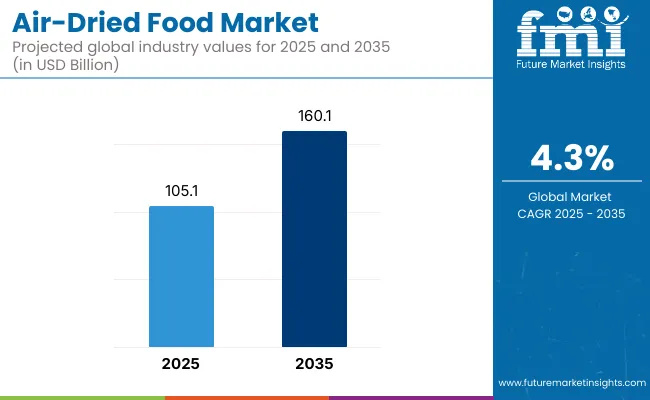

The air-dried food market is projected to advance steadily, reaching roughly USD 160.1 billion by 2035 from about USD 105.1 billion in 2025, at a CAGR of 4.3%. Growth is being propelled by heightened consumer preference for minimally processed, long-shelf-life foods and by wider adoption of cost-effective hot air-drying and nutrient-preserving freeze-drying methods.

Strong demand for convenient snacks and ready meals is expected to keep fruits & vegetables dominant within product sales, while the versatility and scalability of hot air-drying are positioning it as the leading preservation technique.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 105.1 billion |

| Industry Value (2035F) | USD 160.1 billion |

| CAGR (2025 to 2035) | 4.3% |

Consumer demand for additive-free meals has been observed to surge, and that shift has been credited with widening retail shelf space for air-dried fruits, vegetables, and protein snacks. Greater purchasing power in urban centers has encouraged trial of premium freeze-dried offerings, yet value-oriented hot air-dried lines have remained the volume backbone. Retailers have therefore increased private-label assortments, and menu developers in quick-service restaurants have incorporated air-dried inclusions to extend product life without chemical preservatives.

Continuous improvements in hybrid drying equipment have been reported, allowing gentler heat profiles and shorter cycle times, which in turn have preserved color and vitamin content more effectively than legacy systems. Adoption has been strongest among mid-sized processors seeking cost control, while larger multinationals have leveraged modular freeze-drying units to launch limited-edition superfood blends.

As a result, fruits & vegetables segment is expected to retain roughly 45% revenue share, whereas meat & seafood formats are forecast to post the quickest value gains on the back of high-protein snacking trends and expanding military ration contracts.

During 2025 to 2035, the air-dried food value chain is expected to be transformed by precision automation, carbon-neutral energy inputs, and direct-to-consumer e-commerce logistics. AI-guided moisture sensors are projected to bring sub-2% batch-to-batch variance, while modular solar-assisted dryers are anticipated to cut operating costs by roughly 15%. Digitally traceable ingredient passports are likely to become mandatory in major import markets, so blockchain lot coding is being piloted across supplier networks.

Freeze-dried and hot air-dried segments hold the majority in the air-dried food industry due to the fact that customers worldwide are demanding more quality, long-shelf-life, and nutrient-rich food products.

Such drying methods have a critical function in food preservation by providing longer shelf life while preserving key nutrients, flavor, and texture. The clean-label product trend, convenience foods, and green preservation processes trend has motivated the implementation of air-drying methods, and they have become part of the food processing sector.

Hot air drying is the fastest-growing technology to be used in air-dried foods because it is a low-cost and scalable means of drying any food item, including fruits, vegetables, meat, and herbs. It is superior to sun-drying because it provides controlled drying, maintaining food structure integrity and limiting microbial growth and spoilage.

The increasing need for inexpensive, shelf-stable food has encouraged the use of hot air drying, with organizations focusing on energy-saving and bulk drying methods. Research reveals that more than 60% of dry food manufacturers apply hot air drying in their operations, making this segment the market leader.

The spread of hybrid hot air drying technology, using infrared-assisted and microwave-assisted drying, has allowed for market demand, with faster processing and better preservation of nutritional properties.

The use of AI-based moisture content control along with real-time humidity monitoring and auto-adjustment of drying has also driven adoption to higher levels, providing consistency and quality in mass production. Formation of tailor-made hot air-dried foods, with increased texture preservation and reduced heat-activated nutrient loss, has optimized market expansion, guaranteeing expanded use in ready-to-eat meals, instant soups, and health-focused snack markets.

Utilization of renewable energy sources for hot air drying, with solar-powered and biomass-powered drying facilities, has improved market expansion, guaranteeing environmentally friendly food processing and decreased carbon footprint.

Although it offers cost, scalability, and efficiency benefits, the hot air-dried segment is faced with issues of potential heat loss of nutrients, hardening of texture, and longer drying times. However, emerging hybrid heat drying, vacuum-assisted dehydration, and precision-controlled airflow systems are improving food quality, processing volumes, and nutrient retention, ensuring sustained growth for manufacturers of hot air-dried food globally.

Freeze-drying has become very popular in the market, particularly among health-conscious consumers, specialty food manufacturers, and emergency food distributors, because it provides one of the best ways of preserving food without loss of nutrients. Freeze-drying differs from hot air drying in that it is drying at sub-zero temperature by sublimation to remove water, minimizing vitamin, flavor, and textural losses.

Growing consumer need for high-quality dried foods that retain nutrients more effectively, offer better rehydration properties, and have convenient light weights has propelled the use of freeze-drying as companies fulfill expanding markets for specialty food offerings. Research confirms that more than 70% of freeze-dried food consumers value nutrient preservation and natural flavor, affirming strong demand within this market space.

The launch of freeze-dried product ranges, including value-added categories like plant-based protein snacks, probiotic-enriched fruits, and gourmet meal kits, has deepened market demand to provide a variety of consumer choice.

The incorporation of next-generation freeze-drying technologies, including energy-efficient vacuum drying chambers, AI-driven freeze curves, and real-time moisture sensors, has further driven adoption, providing high-quality and affordable food preservation. Freeze-drying food innovations like antioxidant-blessed superfoods, collagen-added snack blends, and high protein sports foods have maximized market growth to enable greater acceptability in the health and wellness market.

Portable freeze-drying technology, including low-volume production modular drying systems and decentralized food preservation centers, has enabled market growth, ensuring availability for large-volume manufacturers as well as specialty craft brands. Though it has the benefits of nutrient maintenance, long shelf life, and storage in light, the freeze-dried category is bogged down with tremendous energy consumption, high equipment cost, and greater processing time.

However, improved low-energy freeze-drying, continuous flow drying, and AI-based quality evaluation systems are enhancing efficiency, cost benefits, and scalability, helping to maintain growth momentum for freeze-dried food manufacturers globally.

The fruits & vegetables and meat & seafood segments represent two of the most significant drivers of the air-dried food market, as consumers prioritize health-conscious eating, long-lasting food storage, and ready-to-eat protein sources.

Among air-dried food products, the fruits & vegetables segment is the most favored one which is providing the consumer the advantages of a high-quality product that is easy to digest and contains very low processing ingredients compared to fresh fruits and vegetables. Air-dried fruits and vegetables also maintain their nutritional structures versus canned or frozen fruits and vegetables, with none of the preservatives or artificial ingredients.

While the adoption is driven largely by growing demand for organic and clean-label dried food, where fruits are preservative-free and vegetable chips are pesticides-free, and there is a rise of naturally sweetened dried fruit snacks, there is growing competition from health-oriented consumers that prefer minimally processed alternatives.

Research has shown that more than 65% of consumers of air-dried food are inclined towards naturally dried produce over sugar-laden or artificially preserved produce, sustaining robust market demand.

In spite of its convenience, shelf life, and nutritional benefits, the fruits & vegetables segment is confronted with color shifts through oxidation, moisture susceptibility, and seasonally fluctuating prices. Nevertheless, recent developments in vacuum-sealed dehydration, artificial intelligence-based ripeness testing, and antioxidant-enriched dehydration technologies are enhancing the shelf life of products, their appearance, and nutrient retention, creating opportunities for long-term market growth.

The meat & seafood category has established strong market momentum, especially with outdoor consumers, fitness-oriented consumers, and emergency preparedness markets, since its products offer protein-rich, light, and shelf-stable food options. In contrast to traditional salted meats or jerky, air-dried meat and sea products offer preservative-free, high-protein foods that preserve natural flavor and texture.

Increasing interest in responsibly sourced, air-dried, and sustainably made protein products such as grass-fed beef jerky, wild-caught dried fish, and free-range chicken strips has fueled adoption due to the fact that customers value clean-label sources of food with sustainable sourcing.

Based on studies, more than 70% of consumers were seen to purchase high-protein snacks with more than 70% choosing air-dried varieties due to the natural ingredient content and convenience of storage. Though it is strong in protein preservation, portability, and long-term shelf life, the meat & seafood category also possesses vulnerabilities such as the risk of oxidation-facilitated rancidity, production costs, and regulation to maintain meat.

Yet emerging technologies such as nitrogen-sealed air-drying, AI-optimized drying regimes, and plant-based protein drying substitutes are improving sustainability, shelf life, and cost, with air-dried meat and seafood producers confident of future prospects across the world.

High Production Costs and Limited Consumer Awareness

High production cost of using sophisticated drying technologies is one of the major challenges facing the air-dried food industry. Keeping the product quality at a level that is both effective and cost-friendly is still a challenge for most manufacturers.

Moreover, as demand for air-dried food is increasing, consumer knowledge about its advantages over conventional drying processes is still low in some markets. Air-dried food is still viewed by some consumers as less fresh or of lower quality compared to frozen foods, which influences buying behavior. These attitudes need to be overcome through successful marketing, product development, and honest labeling to facilitate market growth.

Rising Demand for Clean-Label and Functional Foods

The clean-label, natural, functional foods trend building to address the growing consumer demand presents a quantum opportunity for the air-dried foods sector. With consumers becoming more demanding for preservative-free, nutrient-loaded and minimally processed, air-dried food is a high-performing alternative to traditional dried or frozen food products.

Market demand for air-dried snacking foods like dried legumes, fruits and protein-focused foods also is buoyed by growing demand for plant-based and high-protein diets. Moreover, developments in new air-drying technologies for commercial application enable manufacturers to produce new high-value foods with retained taste, texture, and nutrition, thereby propelling market growth.

The USA air-dried food market is expanding with increased consumer demand for healthy, convenient, and shelf-stable food items. Increasing on-the-go snacking behavior, clean-label solutions, and plant-based food consumption are also propelling market growth. The trend towards freeze-dried and air-dried foods in meal kits and emergency food supplies is also on the rise.

Some of the Market Growth Drivers in the United States are rising demand for preservative-free, nutrient-dense dried food products, rising market for meal-prep solutions and snack foods. trend towards air-dried fruits, vegetables, and meats without artificial preservatives, demand for lightweight, long-shelf-life food in the defense and adventure tourism sectors, technology improvements in air-drying processes for better taste and preservation of nutrients.

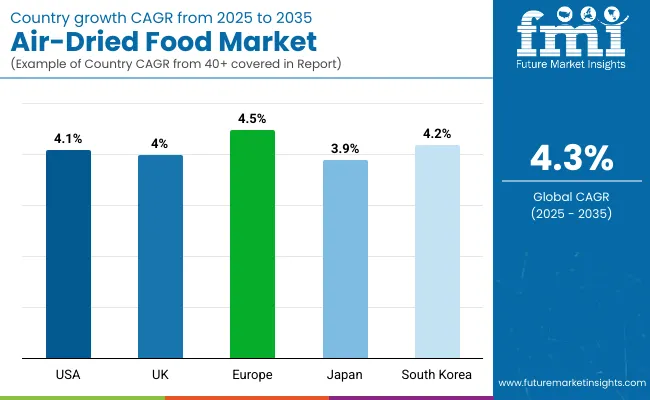

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 4.1% |

The UK air-dried food market is driven by the increasing health-conscious consumers and retail and food service industry. Customers are opting for low-calorie foods that have high nutritional levels, and rising demand for plant-based foods and organic foods is driving the growth of the market.

Growing applications of air-dried fruits, vegetables, and herbs in food items. convenience-led demand for shelf-stable healthy foods, supermarket chains and online platforms fueling market penetration, demand for air-dried foods over frozen foods owing to reduced energy consumption, higher utilization of air-dried foods in plant-based and specialty diets.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 4.0% |

The EU air-dried food industry is booming with the presence of robust food processing economies, the growth of veganism, and favor for natural, non-GMO foods. Germany, France, and Italy dominate the market with the growing demand for organic air-dried food.

Some of the Market Growth Drivers in European Union are universal adoption of air-dried ingredients in snacks, soups, and sauces, increasing demand for plant-based protein sources and dried fruit snacks, EU policies that support low-waste, energy-saving food processing, air-dried foods that are high in antioxidants and vitamins picking up, which stimulates local production of organic air-dried food ingredients.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 4.5% |

Japan's air-dried foods market is increasing steadily owing to consumer demand for classic air-dried foods such as seaweed, mushrooms, and fish. Consumption of instant meal solutions, healthy snacks, and nutrient-dense preserved foods keeps on surging.

Increased use of air-dried seafood, mushrooms, and seaweed, air-dried fruit and vegetable chips becoming popular, texture and nutrient-enhancing innovations in air-dried foods, demand for functional food high in nutrients, government campaigns supporting long-shelf-life food storage.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.9% |

South Korea's air-dried food industry is seeing high growth with expanding markets for food exports, increasing health-conscious consumers, and emerging food processing technologies. Growing global popularity of Korean food is also fueling demand.

Some of the Market Growth Drivers in South Korea are Growing demand for air-dried ingredients in instant food and snacks, increased global demand for dried Korean snacks and ingredients, use of superior techniques to boost taste and texture, strong demand for nutrient-packed dried foods, Online food delivery and specialty food websites driving revenue.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 4.2% |

The sector is fragmented due to the presence of a significant number of small and mid-sized firms. Product launches and mergers and acquisitions are helping air-dried food manufacturers grow their businesses. In the air-dried food sector, businesses face fierce competition. They are working on a capacity expansion to achieve a competitive advantage, in addition to collaborations and product launches.

The global air-dried food market has been shaped by a two-tier structure in which diversified multinationals and agile regional processors coexist. Tier 1 companies such as Nestlé S.A., Unilever PLC, and Kerry Group have been positioned to leverage continent-spanning supply chains, integrated ingredient portfolios, and co-manufacturing agreements that guarantee reliable raw-material access. Their extensive R&D budgets and established brand equity have enabled continual expansion into clean-label snacks and ready-meal inclusions.

Tier 2 players, including Van Drunen Farms, Saraf Foods Pvt Ltd, European Freeze Dry, Harmony House Foods, and B-B Products Pty Ltd, have been concentrating on niche segments where small-batch flexibility and contract drying services are valued. Competitiveness has been strengthened through modular hot-air and low-energy freeze-drying tunnels that cut cycle times by about 18%, allowing swift response to seasonal supply spikes and custom formulation requests.

Three cross-tier strategic themes have been detected. First, hybrid drying lines that combine microwave or infrared assistance with conventional hot-air flows are being adopted to preserve delicate flavor compounds and reduce throughput times. Second, enhanced traceability is being pursued through blockchain-based lot tracking, reassuring export buyers in North America and the EU. Third, packaging optimization light-gauge recyclable films coupled with oxygen-scavenging sachets has been advanced to extend shelf life without chemical preservatives.

Latest Air-Dried Food Industry News

Several regional and niche manufacturers contribute to the air-dried food market, offering specialized products and customized formulations. Notable players include:

The market is estimated to reach a value of USD 105.1 billion by the end of 2025.

The market is projected to exhibit a CAGR of 4.3% over the assessment period.

The market is expected to clock revenue of USD 160.1 billion by end of 2035.

Key companies in the Air-Dried Food Market include Nestlé S.A., Unilever PLC, Kerry Group, Van Drunen Farms, Saraf Foods Pvt. Ltd.

On the basis of product type, fruits and vegetables to command significant share over the forecast period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Air-dried Fish Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Venison Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Air-dried Chicken Dog Food Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage OEE Software Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Crosslinked Polyvinylpolypyrrolidone (PVPP) Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Cassia Gum Powder Market Size and Share Forecast Outlook 2025 to 2035

Food Grade Dry Film Lubricant Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Equipment Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Food Basket Market Forecast and Outlook 2025 to 2035

Food Grade Tremella Polysaccharide Market Size and Share Forecast Outlook 2025 to 2035

Food Sorting Machine Market Size and Share Forecast Outlook 2025 to 2035

Foodservice Paper Bag Market Size and Share Forecast Outlook 2025 to 2035

Food Stabilizers Market Size and Share Forecast Outlook 2025 to 2035

Food Packaging Film Market Size and Share Forecast Outlook 2025 to 2035

Food Certification Market Size and Share Forecast Outlook 2025 to 2035

Food Tray Market Size and Share Forecast Outlook 2025 to 2035

Food & Beverage Industrial Disinfection and Cleaning Market Size and Share Forecast Outlook 2025 to 2035

Food Technology Market Size and Share Forecast Outlook 2025 to 2035

Food Tourism Sector Market Size and Share Forecast Outlook 2025 to 2035

Food Processing Boiler Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA