The plant based beverage market is experiencing robust expansion driven by rising consumer inclination toward sustainable and health-oriented diets. Increasing lactose intolerance prevalence, environmental awareness, and preference for clean-label products are reinforcing demand. Manufacturers are investing in innovation to improve texture, taste, and nutritional value, aligning products with mainstream beverage preferences.

The market is witnessing diversification in distribution networks and an increase in retail penetration, enhancing accessibility across both developed and emerging regions. Regulatory encouragement for plant-based alternatives and advancements in processing technologies are further accelerating product adoption.

The future outlook remains strong as producers focus on expanding portfolios with fortified and functional variants, targeting health-conscious and vegan consumers Growth rationale is anchored on consistent product innovation, improved supply chain integration, and the rising acceptance of dairy alternatives as everyday nutrition sources, positioning the market for continued growth and competitive differentiation over the forecast horizon.

| Metric | Value |

|---|---|

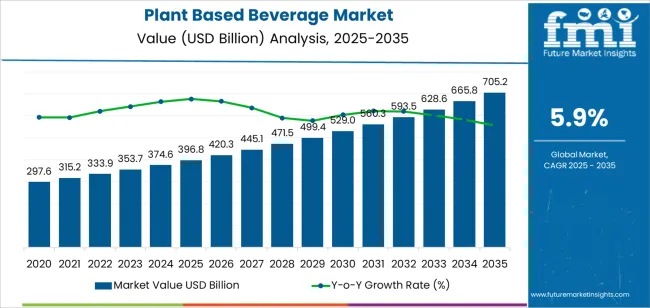

| Plant Based Beverage Market Estimated Value in (2025 E) | USD 396.8 billion |

| Plant Based Beverage Market Forecast Value in (2035 F) | USD 705.2 billion |

| Forecast CAGR (2025 to 2035) | 5.9% |

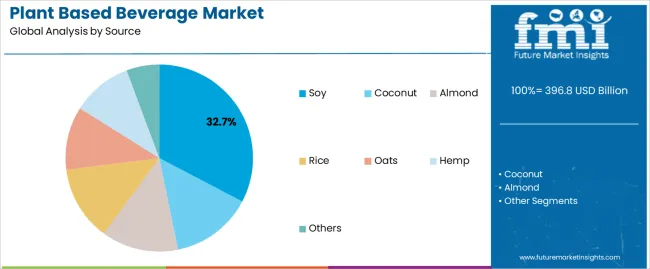

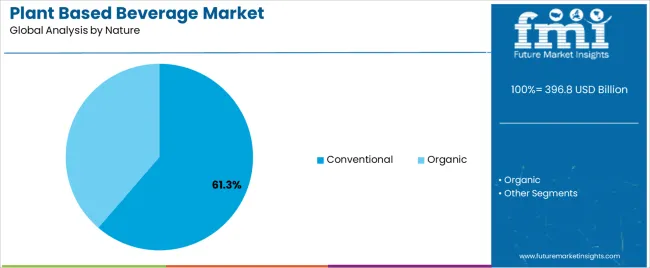

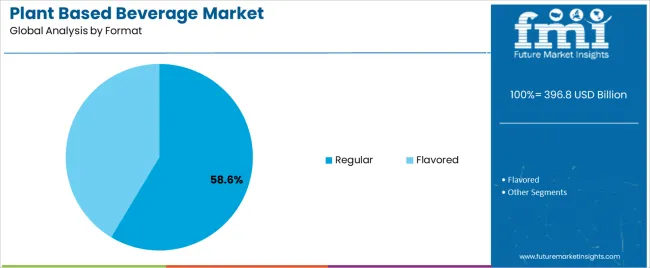

The market is segmented by Source, Nature, Format, Packaging, and Sales Channel and region. By Source, the market is divided into Soy, Coconut, Almond, Rice, Oats, Hemp, and Others. In terms of Nature, the market is classified into Conventional and Organic. Based on Format, the market is segmented into Regular and Flavored. By Packaging, the market is divided into Carton, Glass Bottles, Plastic Bottles and Pouches, and Cans. By Sales Channel, the market is segmented into Hypermarkets/Supermarkets, Convenience Stores, Independent Small Groceries, Specialty Stores, and Online Retailers. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The soy segment, accounting for 32.70% of the source category, has retained dominance owing to its established nutritional profile, wide availability, and compatibility with multiple beverage formulations. Its market leadership is supported by balanced protein content and functional stability, which make it suitable for various processing techniques. Consumer familiarity and affordability have reinforced its sustained consumption.

The segment benefits from consistent raw material supply and efficient production scalability, ensuring cost-effectiveness for manufacturers. Continuous product improvements aimed at reducing the characteristic beany flavor have expanded its appeal among broader consumer groups.

Demand is further supported by its role in fortified plant-based beverages, catering to both vegan and flexitarian consumers These factors collectively contribute to the segment’s ongoing strength within the plant based beverage market.

The conventional segment, holding 61.30% of the nature category, has been leading due to its widespread availability, price accessibility, and large-scale production capabilities. Manufacturers have relied on conventional sourcing to maintain consistent supply and meet high-volume demand from retail and foodservice channels.

The segment’s dominance is supported by the cost advantage it provides over organic counterparts, enabling broader consumer reach. Distribution efficiencies and established procurement systems have reinforced market stability, while manufacturers continue to focus on enhancing product transparency and quality.

Although the organic sub-segment is gaining traction, the conventional segment remains integral due to its affordability and adaptability in mainstream markets Its sustained preference among consumers seeking value-driven plant-based alternatives ensures continued market leadership in the foreseeable period.

The regular segment, representing 58.60% of the format category, has maintained its leading position as the preferred choice among consumers seeking familiar taste profiles and daily consumption options. Its accessibility in standard packaging formats and versatility for use in coffee, smoothies, and direct drinking applications have driven steady sales.

Producers have optimized formulations to balance flavor, consistency, and nutrition, ensuring parity with dairy counterparts. The regular segment continues to attract both new and repeat consumers due to affordability and convenience.

Expanding retail presence, coupled with marketing campaigns promoting plant-based lifestyles, has further strengthened its dominance Future growth will be supported by innovation in flavor diversification and shelf-life improvement, ensuring the segment’s continued prominence within the plant based beverage market.

| Historical CAGR | 5.51% |

|---|---|

| Forecast CAGR | 5.92% |

The historical CAGR of the plant based beverage market was 5.51%, indicating a staggering moderate rate over the past few years. The forecast CAGR is expected to be 5.92%, indicating a slight yet slight increase in the growth rate through 2035.

The forecast CAGR of 5.92% indicates a slight increase in the growth rate of the market in comparison to the historical CAGR in the future. The rise in CAGR can be attributed to several factors, including

Regulatory support for vegan products as well as policy reforms encourage sustainability and health-conscious choices of the industry

The table analyses the top five countries ranked by revenue, with India holding the top position.

Due to the voluminous vegetarian population, long history of plant-based diets, and an increase in desire for healthier options, India considerably rules the world in this market. The diverse agricultural resources of the nation provide a large range of plant based beverage options.

Forecast CAGRs from 2025 to 2035

| Countries | CAGR from 2025 to 2035 |

|---|---|

| The United States | 5.7% |

| Germany | 6.3% |

| China | 8.1% |

| Japan | 4.4% |

| India | 8.5% |

Health-conscious consumers are the main force behind the plant based beverage business in the United States. An increasing number of the population are substituting plant based beverages for traditional dairy products as they become more responsible towards their health.

For example- plant-based milks, like almond, soy, and oat milks, are substituted in place of dairy in a variety of recipes, like cereals, baked goods, and smoothies. Plant based beverages are becoming extensively popular in the market among people who have dairy allergies or lactose intolerance.

The market in Germany is impacted by the rise in vegetarianism and environmental sustainability concerns. As part of their efforts to live a healthy and more sustainable life consumers are lessening their environmental impact, and choosing more and more plant-based dairy substitutes.

The market is realizing significant growth driven by the upsurge on health and wellness among consumers of China. A growth in demand for healthier and more natural food and beverage options is directly proportion to the rise in incomes and urbanization.

Traditionally Chinese ingredients like soybeans and oats are being utilized in the production of plant based beverages for catering to local tastes and preferences.

The traditional beverage culture and health-conscious tendencies in Japan have a major impact on the market for plant based beverages. Due to dietary preferences and health concerns Japan has historically consumed less dairy than Western nations, and has shown a rise in interest in plant-based alternatives.

In Japan, plant-based drinks such as rice milk and soy milk are frequently enjoyed as a complementary to traditional foods and drinks. The country largely emphasises on natural and healthful eating practices with the usage of plant-based products in their cuisines.

India considerably has a pivotal position in this market due to its unique nutritional and cultural customs. India boasts a flourishing market for plant based beverages because of its vast vegetarian population and its enduring practices for plant-based meals.

Health-conscious consumers also look for some wholesome, lactose-free dairy substitutes that are major factors driving the market for plant based beverages in India.

The below section shows the leading segment. Based on nature, the conventional segment is accounted to hold a market share of 92.1% in 2025. Based on source, the plant-based juices segment is accounted to hold a market share of 67.8% in 2025.

Conventional beverages come in a huge range of flavors, textures, and forms to suit a broad range of tastes and preferences, making them a backbone in the diets of many people for decades.

Juices made from plants comprise of components that are high in vitamins, minerals, antioxidants, and phytonutrients, mainly supporting the immune system, hydrating the body, and promoting digestion, among other health advantages.

| Category | Market Share in 2025 |

|---|---|

| Conventional | 92.1% |

| Plant-based Juices | 67.8% |

Based on nature, conventional segment tends to hold a substantial 92.1% market share in 2025. This category mainly involves drinks made using traditional ingredients and manufacturing processes.

Beverages like fruit juices, carbonated drinks, energy drinks, and bottled water are some of them. Conventional beverages often use conventional ingredients and manufacturing techniques for accommodating the tastes, preferences and habits of the general public.

Based on source, plant-based juices hold a noteworthy market share of 67.8% in 2025. This category comprises of drinks that consist only plant based components and not any kind of animal derivatives.

Juices made from plants, like fruits, vegetables, and other botanical sources, provide a natural and health-conscious substitute for traditional fruit juices. Such juices are healthier in content due to the presence of vitamins, minerals, and antioxidants.

The fascination of the market for cruelty-free and sustainable products, along with boom in consumer awareness of health and wellbeing, thus drives the popularity of plant-based drinks.

Established businesses tend to battle against the surge in number of creative startups and niche brands in the competitive environment of the plant based beverage industry. The demand of the customer for plant-based beverages increases in a rightward direction due to health and environmental concerns.

The companies hence compete for market share by providing a wide variety of plant based beverage options, by making investments in product innovation, and developing their distribution networks.

Key Developments in the Plant Based Beverage Industry

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 396.8 billion |

| Projected Market Valuation in 2035 | USD 705.2 billion |

| Value-based CAGR 2025 to 2035 | 5.9% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Source, Nature, Format, Packaging, Sales Channel, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

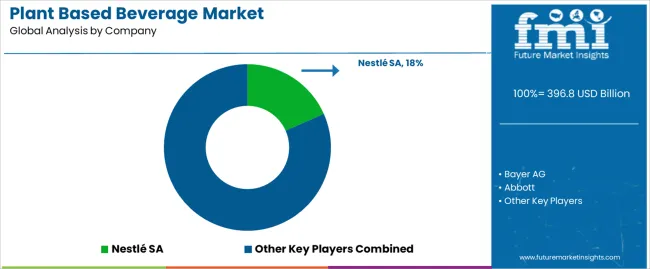

| Key Companies Profiled | Bayer AG; Abbott; DSM; DuPont.; Amway; The Nature's Bounty Co.; GlaxoSmithKline plc.; Nestlé SA; RiceBran Technologies; Mead Johnson & Company LLC; Medifast Inc. |

The global plant based beverage market is estimated to be valued at USD 396.8 billion in 2025.

The market size for the plant based beverage market is projected to reach USD 705.2 billion by 2035.

The plant based beverage market is expected to grow at a 5.9% CAGR between 2025 and 2035.

The key product types in plant based beverage market are soy, coconut, almond, rice, oats, hemp and others.

In terms of nature, conventional segment to command 61.3% share in the plant based beverage market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant-Based Protein Beverages Market Trends – Growth & Forecast 2025 to 2035

Ingredients Market for Plant-based Food & Beverages Size and Share Forecast Outlook 2025 to 2035

Plant-Based Feed Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Vitamin D3 Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Based Meals Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Squalane Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Protein Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Bioplastic Shrink Packaging Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant-Based Methionine Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant-Based Shrimp Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Yogurt Market Analysis - Size, Share, and Forecast 2025 to 2035

Plant-Based Milk Market Insights – Growth & Demand 2025–2035

Plant-Based Chorizo Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Thickener Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA