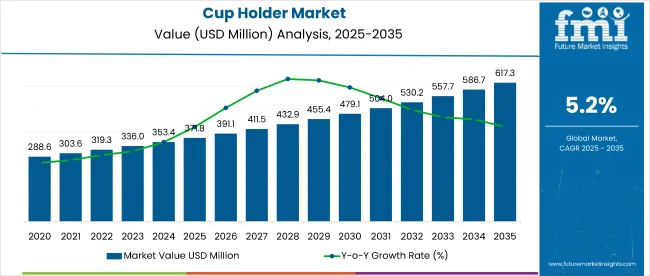

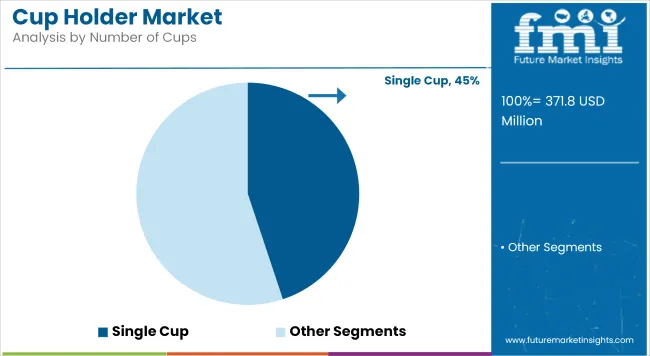

The global cup holder market is valued at USD 371.8 million in 2025 and is forecast to reach USD 617.3 million by 2035, registering a CAGR of 5.2% during the period. In 2025, the single cup segment holds 45% share, reflecting strong demand for convenience packaging solutions.

| Attribute | Detail |

|---|---|

| Market Size (2025) | USD 371.8 million |

| Market Size (2035) | USD 617.3 million |

| CAGR (2025 to 2035) | 5.2% |

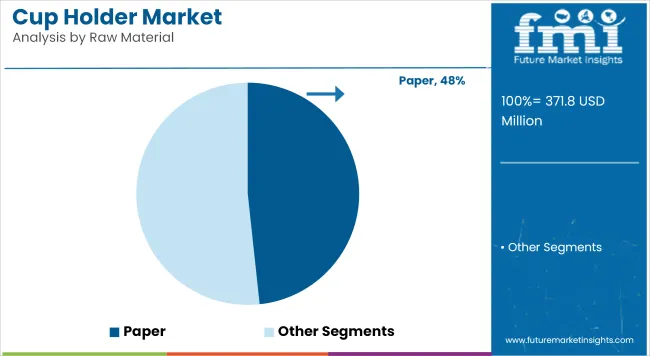

Paper-based cup holders dominate the material landscape with a 48% market share, supported by increasing environmental regulations and consumer preference for recyclable products. Regionally, the United States and European Union markets are poised to grow at 4.8% CAGR, with the UK close behind at 4.7%. Demand is primarily driven by the expanding food service industry and growing institutional use across multiple end-use sectors.

The cup holder market is propelled by rising demand for sustainable and convenient beverage packaging solutions, particularly in quick-service restaurants and institutional settings. Regulations targeting single-use plastics drive material innovation toward paper and molded pulp alternatives.

However, cost constraints and competition from reusable cup holders restrain growth in some regions. Opportunities exist in emerging markets with expanding food service infrastructure and in product innovation to enhance durability and eco-friendliness. Trends include integration of biodegradable materials and customization for brand differentiation.

The Cup Holder Market is segmented by material, carrying capacity, and end use. By material, the market includes Plastic, Paper, Wood, and Molded Pulp. In terms of carrying capacity, segments are Single Cup, 2-4 Cups, and Above 4 Cups.

The end-use classification comprises Food Service (including Quick Service Restaurants, Hotels, Restaurants, Cafes, and Others), Institutional, and Household sectors. This segmentation enables detailed analysis of market dynamics and growth opportunities across various product types and applications.

In 2025, the Paper segment leads the cup holder market by material, accounting for 48% of the total market share. Paper-based cup holders are preferred for their recyclability and alignment with tightening environmental regulations globally. Growth in this segment is driven by increasing consumer and regulatory pressure to reduce single-use plastics.

Plastic cup holders remain significant due to their durability and cost-effectiveness but face headwinds from sustainability mandates. Wood and molded pulp materials are emerging as eco-friendly alternatives, supported by innovation in biodegradable and compostable product designs. These materials are expected to register above-average CAGR through 2035, fueled by food service providers’ shift toward sustainable packaging solutions.

The Single Cup segment holds the largest share of 45% in 2025 within the carrying capacity category. This dominance is driven by the widespread use of single cup holders in quick-service restaurants and takeaway outlets, where convenience and cost-efficiency are paramount.

The 2-4 Cups segment follows, catering primarily to multi-beverage orders and family servings, while the Above 4 Cups segment represents specialized applications such as catering and large orders. Growth in multi-cup holders is supported by evolving consumer behaviorfavoring bulk purchases and group dining experiences. However, single cup holders remain the most widely adopted due to their simplicity and lower cost.

The Food Service segment dominates the cup holder market, driven primarily by quick-service restaurants, hotels, restaurants, and cafes, accounting for the largest share in 2025. Rising consumer demand for convenient and hygienic beverage packaging fuels this segment’s growth. Institutional end use, which includes schools, hospitals, and corporate offices, is expanding steadily due to increased on-premise beverage consumption and catering services.

The Household segment, while smaller, is growing as consumers adopt more at-home beverage consumption habits, supported by the rise of food delivery and takeaway culture. This diverse end-use landscape ensures sustained demand across both commercial and residential channels.

The Cup Holder Market is expected to grow steadily across major countries from 2025 to 2035. The United States and the European Union both register a CAGR of 4.8%, driven by mature food service industries and increasing regulations favoring sustainable packaging. The United Kingdom follows closely with a 4.7% CAGR, supported by growing demand in quick-service restaurants and institutional sectors.

The fourth leading country shows a CAGR of 4.6%, reflecting stable growth through rising consumer convenience trends and environmental policies. These countries collectively represent the bulk of market value and innovation, setting benchmarks for material substitution and product design in the global market.

The United States cup holder market is poised for steady expansion, growing at a CAGR of 4.8% from 2025 to 2035. This growth is underpinned by the country’s well-established food service sector, including a robust network of quick-service restaurants, cafes, and institutional buyers such as schools and hospitals.

Increasing regulatory pressure to reduce plastic waste is driving manufacturers and consumers toward sustainable alternatives, notably paper and molded pulp cup holders. Consumer preference shifts toward environmentally friendly and recyclable packaging further bolster demand.

Innovation in materials and design is expected to remain a key competitive differentiator, with companies investing in biodegradable products and customizable cup holders that meet evolving brand requirements. Despite the positive outlook, challenges persist. Competition from reusable cup holders and higher raw material costs create cost-sensitive conditions for manufacturers and end users. Supply chain disruptions could also impact availability and pricing. Nevertheless, ongoing investments in eco-friendly solutions and regulatory incentives offer significant opportunities for growth.

With a market size estimated at USD 85.6 million in 2025, expanding to USD 132.6 million by 2035, the USA cup holder market presents substantial absolute growth potential. Its mature yet evolving nature makes it a critical region for manufacturers aiming to lead sustainable packaging innovations.

The European Union (EU) cup holder market is forecast to expand at a CAGR of 4.8% between 2025 and 2035. This robust growth is fueled primarily by the region’s rigorous environmental policies and regulations aimed at reducing plastic waste and promoting circular economy principles. Countries within Western Europe are the main contributors to demand, where consumers and institutional buyers increasingly favor sustainable packaging solutions such as paper-based and biodegradable cup holders.

The EU’s commitment to phasing out single-use plastics creates both regulatory impetus and market opportunities. Manufacturers are focusing on innovation in molded pulp, wood, and other bio-based materials to capture emerging market segments. Quick-service restaurants, hotels, and institutional sectors are significant end users, driving volume growth.

Cost pressures, however, remain a notable challenge. The transition to eco-friendly materials can lead to higher production costs and supply chain complexities, potentially constraining margins. Additionally, material availability and fluctuating raw material prices add uncertainty.

Despite these challenges, the EU’s cup holder market benefits from heightened consumer awareness of sustainability and strong government support. The market size is projected to grow from USD 79.3 million in 2025 to USD 123.0 million by 2035. This steady growth aligns with broader European objectives on sustainable packaging, making the EU a vital region for innovation and expansion in the cup holder market.

The United Kingdom cup holder market is expected to grow at a CAGR of 4.7% over the forecast period 2025 to 2035. The market recovery following the pandemic and increased demand for sustainable disposable packaging solutions are key drivers. Quick-service restaurants remain the primary consumers, actively adopting paper and molded pulp cup holders to meet both regulatory requirements and growing consumer preference for environmentally friendly packaging.

Institutional sectors such as education, healthcare, and corporate facilities contribute to steady demand growth. Government policies targeting single-use plastics further encourage manufacturers to innovate and expand their biodegradable product offerings. Despite the positive momentum, rising raw material costs, particularly for eco-friendly materials, exert cost pressures on manufacturers and suppliers.

The UK market is moderately competitive, with players focusing on product differentiation through biodegradability and customization to cater to brand-specific requirements. The food service industry's dynamic nature and evolving consumer expectations create multiple growth avenues. Market size is estimated at USD 18.4 million in 2025 and projected to reach USD 28.9 million by 2035, reflecting consistent growth supported by sustainability initiatives and recovering demand in hospitality sectors.

Overall, the UK cup holder market offers promising opportunities for companies investing in sustainable packaging innovation and efficient supply chain management.

The cup holder market is moderately consolidated with several key players holding significant market shares across regions and segments. Leading companies such as MULTIPAP, Huhtamaki Oyj, Georgia-Pacific Consumer Products, and WestRock Company dominate through broad product portfolios, geographic reach, and strong distribution networks. These firms invest heavily in research and development to innovate sustainable materials, including paper, molded pulp, and wood alternatives, responding to regulatory pressures and shifting consumer preferences toward eco-friendly packaging.

Competition centers on material innovation, cost efficiency, and customization capabilities, particularly for quick-service restaurants and institutional buyers. Companies like Sabert Corporation and Pactiv LLC have strengthened their market positions by expanding biodegradable and compostable product lines, enhancing their appeal in markets with stringent environmental regulations. Mid-tier players such as Green Paper Products, LLC and PakTech focus on niche segments, emphasizing quality and regional expertise.

Supply chain resilience and the ability to adapt to fluctuating raw material costs represent critical competitive factors. The rise of reusable cup holders introduces indirect competition, prompting players to differentiate through sustainability credentials and product design. Startups leveraging novel bio-based materials and digital printing for customization present emerging competitive threats. Overall, winners will be those who balance innovation with operational efficiency and anticipate evolving regulatory landscapes.

| Metric | Value |

|---|---|

| Market Size (2025) | USD 371.8 million |

| Market Size (2035) | USD 617.3 million |

| CAGR (2025 to 2035) | 5.2% |

| Base Year | 2025 |

| Historical Period | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Units | USD Million |

| Segmentation | By Material (Plastic, Paper, Wood, Molded Pulp); By Carrying Capacity (Single Cup, 2-4 Cups, Above 4 Cups); By End Use (Food Service, Institutional, Household) |

| Geographic Coverage | North America (USA, Canada, Mexico), Latin America, Western Europe, Eastern Europe, East Asia (China, Japan, South Korea), South Asia & Pacific (India, Australia, ASEAN), Middle East & Africa |

| Key Companies Covered | MULTIPAP, Green Paper Products, LLC, Huhtamaki Oyj, Georgia-Pacific Consumer Products LP, Sabert Corporation, Pactiv LLC, Southern Champion Tray, LP, Graphic Packaging International, LLC, PakTech, WestRock Company |

| Research Methodology | Secondary research, expert interviews, market modeling and forecasting |

The cup holder market is projected to grow at a CAGR of 5.2% between 2025 and 2035.

Paper-based cup holders lead the market with a 48% share in 2025.

Demand is mainly driven by the food service sector, including quick-service restaurants, hotels, cafes, and institutional users.

North America, especially the United States, and the European Union are among the largest markets, with steady growth in Asia-Pacific and other regions.

Key players include MULTIPAP, Huhtamaki Oyj, Georgia-Pacific Consumer Products LP, WestRock Company, and Sabert Corporation.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Automotive Cups and Glass Holder Market

Cupcake Liner Market Size and Share Forecast Outlook 2025 to 2035

Cup Filling Machines Market from 2025 to 2035

Cupcake Containers Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Cup Fill and Seal Machine Market by Automation Level from 2025 to 2035

Cup Carriers Market Size, Share & Trends 2025 to 2035

Cup Sleeves Market Growth - Demand, Trends & Forecast 2025 to 2035

Industry Share Analysis for Cup Fill and Seal Machine Companies

Market Share Breakdown of Cup Carrier Packaging Suppliers

Competitive Landscape of Cupcake Wrappers Manufacturers

Industry Share Analysis for Cupric Chloride Companies

Cupuacu Butter Market – Growth, Beauty Benefits & Market Demand

Cupcake Box Market Analysis – Growth & Forecast 2024-2034

Cupcake Tray Machines Market

Cup Filler Market

Occupancy Sensor Market Size and Share Forecast Outlook 2025 to 2035

PET Cup Market Trends & Industry Growth Forecast 2024-2034

PLA Cup Market Growth & Sustainability Trends 2024-2034

Foam Cups Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA