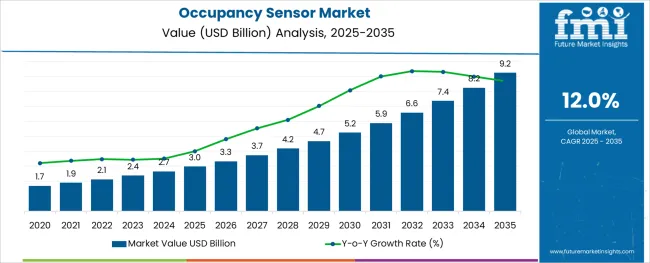

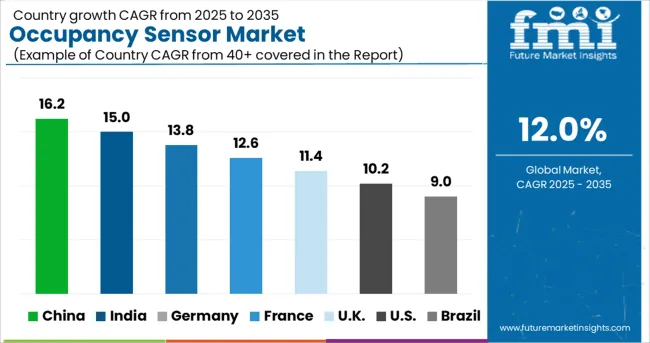

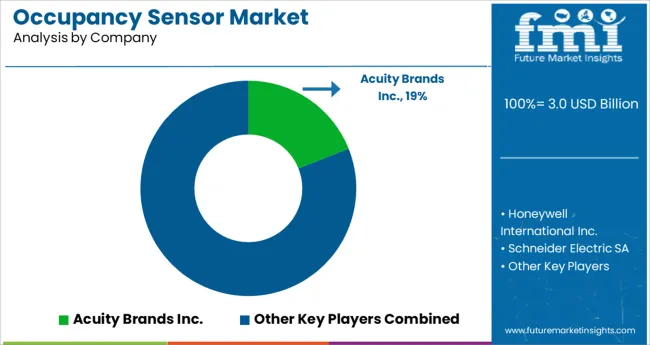

The Occupancy Sensor Market is estimated to be valued at USD 3.0 billion in 2025 and is projected to reach USD 9.2 billion by 2035, registering a compound annual growth rate (CAGR) of 12.0% over the forecast period.

The occupancy sensor market is experiencing strong momentum, fueled by regulatory mandates for energy conservation, rising adoption of smart building systems, and the integration of IoT-enabled infrastructure. These sensors play a pivotal role in automating lighting, HVAC, and security systems by detecting motion or presence, thereby reducing energy waste and improving building operational efficiency.

he shift toward contactless technologies and touch-free environments has further accelerated adoption across both new construction and retrofit projects. Technological advancements in sensor sensitivity, wireless connectivity, and AI-based motion recognition have expanded use cases across commercial, residential, and institutional buildings. Future growth is expected to be supported by ongoing urbanization, green building certifications, and the implementation of intelligent occupancy-based automation in smart city frameworks.

The convergence of building management systems (BMS) with cloud-based analytics is paving the way for real-time optimization and predictive control, making occupancy sensors a cornerstone of next-generation energy infrastructure.

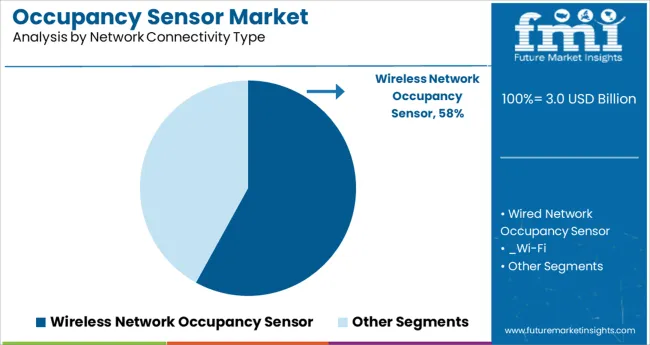

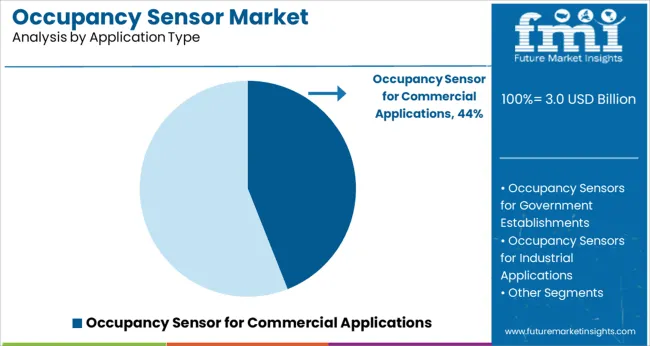

The market is segmented by Network Connectivity Type and Application Type and region. By Network Connectivity Type, the market is divided into Wireless Network Occupancy Sensor and Wired Network Occupancy Sensor. In terms of Application Type, the market is classified into Occupancy Sensor for Commercial Applications, Occupancy Sensors for Government Establishments, Occupancy Sensors for Industrial Applications, and Occupancy Sensor for Residential Sectors. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Wireless network occupancy sensors are expected to account for 58.0% of the total market revenue in 2025, establishing them as the leading connectivity type. This dominance is being driven by the ease of installation, scalability, and cost efficiency offered by wireless systems, particularly in retrofit environments where wired configurations are impractical or expensive. Wireless sensors support seamless integration with building management platforms and enable remote configuration, firmware updates, and data analytics without physical intervention.

The proliferation of standardized wireless protocols such as Zigbee, Z-Wave, Bluetooth Low Energy (BLE), and LoRaWAN has enhanced interoperability across multi-vendor ecosystems, fostering broader deployment across smart offices, campuses, and industrial facilities.

As smart building projects continue to prioritize flexibility and minimal infrastructure disruption, wireless sensors are increasingly favored for their adaptability, energy efficiency, and real-time responsiveness in dynamic occupancy scenarios.

Occupancy sensors used in commercial applications are projected to capture 44.0% of the total market revenue in 2025, making this the leading application segment. Growth in this segment is being driven by large-scale adoption in office buildings, retail stores, educational institutions, and healthcare facilities seeking to lower operational costs through automated lighting and HVAC control.

Sensors used in commercial environments are often integrated with centralized BMS platforms, offering advanced scheduling, usage analytics, and compliance reporting. The high foot traffic and varied occupancy patterns in commercial buildings make them ideal candidates for motion detection and ambient sensing technologies that improve energy performance without manual intervention.

Increased emphasis on sustainability certifications such as LEED and WELL Building Standard is encouraging developers and facility managers to deploy occupancy sensors as a means to meet energy efficiency benchmarks. The ability to reduce energy usage while improving occupant comfort and security has firmly positioned this segment at the forefront of adoption trends.

The growing popularity of energy-efficient sensors is one of the major factors that contribute to the global occupancy sensor market's growth. With government policies pertaining to energy savings and the continuous advancement of advanced and cost-effective occupancy sensors, the global occupancy sensor market is expected to expand over the forecast period.

Global occupancy market growth has been boosted by advanced occupancy sensors like intelligent occupancy sensors, image processing occupancy sensors, and microphonics. Increasingly, lighting controllers are becoming increasingly popular in smart homes, as well as the growing popularity of wireless occupancy sensors, which is positively affecting the growth of the occupancy sensor market. Additionally, under the current technological landscape, key players in the occupancy sensor market are expected to experience high growth opportunities in the coming years.

Furthermore, the development of smart cities has also been shown to be a major factor that encourages growth in the economy. As part of intelligent parking solutions, these sensors are used to monitor parking spaces and control congestion. Occupancy sensors must be implemented both indoors and outdoors to minimize energy consumption and light pollution created in the environment. As a result, all of these factors contribute to the market growth of occupancy sensors.

The inconsistency of wireless network systems and false triggering of switches is anticipated to hamper market growth during the forecast period. Occupancy sensors that trigger incorrectly have been a major roadblock to the growth of the studied market for the last decade.

Sensors will falsely trigger when there is movement in the space. Due to their sensitivity to a wide range of motion, they also react to movements that are not related to occupants. False triggers may occur as a result of sunlight shining on the sensor, persons passing close to it, or machinery heating objects that are positioned nearby. Likewise, sensors don't work well in partitioned offices. Lighting systems and other components that are connected to them have a much shorter life expectancy if sensors are continuously on and off.

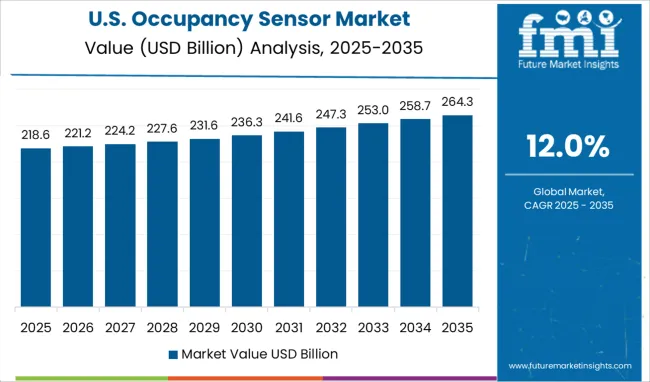

North America is expected to be the largest market for occupancy sensors in the market. These regions have a higher market for occupancy sensors for commercial and residential buildings than any other region in the world. As of 2025, occupancy sensors are expected to account for 38% of the market in these regions.

The region's occupancy sensor value chain is highly organized and regulated. As a result, customer orders and installation are streamlined. Due to advancements in products and alliances between manufacturers, the North American occupancy sensor is expected to maintain its lead in the market.

Due to its cost-effective matrix, technology plays a critical role in this sector. As a result of developments in several sectors and the growth of wireless network infrastructure, the United States is leading the market. As a result, it is predicted that the USA market will be heavily influenced by the growing demand for HVAC systems in this region.

Europe has witnessed a higher 7% CAGR in occupancy sensors in the market. Europe has benefited significantly from increased construction activity, contributing to the growth of occupancy sensor sales in the market. Home automation and smart lighting are expected to gain traction in Europe, driven by strong activity in the smart home space in the United Kingdom.

The occupancy sensors are expected to hold a 24.5% market share in 2025. Since wireless networks are less expensive to install and have better connectivity than wired networks, their demand is expected to grow over the forecast period. Sensors that detect occupancy are lightweight and can be attached to walls with hooks, magnetic tape, or screws. Wireless occupancy sensors will also be in high demand due to their ease of integration with other wireless controls, devices, and networks in this region.

Sensors that are connected to Wi-Fi are placed around an indoor space to do Wi-Fi positioning. Increasing demand for 5G networks has boosted the market growth for wi-fi in various regions and occupancy sensors globally. The use of desk occupancy sensors is growing in popularity because they are placed under desks to detect when the desks are occupied or empty.

The temperature and humidity values of the place where this sensor is installed can also be measured by the sensor's built-in sensor. Recent studies have suggested that the amount of energy consumed for reheating can be reduced by 38% by adjusting HVAC systems according to the number of individuals inside a room. Furthermore, accurate estimation of occupants of rooms improves the building's security and safety. Occupancy sensors are expected to become more prevalent in the market as more and more rooms are equipped with wireless networks.

Based on application type, the market is segmented into government, industrial, commercial, and residential sectors. The residential building market is expected to grow at a CAGR of 9.6% over the forecast period. The latest technology plays a key role in helping homeowners manage their energy consumption, reduce costs, and maintain a green environment in their houses. People are increasingly implementing occupancy sensors at their residences due to home automation trends and a desire to reduce electricity bills.

In recent years, owing to the increasing demand for surveillance and security systems in residential buildings, there has been strong growth in the occupancy sensor market. As disposable income increases, home automation technology is used more often in residences. Not only does the technology automate the house's devices, but it also makes it more secure. In addition, residents are becoming more aware of smart homes and automation, which is expected to drive the need for occupancy sensors in residential buildings. Furthermore, residential buildings need solutions that can reduce their power consumption to decrease the per capita electricity consumption.

With the rise in popularity of smart cities and smart construction, start-ups are introducing occupancy sensors to the market. Additionally, to offering wireless occupancy sensors, these technology start-up companies also engage in a wide range of production and distribution activities. Since the use of wireless occupancy sensors in residential buildings has evolved dramatically, the majority of wireless occupancy sensors are deployed across a variety of technologies.

Major players in the market are developing a wide range of advanced and innovative sensors to gain a long-term competitive advantage, such as image processing sensors, microphonic sensors, and intelligent occupancy sensors.

Key players in the global occupancy sensor market include Eaton Corporation Plc., Honeywell International Inc., Schneider Electric SA, Johnson Controls Inc., Acuity Brands Inc., Texas Instruments Inc., Leviton Manufacturing Co., Inc., Lutron Electronics Co., Inc., Legrand SA, and Hubbell Incorporated, Known Quantity Sensors, Antalis, Enlighted, Novelda, Volvo and among others.

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 12% from 2025 to 2035 |

| Market Value in 2025 | USD 3.0 billion |

| Market Value in 2035 | USD 9.2 billion |

| Base Year for Estimation | 2024 |

| Historical Data | 2020 to 2024 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Network Connectivity, Application, Region |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East and Africa |

| Key Countries Profiled | The USA, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, China, Japan, South Korea, India, Malaysia, Singapore, Thailand, Australia, New Zealand, GCC, South Africa, Israel |

| Key Companies Profiled | Eaton Corporation Plc.; Honeywell International Inc.; Schneider Electric SA; Johnson Controls Inc.; Acuity Brands Inc.; Texas Instruments Inc.; Leviton Manufacturing Co., Inc.; Lutron Electronics Co., Inc.; Legrand SA; Hubbell Incorporated |

| Customization | Available Upon Request |

The global occupancy sensor market is estimated to be valued at USD 3.0 billion in 2025.

It is projected to reach USD 9.2 billion by 2035.

The market is expected to grow at a 12.0% CAGR between 2025 and 2035.

The key product types are wireless network occupancy sensor, wired network occupancy sensor, _wi-fi, _zigbee, _z-wave and _others.

occupancy sensor for commercial applications segment is expected to dominate with a 44.0% industry share in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensor Patches Market Analysis - Growth, Applications & Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Sensor Cable Market

Sensormatic Labels Market

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

CP Sensor for Consumer Applications Market – Growth & Forecast 2025 to 2035

Nanosensors Market Size and Share Forecast Outlook 2025 to 2035

NOx Sensor Market Size and Share Forecast Outlook 2025 to 2035

VOC Sensors and Monitors Market Analysis - Size, Growth, and Forecast 2025 to 2035

Rain Sensors Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA