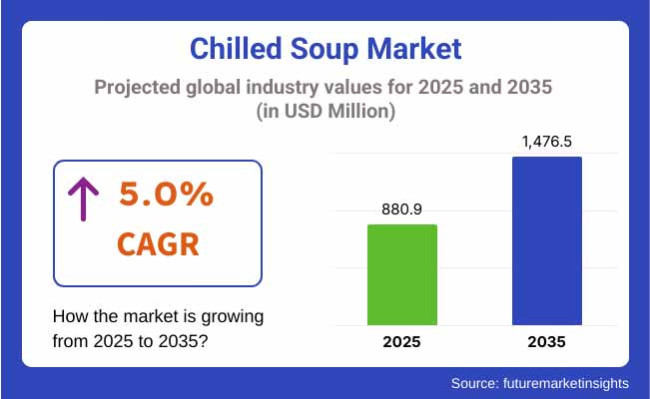

The global chilled soup market value in 2023 was USD 801.0 million. The demand for chilled soup is expected to increase, with a 5.0% year-on-year growth in 2024, and the global market would be USD 880.9 million in 2025.

Global sales are anticipated to show 5.0% CAGR during the projection period 2025 to 2035, valuing at USD 1,476.5 million by end of year 2035.

The primary driver contributing to growth of chilled soups is the increasing consumer demand for healthy, on the go meal options. To meet the needs of health-conscious customers, brands are launching preservative-free and nutrient-rich chilled soups, against the background of growing demand for clean-label and organic products. Chilled soups are also convenient, making them a popular choice for busy eaters who want healthy meals on the go.

Vegan and plant-based chilled soups are also on the rise as consumers lean ever more heavily towards sustainable, cruelty-free food products. Leading flavors are gazpacho, cucumber avocado, tomato basil and beetroot orders are up, especially in premium and gourmet food shops.

The growing retail distribution channels such as supermarkets, hypermarkets, and e-commerce platforms are making chilled soups more available. In addition, chilled soups are being included in the menus by foodservice establishments, such as cafes and delis, which is further broadening the market.

It is expected that the broader range brought along with convenience, health benefits and taste will definitely aid in the growth of the chilled soup industry in the upcoming decade.

The table below compares the amount of the change in the CAGR over the past half-year for the base year (2024) and the current year (2025) for the global chilled soup industry. This analysis is a precursor to critical performance changes and outlines revenue realization patterns which give stakeholders a more in-depth view into how the growth trajectory would rise through the year.

| Particular | Value |

|---|---|

| H1 | 4.8% (2024 to 2034) |

| H2 | 5.1% (2024 to 2034) |

| H1 | 5.0% (2025 to 2035) |

| H2 | 5.2% (2025 to 2035) |

Due to the convenience and healthy ready-to-eat meal options, the market for chilled soup is anticipated to grow at a CAGR of 5.0% over H1 of the decade 2025 to 2035. Soup as a ready meal is on the rise, especially at urban working professionals with busy lifestyles and limited time. Moreover, rising awareness towards health and wellness trends coupled with the growing demand for clean-label and preservative-free products is projected to boost the market growth during this period.

Furthermore, the increasing consumer preference for plant-based and vegan chilled soups will provide beneficial opportunities for market growth. As consumers increasingly opt for sustainable and cruelty-free food products, manufacturers are stepping up with flavorful and nutrient-dense vegan counterparts-gazpacho, cucumber avocado, carrot ginger-to fill that demand. Chilled soups are available through supermarkets, delis, and online channels, which helps promote market penetration and sales.

Tier 1: A competitive group of companies notable in both revenue and leading services across a broad sector. These companies have a large share of the chilled soup market owing to strong brand equity, wide distribution network, and increased advertising spend. They embrace spending on R&D to remain in front. Key players in this tier are: PepsiCo Inc. (through brand Naked): The corporation stands out for its premium chilled soups, with the advantage of a well-established international distribution network and its relationship with retailers. The focus on healthy and plant-based soups gives it a leg up.

Tier 2 represents companies with decent market penetration and reasonable revenue but are slightly smaller than Tier 1 players. They thrive on attracting niche markets, product differentiation, and geographic expansion. Here are some of the main Tier 2 players:Kettle Cuisine LLC: Kettle Cuisine is a state-of-the-art manufacturer focusing on small-batch, chef-crafted soups that deliver on premium, clean-label attributes.

It has an established presence in North America and concentrates on foodservice, as well as retail distribution. In the UK chilled soup segment, New Covent Garden Soup Co. is a leading player known for its fresh and natural ingredients as well as seasonal types that cater to consumers looking for authentic flavors.

Tier 3 includes newcomers and smaller producers that are building momentum through innovative marketing strategies, online sales, and niche products. They have few distribution channels, but they expand rapidly because people enjoy their creative flavors and focusses on health.

Example,The Soup Spoon: A fast-growing retail chain serving up hand-crafted, chilled soups in an array of flavours. It employs direct-to-consumer and digital sales channels to broaden its market presence.The most comprehensively, and sustained, drive is perhaps by Cully & Sully an Irish brand that specialises in convenient gourmet chilled soups and has a firm foothold nationally. Cheapness and sustainability effort are helping it win market share.

Health-Conscious Versions for the Health-Minded

Shift:Consumers are increasingly adopting the clean-label, healthy and functional food products that have propelled this segment into the spotlight. Evolving Product Portfolio as the Demand for Low-sodium, Preservatives Free, Organic and Plant Based Soups Grows Health-conscious consumers are looking for nutrient-dense, minimally processed soups made from wholesome ingredients and superfoods products such as fresh vegetables and legumes.

Plant-based chilled soup continues to be a growing category around the world, driven by the growing flexitarian, vegan and gluten-free trends, in line with most of North America, Europe and Australia where a number of wellness trends are on the rise.

Strategic Response:So brands are iterating, reformulating their products with healthifications and transparent ingredients:Bakkavor Group Plc launched a new line of low-salt and no artificial preservatives fresh plant-soups to heath-conscious shoppers in the UK and Europe.By 2009, the UK-based soup brand, Soupologie introduced a new range of gluten-free, dairy-free, nutritionally-balanced vegan-friendly soups.

The brand also sells immune-boosting soups that are made with functional food ingredients like turmeric, ginger and kale for shoppers looking for wellness benefits.Cully & Sully capitalized on the clean-label trend with natural, low-calorie soups with no more than a handful of simple, recognizable ingredients, and they won fans in Ireland and beyond across Europe.

Strengthening Investment in Ready-to-Eat (RTE) and Grab-and-Go Formats

Shift:The trends observed this far in the convenience food industry is also supporting the increasing demand for ready-to-eat (RTE) chilled soup. As consumers navigate increasingly busy lives, the demand for offshoot meal solutions that require minimal time in preparation have surged. Millennials and urban professionals will be especially attracted to convenient, nutritious packed single-serve, travel-friendly soups.

Strategic Response :Lumbering brands are indeed expanding their RTE and grab-and-go assortments to better reflect growing demand for ready-made meal solutions: Re:Nourish launched refrigerated, ready-to-heat bottled chilled soups with functional health benefits. Their microwavable, resealable bottles cater to busy, health-conscious consumers who want meal options that are convenient to eat.

One of a small, logistically smart number of meal companies with a ‘fresh or frozen pseudo-claim at fame’ that earned national name recognition when The Soup Spoon launched a line of pre-packaged,portable chilled soups for urban commuters in Singapore, Snackaphoria has expanded its electronic pantry in the last decade into a vastly diverse spread of items.

Its soups are sold via convenience stores and supermarkets for easy on-the-go consumption.One new brand, Kettle Cuisine LLC based in the USA, sells single-serve, RTE chilled soups in ekonomize packaging. The company is targeting consumers who want more premium, chef-curated options, gourmet grab-and-go meal prep.

To win over the younger customers

Shift:A common denominator behind the growing appetite for on-trend, experiential food merchandise-meal components that are flavorful, colorful and Instagram-contest material (enter chilled soups) is millennials and Gen Z. Younger consumers are also more willing to be adventurous when it comes to exotic flavors, fusion recipes and plant-based substitutes. This audience is also drawn to sustainable and ethically sourced products.

Strategic Response: Brands are rolling out increasingly fun and visually, not to mention gastronomically, appealing chilled soups to entice younger consumers: At least that was the ethos of the USA.-acquired brand Zupa Noma, which marketed drinkable, cold-pressed vegetable soups, in their eye-popping hues, as Instagram- and trend-friendly. Gen Z loves care, so they respond to the focus on functional ingredients and plant-based formulas.

Attractively scarlet, Soupologie delivers superfood soups like beetroot & ginger and carrot & turmeric, which are lovely and fresh, making it great for health-conscious and Instagrammer alike. Re:Nourish packaged its grub in sustainable packaging, and had aggressive branding to appeal to green-washed Gen Z’ers.

That definitely helps them get to a more Gen Z audience they’re frequently shared in grab-and-go soups on social media.According to the brand’s founders, their mission built on visual appeal, sustainability, and, sometimes, the combination of unconventional flavors has resonated with a younger, trend-conscious audience.

Supermarket partners-How to Build a Better Relationship with Your Partners

Shift:Thanks to consumers seeking convenience, demand for chilled soups at retailers, delis and convenience stores is growing. Another significant trend for this category type has been a booming presence for chilled soups (fresh and premium chill) for supermarket distribution in regions like Europe and North America.

Strategic Response: Physical retail collaboration: As greater SKUs (stock keeping units in stores-essentially products) emerge, brands are strengthening retail partnerships and their physical presence. Shoppers Flyer was delivered with Bakkavor Group Plc, whose results were in good shape, but whose favourites for premium chilled soups, prefer their relations to the large UK grocers such as Tesco, Sainsbury's and Waitrose, and upsizing placement of chilled soups.

They worked with Guild, or Food 25, which had placed the chefs away from their pure trade customers towards supermarkets throughout Ireland which allowed Cully & Sully to be retail products. Partnering with 7-Eleven and other convenience stores in Singapore to provide on-the-go shoppers with its RTE chilled soups. Partnerships with supermarkets and other retailers offer wider access and improved visibility to consumers, which in turn drive sales.

PRH’s Longstanding Commitment to Sustainability and Ethical Sourcing

Shift:As consumers become more eco-conscious, interest is growing in sustainably sourced and packaged chilled soups. More than ever, shoppers are reaching for products that promise earth-friendly packaging, responsible sourcing practices and low carbon footprints.

Strategic Response:The most effective brands are integrating sustainability programs into their corporate DNA: Re:Nourish’s bottled soups are sold in recyclable, biodegradable packaging, so eco-conscious customers are making sustainable meal solutions choices. Zupa Noma has a focus on organic, local ingredients to minimize its environmental impact and attract eco-minded consumers.

Converting good values into a visible presence on the plate In terms of sustainability innovation the Cully & Sully brand have made their amendments; developing carbon neutral manufacturing standards, linking production processes for sustainable sourcing of organic materials locally & further afield, and targeting consumers who are, for want of a better term, choosing food products not just for their culinary excellence but the impact that their ecology. Rise of brand loyalty through the alignment of lifestyle with consumer values: sustainable + ethical practice.

Should other coders make recommendations about price points?

Shift:Clear soups are imported goods, but in every price sensitive market, price sensitivity is an always a factor. It sounds affordability-driven by introducing low-cost variants without compromising on either its quality.

Strategic Response: Its prices, now that chilled soups are taking off, aren’t as high as you might guess: Kettle Cuisine LLC launched value packs of soup, sold chilled, that provide small servings at lower price points, aimed at cost-sensitive buyers. Cully & Sully rolled out multi-pack offers in grocery chains in 2014 to help drive down the price of its soups and to encourage bulk-buying. We began only selling value meal combinations cold soups with a sandwish or salad at a cheaper price, boost sales in stores.” Brands are also now targeting a broader customer spectrum with cheaper products (lots more units sold).

The Fourth Way: Create E-Commerce And Subscription Models

Shift: Chilled soups also stand for a growing e-commerce channel, with more and more consumers ordering groceries online. 7† [7† “What It Takes to Win in Chilled Soups” by Market Research Store, “US E-commerce Grocery Growth Statistics” by Statista] A colorful report about the new trends in both chilled soups and e-commerce channels for chilled soups. Subscription models of regular deliveries of fresh soups to the home are similarly having their moment.

Strategic Response: Brands shifted to direct to e-commerce models: Nourish saw significant customer retention increases since launching a subscription service in which Repeat customers receive fresh chilled soups delivered weekly. The company Zupa Noma also teamed with Amazon Fresh and Instacart, diversifying its sales channels and direct-to-consumer sales. They’re also available online, ‘chilled’ soups through the big grocery services, which bring direct access to the home and grow their market share.

The table below depicts estimated growth for the top five territories. They are poised to show high consumption until 2035.

| Country | CAGR 2025 to 2035 |

|---|---|

| USA | 4.5% |

| Germany | 5.2% |

| China | 6.7% |

| Japan | 5.9% |

| India | 7.3% |

Healthier food choices, with customers promoting minimally processed ingredients, is causing a rise in demand for clean-label, preservative free chilled soups in the market. The workaholic life that asks for convenience without giving up on freshness supports the growth of demand significantly in USA market. Another key factor is sustainability. Food manufacturers are implementing eco-friendly methods, like sustainable packaging, in an effort to lessen food waste.

Wide access to products, owing to expansion of supermarkets, hypermarkets and e-commerce platforms, is increasing sales. Also gaining traction are product innovations with plant-based, organic and functional soups containing superfoods and health-enhancing ingredients, addressing wellness-minded consumers.

As urban populations continue to grow, consumers seek foods that offer convenience and extended shelf life, leading to increased preference for chilled soups. The country’s expanding livestock industry is also a factor, with increasing demand for fresh, healthful soups that do not contain chemical preservatives. Other programs include food safety and waste reduction, the use of clean-label ingredients. The expanding market for chilled soups is propelling its growth, as online grocery platforms and retail chains become more accessible.

Rising demand for convenience foods due to urban busy lifestyles has led to the consumption of chilled soups as ready-to-eat meals. This fits with clean-label trends in Japan, driving food manufacturers to incorporate natural and preservative-free soups to meet the demand from health-conscious consumers.

Consumers trust chilled soups all the more due to stricter food safety standards and regulations with respect to chilled foods. Soup brands also continue to innovate in functional and health-boosting areas, such as developing soups containing added probiotics or collagen, which opens new avenues for market expansion.

| Segment | Value Share (2025) |

|---|---|

| Cups/Tubs (By Packaging Type) | 48.6% |

The Cups/Tubs segment is going through robust growth, and is projected to become the most preferred packaging type in the Chilled Soup market as a need for ready-to-eat meal solutions are progressively increasing among consumers. Cups/tubs are portable and a convenient option for on-the-go consumption, making this option popular among busy professionals and commuters.

Microwave-safe and resealable tubs make things more convenient, too, giving consumers a way to reheat and then stow food away. With single-serve and family-size tub options, major brands are focusing on both solo and group consumption. Moreover, the increased popularity of meal kit deliveries and grab-and-go food services have driven up demand for chilled soups in cup/tub formats, which are becoming a staple in convenience stores and supermarkets.

Clear packaging that shows consumers the soup contents, helping to create attractive product and drive sales

| Segment | Value Share (2025) |

|---|---|

| Hypermarket (By Distribution Channel) | 58.2% |

As consumers continue to look for convenient, fresh meal solutions, supermarkets and hypermarkets emerge as the leading distribution channel for this segment. Increased product availability and the ability to compare multiple brands at once encourages more consumers to buy chilled soups at large retailers. Incentive mechanisms of superstore bulk purchasing and promotional discounts cater to the demand for price-sensitive purchases, thus driving sales volumes.

Very small ready-to-eat meal sections in hypermarkets have led to the surge in popularity of “chilled” soups, which are considered a convenient “lunch” or “dinner” option. Retailers are also amping up the in-store experience by providing free tastings and meal pairing suggestions, which lead to impulse purchases. Chilled soup brands introduced under private-label by leading supermarket chains are relatively less expensive and provide immense variety in flavors, which facilitates higher penetration of the market.

Top players in the category of chilled soup are gaining market share from brand awareness, product development and innovation Through a wider offering of flavors and diet specifically formulated products, from traditional to gourmet to plant-based varieties, they have succeeded in driving consumer preference. This diversity not only attracts new consumers but also allows these businesses to stay competitive.

In addition, packaging innovationsmn including single-serve tubs, resealable pouches, and sustainable containers have improved product usability and convenience, driving sales. Furthermore, affected by strategic pipeline, collaborational in the free market both have base opportunities in chilling soup market. Partnerships with large retailers, foodservice chains, delivery platforms and other brands have boosted visibility and expanded distribution.

For instance:

This segment is further categorized into PET Bottles, Carton Packaging, Cups/Tubs, and Pouches.

The market is segmented into Supermarket/Hypermarket, Premium Grocery Stores, Online Retail, and Direct Selling.

Market segmented into North America,Latin America,Western Europe,Eastern Europe,East Asia,South Asia & Pacific,Central Asia,Russia and Belarus,Balkan & Baltic Countries,Middle East and Africa.

The global Chilled Soup Market is estimated at a value of USD 880.9 million in 2025.

Some of the leaders in Chilled Soup Market include the Billington Group,The Hain Daniels Group Limited, Soupologie Limited,Sonoma Brands.

The Europe is projected to hold a revenue share of 41 % over the forecast period.

The industry is projected to grow at a forecast CAGR of 5.0 % from 2025 to 2035.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Tonnes) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 4: Global Market Volume (Tonnes) Forecast by Packaging, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 6: Global Market Volume (Tonnes) Forecast by Distribution Channel, 2018 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 8: North America Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 10: North America Market Volume (Tonnes) Forecast by Packaging, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 12: North America Market Volume (Tonnes) Forecast by Distribution Channel, 2018 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: Latin America Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 16: Latin America Market Volume (Tonnes) Forecast by Packaging, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 18: Latin America Market Volume (Tonnes) Forecast by Distribution Channel, 2018 to 2033

Table 19: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 20: Europe Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 21: Europe Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 22: Europe Market Volume (Tonnes) Forecast by Packaging, 2018 to 2033

Table 23: Europe Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 24: Europe Market Volume (Tonnes) Forecast by Distribution Channel, 2018 to 2033

Table 25: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Asia Pacific Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 27: Asia Pacific Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 28: Asia Pacific Market Volume (Tonnes) Forecast by Packaging, 2018 to 2033

Table 29: Asia Pacific Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 30: Asia Pacific Market Volume (Tonnes) Forecast by Distribution Channel, 2018 to 2033

Table 31: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: MEA Market Volume (Tonnes) Forecast by Country, 2018 to 2033

Table 33: MEA Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 34: MEA Market Volume (Tonnes) Forecast by Packaging, 2018 to 2033

Table 35: MEA Market Value (US$ Million) Forecast by Distribution Channel, 2018 to 2033

Table 36: MEA Market Volume (Tonnes) Forecast by Distribution Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 5: Global Market Volume (Tonnes) Analysis by Region, 2018 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 9: Global Market Volume (Tonnes) Analysis by Packaging, 2018 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 13: Global Market Volume (Tonnes) Analysis by Distribution Channel, 2018 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 16: Global Market Attractiveness by Packaging, 2023 to 2033

Figure 17: Global Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 23: North America Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 27: North America Market Volume (Tonnes) Analysis by Packaging, 2018 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 31: North America Market Volume (Tonnes) Analysis by Distribution Channel, 2018 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 34: North America Market Attractiveness by Packaging, 2023 to 2033

Figure 35: North America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 41: Latin America Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 45: Latin America Market Volume (Tonnes) Analysis by Packaging, 2018 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 49: Latin America Market Volume (Tonnes) Analysis by Distribution Channel, 2018 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Packaging, 2023 to 2033

Figure 53: Latin America Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 56: Europe Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 57: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 59: Europe Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 60: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Europe Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 63: Europe Market Volume (Tonnes) Analysis by Packaging, 2018 to 2033

Figure 64: Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 65: Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 66: Europe Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 67: Europe Market Volume (Tonnes) Analysis by Distribution Channel, 2018 to 2033

Figure 68: Europe Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 69: Europe Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 70: Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 71: Europe Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 72: Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Asia Pacific Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 74: Asia Pacific Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 75: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 77: Asia Pacific Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 78: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Asia Pacific Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 81: Asia Pacific Market Volume (Tonnes) Analysis by Packaging, 2018 to 2033

Figure 82: Asia Pacific Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 83: Asia Pacific Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 84: Asia Pacific Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 85: Asia Pacific Market Volume (Tonnes) Analysis by Distribution Channel, 2018 to 2033

Figure 86: Asia Pacific Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 87: Asia Pacific Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 88: Asia Pacific Market Attractiveness by Packaging, 2023 to 2033

Figure 89: Asia Pacific Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 90: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 91: MEA Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 92: MEA Market Value (US$ Million) by Distribution Channel, 2023 to 2033

Figure 93: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 95: MEA Market Volume (Tonnes) Analysis by Country, 2018 to 2033

Figure 96: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: MEA Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 99: MEA Market Volume (Tonnes) Analysis by Packaging, 2018 to 2033

Figure 100: MEA Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 101: MEA Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 102: MEA Market Value (US$ Million) Analysis by Distribution Channel, 2018 to 2033

Figure 103: MEA Market Volume (Tonnes) Analysis by Distribution Channel, 2018 to 2033

Figure 104: MEA Market Value Share (%) and BPS Analysis by Distribution Channel, 2023 to 2033

Figure 105: MEA Market Y-o-Y Growth (%) Projections by Distribution Channel, 2023 to 2033

Figure 106: MEA Market Attractiveness by Packaging, 2023 to 2033

Figure 107: MEA Market Attractiveness by Distribution Channel, 2023 to 2033

Figure 108: MEA Market Attractiveness by Country, 2023 to 2033

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Chilled Beams Market Size and Share Forecast Outlook 2025 to 2035

Chilled Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Chilled Water Storage System Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Chilled Beam System Market Analysis - Size and Demand Forecast Outlook 2025 to 2035

Chilled Processed Food Market Analysis by Ready Meal, Processed Meat, Processed Fish or Seafood Through 2035

Analysis and Growth Projections for Chilled Meal Kits Market

Market Share Breakdown of Chilled Food Packaging Manufacturers

Soup Containers Market

Fish Soup Market Analysis by Form, Format, Packaging and Sales Channel Through 2035

Dried Soup Market Size, Growth, and Forecast for 2025 to 2035

Potato Soup Market Size and Share Forecast Outlook 2025 to 2035

Canned Soup Market Size and Share Forecast Outlook 2025 to 2035

Understanding Potato Soup Market Share & Market Trends

UK Potato Soup Market Growth – Trends, Demand & Forecast 2025-2035

USA Potato Soup Market Trends – Growth, Demand & Innovations 2025-2035

Gluten-Free Soup Market Insights - Specialty Diets & Consumer Demand 2025 to 2035

Shelf-stable Soup Market Size and Share Forecast Outlook 2025 to 2035

Europe Potato Market Analysis Through Fresh, Frozen, Canned and Other Packaging Formats

Rundown of Growth Factors Elevating the Asia Pacific Potato Soup Sales.

Analysis and Growth Projections for Refrigerated and Frozen Soup Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA