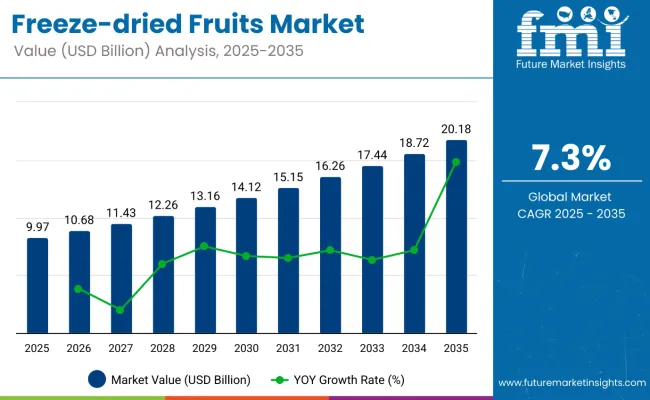

The global freeze-dried fruits market is projected to grow from USD 9.97 billion in 2025 to USD 20.18 billion by 2035, reflecting a compound annual growth rate (CAGR) of 7.3% over the forecast period. This growth is driven by rising consumer demand for convenient, nutritious, and long-shelf-life food options, especially in the context of busy lifestyles and increasing health consciousness. Freeze-dried fruits, known for their ability to retain the nutrients, flavors, and colors of fresh fruits while being lightweight and shelf-stable, are becoming increasingly popular among health-conscious consumers.

The demand for freeze-dried fruits is being further accelerated by the growing preference for natural, clean-label products. These fruits offer a healthy, easy-to-consume alternative to traditional snacks, making them especially popular in the snack food and breakfast product segments. As consumers prioritize convenience without compromising on nutritional value, freeze-dried fruits are emerging as a preferred choice, with applications spanning snacks, smoothies, cereals, and other processed food products.

In addition to health-conscious trends, the increasing popularity of e-commerce and direct-to-consumer sales is facilitating the growth of the freeze-dried fruits market. Online platforms are helping manufacturers reach a wider customer base, making these products more accessible to global consumers. Furthermore, innovations in packaging and product formats are expanding the market's reach, with manufacturers focusing on sustainable packaging solutions to cater to environmentally aware consumers.

The market is also benefiting from an increasing variety of freeze-dried fruit products. As consumer demand shifts toward more diverse flavor profiles and healthy alternatives, companies are expanding their product offerings, incorporating fruits such as strawberries, blueberries, apples, and mangoes, as well as new blends and combinations.

Kerry Group’s acquisition of 70% of Kerry Dairy Ireland in December 2024 strengthens its position in the freeze-dried fruits market. This move enhances its capabilities in dairy and related sectors, benefiting its freeze-dried product offerings. Sustainability remains a key focus, with the company reporting a 38% reduction in food waste in 2024. This highlights Kerry's commitment to sustainable food production practices, responding to growing consumer demand for eco-friendly and ethically produced food products. Through strategic acquisitions and sustainability efforts, Kerry Group continues to expand its influence in the freeze-dried fruits market. As the demand for healthy, convenient food options continues to grow, the freeze-dried fruits market is set for sustained expansion through 2035.

Per capita consumption of freeze-dried fruits varies by region and is shaped by health awareness, snack trends, and availability of packaged natural foods. Demand is higher in regions where consumers actively seek out convenient, nutrient-rich options for snacking, breakfast, and baking.

The freeze-dried fruits market is experiencing steady global trade growth, driven by rising demand for shelf-stable, nutritious, and clean-label ingredients across food, beverage, and snack industries. Trade flows are shaped by agricultural output, processing capacity, and consumer demand in health-focused sectors.

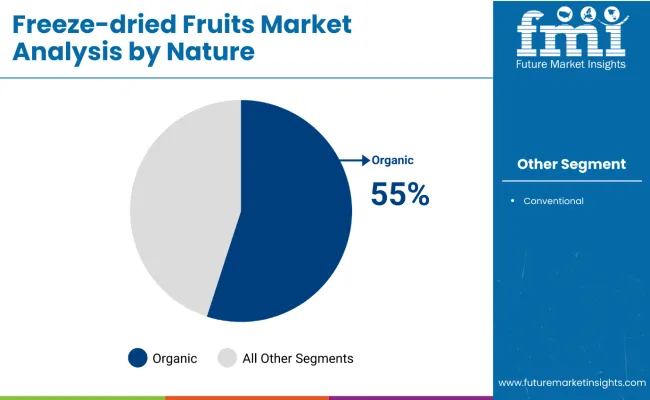

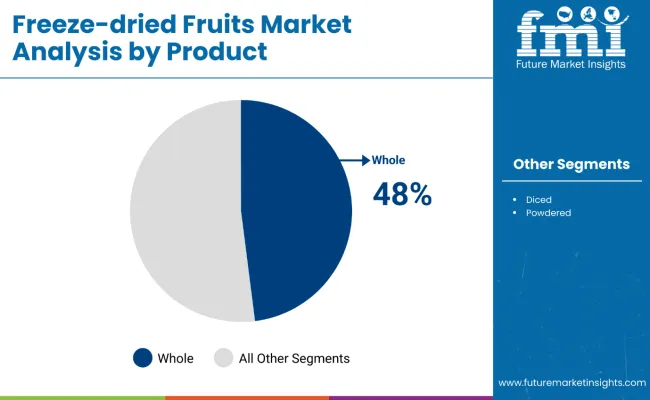

Organic products dominate the nature segment with a 55% share, driven by consumer preference for natural and clean-label options. Whole freeze-dried fruits lead the product type segment with a 48% share, attributed to their convenience and high nutritional value.

Organic freeze-dried fruits are set to dominate the freeze-dried fruits market with a 55% share by 2025, driven by growing consumer demand for organic, clean-label products. As awareness about the health benefits of organic foods increases, more consumers are seeking natural, pesticide-free options in their diets. Organic freeze-dried fruits cater to this demand by providing a convenient, shelf-stable alternative to fresh produce while maintaining most of the fruit’s nutritional value and flavor.

The shift towards organic products in the food industry is also fueled by rising concerns about environmental sustainability. Organic farming practices, which avoid synthetic fertilizers and pesticides, are viewed as more eco-friendly and sustainable. This aligns with the growing trend of sustainability in food production and consumption, further boosting the organic freeze-dried fruit segment. As consumer preferences for organic foods continue to rise, the organic segment is expected to maintain its dominant position, contributing significantly to the overall growth of the freeze-dried fruits market through 2035.

Whole freeze-dried fruits are projected to capture 48% of the market share in 2025, leading the product type segment due to their convenience and high nutritional value. Whole fruits, which undergo a process of freeze-drying that retains nearly all of their original nutrients, are highly favored by health-conscious consumers looking for easy-to-consume, shelf-stable fruit options. Whole freeze-dried fruits are used in a variety of applications, from direct consumption as snacks to incorporation into cereals, smoothies, and baked goods.

The advantages of whole freeze-dried fruits over fresh produce such as extended shelf life, ease of storage, and minimal preparation required make them an appealing choice for busy, health-conscious consumers. Additionally, the preservation of flavor and nutritional content makes whole freeze-dried fruits a preferred option in the premium fruit snack market. As the demand for convenient, nutritious snack options increases globally, the whole freeze-dried fruit segment is expected to maintain a strong market presence, contributing to overall market expansion through 2035.

Furthermore, market growth is being hindered by the high investment costs in turn creating a scarcity of freeze-dried fruits and vegetables in developing countries; freeze-drying technology which involves specialized equipment and energy consumption is a major deterrent. It freezes fruit to extremely low temperatures and then uses vacuum technology to remove moisture, preventing the destruction of texture and nutrients. But, this necessary process is expensive for standalone businesses; therefore freeze-dried items will always have a higher price tag than traditional dried fruits.

A solution to this product quality issue is that companies need to switch to energy efficient freeze-drying technologies, optimizing production process and going for alternative preservations techniques to decrease operational cost. Most excavation techniques operates at an optimal level when utilization is not maximized.

Atoms for freezing fresh fruit availability seasonally dependent on the weather and agricultural yield. Raw material generation, price fluctuations, and supply chain disruptions from transportation and geopolitical changes caused by climate change Furthermore, finding high-quality organic and non-GMO fruits is logistically challenging. Firms should create strategies for diversifying sourcing, invest in contract farming and adopt the use of blockchain for supply chain visibility and risk reduction.

As consumers become increasingly conscious about health and wellness, the demand for nutritious snacks with minimal processing and longer shelf life is on the rise. With minimal impact from heat, freeze-dried fruits preserve nearly all of their original nutrients, flavors and textures, making them a popular choice with health-conscious consumers. TRENDING: Growth opportunities in plant-based diets, clean-label products, and functional foods. Consumer interest to healthy snacking will benefit companies with innovative product offerings, organic certifications, and clean-label branding.

These freeze-dried fruits are being used in many applications which include smoothies, breakfast cereals, confectionery, bakery products, and dietary supplements. Due to their deep nutrient concentration and long shelf life, freeze-dried fruit powders and pieces are being added to functional foods in the food and beverage industries.

Furthermore, technological advancements regarding custom free-dried fruit formulations in sports nutrition, baby food and meal replacement products is a source of new revenue opportunities. Firms that invest in new product formulations, personalized nutrition solutions, and partnerships with manufacturers will be able to differentiate themselves in the market.

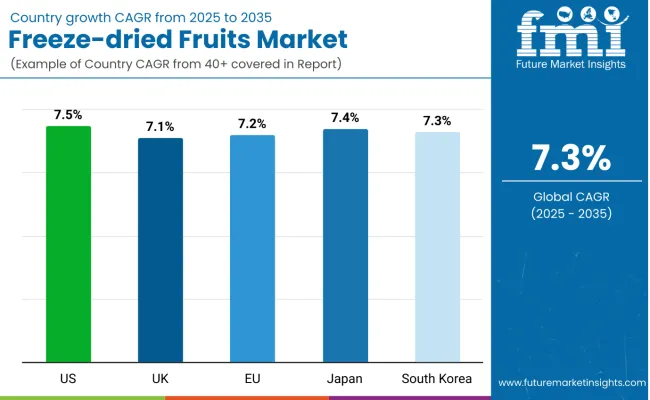

The United States holds a dominant share of the freeze dried fruits market fueled by demand among consumers for healthy snacks with a long shelf life, strong adoption of freeze-drying technology in food preservation, and segment growth of organic and natural foods. The growth of the market continues to be driven by the focus on food that is both convenient and packed with nutrients. Increasing investments in advanced freeze-drying technologies and improvements in flavor retention and texture enhancement also contribute to the market expansion.

Moreover, innovation in eco-friendly packaging along with better moisture barrier coatings and extended shelf-life are further elevating product attractiveness. Additionally, companies are also aimed to focus on product developments involving organic, sugar-free, & antioxidant-rich freeze dried fruit, to cater the evolution of health-conscious consumer trends. The rising use of freeze dried fruits in breakfast cereals, smoothie mixes, and meal kits is also expected to support demand in the USA market.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 7.5% |

The reclamation of frozen fruit (FD) is an important market in the United Kingdom-backwards to capture, powered by increased demand for naturally-ingredients used in food, enhanced is much-of as processed snacks, for as well as clean-label based foods. The growing focus on sustainability and food waste reduction is also driving these market developments. Government initiatives regarding organic and non-GMO food products along with improved vacuum freeze-drying technologies also drive the market growth. And innovations like single-serve, resealable packaging and high-fiber fruit blends are catching on.

Companies are also turning to freeze dried fruit powders for inclusion into functional foods, sports nutrition, and plant-based formulations. The rising popularity of freeze dried fruits as additives in fast-consumer food, high-class baking and baby diet is progressively augmenting the market growth in the region. The transition towards carbon-neutral food production is also driving up the demand for sustainably nabbed freeze dried fruits.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 7.1% |

Germany, France, and Italy dominate the European freeze dried fruits market, driven by the country’s high demand for healthy, stable food products, growing consumer preference for organic and free from additives snacks, and increasing investments in sustainable food processing technologies. Pressure from European Union on low food preservatives and investments in sophisticated freeze-drying facilities with high speed processing technologies promote steady growth of market. Moreover, the rise of premium, traceable fruit sourcing and unique freeze dried fruit blends with added superfoods are enhancing product appeal.

Market growth is also fueled by the escalating demand for these freeze dried fruit products that are plant-based, dairy-free, and allergen-friendly. The increase in adoption in the region is also driven by broader EU regulations related to safety and food control verification, as well as organic and sustainable food packaging solutions. In addition, increasing focus on zero-waste production methods as well as upcycled fruit ingredients are anticipated to drive innovations in the freeze dried fruits market.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 7.2% |

The focus of the Japanese people on quality premium food products, growing demand for portion-controlled convenient healthy snacks, and increasing application in confectionery, dairy, and traditional desserts has driven the Japan freeze dried fruits market. Market Growth Population increase drives the rising demand for durable food with high nutrient density. Its focus on precision food processing, along with improvements in ultra-lightweight, texture-stable freeze drying techniques, is helping spur innovation.

Additionally, stringent government policies regarding food safety and rise in investments on functional and probiotic enriched fruit blends are prompting companies to produce high performance freeze dried fruit products. The demand for travel-friendly, resealable, and freeze dried fruit-infused beverages is further propelling market growth in Japan's food and beverage industry. Furthermore, Japan is advancing the future of premium freeze dried fruits with its substantial investments in automated freeze drying systems and AI-based quality controls.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 7.4% |

Driven by growing health consciousness, rising demand for functional and superfood-based snacks, and strong government support for high-tech food processing innovations, South Korea is emerging as a key market for freeze dried fruits. The establishment of strict regulations on food additives and preservatives along with growing investments in high-speed freeze drying technologies drive the market growth. Moreover, the country’s move to improve fruit quality using controlled-atmosphere packaging, moisture-resistant coatings, and anti-oxidation techniques is boosting competitiveness.

The increasing use of freeze dried fruits in smoothie packs, protein bars, and as natural flavoring agents is also expected to boost the market growth. This involves investing in revitalizing formulations, AI-based food safety monitoring, and high density preservation techniques to deliver optimal product quality. The growing number of premium, export-oriented freeze dried fruit brands and increased e-commerce distribution in South Korea are also increasing the demand for advanced freeze drying.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 7.3% |

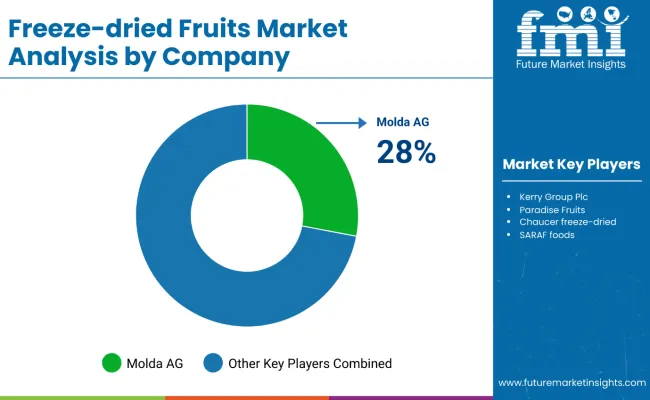

The freeze-dried fruits market is highly competitive, with a mix of global giants and specialized regional players. Major companies like Nestlé, Mondelez, The Kraft Heinz Company, General Mills, Unilever, and Olam dominate through strong distribution networks, diverse product portfolios, and consistent innovation.

Niche players such as European Freeze Dry, Chaucer Foods, Mercer Foods, Van Drunen Farms, OFD Foods, and Paradise Fruits focus on quality, clean-label offerings, and serving foodservice and industrial customers.

Competition revolves around product innovation, ethical sourcing, shelf-life extension, and convenient packaging. Strategic partnerships, mergers, and acquisitions are common as companies seek to expand their market reach and respond to growing demand for healthy, natural, and additive-free snack options across global retail and food manufacturing channels.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 9.97 billion |

| Projected Market Size (2035) | USD 20.18 billion |

| CAGR (2025 to 2035) | 7.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and tons for volume |

| Nature Types Analyzed (Segment 1) | Organic, Conventional |

| Product Types Analyzed (Segment 2) | Whole, Diced, Powdered/Granulated |

| End User Applications Analyzed (Segment 3) | Breakfast Cereals, Dairy Products, Bakery & Confectionery, Nutritional Bars & Supplements, Powdered Beverages, Snacks, Retail (household) |

| Fruit Types Analyzed (Segment 4) | Berries (Strawberry, Raspberry, Blueberry, Cranberry, Others); Exotic & Tropical Fruits (Mango, Papaya, Apple, Guava, Banana, Cantaloupe); Orchard & Citrus Fruits (Kiwi, Pear, Peach, Lemon, Orange, Grapefruits, Others) |

| Sales Channels Analyzed (Segment 5) | B2B, B2C, Hypermarkets/Supermarkets, Convenience Store, Specialty Store, Food & Drinks Specialty Store, Independent Small Grocery Store, Online Retail |

| Regions Covered | North America; Latin America; East Asia; South Asia & Pacific; Eastern Europe; Western Europe; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, UAE, South Africa |

| Key Players Influencing the Market | Kerry Group plc, European freeze dry, OFD foods LLC, Mercer foods, Molda AG, Paradise fruits, Chaucer freeze-dried, SARAF foods, Kanegrade Ltd., Harmony House Foods, Inc. |

| Additional Attributes | Freeze-dried fruit manufacturers seek market size, dollar sales growth, key players' market share, consumer demand drivers (health, convenience), retail vs. e-commerce performance, pricing trends, private label vs. branded competition |

The overall market size for freeze dried fruits market was USD 9,973.04 million in 2025.

The freeze dried fruits market expected to reach USD 20,175.53 million in 2035.

The demand for the freeze-dried fruits market will be driven by increasing consumer preference for healthy and convenient snacks, rising demand in the food and beverage industry, growing applications in cereals and bakery products, advancements in freeze-drying technology, and expanding e-commerce distribution channels.

The top 5 countries which drives the development of freeze dried fruits market are USA, UK, Europe Union, Japan and South Korea.

Organic and conventional freeze-dried fruits drive market growth to command significant share over the assessment period.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Fruit Type, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Fruit Type, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Fruit Type, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Fruit Type, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 24: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Fruit Type, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Fruit Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 31: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 33: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 34: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 35: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 36: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Fruit Type, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Fruit Type, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 41: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 43: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 44: Asia Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 45: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 46: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 47: Asia Pacific Market Value (US$ Million) Forecast by Fruit Type, 2018 to 2033

Table 48: Asia Pacific Market Volume (MT) Forecast by Fruit Type, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 50: Asia Pacific Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 51: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 53: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 54: MEA Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 55: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 56: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 57: MEA Market Value (US$ Million) Forecast by Fruit Type, 2018 to 2033

Table 58: MEA Market Volume (MT) Forecast by Fruit Type, 2018 to 2033

Table 59: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: MEA Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Fruit Type, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 11: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Fruit Type, 2018 to 2033

Figure 19: Global Market Volume (MT) Analysis by Fruit Type, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Fruit Type, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Fruit Type, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 23: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 26: Global Market Attractiveness by Nature, 2023 to 2033

Figure 27: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Global Market Attractiveness by Fruit Type, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Fruit Type, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 41: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 45: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Fruit Type, 2018 to 2033

Figure 49: North America Market Volume (MT) Analysis by Fruit Type, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Fruit Type, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Fruit Type, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 53: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 56: North America Market Attractiveness by Nature, 2023 to 2033

Figure 57: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 58: North America Market Attractiveness by Fruit Type, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Fruit Type, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 71: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 75: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Fruit Type, 2018 to 2033

Figure 79: Latin America Market Volume (MT) Analysis by Fruit Type, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Fruit Type, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Fruit Type, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 83: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Fruit Type, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 92: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 93: Europe Market Value (US$ Million) by Fruit Type, 2023 to 2033

Figure 94: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 95: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 98: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 101: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 102: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 103: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 104: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 105: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 106: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 107: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 108: Europe Market Value (US$ Million) Analysis by Fruit Type, 2018 to 2033

Figure 109: Europe Market Volume (MT) Analysis by Fruit Type, 2018 to 2033

Figure 110: Europe Market Value Share (%) and BPS Analysis by Fruit Type, 2023 to 2033

Figure 111: Europe Market Y-o-Y Growth (%) Projections by Fruit Type, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 113: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 114: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 115: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 116: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 117: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 118: Europe Market Attractiveness by Fruit Type, 2023 to 2033

Figure 119: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 120: Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 122: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 123: Asia Pacific Market Value (US$ Million) by Fruit Type, 2023 to 2033

Figure 124: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 125: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 128: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 131: Asia Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 132: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 133: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 134: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 135: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 136: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Asia Pacific Market Value (US$ Million) Analysis by Fruit Type, 2018 to 2033

Figure 139: Asia Pacific Market Volume (MT) Analysis by Fruit Type, 2018 to 2033

Figure 140: Asia Pacific Market Value Share (%) and BPS Analysis by Fruit Type, 2023 to 2033

Figure 141: Asia Pacific Market Y-o-Y Growth (%) Projections by Fruit Type, 2023 to 2033

Figure 142: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 143: Asia Pacific Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 144: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 145: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 146: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 147: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 148: Asia Pacific Market Attractiveness by Fruit Type, 2023 to 2033

Figure 149: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 151: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 152: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 153: MEA Market Value (US$ Million) by Fruit Type, 2023 to 2033

Figure 154: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 155: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 158: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 161: MEA Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 162: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 163: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 164: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 165: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 166: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 167: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 168: MEA Market Value (US$ Million) Analysis by Fruit Type, 2018 to 2033

Figure 169: MEA Market Volume (MT) Analysis by Fruit Type, 2018 to 2033

Figure 170: MEA Market Value Share (%) and BPS Analysis by Fruit Type, 2023 to 2033

Figure 171: MEA Market Y-o-Y Growth (%) Projections by Fruit Type, 2023 to 2033

Figure 172: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 173: MEA Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 174: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 175: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 176: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 177: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 178: MEA Market Attractiveness by Fruit Type, 2023 to 2033

Figure 179: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Freeze Dried Fruits And Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Competitive Overview of Freeze Dried Fruits Market Share

UK Freeze Dried Fruits Market Insights – Size, Demand & Industry Growth 2025–2035

USA Freeze Dried Fruits Market Growth – Innovations, Trends & Forecast 2025–2035

ASEAN Freeze Dried Fruits Market Growth – Trends, Demand & Innovations 2025–2035

Europe Freeze Dried Fruits Market Growth – Demand, Innovations & Forecast 2025–2035

Australia Freeze Dried Fruits Market Report – Growth, Demand & Forecast 2025–2035

Latin America Freeze Dried Fruits Market Report – Demand, Growth & Industry Forecast 2025–2035

Freezer Liner Market Size and Share Forecast Outlook 2025 to 2035

Freeze Neutralising Kit Market Size and Share Forecast Outlook 2025 to 2035

Freeze Drying Market - Size, Share, and Forecast Outlook 2025 to 2035

Freeze Drying Equipment Market Size and Share Forecast Outlook 2025 to 2035

Freezer Paper Market Size and Share Forecast Outlook 2025 to 2035

Freezer Bags Market Growth, Trends and Demand from 2025 to 2035

Competitive Breakdown of Freezer Paper Manufacturers

Freezer Label Market Analysis – Size, Share & Forecast 2024-2034

Freezer Tape Market

Freeze Dried Fruit Powder Market Size and Share Forecast Outlook 2025 to 2035

Freeze-dried Food Market Analysis - Size, Growth, and Forecast 2025 to 2035

Freeze-Dried Vegetables Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA