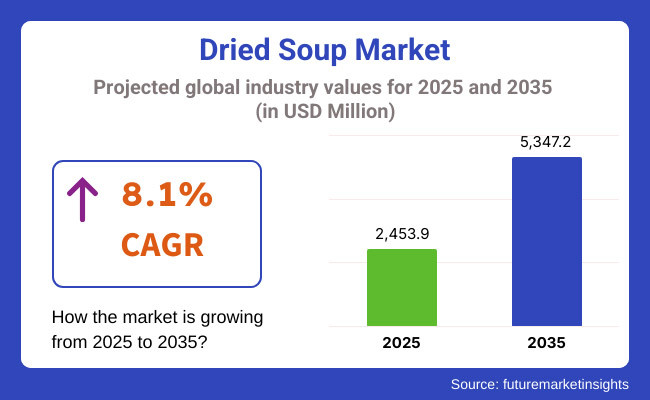

Global dried soup sales reached approximately USD 2,453.9 million at the end of 2025. Forecasts suggest the market will achieve a compound annual growth rate (CAGR) of 8.1% and surpass USD 5,347.2 million in value by 2035.

The sector’s outlook has been shaped by heightened consumer demand for nutrient-rich, portable, and quick-preparation meal formats, particularly in urbanized regions. The market’s robustness is largely attributed to the confluence of modern dietary preferences, long shelf-life advantages, and convenience-driven consumption behavior. As households and individuals increasingly adopt fast-paced lifestyles, dried soups have positioned themselves as both functional and accessible solutions in the daily meal repertoire.

A critical driver supporting this expansion has been the aggressive product reformulation strategy employed by leading manufacturers. Vegetable-based, plant-forward, and reduced-sodium options have gained widespread traction, reflecting growing health awareness and regulatory pressures.

Furthermore, technological advancements in dehydration and encapsulation have elevated the quality, texture, and reconstitution performance of dried soup offerings-enhancing consumer satisfaction and repeat purchases.

From a branding and distribution standpoint, the rise of e-commerce and digital-first platforms has amplified access to diverse dried soup formats across global markets. Traditional retailers, online grocery providers, and DTC brands have capitalized on evolving purchasing habits by offering curated selections, single-serve packs, and premium organic or clean-label options. Clean-label certification, in particular, has emerged as a key differentiator, supported by consumer inclination toward ingredient transparency and natural formulations.

Regionally, North America and Western Europe dominate in terms of value share due to a matured soup culture, robust retail penetration, and innovation-focused incumbents. However, Asia Pacific is expected to exhibit the fastest growth rate, spurred by expanding middle-class demographics, rising health consciousness, and modern trade channel development.

Multinational players such as Campbell Soup Company, Nestlé, Unilever, and Kraft Heinz continue to maintain stronghold positions through aggressive product launches and regional adaptations. The landscape also sees participation from emerging local brands who offer ethnically tailored or sustainability-centered propositions.

Overall, the dried soup market is poised for sustained growth through 2035, driven by the convergence of consumer wellness priorities, technological enhancements, packaging sustainability, and strategic retail expansion. As the category continues to evolve, stakeholder focus will remain on balancing functionality, health benefits, and brand authenticity in a competitive and innovation-sensitive environment.

The table below presents a comparative assessment of the variation in CAGR over six months for the base year (2024) and the current year (2025) in the global dried soup market. This analysis highlights key performance shifts and revenue realization patterns, offering stakeholders a clearer perspective on market growth.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 7.5% |

| H2 (2024 to 2034) | 8.1% |

| H1 (2025 to 2035) | 7.6% |

| H2 (2025 to 2035) | 8.2% |

The first half (H1) spans from January to June, while the second half (H2) includes the months from July to December. In the first half (H1) of the decade from 2025 to 2035, the industry is projected to grow at a CAGR of 8.1%, followed by a sustained growth rate in the second half (H2) of the same period.

Moving forward, from H1 2025 to H2 2035, the CAGR is expected to remain steady, indicating a stable expansion trajectory. The sector experienced an increase of 10 BPS in the first half (H1), whereas a slight increase of 10 BPS was noted in the second half (H2).

Commanding the largest market share in 2025, vegetable-based dried soups are forecast to retain dominance through 2035, underpinned by a CAGR of 7.9%. This segment’s sustained leadership reflects a strong alignment with consumer preferences for clean-label, nutrient-dense meal formats that balance convenience and health.

As the dried soup category undergoes rapid evolution, the vegetable-based segment has emerged as the core pillar in positioning dried soups as credible functional foods rather than merely utilitarian pantry staples.

Product innovation has been heavily centered on plant-forward formulations, with reformulations emphasizing reduced sodium, fiber enrichment, and clean ingredient decks. Advances in dehydration and flavor encapsulation technologies have narrowed the sensory gap between dried and fresh soups, particularly in the vegetable-based segment, improving taste fidelity, texture, and visual appeal. These improvements have not only elevated consumer trust but also boosted brand retention rates in health-conscious segments.

Furthermore, the segment benefits from heightened institutional and retail demand, particularly among single-person households, office-goers, and aging populations seeking lightweight, low-preparation nutrition.

Regional cuisines, such as Asian-style miso and Mediterranean vegetable blends, continue to gain relevance in urban markets. Looking ahead, growth will hinge on sustainability narratives, functional fortification, and targeted wellness claims, solidifying vegetable-based dried soups as a category benchmark.

Expected to register a CAGR of 9.4% between 2025 and 2035, the clean label and organic segment is emerging as the fastest-growing category in the dried soup market. Although it represents a relatively smaller share in 2025, its expansion trajectory signals a decisive shift toward ingredient transparency, health consciousness, and environmental accountability-particularly among urban, affluent, and digitally engaged consumers.

This segment’s momentum is being catalyzed by a growing aversion to artificial additives, preservatives, and excessive sodium content. In response, manufacturers have reformulated offerings with certified organic vegetables, natural flavor enhancers, and non-GMO ingredients, while removing synthetic thickeners and colorants. These moves resonate with consumers seeking simplified ingredient lists and “pantry kitchen” authenticity, especially within e-commerce and specialty retail formats.

Premium positioning has allowed players to command higher price points, with differentiation focused on provenance storytelling, minimal processing, and eco-conscious packaging. Brands that combine organic certification with functional claims-such as immunity support, gut health, or anti-inflammatory benefits-are gaining strategic shelf space and digital visibility. The segment also attracts younger demographics and wellness-focused buyers, making it a key area for brand extension and influencer-led marketing.

As regulatory scrutiny and consumer education deepen, clean label and organic dried soups are set to redefine quality benchmarks across global markets.

Elevating Convenience: The Rise of Gourmet Dried Soups Market

Shift: Consumers are making the switch to high-end, gourmet dried soups that give the exciting experience of a restaurant and unique flavors. There is a vast growth of artisanal, chef-crafted recipes with the addition of exotic spices, slow-cooked broths, and high-protein ingredients. This movement is most noticeable in North America and Europe, where premium and gourmet packaged foods are steadily making their way into the market among the time-squeezed, conscious buyers.

Strategic Response: Launching the premium lines of dried soup lines with internationally inspired flavors, organic ingredients, and nutritional benefits is one way to manufacturers' strategy. Many brands are using slow-drying techniques to preserve taste and nutrients, while some are incorporating truffle oils, bone broths, and ancient grains to cater to evolving consumer palates. Luxury packaging and limited-edition seasonal flavors are also being introduced to position dried soups as indulgent, high-end meal solutions.

Hyper-Personalized Nutrition in Soup Formulations

Shift: The trend of consumers looking for soups that fit their specific dietary requirements has risen. They seek soups such as keto-friendly, high-protein, low-sodium, and gut-health-supporting options. Demand for soups fortified with probiotics, collagen, and functional mushrooms is rising, as people seek specific health benefits from their meals. Personalized nutrition is gaining popularity, especially in the USA and Asia-Pacific.

Strategic Response: Companies are creating their product portfolio with health-focused, diet-specific options in diversified dried soups. The reason for including AI-driven insights in product lines will be the development of personalized product lines and subscription meal plans. Ingredients that are functional, like turmeric, ginger, and medicinal mushrooms, are being added to the formulations, while single-serve packets that have customizable seasoning levels are being introduced for more flexibility.

Demand for Ultra-Convenient, On-the-Go Formats

Shift: Lifestyles seems to be busy, so more and more desire is coming for super-convenient dried soup formats in a single unit. Instant hydration soup formats are becoming popular among office workers, students, and traveller. These demand trends are very characteristic of urban areas around the globe, especially in Europe, North America, and Asia, where swapping meals for time-saving ones often means eating unhealthy.

Strategic Response: Companies are evolving and making considerable strides in enhancing short-time meals by making soups that only need slight prep, such as instant heat-and-eat pouches and self-heating soup cups. Freeze-dried technology is furthermore a tool to improve the flavor while preserving a long shelf life. Some brands are also offering multipurpose soup powders that can be used as broths, meal bases, or seasoning blends, allowing greater versatility in the preparation of meals.

Increased Functional & Therapeutic Soup Ingredients

Shift: Consumers are utilizing dried soups as a mode of nutrition involving functional and nutritional ingredients that include those helpful for digestion, immunity, and energy. Ingredients like seaweed, moringa, and ashwagandha are examples of the popular superfoods that are being added to soup formulations to enhance their health benefits. This tendency is more noticeable in the wellness markets like Japan, South Korea, and the USA

Strategic Response: The functional food trend has led to manufacturers formulating dried soups with adaptogens, superfoods, and medicinal herbs. Many brands are teaming up with nutritionists and wellness influencers to publicize the health benefits of their products. The packaging is also being revitalized, by including functional claims such as immunity-boosting, anti-inflammatory, and gut-friendly, thereby ensuring their products will be more appealing to health-driven markets.

The dried soup market at a global scale is characterized by a structure that involves organized as well as unorganized players with the regional brands mainly leading the market development. Global food companies control a big portion of the market, but at the same time, numerous regional and local producers meet country-specific consumer preferences with traditional tastes and more affordable alternatives.

Organized Players: The organized section in the dried soup market is made up of well-known companies, that have an established image, a great knowledge of regional and local markets, and diversification of the product assortment. These manufacturers concentrate on product innovation, upscale options, and entry into upcoming markets.

They take advantage of the digital platform and direct sales to consumers as their principal access route to their products. The organization also represents the primary manufacturer of the product for the study of and the implementation of healthy formulations such as low-sodium, organic, and gluten-free foods to the changing consumer demands.

Unorganized Players: The non-organized section refers to the small manufacturers and other companies that are in low distribution while they serve a specific niche through their traditional recipes and regional ingredients. These producers frequently appeal to public areas, including local and national food traditions that most consumers can identify with.

In addition, they use attractive bracketed prices and practical distribution channels, functioning mainly in Asia-Pacific, Latin America, and Africa. The unorganized sector's procurement process is mainly through small and closed outlets, street markets, and small grocery shops rather than supermarkets.

Local brands have always played a key part in the dried soup market by providing the tastes that locals prefer, the affordability issue, and the different learning needs that are present at the global level. Marketing issues highlighting superior quality, gourmet flavors, and palatable meals have also been influential in the choice of products.

Besides that, the opening of online shopping and distance selling channels has increased the availability enabling brands to access a new group of customers. The companies are investing in new drying methods and the acquisition of raw materials to stay ahead in the market of innovative and healthy dried soup products.

| Country | United States |

|---|---|

| Market Volume (USD Million) | 1,200.00 |

| CAGR (2025 to 2035) | 5.50% |

| Country | Germany |

|---|---|

| Market Volume (USD Million) | 850.00 |

| CAGR (2025 to 2035) | 4.80% |

| Country | United Kingdom |

|---|---|

| Market Volume (USD Million) | 750.00 |

| CAGR (2025 to 2035) | 4.50% |

| Country | China |

|---|---|

| Market Volume (USD Million) | 600.00 |

| CAGR (2025 to 2035) | 6.20% |

| Country | Japan |

|---|---|

| Market Volume (USD Million) | 500.00 |

| CAGR (2025 to 2035) | 3.90% |

In 2025, the dried soup market in the United States is projected to be worth around USD 1,200 million, further growing with a CAGR of 5.5% from 2025 to 2035. This increase in the market is attributed to the consumers' need for easy meal-prepping due to their busy schedules.

There is a slight preference for health products which causes the manufacturers to add items such as low-sodium, organic, and protein-enriched dried soup options. The growth of e-commerce platforms that sell these products, has further contributed to the market surge.

Germany's dried soup market, with a projected volume of around USD 850 million in 2025, will expand at a CAGR of 4.8% throughout the foreseen period. The Hamburg market has a strong emphasis on the demand for high-quality, gourmet, and organic dried soups.

Consumers are looking for products more and more that match their health and wellness trends, which is why manufacturers are making natural ingredients and recipes. The focus of retail chains and the online food retailing sector to push out the market stands firm.

The dried soup market in China is set to achieve a volume of about USD 600 million by the year 2025 with a CAGR of 6.2% from 2025 to 2035. The main drivers of the market are the process of rapid urbanization and the shift in food habits.

Due to hectic urban life, Chinese consumers are inclined towards food items that are ready to eat, hence driving the market sales of dried soups. Producers are coming up with local flavors and, in response to the trend of premiumization consumers, are willing to cough up more money for both quality and health aspects. Online retail platforms, in addition to that, help the market once again big time.

The global dried soup market is the setting for shopping since it is very much involved whereas the companies are leading the way and adjusting to changes brought about by the consumer and the market itself. The big players have been also trying to grow beyond the traditional soup businesses by diversifying into other high-margin products such as snacks and sauces. From this point of view, the strategic change is fto reachmore potential customers and also to stimulate the profit of other food groups.

Besides, the firms are working on cutting-edge packaging technology and are broadly entering new markets to facilitate the accessibility of meals that are meant for convenience. The ambiance of competition is rallied by the entry of the new brands promoting health-conscious and top-quality articles in turn the original manufacturers accepted innovation as a necessity and were forced to present new product lines.

For instance:

The dried soup market is segmented into dehydrated dried soups and instant dried soups.

The market is segmented into pouches, cups, and boxes, catering to varying consumer convenience and storage needs.

The market is categorized into HORECA, modern trade, convenience stores, online stores, and others, reflecting diverse distribution strategies.

The market is segmented into North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic countries, Russia and Belarus, and the Middle East & Africa.

The global dried soup market is projected to grow at a CAGR of 8.1% from 2025 to 2035.

The global dried soup market is anticipated to reach a valuation of USD 5,347.2 million by 2035.

Instant dried soups are expected to register the highest growth due to their convenience, quick preparation, and increasing adoption in urban households.

Rising demand for convenient meal solutions, expanding e-commerce penetration, growing consumer preference for clean-label products, and increasing adoption of plant-based ingredients are key growth drivers.

Leading companies in the market include Nestlé S.A., Unilever PLC, Campbell Soup Company, General Mills, The Kraft Heinz Company, and B&G Foods.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 10: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Product, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 18: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 20: Latin America Market Volume (MT) Forecast by Product, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Western Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 28: Western Europe Market Volume (MT) Forecast by Product, 2018 to 2033

Table 29: Western Europe Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 30: Western Europe Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 32: Western Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 34: Eastern Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 36: Eastern Europe Market Volume (MT) Forecast by Product, 2018 to 2033

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 38: Eastern Europe Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Eastern Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: South Asia and Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 44: South Asia and Pacific Market Volume (MT) Forecast by Product, 2018 to 2033

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 46: South Asia and Pacific Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: South Asia and Pacific Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: East Asia Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 52: East Asia Market Volume (MT) Forecast by Product, 2018 to 2033

Table 53: East Asia Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 54: East Asia Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 55: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 56: East Asia Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 58: Middle East and Africa Market Volume (MT) Forecast by Country, 2018 to 2033

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2018 to 2033

Table 60: Middle East and Africa Market Volume (MT) Forecast by Product, 2018 to 2033

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Packaging, 2018 to 2033

Table 62: Middle East and Africa Market Volume (MT) Forecast by Packaging, 2018 to 2033

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 64: Middle East and Africa Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 6: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 10: Global Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 13: Global Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 14: Global Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 15: Global Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 16: Global Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 18: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 21: Global Market Attractiveness by Product, 2023 to 2033

Figure 22: Global Market Attractiveness by Packaging, 2023 to 2033

Figure 23: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 24: Global Market Attractiveness by Region, 2023 to 2033

Figure 25: North America Market Value (US$ Million) by Product, 2023 to 2033

Figure 26: North America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 28: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 30: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 34: North America Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 37: North America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 38: North America Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 39: North America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 40: North America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 42: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 45: North America Market Attractiveness by Product, 2023 to 2033

Figure 46: North America Market Attractiveness by Packaging, 2023 to 2033

Figure 47: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 48: North America Market Attractiveness by Country, 2023 to 2033

Figure 49: Latin America Market Value (US$ Million) by Product, 2023 to 2033

Figure 50: Latin America Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 52: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 54: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 58: Latin America Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 62: Latin America Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 66: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 69: Latin America Market Attractiveness by Product, 2023 to 2033

Figure 70: Latin America Market Attractiveness by Packaging, 2023 to 2033

Figure 71: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 73: Western Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 74: Western Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 75: Western Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 76: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 78: Western Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 82: Western Europe Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 85: Western Europe Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 86: Western Europe Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 89: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 90: Western Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 93: Western Europe Market Attractiveness by Product, 2023 to 2033

Figure 94: Western Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 95: Western Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 96: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2023 to 2033

Figure 98: Eastern Europe Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 99: Eastern Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 102: Eastern Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 106: Eastern Europe Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 110: Eastern Europe Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 114: Eastern Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 117: Eastern Europe Market Attractiveness by Product, 2023 to 2033

Figure 118: Eastern Europe Market Attractiveness by Packaging, 2023 to 2033

Figure 119: Eastern Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2023 to 2033

Figure 122: South Asia and Pacific Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 123: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 126: South Asia and Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 130: South Asia and Pacific Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 134: South Asia and Pacific Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 138: South Asia and Pacific Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2023 to 2033

Figure 142: South Asia and Pacific Market Attractiveness by Packaging, 2023 to 2033

Figure 143: South Asia and Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 145: East Asia Market Value (US$ Million) by Product, 2023 to 2033

Figure 146: East Asia Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 147: East Asia Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 148: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 150: East Asia Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 154: East Asia Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 157: East Asia Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 158: East Asia Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 161: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 162: East Asia Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 165: East Asia Market Attractiveness by Product, 2023 to 2033

Figure 166: East Asia Market Attractiveness by Packaging, 2023 to 2033

Figure 167: East Asia Market Attractiveness by Sales Channel, 2023 to 2033

Figure 168: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2023 to 2033

Figure 170: Middle East and Africa Market Value (US$ Million) by Packaging, 2023 to 2033

Figure 171: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 174: Middle East and Africa Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2018 to 2033

Figure 178: Middle East and Africa Market Volume (MT) Analysis by Product, 2018 to 2033

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2023 to 2033

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2023 to 2033

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Packaging, 2018 to 2033

Figure 182: Middle East and Africa Market Volume (MT) Analysis by Packaging, 2018 to 2033

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Packaging, 2023 to 2033

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Packaging, 2023 to 2033

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 186: Middle East and Africa Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 189: Middle East and Africa Market Attractiveness by Product, 2023 to 2033

Figure 190: Middle East and Africa Market Attractiveness by Packaging, 2023 to 2033

Figure 191: Middle East and Africa Market Attractiveness by Sales Channel, 2023 to 2033

Figure 192: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Dried Baby Food Market Size and Share Forecast Outlook 2025 to 2035

Dried Herbs Market Size and Share Forecast Outlook 2025 to 2035

Dried Honey Market Size and Share Forecast Outlook 2025 to 2035

Dried Spices Market Analysis by Type, End-Use Industry, Distribution Channel and Others Through 2035

Dried Spent Grain Market Trends – Growth & Industry Forecast 2025 to 2035

Dried Eggs Market Insights – Shelf-Stable Nutrition & Industry Growth 2025 to 2035

Dried Apricot Market - Growth, Demand & Nutritional Trends

Dried Mushrooms Market Analysis – Trends & Forecast 2024-2034

Dried Distillers' Grains with Soluble Market

Air-dried Venison Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Fish Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Chicken Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-Dried Food Market Growth, Forecast, and Analysis 2025 to 2035

Roll-dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Spray-dried Animal Plasma (SDAP) Market Size and Share Forecast Outlook 2025 to 2035

Spray Dried Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Freeze Dried Fruit Powder Market Size and Share Forecast Outlook 2025 to 2035

Rolled-Dried Starch Market Size and Share Forecast Outlook 2025 to 2035

Freeze-dried Food Market Analysis - Size, Growth, and Forecast 2025 to 2035

Freeze Dried Fruits Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA