Functions of secondary packing in providing protection and the addition of tamper-evidence film around cartons and boxes apply to all. The food, pharma, cosmetics, and tobacco industries are typically all considered sectors employing these machines.

These machines guarantee consistency in packaging quality, high-speed processing capabilities, and minimal human errors, thus contributing to better presentation of products. With the trends of some of these factories heading towards automation and sustainability, new dimensions are being added to overproofing machines with the introduction of smart control, energy efficiency as well as better compatibility with various films.

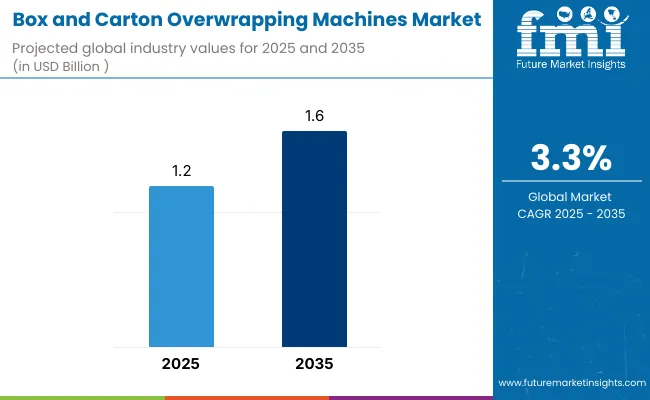

It is expected that the global box and carton overwrapping machines market will grow to USD 1.2 billion by 2025 at an annual growth rate of 3.3% and attain a value of USD 1.6 billion by 2035. The growth of this market is being driven by the demand for automated packaging lines, increased e-commerce shipments, and stringent anti-counterfeiting measures.

The developments in smart packaging and demands for traceability in supply chains are also driving the machine's capabilities. The end users also want machines to be multifunctional, giving fast changeovers for many formats.

The investments into advanced overwrapping systems that will offer spare parts and operate with minimal time constraints on changeover are already an area of great interest. Sustainable packaging is putting pressure on manufacturers to design systems that can operate with minimum waste and energy consumption.

Besides, rising competition in the retail and FMCG sectors is another driver for the machines that can enhance shelf-ready presentation. Manufacturers are investing in modular overwrapping systems, as well as robotics integration and digital control platforms to increase speed, modularity, and product tracking.

Flexibility for a small machine footprint is becoming quite popular in production lines with space constraints. Innovations in hybrid overwrapping systems should allow for the compatibility of traditional and eco-friendly films. Additionally, growing demand for customization features is being spurred on by an increased uptake for artisanal and special arrangements. Finally, remote servicing capabilities and cloud-enabled diagnostics are becoming key factors in deciding competitive machine offerings.

Key Market Metrics

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 1.2 Billion |

| Projected Market Size in 2035 | USD 1.6 Billion |

| CAGR (2025 to 2035) | 3.3% |

Asia-Pacific has experienced a surge in manufacturing activity and growing investments toward high-speed automated packaging, consequently becoming the largest market for overwrapping machines. The countries such as China, Japan, and South Korea are favoring servo-driven and PLC-controlled machines for higher precision and flexibility.

The continually expanding e-commerce and retail packaging within the region boost the adoption of more versatile overwrapping technologies. Conversely, the government's promotion of smart manufacturing is accelerating the digitization of machines and their integration with the Industry 4.0 platform.

The rapidly modernizing North American packaging sector sees the two countries, the U.S. and Canada, equipping themselves with advanced overwrapping machines for pharmaceuticals, personal care, and luxury goods. Sustainability targets are spurring the introduction of motors and machines compatible with recyclable and compostable films.

Increased requests for tamper-evident and secure packaging are being answered with investment in smart sealing and thermal control systems. Real-time monitoring and predictive maintenance are enabled through AI and machine learning integration.

Europe's overwrapping machine market is all about its regulations about sustainability, automation, and safety. Germany, Italy, and France are pouring money into high-speed compact overwrapping machines that can dispense the least wastage possible for food, medical, and consumer products.

This is to shift toward modular, low-footprint machinery, which allows flexibility in the packaging format. Furthermore, digital HMI interfaces, data-driven analytics, and compatibility with eco-friendly films can improve the competition in the market.

Challenges

High capital costs and operational complexity Initial equipment cost, need for skilled operators, and integration challenges with legacy systems limit adoption among SMEs. Frequent format changes and material variability also require highly adaptable machine designs.

Opportunities

Automation, smart technology, and sustainable film compatibilityThe shift toward connected packaging lines and real-time data sharing creates opportunities for smart overwrapping machines. AI-enabled quality control, remote diagnostics, and robotic integration are redefining operational efficiency. Moreover, the push for compostable and recyclable film usage is creating demand for film-compatible, precision-controlled machines.

Between 2020 and 2024, the key drivers for the overwrapping machine had become hygiene and efficiency during the pandemic peak demand. The tamper-evident packaging trend spurred investments in sealing and inspection systems, while the manufacturers relied on servo-based controls and cost-efficient retrofits.

Then the market would be dislocated to intelligent modular overwrapping machines from 2025 to 2035, offering cloud connectivity, energy-saving technologies, and sustainability-linked design. Robotics integration, digital twin simulation, and AI-based maintenance systems would be the key innovations. Flexible machines designed for fast changeovers will dominate the company preferences with advanced diagnostics and smart data feedback loops.

Market Shifts: A Comparative Analysis (2020 to 2024 vs. 2025 to 2035)

| Market Shift | 2020 to 2024 Trends |

|---|---|

| Regulatory Landscape | Basic hygiene and safety standards |

| Material Compatibility | Compatibility with standard shrink and PE films |

| Industry Adoption | Pharmaceuticals, cosmetics, and food sectors |

| Market Competition | Dominated by traditional machine suppliers |

| Market Growth Drivers | Efficiency, hygiene, and security |

| Sustainability and Environmental Impact | Energy-efficient retrofitting and material reduction efforts |

| Integration of AI and Process Optimization | Basic machine automation and predictive controls |

| Advancements in Packaging Technology | Servo-based film control and thermal sealing |

| Market Shift | 2025 to 2035 Projections |

|---|---|

| Regulatory Landscape | Smart compliance systems, environmental audits, and traceable packaging mandates |

| Material Compatibility | Flexible handling of compostable, recyclable, and bio-based overwrap films |

| Industry Adoption | Broader use in e-commerce, personal care, smart logistics, and branded product markets |

| Market Competition | Emergence of robotics-driven systems and AI-integrated overwrapping start-ups |

| Market Growth Drivers | Digital optimization, sustainability goals, and intelligent packaging |

| Sustainability and Environmental Impact | Eco-machine designs, emission tracking, and zero-waste integration |

| Integration of AI and Process Optimization | AI-based anomaly detection, remote analytics, and automated performance optimization |

| Advancements in Packaging Technology | Modular robotics, dynamic sensors, and digital twin-supported design |

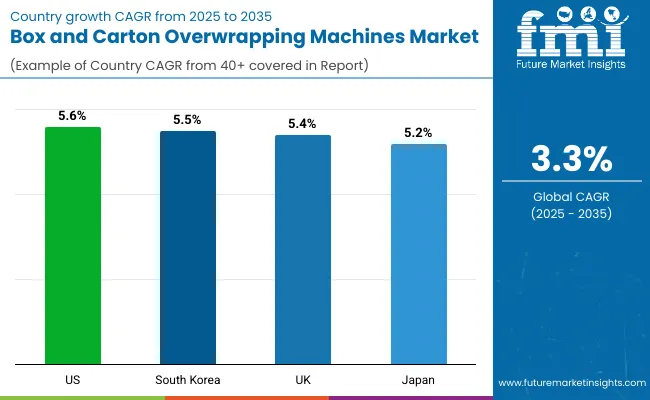

By using the pharmaceutical, food, and personal care sectors, the U.S. leads the market of box and carton overwrapping machines. American manufacturers focus on developing high-speed servo-controlled systems that are used for overwrapping with both traditional cellophane and environmentally friendly BOPP films. They are compact in machine footprints, low maintenance designs, and plug-and-play modularity.

Automation trends have fast-tracked touchless, tamper-evident wrapping systems integrated with vision inspection into mainstream machine design. Demand also increases for machines permitting mono-material film usage to meet recycling goals.

Improved machine uptime is driven by the integration of predictive maintenance sensors and AI-driven diagnostics. Process transparency is enhanced through smart interfaces, real-time analytics. Robotic film handling units also gain popularity in improving the flexibility and throughput of a production line.

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 5.6% |

The UK market is witnessing sustained growth because of increasing regulatory pressures regarding tamper-proof pharmaceutical packaging and sustainability in consumer goods. The British manufacturers are introducing overwrapping solutions exhibiting compatibility with hot and cold seal handling and mono-material films. Demand for machines with quick changeover facilities and digital interfaces to support short-run seasonal packaging is gaining momentum.

Companies invest in recyclable wrapping films and low-energy sealing technologies. The manufacturers are increasingly investing in modular overwrapping systems for easy integration into upstream and downstream automation. There is growing interest in machines that support biodegradable and compostable film materials. In addition, AI-enabled control panels are enhancing process visibility and fault diagnostics in real time.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 5.4% |

The Japanese market for overpacking machines is developing with precision-engineered compact machines specifically for confectionary, cosmetic, and premium gift packaging industries. Japanese companies are investing in super-quiet, high-accuracy wrapping technologies with adaptive tension control. A trend toward the adoption of smart HMIs and automated material feed systems is being observed with a view to reducing operator workload.

Cleanroom-compatible configurations and the sustainable film are becoming trending options. Fast changeover for high-mix low-volume production has also been attracting manufacturers' attention. Tamper-evident overwraps intended for gifts and luxury segments are on demand.

The machines' uptime is further enhanced through integration with AI-based predictive maintenance modules. Recyclable wrapping substrates in line with domestic sustainability initiatives are also being widely accepted in Japan.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 5.2% |

Market expansion in South Korea comes out of pumping intelligent overwrapping machine technology using IoT-enabled auto-correction systems into the industry. Sustainable packaging alternatives are in very high demand given the beauty, electronics, and food segments. AI application-based film tracking, error detection, and wrap optimization systems are also being explored by Korean companies.

The compact, multi-format machines have brought the flexibility of being able to package several types and sizes of products geometrically. This means that the energy-efficient components they use enable their operations concerning support for eco-friendly activities.

Most start-up, small, and medium-sized enterprises need modularizing and scalable machines. The integration of maintenance and training modules supplemented by AR will enhance operator efficiency even more. Touch-free control interfaces are also gaining popularity in order to meet the sectional hygiene standards in hygiene-sensitive packaging environments.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 5.5% |

Carton and box overwrapping machines are classified into automatic, semi-automatic, or compact variants, depending on production requirement and type of packaging. Automatic operations constitute high-throughput industrial lines in which human intervention is either limited or non-existent.

Semi-automatic machines provide cheaper alternatives for flexible packaging applications. Compact machines are built for those facilities that face space constraints but have to deal with frequent changeovers. Each format provides various customization, integration, and energy efficiency possibilities based on the final user needs.

Mass production will require automatic machines to manufacture items in pharmaceuticals, food, and cosmetic sectors. They allow a continuous supply of the film for running, servo motion control, an integrated module for seal integrity inspection, and aesthetic precision.

Such systems have the capability of making very fast changeovers with minimum downtime between product batches. It contains embedded smart sensors for real-time monitoring of film tension and alignment. Such devices are actually provided with auto-calibration features by manufacturers to maintain uniformity in wrap quality. At the same time, machine flexibility and operational uptime is enhanced by remote diagnostics and firmware updates.

Semi-automatic machines provide flexibility, less capital outlay, and simple operation for small and medium-sized companies. They suit short-run batches, multi-size SKUs, and contract packaging.

Compact models are meant for operations with limited floor space, and these have been adopted widely into the urban production hubs. These machines, with modular upgrades, provide consistent performance, energy efficiency, and user-friendly interfaces. Thus, their lightweight frames and plug-and-play designs make installation easier in confined spaces.

Manufacturers, however, are now making advancements in compact machines with quick-change tooling to suit multi-size packages. The demand for such compact overwrappers is increasing now, endowed with smart diagnostics and real-time maintenance alerts. That's doing very well, too, considering the recyclable and bio-based film compatibility, which makes these machines sustainable alternatives for smaller operations.

Overwrapping technology innovations cover eco-film-friendly sealing systems, multi-axis control systems, and AI to control wrap tension. Manufacturers are introducing components for easy dismantling for sanitation, digital twins for machine diagnostics, and cloud-based tracking of system health. Integration with augmented reality-based operator training and smart maintenance alerts is increasing machine uptime.

While the brands try to balance protection, presentation, and environmental compliance, overwrapping machines are transforming into versatile and smart packaging systems. Developments in zero contact film handling would greatly reduce the risk of contamination in pharmaceutical applications.

Improved motion control algorithms are enhancing synchronization at high speed. Voice-commanded machine interfaces are undergoing trials for hands-free control. In parallel, biodegradable film sealing solutions are being embraced by eco-conscious industries.

The market for box and carton overwrapping machines is on an upward trend owing to the growing requirement for improved product presentation, tamper-evident packs, and automated operations. These machines wrap cartons and boxes in clear or printed film, which helps give retail-ready presentations for protection during transit.

Applications of overwrapping machines can be seen in pharmaceuticals, cosmetics, food and beverages, and personal care. They are used for aesthetic purposes, to avert pilferage, and to make sure that packaging is uniform. The acceptance of high-speed multi-format overwrappers is gaining momentum for high-throughput production environments with visual merchandising requirements.

More companies are moving towards overwrapping for bundled promotions and seasonal packaging. Advanced film cutting and tension control systems allow the overwrappers to enhance the quality of finish. Some manufacturers also include modular upgrades for scalability and multi-product use.

Small-sized overwrappers are getting a lot of approval from SMEs that are quite limited in terms of floor space. Integration with upstream and downstream machines will ensure streamlined flow on the packaging line. Furthermore, there is an increasing demand for overwrapping machines that can handle irregular-shaped or windowed cartons.

Pharmaceutical companies use overwrapping machines to ensure tamper-evident packaging for prescription and OTC drugs, complying with global safety standards. Cosmetic brands employ overwrappers for upscale, premium packaging with wrinkle-free and high-gloss finishes that elevate shelf presence.

Leading manufacturers are integrating servo-motors, PLC systems, and touch-screen controls to increase machine precision and ease of use. Sustainable overwrapping options, such as recyclable films and bio-based shrink wrap materials, are gaining popularity as brands aim for lower carbon footprints.

Packaging machinery for boxes and carton-wrapping machines are evolving with sustainable materials and smart automation and modular flexibility. Compact and high-speed machines are developed by companies for application on packaging lines in pharmaceuticals, cosmetics, and luxury goods. Manufacturers are integrating predictive-maintenance techniques to limit downtime. Many companies are opting for AI-based systems to enhance packaging precision and quality control.

High-speed overwrappers wherein the film changes automatically are in demand in high-capacity installations. Tamper evident film designs are fast becoming a standard to satisfy stringent regulatory requirements. Custom packaging, thus driving demand for overwrappers suitable for digital printing. Besides, eco-design innovations are reducing the overall material consumption and packaging waste.

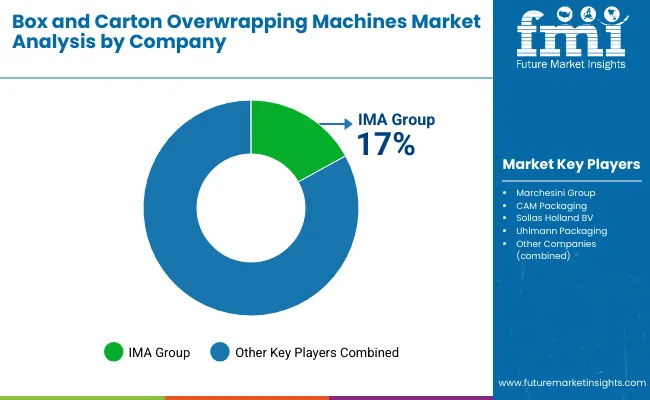

Market Share Analysis by Company

| Company Name | Estimated Market Share (%) |

|---|---|

| IMA Group | 13-17% |

| Marchesini Group | 10-14% |

| CAM Packaging | 8-12% |

| Sollas Holland BV | 6-10% |

| Uhlmann Packaging | 4-7% |

| Other Companies | 51-61% |

| Company Name | Key Offerings/Activities |

|---|---|

| IMA Group | Offers multi-format overwrapping machines with high-speed and pharmaceutical-grade features. |

| Marchesini Group | Develops precision overwrappers with integrated carton orientation and label systems. |

| CAM Packaging | Provides compact overwrapping machines for luxury and cosmetic carton applications. |

| Sollas Holland BV | Specializes in user-friendly overwrappers with quick format change and eco-film compatibility. |

| Uhlmann Packaging | Manufactures high-performance overwrapping systems for compliance-driven industries. |

Key Company Insights

Other Key Players (51-61% Combined) Include:

The market size was USD 1.2 Billion in 2025.

The market is projected to reach USD 1.6 Billion in 2035.

The market will be driven by increased regulatory compliance, demand for premium shelf presence, automation, and shift toward recyclable overwrapping materials.

The top 5 contributing countries are the USA, Germany, Italy, China, and Japan.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2017 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2017 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 4: Global Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 5: Global Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 6: Global Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 7: North America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 8: North America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 9: North America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 10: North America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 11: North America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 12: North America Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 13: Latin America Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 14: Latin America Market Volume (Units) Forecast by Country, 2017 to 2033

Table 15: Latin America Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 16: Latin America Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 17: Latin America Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 18: Latin America Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 19: Western Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 20: Western Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 21: Western Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 22: Western Europe Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 23: Western Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 24: Western Europe Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 25: Eastern Europe Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 26: Eastern Europe Market Volume (Units) Forecast by Country, 2017 to 2033

Table 27: Eastern Europe Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 28: Eastern Europe Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 29: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 30: Eastern Europe Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 31: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 32: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 33: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 34: Asia Pacific Excluding Japan Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 35: Asia Pacific Excluding Japan Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 36: Asia Pacific Excluding Japan Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 37: Japan Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 38: Japan Market Volume (Units) Forecast by Country, 2017 to 2033

Table 39: Japan Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 40: Japan Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 41: Japan Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 42: Japan Market Volume (Units) Forecast by End Use, 2017 to 2033

Table 43: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2017 to 2033

Table 44: Middle East and Africa Market Volume (Units) Forecast by Country, 2017 to 2033

Table 45: Middle East and Africa Market Value (US$ Million) Forecast by Product Type, 2017 to 2033

Table 46: Middle East and Africa Market Volume (Units) Forecast by Product Type, 2017 to 2033

Table 47: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2017 to 2033

Table 48: Middle East and Africa Market Volume (Units) Forecast by End Use, 2017 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by End Use, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 4: Global Market Value (US$ Million) Analysis by Region, 2017 to 2033

Figure 5: Global Market Volume (Units) Analysis by Region, 2017 to 2033

Figure 6: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 7: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 8: Global Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 9: Global Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 10: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 11: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 12: Global Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 13: Global Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 14: Global Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 15: Global Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 16: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 17: Global Market Attractiveness by End Use, 2023 to 2033

Figure 18: Global Market Attractiveness by Region, 2023 to 2033

Figure 19: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 20: North America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 21: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 22: North America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 23: North America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 24: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 25: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 26: North America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 27: North America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 28: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 29: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 30: North America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 31: North America Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 32: North America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 33: North America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 34: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 35: North America Market Attractiveness by End Use, 2023 to 2033

Figure 36: North America Market Attractiveness by Country, 2023 to 2033

Figure 37: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: Latin America Market Value (US$ Million) by End Use, 2023 to 2033

Figure 39: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 40: Latin America Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 41: Latin America Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 42: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 43: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 44: Latin America Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 45: Latin America Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 46: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 47: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 48: Latin America Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 49: Latin America Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 50: Latin America Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 51: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 52: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 53: Latin America Market Attractiveness by End Use, 2023 to 2033

Figure 54: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 55: Western Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 56: Western Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 57: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 58: Western Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 59: Western Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 60: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 61: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 62: Western Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 63: Western Europe Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 64: Western Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 65: Western Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 66: Western Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 67: Western Europe Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 68: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 69: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 70: Western Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 71: Western Europe Market Attractiveness by End Use, 2023 to 2033

Figure 72: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 73: Eastern Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Eastern Europe Market Value (US$ Million) by End Use, 2023 to 2033

Figure 75: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 76: Eastern Europe Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 77: Eastern Europe Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 78: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 79: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 80: Eastern Europe Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 81: Eastern Europe Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 82: Eastern Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 83: Eastern Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 84: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 85: Eastern Europe Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 86: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 87: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 88: Eastern Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 89: Eastern Europe Market Attractiveness by End Use, 2023 to 2033

Figure 90: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 91: Asia Pacific Excluding Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 92: Asia Pacific Excluding Japan Market Value (US$ Million) by End Use, 2023 to 2033

Figure 93: Asia Pacific Excluding Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 94: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 95: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 96: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 97: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 98: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 99: Asia Pacific Excluding Japan Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 100: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 101: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 102: Asia Pacific Excluding Japan Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 103: Asia Pacific Excluding Japan Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 104: Asia Pacific Excluding Japan Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 105: Asia Pacific Excluding Japan Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 106: Asia Pacific Excluding Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 107: Asia Pacific Excluding Japan Market Attractiveness by End Use, 2023 to 2033

Figure 108: Asia Pacific Excluding Japan Market Attractiveness by Country, 2023 to 2033

Figure 109: Japan Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Japan Market Value (US$ Million) by End Use, 2023 to 2033

Figure 111: Japan Market Value (US$ Million) by Country, 2023 to 2033

Figure 112: Japan Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 113: Japan Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 114: Japan Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 115: Japan Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 116: Japan Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 117: Japan Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 118: Japan Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 119: Japan Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 120: Japan Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 121: Japan Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 122: Japan Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 123: Japan Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 124: Japan Market Attractiveness by Product Type, 2023 to 2033

Figure 125: Japan Market Attractiveness by End Use, 2023 to 2033

Figure 126: Japan Market Attractiveness by Country, 2023 to 2033

Figure 127: Middle East and Africa Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 128: Middle East and Africa Market Value (US$ Million) by End Use, 2023 to 2033

Figure 129: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 130: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2017 to 2033

Figure 131: Middle East and Africa Market Volume (Units) Analysis by Country, 2017 to 2033

Figure 132: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 133: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 134: Middle East and Africa Market Value (US$ Million) Analysis by Product Type, 2017 to 2033

Figure 135: Middle East and Africa Market Volume (Units) Analysis by Product Type, 2017 to 2033

Figure 136: Middle East and Africa Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 137: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 138: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2017 to 2033

Figure 139: Middle East and Africa Market Volume (Units) Analysis by End Use, 2017 to 2033

Figure 140: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2023 to 2033

Figure 141: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2023 to 2033

Figure 142: Middle East and Africa Market Attractiveness by Product Type, 2023 to 2033

Figure 143: Middle East and Africa Market Attractiveness by End Use, 2023 to 2033

Figure 144: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Box Liners Market Size and Share Forecast Outlook 2025 to 2035

Boxboard Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Box Compression Tester Market Size and Share Forecast Outlook 2025 to 2035

Box Latch Market Size and Share Forecast Outlook 2025 to 2035

Box Pouch Market by Pouch Type from 2025 to 2035

Box Filling Machine Market from 2025 to 2035

Boxcar Scars Market – Demand, Growth & Forecast 2025 to 2035

Competitive Breakdown of Box Pouch Providers

Market Share Insights of Boxboard Packaging Providers

Box Latch Market Positioning & Competitive Analysis

Industry Share Analysis for Box Liners Companies

Box Sealing Machines Market Trends – Growth & Forecast 2025 to 2035

Box and Carton Overwrap Films Market Demand and Growth

Carboxymethyl Tamarind Gum (CMT) Market Size and Share Forecast Outlook 2025 to 2035

Carboxylic Acid Market Size and Share Forecast Outlook 2025 to 2035

Carboxylated Nitrile Rubber Market Size and Share Forecast Outlook 2025 to 2035

Carboxy Therapy Market Size and Share Forecast Outlook 2025 to 2035

Carboxymethyl Cellulose Market 2024-2034

Ice Boxes Market Size and Share Forecast Outlook 2025 to 2035

Cryoboxes Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA