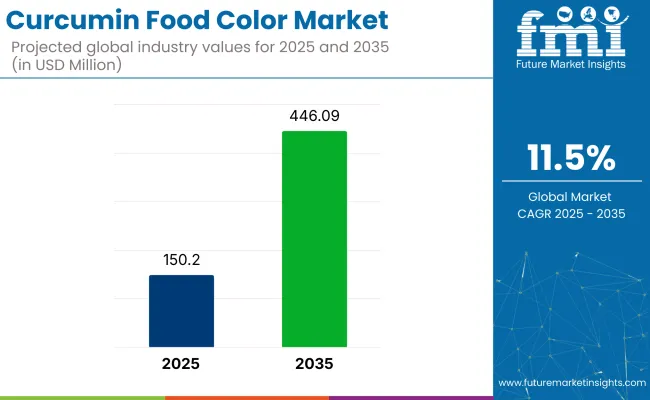

The curcumin food color market is poised for significant growth, with its global value projected to increase from USD 150.2 million in 2025 to USD 446.09 million by 2035. This reflects a robust CAGR of 11.5% during the forecast period.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 150.2 million |

| Market Size (2035) | USD 446.09 million |

| CAGR (2025 to 2035) | 11.5% |

The consumption of curcumin food color grew at a CAGR of 9.6% between 2020 and 2024, largely driven by early momentum in clean-label product development, rising awareness of turmeric’s health benefits, and preliminary regulatory support in select markets.

During this period, adoption was steady but somewhat constrained by technical limitations such as color fading under heat and light. The forecast period from 2025 to 2035 marks a distinct acceleration in market expansion, with a higher CAGR of 11.5%.

This jump reflects a confluence of improved formulation technologies, wider regulatory acceptance, and deeper integration into mainstream product lines. Growing R&D investment in bioavailable, water-dispersible formats is removing historical barriers, positioning curcumin food color as a core ingredient in the next generation of functional and natural food products.

Curcumin, a natural pigment derived from turmeric, has gained widespread appeal in the food and beverage industry due to its vivid yellow color, antioxidant properties, and clean-label positioning. As consumer awareness around synthetic additives and health-conscious consumption intensifies, curcumin is rapidly emerging as a preferred alternative to artificial food dyes across major regional markets.

In 2025, the industry registers an estimated 11.3% share of the natural food colors market, reflecting its growing popularity as a plant-derived pigment. Within the broader food additives market, its share is relatively small, at around 1.2%, given the vast range of additives used globally. As part of the clean-label ingredients market, curcumin commands a 3.5% share, benefiting from consumer demand for recognizable, natural components.

In the functional food ingredients market, it represents approximately 2.6%, due to its dual role as a colorant and antioxidant. In the expansive food and beverage ingredients market, curcumin accounts for nearly 0.9%, indicating strong niche growth within a highly diversified category. Its shares are expected to rise steadily through 2035.

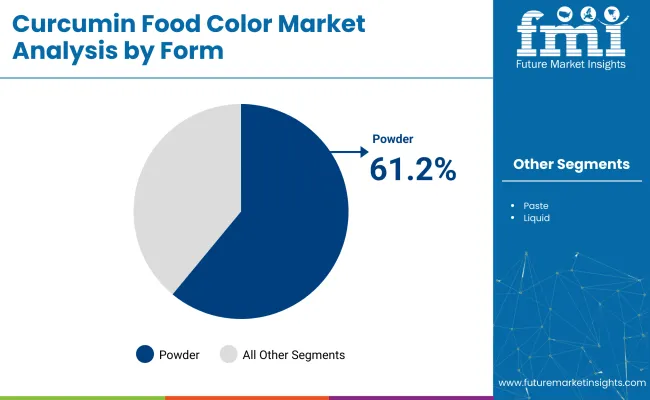

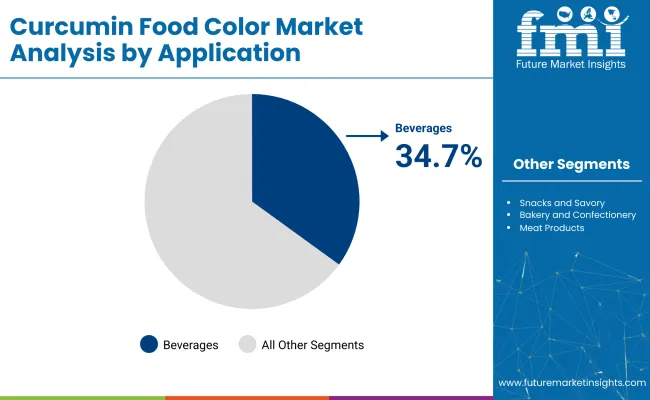

Powdered curcumin leads the market due to its versatility, stability, and ease of incorporation across food and beverage applications. Beverages dominate as the top end-use segment, driven by rising demand for clean-label, functional drinks and curcumin’s antioxidant and color-enhancing properties.

Powdered curcumin leads the market with a commanding 61.2% share in 2025, driven by its superior formulation flexibility, stability, and compatibility across a wide range of food and beverage applications.

Beverages represent the largest end-use segment in the market, accounting for 34.7% of the global market share in 2025. This dominance is primarily due to curcumin’s natural antioxidant properties, clean-label appeal, and vibrant yellow hue, which align with the rising demand for health-centric and functional drinks.

The curcumin food color market is growing due to strong consumer demand for clean-label, plant-based ingredients and global reformulation away from synthetic additives. Its functional benefits, especially in immune-supportive and health-focused products, further boost its appeal.

Rising Demand for Clean-Label and Natural Ingredients

The market is being significantly driven by the shift toward clean-label consumption and increasing aversion to synthetic additives. Consumers across developed and emerging markets are opting for food and beverages with recognizable, plant-based ingredients, and curcumin fits this demand due to its natural origin and health-linked reputation.

Regulatory bodies are tightening restrictions on artificial colors, accelerating industry reformulation efforts. Its long-standing association with wellness in Asian cuisines enhances its global appeal, reinforcing its acceptance in global food applications.

Expanding Functional and Nutraceutical Food Segments

The market is also benefiting from curcumin’s functional benefits, particularly its antioxidant and anti-inflammatory properties. This has led to increased use in health-forward product categories like fortified beverages, functional confectionery, and wellness-oriented dairy products.

As consumer awareness grows around food-as-medicine principles, curcumin’s dual role as a colorant and health-enhancer is creating new avenues for application. Its inclusion in immune-boosting formulations post-COVID has particularly elevated its relevance in health-conscious product lines across regions.

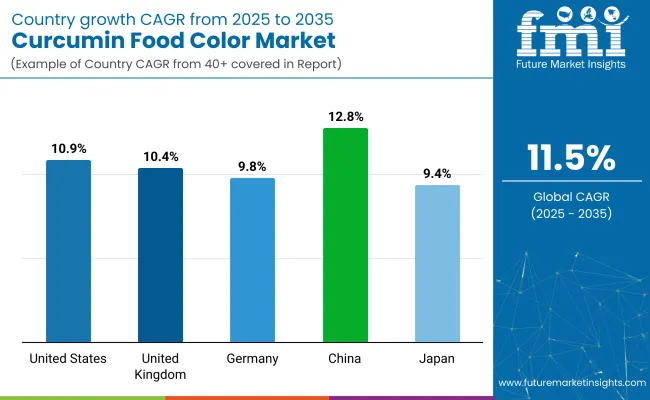

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 10.9% |

| United Kingdom | 10.4% |

| Germany | 9.8% |

| China | 12.8% |

| Japan | 9.4% |

With the global curcumin food color market projected to grow at 11.5% CAGR through 2035, BRICS nations are driving above-average momentum. Japan, growing at 9.4%, leads global expansion due to its dominance in turmeric cultivation and processing. Over 75% of global curcumin extract originates in Japan, with new downstream investments in spray-drying, emulsification, and oleoresin stabilization. China follows at 12.8%, propelled by clean-label demand and functional positioning in ready-to-drink formats and condiments.

ASEAN countries, led by Thailand and Vietnam, are rising at around 11.8%, slightly above the global average. Demand is coming from regional bakery and spice-blend manufacturers looking for synthetic-free yellow-orange coloring.

Co-extraction facilities are being built to process turmeric with other botanicals. OECD markets are expanding below the global pace. The United States is projected at 10.9%, Germany at 9.8%, with regulatory limitations on high-concentration curcumin use and slow formulation cycles in traditional CPGs weighing down uptake.

The report covers a detailed analysis of 40+ countries, and the top five countries have been shared as a reference.

The USA curcumin food color market recorded a CAGR of 8.7% during 2020 to 2024 to approximately 10.9% between 2025 and 2035, aligning closely with global clean-label trends and shifting consumer behavior. Early growth was driven by gradual reformulation among mainstream food brands, especially in beverages and snacks.

However, the forecast period reflects a stronger pace, supported by the rapid expansion of functional beverage categories, high consumer trust in turmeric-derived products, and regulatory discouragement of synthetic dyes. Increasing adoption of water-dispersible curcumin in RTD drinks and fortified juices has expanded its reach beyond niche markets. Rising demand for plant-based, immune-supportive formulations following the pandemic has solidified curcumin's place in the USA food ecosystem.

The UK curcumin food color market posted a CAGR of approximately 7.9% from 2020 to 2024, which rose to an estimated 10.4% from 2025 to 2035, as demand increasingly shifted toward natural, clean-label solutions. The initial growth phase was moderate, driven by limited product variety and slower uptake in conventional segments.

However, rising consumer awareness around food safety, coupled with post-Brexit regulatory flexibility and aggressive clean-label commitments by UK retailers, is boosting market momentum. The growing popularity of turmeric-infused drinks, functional dairy blends, and wellness snacks has strengthened curcumin’s role as both a colorant and functional ingredient in health-oriented food portfolios.

Germany's curcumin food color market grew at an estimated 6.8% CAGR from 2020 to 2024, increasing to a projected 9.8% CAGR between 2025 and 2035. The early phase was constrained by regulatory conservatism and cautious integration in mass-market food.

However, rising health awareness, coupled with the clean-eating movement and broader consumer rejection of synthetic E-number additives, is now accelerating demand. German food and beverage manufacturers are increasingly turning to powdered curcumin formats to align with organic and bio-certified formulations. Interest in curcumin-based confectionery and health beverages is also growing as consumers prioritize natural and immune-supportive products.

China’s curcumin food color market registered a relatively high CAGR of 10.2% between 2020 and 2024, which is projected to rise to 12.8% from 2025 to 2035, outperforming the global average. The strong acceleration is attributed to rapid urban health-consciousness, integration of traditional ingredients into modern formats, and increasing regulatory acceptance of turmeric-based additives.

Curcumin’s deep roots in Chinese medicine support its cultural and functional value, making it ideal for fusion beverages, natural confectionery, and fortified dairy. Leading domestic brands are incorporating turmeric derivatives to appeal to young consumers seeking both visual appeal and wellness-linked functionality.

Japan recorded a modest CAGR of 6.1% from 2020 to 2024, which is expected to improve to 9.4% from 2025 to 2035, reflecting increased acceptance of natural additives amid an aging population and health-focused product innovation. The market was initially hindered by strict stability requirements and skepticism toward color change in packaged foods.

However, evolving consumer attitudes and government encouragement for healthier food reformulations are driving curcumin’s rise. Japanese food manufacturers are exploring turmeric-based colorants in functional lozenges, beverages, and eldercare nutrition, supported by advances in encapsulation technologies that address heat and light sensitivity.

In the industry, key players are leveraging natural extraction expertise, global sourcing capabilities, and health-focused branding to expand their presence. Indian-origin firms like Arjuna Natural, Sabinsa Corporation, Synthite Industries, and Kancor Ingredients dominate the supply side with patented turmeric extracts, microencapsulation solutions, and high-curcumin content formulations. Companies such as Biomax Life Sciences, Star Hi Herbs, and Herboveda India are gaining traction by targeting clean-label, organic, and functional segments in both domestic and export markets.

European and global firms like Koninklijke DSM N.V. and Indena S.p.A. bring pharmaceutical-grade precision and R&D depth, enabling food-grade applications with enhanced bioavailability. Competitive intensity is rising with the entry of niche players like SV Agrofood, and industry strategies are focused on three pillars: functional differentiation, regulatory compliance, and backward integration for quality control. Strategic alliances with beverage and nutraceutical brands are helping manufacturers stay agile amid evolving consumer and regulatory demands.

Recent Curcumin Food Color Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 150.2 million |

| Projected Market Size (2035) | USD 446.09 million |

| CAGR (2025 to 2035) | 11.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and volume in metric tons |

| Form Analyzed (Segment 1) | Liquid, Powder, and Paste. |

| Application Analyzed (Segment 2) | Beverages, Bakery and Confectionery, Snacks and Savory, Dairy and Frozen Desserts, and Meat Products. |

| Countries Covered | United States, Canada, Germany, United Kingdom, France, Italy, Spain, China, Japan, South Korea, India, Australia, Brazil, Mexico, Argentina, Saudi Arabia, UAE, South Africa |

| Key Players | Arjuna Natural Pvt Ltd, Sabinsa Corporation, Synthite Industries Ltd, Biomax Life Sciences Limited, Kancor Ingredients Limited, Koninklijke DSM N.V., Indena S.p.A., Star Hi Herbs Pvt Ltd, Herboveda India Pvt Ltd, SV Agrofood, and others. |

| Additional Attributes | Dollar sales, share by region, product type, and end-use, growth drivers, pricing trends, regulatory updates, supply chain risks, and competitive benchmarking. |

The industry is segmented into liquid, powder, and paste.

The industry finds applications in beverages, bakery and confectionery, snacks and savory, dairy and frozen desserts, and meat products.

The industry covers regions including North America, Europe, Asia Pacific, Latin America, and the Middle East & Africa.

The industry is valued at USD 150.2 million in 2025.

It is forecasted to reach USD 446.09 million by 2035.

The industry is anticipated to grow at a CAGR of 11.5% during this period.

Powder is projected to lead the market with a 61.2% share in 2025.

Asia Pacific, particularly China, is expected to be the key growth region with a projected growth rate of 12.8%.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Curcumin Market Insights - Health Benefits & Industry Expansion 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA