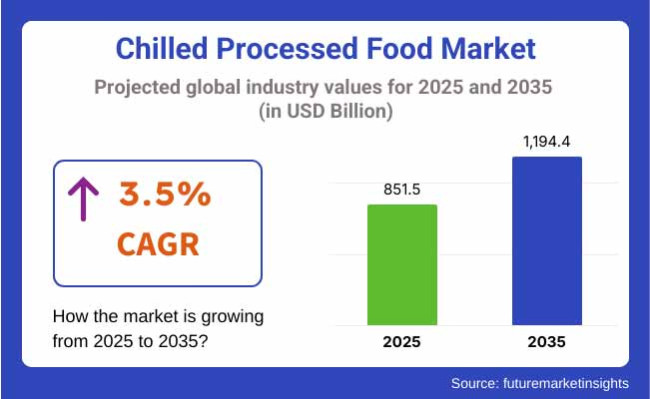

The global chilled processed food market was worth USD 776 billion in 2022, and is projected to reach USD 851.5 billion by 2025. The Market size is projected to grow from USD 832.7 Billion to USD 1,194.4 Billion by 2035 at a 3.5% CAGR.

Consumer habits that are changing, urbanization and a growing need for convenience food are enhancing the consumption of food cooked for its nutritional value without any heat being applied. There are several product classes under this industry business such as processed meat, ready meals, dairy, and baked goods that are primarily consumed at a larger scale in both developed and developing economies. Advances in cold storage and cold-chain logistics have also played a role, leading to shorter product shelf life and real-time in-store availability.

Growing dual-income households and busy lifestyles are driving the sale of easy to prepare and ready to eat meals. Clean-label food and minimally-processed food innovation speeds up because consumers are searching for better-quality, great-tasting food with fewer preservatives. In response, companies are raising the nutritional profile of their foods by reducing sodium, artificial added ingredients and bad fats, and increasing protein and fiber.

Europe and North America are the largest markets for chilled processed food, and these regions have a well-organized cold-chain infrastructure and growing consumer demand for better quality foodstuffs. Asia-Pacific especially will be a growth market as high levels of urbanization are matched with emerging middle-class consumer markets and greater disposable income.

The chill processed food is suspended in medium, in order to increase the shelf life of the food, and it is a preferred product in the Asia Pacific region, due to rapidly increasing awareness regarding food safety and convenience among consumers in countries, such as China, India, and Japan.

The importance of hypermarkets, supermarkets and on-line retailing as distribution channels for the supply chain of chilled processed foods is increasing. What happens at the end home food delivery online emerged features for the customer with respect to fresh /high quality processed food products and that too in reduced time intervals allowing quicker market penetration.

This is driving the trends of vacuum packing, intelligent packaging, and bioplastics which are extending the food shelf life for a long time, while at the same time building the brands (from sustainability demand perspective). However, companies are using special offers to bump up sales from health-conscious customers who are looking for chilled processed foods that are organic, plant-based and high in protein, and online layers are taking up the slack.

In the table below, half yearly comparison CAGR estimate of base year (2024) and following year (2025) study is covered to define the revenue patterns and growth factors as per the most fascinate for the stakeholders with supporting numbers and information.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.3% |

| H2 (2024 to 2034) | 3.4% |

| H1 (2025 to 2035) | 3.4% |

| H2 (2025 to 2035) | 3.5% |

During the first half (H1) of the forecasting period 2025 to 2035 the market grows at a CAGR of 3.4%, with H2 seeing an increase to 3.5%. The steady changing consumer behaviour of demand for chilled processed food contributes to the stable CAGR growth. The increase on the market was low, but steady, reflecting 10 BPS increase in H1 2025 and 10 BPS rise at later stage of 2025 on chilled processed food.

The chilled processed foods market is thus on track for substantial growth as we approach 2031 with refrigeration technology developing rapidly with spending on supply chain logistics strengthening and preferences towards fresh, low processed and, high protein food products building. They’ll also be investing more in clean label formats, green packaging and online-driven marketing campaigns that boost their market share and fulfill the evolving needs of health-focused and convenience-oriented consumers.

The organised chilled processed food market is competitive and is on the growth trajectory with increasing demand for convenience foods to be eaten directly, fresh convenience foods, and health-oriented substitutes for frozen food. Organised and unorganised markets are the industry segments, and the two are differentiated based on production geography, distribution, and consumer trend.

Organised Market, The supermarket store brands, multi-national food companies, and premium ready-meal brands hold sway in the organized segment, which offers an enormous variety of chilled processed foods such as deli meat, fresh pasta, salads, dairy desserts, and meat-free food. Nestlé, Tyson Foods, Conagra Brands, Kraft Heinz, Unilever, and Sigma Alimentos are the leaders.

They control North America, Europe, and developed Asia-Pacific, wherein chilled meal demand is growing for premium, preservative-free, and organic solutions. Organized players focus on best-in-class refrigeration technology, sustainable packaging, and strong food safety procedures to meet consumer needs. They invest in R&D for majority of them to render them healthier, high-protein, and plant-based in order to address vegan, gluten-free, and clean-label demands.

Retail distribution is a common trend in the organised market whose shelf space in supermarket, hypermarket, and food store is dominated by large brands. Growth in quick-commerce and home-delivery has also enabled the organised brands' catchment to extend to more customers beyond stores.

The unorganised sector comprises food processors, small meat and dairy plants, and catering. They are highly localised in township towns, small towns, and new markets where cold-chain supply facilities are weakly developed. Most of the unorganised producers produce fresh, lightly processed products such as local specialties, fresh milk, and small-scale meat products, which are sold through local markets, street vendors, and small-scale retail shops.

These products cannot easily be switched to formal retail chains or export markets due to the absence of good food safety regulation and irregular quality control.

The market will increase globally with organised players tapping the end-of-the-line food processing and retail chains, and unorganised players to grow business with improved cold-chain infrastructure, certifications, and retail tie-ups.

Clean-Label and Preservative-Free Trends

Shift: Consumers are increasingly opting for fewer additive, cleaner-label ingredient-containing chilled processed food and preservative-free products. Health-conscious consumers eschew artificial preservatives like nitrites, phosphates, and emulsifiers from chilled meat, ready meals, and dairy snacking foods. The trend is now creeping into Europe and North America as regulatory authorities and activist organizations stay one step ahead of the game in calling for more transparency and healthier-for-you options.

Strategic Response: Nestlé repositioned its Lean Cuisine refrigerated dinners by removing artificial preservatives using natural flavorings and plant stabilizers, achieving a 7% clean-label SKUs gain. Hormel Foods rolled out its Natural Choice® refrigerated deli meats, "no artificial ingredients" positioning, and 9% market share gain.

Marks & Spencer rolled out ready-to-eat preservative-free pasta bowls in the UK with natural rosemarine extracts to extend shelf life. These trends are being translated into increased migration towards healthier, lower-processed chilled foods and clean-label is therefore a definite priority differentiator in an intense marketplace.

Plant-Based and Flexitarian Chilled Products Boom

Shift: Flexitarianism and plant foods are transforming the chilled processed foods space. Consumers, especially Millennials and Gen Z, are seeking to replace conventional dairy and meat with plant foods and desire the same taste, texture, and convenience in chilled form. The trend is extremely high in urban North American, European, and Asia-Pacific markets.

Strategic Response: Beyond Meat introduced chilled counters with Beyond Sausage and Beyond Mince, registering 12% YoY value sales growth, gaining shelf space with leading European retailers.

Quorn Foods introduced chilled meat-free deli slices and convenient meals to flexitarian UK and German consumers. Tofurky introduced chilled vegan lunch kits with green packaging to the USA, to career professionals who never find time for anything. Tyson Foods partnered with Raised & Rooted® chilled plant protein bowls, yet another chilled plant-based format innovation by another such meat competitor. It indicates the manner in which the plant trend is transforming chilled shelves by combining health, sustainability, and convenience.

Convenience and Ready-to-Heat Meal Solutions focus

Shift: Dynamic way of life and fashionable ready-to-heat food are driving convenience foods. Light-prep foods must deliver restaurant-like experience within the home setting by the consumers. Growth picked up pandemic and with the hybrid work culture and urbanized life becoming trends, particularly in Asia-Pacific and North America.

Strategic Response: Conagra Brands reinvented its Healthy Choice Power Bowls through refrigerated, microwave-ready meal solutions in global flavors (Korean BBQ, Mediterranean, etc.) that delivered 8% USA growth. 7-Eleven in Japan retailed chilled bento dishes of premium quality with actual ingredients, with the growth of convenience store chilled meal sales by 10%.

Lite n' Easy in Australia recorded success with ready-to-heat chilled meal delivery subscription among middle-aged working persons and the aged. Packagers are even utilizing innovative packaging that ensures freshness and convenience, supplying chilled meals as an actual replacement for home preparation of meals or fast food.

Fortified and Functional Chilled Snack Innovation

Shift: Indulgence is being eschewed in chilled food as consumers increasingly demand functional benefit in the form of protein boosting, gut health benefit, and ingredients providing energy. This is reshaping formats like chilled dairy, bars, and snack kits, especially in fitness-driven and health-driven economies like the USA, UK, and Japan.

Strategic Response: Danone launched probiotic and plant protein-fortified chilled yogurt snack cups under its Activia Probiotic+ brand and registered a 6% point share in its functional chilled snacks segment. PepsiCo’s Off the Eaten Path brand launched chilled plant-protein snack kits in the USA, combining hummus with high-fiber veggie chips.

Siggi’s offered low-sugar Icelandic skyr snacks in chilled grab-and-go packs, addressing consumer demand for high-protein, low-carb options. Such startups as Perfect Snacks are disrupting with cold-temperature protein bars engineered with adaptogens, which attract health-conscious snackers. Functional foods are transforming chilled snacks into calorie-dense, nutrient-rich minimeals, connecting pleasure and wellness.

Regionalization and Region-Locally Chilled Food Lines

Shift: Region-conforming region-local cold foods are very hot, catering to regional food culture and palate. Nostalgia, tradition, and freshness are driving the trend, especially in Europe and Asia. Cold food makers are modifying recipes and product lines to fit regional tastes, adopting local ingredients and traditional preparation methods.

Strategic Response: Sadia (BRF Foods) introduced Brazilian-style chilled empanadas and coxinhas in Latin America, which were locally accepted and propelling double-digit regional growth.

Regionally chilled ready meals (South Indian dosa wraps, Punjabi butter paneer) were locally accepted in ITC Foods in India. Locally manufactured chilled charcuterie and cheese platters were locally accepted by consumers who want fresh, familiar food in E.Leclerc supermarkets in Europe. Whole Foods, in the US, introduced its regional meal kits with New England seafood-line and Southern BBQ-line. Regionalization is just a subset of overall trend of glocalization, wherein the companies walk this thin line between putting local and growing global to cater to different segments of customers.

Introduction of Eco-Friendly Packaging and Green Logistic

Shift: The market for chilled processed foods is shifting fundamentally towards sustainability as consumers and regulators are putting pressure on companies to offer green packaging and carbon-efficient supply chains. With the role of plastic packaging in the environment and the energy consumed in refrigeration and cold-chain transportation, companies are being compelled to adopt biodegradable, recyclable, and reusable packaging and reduce transport and storage processes. This is especially so in North America and Europe, where ESG metrics inform company strategy.

Strategic Response: Unilever launched Knorr range of fully recyclable chilled food trays reducing 20% of plastic use in Europe as part of net-zero carbon ambition. Canada's Maple Leaf Foods also invested in carbon-free chilled food production and partnered with eco-sustainable logistics providers, reducing its cold-chain distribution carbon footprint by 30%.

Tesco in the UK launched chilled foods in plant-based compostable packs that gained consumer acceptance and helped create brand value. Besides, brands like NotCo and Allplants are adopting minimalist, recycled packs and low-carbon modes of delivery (e.g., electric vans), which are widely accepted by consumers with sustainability at the forefront

The following table shows the estimated growth rates of the top five territories. These markets are set to experience high consumption through 2035.

| Country | CAGR 2025 to 2035 |

|---|---|

| USA | 3.2% |

| Germany | 3.7% |

| China | 3.4% |

| Japan | 3.1% |

| India | 3.9% |

The USA market for chilled processed food is growing as consumers increasingly turn to ready-to-eat, fresh, and minimally processed meals. An increasing number of pre-packaged, ready-to-eat and minimally processed chilled foods are being produced as hectic lifestyles and an inclination towards adequate nutrition become more common.

To respond to such demand, retailers are increasing their ranges of chilled products, including ready meals, deli food, and dairy-based products. And there is an emerging trend towards clean-label ingredients, and also towards organic chilled foods, impacting market dynamics. Moreover, the innovations in cold chain logistics and packaging technologies are assisting to enhance product shelf life and distribution efficiency.

The refrigerated food industry in Germany is highly developed, due to high consumer preference for freshly high-quality chilled foods. The demand for natural, preservatives-free chilled meals, meats and dairy products are quickly gaining traction as the country’s burgeoning organic and clean-label food culture flourishes.

Supermarkets and specialist stores are also getting in the act by offering more chilled plant-based foods for a growing vegan and flexitarian audience. Technological improvements in the field of refrigeration and packaging along with sustainability initiatives are also serving to provide stronger growth prospects for the market.

Rapid urbanization and a rapidly evolving retail landscape in China have driven strong growth in demand for the chilled processed food category. Fresh and convenient meal solutions are increasingly preferred by consumers and available in the form of chilled ready meals, dairy, and premium processed meats segments.

This, alongside the proliferation of modern grocery chains and e-commerce platforms, has opened up chilled foods to a broader constituency. Moreover, strong government initiatives catering towards food safety and cold chain infrastructure advancements have facilitated product quality and availability. Growing disposable incomes and expanding middle class are also contributing to increasing demand for premium chilled food products.

Japan’s chilled processed food market is fueled by an aging population that wants fresh, portion-controlled and easy-to-prepare meals. And, the country’s stringent food safety laws, coupled with a domestic preference for quality, has resulted in growing demand for premium chilled foods, encompassing sushi, bento boxes and fresh-cut salads.

Dairy products, alcoholic beverages, chips, and other food items are often available, ranging from convenience stores to supermarkets, to save busy individuals time in grocery shopping. Moreover, advancements in food preservation methods and packaging technologies have improved shelf biocycle without compromising freshness, propelling market growth even further.

| Segment | Value Share (2025) |

|---|---|

| Ready Meal (By Food Type) | 38.7% |

Growing lifestyles of consumers, urbanization, and growing time constraint coupled with the convenience in food consumption are driving the demand for ready meals from chilled processed food market. Ready meals are ideal for working professionals, students and people with busy schedules as they save them time on meal preparation (cooking/cleaning after). Consumers demand healthy and convenient meal choices, hence, the emergence of chilled ready meals that offer a fresh product with homemade flavor.

In addition, the diversity of ready-to-eat meals available, such as vegetarian, vegan, and high-protein foods, also drives market growth. As the nation becomes increasingly health-conscious, companies have placed a greater emphasis on their cleaner formulations of this on-the-go, ready-meal food, touting fewer preservatives, lower sodium levels and more organic components in an effort to win over the right brand of consumer.

Likewise, the rise of online grocery shopping, with various retailers offering direct-to-consumer delivery services, has been key to the success of chilled prepared meals. The market is driven by packaging technologies innovations that extend their shelf life, without any sacrifice of taste and quality. The ready meal sector accounts for the biggest share of the chilled processed food space, with consumers ever-seeking for ready-to-eat dishes that aren't lacking on the nutrition front.

| Segment | Value Share (2025) |

|---|---|

| Supermarkets & Hypermarkets (By Distribution Channel) | 45.2% |

Supermarkets and hypermarkets account for a larger share of the distribution of chilled processed foods as they can provide a wide variety of products to customers in one location. Some of this ready-to-eat chilled food includes ready meals, processed meat, bakery products, and many others that are made available to the consumer through these retail formats. Products stay fresh in dedicated refrigeration, which is one of the highest-rated drivers of supermarket consumers’ confidence and preference.

Supermarkets and hypermarkets are one of the major advantages that run promotional campaigns, discounts and combined purchases through which bulk purchase is taking place. Moreover, those stores offer in-stores shopping experience allowing consumers to see the quality of products physically before purchasing. Consumers also feel that they can better gauge the freshness of chilled food products in physical stores than through online shopping, where the latter cannot guarantee a product's storage condition until delivery.

As well, retailers are merging the digital and physical experience to give consumers the ability to order online and shop at the same time by picking up what they purchased in-store. Multiple channel use is also strengthening the supermarkets and hypermarkets channel for chilled processed food sales. With increasing consumer demand for fresh, convenient and high-quality chilled foods, these retail outlets are set to continue as the foremost channel of distribution.

As the Chilled Processed Food Market grows more competitive, top players like Nestlé, Kraft Heinz, and Tyson Foods are increasing market share via brand recognition, product development, and innovation. All of these firms have improved consumer preference by providing a wider selection of ready-to-cook meals, processed meats, and chilled bakeries have become popular due to the growing consumer need for quick, fresh, and preservative-free food alternatives.

This diversity helps attract more consumers and allows these companies to stay competitive with smaller, niche brands. In this competitive world, manufacturers are striving hard to come up with packaging innovations. Chilled processed foods retain their freshness for longer periods of time thanks to the usage of modified atmosphere packaging (MAP) and vacuum sealing. The eco-friendly and resealable packaging also attracts environmentally-conscious consumers, increasing customer loyalty.

For example:

Market segmented into Ready Meal, Processed Meat, Processed Fish or Seafood, Processed Vegetables & Potatoes, Bakery Products, Pizza, Soup, & Noodles, and Others.

Market segmented into Supermarkets or Hypermarkets, Convenience Stores, Online Retailing, and Others.

Market segmented into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa (MEA).

The global chilled processed food market is projected to grow at a CAGR of 3.5% during the forecast period.

The market is estimated to reach approximately USD 1,194.4 million by 2035.

The ready-to-eat meals segment is expected to witness the fastest growth due to increasing demand for convenient and time-saving food options.

Key growth drivers include rising urbanization, increasing consumer preference for fresh and minimally processed foods, and advancements in refrigeration and packaging technologies.

Leading companies in the market include Nestlé S.A., Kraft Heinz Company, General Mills Inc., Conagra Brands Inc., Tyson Foods Inc., and Unilever PLC.

Table 1: Global Market Value (US$ million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tons) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 4: Global Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 5: Global Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 6: Global Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 7: North America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 10: North America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 11: North America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 12: North America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 13: Latin America Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 16: Latin America Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 17: Latin America Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 18: Latin America Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 19: Europe Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 22: Europe Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 23: Europe Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 24: Europe Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 28: Asia Pacific Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 30: Asia Pacific Market Volume (Tons) Forecast by Application, 2018 to 2033

Table 31: MEA Market Value (US$ million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Tons) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ million) Forecast by Type, 2018 to 2033

Table 34: MEA Market Volume (Tons) Forecast by Type, 2018 to 2033

Table 35: MEA Market Value (US$ million) Forecast by Application, 2018 to 2033

Table 36: MEA Market Volume (Tons) Forecast by Application, 2018 to 2033

Figure 1: Global Market Value (US$ million) by Type, 2023 to 2033

Figure 2: Global Market Value (US$ million) by Application, 2023 to 2033

Figure 3: Global Market Value (US$ million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tons) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 9: Global Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 12: Global Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 13: Global Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 16: Global Market Attractiveness by Type, 2023 to 2033

Figure 17: Global Market Attractiveness by Application, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ million) by Type, 2023 to 2033

Figure 20: North America Market Value (US$ million) by Application, 2023 to 2033

Figure 21: North America Market Value (US$ million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 27: North America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 30: North America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 31: North America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 34: North America Market Attractiveness by Type, 2023 to 2033

Figure 35: North America Market Attractiveness by Application, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ million) by Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ million) by Application, 2023 to 2033

Figure 39: Latin America Market Value (US$ million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 45: Latin America Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 49: Latin America Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Application, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ million) by Type, 2023 to 2033

Figure 56: Europe Market Value (US$ million) by Application, 2023 to 2033

Figure 57: Europe Market Value (US$ million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 63: Europe Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 66: Europe Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 67: Europe Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 70: Europe Market Attractiveness by Type, 2023 to 2033

Figure 71: Europe Market Attractiveness by Application, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ million) by Type, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ million) by Application, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Type, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Application, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ million) by Type, 2023 to 2033

Figure 92: MEA Market Value (US$ million) by Application, 2023 to 2033

Figure 93: MEA Market Value (US$ million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Tons) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ million) Analysis by Type, 2018 to 2033

Figure 99: MEA Market Volume (Tons) Analysis by Type, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Type, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Type, 2023 to 2033

Figure 102: MEA Market Value (US$ million) Analysis by Application, 2018 to 2033

Figure 103: MEA Market Volume (Tons) Analysis by Application, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Application, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Application, 2023 to 2033

Figure 106: MEA Market Attractiveness by Type, 2023 to 2033

Figure 107: MEA Market Attractiveness by Application, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chilled Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Market Share Breakdown of Chilled Food Packaging Manufacturers

Fermented Processed Food Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA