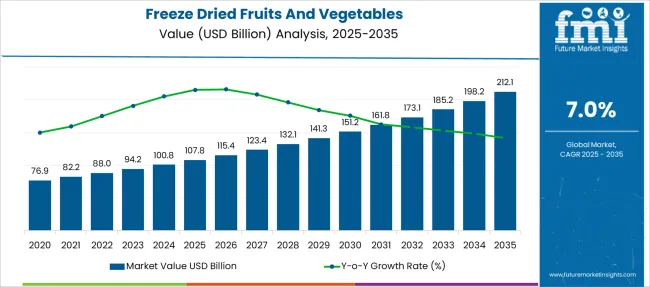

The Freeze Dried Fruits And Vegetables Market is estimated to be valued at USD 107.8 billion in 2025 and is projected to reach USD 212.1 billion by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period.

| Metric | Value |

|---|---|

| Freeze Dried Fruits And Vegetables Market Estimated Value in (2025 E) | USD 107.8 billion |

| Freeze Dried Fruits And Vegetables Market Forecast Value in (2035 F) | USD 212.1 billion |

| Forecast CAGR (2025 to 2035) | 7.0% |

Freeze drying retains flavor, texture, and nutrient profile without the use of preservatives, making it a favored technique in both direct consumption and food processing applications. Rising demand for healthy snacking options, especially among urban and health-conscious consumers, has supported growth in both retail and food service formats.

The versatility of freeze dried products in baking, ready meals, beverages, and nutritional supplements is also accelerating market adoption. Additionally, rising global demand for minimally processed and shelf-stable ingredients is being met by innovations in freeze drying technology that reduce processing time and improve yield.

As consumer preferences shift toward clean label and additive-free products, manufacturers are increasing investments in sourcing, traceability, and packaging innovation. The market is expected to grow further across emerging markets where urbanization and western dietary patterns continue to influence consumption.

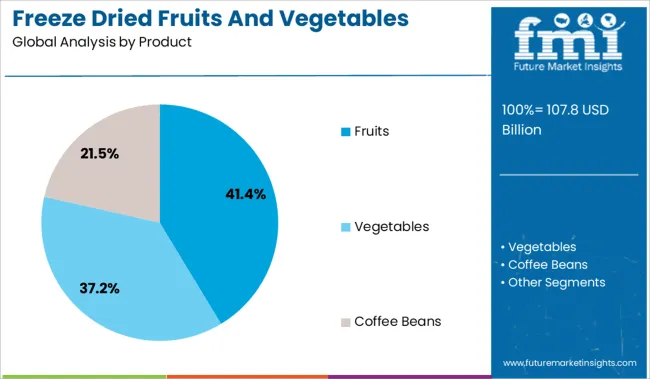

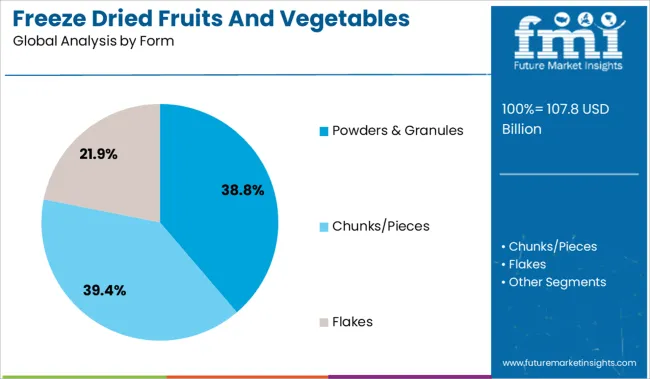

The market is segmented by Product, Form, Distribution Channel, and region. By Product, the market is divided into Fruits, Vegetables, and Coffee Beans. In terms of Form, the market is classified into Powders & Granules, Chunks/Pieces, and Flakes.

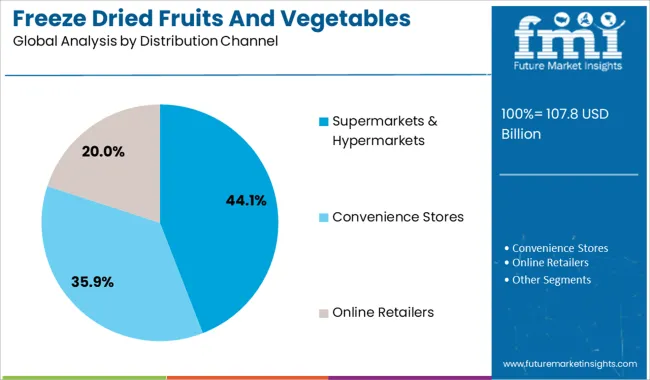

Based on Distribution Channel, the market is segmented into Supermarkets & Hypermarkets, Convenience Stores, and Online Retailers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The fruits category is projected to lead the product segment in 2025 with a revenue share of 41.4% owing to its wide consumption base and functional versatility. Freeze dried fruits are widely used in cereals, snacks, baking mixes, and dairy applications, driven by their ability to retain original color, flavor, and nutrients.

The absence of added sugars or preservatives has made them appealing to consumers seeking natural food alternatives. The growth in plant-based diets and clean label trends has further reinforced demand.

Additionally, global supply chain improvements and advanced drying processes have enabled consistent quality and availability of exotic and seasonal fruits throughout the year, supporting this segment’s leading share in both B2B and B2C categories.

Powders and granules are anticipated to hold 38.8% of the total market share in 2025 within the form category. Their dominance is supported by extensive usage in food and beverage manufacturing, where consistency and solubility are critical.

These formats offer greater storage efficiency and application flexibility in nutritional powders, smoothie blends, infant food, and seasoning formulations. Their concentrated flavor profile and enhanced rehydration properties have made them a preferred ingredient in functional food development.

Food companies are investing in advanced micronization and flavor encapsulation techniques, increasing demand for high-performance freeze dried powders and granules. This segment’s broad compatibility with diverse food processing systems has helped maintain its leading position.

Supermarkets and hypermarkets are expected to contribute 44.1% of the revenue in 2025 within the distribution channel segment, underscoring their role as the primary consumer touchpoint. The dominance of this channel is driven by its ability to provide wide product variety, bulk packaging options, and immediate availability.

In-store promotions, private label launches, and premium shelf placements have amplified product visibility and trial. Freeze dried fruit and vegetable products have gained traction among consumers seeking convenient, on-the-go health snacks and cooking ingredients.

Retailers are also expanding organic and specialty offerings, with dedicated sections for freeze dried goods aligned with wellness and sustainability themes. These initiatives, combined with growing consumer interest in label transparency and product origin, are reinforcing the segment’s leadership in the retail landscape.

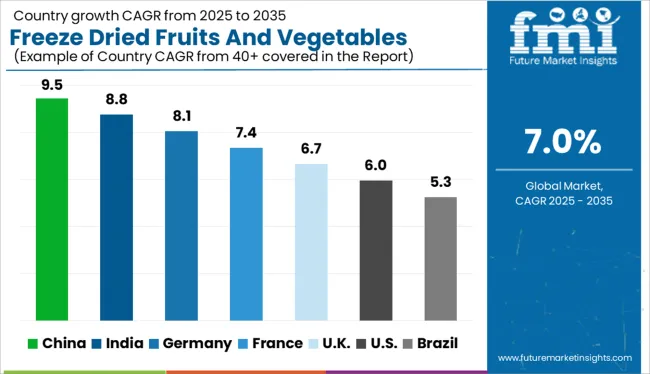

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

Global freeze dried fruits and vegetables market demand is projected to rise at a 7% CAGR from 2025 to 2035. Of the five profiled markets out of 40 covered, China leads at 9.5%, followed by India at 8.8%, and Germany at 8.1%, while the United Kingdom posts 6.7% and the United States records 6%. These rates translate to a growth premium of +36% for China, +26% for India, and –14% for the United States versus the baseline, while Germany shows steady growth. Divergence reflects local catalysts: increasing demand for convenient, healthy snacks in China and India, with the United States and the United Kingdom showing slower growth due to mature markets and established demand in freeze-dried foods. Germany reflects steady growth driven by the rising demand for innovative food preservation methods.

Sales of freeze-dried fruits and vegetables in the United Kingdom are forecasted to grow at a CAGR of 6.7% through 2035. Rising preference for ambient-stable snacks, along with the expansion of private-label health food categories, has supported product placement across major retailers. Demand has grown in cereal mixes, pet food supplements, and emergency meal kits. The UK’s reliance on imports of berries and tropical fruit has also opened avenues for freeze-dried formats with longer shelf life and preserved nutrition.

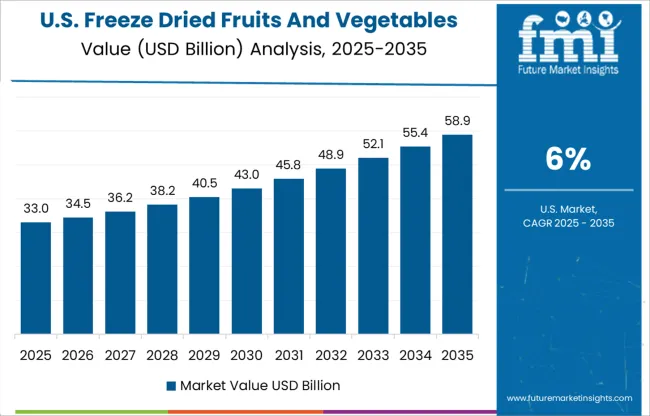

The United States market is projected to expand at a CAGR of 6.0% from 2025 to 2035. The demand is being reinforced by health-forward consumer behavior and snacking habits focused on clean labels and sugar-free content. Freeze-dried strawberries, blueberries, and kale are gaining traction across wellness-oriented product lines. The USA is also witnessing B2B demand from nutraceuticals and rehydrated meal producers.

The freeze-dried fruits and vegetables market in China is estimated to grow at a CAGR of 9.5% through 2035. Urban consumer groups are adopting freeze-dried mango, durian, and lotus root snacks due to convenience and shelf-stability. Online platforms and convenience store chains are accelerating distribution. Manufacturers are investing in domestic freeze-drying infrastructure to reduce post-harvest losses and to process excess fruit harvests during peak seasons.

The market in India is anticipated to expand at a CAGR of 8.8% between 2025 and 2035. Increasing health consciousness among urban households and expanding backpacking and trekking communities are driving adoption. Companies are targeting the functional food segment with freeze-dried banana, pineapple, and beetroot. The demand is also supported by rising exports of freeze-dried mango and jackfruit to EU and GCC countries.

The market in Germany is forecasted to grow at a CAGR of 8.1% during the period under review. Demand is rising from health-conscious consumers favoring fiber-rich, non-GMO produce with low processing. Freeze-dried apple, raspberry, and carrot formats are expanding in organic retail chains and vegan specialty stores. B2B adoption in cereal bars, baby food, and yogurt inclusions is also contributing to market penetration.

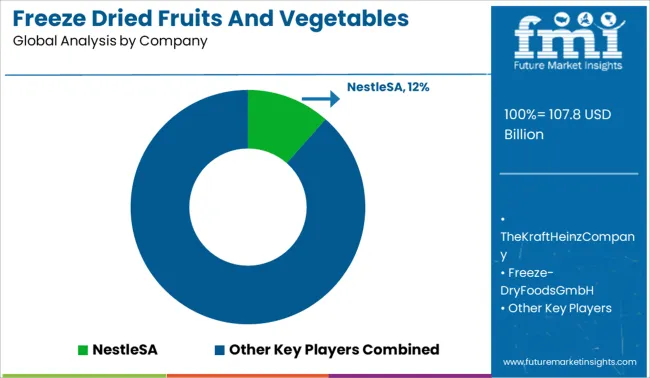

Nestlé SA commands a strong position in the global freeze-dried food market, especially in North America, with its extensive product portfolio, packaging innovations like resealable pouches, and broad B2B/B2C distribution through supermarkets and e commerce platforms. With an estimated 11.5% market share, the company benefits from scale, advanced equipment, and R&D-backed product offerings that meet demand for long shelf-life, nutrient-preserved foods. It competes alongside peers such as Ajinomoto, Asahi Group, European Freeze Dry, Harmony House, Mondelez, and Kerry—all of which occupy smaller slices of a highly fragmented, fast-growing market.

| Item | Value |

|---|---|

| Quantitative Units | USD 107.8 Billion |

| Product | Fruits, Vegetables, and Coffee Beans |

| Form | Powders & Granules, Chunks/Pieces, and Flakes |

| Distribution Channel | Supermarkets & Hypermarkets, Convenience Stores, and Online Retailers |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | NestleSA, TheKraftHeinzCompany, Freeze-DryFoodsGmbH, TheJMSmuckerCompanyLLC, VanDrunenFarms, OlamInternational, AsahiGroup, AjinomotoCo., DamtuhCo.Ltd., PrinovaEuropeLimited, MondelezInternationalInc., AcceleratedFreezeDryingCompanyLtd., OFDFoods, EuropeanFreezeDryLtd., and MercerFoodsLLC. |

| Additional Attributes | Dollar sales concentrated in ready-to-eat meal kits, snack bars, and emergency food supplies, share led by premium whole-piece freeze-dried berries and diced vegetables, demand driven by on-the-go convenience and extended shelf-life automation in food processing lines, retrofitting visible in traditional spray-drying setups being upgraded to freeze-drying tunnels, ergonomic packaging design key for consumer handling and resealability, and clean-label organic options gaining ground over sugar- or preservative-infused formats in health-conscious retail segments. |

The global freeze dried fruits and vegetables market is estimated to be valued at USD 107.8 billion in 2025.

The market size for the freeze dried fruits and vegetables market is projected to reach USD 212.1 billion by 2035.

The freeze dried fruits and vegetables market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in freeze dried fruits and vegetables market are fruits, vegetables and coffee beans.

In terms of form, powders & granules segment to command 38.8% share in the freeze dried fruits and vegetables market in 2025.

Explore Similar Insights

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA