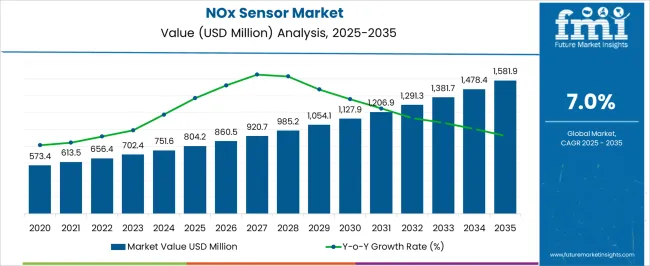

The NOx sensor market is estimated to be valued at USD 804.2 million in 2025 and is projected to reach USD 1581.9 million by 2035, registering a compound annual growth rate (CAGR) of 7.0% over the forecast period. The market’s cost structure is primarily influenced by raw material acquisition, sensor design and manufacturing, calibration, testing, and integration into automotive and industrial systems. Semiconductor materials and electrochemical components form a substantial portion of direct production costs, while high-precision assembly and testing contribute significantly to operational expenditures.

In the value chain, the upstream segment includes suppliers of semiconductors, ceramics, and precious metals, whose pricing volatility directly affects sensor manufacturing costs. Midstream activities encompass sensor fabrication, calibration, and module integration, where efficiency in production lines and automation can lower per-unit costs and improve margins. Downstream, OEMs and aftermarket distributors engage in procurement, installation, and after-sales support, with logistics and warranty services influencing overall cost absorption and pricing strategies.

Over the forecast period, cost reduction initiatives such as advanced fabrication techniques, modular designs, and economies of scale are expected to enhance profitability across the chain. Strategic collaborations between component suppliers, sensor manufacturers, and automotive OEMs are projected to optimize the value chain, enabling wider deployment of NOx sensors while maintaining competitive pricing, thereby supporting sustained market growth.

| Metric | Value |

|---|---|

| NOx Sensor Market Estimated Value in (2025 E) | USD 804.2 million |

| NOx Sensor Market Forecast Value in (2035 F) | USD 1581.9 million |

| Forecast CAGR (2025 to 2035) | 7.0% |

The NOx sensor market is experiencing substantial growth, propelled by increasingly stringent emissions norms, especially in the transportation and power generation sectors. Regulatory frameworks such as Euro 6, China VI, and EPA standards are compelling manufacturers to adopt sensor-based exhaust monitoring systems that enable real-time measurement and control of nitrogen oxide emissions. As internal combustion engines continue to be used in both on-road and off-road vehicles, the demand for high-accuracy sensing technologies has risen to ensure compliance with legal limits.

Developments in sensor materials, durability under harsh conditions, and miniaturized electronics are playing a crucial role in enabling long-term stability and accuracy of NOx detection systems. The integration of NOx sensors into diesel after-treatment systems and selective catalytic reduction units is becoming increasingly common.

Additionally, industrial boilers and stationary engines are also seeing increased deployment of NOx sensors to meet local emission codes In the coming years, the market is expected to benefit from increasing hybrid vehicle adoption and the ongoing electrification of commercial fleets, which still rely on NOx monitoring during transitional phases.

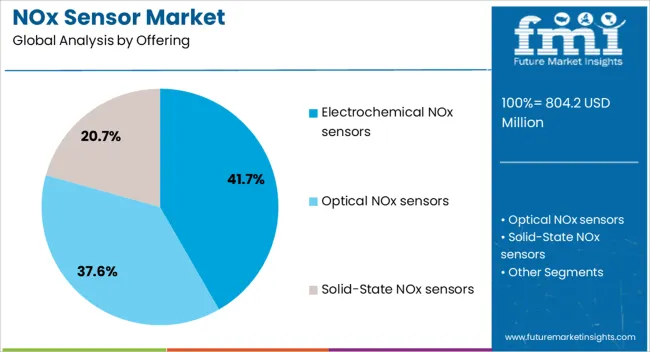

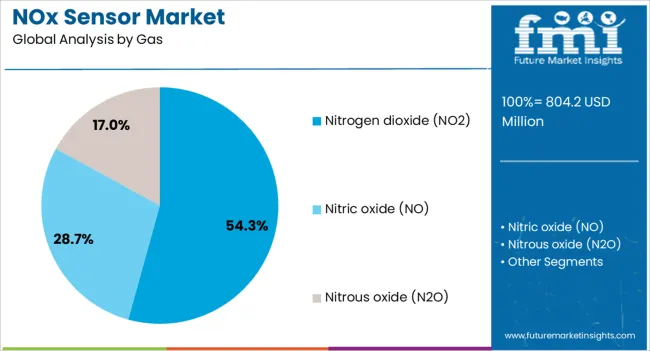

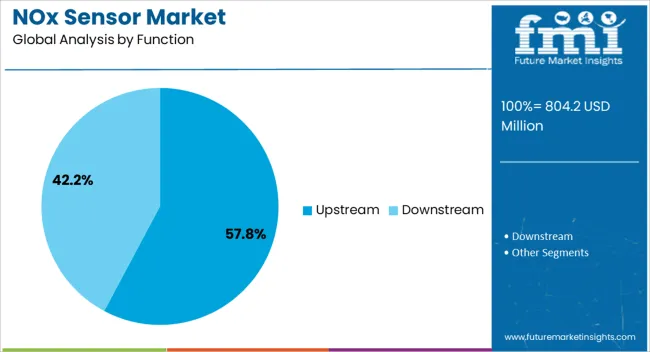

The NOx sensor market is segmented by offering, gas, function, fuel, application distribution channel, and geographic regions. By offering of the NOx sensor market is divided into Electrochemical NOx sensors, Optical NOx sensors, and Solid-State NOx sensors. In terms of gas of the NOx sensor market is classified into Nitrogen dioxide (NO2), Nitric oxide (NO), and Nitrous oxide (N2O). Based on function of the NOx sensor market is segmented into Upstream and Downstream. By fuel of the NOx sensor market is segmented into Diesel and Petrol. By application of the NOx sensor market is segmented into Passenger vehicle and Commercial vehicle. By distribution channel of the NOx sensor market is segmented into OEM and Aftermarket. Regionally, the NOx sensor industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Electrochemical NOx sensors are expected to capture 41.7% of the NOx sensor market’s revenue share in 2025, making them the leading offering type. The widespread use of these sensors is being supported by their high sensitivity, low power requirements, and ability to detect low parts-per-million concentrations in automotive and industrial exhaust streams.

Their robust performance across wide temperature ranges and harsh operating conditions has made them particularly suitable for deployment in diesel engines and heavy-duty vehicles. The segment’s leadership is also influenced by the cost-effectiveness of electrochemical sensing platforms, which allow for broader scalability across emission-critical applications.

Advancements in cell design and electrode materials have enhanced the longevity and accuracy of these sensors, reinforcing their suitability for long-term monitoring in mobile and stationary systems The growing preference for compact and energy-efficient devices within after-treatment systems has further elevated the role of electrochemical NOx sensors as a core technology in emission compliance solutions.

Nitrogen dioxide is projected to hold 54.3% of the total revenue share in the NOx sensor market by 2025, emerging as the most monitored gas within this segment. This dominance is being driven by the critical health and environmental risks posed by NO2, particularly in densely populated urban regions and industrial zones. The high reactivity and persistence of nitrogen dioxide in the atmosphere necessitate accurate real-time monitoring to support regulatory compliance and public safety.

NOx sensors specifically designed for NO2 detection have gained prominence due to their ability to provide granular insights into combustion efficiency, pollutant dispersion, and catalytic converter performance. Continuous advancements in selective detection techniques have improved sensitivity to NO2 under varying humidity and thermal conditions.

The adoption of real-time NO2 monitoring has expanded across sectors such as power plants, marine vessels, and fleet vehicles, where precise emissions profiling is required Regulatory pressure and growing environmental awareness are expected to further reinforce the demand for NO2-focused NOx sensors across both legacy and next-generation platforms.

The upstream function segment is forecast to account for 57.8% of the total revenue share in the NOx sensor market in 2025, reflecting its essential role in pre-treatment emissions control. Sensors positioned upstream are responsible for providing critical input to engine control units by measuring raw exhaust emissions immediately after combustion. This real-time data is used to adjust fuel injection timing, air-fuel ratio, and EGR flow, helping to optimize combustion efficiency and reduce NOx formation at the source.

The segment’s dominance is supported by the increasing deployment of closed-loop control strategies in diesel and gasoline engines, which rely heavily on accurate upstream sensing. Technological advancements have enabled upstream sensors to function reliably under high-temperature and high-pressure environments, ensuring consistent performance even during engine transients.

As OEMs focus on achieving ultra-low NOx targets, upstream NOx sensing has become a vital enabler for maintaining regulatory compliance without compromising engine output. Continued evolution in thermal management and signal processing is expected to sustain growth in this function segment.

The market has been shaped by the stringent implementation of vehicle emission regulations across major economies. These sensors have been adopted widely in diesel and gasoline vehicles to monitor and reduce nitrogen oxide emissions, ensuring compliance with regulatory standards. Rising environmental concerns have accelerated the transition toward advanced exhaust aftertreatment systems, where NOx sensors serve as a key component. Market growth has also been influenced by advancements in sensor design, durability, and integration within on-board diagnostics systems in modern vehicles.

Emission reduction policies implemented in Europe, North America, and Asia have been the primary drivers for NOx sensor adoption. Governments have enforced standards such as Euro 6 in Europe and EPA Tier regulations in the United States, which mandate tighter control of nitrogen oxide levels from combustion engines. Compliance has required automakers to install reliable NOx sensing technologies in both light-duty and heavy-duty vehicles. These mandates have not only shaped design requirements but also reinforced the need for continuous sensor calibration and improved detection accuracy. Consequently, regulatory frameworks have served as a central pillar for the expansion of the NOx sensor market.

NOx sensors have been widely installed in diesel vehicles where nitrogen oxide emissions have historically been higher. The growing emission restrictions on gasoline-powered vehicles have also expanded their use in spark-ignition engines. The broader integration of sensors across multiple vehicle types has been enabled by technological advancements in exhaust aftertreatment systems such as selective catalytic reduction. Automakers have increasingly relied on NOx sensors to optimize engine control units and ensure real-time monitoring of emission levels. This cross-fuel adoption trend has supported steady market growth while reinforcing the critical role of these sensors in compliance-driven vehicle designs.

Technological innovations have significantly enhanced the efficiency, responsiveness, and longevity of NOx sensors. Modern designs have been engineered to deliver faster measurement times, higher thermal endurance, and improved resistance against exhaust contaminants. Manufacturers have focused on miniaturization, material improvements, and integration with advanced software algorithms to deliver real-time feedback for emission control systems. These developments have reduced sensor failure rates, lowering long-term maintenance costs for fleet operators. The ongoing pursuit of robust and accurate sensors has also been fueled by the need to meet upcoming emission standards, ensuring that NOx sensors remain indispensable in evolving vehicle architectures.

Commercial vehicles and off-highway equipment have increasingly adopted NOx sensors to comply with emission limits that extend beyond passenger cars. Heavy trucks, construction machinery, and agricultural vehicles have been required to integrate advanced sensors for regulatory compliance. The importance of NOx detection in these segments has grown due to the high fuel consumption and emission levels of larger engines. Fleet operators have prioritized reliable NOx sensors to minimize penalties and extend operational life while meeting stringent standards. This widespread adoption across transportation and industrial sectors has broadened the market scope, making NOx sensors essential across multiple applications.

| Country | CAGR |

|---|---|

| China | 9.5% |

| India | 8.8% |

| Germany | 8.1% |

| France | 7.4% |

| UK | 6.7% |

| USA | 6.0% |

| Brazil | 5.3% |

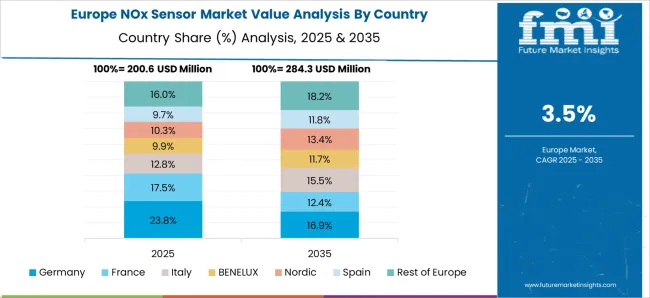

The market is projected to grow at a CAGR of 7.0% from 2025 to 2035, propelled by tighter on-road and off-road emissions standards, wider adoption of aftertreatment systems (SCR), and the need for real-time exhaust monitoring. China leads with a 9.5% CAGR, driven by China 6b implementation and strong commercial-vehicle production. India follows at 8.8%, as BS-VI Phase 2 norms and expanding heavy-duty fleets accelerate sensor deployment. Germany grows at 8.1%, supported by Euro 7 preparation and deep Tier-1/Tier-2 supplier ecosystems. The UK, at 6.7%, advances through compliance upgrades and retrofits across light- and heavy-duty segments. The USA, at 6.0%, sees steady demand under EPA/CARB rules and continued modernization of diesel and hybrid platforms across trucking, construction, and agriculture. This report includes insights on 40+ countries; the top markets are shown here for reference.

The market in China is anticipated to grow at a CAGR of 9.5%, supported by stricter environmental regulations and rising automotive production. The Chinese government has introduced rigorous emission standards for both passenger and commercial vehicles, which has accelerated the adoption of advanced exhaust monitoring technologies. With the world’s largest automotive manufacturing base, integration of NOx sensors has become increasingly mandatory to meet compliance. Domestic and global sensor manufacturers are also investing in localized production to improve supply efficiency. Additionally, the increasing number of electric and hybrid vehicles with efficient emission control systems continues to influence market expansion positively.

India is forecast to register a CAGR of 8.8%, largely driven by the adoption of Bharat Stage VI emission norms. The introduction of these standards has created a strong requirement for efficient NOx monitoring systems in passenger cars, commercial vehicles, and two-wheelers. Automotive OEMs are increasingly incorporating sensors to comply with regulatory frameworks and avoid penalties. Growing awareness about air quality and rising government pressure on emission reduction are further supporting adoption. With the gradual increase in production of cleaner vehicles, India represents a promising landscape for NOx sensor expansion in the coming years.

Germany’s market is projected to expand at a CAGR of 8.1%, encouraged by its strong focus on emission reduction and automotive innovation. As a hub for premium and commercial vehicle manufacturing, the integration of advanced NOx detection systems has become standard to comply with European Union emission directives. Leading German automakers are investing in advanced sensor technologies with improved response time and durability. The adoption of hybrid and efficient combustion technologies has also increased reliance on emission sensors. Strong R&D efforts and regulatory oversight ensure steady market development in Germany.

The United Kingdom estimated to grow at a CAGR of 6.7%, influenced by emission compliance obligations and increased urban air quality concerns. The government’s policies toward reducing harmful emissions from vehicles have encouraged manufacturers to integrate advanced NOx detection systems. The market is witnessing adoption in both heavy commercial vehicles and passenger cars as emission testing becomes more rigorous. Additionally, the ongoing transition to cleaner transportation technologies is expanding opportunities for sensor deployment. With growing consumer expectations for cleaner transport, the UK market is expected to steadily expand.

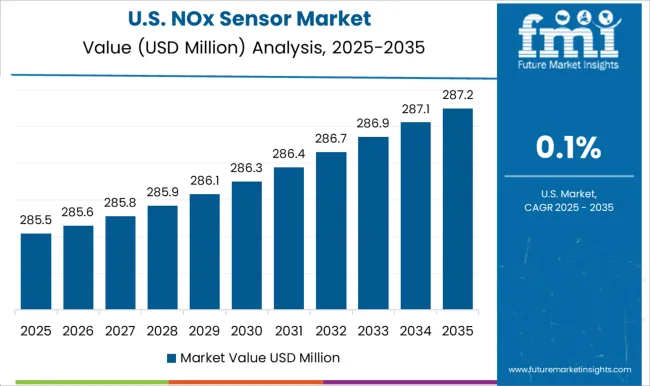

The market in the United States is expected to progress at a CAGR of 6.0%, supported by federal emission standards and consumer preference for cleaner vehicles. Stricter enforcement of regulations on commercial fleets has resulted in high adoption of emission monitoring systems. Automotive suppliers are increasingly focusing on developing robust and durable sensors suited for varying conditions. Additionally, the rising popularity of hybrid and advanced gasoline technologies is driving continued demand for efficient NOx monitoring. With regulatory focus on both passenger and heavy-duty vehicles, the US is positioned to remain a key market for NOx sensors.

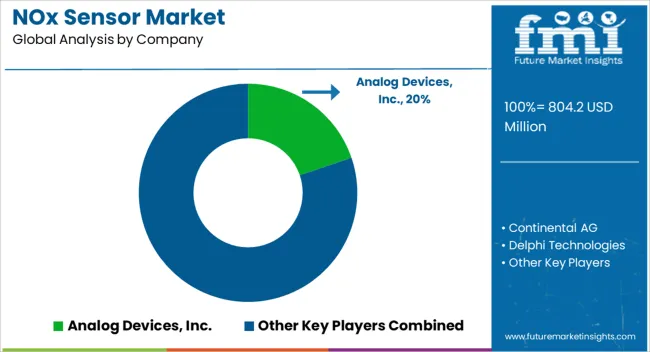

The market is primarily influenced by leading automotive electronics and sensor manufacturers that focus on vehicle emission monitoring and compliance with stringent environmental regulations. Robert Bosch has established a dominant presence, offering high-precision NOx sensors designed for passenger cars, commercial vehicles, and industrial engines, ensuring adherence to global emission standards. Denso Corporation complements this by delivering sensors with robust durability and accuracy, supporting both light and heavy-duty vehicle applications. Continental AG and Delphi Technologies have expanded their offerings to include advanced NOx sensor systems integrated with engine control units, enhancing emission control efficiency and real-time monitoring capabilities.

NGK Insulators, Ltd. leverages its expertise in ceramics and precision manufacturing to provide reliable sensors suitable for extreme engine environments. Honeywell and Sensata Technologies contribute significantly through innovative sensing technologies that enable rapid and precise detection of nitrogen oxides, supporting regulatory compliance and fuel efficiency optimization. STMicroelectronics and Analog Devices, Inc. drive advancements in semiconductor integration, allowing NOx sensors to achieve faster response times and improved signal processing. TE Connectivity ensures sensor system reliability through robust interconnects and housing solutions tailored for automotive environments. Collectively, these companies are shaping the NOx sensor landscape by providing comprehensive solutions across passenger, commercial, and industrial segments, promoting sustainability and regulatory alignment.

| Item | Value |

|---|---|

| Quantitative Units | USD 804.2 Million |

| Offering | Electrochemical NOx sensors, Optical NOx sensors, and Solid-State NOx sensors |

| Gas | Nitrogen dioxide (NO2), Nitric oxide (NO), and Nitrous oxide (N2O) |

| Function | Upstream and Downstream |

| Fuel | Diesel and Petrol |

| Application | Passenger vehicle and Commercial vehicle |

| Distribution Channel | OEM and Aftermarket |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Analog Devices, Inc., Continental AG, Delphi Technologies, Denso Corporation, Honeywell, NGK Insulators, Ltd., Robert Bosch, Sensata Technologies, STMicroelectronics, and TE Connectivity |

| Additional Attributes | Dollar sales by sensor type and vehicle category, demand dynamics across passenger cars, commercial vehicles, and industrial applications, regional trends in emission regulation compliance, innovation in detection accuracy and durability, environmental impact of sensor disposal and material use, and emerging use cases in hybrid and electric vehicle exhaust monitoring systems. |

The global NOx sensor market is estimated to be valued at USD 804.2 million in 2025.

The market size for the NOx sensor market is projected to reach USD 1,581.9 million by 2035.

The NOx sensor market is expected to grow at a 7.0% CAGR between 2025 and 2035.

The key product types in NOx sensor market are electrochemical NOx sensors, optical NOx sensors and solid-state NOx sensors.

In terms of gas, nitrogen dioxide (no2) segment to command 54.3% share in the NOx sensor market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Minoxidil Market Size and Share Forecast Outlook 2025 to 2035

Analysis and Growth Projections for Phenoxyethanol Market

Phenoxycycloposphazene Market Growth - Innovations, Trends & Forecast 2025 to 2035

Market Positioning & Share in the Arabinoxylan Fiber Industry

Arabinoxylan Fiber Market Trends - Growth, Applications & Outlook 2025-2035

Carbon Monoxide Analyzers Market

Silicon Monoxide Market Growth – Trends & Forecast 2024-2034

Industrial Denox System Market Size and Share Forecast Outlook 2025 to 2035

Smoke and Carbon Monoxide Alarm Market Size and Share Forecast Outlook 2025 to 2035

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Testing Market Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensor Patches Market Analysis - Growth, Applications & Outlook 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Sensor Cable Market

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA