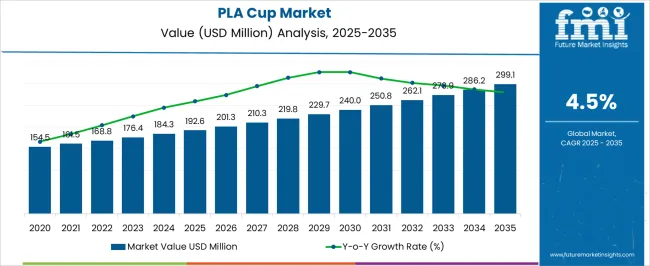

The PLA Cup Market is estimated to be valued at USD 192.6 million in 2025 and is projected to reach USD 299.1 million by 2035, registering a compound annual growth rate (CAGR) of 4.5% over the forecast period.

The PLA Cup market is experiencing significant growth, driven by increasing environmental awareness and the global shift toward sustainable packaging solutions. Rising consumer preference for biodegradable and compostable materials has supported adoption across food and beverage sectors. The market is further fueled by regulatory initiatives that encourage the replacement of conventional plastic cups with environmentally friendly alternatives.

PLA cups are being leveraged in various applications due to their compostability, lightweight design, and compatibility with hot and cold beverages. Advancements in manufacturing processes, including improvements in material consistency, heat resistance, and durability, have enhanced product performance and appeal. The integration of PLA cups into foodservice, retail, and e-commerce channels is facilitating broader distribution and market penetration.

As businesses and consumers continue to prioritize sustainability and regulatory compliance, the demand for PLA cups is expected to sustain growth Ongoing innovations in material formulations and production efficiency are anticipated to further strengthen market expansion, creating opportunities for manufacturers and suppliers to meet evolving environmental and operational requirements.

| Metric | Value |

|---|---|

| PLA Cup Market Estimated Value in (2025 E) | USD 192.6 million |

| PLA Cup Market Forecast Value in (2035 F) | USD 299.1 million |

| Forecast CAGR (2025 to 2035) | 4.5% |

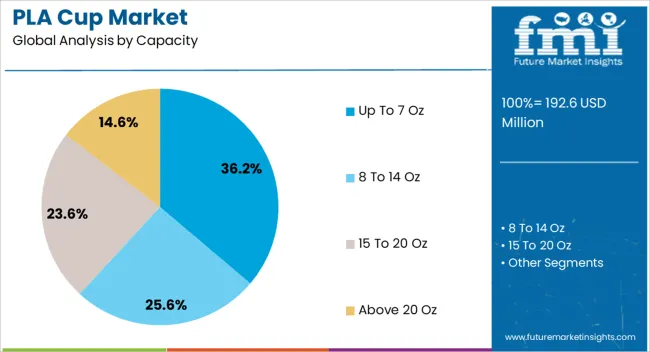

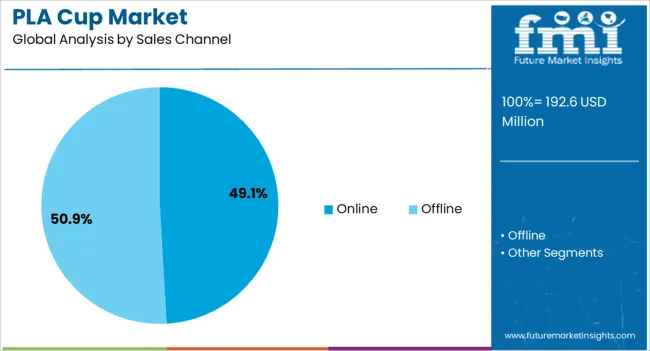

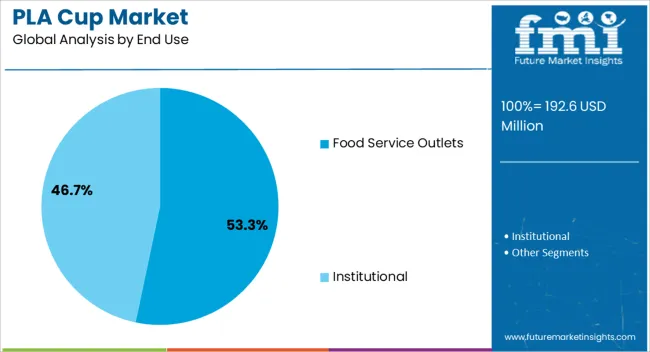

The market is segmented by Capacity, Sales Channel, and End Use and region. By Capacity, the market is divided into Up To 7 Oz, 8 To 14 Oz, 15 To 20 Oz, and Above 20 Oz. In terms of Sales Channel, the market is classified into Online and Offline. Based on End Use, the market is segmented into Food Service Outlets and Institutional. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The up to 7 oz capacity segment is projected to hold 36.2% of the market revenue in 2025, making it the leading capacity category. This segment is being favored due to its suitability for single-serve beverages, portion-controlled drinks, and convenience-focused consumption. The small capacity enables cost-effective production and distribution, while also aligning with sustainability objectives by minimizing material usage.

The versatility of this capacity range allows adoption across cafes, fast-food outlets, and retail settings, where consumer demand for convenient, eco-friendly packaging is high. Manufacturers are optimizing PLA formulations to enhance heat resistance and structural stability for smaller cup sizes, ensuring durability without compromising biodegradability.

The growing focus on environmentally responsible packaging and compliance with regulatory standards has further reinforced preference for smaller capacity cups As sustainable packaging adoption accelerates globally, the up to 7 oz segment is expected to maintain its leading position, supported by ongoing product innovations and expanding application opportunities across food and beverage consumption contexts.

The online sales channel segment is anticipated to account for 49.1% of the market revenue in 2025, establishing it as the leading distribution channel. Growth in this segment is being driven by increasing e-commerce adoption, convenience-oriented purchasing behavior, and expanding digital marketplaces for foodservice and retail packaging solutions. Online channels provide manufacturers and suppliers with a platform to reach a wide range of customers efficiently, offering bulk and customizable order options.

Real-time inventory management, flexible shipping solutions, and digital marketing campaigns are enhancing customer accessibility and engagement. The trend toward online procurement is particularly evident among small and medium-sized foodservice operators seeking quick, reliable, and cost-effective sourcing options.

As consumer preference shifts toward digital ordering, the online channel is expected to remain the primary revenue contributor in the PLA cup market The adoption of AI-driven supply chain management and e-commerce analytics further strengthens operational efficiency and market reach, supporting continued expansion of online sales as a key distribution method.

The food service outlets segment is projected to hold 53.3% of the market revenue in 2025, establishing it as the largest end-use industry. Growth in this segment is being driven by the widespread adoption of eco-friendly packaging solutions in cafes, restaurants, fast-food chains, and quick-service establishments. PLA cups provide a sustainable alternative to conventional plastic, aligning with growing consumer demand for environmentally responsible dining experiences.

The ability to serve both hot and cold beverages while maintaining structural integrity and biodegradability enhances their appeal for foodservice operators. Increasing regulatory pressures to phase out single-use plastics further accelerate adoption in this sector.

Operational benefits, including ease of storage, lightweight design, and compatibility with automated dispensing systems, contribute to efficiency improvements for foodservice providers As sustainability awareness and regulatory compliance continue to shape business practices, the food service outlets segment is expected to remain the dominant end-use category, driving ongoing growth in the PLA cup market and encouraging further product innovation.

Certifications that assure the quality and biodegradability of their products are catching the attention of the market players. They seek recognitions like PEFC (Programme for the Endorsement of Forest Certification) and FSC (Forest Stewardship Council). These certifications ensure that responsibly managed forests were only used to produce these materials.

Personalization and aesthetics are also gaining the interest of end users in this industry. The PLA cup market is experiencing innovations in printing and design. Market players are aimed to invest in eye catching and attractive designs that enhance the visual appeal of the PLA cups. This works as an effective marketing tool for the manufacturers.

The PLA cup market reached a valuation of USD 154.5 million in 2020, according to a Future Market Insights (FMI) report. It garnered a CAGR of 3.60% during the historical period.

| Historical CAGR (2020 to 2025) | 3.60% |

|---|---|

| Forecast CAGR (2025 to 2035) | 4.50% |

The recyclability of PLA cups is gaining the attention of consumers from various industries. Recycling companies can effectively use these cups for various new applications as their building blocks.

In the food service sector, the cafes are using these cups on a large scale. Be it a small chain or large scale, at some point, companies do require PLA cups for various applications in their business.

Adoption of Biodegradable products across Various Industries is pushing the Demand for PLA Cup

A substantial proportion of consumers are moving towards biodegradable products, like PLA cups, owing to their eco consciousness towards nature. The packaging and food service industries are the two major end users of the PLA cup market, surging sales.

Plastic pollution is another significant driver of the PLA cup market. Plastic is non-biodegradable and ultimately causes immense harm to nature. Manufacturers are owing to the eco-friendly set of consumers and focusing on strategies that can boost the quality of the cups.

Disposability and Longevity of the PLA Cup May Hinder Market Development

Although these cups are not as harmful as plastic ones, they take almost 90 days to decompose in a plant. This makes it a challenge to dispose of the cups in a proper manner.

Corn is one of the dominant sources with which these cups are manufactured. To manufacture the PLA cups, large quantities of corn are needed, which can increase the pricing of the corn in the long run.

The entire lifespan of a single cup can be almost six months, from sourcing, manufacturing, packing food, selling it, and disposing of it. This makes the cups an unsuitable option for exports as they will not provide prolonged longevity and protection.

This section provides a detailed analysis of two particular market segments for the PLA cup, the dominant capacity, and the end user. The two main segments discussed below are 8 to 14 oz capacity and food service outlets.

| Capacity | 8 to 14 oz |

|---|---|

| Market Share in 2025 | 36.2% |

In 2025, the PLA cup will be mostly used up for beverages within the capacity of 8 to 14 oz. The cups having this capacity will be widely in demand during the forecast period. The 8 to 14 oz capacity aligns with the consumer demand for medium or moderate serving sizes of beverages.

Smaller capacities are intended for consumers who want more modest servings for everyday usage, while bigger ones are appropriate for specialized cocktails or rich desserts. The surging demand for PLA cups with an 8 to 14 oz capacity range can be attributed to this balance, which appeals to health conscious customers aware of portion sizes and calorie consumption.

| End Use | Food Service Outlets |

|---|---|

| Market Share in 2025 | 47.4% |

In 2025, the food service outlets segment is poised to take a dominant share in the global market. The transparency and rigidity of these cups are making them so popular within various food service sectors.

Not only beverages, but these cups can also be used for salads, prepackaged meals, and fresh produce. These cups act as a protective barrier against carbon dioxide, oxygen, and water vapor, preventing the food from rotting.

This section will detail the PLA cup markets in key countries, including the United States, Germany, China, Spain and India. The below section will emphasize the reasons that are pushing growth in each of the regions.

| Countries | CAGR from 2025 to 2035 |

|---|---|

| The United States | 2.7% |

| Germany | 2.1% |

| China | 5.9% |

| Spain | 3.5% |

| India | 6.7% |

The United States PLA cup industry to gain a CAGR of 2.7% through 2035. The growing impact of large companies and restaurant chains on the promotion of sustainable practices is another driver propelling the PLA cup industry in the United States.

Numerous significant corporations have committed to diminishing their ecological impact and are actively pursuing substitutes for conventional plastic packaging, such as PLA cups.

The PLA cup market in Germany is expected to expand with a 2.1% CAGR through 2035. Manufacturing sustainable products is a priority for many German companies.

Shifting to PLA cups from plastic cups is in line with corporate sustainability objectives, enabling companies to show their dedication to environmental responsibility as well as draw in eco aware customers.

The PLA cup ecosystem in China is anticipated to develop with a 5.9% CAGR from 2025 to 2035. The usage of plastic is strictly prohibited in various Chinese regions. Plastic causes harm to the environment and prevents the country from reaching its carbon neutral targets.

The government and other regulatory bodies are thus issuing strict measures to limit plastic and promote the usage of biodegradable cutlery like PLA cups.

The PLA cup industry in Spain is anticipated to reach a 3.5% CAGR from 2025 to 2035. PLA cups are a type of cup that will continue to be in high demand as consumers become more conscious of using environmentally friendly products.

PLA cup are biobased polymer products from plant based renewable resources such as sugarcane starch and bamboo. PLA is a popular eco-friendly packaging solution among fast food restaurants, cafes, and other food businesses. Bio Cups lined with PLA are compostable and thus gaining traction.

The PLA cup ecosystem in India will likely evolve with a 6.7% CAGR during the forecast period. Every corner of the country has one or more fast food centers, which require disposable cutlery on a large scale.

Local delicacies from various parts of the country are a big factor behind the immense demand for PLA cups. Taste, affordability, and convenience are supporting the growth of fast food in India, which in turn is propelling the PLA cup market.

Innovation and product development are the key concerns of the global PLA cup market players. They are launching new products and new ranges on a regular basis. The products they are developing need to be favorable for the end users. More ergonomic design, more sustainable and higher quality products are catching the attention of the end users.

Market players are also working towards satisfying the personal requirements of the consumers. They are futureproofing the brand by including various innovative materials to their portfolio.

The key players in this market include:

Key Development by Market Players

| Report Attribute | Details |

|---|---|

| Growth Rate | CAGR of 4.5% from 2025 to 2035 |

| Market value in 2025 | USD 192.6 million |

| Market value in 2035 | USD 299.1 million |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | USD million for value |

| Report Coverage | Revenue Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered |

Capacity, Sales Channel, End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East & Africa |

| Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Poland, Russia, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC Countries, South Africa, Israel |

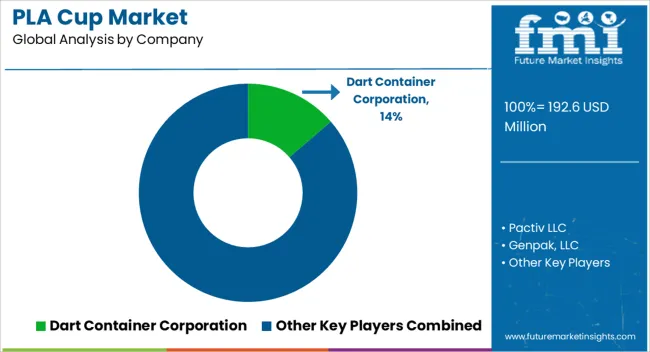

| Key Companies Profiled | Biopac Ltd; Celebration Paper & Plastics Ltd.; Avani Eco Hub; Eco Products, Inc.; Betterearth LLC; Green Paper Products; Genpak, LLC; Dart Container Corporation; Pactiv LLC; Lollicup USA Inc.; Eco Products Inc.; Go Pak UK LTD |

| Customisation Scope | Available on Request |

The global pla cup market is estimated to be valued at USD 192.6 million in 2025.

The market size for the pla cup market is projected to reach USD 299.1 million by 2035.

The pla cup market is expected to grow at a 4.5% CAGR between 2025 and 2035.

The key product types in pla cup market are up to 7 oz, 8 to 14 oz, 15 to 20 oz and above 20 oz.

In terms of sales channel, online segment to command 49.1% share in the pla cup market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plastic Portion Cup Market Trends & Industry Growth Forecast 2024-2034

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Derived Analgesics Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Packaging Market Forecast and Outlook 2025 to 2035

Plastic Cases Market Size and Share Forecast Outlook 2025 to 2035

Plastic Jar Industry Analysis in the United States Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plastic Cutlery Market Forecast and Outlook 2025 to 2035

Plastic Vial Market Forecast and Outlook 2025 to 2035

Plastic Tube Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plastic Hot and Cold Pipe Market Forecast and Outlook 2025 to 2035

Plastic Retort Can Market Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plastic Gears Market Size and Share Forecast Outlook 2025 to 2035

Plastic Additive Market Size and Share Forecast Outlook 2025 to 2035

Plastic Market Size and Share Forecast Outlook 2025 to 2035

Plain Bearing Market Size and Share Forecast Outlook 2025 to 2035

Platelet Shaker Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA