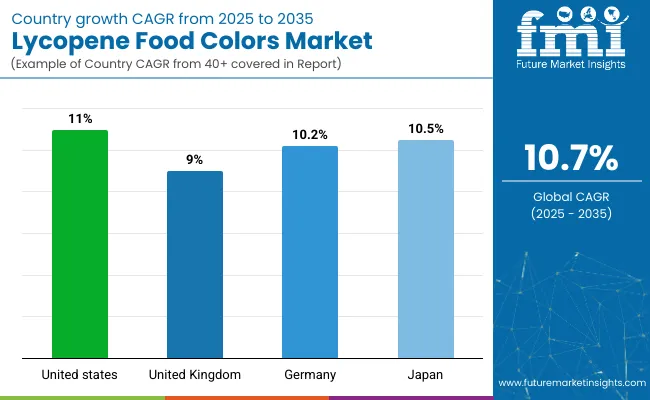

The USA lycopene food-colors category is the growth pacesetter: from USD 44 million in 2025 it is expected to touch roughly USD 125 million by 2035, compounding at about 11 percent a year. Production economics remain tight, extraction and processing soak up 24 percent of costs and stability-related waste adds another eight, but regulatory momentum is on the brand side.

Five FDA GRAS notifications cleared in 2024 have opened the door for a wave of functional-food launches, while natural pigments already command 12 percent of food-color shelf space. A decisive 68% of USA shoppers now screen for clean-label claims, so brands that marry “raw, with the mother” storytelling to tight cost control are poised to take share.

The UK market sits at a much smaller base-USD 7.5 million in 2025-and is forecast to reach only about USD 17.8 million by 2035, a steadier 9%CAGR. Two Novel Foods approvals for pomace-derived lycopene in 2024 prove the science is acceptable, and online channels already capture 14 percent of national sales. Yet retailers continue to push private-label naturals and cost-of-living pressures are keeping price-elastic shoppers cautious. Clean-label sentiment is solid (64 percent), but velocity will hinge on brands positioning lycopene as a functional upgrade rather than a premium décor ingredient.

Germany’s demand-USD 9.2 million in 2025-should climb to roughly USD 24.3 million by 2035, translating into a 10.2 percent compound rate. EFSA’s rigorous oversight keeps safety barriers high, but it also grants credibility that helps lycopene migrate into nutraceutical powders and cosmetics. Producers are experimenting with micro-encapsulation and pomace-extraction pilots to cut waste and boost heat stability, yet most remain at pilot scale. With 69 percent of German consumers favouring natural colours, the real unlock will be proving lycopene’s functional benefits beyond hue-think antioxidant positioning in gummies or beauty-from-within shots.

Japan starts at USD 6.8 million in 2025 and is projected to reach about USD 18.5 million by 2035, a 10.5% CAGR that balances demographic headwinds against innovation tail-winds. Two PMDA approvals for novel lycopene formulations in 2024 have energised R&D, and e-commerce already accounts for 11 percent of national lycopene-colour turnover.

Extraction and processing still absorb 24 percent of production spend while stability losses bite another 7 percent, so suppliers are exploring beadlet formats and electrolyte-fortified “beauty vinegar” drinks to justify a margin premium. Roughly 66%of Japanese consumers report a clean-label bias-enough to sustain double-digit growth if brands keep pushing functional cross-overs into RTD tonics and on-the-go gummies.

The lycopene food colors market is moderately consolidated, with a handful of key players dominating global production and formulation. These players operate across the entire value chain from raw material sourcing (primarily tomato pomace) to extraction, formulation, and blending into food-grade solutions.

Competitive Moats

Emerging Entrants

Fermentation startups (e.g., using engineered Yarrowia lipolytica or E. coli) are entering the scene with synthetic biology-based lycopene. These players aim to offer purer, cheaper, and scalable alternatives-especially appealing to formulators chasing clean-label + precision control.

| Attribute | Details |

|---|---|

| Market Size (2025) | USD 114 million |

| Market Size (2035) | USD 314.9 million |

| CAGR (2025 to 2035) | 10.7% |

| Base Year | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Report Coverage | Market size, growth rate, segmentation, competitive landscape, regulatory trends, and innovation pipeline |

| Units | USD Million |

| Segments Covered | Nature, Application, Form, Region |

| By Nature | Conventional, Organic |

| By Application | Confectionery and Bakery Products, Beverages, Packaged/Frozen Food, Dairy Food Products, Cosmetics, Dietary Supplements, Others |

| By Form | Powder, Capsule, Syrup |

| By Region | North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, Middle East & Africa |

| Top Countries Covered | United States, United Kingdom, Germany, Japan |

| Key Companies Profiled | DSM-Firmenich, BASF SE, DDW (Kerry Group), LycoRed (IFF), EID Parry |

| Data Sources | FMI primary surveys, secondary research, FDA/EFSA filings, industry reports |

| Output Format | PDF, Excel Sheet, Dashboard (on request) |

As per nature, the industry has been categorized into Organic and Conventional.

As per Application, the industry has been categorized into Confectionery and Bakery Products, Beverages, Packaged Food/Frozen Products, Dairy Food Products, Cosmetics, Dietary supplements and Others.

This segment is further categorized into Powder, Capsule and Syrup.

Industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The lycopene food colors market is expected to reach USD 314.9 million by 2035, growing at a CAGR of 10.7%.

Powder form leads the lycopene food colors market with a 42.3% share in 2025 due to its stability and ease of use.

The lycopene food colors market is growing due to clean-label trends, regulatory bans on synthetic dyes, and consumer preference for natural ingredients.

Beverages account for the largest application segment in the lycopene food colors market with a 40% revenue share in 2025.

North America dominates the lycopene food colors market, holding a 38.6% share in 2025, driven by strong clean-label demand.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Natural Food Colors Market Analysis - Size, Share, and Forecast 2025 to 2035

Caramel Food Colors Market Growth - Applications & Demand 2025 to 2035

Anthocyanin Food Colors Market Analysis by Source, Form, and End Use Industry

Plant-Based Food Colors Market Growth - Types & Solubility Trends

Demand for Caramel Food Colors in Japan Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA