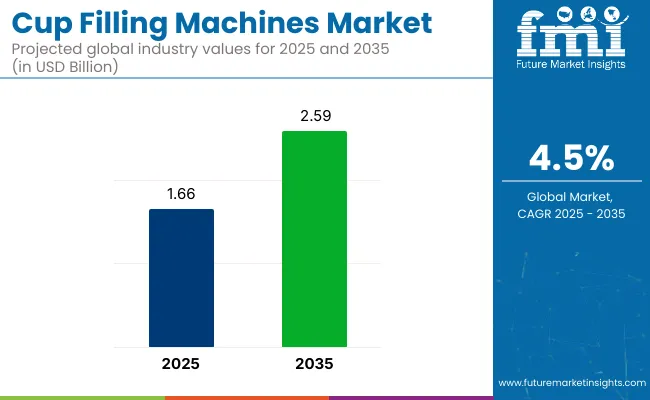

The global sales of cup filling machines are worth USD 1.66 billion in 2025 and are anticipated to reach a value of USD 2.59 billion by 2035. Sales are projected to rise at a CAGR of 4.5% over the forecast period between 2025 and 2035. This growth is being driven by increasing demand for packaged dairy products, desserts, sauces, yogurt, ready-to-eat meals, and single-serve beverages.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 1.66 billion |

| Industry Value (2035F) | USD 2.59 billion |

| CAGR (2025 to 2035) | 4.5% |

Cup filling machines are essential in automating the filling and sealing process for a wide variety of viscous and semi-solid products, offering precision, hygiene, and efficiency to food and beverage manufacturers operating at both small and industrial scales.

Technological advancements in filling equipment are improving speed, accuracy, and versatility. Modern cup filling machines are now equipped with PLC controls, servo-driven systems, and multi-lane configurations that allow for high-output production with minimal product waste. Manufacturers are designing machines compatible with various cup sizes, materials, and sealing technologies, including pre-cut lids, roll film sealing, and ultrasonic welding.

Innovations in hygienic design, clean-in-place systems, and integration with packaging and labeling units are enabling seamless automation across production lines. This has led to growing adoption in sectors such as dairy, plant-based products, baby food, and condiments, where consistency and food safety are paramount.

Global regulatory compliance and the push for sustainable packaging are influencing product development and market expansion. Manufacturers are increasingly developing cup filling solutions that accommodate eco-friendly materials such as compostable cups, paper-based laminates, and recyclable plastics.

In addition, expanding consumption of convenience food in urban areas, growth in online grocery channels, and demand for portion-controlled packaging are contributing to increased installations of advanced cup filling systems. As operational efficiency and packaging innovation become critical competitive factors, the global cup filling machines market is expected to witness consistent growth across foodservice, retail, and industrial applications from 2025 to 2035.

Governments and regulatory agencies across major markets have introduced stringent standards to ensure that these machines operate safely, maintain product quality, and prevent contamination during the packaging process. Regulatory frameworks cover various aspects, including the use of food-safe materials, adherence to good manufacturing practices, machine safety, and the implementation of traceability systems.

The global trade of cup filling machines is driven by the rising demand for automated and hygienic packaging solutions in food, dairy, and beverage industries. Export and import trends reflect technological capabilities, manufacturing hubs, and regional consumption needs.

The below table presents the expected CAGR for the global cup filling machines market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 4.2%, followed by a slightly higher growth rate of 4.8% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 4.2% |

| H2 (2024 to 2034) | 4.8% |

| H1 (2025 to 2035) | 4.0% |

| H2 (2025 to 2035) | 5.0% |

Moving into the subsequent period, from H1 2025 to H2 2035, the CAGR is projected to decrease slightly to 4.0% in the first half and increase to 5.0% in the second half. In the first half (H1) the market witnessed a decrease of 20 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

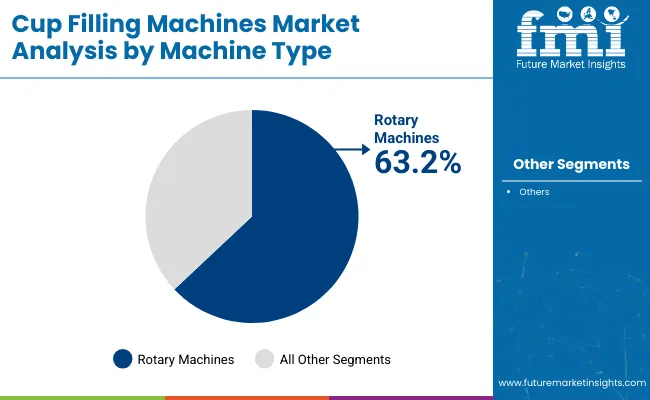

The market is segmented based on machine type, technology, capacity, aseptic application, and region. By machine type, the market is divided into linear and rotary machines. In terms of technology, it is segmented into form fill and sealing and fill seal.

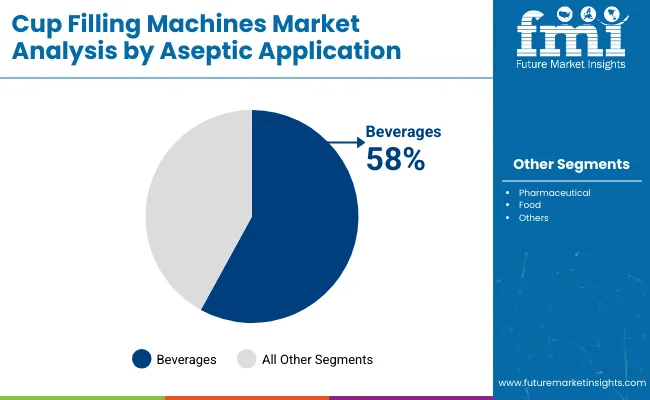

Based on capacity, the market includes above 6000/hr, 3001 to 6000/hr, 1001 to 3000/hr, and below 1000/hr. By aseptic application, the market is categorized into pharmaceutical, beverages, and food. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia and Pacific, East Asia, and the Middle East and Africa.

Rotary machines are projected to dominate the cup filling machines market by machine type, capturing an estimated 63.2% market share in 2025. These machines are favored in high-speed production lines due to their continuous operation, minimal downtime, and efficient use of space. Rotary systems are widely adopted in industries requiring large-scale packaging, particularly for dairy products, beverages, and single-serve food applications.

| Machine Type Segment | Market Share (2025) |

|---|---|

| Rotary Machines | 63.2% |

The circular motion design of rotary machines enables simultaneous operations such as cup placement, filling, sealing, and ejection reducing the cycle time significantly compared to linear counterparts. Key players like Serac, Bosch Packaging Technology, and Trepko have developed advanced rotary models equipped with features like multi-lane filling, automated cup detection, and vision-based quality control systems.

Rotary machines also integrate well with aseptic technologies and secondary packaging lines, offering a complete automation ecosystem. Their flexibility in handling a wide range of cup sizes, materials, and viscosities makes them ideal for both standard and specialized applications. As manufacturers increasingly prioritize production scalability and process reliability, the demand for rotary systems is expected to remain dominant during the forecast period.

Beverages are anticipated to grow at the fastest rate among aseptic applications in the cup filling machines market, registering a CAGR of 5.6% from 2025 to 2035. This growth is driven by rising demand for shelf-stable drinks including fruit juices, dairy-based beverages, plant-based alternatives, and functional drinks that require precise aseptic filling to maintain flavor, nutrition, and safety without refrigeration.

Aseptic cup filling in beverages ensures minimal microbial contamination and eliminates the need for preservatives, which appeals to health-conscious consumers. As beverage portfolios diversify and smaller, on-the-go formats become more popular, brands are increasingly shifting toward advanced filling equipment that delivers high throughput and hygiene.

Companies such as Tetra Pak, Oystar Group, and IMA Group are innovating in aseptic beverage filling by integrating features like ultra-clean filling heads, UV sterilization systems, and automated clean-in-place (CIP) cycles. These innovations help meet regulatory and quality requirements while enhancing efficiency. As global consumption of non-alcoholic and dairy-alternative beverages continues to rise, especially in emerging economies, investment in aseptic cup filling technology tailored for beverage applications will be pivotal.

| Aseptic Application Segment | CAGR (2025 to 2035) |

|---|---|

| Beverages | 5.6% |

Form fill and sealing (FFS) technology is projected to grow at the highest rate in the cup filling machines market, recording a CAGR of 5.8% from 2025 to 2035. This technology has gained preference due to its cost-effectiveness, operational efficiency, and compatibility with high-volume production lines. FFS systems perform three functions forming cups from roll stock, filling with the desired product, and sealing on a single integrated platform, which reduces labor and production downtime significantly.

Industries such as dairy, beverages, snacks, and ready-to-eat foods are investing in FFS machines for their adaptability across packaging shapes and sizes. The growing trend toward automation and customized packaging solutions has further fueled demand for FFS systems. These machines offer lower packaging waste, consistent fill accuracy, and better seal integrity, which are critical for preserving shelf life and product safety.

Key manufacturers such as IMA Group, Bosch Packaging, and GEA Group are expanding their FFS product lines with features like hygienic design, CIP (clean-in-place) systems, and touchscreen-controlled operation. As the food and beverage sector becomes more competitive and regulated, the advantages of FFS in speed, versatility, and compliance are positioning it as the dominant growth engine within the cup filling machines market.

| Technology Segment | CAGR (2025 to 2035) |

|---|---|

| Form Fill and Sealing | 5.8% |

The above 6000/hr capacity segment is expected to grow at the fastest pace in the cup filling machines market, registering a CAGR of 5% from 2025 to 2035. This segment caters to high-throughput industries such as beverages, dairy, desserts, and ready-to-eat meals, where continuous and efficient filling operations are crucial to maintain competitive lead times and unit economics. These machines are preferred by large manufacturers aiming to scale production without compromising on consistency or quality.

Above 6000/hr machines enable rapid, uninterrupted packaging, reducing downtime and manual intervention. As global consumption of single-serve and convenience-packaged foods rises, especially in urban centers, demand for high-capacity filling systems continues to strengthen.

Leading machine producers such as Serac, Trepko, and Bosch Packaging have introduced modular and customizable models that combine speed with hygienic designs and automation features, ensuring both food safety and process optimization.

The segment’s growth is also supported by advancements in robotic arm integration, smart sensors, and AI-driven performance monitoring, which enhance overall line efficiency. As more companies transition toward Industry 4.0-compliant packaging systems, high-capacity cup filling machines are poised to lead capital investment decisions.

| Capacity Segment | CAGR (2025 to 2035) |

|---|---|

| Above 6000/hr | 5% |

Future consumption trend of portable snacks and ready-to-eat meals will further boost the demand for single-serve packaging, especially among the beverage segment. Consumers have increasingly come to rely on portable and convenient, easy-fitting packaging, matching their fast-paced lives.

This demand shift is mainly observed in segments like dairy products such as yogurt, milk, and others, coupled with a beverage segment that has single-serve juice, smoothies, or coffee cups. One of the options to meet demand is to fill rapid and straightforward solutions into small containers with minimal compromise in quality and precision; cup filling machines do just that.

Manufacturers are, therefore, inclined toward investing in machines that could accommodate smaller package sizes and have flexible production lines capable of creating rapid format changes.

Demand for improved packaging hygiene standards and shall adaptation of safety has challenged every sector in food, beverage and pharmaceutical. Consumers have got more hygiene-consumable and safety-conscious products that somehow eliminate contaminations.

In addition, regulatory bodies enforce stringent norms for ensuring cleanliness and sterility of the processes in packaging. These factors are leading to more applications of aseptic filling techs that provide sterile and contaminated solutions for packaging liquids, semi-solids and powders.

This has opened new avenues in the creation of advanced-technology cup filling machines, where these machines come with aseptic systems, all mandatory for manufacturers to achieve these increasing measures. Fill the containers holding the filling process under maintained sterility manipulations with advanced sterilization modes for taking care of both materials here involved with product and packaging.

Dairy, read-to-eat meal products, and pharmaceutical product integrity for shelf length attainment depend massively on such technologies. There is a new revolution in innovation changes with respect to filling cups under hygienic, and now they have benchmark standards concerning safety and efficiencies.

Aseptic filling technology is widely known to apply to liquid products; however, it becomes highly challenged when it comes to non-liquid products such as semi-solid, paste, or powder-form products. Such products need to be specially handled for filling operations to maintain fill sterility, considering their viscosity and granular texture differences.

For instance, with products like yogurt or thick sauces, the mechanism used for dispensing the product should be very precise due to the need for filling consistent amounts; however, powders would need systems that prevent contaminants from becoming airborne.

Advanced sterilizing both for product and packaging should be part of the complex design itself, so that exposure can be minimized during fill time. Such machines require adjustment from time to time and strict monitoring, thus enhancing the level of operation complexity and cost to the manufacturers.

This becomes more challenging for the food and pharmaceutical industry, where the importance of the product with regards to sterility also determines how safe it is for use with respect to regulations. Hence, manufacturers must invest in innovations so as to offset the hurdles brought about by these two factors.

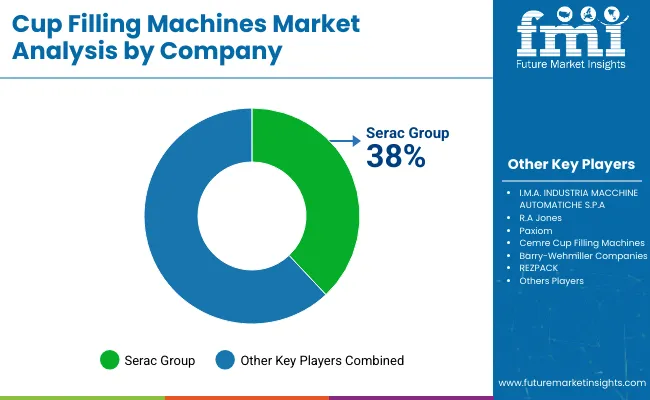

Tier 1 company leaders are characterized by high production capacity and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality.

Prominent companies within Tier 1 include I.M.A. Industria Macchine Automatiche S.P.A, R.A. Jones, Serac Group, Barry-Wehmiller Companies, Gea Process Engineering A/S, Syntegon Group, Trepko Group, And Hermann Waldner Gmbh & Co. Kg.

Tier 2 companies are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach.

Prominent companies in Tier 2 include Paxiom, Cemre Cup Filling Machines, Rezpack, Ams Filling, Nhm Machinery, Shikoku Kakoki Co., Ltd, Spee-Dee Packaging Machinery, Inc, Associated Pack Tech Engineers, Rovema North America, Inc., Controlgmc, Alter Pack Canada, And Cda Usa.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment.

They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

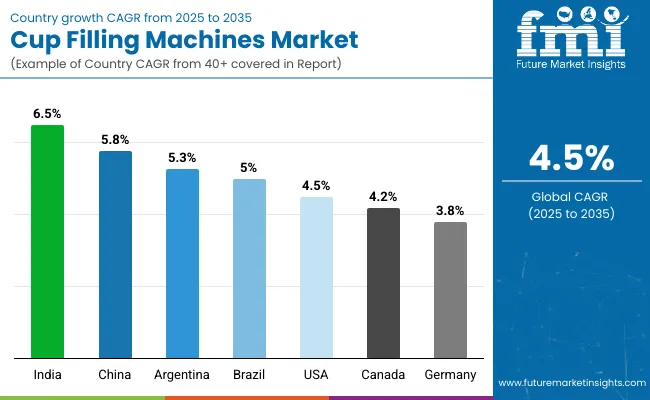

The section below covers the industry analysis for the cup filling machines market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided.

USA is anticipated to remain at the forefront in North America, with a CAGR of 4.5% through 2035. In South Asia & Pacific, India is projected to witness a CAGR of 6.5% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 4.5% |

| Canada | 4.2% |

| Brazil | 5.0% |

| Argentina | 5.3% |

| Germany | 3.8% |

| China | 5.8% |

| India | 6.5% |

The growth in private label items in the United States is the most significant driving force for the cup filling machine market. Retailers are launching a lot of their branded food, beverages, and dairy products to be able to address the cost-sensitive consumer who still wants quality in the national brand. This is creating demand for flexible and inexpensive packaging solutions for the production of a wide array of private-label items.

Private label manufacturers are increasingly dependent on cup filling machines that have flexibility in their ability to deal with multiple types of products, sizes, and packaging materials. These allow retailers to promptly respond to any shift in consumer demand and expand the product lines quickly without much operation disruption.

In addition, there is the necessity of attractive, high-quality packaging to be on par with branded products. Thus, there has been a demand for advanced filling technologies that are precision-based and have an appealing appearance for private labels, driving further market growth.

Germany is one of the biggest markets for food and beverage exports, and thus is a key driver for the cup filling machine market. Germany has been a world leader in food and beverage exports, and the manufacturers here are now increasingly focusing on the international market with a focus on compliance with international packaging standards.

The result is that the demand for versatile, efficient cup filling machines to handle the diversity of products and packaging formats needed by various international markets is growing.

German cup filling machines are engineered to satisfy every product specification, and in order for the company to survive in the market, it ensures consistency and quality in and outside Germany.

In addition, international regulations on packaging and food safety labeling standards are becoming stricter; hence manufacturers need more accurate filling technologies to meet local and global requirements.

This pushes innovative filling technology development, as well as an insistence on manufacturers further increasing the flexibility and scalability of their production, in order to keep pace with the increased international demand for food and beverage goods from Germany.

Key players operating in the cup filling machines market are investing in the development of innovative sustainable solutions and also entering into partnerships. Key cup filling machines providers have also been acquiring smaller players to grow their presence to further penetrate the cup filling machines market across multiple regions.

In terms of machine type, the industry is divided into linear, rotary.

In terms of technology, the industry is segregated into form fill and sealing, fill seal.

By capacity, the market is divided into above 6000/hr, 3001 to 6000/hr, 1001 to 3000/hr, below 1000/hr.

The market is classified by aseptic applications such as pharmaceutical, beverages, food.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa have been covered in the report.

The global cup filling machines market is anticipated to reach USD 2.59 billion by 2035, up from USD 1.66 billion in 2025, growing at a CAGR of 4.5% over the forecast period.

Rotary machines are projected to lead with a 63.2% market share in 2025, due to their high-speed, continuous operation and integration with automated packaging lines in dairy and beverage applications.

The beverages segment is expected to grow at the fastest pace, registering a CAGR of 5.6% from 2025 to 2035, driven by demand for shelf-stable, preservative-free drink products requiring aseptic processing.

Form fill and sealing technology is forecasted to record the highest CAGR of 5.8%, owing to its cost-efficiency, automation benefits, and growing use in single-serve food and dairy packaging formats.

Machines with above 6000/hr capacity are anticipated to grow at a CAGR of 5.0%, fueled by high-volume needs in the dairy, ready-to-eat, and beverage sectors aiming for speed and hygiene in filling operations.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cupcake Liner Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Containers Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Cup Holder Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cup Fill and Seal Machine Market by Automation Level from 2025 to 2035

Cup Carriers Market Size, Share & Trends 2025 to 2035

Cup Sleeves Market Growth - Demand, Trends & Forecast 2025 to 2035

Industry Share Analysis for Cup Fill and Seal Machine Companies

Market Share Breakdown of Cup Carrier Packaging Suppliers

Competitive Landscape of Cupcake Wrappers Manufacturers

Industry Share Analysis for Cupric Chloride Companies

Cupuacu Butter Market – Growth, Beauty Benefits & Market Demand

Cupcake Box Market Analysis – Growth & Forecast 2024-2034

Cup Filler Market

Cupcake Tray Machines Market

Occupancy Sensor Market Size and Share Forecast Outlook 2025 to 2035

PET Cup Market Trends & Industry Growth Forecast 2024-2034

PLA Cup Market Growth & Sustainability Trends 2024-2034

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Deli Cup Market Analysis – Trends & Growth 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA