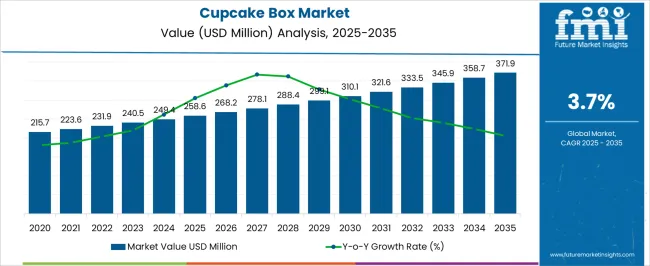

The Cupcake Box Market is estimated to be valued at USD 258.6 million in 2025 and is projected to reach USD 371.9 million by 2035, registering a compound annual growth rate (CAGR) of 3.7% over the forecast period.

The cupcake box market is experiencing consistent expansion due to the growing bakery industry, increasing consumer inclination toward packaged confectionery products, and rising demand for visually appealing and durable packaging solutions. Current market conditions are shaped by higher production volumes in commercial bakeries and expanding retail distribution networks that rely on efficient and protective packaging. Sustainability initiatives are also influencing material choices, with manufacturers adopting recyclable and food-grade materials to align with regulatory and consumer expectations.

The future outlook remains optimistic as customization, branding integration, and structural innovation continue to drive market differentiation. Growth rationale is rooted in the demand for lightweight, cost-effective, and high-barrier packaging that maintains product freshness and presentation.

Urbanization, expansion of online bakery sales, and the popularity of gifting culture are expected to further stimulate demand Continuous investment in packaging design technology and automated manufacturing processes will sustain competitive advantage and ensure consistent revenue generation across global bakery packaging markets.

| Metric | Value |

|---|---|

| Cupcake Box Market Estimated Value in (2025 E) | USD 258.6 million |

| Cupcake Box Market Forecast Value in (2035 F) | USD 371.9 million |

| Forecast CAGR (2025 to 2035) | 3.7% |

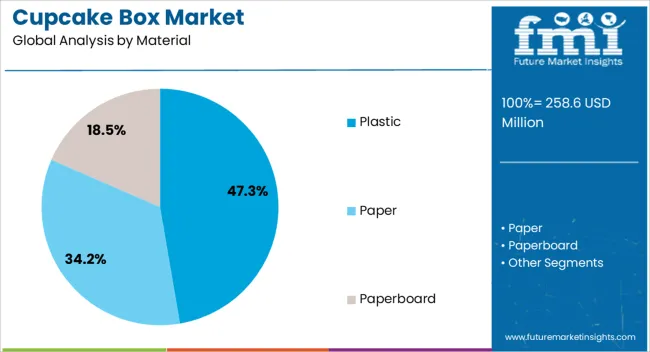

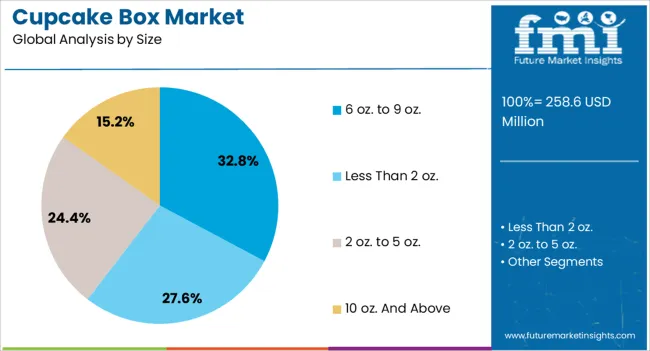

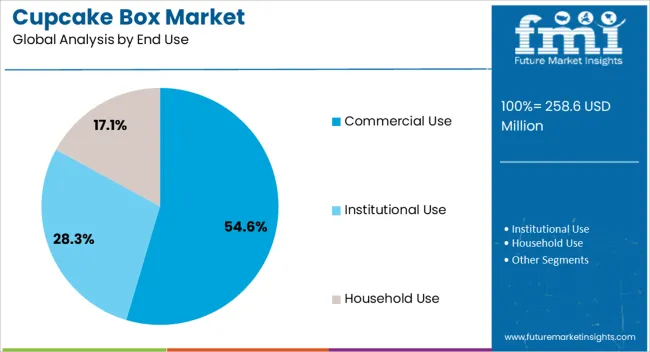

The market is segmented by Material, Size, and End Use and region. By Material, the market is divided into Plastic, Paper, and Paperboard. In terms of Size, the market is classified into 6 oz. to 9 oz., Less Than 2 oz., 2 oz. to 5 oz., and 10 oz. And Above. Based on End Use, the market is segmented into Commercial Use, Institutional Use, and Household Use. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The plastic segment, holding 47.30% of the material category, has maintained its leading position owing to its durability, lightweight nature, and superior protection against moisture and contamination. It remains the preferred choice for both small-scale and large-scale bakeries that prioritize product visibility and extended shelf life.

Clear plastic cupcake boxes offer aesthetic appeal and convenient stacking, enhancing their suitability for retail and catering applications. Despite increasing scrutiny of plastic usage, advancements in biodegradable and recyclable plastic formulations are supporting continued adoption.

Production scalability and cost efficiency further strengthen its dominance, while innovations in sustainable polymer technology are expected to secure long-term relevance As packaging producers align with circular economy goals, the plastic segment is anticipated to retain a strong market share through material diversification and enhanced recyclability.

The 6 oz. to 9 oz. segment, representing 32.80% of the size category, has emerged as a prominent segment due to its compatibility with standard-sized cupcakes widely sold across commercial outlets and bakeries. Its moderate capacity allows for versatile packaging configurations that balance space efficiency and product protection.

Manufacturers favor this size range for its adaptability to both single and multi-cavity box formats, facilitating broad market applicability. The segment’s demand is reinforced by its alignment with retail display standards and online delivery packaging specifications. Production optimization and uniform sizing have contributed to reduced manufacturing waste and improved logistics handling.

With consistent consumption patterns in bakery chains and retail channels, the 6 oz to 9 oz category is expected to sustain stable growth and maintain its position as a preferred packaging format in the cupcake box market.

The commercial use segment, accounting for 54.60% of the end-use category, has dominated the market due to increasing utilization of cupcake boxes by bakeries, cafés, catering services, and event organizers. The segment’s leadership is driven by bulk packaging demand, frequent restocking cycles, and the need for cost-effective yet premium-quality packaging solutions.

Standardized sizing, efficient material utilization, and customized branding options have enhanced the segment’s appeal among commercial users. The rise of online bakery delivery platforms and quick-service chains has further amplified large-volume packaging requirements.

Manufacturers are focusing on supplying durable and tamper-resistant solutions to meet safety and transportation needs As commercial production and distribution networks expand globally, the commercial use segment is projected to maintain strong momentum, reinforcing its position as the leading end-use category within the cupcake box market.

Rundown of Growth Drivers Influencing Cupcake Box Sales Transactions

The cupcakes are picking up steam as a fashionable and convenient dessert alternative has led to an amplifying cupcake box demand. This trend is evident in urban regions where bakery items are a staple in events or celebrations. The cupcake box vendors need to keep a check on consumer choices and adjust to the changes in demand to be relevant in the industry.

There is a strengthening consumer alternative for environment-friendly packaging choices. The cupcake box providers that invest in recyclable or reusable boxes lure eco-conscious customers and adhere to the spurring regulatory demands for sustainable activities.

The evolution of e-commerce websites has surged the demand for safe and attractive cupcake box packaging alternatives. Cupcake boxes are made for safe transportation, and luring presentations are crucial for online sales. Using the e-commerce growth, open novel supply chains and customer bases. These factors augment the cupcake box market expansion.

Restraints Affecting Cupcake Container Market Growth

The cost shifts of raw materials like paper, cardboard, and printing ink adversely influence the operation costs. Shifts in distribution network dynamics, geopolitical catalysts, or transitions in cupcake box demand for such materials in diverse industries usher these fluctuations.

The strict environmental rules are a significant constraint. Adherence to these rules needs substantial investment in eco-friendly materials and manufacturing processes. The cupcake box vendors should invest in sustainable alternatives, which are available at a higher cost.

The transition in consumer choices towards environment-friendly and customizable packaging alternatives poses a threat. Satisfying these shifting demands needs flexibility in manufacturing procedures and soaring costs because of the sector for personalized solutions. These factors impede the cupcake box market growth.

The global cupcake box ecosystem recorded sales of USD 215.7 million in 2020. Between 2020 and 2025, the cupcake box market witnessed strong growth ushered by the amplifying traction of cupcakes as a contemporary dessert alternative for diverse occasions.

The upsurged consumer demand for fascinating packaging solutions strengthened the growth of the cupcake box industry. The historical period from 2020 to 2025 witnessed a boom in artisanal bakeries and specialty dessert retailers, aiding the soaring competition and revolution in cupcake box packaging designs.

From 2025 to 2035, the demand analysis of cupcake boxes is on an upward growth trajectory, notwithstanding a slower pace in comparison to the previous forecast period. While cupcakes are an admirable treat, industry saturation and evolving consumer choices moderate growth rates.

The cupcake box ecosystem aids in continuous product diversification, with a concentration on environment-friendly and personalized packaging solutions to favor shifting consumer values.

The cupcake box industry is slated for supported growth between 2025 and 2035, prompted by continuous product innovation, proliferating supply chains, and spurring consumer demand for suitable and visually appealing packaging alternatives for sweet treats. The cupcake box vendors operating in the industry should adapt to shifting industry dynamics and consumer alternatives to foster a competitive edge in the upcoming years.

The section below covers the forecast for the cupcake box market in terms of countries. Information on key countries in several parts of the globe, including North America, Asia Pacific, Europe, and others, is provided. The United States is moving at a moderate pace in North America’s cupcake box industry, with a CAGR of 2.4% through 2035. In Asia Pacific, India infers a CAGR of 6.4% by 2035, followed by China at 5.6%.

| Countries | CAGR 2025 to 2035 |

|---|---|

| United States | 2.4% |

| United Kingdom | 2.8% |

| Spain | 3.7% |

| China | 5.6% |

| India | 6.4% |

The United States cupcake box industry experienced a transition into premium packaging alternatives, catering to the demand for superior and artisanal bakery items. The spurring demand for eco-conscious packaging solutions impacts the market trends in the United States, indicating an expanding environmental awareness in consumers.

Personalization is a key catalyst to shape the cupcake box sector in the United States, serving varied consumer choices. Online bakery service providers use innovative packaging designs in the United States cupcake box ecosystem to improve brand appeal and customer participation.

The eco-conscious packaging activities are gaining traction in the United Kingdom cupcake box industry, ushered by government schemes and consumer awareness strategies. Accessibility and flexibility are pivotal factors transforming the United Kingdom cupcake box sector, with a concentration on compact and portable packaging solutions for on-the-go utilization.

The advent of home bakers in the United Kingdom strengthens the demand for small-sized cupcake boxes, satisfying DIY bakers and SMEs. Premiumization trends in the United Kingdom cupcake box ecosystem are prevalent, with a focus on supreme materials and complex designs to lure high-end customers.

The Indian cupcake box market is ushered by the rising café culture and the traction towards western desserts among urban millennials. The economical and lightweight packaging solutions prevail in the Indian cupcake box sector, serving price-sensitive individuals and small-scale or home bakeries.

The impact of festivals and celebrations severely affects the Indian cupcake box industry, with a demand upsurge perceived during significant cultural events. E-commerce websites play a considerable role in the supply of cupcake boxes in India, presenting a conducive pathway for consumers as well as vendors to access an array of alternatives.

The section contains information about the leading segments in the cupcake box industry. In terms of material category, the paper and paperboard segment accounts for a share of 67.9% by 2035. By end use category, the commercial use segment dominates by holding a share of 45.1% in 2035.

| Segment | Paper and Paperboard |

|---|---|

| Value Share (2035) | 67.9% |

The rise in the adoption of paper and paperboard packaging appeals to vendors looking for effective solutions without compromising quality. Consumer sensitivity favors paper packaging because of its natural and biodegradable attributes, improving brand trust.

Paper-based packaging is easily personalized, permitting providers to display branding and strengthen product presentation. The rising regulatory scrutiny on plastic adoption directs businesses towards paper and paperboard substitutes for adherence and reputation management.

| Segment | Commercial Use |

|---|---|

| Value Share (2035) | 45.1% |

Commercial businesses like bakeries and retail stores have a stable and significant demand for cupcake boxes to pack their products proficiently. The commercial use segment involves custom branding on packaging, which amplifies the sales of cupcake boxes.

The providers serve at events, parties, and celebrations, ushering in the demand for large quantities of cupcake boxes for transit and presentation. Commercial units adhere to packaging and food safety rules, compelling the adoption of cupcake boxes.

The cupcake box industry is very competitive, ushered by an evolving demand for pleasing and functional packaging solutions. The leading cupcake box vendors like established packaging producers and emerging providers specializing in niche industries.

The packaging market is remarked by a strong emphasis on eco-friendliness. Numerous cupcake box manufacturers are adopting sustainable materials and renewable alternatives to align with evolving consumer preferences. This focus on sustainability is a key driver of innovation in design and personalization alternatives.

The upsurge of online bakeries and home-based firms has developed cupcake box market opportunities. Competitive costs, product integrity, and customer service are necessary factors impacting the market share. The cupcake box sector impedes shifting the raw material costs and regulatory guidelines associated with food packaging safety.

Industry Updates

The market is bifurcated into paper, paperboard, and plastic.

Key sizes include Less than 2 oz., 2 oz. to 5 oz., 6 oz. to 9 oz., and 10 oz. and above.

The market is trifurcated into commercial use, institutional use, and household use.

Analysis of the market has been carried out in key countries of North America, Latin America, East Asia, South Asia and Pacific, Western Europe, Eastern Europe, and the Middle East and Africa.

The global cupcake box market is estimated to be valued at USD 258.6 million in 2025.

The market size for the cupcake box market is projected to reach USD 371.9 million by 2035.

The cupcake box market is expected to grow at a 3.7% CAGR between 2025 and 2035.

The key product types in cupcake box market are plastic, paper and paperboard.

In terms of size, 6 oz. to 9 oz. segment to command 32.8% share in the cupcake box market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Cupcake Liner Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Containers Market Size and Share Forecast Outlook 2025 to 2035

Cupcake Wrappers Market Size and Share Forecast Outlook 2025 to 2035

Competitive Landscape of Cupcake Wrappers Manufacturers

Cupcake Tray Machines Market

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

Boxboard Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Box Compression Tester Market Size and Share Forecast Outlook 2025 to 2035

Box Latch Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Box Filling Machine Market from 2025 to 2035

Box and Carton Overwrap Films Market Demand and Growth

Box and Carton Overwrapping Machines Market Insights and Growth 2025 to 2035

Boxcar Scars Market – Demand, Growth & Forecast 2025 to 2035

Box Sealing Machines Market Trends – Growth & Forecast 2025 to 2035

Competitive Breakdown of Box Pouch Providers

Market Share Insights of Boxboard Packaging Providers

Box Latch Market Positioning & Competitive Analysis

Industry Share Analysis for Box Liners Companies

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA