The sensor testing market is expanding significantly, driven by rising integration of sensors across automotive, industrial, and consumer electronics sectors. Growing complexity in sensor design and the need for accurate performance validation under varying environmental conditions have increased demand for advanced testing systems.

The market benefits from technological innovation in automated testing equipment, enabling higher precision, faster throughput, and multi-sensor capability. The increasing adoption of IoT and connected devices has also contributed to greater testing requirements for digital and MEMS sensors.

Additionally, regulatory standards mandating quality assurance in safety-critical applications, such as automotive and aerospace, are reinforcing market growth. As sensor functionality becomes integral to modern technologies, the sensor testing market is poised for sustained expansion, supported by automation, miniaturization, and rising R&D investment..

| Metric | Value |

|---|---|

| Sensor Testing Market Estimated Value in (2025 E) | USD 1.9 billion |

| Sensor Testing Market Forecast Value in (2035 F) | USD 3.5 billion |

| Forecast CAGR (2025 to 2035) | 6.1% |

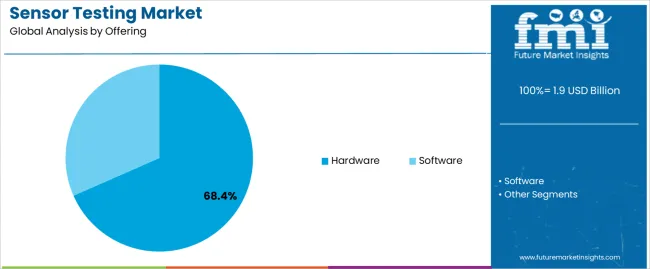

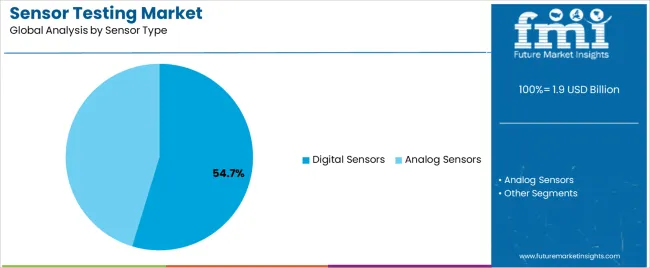

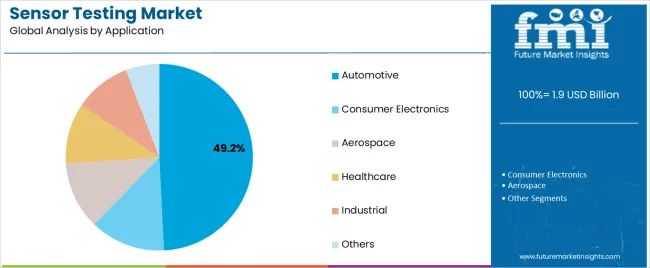

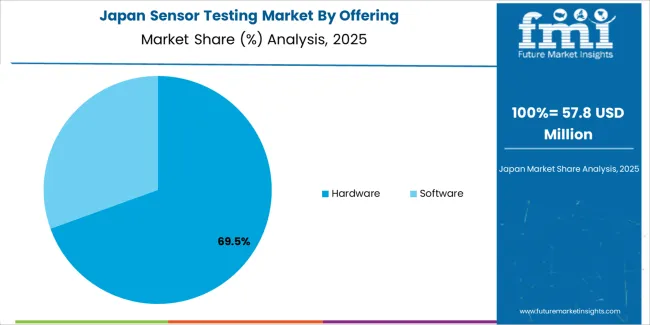

The market is segmented by Offering, Sensor Type, and Application and region. By Offering, the market is divided into Hardware and Software. In terms of Sensor Type, the market is classified into Digital Sensors and Analog Sensors. Based on Application, the market is segmented into Automotive, Consumer Electronics, Aerospace, Healthcare, Industrial, and Others. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hardware segment accounts for approximately 68.4% share in the offering category, driven by the widespread use of testing instruments, analyzers, and calibration systems in quality assurance processes. Hardware solutions provide the precision and repeatability required to ensure sensor performance reliability across varying applications.

Growth in this segment is reinforced by technological advancements such as real-time data acquisition and automated calibration platforms. The increasing adoption of multi-sensor devices across industries has expanded the need for integrated testing setups that can handle diverse sensor types.

Manufacturers are focusing on developing scalable hardware solutions compatible with high-volume production lines. With continued emphasis on accuracy, consistency, and compliance with international standards, the hardware segment is expected to maintain its dominant position in the market..

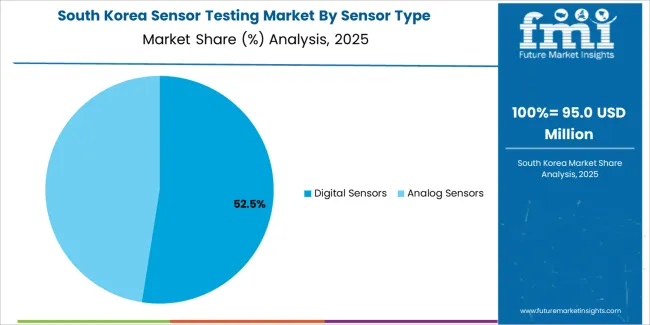

The digital sensors segment leads the sensor type category with approximately 54.7% share, supported by their expanding role in smart devices, vehicles, and industrial automation systems. These sensors provide high accuracy, minimal signal degradation, and direct data output, reducing the need for analog conversion.

The increasing use of IoT platforms and real-time monitoring systems has further accelerated demand. The segment benefits from compatibility with advanced testing systems capable of validating multiple parameters simultaneously.

Cost reductions in semiconductor manufacturing and miniaturization have enhanced scalability, driving mass deployment. With the growing number of applications requiring intelligent sensing capabilities, the digital sensors segment is expected to remain the dominant category throughout the forecast period..

The automotive segment represents approximately 49.2% share of the application category, reflecting its pivotal role in the sensor testing market. The integration of advanced driver-assistance systems (ADAS), electric powertrains, and emissions monitoring has significantly increased the number of sensors used per vehicle.

As vehicle systems become more complex, rigorous testing protocols are required to ensure accuracy, durability, and compliance with safety standards. The segment is further supported by investments in autonomous vehicle development, where sensor precision directly impacts system performance.

OEMs and Tier 1 suppliers are deploying automated testing platforms to streamline production and improve validation speed. With continued advancements in vehicle electronics, the automotive segment is expected to sustain its leading share in the coming years..

From 2025 to 2035, the market is anticipated to experience steady growth, with a CAGR of 6.1%. This marks a slight deceleration compared to the robust CAGR of 8.9% witnessed from 2020 to 2025.

| Attributes | Details |

|---|---|

| Offering | Hardware |

| Forecasted CAGR from 2025 to 2035 | 6.0% |

| Attributes | Details |

|---|---|

| Application | Automotive |

| Forecasted CAGR from 2025 to 2035 | 5.9% |

| Countries | Forecasted CAGR from 2025 to 2035 |

|---|---|

| United States | 6.2% |

| United Kingdom | 7.2% |

| China | 6.6% |

| Japan | 6.7% |

| South Korea | 7.3% |

The sensor testing market is quite diverse, with several players vying for market share. Companies bring their strengths and capabilities to the table, ranging from deep technical expertise to extensive industry experience.

Ultimately, the success of any player in this market depends on its ability to deliver high-quality sensor testing solutions that meet the needs of its customers.

Recent Developments

In 2025, AVL established a new Mobility and Sensor Test Center in Roding, Bavaria, which serves as an innovative indoor laboratory for the validation and verification of sensors used in driver assistance systems.

This development is unique and significant as it ensures the reliability and effectiveness of these systems, thereby enhancing the safety of drivers and passengers.

In 2025, to improve laboratory sensor testing and ensure compliance with United Kingdom safety standards, the Science and Innovation Park in the United Kingdom has invested funds in procuring mobile calibration services.

This investment is aimed at enhancing the efficiency and accuracy of laboratory procedures, ultimately promoting the safety and well-being of all stakeholders involved.

The global sensor testing market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the sensor testing market is projected to reach USD 3.5 billion by 2035.

The sensor testing market is expected to grow at a 6.1% CAGR between 2025 and 2035.

The key product types in sensor testing market are hardware and software.

In terms of sensor type, digital sensors segment to command 54.7% share in the sensor testing market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Sensor Data Analytics Market Size and Share Forecast Outlook 2025 to 2035

Sensor Fusion Market Size and Share Forecast Outlook 2025 to 2035

Sensor Based Glucose Measuring Systems Market Size and Share Forecast Outlook 2025 to 2035

Sensor Development Kit Market Size and Share Forecast Outlook 2025 to 2035

Sensory Modifier Market Size and Share Forecast Outlook 2025 to 2035

Sensor Bearings Market Insights - Growth & Forecast 2025 to 2035

Sensor Hub Market Analysis - Growth, Demand & Forecast 2025 to 2035

Sensor Patches Market Analysis - Growth, Applications & Outlook 2025 to 2035

Testing, Inspection & Certification Market Growth – Trends & Forecast 2025 to 2035

Sensors Market Analysis by Type, Technology, End User & Region - Forecast from 2025 to 2035

Sensor Cable Market

Sensormatic Labels Market

5G Testing Market Size and Share Forecast Outlook 2025 to 2035

AB Testing Software Market Size and Share Forecast Outlook 2025 to 2035

3D Sensor Market Size and Share Forecast Outlook 2025 to 2035

Biosensors Market Trends – Growth & Future Outlook 2025 to 2035

5G Testing Equipment Market Analysis - Size, Growth, and Forecast 2025 to 2035

UV Sensors Market Analysis by Type, End User, and Region from 2025 to 2035

CP Sensor for Consumer Applications Market – Growth & Forecast 2025 to 2035

Eye Testing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA