The global Refrigerated and Frozen Soup Market will grow to a value of USD 2790.27 Million during 2025 and it is expected to reach USD 6845.7 Million by 2035 with a projected compound annual growth rate of 9.2% throughout 2025 to 2035.

The Refrigerated and Frozen Soup market remains active since customers seek ready-to-eat nutritional meals with superior quality standards. These soups meet customers who need time-efficient eating solutions with their convenient and healthful nature. The development of new food preservation methods boosted the quality standards and extended the shelf life of soups.

The market continues to advance as people show increasing demand for plant-based organic food together with increased consumer interest in such products. More people in today's society focus on health and seek food choices which match their eating habits combined with their nutritional requirements.

Several main geographical areas together comprise the market's expansion including North America Europe and Asia-Pacific. The market leadership consists of Campbell Soup Company as well as Conagra Foods and Kraft Heinz because of their broad product selection and expansive distribution capabilities.

The market receives substantial support from three specialized companies which include Blount Fine Foods and Kettle Cuisine and Amy's Kitchen. The European market expansion is carried out by Nestlé and Progresso through their innovative soup product offerings. New brands have established their position by choosing specific market segments combined with tailored product offerings for local consumer tastes.

| Attributes | Description |

|---|---|

| Estimated Industry Size (2025) | USD 2790.27 Million |

| Projected Industry Value (2035) | USD 6845.7 Million |

| Value-based CAGR (2025 to 2035) | 9.2% |

The market mainly draws its momentum from two essential factors: consumer lifestyles together with growing preferences for people choosing healthy eat options. Individuals in urban areas choose ready-to-eat options since their tight work schedules demand it. The market shows a rising trend in refrigerated and frozen soup sales because these options provide quick servings of nutritious meals.

Packaging and delivery system advancements have successfully rendered these products easier to access and more attractive to market consumers. The market displays steady expansion and product variety because consumers find refrigerated and frozen soups both convenient and nutritious and of high quality.

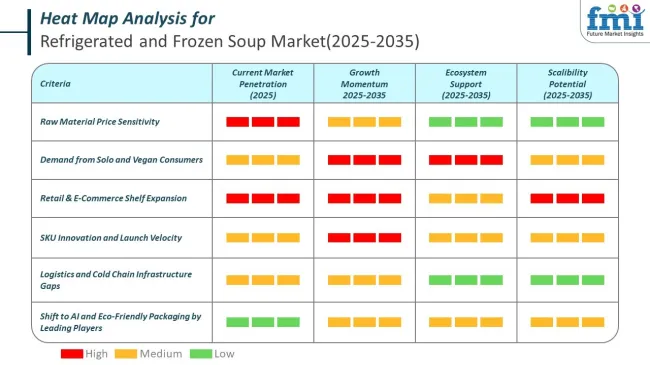

In 2025, refrigerated and frozen soup market raw material pricing especially for tomatoes, pulses, and herbs shows volatility. Onion and garlic price cycles also continue to spike during lean months. Indian NCDEX futures for lentils, used in vegan soup variants, reflect upward movement as bulk export orders from Southeast Asia grow. These ingredients make up the core cost base in the refrigerated and frozen soup market, affecting batch-level profitability.

Single-person households, vegan eaters, and office-goers now dominate consumer demand. USA retail units show heavier pull for plant-based SKUs, especially those under 400g. While chilled soups with lower sodium, no binders, and traceable sourcing are gaining popularity, shelf-stable options continue to maintain a strong presence in the market due to their longer shelf life and convenience

Supermarkets still own 45% of shelf-space across frozen aisles. Refrigerated soup SKU listings have achieved a two-fold growth on quick-commerce platforms in 2025. Amazon Fresh, JioMart, and Blinkit have added smaller-size SKUs for immediate consumption. Shelf-stability now matters less than last-mile fulfillment velocity. Refrigerated and frozen soup market players must adapt to dynamic merchandising cycles.

Cold warehouse capacity in top Indian metros increased by 9% in 2025. However, zone-specific constraints persist. In the USA, Midwest regions saw 3-day average delivery times for frozen SKUs. SKU failure rates in rural belts remain high due to broken cold chains. The industry continues to struggle with balancing SKU agility and logistics reliability.

More focus on functional ingredients like superfoods and antioxidants

Superfoods and antioxidant ingredients receive more market focus which affects refrigerated and frozen soup products. Commodities containing superfoods and antioxidants have become increasingly popular because consumers understand their health advantages and seek nutritious convenience foods.

Basic food nutrition is only one aspect of functional food ingredients since these components offer additional health advantages beyond caloric value. The superfood classification exists for foods like kale, quinoa and chia seeds alongside turmeric since these ingredients deliver numerous health benefits together with abundant nutrients.

Our body utilizes antioxidants as compounds to counteract the damaging effects of free radicals until they generate stress leading to diseases that involve cardiovascular issues along with cancer and neurodegenerative diseases. Regular antioxidant components used in soup-making are berries and green tea along with spinach and tomatoes. Manufacturers add these ingredients to their soup products because they desire to provide consumers with both hunger satisfaction as well as sustained health advantages.

Adoption of plant-based protein-rich soups for a vegan diet

Plant-based protein-rich soups continue to rise in popularity for vegan diets thus driving growth in the refrigerated and frozen soup market. Plants become the dietary preference of increased numbers of individuals who want nutritious protein sources both for their health benefits and environmental and moral reasons. The refrigerated and frozen soup market integrates plant-proteins from lentils and chickpeas alongside tofu and quinoa and beans because of growing demand from vegan consumers.

Many health advantages accompany plant-based proteins since they manage cholesterol while decreasing heart disease risks and supporting better digestion functions. The nutritional advantages of plant-proteins surpass those of animal proteins because they contain no saturated fat while delivering important vitamins and minerals in addition to fiber.

These proteins suit health-oriented individuals because they provide a nutritious eating alternative without animal proteins. Roughly speaking plant-based proteins need less resources and produce fewer environmental emissions than animal-based proteins when generated for consumption.

Food producers develop numerous vegan and flexitarian-friendly plant-based protein soups that use both benefits for meeting customer needs. The culinary developers have created complete nutritious soups which deliver important vitamins and minerals together with delectable tastiness. Food technology innovations permit manufacturers to develop meat analogs which duplicate authentic meat-based soup tastes and measures for plant-based consumers.

Enhancements in cold chain logistics ensuring better product quality

Cold chain logistics improvements deliver essential benefits toward maintaining better quality standards for refrigerated as well as frozen soup products. The term cold chain logistics describes the controlled temperature supply chain system which ensures safe handling of perishable products. The main objective of this process ensures product integrity alongside target quality standards maintain themselves between manufacturing sites and end consumers.

The main advancement of cold chain logistics incorporates advanced refrigeration systems. Modern refrigeration technologies provide improved efficiency while delivering dependable temperature control operations until the end of supply chain distribution. The proper refrigeration systems guarantee optimal temperatures for Refrigerated and Frozen Soups that help protect their nutritional content and flavor profile.

Real-time monitoring and tracking systems maintain an essential position in the processes of cold chain logistics operations. Temperature monitoring through sensors powered by Internet of Things technology creates non-stop recording of data for maintenance of product quality throughout distribution and storage periods.

Slight changes from temperature standards trigger an automated alert system that informs all stakeholders who can start executing prompt solutions. The planned methodology reduces product deterioration risk therefore delivering soups to customers in optimal condition.

Better packaging options play an essential role in keeping products at their best quality throughout cold chain distribution. The market now uses advanced packaging solutions which ensure better insulation and protection capabilities for refrigerated and frozen soup products. The designed packaging enables temperature stability together with protection against physical damage during both delivery and shipping operations.

Introduction of single-serve and portion-controlled packaging

Customers today can benefit from single-serve and portion-controlled packaging in refrigerated and frozen soup products because it follows changing customer demands for convenient meal options and waste management methods. Single-serve packages deliver the right option for people who want instant ready-to-eat portioned portions instead of making large batches of food at once. Third-generation packaging solutions have gained popularity among busy student’s professionals and single dwellers since they suit users who do not need oversized portions.

Single-serve and portion-controlled packaging present the main advantage of delivering convenient usage. The prepackaged portions remove any necessity for measuring or dividing soup portions in order to speed up meal preparation steps. The package design allows people to quickly take one serving portion which they heat before they can eat it right away. Time-saving solutions which match the fast-laced modern lifestyle are precisely why consumers appreciate the easy-to-use features of single-serve packaging.

The exact portioned packaging formats assist customers in portion control so they avoid eating more than they need and generate less waste. Reduction of food waste and development of mindful eating habits happen as a result of this packaging format. The packaging allows customers to savor their favorite soups with a guilt-free experience along with hassle-free storage and reheating of large portions.

During the period 2020 to 2024, the sales grew at a CAGR of 8.9% and it is predicted to continue to grow at a CAGR of 9.2% during the forecast period of 2025 to 2035.

The worldwide refrigerated and frozen soup industry has experienced considerable expansion during the previous ten-year period. Consumer lifestyles transformed mainly because they needed convenient rapid eating solutions which propelled market expansion.

As the market evolved after its initial basic period it multiplied its soup options to diversity its selection for multiple dietary choices and cultural preferences. The market expansion has significantly benefited from new preservation technology along with the creative introduction of novel flavor options. People prefer quick eating options requiring minimal preparation so refrigerated and frozen soups have become successful product choices in this market.

Analysis reveals that the refrigerated and frozen soup market will continue strengthening its growth pattern in the forthcoming years. Market demand for cold and frozen soups will continue to expand because consumers prioritize eating healthily with organic and natural ingredients. The market will expand through corporate innovation focused on developing healthy ingredients like gluten-free items and low-sodium choices as well as creating novel flavors.

New developments in packaging and preservation methods will enable manufacturers to lengthen the shelf stability of these products so they gain more consumer appeal. The expanding vegan and vegetarian consumer base will create new business opportunities for market growth. The market for refrigerated and frozen soups will continue growing because of prevalent busy lifestyles and consumer requirement for convenience and this expansion will mainly stem from both established markets and new emerging markets.

Tier 1: The upper tier consists of Campbell Soup Company, Conagra Foods, Kraft Heinz and Nestle as its largest members. These firms rule the market through strong product diversity as well as their well-known brand identity and extensive delivery systems. The companies intensively fund research and development and marketing and worldwide expansion operations to preserve their large market presence and lead industry developments.

Tier 2: The players in this level of market segmentation maintain significant industry visibility while operating smaller than leaders from Tier 1. The specialized product offer of these companies includes organic, gluten-free and gourmet as they target specific market segments. The companies stress quality innovations coupled with sustainability while targeting particular consumer tastes for building strong customer loyalty

Tier 3: This tier consists of smaller companies and regional players like Tabat chnick, Ivar's Soup & Sauce Company, The Schwan Food Company, SpringGlen Fresh Food, Boulder Organic Foods, and Progresso. The companies operate with restricted market spread and fewer resources than Tier 2 and Tier 1 competitors. Local markets are their main focus as they deliver special or locally produced items that align with local cultural tastes. The quickness of operations and market flexibility equips these companies to succeed against competition in their specific markets.

The following table shows the estimated growth rates of the significant three geographies sales. USA and Germany are set to exhibit high consumption, recording CAGRs of 5.7% and 6.7% respectively, through 2035.

| Countries | CAGR, 2025 to 2035 |

|---|---|

| USA | 5.7% |

| Germany | 6.7% |

| India | 8.3% |

The rising consumer preference for quick prepared meals within the United States strongly supports the increased expansion of the refrigerated and frozen soup industry. Faster modern American lifestyles between work and family life require quick easy meals that have become vital to consumers. Freezers and refrigerators provide an excellent alternative for customers seeking nutritious and quick-preparation meals without extensive work. The market demand continues to rise because consumers choose these soups instead of fast-food because of their health benefits.

People living in the busy lifestyle choose refrigerated and frozen soups because they appreciate their convenience and their wide selection of options in addition to single-person and dual-wage families. To address the continuously expanding market segment manufacturers of food products enhance their product innovation through new flavor variations while boosting nutritional and quality standards of their offerings.

Plant-based soups find growing demand in the German refrigerated and frozen soup market because of the expanding popularity of vegetarian and vegan diets. People who follow plant-based diets along with ethical preferences now actively search for meals made from plant sources due to their health commitment and environmental stewardship. More people adopt plant-based diets because they understand such eating patterns promote better heart wellness as well as maintain weight and decrease risks for chronic diseases.

People who value environmental protection together with animal well-being now limit their intake of animal products. Food production enterprises establish new innovative plant-based soups as they aim to provide options that support various taste choices and nutritional requirements. Plant-based soups provide customers with a tasty option to consume more vegetable-based and legume and grain-rich foods through convenient meal solutions. The market for refrigerated and frozen plant-based soups grows swiftly because Germans increasingly follow vegetarian and vegan diets.

Indian urban development patterns create substantial market demand for ready-to-eat food products which particularly includes refrigerated and frozen soups. The combination of rapid city expansion together with urban population migration results in accelerated lifestyles which necessitates consumers to use convenient meal solutions. The limited time commitment of urban professionals makes ready-to-eat meals extremely desirable because they provide an alternative to home-made food.

The fastness and nutritional value along with delicious taste of refrigerated and frozen soups creates an appealing dining choice for people who have time limitations. High-income levels among urban residents enable them to spend more money on premium as well as convenient food items.

The entry of contemporary retail stores and e-commerce websites enables better access for people to experience many different types of refrigerated and frozen soups. India's refrigerated and frozen soup market experiences rapid growth due to the rising urbanization levels together with lifestyle changes and increasing disposable income of people.

| Segment | Value Share (2025) |

|---|---|

| refrigerated soup (Type) | 58% |

Multiple participants compete in the refrigerated and frozen soup market due to their different strengths which they contribute to the sector. Major companies including Orgatma Cold-Pressed Oils, NOW Foods, Mountain Rose Herbs and Aura Cacia enhance quality and innovation in order to boost market penetration. Through its natural and organic product expertise Orgatma Cold-Pressed Oils develops premium health-oriented soup products.

Now Foods operates as a food supplement and natural product giant which evolves its product lines to include ready-to-share healthy soup options. Environmentally friendly consumers who want wholesome and natural soups find Mountain Rose Herbs attractive because it follows organic and sustainable practices. The company Aura Cacia brings its aromatherapy expertise into the food market through wellness-focused condensed soup products containing natural ingredients.

| Segment | Value Share (2025) |

|---|---|

| supermarkets/hypermarkets (Application) | 43% |

Retailers operating supermarkets and hypermarkets control the worldwide refrigerated and frozen soup market because they maintain extensive coverage along with diverse product availability. Retailers present an extensive collection of frozen and chilled soups because they support different consumer taste choices as well as dietary requirements. Their large purchasing abilities enable them to reach cost-effective terms with producers which in turn produces advantageous pricing strategies to draw bigger numbers of shoppers.

Locating every shopping need under one roof together with the opportunity to view products directly make supermarkets and hypermarkets the favored destination for several shoppers. Private label brands from these retail chains increase their domination by providing premium quality products which lowers prices to boost sales even more.

The lower tier of the soup market includes business entities including Tabatchnick, Ivar's Soup & Sauce Company and The Schwan Food Company, Spring Glen Fresh Food, Boulder Organic Foods and Progresso. The companies in this group maintain restricted market presence alongside limited assets compared to major competitors in Tier 1 along with Tier 2 players.

Within their market sphere these companies serve their local areas by providing special food products that match regional eating habits. Small companies with market agility collectively maintain effective competition across their defined market segments.

Based on type, the industry is segmented into refrigerated soup and frozen soup.

In terms of applications, the sector is segmented into supermarkets/hypermarkets, Foodservice, retail, and others.

Refrigerated and Frozen Soup industry analysis has been carried out in key countries of North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East and Africa.

The market is expected to grow at a CAGR of 9.2% throughout the forecast period.

By 2035, the sales value is expected to be worth USD 6845.7 Million.

North America region is expected to dominate the global consumption.

Blount Fine Foods, Campbell Soup Company, Kettle Cuisine, Tabatchnick.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Refrigerated / Frozen Dough Products Market Size and Share Forecast Outlook 2025 to 2035

Frozen Pet Food Market Size and Share Forecast Outlook 2025 to 2035

Frozen Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Frozen Egg Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Display Case Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Market Size and Share Forecast Outlook 2025 to 2035

Frozen Tissues Samples Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Packaging Machines Market Size and Share Forecast Outlook 2025 to 2035

Frozen Food Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Refrigerated Trailer Market Size and Share Forecast Outlook 2025 to 2035

Frozen Pastries Market Size and Share Forecast Outlook 2025 to 2035

Frozen Baked Goods Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Transport Market Size and Share Forecast Outlook 2025 to 2035

Frozen Potatoes Market Size and Share Forecast Outlook 2025 to 2035

Frozen Beverage Dispenser Market Size and Share Forecast Outlook 2025 to 2035

Frozen Meat Grinder Market Size and Share Forecast Outlook 2025 to 2035

Frozen Fruits and Vegetables Market Size and Share Forecast Outlook 2025 to 2035

Refrigerated Ice Cream Merchandise Market Size and Share Forecast Outlook 2025 to 2035

Frozen Vegetable Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Refrigerated Vending Machine Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA