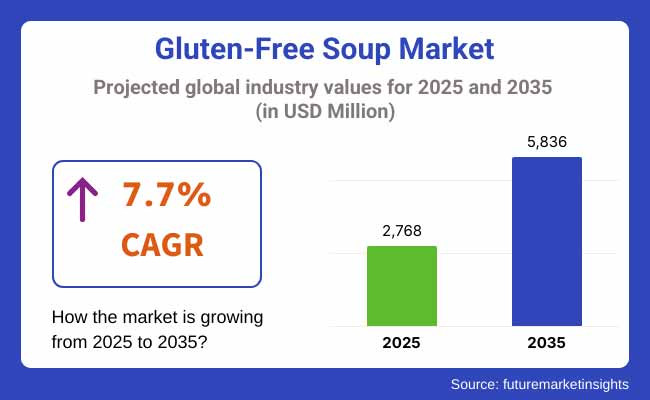

Gluten-free soup market will grow moderately during 2025 to 2035 with growth driven by increased demand from health-oriented individuals, gluten-intolerant consumers, and growing adoption of special diet lifestyle. The market is around USD 2,768 million in 2025 and will reach around USD 5,836 million in 2035 with a compound annual growth rate (CAGR) of 7.7% during 2025 to 2035.

Some of the strongest catalysts for this market trend are accessible. One of the most powerful motivators is a growing incidence of celiac disease and gluten intolerance, which is leading firms to launch a product line of gluten-free soups.

For example, Amy's Kitchen and Progresso both launched gluten-free brands of best-selling soups as part of their product offerings. Demand for natural and organic food is also leading demand for gluten-free soups forward. Yet, the market is limited by the cost of production, which is comparatively high, and customer requirements for improved taste and texture without gluten-based thickeners.

Gluten-free soup segments into a number of categories based on soups and ingredients. They are the largest category of gluten-free soups, seafood-based, meat-based, and vegetable-based. Vegetarian soups such as gluten-free tomato bisque and lentil soup are in high demand since vegetarians and gluten-intolerant individuals consume them in massive amounts.

Meat soups prepared without any wheat thickeners such as beef and chicken stew are more in demand these days. Seafood soups such as clam chowder made using substitute flours such as rice or chickpea flour are also becoming enormously popular.

North America is one of the fastest-growing gluten-free soup markets due to a health-food-aware base population and exposure to large food companies with gluten-free offerings. New product development in the United States and Canada has been propelled at a rapid rate, and market leaders Pacific Foods and Campbell's have introduced gluten-free soup brands due to consumer demand. Regulatory encouragement in the guise of gluten-free labelling has allowed for integrity and continuous establishment of trust by consumers towards gluten-free soups.

Internet and chain stores have also contributed to the expansion of the market, with chains like Walmart, Trader Joe's, and Whole Foods providing most of the gluten-free soups. The use of the gluten-free meal kit meal delivery plans has also expanded through the channels of Freshly and HelloFresh offering the gluten-free soup meal kits.

Europe holds most of the market share of gluten-free soups, and the top demand positions are held by Germany, France, and the United Kingdom. The regulation on food labelling controlled tightly to qualify as gluten-free in the country and increased natural and organic food consumption drive the market. Some of the businesses that have formulated gluten-free soups in an attempt to stay abreast of changing consumers' behaviours include Knorr and Heinz.

Italy, however, is renowned for its wheat food culture and has seen rising demand for gluten-free soup, particularly from consumers who are willing to consume healthier and allergen-free food. Online retailers like Ocado and Carrefour have also triggered market growth by making their products available as gluten-free soup to the masses.

Asia-Pacific will be the most likely to be the fastest-growing market for gluten-free soups with increasing numbers of consumers becoming gluten intolerant and with growing disposable incomes. Chinese, Japanese, Indian, and Australian economies are the driver of growth for this growth with the high base of Australia pushing the trend in the trends of gluten-free food. Other companies such as Hart & Soul and The Soup Co. introduced gluten-free soups using fresh locally accessible ingredients such as coconut milk and miso to appeal to locals.

In India, with its gigantic per capita consumption of wheat, gluten-free foods have become a gigantic demand in the urban Indian middle class, particularly in the metropolitan cities with dense population like Mumbai and Delhi. Consistent with increased numbers of foreign chains of supermarket giants making outlets in the cities and increased trend towards setting up specialist food shops offering health foods, heightened supply of gluten-free soups in the cities has been underway.

Challenge: More Expensive to Produce and Preserving Taste

Gluten-free soups also need gluten alternatives like potato starch, corn-starch, or tapioca flour as thickeners, which are relatively very costly compared to wheat material. This is looking at the production cost, which can be passed through over-pricing on the retail end. Secondly, manufacturers find it hard to have the perfect texture and taste without gluten. Most of the consumers are accustomed to the same richness and uniformity with everyday soups, and that does not come cheap.

Opportunity: Expansion in Plant-Based and Organic Gluten-Free Soups

The transition of consumer preference towards plant intake offers the highest opportunity for the gluten-free soup market. The buyers are not only seeking gluten-free soups but also vegan, organic, and artificial preservative-free soups. The trend is being adopted by the market with new products such as coconut cream butternut squash soup and organic miso soup with quinoa noodles.

New processing technology is also allowing entry of gluten-free soups with better flavour and texture. Addition of superfoods like kale, turmeric, and chia seeds in gluten-free soups is also adding to their nutritional value.

2020 to 2024 witnessed the growth of gluten-free soups sky-high with home cooking as the latest trend during the times of the COVID-19 pandemic. Consumers wanted healthier and allergen-friendly products, and package-free gluten-free soups were the call of the times. Growing numbers of such types of products were stocked on shop shelves for sale in supermarkets and online retailers, and food firms acted quickly by introducing new ranges of products.

Gluten-free food technology, sustainability trends, increased consumer awareness, and gluten-free food ingredients will be propelling the market in 2025 to 2035. Companies will attempt to include local ingredients, organic and minimally processed ingredients, to gain consumer acceptance. Functional soup with probiotics and immune-boosting ingredients will also be a trendsetter in the gluten-free soup market.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 |

|---|---|

| Regulatory Landscape | Governments controlled labelling for gluten-free certification. Governments regulated gluten levels strictly. |

| Technological Advancements | Companies created new gluten-free thickeners from rice and corn starch. New packaging methods increased product shelf life. |

| Consumer Preferences | Gluten-free soup sales increased among health-aware and celiac consumers. Stores increased gluten-free product lines. |

| E-commerce & Distribution | Online food shopping websites increased gluten-free soup sales. Subscription meal kits provided gluten-free choices. |

| Ingredient Sourcing | Replacement foods such as millet and quinoa substituted wheat-based food. Green product sourcing became the consumer's major concern. |

| Sustainability Initiatives | Companies utilized recyclable packaging material to reduce waste. Production cut carbon emissions through the use of smart logistics in distribution. |

| Market Growth Drivers | Growing awareness of gluten intolerance and celiac disease drove demand. The wellness and healthy culture spurred innovation in gluten-free food. |

| Market Shift | 2025 to 2035 |

|---|---|

| Regulatory Landscape | Tighter worldwide regulations guarantee gluten-free compliance. Regulators require increased testing protocols and supply chain traceability. |

| Technological Advancements | Technological innovations in plant-based formulation result in improved texture and flavour. Artificial intelligence -based quality control improves consistency and reduces risks of cross-contamination. |

| Consumer Preferences | Functional ingredients and personalized nutrition influence product innovation. Gluten-free soups with high protein and fibre content become increasingly popular. |

| E-commerce & Distribution | Direct-to-consumer brands shake up the market with personalized gluten-free products. AI-driven recommendations improve customer interaction. |

| Ingredient Sourcing | Vertical farming and hydroponics streamline gluten-free ingredient production. Block chain provides end-to-end transparency into gluten-free soup ingredient sources. |

| Sustainability Initiatives | Circular economy imperatives control manufacture, with carbon-neutral and compostable packaging evolving as industry standards. |

| Market Growth Drivers | Functional nutrition trends create demands for vitamin and probiotic fortified soups. Increasing vegan and flexitarian bases broaden the scope of the gluten-free soup segment. |

The market for gluten-free soup is growing in the United States together with expanding trends of consumerism driven by health and the rising levels of gluten intolerance. Gluten-free soups are currently available at grocery stores and specialty food houses, and large companies are launching new flavours and healthier variants.

Demand for easy foods continues as a main industry driver, with ready-to-eat and microwaveable gluten-free soups in high demand. Increased expansion of more foodservice establishments offering gluten-free products also drives market growth. The rigorous labelling requirements of the USA FDA also provides consumers with confidence assurance and quality assurance.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.6% |

The UK market for gluten-free soup is rising incrementally as increasing numbers of consumers are opting for allergen-free and plant-based products. Retailers are increasingly broadening the scope of gluten-free products with private label brands launching competitive price alternatives.

The regulative power of the European Union's food safety policies, even after Brexit, ensures product quality and consumers' trust. Moreover, the rising trend of flexitarian and vegan eating patterns continues to drive demand for gluten-free soups enriched with plant proteins and superfoods.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.9% |

European Union's gluten-free soups market is controlled by robust regulatory regimes requiring testing and certification of gluten. Major food firms are pouring money into research to enhance texture and taste of products, silencing previous consumer fears about gluten-free foods.

The greater demand for organic and natural gluten-free soups is propelling market growth in Germany, Italy, and France. The consumer trend toward clean-label and low-sodium soups is also propelling the premiumization trend in the market.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union | 7.4% |

Japan's gluten-free soup market is growing as more and more people become aware of dietary limitations and need more functional food. Although the Japanese diet itself is not very gluten-dense, processed foods include unsuspected sources of gluten, so assured gluten-free products are in demand.

The expansion of high-end convenience stores and online grocery websites enhances access to gluten-free soups, as technological innovation in umami-dense, gluten-free foods enhances flavour and appeal to mass-market consumers.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.8% |

There is growing demand for gluten-free soup in South Korea as Western diets change and food allergy causes more problems. The local food market is investing in gluten-free technology, launching new brands aimed at the health-conscious consumer along with medically diet required.

Government support of open labelling and allergen-free food processing makes consumers more confident. In addition, the penetration of upscale food delivery chains and global hypermarkets enhances supply and convenience for gluten-free soups.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.6% |

Liquid gluten-free soups lead the market, mainly because of convenience and high consumption of ready-to-eat meal solutions. Liquid soups are consumed by people as they need to be prepared less and can be taken directly from the pack. Market leaders such as Pacific Foods and Amy's Kitchen provide diversified gluten-free soups in a liquid format such as creamy tomato, butternut squash, and chicken noodle, which are also being demanded by vegetarians and non-vegetarians.

With this increasing trend towards eating foods on the move, liquid soup sales picked up even faster among health-conscious consumers and working professionals. Furthermore, the increasing popularity of liquid gluten-free organic and clean-label soups also resulted in their predominance in upscale retailers.

Dry gluten-free soups, even powder or dehydrated, are also on the rise because they have a longer shelf life and can be tailored to meet personal modification needs. Customers who opt for cheap and easy food sources turn to dry soups, which can be reconstituted using water or broth intake. Dr. McDougall's and Frontier Soups are two such companies that market gluten-free solid soups in lentil, split pea, and miso varieties that are hot selling items among health-conscious consumers.

The increased popularity of plant-based diets has also demanded more solid gluten-free soups that can be added with the consumer's preferred fresh vegetables for more nutrition and taste. The trend towards bulk purchases and emergency food supplies has also pushed the segment's growth.

Vegetarian gluten-free soups are leading, spurred on by rising plant-based diet consumption and rising food allergy awareness. Foods that contain no dairy, soy, or nuts are increasingly demanded by consumers, and manufacturers are thus creating soups from clean ingredients like organic vegetables, lentils, and legumes. Progresso vegetable minestrone and Imagine Foods lentil soup are among the top-selling vegetarian gluten-free soup brands available in the market.

High-nutrient, high-protein soups made of chickpeas, quinoa, and black beans are also putting pressure on the vegetarian gluten-free soup category. As consumers are increasingly focusing on digestive health as well as gut health, companies are focusing on fibre-enriched and fortified formats.

Non-vegetarian gluten-free soups remain among the most popular with consumers who want high-protein and full-meal soups. Chicken, beef, and seafood soups are characteristic of this category, with Kettle & Fire and Campbell's producing bone broth and whole meat soups in lieu of gluten-based soups.

With the consumer taking interest in consuming food that will enhance their immunity and assist in the production of collagen, the sale of gluten-free bone broth soups has significantly increased. Secondly, with the trend for organically grown and ethically bred animals, there has been a launch by the manufacturers of grass-fed and free-range meat as the core product ingredient.

Gluten-free canned soups are in the lead when it comes to market share based on convenience, shelf life, and convenience in storage. Giant sizes of well-known brands like Amy's Organic Soups and Campbell's Well Yes! are some of the most sought-after brands of gluten-free canned soups like creamy mushroom soup, lentil vegetable soup, and chicken & wild rice. The convenience of easy instant heating and consumption of such foods has brought them to consumers' first preference for quick consumption of food.

Other than this, growing need for green, BPA-free packaging is compelling companies to develop new canning technologies. Consumers are shifting toward lower-sodium and organic-ingredient-based canned soups, and this is compelling companies to transform and reposition themselves.

Packet or pouched gluten-free soups are gaining popularity among organic and premium shoppers. Pouches are very cost-effective to ship, convenient to eat, and more environmentally friendly than cans. Some companies selling gluten-free soups in pouched packs include Tetra Pak and Boulder Organic, such as spicy black bean, coconut curry, and roasted red pepper.

The increasing trend toward single-serve and reseal pack goods has also driven the increase in the consumption of pouched soup. Pouches are being consumed by buyers looking for fresh, low-processing products since they contain less preservative than canned food.

Hypermarkets and supermarkets are the core distribution channels of gluten-free soups, in which customers purchase in stores for them to visually inspect food containers and mix foods. Mass marketers like Walmart, Whole Foods, and Kroger stock many gluten-free soup brands for all types of diet need and price segment. Store presence of special gluten-free shelves also increased demand more, as these products are accessible for easy checking out.

Department and convenience stores also drive sales, particularly on ready-to-eat liquid soups. Convenience shopping incorporates single-serve gluten-free soup as a convenience meal option grab. Specialty health food stores also represent major points of distribution for upscale gluten-free soups with organic, non-GMO, and allergen status.

Doorstep delivery and subscription sales channels reflect growing growth in the gluten-free soup market with growing use of doorstep delivery and subscription sales channels by more consumers. Ex-large sizes of gluten-free soups, such as international and specialty ones that typically do not reach local stores, are retailed through internet channels such as Amazon, Thrive Market, and Vitacost.

Their sites have also been successful sales drivers, allowing the consumer to shop product information, consumer reviews, and direct purchase link. Subscription-priced block-buying prices for gluten-free soups have also triggered online buying. With more grocery buying online, packagers are focusing on packaging optimization and direct-to-consumer promotion to bring their web presence together in a cohesive manner.

Gluten-free soup market is a fast-evolving and expanding market driven by high demand for healthy, allergen-free food products. International industry firms and indigenous food companies compete on rolling out new flavour, green, and organic packaging.

Companies foray into product diversification in plant and high-protein soups as they aim to target rising numbers of wellness-oriented customers. Market new entrants and incumbent food companies dominate the industry market and determine trends through shifts in consumers' preferences.

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| Campbell Soup Company | 15-20% |

| The Hain Celestial Group | 10-14% |

| General Mills (Progresso) | 8-12% |

| Amy’s Kitchen | 6-10% |

| Pacific Foods | 4-8% |

| Other Companies (combined) | 40-50% |

| Company Name | Key Offerings/Activities |

|---|---|

| Campbell Soup Company | Offers several gluten-free soups under its Well Yes! and Healthy Request lines. Invests in re-formulating original recipes to appeal to gluten-sensitive customers. |

| The Hain Celestial Group | Creates non-GMO and organic gluten-free soups to sell under its brand, Imagine. Delivers plant-based and dairy-free options to accommodate vegan and vegetarian purchasers. |

| General Mills (Progresso) | Develops classic and creative gluten-free soup flavour profiles with emphasis on strong taste and texture. Uses premium ingredients to enable competitive differentiation. |

| Amy’s Kitchen | Has expertise in organic, gluten-free, and dairy-free soups. Focuses on sustainability through eco-friendly packaging and socially conscious sourcing practices. |

| Pacific Foods | Creates bone broth-based and creamy gluten-free soups. Focuses on minimally processed, clean-label ingredients and BPA-free packaging. |

Key Company Insights

Campbell Soup Company (15-20%)

Campbell Soup Company leads the gluten-free soup market through its wide portfolio of healthy, great-tasting soups. Reconstituting recipe items in core brands continues to meet consumers' need for gluten-free products. With high brand equity and wide in-store distribution, Campbell sells by opportunistically tying up in chain grocery stores and the internet.

The Hain Celestial Group (10-14%)

Hain Celestial Group has a premium category for plant-based and organic gluten-free soups under Imagine. It offers non-GMO, low-sodium, and preservative-free ingredients that health-conscious consumers prefer. It augments the line with new extensions of flavours like coconut- and lentil-based soups periodically to address shifting nutritional requirements.

General Mills (Progresso) (8-12%)

General Mills' Progresso also has a niche for premium ready-to-eat soups with a strong gluten-free position. The company intends to produce hearty, protein-high, comfort-food-flavoured soups such as gluten-free chicken noodle and minestrone to attract mainstream consumers looking for diet-friendly offerings.

Amy's Kitchen (6-10%)

Amy's Kitchen is a top-selling name in organic and gluten-free soup with homemade-style, wholesome soups that are artificial preservative-free. Eco-friendly consumers praise the company for its emphasis on sustainability and environmentally friendly supplies. It produces a wide range of products encompassing lentil, vegetable, and split pea soups and retails in large natural food chains as well as online retailers.

Pacific Foods (4-8%)

Pacific Foods is the bone broth-based and hearty gluten-free soup market leader that uses high-quality, minimally processed ingredients. Pacific Foods' commitment to sustainability comes to life in its organic sourcing and BPA-free cartons. Its gluten-free products are tomato basil, roasted red pepper, and butternut squash soup, which are consumed by customers looking for nutrition and taste.

Other Key Players (40-50% Combined)

Apart from these giants, there are few participants who are involved in the gluten-free soup market in the fields of niche products, private label manufacturing, and in-line distribution channels. These include:

The overall market size for gluten-free soup was approximately USD 2,768 million in 2025.

The gluten-free soup market is projected to reach approximately USD 5,836 million by 2035.

The increasing prevalence of celiac disease and gluten intolerance, along with growing consumer awareness about the benefits of gluten-free diets, are expected to drive the demand for gluten-free soup during the forecast period.

The top 5 regions contributing to the development of the gluten-free soup market are North America, Europe, Asia-Pacific, South America, and the Middle East & Africa.

On the basis of consumer demographics, health-conscious consumers represent a vital segment, driven by a growing trend towards healthier eating habits and clean labels that cater to their nutritional needs.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Form, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Category, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Form, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Category, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Form, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Category, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 34: Europe Market Volume (Units) Forecast by Form, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 36: Europe Market Volume (Units) Forecast by Category, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 38: Europe Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 44: Asia Pacific Market Volume (Units) Forecast by Form, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 46: Asia Pacific Market Volume (Units) Forecast by Category, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 48: Asia Pacific Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Form, 2018 to 2033

Table 54: MEA Market Volume (Units) Forecast by Form, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Category, 2018 to 2033

Table 56: MEA Market Volume (Units) Forecast by Category, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 58: MEA Market Volume (Units) Forecast by Packaging, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (Units) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Form, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Category, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Category, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Form, 2023 to 2033

Figure 27: Global Market Attractiveness by Category, 2023 to 2033

Figure 28: Global Market Attractiveness by Packaging, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Form, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Category, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Category, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Form, 2023 to 2033

Figure 57: North America Market Attractiveness by Category, 2023 to 2033

Figure 58: North America Market Attractiveness by Packaging, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Form, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Category, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Category, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Form, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Category, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Packaging, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Form, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Category, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 101: Europe Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 105: Europe Market Volume (Units) Analysis by Category, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 109: Europe Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Form, 2023 to 2033

Figure 117: Europe Market Attractiveness by Category, 2023 to 2033

Figure 118: Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Form, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Category, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 131: Asia Pacific Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 135: Asia Pacific Market Volume (Units) Analysis by Category, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 139: Asia Pacific Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Form, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Category, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Packaging, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Form, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Category, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Form, 2018 to 2033

Figure 161: MEA Market Volume (Units) Analysis by Form, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Form, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Form, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Category, 2018 to 2033

Figure 165: MEA Market Volume (Units) Analysis by Category, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Category, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Category, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 169: MEA Market Volume (Units) Analysis by Packaging, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (Units) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Form, 2023 to 2033

Figure 177: MEA Market Attractiveness by Category, 2023 to 2033

Figure 178: MEA Market Attractiveness by Packaging, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Soup Containers Market

Fish Soup Market Analysis by Form, Format, Packaging and Sales Channel Through 2035

Dried Soup Market Size, Growth, and Forecast for 2025 to 2035

Potato Soup Market Size and Share Forecast Outlook 2025 to 2035

Canned Soup Market Size and Share Forecast Outlook 2025 to 2035

Understanding Potato Soup Market Share & Market Trends

Chilled Soup Market Analysis by Packaging Type and Distribution Channels Through 2035

UK Potato Soup Market Growth – Trends, Demand & Forecast 2025-2035

USA Potato Soup Market Trends – Growth, Demand & Innovations 2025-2035

Shelf-stable Soup Market Size and Share Forecast Outlook 2025 to 2035

Europe Potato Market Analysis Through Fresh, Frozen, Canned and Other Packaging Formats

Rundown of Growth Factors Elevating the Asia Pacific Potato Soup Sales.

Analysis and Growth Projections for Refrigerated and Frozen Soup Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA