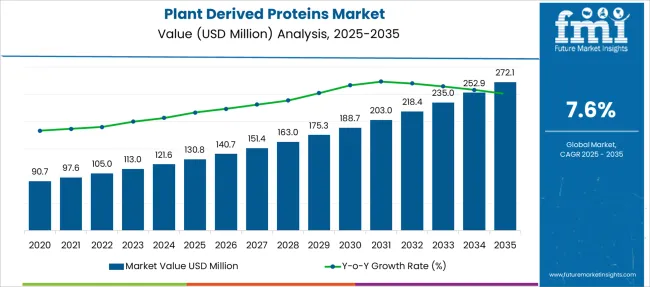

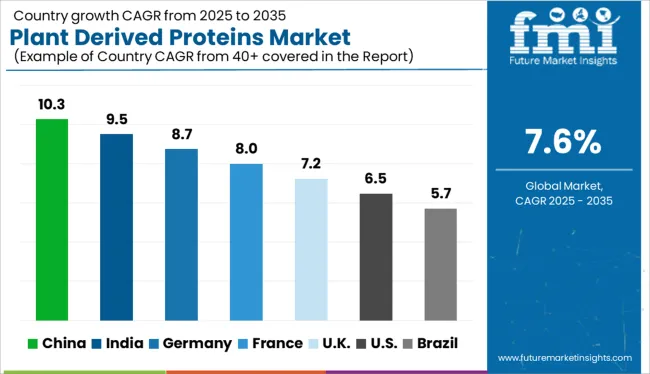

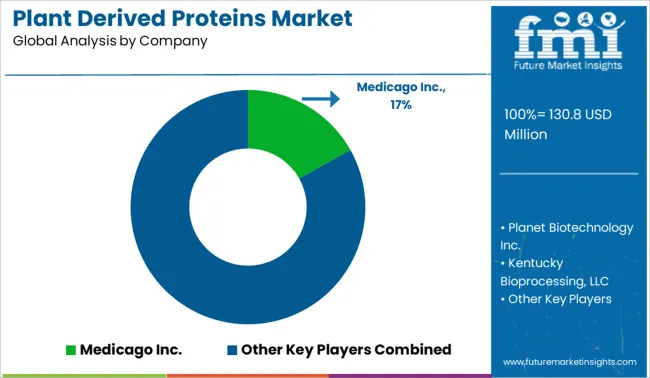

The Plant Derived Proteins Market is estimated to be valued at USD 130.8 million in 2025 and is projected to reach USD 272.1 million by 2035, registering a compound annual growth rate (CAGR) of 7.6% over the forecast period.

| Metric | Value |

|---|---|

| Plant Derived Proteins Market Estimated Value in (2025 E) | USD 130.8 million |

| Plant Derived Proteins Market Forecast Value in (2035 F) | USD 272.1 million |

| Forecast CAGR (2025 to 2035) | 7.6% |

The plant derived proteins market is expanding due to the rising demand for sustainable and eco-friendly protein sources in food pharmaceutical and industrial applications. Growing consumer awareness about health and environmental impacts has accelerated interest in plant-based alternatives. Advances in biotechnology and agricultural practices have enabled enhanced extraction and processing methods that improve protein quality and yield.

Increased investments in research have also supported the development of novel protein products with tailored functional properties. Additionally regulatory encouragement and public interest in reducing reliance on animal proteins have contributed to market expansion.

The market outlook remains positive as innovations in plant cultivation and protein processing continue to evolve. Growth is expected to be driven by tobacco as a versatile plant type protein biopolymers as a functional protein form and in-vitro culture systems as an advanced production platform.

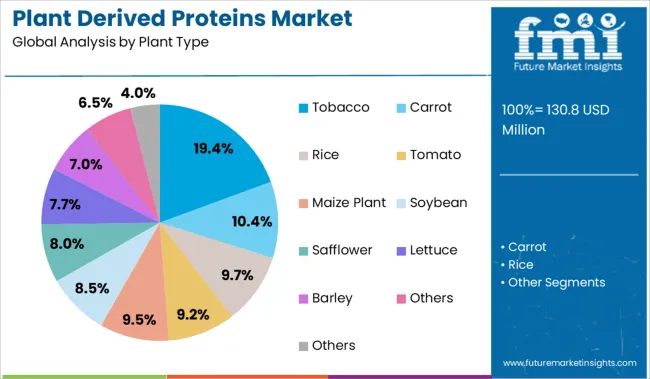

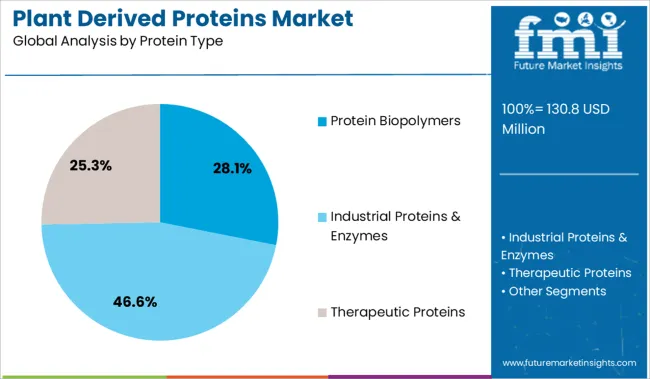

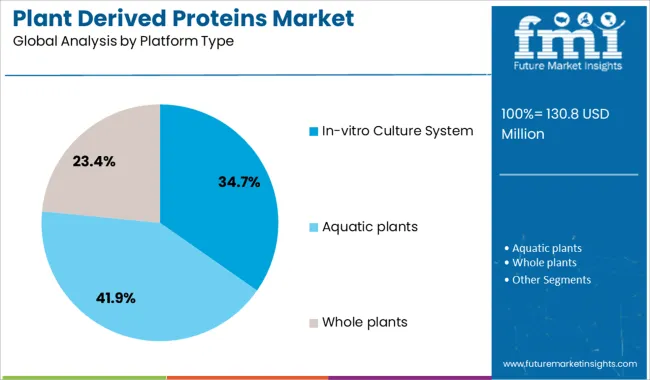

The market is segmented by Plant Type, Protein Type, Platform Type, Application, and End User and region. By Plant Type, the market is divided into Tobacco, Carrot, Rice, Tomato, Maize Plant, Soybean, Safflower, Lettuce, Barley, Others, and Others. In terms of Protein Type, the market is classified into Protein Biopolymers, Industrial Proteins & Enzymes, Therapeutic Proteins, and Cell Culture Functional Proteins. Based on Platform Type, the market is segmented into In-vitro Culture System, Aquatic plants, and Whole plants. By Application, the market is divided into Regenerative Medicine-Therapeutic Agents, Regenerative Medicine-Functional Material, and Cell Culture Application. By End User, the market is segmented into Biopharmaceutical Companies, Academic & Research Institutes, Contract Research Organization (CROs), and Contract Manufacturing Organization (CMOs). Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The tobacco segment is projected to hold 19.4% of the plant derived proteins market revenue in 2025 becoming a significant plant source. Tobacco’s value has been recognized due to its fast growth cycle and high protein content which make it an attractive candidate for scalable protein extraction. Biotechnological advancements have allowed the modification of tobacco plants to produce specific proteins for pharmaceutical and industrial uses.

The plant’s adaptability to diverse climates supports its cultivation in multiple regions enhancing supply stability.

These factors combined have positioned tobacco as a leading plant source within the market.

Protein biopolymers are expected to contribute 28.1% of the market revenue in 2025 dominating the protein type category. This segment has been driven by the growing use of protein biopolymers in biodegradable materials packaging and medical applications. The functional versatility of these biopolymers has made them a preferred choice in developing sustainable alternatives to synthetic polymers.

Innovations in extraction and processing techniques have improved the performance characteristics of protein biopolymers enhancing their market adoption.

Increased environmental regulations have further supported the shift toward biodegradable protein-based products. These trends are anticipated to sustain growth in the protein biopolymers segment.

The in-vitro culture system segment is forecasted to represent 34.7% of the plant derived proteins market revenue in 2025 leading the platform type category. This growth is attributed to the ability of in-vitro systems to provide controlled environments for consistent high-quality protein production. These systems offer advantages such as rapid scalability reduced dependency on climatic factors and minimized land use.

Research advancements have enabled optimization of culture conditions increasing yield and purity of target proteins.

Furthermore in-vitro platforms facilitate the production of proteins that are difficult to extract from whole plants opening new application avenues. As demand for reliable sustainable protein sources grows in food pharmaceutical and material sectors the in-vitro culture system segment is expected to maintain its leadership position.

| Particulars | Details |

|---|---|

| H1, 2024 | 8.89% |

| H1, 2025 Projected | 8.36% |

| H1, 2025 Outlook | 7.86% |

| BPS Change - H1, 2025 (O) - H1, 2025 (P) | (-) 50 ↓ |

| BPS Change - H1, 2025 (O) - H1, 2024 | (-) 102 ↓ |

According to Future Market Insights analysis, the global plant derived proteins market expects to drop by 102 Basis Point Share (BPS) in H1-2025 as compared to H1- 2024. Whereas in comparison to H1-2025 projected value, the market during H1-2025 outlook period will show a dip of 50 BPS. The market is subject to regulatory dynamics, pricing fluctuations, and licensing of biologics.

The dip in the BPS values for the market is associated with the emergence of the “free-form” anthology in specialty foods which encloses a gluten and soy-free diet. With the establishment of increased customer choice for gluten and soy-free food products, the market for plant derived products observed a decline in the BPS values.

Conversely, plant derived scaffold proteins for research purposes support cell adhesion and proliferation for regenerative medicine and drug screening by forming critical biomatrices. This has supported promising clinical outlooks, and will pose a positive impact upon the market growth.

The demand in the global plant derived proteins market grew at a CAGR of 7.6% over the past assessment period 2014 to 2024. Plant derived proteins are estimated to create an absolute dollar opportunity of USD 130.8 Million by the end of 2025.

Plant derived proteins are biologics sourced from tobacco leaves, rice seeds, carrots, and others by molecular farming or cell-culture procedures. These proteins are natural and environmentally sustainable and have significant potential in comparison to other biologics such as microbial and mammalian cells. For instance, the plant derived experimental antibody named ZMapp was reported to be more effective against the Ebola Virus than others.

Hence, advancements in plant expression vectors, glycoengineering, and downstream processing have resulted in increasing use of plants as a superior alternative for biologics production. Driven by this, the sales in the global plant derived proteins are estimated to surpass USD 272.1 Million by the end of 2035.

Rising prevalence of diseases such as diabetes, hepatitis, lymphoma, and Gaucher disease among others across the world has created strong demand for advanced therapeutics. This significant surge in demand for biologics and drugs cannot be met by current production platforms such as microbial and mammalian cells due to their higher cost and limited scalability.

Hence, numerous biopharmaceutical companies are shifting their focus on using animal-free substitutes such as plants owing to their benefit such as eukaryotic protein modification, high scalability, low cost. This is estimated to accelerate the sales of plant derived proteins in the market.

In addition to this, increasing usage of plant derived proteins as raw materials for therapeutic drug production and surging demand for replacement proteins such as insulin and albumin is expected to assist the market to expand at a CAGR of 8.4% over the forecast period 2025 to 2035.

Implementation of stringent guidelines and standards for the production of plant derived proteins by regulatory bodies such as European Medicines Agency (EMA) and Food and Drug Administration (FDA) is hampering the sales in the market.

Also, implementation of ban on the plantation of tobacco in certain countries across Europe, increasing inclination towards biosimilar drugs, and rising incidence of allergic reactions to the drugs produced from genetically engineered plants are factors restraining the growth in the plant derived proteins market.

Growing Emphasis on Launching Novel Therapeutics to Bolster Plant Derived Proteins Sales

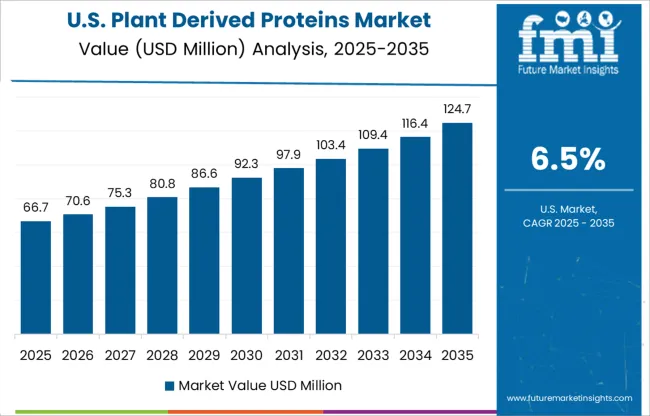

Future Market Insights states that the USA is projected to register the fastest growth in the North America plant derived proteins market over the assessment period.

With increasing demand for novel plant derived proteins and other biologics-based drugs, leading players in the country are increasingly focusing on developing novel therapeutics and vaccines. For instance, iBio, Inc., an American biologics manufacturing company, announced using its advanced FastPharming technologies to develop three novel plant-based biologics, IBIO-100, IBIO-200, and IBIO-201 in October 2024.

A slew of such developments and product launches is estimated to bolster the sales of plant derived proteins in the USA market.

Increasing Burden of Diabetes to Fuel the Demand for Plant Derived Recombinant Proteins

As per FMI, India, home to a large number of biotechnology and pharmaceutical companies, is estimated to emerge as the most lucrative plant derived proteins market in South Asia between 2025 and 2035.

The incidence of lifestyle diseases such as diabetes is rapidly increasing owing to the growing fast-paced lifestyle and changing eating habits in India. For instance, according to the International Diabetes Federation, around 121.6 million cases of diabetes between ages 20 to 79 were reported across India, exhibiting a 9.6% rate of incidence in 2024.

As plant derived recombinant proteins such as insulin are extensively being used by diabetic patients to maintain their insulin levels, rising burden of diabetes is expected to elevate the demand for plant derived proteins in India market.

Rising Demand for Cosmetic Products to Bolster the Plant Derived Proteins Sales

The UK is anticipated to register robust growth in the plant derived proteins market in Europe during the forecast period 2025 to 2035, reveals FMI.

Plant derived proteins are gaining immense popularity across the cosmetic industry, owing to their natural, better results, and environmentally-sustainable attributes. On account of this, leading industry players are shifting the preference towards using plant derived proteins from microbial and mammalian cells for the formulation of face creams, serums, and others cosmetic products.

Hence, rapidly increasing demand for cosmetic products on the back of rising emphasis on enhancing facial aesthetics among the population in the UK is projected to bolster the sales of plant derived proteins in the market.

Growing Usage in Breast Cancer Treatment Drugs to Accelerate Plant Derived Therapeutic Proteins Demand

The tobacco segment is estimated to register robust growth, accounting for nearly 39.6% of the plant derived proteins sales through 2025.

Tobacco plant is considered as the ideal host for plant-based engineered proteins owing to its high yield production, rapid plant growth, and ability to produce large amounts of antibodies within 6 to 7 days. In addition to this, increasing use of tobacco derived proteins in breast cancer treatment drugs is favoring sales of plant derives therapeutic proteins in the segment.

Rising Adoption of Novel Cell Culture Platforms to Favor the Plant Derived Proteins Market Growth

On the basis of platform, the global plant derived proteins market is segmented into in-vitro cell culture systems, whole plants, and others. FMI estimates that the in-vitro cell culture systems will account for a significant share in the market over the forecast period. Increasing adoption of novel cell culture platforms such as in-vitro cell culture by biopharmaceutical companies for novel drug production is driving the growth in the segment.

In terms of application, the regenerative medicine-therapeutic agents segment is projected to exhibit rapid growth in the global market through 2035. Growing usage of plant derived proteins as therapeutic agents across the cosmetics industry is the primary factor augmenting sales across the segment.

Therapeutic Proteins Segment to Account for the Maximum Plant Derived Therapeutic Proteins Sales

Therapeutic proteins demand is likely to grow at a rapid pace, accounting for more than 70% of the plant derived proteins sales from 2025 to 2035 in terms of protein.

Demand for plant derived therapeutics proteins such as monoclonal antibodies and vaccines is rapidly increasing on the back of their efficiency in the treatment of diseases. Hence, they are extensively being used for the production of biologics and drugs for the treatment of diseases such as anemia, hepatitis, cancer, hemophilia, and others, which is in turn, facilitating the growth in the segment.

Rising Novel Drug Development Activities to Spur Sales of Plant Derived Proteins

Among end users, biopharmaceutical companies are projected to continue leading the plant derived proteins market, accounting for over 50% of the demand share by the end of assessment period.

Increasing government support in research and development (R&D) activities for the production of more effective therapeutics drugs and shifting preference on using plant-based biologics owing to their high scalability and low cost are factor augmenting the sales across the segment.

Key players in the plant derived proteins market are focusing in adoption expansion strategies such as new product launch and product approval to gain competitive edge. Some of the other companies are aiming at collaboration, merger, and acquisition with other players to expand their market share. For instance,

| Attribute | Details |

|---|---|

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2014 to 2024 |

| Market Analysis | USD Million for Value |

| Key Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa |

| Key Countries Covered | USA, Canada, Germany, UK, France, Italy, Spain, Poland, Russia, China, Japan, South Korea, India, Thailand, Malaysia, Vietnam, Indonesia, Australia, New Zealand, GCC Countries, Turkey, Northern Africa, South Africa |

| Key Segments Covered | Plant, Protein, Platform, Application, End User, and Region |

| Key Companies Profiled | Amgen Inc; Abbott Laboratories; AstraZeneca; Merck KGaA; Baxter International; Boehringer Ingelheim; Chugai Pharmaceutical; Diasome Pharmaceuticals; Eli Lilly & Company; Protalix Biotherapeutic; F. Hoffmann-La Roche; Generex Biotechnology; GeneScience Pharmaceuticals; Group Biogen Idec Inc; Hualan Biological Engineering; Johnson & Johnson; Kyowa Hakko Kirin; Novo Nordisk |

| Report Coverage | Market Forecast, brand share analysis, competition intelligence, DROT analysis, Market Dynamics and Challenges, Strategic Growth Initiatives |

| Customization & Pricing | Available upon Request |

The global plant derived proteins market is estimated to be valued at USD 130.8 million in 2025.

The market size for the plant derived proteins market is projected to reach USD 272.1 million by 2035.

The plant derived proteins market is expected to grow at a 7.6% CAGR between 2025 and 2035.

The key product types in plant derived proteins market are tobacco, carrot, rice, tomato, maize plant, soybean, safflower, lettuce, barley, others and others.

In terms of protein type, protein biopolymers segment to command 28.1% share in the plant derived proteins market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Plant Genome Extraction Kit Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Beverage Market Forecast and Outlook 2025 to 2035

Plant-based Body Paint Pigments Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Plastic Market Forecast and Outlook 2025 to 2035

Plant Stem Cell Encapsulation Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Stem Cell Skincare Product Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Cheese Market Size and Share Forecast Outlook 2025 to 2035

Plant Based Meat Packaging Market Size and Share Forecast Outlook 2025 to 2035

Plant Sterol Supplements Market Size and Share Forecast Outlook 2025 to 2035

Plant Protein Hydrolysate Market Size and Share Forecast Outlook 2025 to 2035

Plant Asset Management Market Size and Share Forecast Outlook 2025 to 2035

Plant Peptides Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Foam Market Size and Share Forecast Outlook 2025 to 2035

Planting Machinery Market Size and Share Forecast Outlook 2025 to 2035

Plant-based Snacks Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Plant Based Meals Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Squalane Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Plant Breeding Market Size and Share Forecast Outlook 2025 to 2035

Plant-Based Protein Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Plant-Powered Exfoliants Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA