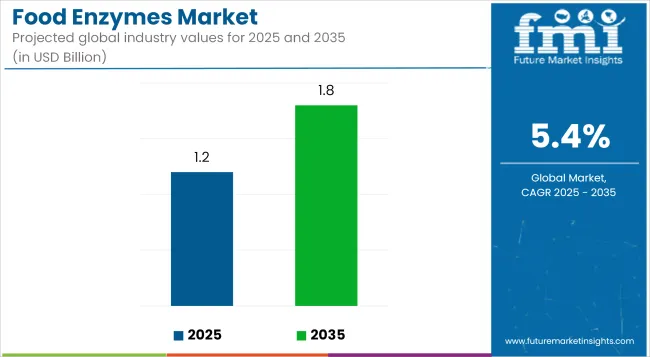

The food enzyme market is projected to expand significantly between 2025 and 2035. A market value of USD 1.2 billion is expected in 2025, and this figure is forecasted to reach USD 1.8 billion by 2035. A CAGR of 5.4% is anticipated during this period.

This growth is being driven by increasing consumer preference for natural and clean-label food ingredients. Enhanced food quality, safety, and processing efficiency have been enabled by the widespread use of food enzymes. Their demand is being supported by a shift toward healthier and more sustainable food production methods.

| Attributes | Description |

|---|---|

| Estimated Global Industry Size (2025E) | USD 1.2 Billion |

| Projected Global Industry Value (2035F) | USD 1.8 Billion |

| Value-based CAGR (2025 to 2035) | 5.4% |

Among various product segments, the carbohydrase category is expected to be the largest in 2025, capturing an estimated 41.5% of the total market share. Its dominance is attributed to its extensive application in sectors such as baking, brewing, and dairy processing. In terms of application, the meat processing segment is predicted to be led by proteases, which are expected to account for a 37.2% share.

The ability of proteases to tenderize meat and improve texture has made them widely adopted across global meat industries. Technological advancements in enzyme formulation and processing are being utilized to improve performance and stability, making these enzymes increasingly viable for industrial-scale applications.

A key role is being played by Novonesis, the biosolutions company formed by the 2024 merger of Novozymes and Chr. Hansen. Under the leadership of CEO Ester Baiget-who also serves as vice-chair of The B Team-multiple breakthrough innovations have been introduced.

In May, Cell-Tech, a nitrogen-fixing bacteria developed with Andermatt Group AG, was launched to improve soybean yields in Southern and Eastern Africa. Additionally, Luminous, a non-petroleum-based detergent enzyme that maintains fabric whiteness, and enzyme-based plastic recycling solutions in partnership with Carbios, are being deployed to address both environmental and industrial demands.

Lipases are projected to account for approximately 12.3% of the global food enzyme market share by 2025, with expected gains in cheese ripening, flavor development, and lipid processing sectors.

While historically overshadowed by carbohydrases and proteases, lipases are becoming critical in dairy maturation, particularly in enhancing free fatty acid release during cheese aging. This improves flavor intensity and authenticity in premium cheese segments. Firms like Chr.

Hansen and DSM-Firmenich have expanded microbial lipase offerings, including thermostable variants suitable for high-fat bakery and confectionery matrices. Regulatory flexibility-such as EFSA's approval for microbial lipases derived from Aspergillus oryzae-is further enabling innovation across EU markets. In Southeast Asia, lipases are gaining traction in coconut and palm-based applications for fat fractionation and specialty oil synthesis.

Precision lipase use is also being explored for flavor encapsulation in savory snacks, where it aids lipid breakdown under controlled conditions to release aroma compounds. Recent R&D indicates potential use in reducing trans fats by catalyzing healthier lipid structures.

As the fat reformulation trend accelerates globally, particularly in plant-based dairy alternatives, demand for functional lipase blends is expected to rise sharply. By 2035, lipase-driven enzyme systems may serve as key levers in clean-label fat modification strategies, particularly in functional and gourmet food niches.

Multienzyme complexes are anticipated to reach 9.8% of the global food enzymes market share by 2025, primarily driven by their role in nutritional enhancement and functional food production.

Rather than targeting a single substrate, tailored enzyme blends-including combinations of amylase, cellulase, phytase, and xylanase-are being deployed to unlock bound nutrients in whole grains, legumes, and plant-based flours. Key players such as Novozymes and Biocatalysts Ltd. are commercializing customizable blends for soluble fiber generation, mineral bioavailability, and anti-nutrient degradation. For example, phytase-rich complexes are now integral to cereal and granola fortification in European markets due to their role in breaking down phytic acid, enhancing iron and zinc uptake.

The European Food Safety Authority (EFSA) has approved specific enzyme-based nutritional claims under Regulation (EC) No 1924/2006 when paired with validated efficacy studies. Enzyme systems are also seeing integration into high-protein functional beverages to enhance digestibility, especially for older adults and sports recovery segments. Granular formats that retain stability across pH and thermal ranges are being adopted for ready-to-drink (RTD) applications.

By 2035, demand for fortified food applications-especially in aging, vegan, and metabolic health categories-will push enzyme companies to offer next-gen blends with proven bioactive conversion capabilities, serving both functional and regulatory performance standards.

Demand for Processed Food is Driving the Market Growth

Due in large part to the expanding economies of the Asian continent the demand for processed foods is rising globally. The two main countries propelling the processed food markets notable expansion are China and India. An increasingly busy lifestyle rising disposable incomes and an expanding middle class all contribute to the markets expansion.

Applications of food enzymes increase the final products freshness extending the convenience foods shelf life while maintaining their texture color and flavor.

Tier 1 companies comprises industry leaders acquiring a 55% share in the global business market. These leaders are distinguished by their extensive product portfolio and high production capacity. These industry leaders stand out due to their broad geographic reach, in-depth knowledge of manufacturing and reconditioning across various formats and strong customer base.

They offer a variety of services and manufacturing with the newest technology while adhering to legal requirements for the best quality.

Tier 2 companies comprises of mid-size players having a presence in some regions and highly influencing the local commerce and has a market share of 30%. These are distinguished by their robust global presence and solid business acumen. These industry participants may not have cutting-edge technology or a broad global reach but they do have good technology and guarantee regulatory compliance.

Tier 3 companies comprises mostly of small-scale businesses serving niche economies and serving at the local presence having a market share of 15%. Due to their notable focus on meeting local needs these businesses are categorized as belonging to the tier 3 share segment, they are minor players with a constrained geographic scope.

As an unorganized ecosystem Tier 3 in this context refers to a sector that in contrast to its organized competitors, lacks extensive structure and formalization.

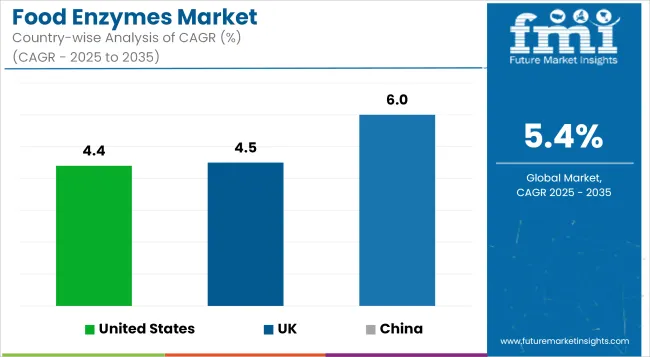

The following table shows the forecasted growth rates of the significant three geographies revenues. USA, UK and China come under the exhibit of high consumption, recording CAGRs of 4.4%, 4.5% and 6.0%, respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| United States | 4.4% |

| UK | 4.5% |

| China | 6.0% |

It is projected that the food enzyme market in the USA will grow over the course of the evaluation. Rising trends in health and wellness an increase in the demand for convenience foods and the growing acceptance of specialty enzymes are all responsible for this.

Consumers are placing a greater emphasis on their health and well-being which is driving up demand for clean-label and natural products. The use of food enzymes is therefore anticipated to rise since they are frequently seen as natural and less hazardous than chemical additives. Foods with digestive health benefits are also in high demand among American consumers.

Thus, in the countrys functional food and dietary supplement industries enzymes such as probiotics and digestive aids are gaining popularity which boosts sales.

From 2025 to 2035 food enzyme sales in China are expected to grow at a compound annual growth rate (CAGR) of 6.0%. Growing health consciousness and the expanding use of enzymes in the booming food and beverage sector are two major factors propelling this sales growth.

The food and beverage sector are expanding rapidly in China due to the country’s rapidly growing population and rising disposable incomes. As a result, it is anticipated that the nation’s food enzyme producers will have profitable growth opportunities through 2035.

Chinese food and beverage manufacturers are increasingly utilizing enzymes to improve the flavor and texture of their goods while also extending their shelf life. Food enzyme sales will therefore increase in tandem with Chinas growing demand for packaged and processed foods.

A compound annual growth rate (CAGR) of 4.5% is projected for the UK during the evaluation period. The nations expanding bakery industry high consumer spending on convenience foods and rising interest in plant-based enzymes are the main factors propelling the food enzyme markets expansion.

There is a thriving bakery sector in the UK and food enzymes are essential for enhancing the caliber and durability of baked goods. Bakers use them frequently to create high-quality bread products. Therefore through 2034 the nations rising baked goods production and consumption will be a major factor in promoting industry growth.

The food enzyme market is moderately consolidated, with Tier 1 players such as Novozymes A/S, DuPont de Nemours Inc., Kerry Group PLC, and Chr. Hansen Holding A/S commanding significant market shares. These companies lead the market due to their extensive R&D pipelines, global distribution networks, and diverse enzyme portfolios for various food processing applications.

Novozymes A/S holds a dominant position, providing enzyme solutions that improve food production efficiency and sustainability. Tier 2 players like Advanced Enzyme Technologies Ltd., Amano Enzyme Inc., and Associated British Foods plc focus on regional markets and specialized food enzyme solutions. Emerging firms such as Enzyme Development Corporation and Dyadic International are gaining traction with innovative enzyme technologies for niche food applications.

Recent Food Enzyme Industry News

The market is expected to grow at a CAGR of 5.4% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 1.8 Billion.

Demand for processed food is increasing demand for Food Enzyme.

North America is expected to dominate the global consumption.

Some of the key players in manufacturing include BASF, DowDuPont, Chr. Hansen Holding A/S and more.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Food Minerals Market Size and Share Forecast Outlook 2025 to 2035

Food And Beverage Chemicals Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA