The cup fill and seal machine market is expanding rapidly as industries demand efficient, automated packaging solutions. Food, beverage, dairy, and pharmaceutical sectors rely on these machines for precise, high-speed filling and sealing operations. Manufacturers focus on technological advancements, sustainable materials, and automation to maintain a competitive edge. The growing demand for convenience packaging and extended shelf life fuels market growth.

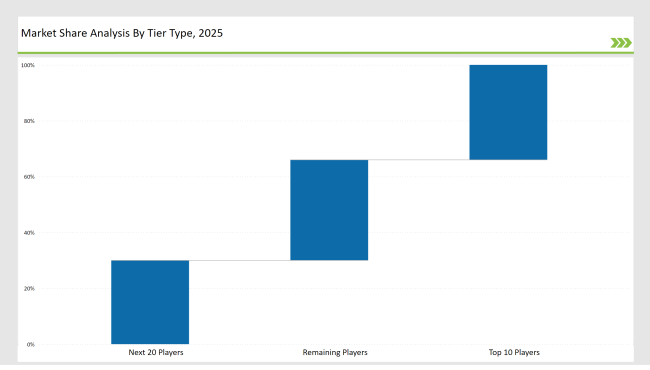

Leading companies such as IMA Group, Serac, and Waldner dominate 34% of the market through extensive R&D, strong distribution networks, and cutting-edge machine innovations. Tier-2 manufacturers, including ProMach, Ronchi Mario, and GEA Group, account for 30% of the market by offering cost-effective and customizable solutions. Regional and niche players capture the remaining 36%, providing specialized solutions tailored to local industry requirements.

Global Market Share by Key Players (2025)

| Category | Market Share (%) |

|---|---|

| Top 3 (IMA Group, Serac, Waldner) | 18% |

| Rest of Top 5 (ProMach, Ronchi Mario) | 10% |

| Next 5 of Top 10 (GEA Group, Trepko, Sealpac) | 6% |

The cup fill and seal machine market caters to various industries requiring precision, efficiency, and hygiene in packaging solutions.

Manufacturers focus on high-efficiency, hygienic, and automated solutions to meet industry demands. They develop user-friendly designs and integrate AI-driven processes for enhanced precision.

Industry leaders continue investing in automation, sustainability, and smart packaging solutions. AI integration in machine operations, sustainable materials, and digital monitoring systems drive efficiency and reduce production costs. Companies also focus on predictive maintenance, reducing downtime and improving machine reliability. Enhanced software-driven quality control further ensures consistent packaging standards.

Year-on-Year Leaders

Technology suppliers should prioritize efficiency, sustainability, and automation to stay ahead in the market. They must also invest in AI-driven predictive maintenance, real-time monitoring, and eco-friendly materials to enhance performance. Additionally, fostering strategic partnerships with packaging firms will accelerate innovation and market reach.

| Tier Type | Example of Key Players |

|---|---|

| Tier 1 | IMA Group, Serac, Waldner |

| Tier 2 | ProMach, Ronchi Mario, GEA Group |

| Tier 3 | Trepko, Sealpac, Modernpack |

Manufacturers invest in automation, digital monitoring, and eco-friendly solutions to enhance machine efficiency and market positioning.

| Manufacturer | Latest Developments |

|---|---|

| IMA Group | April 2024: Launched AI-powered, high-speed cup fillers. |

| Serac | June 2024: Introduced aseptic cup sealing with minimal waste. |

| Waldner | February 2024: Developed IoT-enabled, high-precision sealing machines. |

| ProMach | May 2024: Expanded biodegradable packaging machine production. |

| Ronchi Mario | August 2024: Enhanced flexibility in modular filling systems. |

The cup fill and seal machine market is evolving rapidly as manufacturers integrate automation and sustainability into their operations. Companies are adopting AI-driven systems and eco-friendly packaging solutions to enhance efficiency and reduce waste.

Manufacturers will continue integrating AI, robotics, and sustainable packaging innovations to optimize production and minimize environmental impact. The demand for smart, self-monitoring machinery will rise, further enhancing efficiency and cost-effectiveness in packaging industries. Companies will increasingly adopt predictive maintenance systems to reduce downtime and improve operational reliability. Advanced sensors and data analytics will drive real-time quality control, ensuring consistent output. Automation will streamline packaging processes, reducing waste and improving resource utilization. Additionally, modular machine designs will gain traction, allowing greater flexibility for diverse production needs.

Leading players include IMA Group, Serac, Waldner, ProMach, and Ronchi Mario.

The top 3 players collectively control 18% of the global market.

The market is moderately concentrated, with the top players holding 34%.

Key drivers include automation, aseptic packaging, AI integration, and sustainable packaging solutions.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cupcake Box Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Liner Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Containers Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Cup Holder Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Cup Carriers Market Size, Share & Trends 2025 to 2035

Cup Sleeves Market Growth - Demand, Trends & Forecast 2025 to 2035

Cupuacu Butter Market – Growth, Beauty Benefits & Market Demand

Industry Share Analysis for Cupric Chloride Companies

Competitive Landscape of Cupcake Wrappers Manufacturers

Market Share Breakdown of Cup Carrier Packaging Suppliers

Cupcake Tray Machines Market

Cup Filler Market

Cup Filling Machines Market Forecast and Outlook 2025 to 2035

Cup Fill and Seal Machine Market by Automation Level from 2025 to 2035

Occupancy Sensor Market Size and Share Forecast Outlook 2025 to 2035

PLA Cup Market Forecast and Outlook 2025 to 2035

PET Cup Market Trends & Industry Growth Forecast 2024-2034

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Deli Cup Market Analysis – Trends & Growth 2024-2034

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA