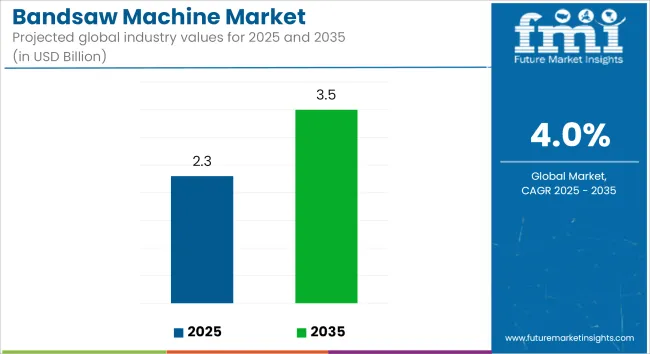

The global bandsaw machines market is estimated to generate sales of USD 2.3 billion in 2025 and is projected to reach approximately USD 3.5 billion by 2035, registering a compound annual growth rate (CAGR) of 4% during the forecast period. Steady demand has been observed from the metalworking, construction equipment, and heavy manufacturing sectors, where precision cutting of large workpieces is routinely required.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 2.3 Billion |

| Market Value (2035F) | USD 3.5 Billion |

| CAGR (2025 to 2035) | 4% |

Product advancements in 2024 and 2025 have continued to center around automation, blade technology, and energy efficiency. Cosen Saws, a manufacturer of industrial cutting equipment, launched its CNC-530 high-production horizontal bandsaw.

This model was developed for demanding structural steel applications and includes programmable logic control (PLC), automatic material feed, and enhanced blade life monitoring systems. These upgrades were introduced to reduce manual intervention while improving production consistency for high-volume users such as steel fabricators and OEM suppliers.

The vertical bandsaw segment has also seen innovation tailored to small and mid-sized operations. Grizzly Industrial announced the release of its 14" Vertical Metal-Cutting Bandsaw, which incorporates dual-speed settings and variable pitch blade compatibility.

The model was designed to meet performance demands for toolrooms, educational labs, and low-to-medium throughput machining environments. According to Grizzly’s product development team, emphasis has been placed on enhancing rigidity and thermal management for prolonged cutting accuracy under repeated operation cycles.

Blade technology remains a focus area for competitive differentiation. In 2024, WIKUS introduced a new line of bimetal bandsaw blades under the PRIMAR® M42 product category. These blades were engineered to offer improved tooth geometry and reduced vibration during segmented cutting operations, addressing end-user requirements for extended tool life and enhanced surface finish quality. According to WIKUS, such products are being positioned for use in machine shops transitioning toward digital workflow automation and predictive maintenance schedules.

Demand growth is being supported by infrastructure development, industrial automation, and maintenance-heavy applications where precise cutting of hardened materials is necessary. Integration of digital control units and machine learning algorithms for blade wear prediction has begun to shape the R&D pipeline for global manufacturers.

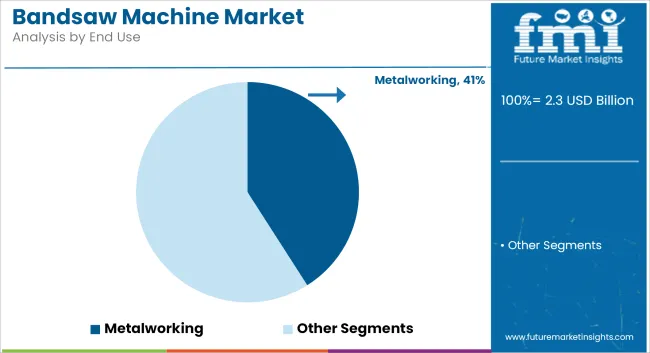

The metalworking segment is estimated to account for approximately 41% of the global bandsaw machines market share in 2025 and is projected to grow at a CAGR of 4.2% through 2035. Demand is driven by the widespread use of bandsaw machines for cutting steel, aluminum, and alloy billets in industrial workshops, tool rooms, and metal processing plants.

These machines offer high precision, clean cutting surfaces, and versatility in handling various profiles such as pipes, beams, and sheets. Manufacturers in sectors like shipbuilding, aerospace, and metal component manufacturing continue to invest in horizontal and vertical bandsaws to improve cutting efficiency and reduce material waste. Technological advancements such as automatic feed systems, servo-driven motors, and carbide-tipped blades further enhance productivity and user safety in metalworking operations.

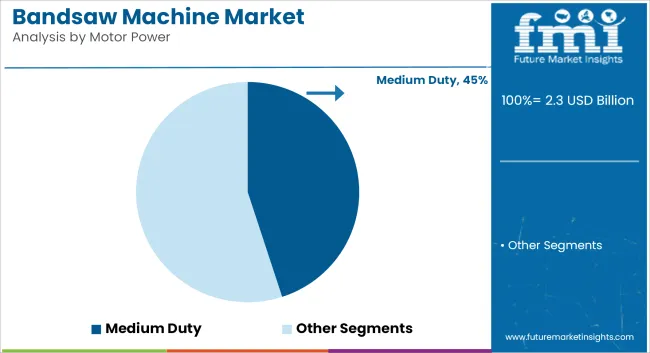

Medium duty machines are projected to hold approximately 45% of the global bandsaw machines market in 2025 and are expected to grow at a CAGR of 4.1% through 2035. These machines offer a balanced combination of cutting capacity, operating speed, and durability, making them suitable for diverse applications in fabrication shops, furniture production, automotive workshops, and general-purpose manufacturing.

With growing demand from small- and mid-sized enterprises, medium duty bandsaws continue to serve as the standard solution for both ferrous and non-ferrous material cutting. Manufacturers are enhancing machine ergonomics, blade tensioning systems, and cutting automation to cater to the evolving requirements of semi-automated industrial environments. As infrastructure development and industrial machining expand globally, medium duty segments remain the go-to option for versatile and reliable cutting operations.

Challenges

Opportunities

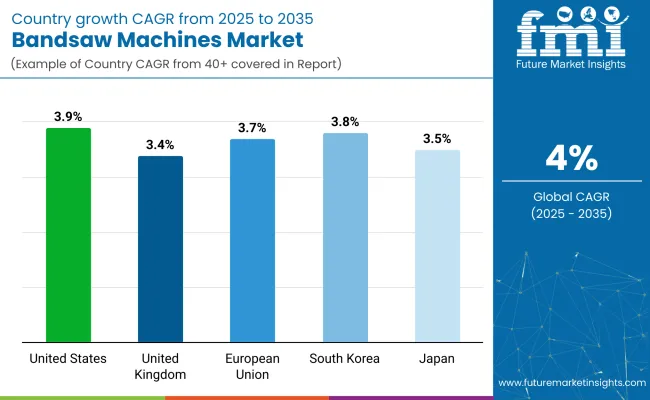

The growth of the bandsaw machines market in the United States is driven by increasing demand from the metalworking, woodworking, and automotive industries. The surging demand for cutting precision in industrial manufacturing, combined with rapid development of automation, drives the market growth substantially. Additionally, the increasing use of CNC-controlled bandsaw machines in mass production plants is improving operational efficiency and minimizing material waste.

Demand comes most prominently from the metal fabrication industry, notably aerospace and defence. Security in the United States has been tight, and the USA has been investing in its defence sector, so manufacturers need advanced bandsaw machines to handle high-strength alloys and complex cuts. Moreover, the trend for lightweight automotive components has helped propel the demand for high-precision cutting tools in the automobile sector.

Market dynamics are also being influenced by sustainability trends. Demand for machinery that is energy efficient as well as being equipped with advanced safety features in industrial equipment has compelled manufacturers to launch bandsaws that offer enhanced blade longevity, less heat generation as well as optimized cutting speeds.

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 3.9% |

The UK bandsaw machines market is witnessing growth owing to the growing demand from the construction, metalworking, and aerospace industries. A strong emphasis on precision engineering, along with a shift to automation, are spurring market growth in the country. Also, the UK government has joint safety and efficiency regulations that are promoting industries to enrich their cutting tools using advanced technologies.

The growth of the aerospace industry is one of the key drivers impacting the market. There are major manufacturers of aerospace in the UK, and high-precision metal cutting tools remain in demand. Their demand is being led by the construction sector, which is supported by government investments on infrastructures to provide high performance bandsaws utilized for cutting steel, concrete and different building materials.

Trends around sustainability and the transition to low-carbon manufacturing are also changing the industry. Businesses are sourcing new energy-efficient bandsaws with lower noise and vibration. High-durability bandsaws are also seeing increased demand as recycling and scrap metal processing becomes more valuable.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 3.4% |

Styling of bandsaw machines in the European Union Severing of Frozen Food bandsaw machines in the European Union European marketplace for bandsaw machines is gaining momentum owing to an uptrend in demand from automotive, construction and industrial manufacturing sectors. Germany, France, and Italy lead in high-accuracy cutting solutions, due to their robust industrial bases. High adherence to safety regulations in the region REACH and CE directives and the desire for sustainable manufacturing are major factors influencing the market.

Trends like Industry 4.0 technology adoption are reshaping the bandsaw market as companies incorporate artificial intelligence-based diagnostics and predictive maintenance systems into their devices. From green manufacturing there has been an increased focus in energy efficient and noise reducing bandsaws.

In the automotive sector, the EU’s ambitious shift in focus toward electric vehicle (EV) production has spurred demand for lightweight materials including aluminium and composites, which in turn is propelling demand for precision cutting tools. Moreover, increasing focus on recycling and circular economy practices is encouraging the adoption of bandsaws in metal recycling facilities.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 3.7% |

Demand from the electronics, automotive, and precision engineering industries fuels the growth of Japan's bandsaw machines market. So the country is dedicated to high-precision manufacturing and automation, resulting in the prevalence of CNC bandsaws with ultra-fine cutting functions. Also, advancements in blade coatings and cooling systems have improved machine efficiency.

One of its key drivers is the electronics sector, which demands highly precise cutting of metals for semiconductor parts. Also, the country's increasing adoption of electric vehicles (EVs) has raised the demand for lightweight materials, hence creating the need for advanced cutting solutions.

Japan’s strict environmental regulations are an influence, too. Manufacturers have also released bandsaws with energy-efficient motors and noise-dampening designs as regulations prohibiting excessive industrial emissions have become stricter.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 3.5% |

As the automotive, electronics, and construction industries grow, so too does the market for bandsaw machines in South Korea. South Korea’s technological progress and smart factory programs have spurred the use of automated and AI-powered cutting tools.

The booming semiconductor industry in South Korea, which is a major consumer of precision metal cutting tools, sharply propels market growth. On the contrary, government initiatives promoting eco-friendly industrial production are compelling manufacturers to come up with energy-efficient bandsaws.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 3.8% |

The bandsaw machines market has gained a significant increase global market value owing to the rise in demand from metalworking, woodworking, and automotive sectors. High precision cutting solutions and automation trends are reshaping energy saving bandsaw machines buying patterns are significantly changing as organizations seek better productivity and cost reduction from their in-line manufacturers, so firms are focusing on high-precision cutting solutions and energy-efficient bandsaw machines to optimize operational costs.

There are technologies such as evolved global leaders and regional manufacturers making innovative catalysts, cost-effective approaches, and domain-specific applications.

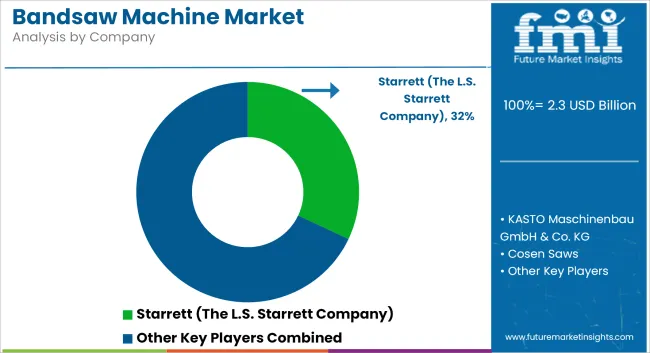

The overall market size for Bandsaw Machine Market was USD 2.3 Billion in 2025.

The Bandsaw Machine Market is expected to reach USD 3.5 Billion in 2035.

The demand in the Bandsaw Market is likely to increase with increasing industrialization, infrastructure growth, and more applications in woodworking, metalworking, and automobile manufacturing, where precision cutting and effectiveness are essential.

The top 5 countries which drives the development of Bandsaw Machine Market are USA, UK, Europe Union, Japan and South Korea.

Horizontal Bandsaw Machines to Command a Significant Share over the Assessment Period.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Lathe Machines Market

Sorter Machines Market Size and Share Forecast Outlook 2025 to 2035

Virtual Machines Market by Type, by Enterprise Size, by Industry & Region Forecast till 2035

Wrapping Machines for Handkerchiefs Market Size and Share Forecast Outlook 2025 to 2035

Sleeving Machines Market Size and Share Forecast Outlook 2025 to 2035

Drilling Machines Market Size and Share Forecast Outlook 2025 to 2035

Spinning Machines Market Size and Share Forecast Outlook 2025 to 2035

Knitting Machines Market Size and Share Forecast Outlook 2025 to 2035

Stamping Machines Market Growth and Outlook 2025 to 2035

Twist Tie Machines Market Size and Share Forecast Outlook 2025 to 2035

Cartoning Machines Market from 2025 to 2035

Flow Wrap Machines Market by Horizontal & Vertical Systems Through 2025 to 2035

Flake Ice Machines Market - Industry Growth & Market Demand 2025 to 2035

Flow Wrap Machines Market Analysis – Size, Share & Industry Trends 2025-2035

Ice Maker Machines Market

Granulator Machines Market Size and Share Forecast Outlook 2025 to 2035

Laminating Machines Market Size and Share Forecast Outlook 2025 to 2035

Anesthesia Machines Market - Size, Share, and Forecast 2025-2035

Nugget Ice Machines Market – Market Innovations & Future Trends 2025 to 2035

Compaction Machines Market Growth - Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA