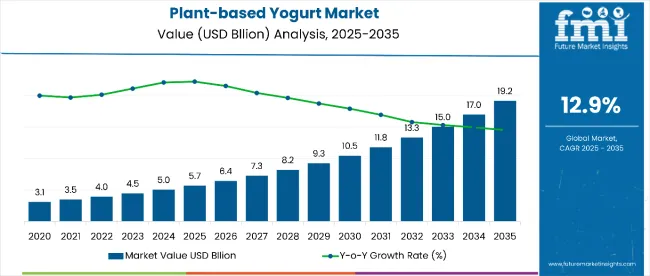

The plant-based yogurt market is valued at USD 5.7 billion in 2025 and is slated to reach USD 19.3 billion by 2035, which shows a 12.9% CAGR. The plant-based yogurt market is experiencing significant growth due to increasing consumer awareness of health and wellness.

| Metric | Value |

|---|---|

| Market Size in 2025 | USD 5.7 billion |

| Projected Market Size in 2035 | USD 19.3 billion |

| CAGR (2025 to 2035) | 12.9% |

Many people are turning away from traditional dairy products because of lactose intolerance, dairy allergies, and concerns about cholesterol and saturated fat. Plant-based yogurts, often made from almond, coconut, oat, or soy, provide a lactose-free and cholesterol-free alternative that is often fortified with probiotics and essential nutrients. The rising demand for gut-friendly and low-sugar options, particularly among younger, health-conscious demographics, is driving this shift.

Another key factor behind the market’s growth is the rising concern over environmental sustainability and animal welfare. Consumers are increasingly aware of the ecological footprint of dairy farming, including its greenhouse gas emissions, water usage, and impact on biodiversity. As a result, many are choosing plant-based options as a way to reduce their environmental impact. This trend is reinforced by the popularity of vegan, vegetarian, and flexitarian diets, which are being adopted by a growing number of people for ethical, environmental, or personal health reasons.

Innovation and accessibility are also playing major roles in the expansion of the plant-based yogurt market. Advances in food technology have led to significant improvements in taste, texture, and nutritional content, making these products more appealing and comparable to dairy yogurt.

At the same time, increased availability in mainstream supermarkets, health food stores, and online platforms has made it easier for consumers to access these options. Companies are offering a wider range of flavors and formats, including drinkable yogurts and high-protein variants, catering to diverse consumer preferences and further fueling market growth.

In terms of nature, the functional ingredients segment leads with 48% share.Based on sales channel, the retail segment captures 62% share. South Korea is the fastest-growing market with 13.2% CAGR. Innovation and accessibility are playing major roles in the expansion of the plant-based yogurt market. Advances in food technology have led to significant improvements in taste, texture, and nutritional content, making these products more appealing and comparable to dairy yogurt.

At the same time, increased availability in mainstream supermarkets, health food stores, and online platforms has made it easier for consumers to access these options. Companies are offering a wider range of flavors and formats, including drinkable yogurts and high-protein variants, catering to diverse consumer preferences and further fueling market growth.

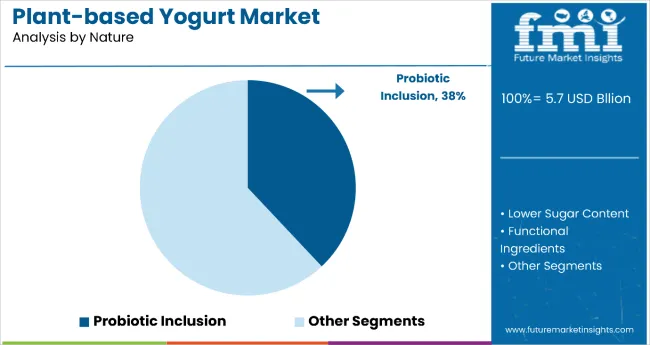

Probiotic inclusion holds the dominant position with 38% of the market share in the nature category within the plant-based yogurt market. This leadership is driven by growing consumer awareness of gut health benefits and the increasing demand for functional foods that deliver probiotics alongside plant-based nutrition.

Probiotic-rich plant-based yogurts appeal to health-conscious consumers seeking to support digestive wellness and immune function through beneficial bacteria strains like Lactobacillus and Bifidobacterium.

The segment's dominance is reinforced by the rising trend toward functional foods and the consumer preference for products that provide health benefits beyond basic nutrition. Many plant-based yogurt brands are emphasizing probiotic inclusion as a key differentiator, with products containing billions of live active cultures that survive the manufacturing and storage process.

As consumers continue to prioritize gut health and seek plant-based alternatives that match or exceed the functional benefits of traditional dairy yogurt, the probiotic inclusion segment is positioned to maintain its market leadership through continued innovation in probiotic strain diversity and delivery systems.

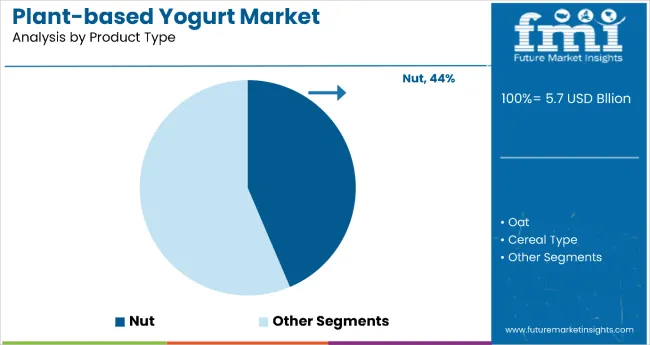

Nut-based plant yogurt dominates the product type category with 43.6% of the market share within the plant-based yogurt market. This leadership is attributed to nut-based yogurts' superior creamy texture, rich nutritional profile, and premium taste experience that closely mimics traditional dairy yogurt.

Almond, cashew, and coconut-based yogurts are particularly popular due to their natural creaminess and ability to deliver satisfying mouthfeel and flavor profiles that appeal to both plant-based newcomers and experienced consumers.

The segment's dominance is reinforced by nut-based yogurts' premium positioning and their ability to provide healthy fats, protein, and essential nutrients that align with consumer health priorities. The nut milk yogurt market is experiencing exceptional growth with a projected CAGR of 14.0% from 2026 to 2033, driven by increasing consumer preference for artisanal, small-batch productions that emphasize quality and taste.

As the market continues to evolve toward more sophisticated flavor profiles and premium experiences, the nut segment is expected to maintain its dominant position through continued innovation in processing techniques and ingredient sourcing that enhance texture, taste, and nutritional value.

High Production Costs and Supply Chain Complexities

High production costs and the supply and demand imbalance are some of the limitations that the Plant-based yogurt market is dealing with. The prices of raw ingredients like almonds, coconuts, and oats are also increasing in cost with changing agricultural harvests and disruptions in supply chains.

Also, to approximate the taste and texture of dairy-based yogurt, plant-based ingredients must be processed using specialized equipment and advanced formulations. For improved profitability and affordability for the consumer, companies must invest in sustainable sourcing to increase revenue in manufacturing processes, and invest heavily in innovative and cost-effective new ingredient blending.

Regulatory Compliance and Labeling Standards

As befits the plant-based yogurt industry, it is highly regulated when it comes to listing of ingredients, nutritional claims and food safety. Dairy definition varies between countries, which is an important consideration for labeling and marketing strategies.

In addition, plant-based products must also adhere to stringent food safety and quality standards, thereby incurring higher compliance costs. These regulatory challenges call for companies to collaborate with regulators, invest in transparent laboratory practices, and work around local food safety laws.

Rising Consumer Demand for Dairy Alternatives

The shift to increasingly plant-based diets is creating a market for dairy-free yogurt products. Especially lactose-free, vegan products that contain a lot of probiotics. In addition to health consciousness, growing concerns over dairy allergies and ethical food choices is opening opportunities for manufacturers to focus on expanding their product offerings. Brands that introduce innovations with functional ingredients like protein fortification, probiotics, and added vitamins will appeal to a top of mind health-minded consumer base.

Expansion of Retail and Online Distribution Channels

Distribution channels have also diversified, with distribution of plant-based yogurt taking place through various e-commerce and retail channels across local and international marketplaces. Online grocery platforms, specialty health food stores and mainstream supermarkets are allotting more shelf space for plant-based dairy alternatives.

Moreover, direct-to-consumer sales models allow brands to expand their reach. The companies making rental solutions in different mediums, working through the digital marketing, influencer, and personalized customer segments will prevail in this new market.

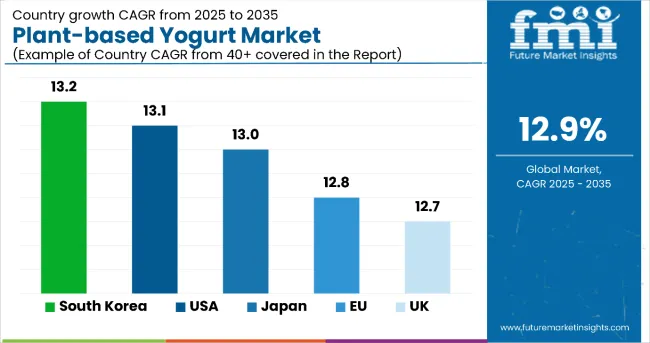

The plant-based yogurt market is expected to grow robustly across all these regions from 2025 to 2035, with South Korea leading slightly at a CAGR of 13.2%. The USA follows closely with a 13.1% growth rate, reflecting strong consumer demand and innovation.

Japan and the European Union show similarly strong growth at 13.0% and 12.8%, respectively, driven by increasing health awareness and plant-based diet adoption. The UK has a slightly lower but still impressive CAGR of 12.7%. Overall, these figures highlight rapid and relatively uniform expansion globally, with Asia-Pacific markets like South Korea and Japan marginally outpacing Western markets.

Growth of this market in the United States is fueled by the rapidly increasing consumer preference for dairy alternatives and plant-based diets. This demand is supported by lactose intolerance, health awareness, and the increasing popularity of veganism. The increase in the number of products and brands in the free product ranges of supermarkets and health stores and its impact on the market growth

Key players are launching new and innovative flavors as well as fortified options to meet the changing tastes of consumers. Marketing campaigns that promote sustainability and ethical consumption affect purchasing decisions;

| Country | CAGR (2025 to 2035) |

|---|---|

| USA | 13.1% |

Growth in the UK dairy alternatives sector is largely being driven by greater public awareness about the negative environmental impact of dairy farming as well as a healthier, more nutritional approach to eating among UK consumers. Demand for organic, non-GMO, and clean-label products is growing too.

In response to the trend, retailers and foodservice providers are embracing a wider variety of dairy-free yogurts. The market is also expanding due to governmental initiatives encouraging plant-based diets as well as sustainability objectives.

| Country | CAGR (2025 to 2035) |

|---|---|

| UK | 12.7% |

The plant-based yogurt market in the European Union is seeing a boom, led by Germany, France, and the Netherlands. Demand for dairy analogues based on plants is increasing, and regulations on the production and labeling of dairy products are strict, driving the growth of the market.

Supermarket chains introduce dedicated plant-based sections, which makes things more accessible too. And companies are responding with better formulations, including high-protein and probiotic-enriched varieties.

| Region | CAGR (2025 to 2035) |

|---|---|

| European Union (EU) | 12.8% |

Lactose intolerance is rising among Japanese people, and they are now increasingly interested in functional foods, fuelling the plant-based yogurt market in Japan. And traditional dietary habits are driving consumers to soy-based and rice-based yogurt substitute.

Accessibility has also improved with the availability of convenience stores and supermarkets offering plant-based products. Moreover, advancements in fermentation technology and sourcing local ingredients are creating opportunities for market growth. Various government initiatives for healthy aging and functional foods further support the market.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 13.0% |

The report provides a comprehensive analysis of the South Korea plant-based yogurt market and its major drivers including rising inclination among consumer for plant-based as well as functional food. The country’s café culture has made dairy-free yogurt-based smoothies and desserts easy to find. Plant-based fermentation techniques and flavors especially almond and oat-based yogurts are also opening possibilities.

The increasing population of vegan and flexitarian people is also benefitting the market growth. In addition, demand is being driven by social media influence and celebrity endorsements.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 13.2% |

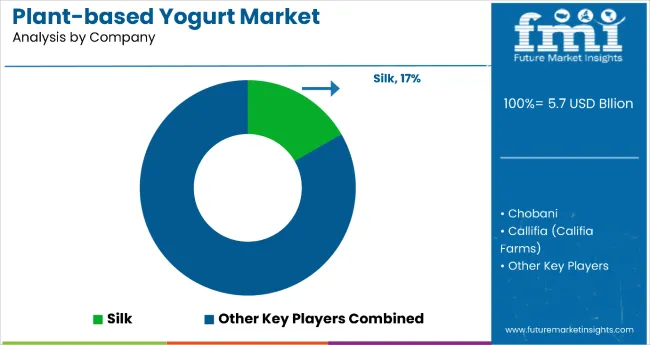

The plant-based yogurt market is moderately fragmented, with several key players driving innovation and growth. Companies like Chobani and Silk leverage strong brand recognition and wide distribution, while niche brands such as Kite Hill, Forager, and Good Karma focus on artisanal quality and specialized ingredients. Callifia and LAVVA emphasize clean-label and functional benefits, catering to health-conscious consumers.

Nancy’s and So Delicious offer a broad range of dairy-free options, enhancing market diversity. Good Plants targets environmentally sustainable production. This diverse competitive landscape reflects varying consumer preferences, preventing consolidation and fostering a dynamic market where both established giants and smaller innovators coexist and compete.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 5.7 billion |

| Projected Market Size (2035) | USD 19.3 billion |

| CAGR (2025 to 2035) | 12.9% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD billion, kilotons in volume |

| By Nature | Probiotic Inclusion (38% share in 2025), Lower Sugar Content (27%), Functional Ingredients (21%) |

| By Product Type | Oat (32%), Nut (24%), Legume (18%), Cereal Type (11%), Seed (9%), Pseudo Cereal (6%) |

| By Flavor | Regular (28%), Vanilla (18%), Strawberry (14%), Blueberry (9%), Coconut (7%), Others (24%) |

| By Price Range | Mid-Range (46%), Premium (35%), Economic (19%) |

| By Sales Channel | Retail (62%), E-commerce (14%), Food Service (9%), Others (15%) |

| By Region | North America, Latin America, East Asia, South Asia & Pacific, Eastern Europe, Western Europe, Middle East & Africa |

| Countries Covered | USA, UK, Germany, Japan, South Korea |

| Key Players influencing the Plant-based Yogurt Market | Danone S.A., Chobani LLC, Califia Farms, General Mills Inc., Forager Project |

| Additional Attributes | Segment-wise Market Share, Country-wise CAGR, Product Development Trends |

| Customization and Pricing | Available upon Request |

The overall market size for plant-based yogurt market was USD 5.7 billion in 2025.

The plant-based yogurt market expected to reach USD 19.3 billion in 2035.

What will drive the demand for plant-based yogurt market during the forecast period?

The top 5 countries which drives the development of plant-based yogurt market are USA, UK, Europe Union, Japan and South Korea.

Conventional plant-based yogurt driving market growth to command significant share over the assessment period.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Yogurt Powder Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Yogurt Dips Market Size, Growth, and Forecast for 2025 to 2035

Yogurt Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Yogurt Maker Market – Trends, Growth & Forecast 2025 to 2035

Yogurt Packaging Market Trends – Growth & Demand Forecast 2025 to 2035

Yogurt And Probiotic Drink Market Analysis by Product Type, Source Type, and Region Through 2035

A2 Yogurt Market Trends – Growth, Demand & Innovations

Dry Yogurt Market Outlook - Growth, Demand & Forecast 2025 to 2035

Greek Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Vegan Yogurt Market Size, Growth, and Forecast for 2025 to 2035

Japan Yogurt Powder Market Analysis by Product Type, Flavor, Nature, Application, End-Use, and Distribution Channel Through 2035

Frozen Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Citrus Yogurt Market Insights – Flavor Trends & Consumer Demand 2025 to 2035

Analysis and Growth Projections for Savory Yogurt Market

Non-GMO yogurt Market Analysis by Product Type, By End use, By Distribution Channel of the and End User Through 2035

Flavored Yogurt Market Analysis by Form, Flavor, End Use and Distribution Channel Through 2035

Non-Dairy Yogurt Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Drinkable Yogurt Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

High Protein Yogurt Market Trends - Growth & Industry Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA