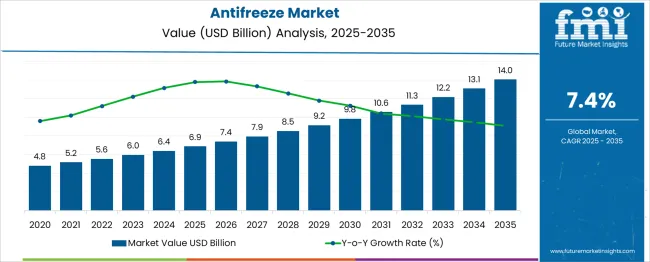

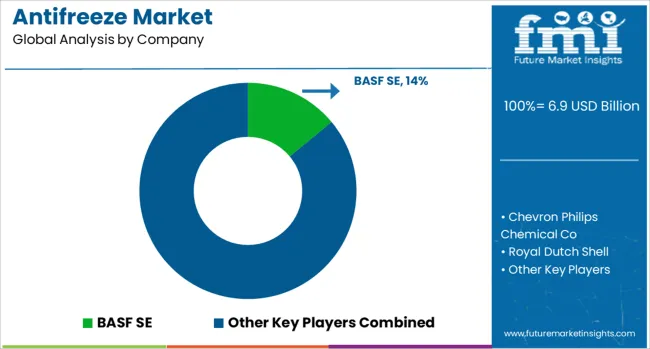

The Antifreeze Market is estimated to be valued at USD 6.9 billion in 2025 and is projected to reach USD 14.0 billion by 2035, registering a compound annual growth rate (CAGR) of 7.4% over the forecast period.

In 2025, global market leadership is primarily concentrated among a few key players such as BASF, Chevron, and Total Energies, collectively accounting for over 58% of the total market share. These companies leverage strong distribution networks and proprietary additive technologies to dominate OEM and aftermarket supply chains across North America and Europe. However, over the next decade, the competitive landscape is anticipated to shift. Rising demand in emerging markets particularly in Asia-Pacific, which is expected to contribute over 35% of global antifreeze revenues by 2035 is opening opportunities for regional manufacturers such as Sinopec, Bharat Petroleum, and Petronas to gain share. Chinese and Indian players are projected to collectively grow their share from 12% in 2025 to nearly 22% by 2035, driven by cost competitiveness, increased local vehicle production, and government support for indigenous chemical manufacturing. Additionally, the transition towards electric vehicles is prompting innovation in thermal management fluids, allowing niche players with advanced formulations to carve out 5–8% market share by 2035. As environmental standards tighten, sustainable and bio-based antifreeze solutions are expected to further fragment the market.

| Metric | Value |

|---|---|

| Antifreeze Market Estimated Value in (2025 E) | USD 6.9 billion |

| Antifreeze Market Forecast Value in (2035 F) | USD 14.0 billion |

| Forecast CAGR (2025 to 2035) | 7.4% |

The antifreeze market is set to experience key breakpoints that redefine demand trajectories, regional dominance, and product innovation. The first major breakpoint emerges between 2028 and 2030, when global regulatory shifts especially in the EU and North America tighten restrictions on conventional glycol-based antifreeze products. During this phase, environmentally compliant and low-toxicity formulations are expected to see an uptake surge of over 60%, reshaping procurement strategies for OEMs and fleets. The second breakpoint is expected around 2031, coinciding with the broader electrification of transport fleets.

While electric vehicles (EVs) reduce the need for traditional engine coolants, they introduce demand for specialized thermal management fluids that serve battery and power electronics systems. This new segment is forecasted to represent 15–18% of total antifreeze revenues by 2035, with rapid uptake especially in China, Germany, and the USA. The final breakpoint occurs post-2033, driven by emerging economies accelerating automotive and industrial coolant demand. As Asia-Pacific solidifies its lead with over 38% market share, global players are expected to restructure supply chains and form joint ventures to maintain relevance in cost-sensitive, high-volume markets.

The antifreeze market is experiencing sustained growth due to rising global vehicle production, stringent emission norms, and the increasing need for engine protection in extreme weather conditions. Demand is particularly strong in the automotive and industrial sectors, where coolant efficiency, corrosion resistance, and long service intervals are vital.

Regulatory mandates for low-toxicity and environmentally friendly formulations are also accelerating the shift toward advanced additive technologies. Additionally, the expansion of aftermarket service networks and increasing consumer awareness regarding engine maintenance are reinforcing antifreeze adoption across developing economies.

Market players are actively investing in R&D to develop long-life and biodegradable antifreeze solutions compatible with hybrid and electric vehicle platforms.

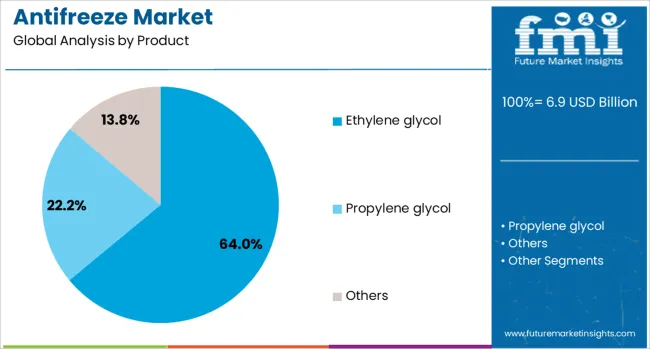

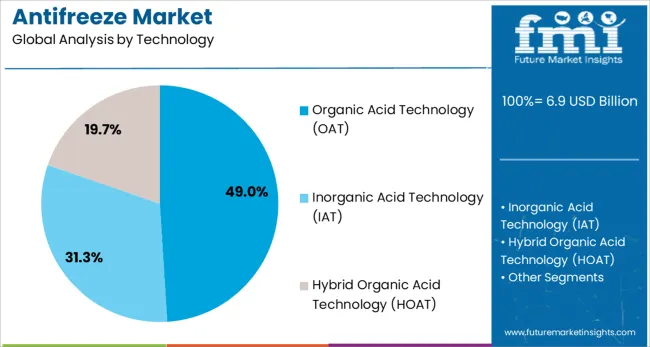

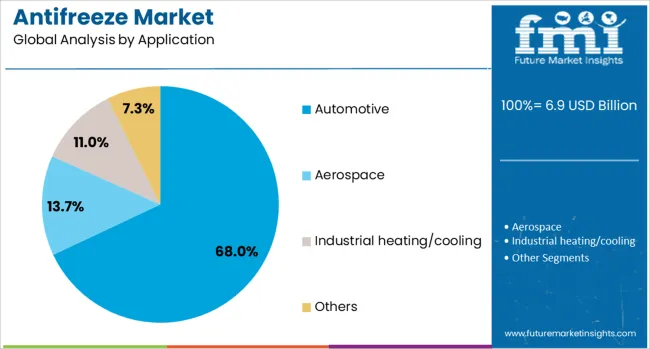

The antifreeze market is segmented by product, technology, application, and geographic regions. The antifreeze market is divided into Ethylene glycol, Propylene glycol, and Others. The antifreeze market is classified into Organic Acid Technology (OAT), Inorganic Acid Technology (IAT), and Hybrid Organic Acid Technology (HOAT). The antifreeze market is segmented into Automotive, Aerospace, Industrial heating/cooling, and Others. Regionally, the antifreeze industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Ethylene glycol is expected to dominate the antifreeze market with a 64.00% share in 2025, making it the leading product type. This leadership is attributed to its superior heat transfer capabilities, affordability, and wide commercial availability.

Ethylene glycol-based coolants offer effective freezing and boiling protection across a broad temperature range, making them suitable for both light-duty and heavy-duty engines. Despite toxicity concerns, their consistent performance in automotive, marine, and industrial cooling systems has maintained their dominance.

Ongoing improvements in additive blending are helping reduce environmental impact and extend the product’s lifecycle, supporting its continued usage in both OEM and aftermarket channels.

Organic Acid Technology (OAT) is projected to lead the antifreeze market by technology type with a 49.00% share in 2025. OAT-based antifreeze solutions provide extended drain intervals, reduced scaling, and long-term corrosion protection, especially for aluminum and alloy components in modern engines.

Their compatibility with newer engine designs and fuel efficiency goals makes OAT the preferred technology in both automotive and industrial cooling systems. Unlike traditional silicate-based formulations, OAT coolants maintain stability over longer durations without frequent replacement.

This not only lowers total cost of ownership but also aligns with sustainability objectives by minimizing coolant disposal frequency.

The automotive sector is projected to account for 68.00% of the antifreeze market in 2025, establishing it as the dominant application area. This growth is driven by increasing global vehicle sales, demand for thermal management in internal combustion and electric vehicles, and growing replacement needs due to rising vehicle age.

Antifreeze plays a critical role in engine temperature regulation, corrosion prevention, and system longevity—particularly in high-mileage regions and harsh climate zones. OEMs are also standardizing coolant specifications to ensure compatibility with a wide range of engine materials and designs.

The sector’s dominance is expected to continue as global automotive production scales and hybrid/electric vehicle penetration increases.

The antifreeze market continues to grow as vehicle ownership expands and engine maintenance becomes a higher priority across both automotive and industrial sectors. Antifreeze plays a crucial role in regulating engine temperatures and preventing damage from extreme climates. It is also gaining relevance in heavy machinery, marine engines, and HVAC systems. With increased equipment usage across sectors and a greater focus on long-term asset protection, antifreeze products remain essential for maintaining performance, minimizing downtime, and extending the service life of engines and systems.

The antifreeze market is directly influenced by the expanding global vehicle fleet and increasing use of heavy-duty engines in industrial sectors. As more cars, trucks, and off-road machinery enter service, the demand for engine protection fluids increases. Antifreeze ensures reliable operation by preventing overheating in high temperatures and freezing in low temperatures. In colder regions, regular antifreeze maintenance is standard practice, and in warmer climates, it plays a vital role in cooling systems. Heavy-duty vehicles in mining, construction, and agriculture require robust coolant formulations, further driving demand. Fleet operators and service centers prioritize antifreeze for preventive maintenance, ensuring uninterrupted engine performance across extended operation cycles. The aftermarket demand also contributes significantly, with vehicle owners increasingly aware of the role of antifreeze in preventing engine failure. As industrial and consumer equipment becomes more widespread, the antifreeze market remains a critical part of supporting engine longevity and reliability in all working conditions.

Antifreeze production and disposal face growing scrutiny due to the environmental risks associated with conventional glycol-based formulations. Many common antifreeze products contain ethylene glycol, which is toxic to humans, animals, and aquatic life if leaked or improperly disposed of. Regulatory bodies have imposed stricter controls on the composition and handling of coolant fluids to mitigate environmental damage. These controls add complexity to manufacturing, requiring safer formulations and better labeling. Producers must also ensure proper waste handling procedures are in place for end users, especially in industrial settings. For global suppliers, complying with diverse regional regulations for hazardous chemical content and waste management increases cost and operational burden. Moreover, shifts toward less harmful ingredients may affect product performance or compatibility with older engine models. Balancing compliance with efficiency and safety without compromising on coolant lifespan or thermal management remains a major challenge for both established brands and emerging manufacturers in the antifreeze space.

As engine technologies evolve, there is increasing interest in advanced antifreeze formulations that are compatible with high-efficiency engines, electric vehicle systems, and extended service intervals. Modern vehicles require coolants that can withstand higher thermal loads, resist corrosion over longer periods, and function in diverse operating environments. This need creates room for hybrid organic acid technology (HOAT) and fully organic acid technology (OAT) coolants, which offer longer life spans and reduced maintenance requirements. Additionally, the rise of electric and hybrid vehicles presents new opportunities for thermal management fluids that not only prevent freezing or boiling but also support battery cooling. Manufacturers capable of offering extended-drain products tailored to new powertrain designs gain an edge in aftermarket and OEM partnerships. Innovation in biodegradable and low-toxicity formulations also provides access to environmentally sensitive applications. By targeting specialty equipment, commercial fleets, and next-generation automotive systems, companies can tap into new segments with evolving coolant performance expectations.

A key restraint in the antifreeze market stems from the diversity of formulations and the risks associated with mixing incompatible types. Different vehicles and machinery often require specific coolant chemistries, such as inorganic additive technology (IAT), organic acid technology (OAT), or hybrid variants. Using the wrong formulation can cause corrosion, scaling, or premature component failure. In the aftermarket, users often top off or replace coolants without full understanding of compatibility requirements, which poses risks to engines and cooling systems. For fleet operators, the need to stock multiple antifreeze types adds logistical burden and increases the risk of misapplication. Even among professional mechanics, incorrect mixing or product substitutions can lead to warranty issues or long-term equipment damage. Until a universal or cross-compatible standard is widely adopted, these compatibility risks hinder broader antifreeze adoption, especially in regions with limited access to technical support or standardized vehicle servicing infrastructure.

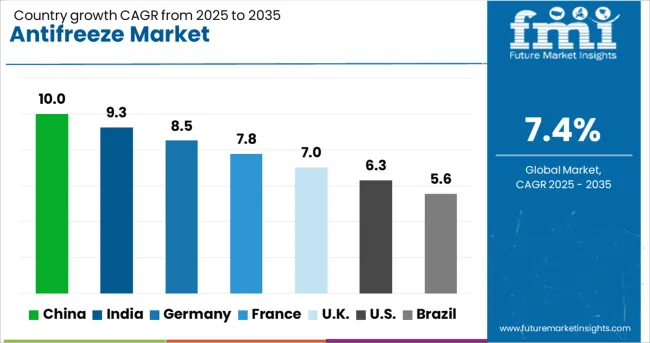

| Country | CAGR |

|---|---|

| China | 10.0% |

| India | 9.3% |

| Germany | 8.5% |

| France | 7.8% |

| UK | 7.0% |

| USA | 6.3% |

| Brazil | 5.6% |

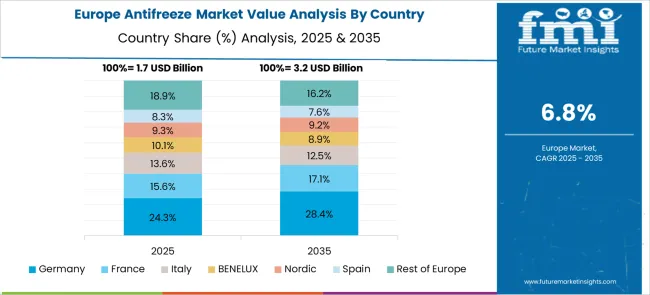

The global antifreeze market is growing at a CAGR of 7.4%, driven by rising automotive production, industrial equipment usage, and demand for temperature-resistant fluids. China leads with 10.0% growth, supported by its expansive automotive manufacturing base and colder regional climates requiring seasonal coolant demand. India follows at 9.3%, fueled by increasing vehicle ownership and aftermarket consumption. Germany records 8.5% growth, reflecting a strong automotive sector with a focus on high-performance and eco-friendly formulations. The United Kingdom shows steady growth at 7.0%, driven by demand in both passenger and commercial vehicles. The United States, at 6.3%, remains a mature but vital market, emphasizing regulatory compliance and advancements in extended-life coolants. Market trends are influenced by environmental regulations, corrosion inhibitors, and vehicle-specific formulation standards. This report includes insights on 40+ countries; the top countries are shown here for reference.

The antifreeze market in China is expanding at a CAGR of 10.0%, reflecting growing applications across automotive, industrial, and agricultural machinery. With domestic vehicle production remaining high, demand for high-performance coolant solutions has increased. Chinese automakers are formulating antifreeze blends suitable for electric vehicles, which require efficient thermal management. Heavy-duty trucks, buses, and off-road equipment are also incorporating specialized antifreeze products designed for varying climatic zones within the country. In colder regions, municipal vehicles and construction fleets are switching to longer-life formulations that reduce maintenance frequency. Domestic chemical manufacturers are also investing in plant expansions and export-focused production. The presence of multiple tiers of suppliers helps ensure affordability and access to both synthetic and glycol-based variants.

India’s antifreeze market is growing steadily with a CAGR of 9.3%, driven by increasing vehicle ownership and infrastructure development. With vehicle engines facing high ambient temperatures and load variations, there is rising interest in coolant solutions that improve heat dissipation and engine life. Tractor and construction equipment usage across agricultural and urban projects has led to higher consumption of antifreeze in rural and semi-urban zones. Local producers are offering cost-effective concentrates and pre-mixed variants that appeal to small workshops and fleet operators. Two-wheeler manufacturers are also exploring antifreeze adoption in newer engine platforms to enhance efficiency. The availability of smaller packaging sizes allows wider distribution across fragmented markets.

Antifreeze market in Germany is growing at a 8.5% CAGR, benefits from the country’s strong automotive engineering and cold climate requirements. German automakers and tier-one suppliers continue to rely on high-performance coolants that maintain thermal stability across long mileage intervals. Antifreeze formulations in Germany must meet stringent regulatory and performance standards, including compatibility with hybrid and electric drivetrains. In addition to personal vehicles, antifreeze is widely used in commercial fleets and rail networks where freeze protection and corrosion control are critical. Research institutions and chemical companies collaborate to develop environmentally responsible and biodegradable coolant alternatives. Winter conditions in northern and alpine regions further boost seasonal demand.

The antifreeze market in the United Kingdom is progressing with a 7.0% CAGR, supported by steady automotive aftersales demand and moderate climatic fluctuations. While winters are less extreme than in some regions, antifreeze remains a staple for both engine protection and rust prevention in passenger and commercial vehicles. Light-duty fleets operating in urban delivery and intercity transit sectors are switching to extended-life antifreeze blends to reduce downtime. Independent garages and repair shops continue to dominate distribution channels, sourcing products from local and European suppliers. The rise of hybrid cars is creating new demand for antifreeze systems tailored to thermal battery support.

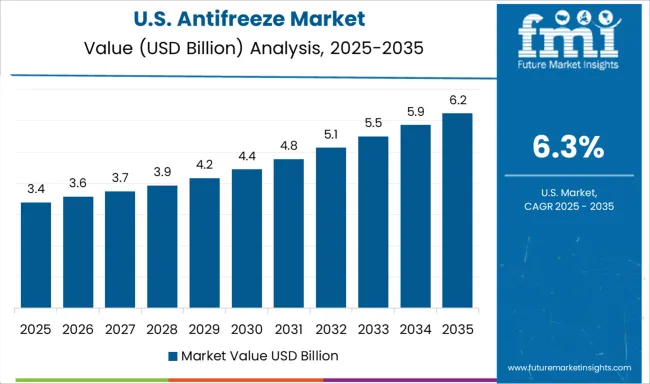

The United States antifreeze market is growing at a 6.3% CAGR, with adoption across a wide spectrum of vehicles and climate zones. The country’s vast geography, from extremely cold northern regions to hot southern states, creates diverse antifreeze needs. Trucking companies, heavy-duty equipment operators, and passenger car owners prioritize engine longevity and corrosion protection. Coolant recycling services are gaining popularity, especially among large fleet operators and municipal agencies. Antifreeze blends compatible with electric vehicle battery packs are seeing early interest in select states. Automotive retailers and service centers offer a range of products from global brands and local refineries.

The antifreeze market plays a crucial role in the automotive and industrial sectors, with products engineered to regulate engine temperature by lowering the freezing point and raising the boiling point of cooling systems. As vehicles are expected to operate efficiently in extreme conditions from sub-zero cold to intense heat antifreeze remains essential for engine longevity and performance. The growing number of vehicles on the road, combined with higher engine load requirements, continues to drive steady demand for effective and long-lasting coolant solutions. BASF SE, Chevron Phillips Chemical Co, and Royal Dutch Shell are among the key players offering a range of ethylene glycol- and propylene glycol-based antifreeze formulations, catering to both passenger and heavy-duty commercial vehicles.

ExxonMobil, Total S.A, and Castrol focus on additive-enhanced products that provide corrosion protection and extended service intervals. Kost USA and Ashland Inc are notable for their formulation expertise and strong OEM partnerships in North America, while PETRONAS and Sinopec Corporation cater to expanding automotive markets in Asia. Environmental regulations have led to increased interest in low-toxicity and biodegradable antifreeze products, prompting R&D investments in alternative glycol blends. Companies like Dow Chemicals and DuPont are at the forefront of introducing performance coolants that balance environmental safety with durability. As vehicle technology evolves especially with the growth of electric and hybrid vehicles the antifreeze market is adapting by developing thermally efficient fluids tailored to advanced battery systems and compact engine designs.

On February 6, 2024, Prestone announced its strategic expansion into EV thermal management fluids, supported by OEM partnerships and dedicated R&D. By appointing Bianchi PR, the company aims to raise awareness of EV-specific coolants, marking a shift from traditional antifreeze products to advanced, battery-friendly solutions for electric mobility.

| Item | Value |

|---|---|

| Quantitative Units | USD 6.9 Billion |

| Product | Ethylene glycol, Propylene glycol, and Others |

| Technology | Organic Acid Technology (OAT), Inorganic Acid Technology (IAT), and Hybrid Organic Acid Technology (HOAT) |

| Application | Automotive, Aerospace, Industrial heating/cooling, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | BASF SE, Chevron Philips Chemical Co, Royal Dutch Shell, Kost USA, Total S.A, Exxon Mobil Corporation, Ashland Inc, PETRONAS, Castrol, Dow Chemicals, Sinopec Corporation, and DuPont |

| Additional Attributes | Dollar sales vary by base-fluid type and additive technology, with ethylene glycol-based coolant dominating, while propylene glycol formulations grow fastest. Asia‑Pacific leads volume, and North America and Europe drive premium aftermarket demand. Pricing fluctuates with crude oil feedstock and catalyst costs. Growth accelerates through biodegradable green coolants, OAT/HOAT tech, and EV battery-thermal management systems under tightening environmental regulations. |

The global antifreeze market is estimated to be valued at USD 6.9 billion in 2025.

The market size for the antifreeze market is projected to reach USD 14.0 billion by 2035.

The antifreeze market is expected to grow at a 7.4% CAGR between 2025 and 2035.

The key product types in antifreeze market are ethylene glycol, propylene glycol and others.

In terms of technology, organic acid technology (oat) segment to command 49.0% share in the antifreeze market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Antifreeze proteins Market Size and Share Forecast Outlook 2025 to 2035

Europe Antifreeze Coolant Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA