The global probiotic yogurt market is projected to grow from USD 31.38 billion in 2025 to USD 67.75 billion by 2035, reflecting a robust CAGR of 8% throughout the forecast period. This surge is primarily fueled by rising consumer demand for functional foods that promote digestive and immune health.

As awareness of gut microbiota and its link to overall well-being continues to grow, consumers are increasingly opting for probiotic-enriched options as part of their daily diet. The market is further strengthened by innovation across both dairy and non-dairy segments, particularly the introduction of plant-based probiotic yogurt catering to lactose-intolerant and vegan populations.

With enhanced retail penetration and evolving preferences for on-the-go nutrition, brands are tapping into diverse formats and clean-label formulations to boost consumer appeal.

Manufacturers are responding to demand by investing in advanced probiotic strains backed by clinical research to support health claims related to gut-brain axis regulation, mood balance, and immunity. Consumer education through digital health platforms and influencers has accelerated awareness, creating a surge in trial and repeat purchases.

Expanded shelf space in supermarkets and growing dominance of e-commerce are further enhancing product accessibility, allowing brands to reach urban and rural consumers alike. Demand is particularly strong in Asia-Pacific and Western Europe, where probiotic-rich diets and preventive health culture are deeply ingrained. These trends are positioning product not just as a food item, but as a daily wellness essential.

Looking ahead, the market is likely to evolve in response to innovations in fermentation technology, encapsulation methods, and microbiome-targeted nutrition. Products are likely to become more specialized, with targeted strains for metabolic health, skin health, and mental well-being.

Government regulation plays a critical role in this transformation. The USA FDA does not mandate pre-market approval for probiotic foods, but requires substantiation for any health-related claims.

The EFSA in the European Union enforces stricter standards, often disallowing the use of the word “probiotic” without approved evidence. On the other hand, Japan and South Korea have adopted supportive regulatory frameworks like FOSHU and the Health Functional Foods Act, enabling approved gut health claims. This global variation in regulatory environments is pushing companies to adopt region-specific compliance strategies and invest in clinical trials to gain a competitive edge.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 31.38 billion |

| Industry Value (2035F) | USD 67.75 billion |

| CAGR (2025 to 2035) | 8% |

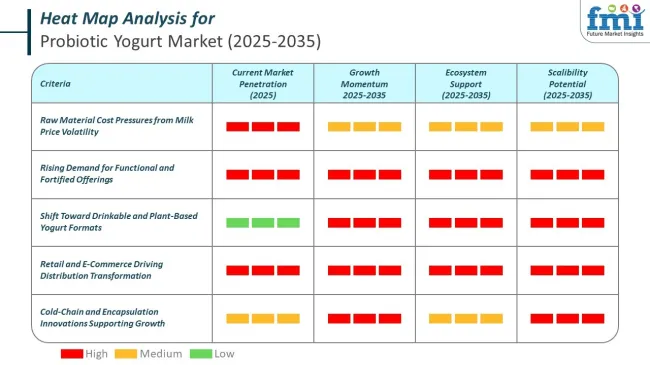

The probiotic yogurt market in 2025 continues to evolve under rising production cost pressures. Unstable milk prices, coupled with elevated energy and labor inputs, are compressing margins and prompting manufacturers to rethink their strategies. Many brands are diversifying their portfolios by expanding into non-dairy probiotic offerings, reducing dependency on traditional supply chains. This shift is especially important as ingredient availability remains inconsistent across key production regions.

Consumer demand for probiotic yogurt is accelerating, especially in wellness-centric segments. Urban populations and aging demographics are driving interest in products that support gut health, immunity, and daily wellness. Drinkable probiotic formats are gaining share due to portability and perceived nutritional value. Across global markets, clean-label positioning and functional fortification are now essential for driving sales in the probiotic yogurt market.

Key product demand trends include:

Distribution strategies are shifting as retail dynamics change. Supermarkets remain the primary outlet, but digital platforms are expanding rapidly. Online wellness stores, personalized subscription models, and curated e-commerce assortments are contributing to greater reach. Personalized nutrition insights are increasingly integrated into these digital experiences, helping brands tailor offerings to specific health needs within the probiotic yogurt market.

The market is segmented based on product type, source, nature, flavour, sales channel, and region. By product type, the market is divided into drinkable and spoonable. In terms of source, it is segmented into animal-based and plant-based. Based on nature, the market is categorized into organic and conventional.

By flavour, the market includes unflavoured and flavoured. In terms of sales channel, the market is segmented into hypermarkets/supermarkets, convenience stores, specialty stores, and online retailers. Regionally, the market is classified into North America, Latin America, Europe, Asia Pacific, and the Middle East & Africa.

The drinkable segment is projected to be the fastest-growing, registering a CAGR of 8.6% between 2025 and 2035, surpassing the overall market growth of 8%. This growth is primarily driven by shifting consumer lifestyles that demand portability and functional health benefits in compact formats. Drinkable yogurt caters to busy professionals, children, and fitness-conscious individuals looking for quick, gut-friendly nutrition.

Its convenience, coupled with product innovations such as resealable bottles, multivitamin infusions, and immunity-boosting formulations, is enhancing its market traction globally. Additionally, increased marketing around probiotic benefits and expanding retail penetration across both modern trade and online platforms are supporting segment growth.

Emerging economies in Asia and Latin America are also seeing rising adoption of drinkable variants due to urbanization and dietary diversification. In contrast, spoonableproduct continues to dominate consumption in traditional markets where consumers prefer a thick texture, but its growth remains slower than drinkable formats.

| Product Type | CAGR (2025 to 2035) |

|---|---|

| Drinkable Yogurt | 8.6% |

The plant-based probiotic yogurt segment is projected to be the fastest-growing, with a CAGR of 9.1% between 2025 and 2035. Rising demand for dairy alternatives, especially among vegans, lactose-intolerant individuals, and environmentally conscious consumers, is driving this growth. Brands are innovating with ingredients such as almond, coconut, oat, and soy to replicate the creamy texture and tangy flavor of traditional yogurt while enhancing nutritional profiles with fortified calcium and B12.

Technological advancements in fermentation and emulsification are further improving mouthfeel and taste, boosting consumer satisfaction. The surge in ethical eating habits, driven by climate change awareness and animal welfare concerns, is accelerating shelf space for plant-based options across both developed and emerging markets.

Meanwhile, animal-based product continues to dominate in regions with strong dairy traditions, benefiting from cost-effectiveness, brand familiarity, and high protein content. However, the rapid expansion of plant-based product lines is narrowing this gap at an unprecedented pace.

| Source | CAGR (2025 to 2035) |

|---|---|

| Plant-Based Yogurt | 7.9% |

The organic probiotic yogurt segment is witnessing accelerated growth, supported by rising consumer demand for clean-label and chemical-free food products. It is expected to register a compound annual growth rate (CAGR) of 8.8% between 2025 and 2035, driven by increased health awareness and a preference for naturally sourced ingredients.

Organic yogurts, often free from artificial preservatives, GMOs, and synthetic additives, are gaining traction among premium shoppers, especially in North America and Europe. The segment is also benefitting from expanded retail visibility, private-label offerings, and certifications that build consumer trust. Though conventional product currently dominates due to its affordability and wider accessibility, its growth is stabilizing. However, conventional formats remain essential in price-sensitive markets and among bulk buyers, maintaining volume leadership.

As disposable incomes rise and environmental consciousness deepens, organic options are expected to expand further across urban and semi-urban regions globally, especially where consumers actively seek health-enhancing, eco-conscious dairy alternatives.

| Nature | CAGR (2025 to 2035) |

|---|---|

| Organic | 8.8% |

The flavoured probiotic yogurt segment is anticipated to dominate and expand at a significant CAGR of 8.4% from 2025 to 2035, driven by strong consumer preference for taste variety combined with health benefits. Fruit-infused, dessert-inspired, and exotic blends such as mango, vanilla-chia, and berry-acai are attracting new consumer segments, including children and young adults.

Many brands are now incorporating functional ingredients like protein, prebiotics, and collagen into flavoured yogurts, widening their nutritional appeal. Convenience formats such as pouches and multipacks are also supporting impulse buys and repeat purchases. In contrast, the unflavoured probiotic yogurt segment continues to attract older consumers and health purists who prefer unsweetened, additive-free options for direct consumption or culinary use.

It remains vital for diabetic consumers and fitness-focused buyers seeking protein and probiotic intake without added sugars. While flavoured yogurt leads in volume and innovation, both segments are being redefined by evolving wellness and personalization trends.

| Flavour | CAGR (2025 to 2035) |

|---|---|

| Flavoured | 8.4% |

The online retailers segment is expected to grow at the fastest pace in the market, registering a CAGR of 10.2% between 2025 and 2035. The rise of digital grocery platforms, mobile app usage, and direct-to-consumer models is transforming how consumers access perishable health foods like yogurt. Subscription-based product deliveries, flash sales, and AI-driven personalized recommendations are increasing consumer loyalty and basket size.

Urban millennials and Gen Z shoppers are leading this shift due to convenience, wider selection, and product comparison ease. The COVID-19 pandemic also permanently altered shopping behavior, normalizing the purchase of refrigerated goods online.

While hypermarkets and supermarkets continue to lead in absolute volume, offering in-store sampling and multi-brand displays, online channels are rapidly gaining ground. Convenience stores and specialty retailers maintain niche appeal in urban clusters, however it is the online format that offers the scalability and data-driven engagement fueling future growth.

| Sales Channel | CAGR (2025 to 2035) |

|---|---|

| Online Retailers | 10.2% |

| Countries | CAGR (2025 to 2035) |

|---|---|

| United States | 8.3 % |

| United Kingdom | 12.2% |

| France | 11.5% |

| Germany | 9.9% |

| Japan | 7.6% |

The USA probiotic yogurt market is expected to grow at a CAGR of 8.3% between 2025 and 2035, driven by the surging popularity of functional foods and growing consumer focus on digestive wellness. With strong demand from health-conscious millennials and aging Baby Boomers alike, product is emerging as a daily dietary staple.

The presence of major players such as Chobani, General Mills, and Danone North America has fueled large-scale product innovation, including Greek yogurt blends, drinkable formats, and high-protein varieties. Additionally, plant-based probiotic options using almond, oat, and coconut milk are expanding shelf space due to rising vegan and lactose-intolerant populations.

The market is also benefitting from the DTC boom and health app integrations that promote gut-friendly eating. Although the FDA does not strictly regulate the term “probiotic,” increasing demand for strain-specific formulations and transparent CFU labeling is shaping the next wave of consumer trust. As e-commerce and personalized nutrition platforms grow, the USA remains a core innovation hub for probiotic dairy products.

The UK probiotic yogurt market is projected to grow at a CAGR of 12.2% between 2025 and 2035. Growth is being fueled by rising consumer focus on gut health, preventive nutrition, and plant-based lifestyles. Probiotic drinks are outpacing traditional formats due to their convenience and high functional appeal.

Major players like Danone and Müller are expanding portfolios to include on-the-go formats, kid-friendly variants, and dairy-free options using coconut and oat bases. The UK’s progressive stance on food labeling, combined with digital retail growth, is supporting product visibility and access. Additionally, the growing demand for organic and clean-label yogurts is prompting manufacturers to reformulate using natural cultures and reduced sugar.

Government-led health awareness campaigns and NHS-backed dietary guidelines are also helping normalize daily probiotic consumption. With innovations around taste, strain diversity, and gut-brain health benefits, the UK market is expected to remain one of Europe’s fastest-growing in functional dairy.

France’s probiotic yogurt market is expected to grow at a CAGR of 11.5% from 2025 to 2035, driven by its longstanding dairy culture and heightened demand for health-forward foods. French consumers are embracing probiotics as part of daily wellness, especially as digestive health concerns and awareness about microbiota increase. Companies like Danone and Lactalis are leading innovation with multifunctional products that address immunity, metabolism, and skin health.

Government initiatives promoting clean eating, combined with a well-established cold chain infrastructure, enable strong national distribution. Furthermore, France’s tradition of spoonable yogurt aligns with probiotic offerings, especially when combined with premium ingredients like acacia fiber or fruit purée. The expanding organic segment is also attracting discerning buyers who value natural fermentation and sustainable sourcing.

As e-commerce and retail channels converge, demand for personalized and premium products in France is set to strengthen, creating space for niche and startup brands alongside established players.

Germany’s probiotic yogurt market is projected to expand at a CAGR of 9.9% between 2025 and 2035. As one of Europe’s most health-conscious nations, Germany shows high adoption of functional foods with proven benefits. The market is supported by a strong domestic dairy industry and a consumer base that values high-quality, bio-active cultures in daily diets.

Spoonable yogurts dominate in volume, while drinkable probiotics are gaining favor for their mobility and precision health benefits. Brands such as Müller are diversifying offerings with lactose-free and high-protein formats to capture wider demographic appeal. Additionally, the rise of veganism and interest in sustainability is fueling demand for plant-based probiotic yogurts made from soy, almond, and oat.

Compliance with the EU's stringent labeling regulations has also improved consumer trust in probiotic claims. Retailers are increasingly stocking personalized probiotic SKUs, often paired with lifestyle branding and digital tracking apps, reinforcing Germany's market position as a leader in food innovation.

The Japanese probiotic yogurt market is anticipated to grow at a CAGR of 7.6% through 2035, driven by the country’s deep-rooted culture of fermented foods and preventive healthcare. Functional products are well-established in Japanese households, with Yakult Honsha and Meiji leading innovation in both strain technology and delivery formats.

Products that support gut health, immunity, and nutrient absorption are highly popular among aging demographics. Technological advancements in encapsulated probiotics and heat-stable cultures have expanded application formats, including drinkable and fortified snack yogurts. The direct-to-consumer model, particularly in health foods, is gaining traction, supported by Japan’s mature logistics and cold chain systems.

Regulatory support under Japan’s FOSHU framework further enables specific health claims, strengthening product credibility. Additionally, the trend toward personalized nutrition and wearable health devices is integrating seamlessly with functional yogurt tracking, positioning Japan as a tech-savvy, health-aligned probiotic market with high-quality and niche potential.

The competitive landscape of the market is moderately fragmented, comprising a mix of multinational giants, functional dairy specialists, and plant-based innovators. Tier 1 players such as Danone, Chobani, General Mills, and Nestlé dominate global sales through broad distribution, advanced probiotic R&D, and diversified brand portfolios.

Danone’s Activia and Chobani’s probiotic Greek yogurts maintain leading shelf presence across North America and Europe, driven by clinically backed strains and functional health positioning. Tier 2 firms like Lifeway Foods and Yofix Probiotics focus on niche fermented dairy and plant-based formats, leveraging kefir and multi-strain yogurts to build brand loyalty among health-conscious consumers.

Meanwhile, regional players such as Meiji (Japan) and Lactalis (France) are expanding probiotic dairy lines through localized flavor innovation and clean-label positioning. Entry barriers include strain validation, clinical substantiation, and cold chain logistics. While the market remains fragmented, M&A activity is increasing as major firms acquire startups offering cutting-edge probiotic technologies and plant-based innovations.

Danone continues to lead the global probiotic yogurt segment, with its Activia brand featuring proprietary strains like BifidusActiRegularis. The company has invested in personalized nutrition platforms and introduced low-sugar, gut-health-focused SKUs targeting women’s health and immunity.

In 2024, it launched a probiotic shot series in the EU targeting digestive and metabolic support. Chobani, a major USA player, has aggressively expanded into plant-based probiotics and functional yogurt drinks. Its 2025 investment of over $1 billion in a new manufacturing plant in New York underscores its long-term confidence in the category.

General Mills, through Yoplait, continues to refine its probiotic formulations by adding prebiotics and dietary fibers, targeting digestive health across various age groups.

In Japan, Yakult Honsha and Meiji Holdings lead the way with high clinical credibility and specialized probiotic strains, backed by decades of microbiome research. Yakult's flagship fermented milk drink remains a staple in Asian households, and its global expansion has introduced strain-specific education campaigns.

In France, Lactalis has scaled probiotic production with expanded capabilities for lactose-free and children-specific SKUs. Meanwhile, companies like Yofix and The Coconut Collaborative are capturing niche market segments through dairy-free probiotic options made from oats, almonds, and coconut.

These brands are focused on ethical sourcing, gut-brain axis support, and traceable ingredient claims, appealing to younger, label-conscious consumers.

Emerging entrants, such as Next Gen Foods and Symprove, are disrupting the market with synbiotic formulations and precision probiotics linked to mental wellness and metabolic health.

The surge in direct-to-consumer probiotic yogurt subscriptions and microbiome tracking apps is enabling startup brands to personalize offerings and build loyal communities. As regulatory clarity improves in regions like APAC and Europe, science-led product validation and transparency are becoming decisive factors.

The race toward differentiation now centers on strain specificity, clinical trials, and functional benefit targeting. Mergers, scientific partnerships, and vertically integrated production are being pursued to gain edge in this rapidly evolving wellness-driven segment.

Recent Probiotic Yogurt Industry News

| Attribute | Details |

|---|---|

| Current Total Market Size (2025) | USD 31.38 billion |

| Projected Market Size (2035) | USD 67.75 billion |

| CAGR (2025 to 2035) | 8% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 - 2024 |

| Projections Period | 2025 - 2035 |

| Report Parameter | Revenue in USD billion/volume in units |

| By Product Type | Drinkable and Spoonable |

| By Source | Animal-based and Plant-based |

| By Nature | Organic and Conventional |

| By Flavour | Unflavoured and Flavoured |

| By Sales Channel | Hypermarkets/Supermarkets, Convenience Stores, Specialty Stores, and Online Retailers |

| Regions Covered | North America, Latin America, Europe, Asia Pacific, and MEA |

| Countries Covered | United States, United Kingdom, France, Germany, Japan |

| Key Players | Danone S.A., General Mills, Inc., Nestlé S.A., Fonterra Co-operative Group Limited, Groupe Lactalis S.A., Chobani LLC, AGE International S.A., Good Karma Foods, Inc., The Coconut Collaborative, Mother Da iry Fruit & Vegetable Pvt Ltd., Lancashire Farm Dairies, Meiji Holdings Company, Ltd., Ehrmann AG, Yofix Probiotics Ltd., GT's Living Foods LLC |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

The global market is expected to reach USD 67.75 billion by 2035, growing from USD 31.38 billion in 2025, at a CAGR of 8% during the forecast period.

The drinkable probiotic yogurt segment is projected to grow at the fastest pace, registering a CAGR of 8.6%, driven by rising demand for convenient, on-the-go nutrition solutions.

The plant-based segment is the fastest-growing by source, expanding at a CAGR of 9.1%, supported by increasing veganism, lactose intolerance, and sustainable consumption trends.

The online retailers segment is expected to grow at the fastest pace, with a CAGR of 10.2%, fueled by digital grocery adoption, subscription models, and personalization via e-commerce.

Top companies include Danone S.A., General Mills, Nestlé S.A., Chobani LLC, Fonterra Co-operative Group, Groupe Lactalis, Meiji Holdings, and Yofix Probiotics Ltd., known for their innovation, clinical research, and global distribution strategies.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (MT) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 4: Global Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 6: Global Market Volume (MT) Forecast by Source, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 8: Global Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Flavour, 2018 to 2033

Table 10: Global Market Volume (MT) Forecast by Flavour, 2018 to 2033

Table 11: Global Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 12: Global Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 14: North America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 16: North America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 18: North America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 20: North America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 21: North America Market Value (US$ Million) Forecast by Flavour, 2018 to 2033

Table 22: North America Market Volume (MT) Forecast by Flavour, 2018 to 2033

Table 23: North America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 24: North America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 26: Latin America Market Volume (MT) Forecast by Country, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 28: Latin America Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 30: Latin America Market Volume (MT) Forecast by Source, 2018 to 2033

Table 31: Latin America Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 32: Latin America Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 33: Latin America Market Value (US$ Million) Forecast by Flavour, 2018 to 2033

Table 34: Latin America Market Volume (MT) Forecast by Flavour, 2018 to 2033

Table 35: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 36: Latin America Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 37: Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 38: Europe Market Volume (MT) Forecast by Country, 2018 to 2033

Table 39: Europe Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 40: Europe Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 41: Europe Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 42: Europe Market Volume (MT) Forecast by Source, 2018 to 2033

Table 43: Europe Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 44: Europe Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 45: Europe Market Value (US$ Million) Forecast by Flavour, 2018 to 2033

Table 46: Europe Market Volume (MT) Forecast by Flavour, 2018 to 2033

Table 47: Europe Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 48: Europe Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 49: Asia Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 50: Asia Pacific Market Volume (MT) Forecast by Country, 2018 to 2033

Table 51: Asia Pacific Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 52: Asia Pacific Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 53: Asia Pacific Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 54: Asia Pacific Market Volume (MT) Forecast by Source, 2018 to 2033

Table 55: Asia Pacific Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 56: Asia Pacific Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 57: Asia Pacific Market Value (US$ Million) Forecast by Flavour, 2018 to 2033

Table 58: Asia Pacific Market Volume (MT) Forecast by Flavour, 2018 to 2033

Table 59: Asia Pacific Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 60: Asia Pacific Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Table 61: MEA Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: MEA Market Volume (MT) Forecast by Country, 2018 to 2033

Table 63: MEA Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 64: MEA Market Volume (MT) Forecast by Product Type, 2018 to 2033

Table 65: MEA Market Value (US$ Million) Forecast by Source, 2018 to 2033

Table 66: MEA Market Volume (MT) Forecast by Source, 2018 to 2033

Table 67: MEA Market Value (US$ Million) Forecast by Nature, 2018 to 2033

Table 68: MEA Market Volume (MT) Forecast by Nature, 2018 to 2033

Table 69: MEA Market Value (US$ Million) Forecast by Flavour, 2018 to 2033

Table 70: MEA Market Volume (MT) Forecast by Flavour, 2018 to 2033

Table 71: MEA Market Value (US$ Million) Forecast by Sales Channel, 2018 to 2033

Table 72: MEA Market Volume (MT) Forecast by Sales Channel, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Source, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Nature, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 6: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 7: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 8: Global Market Volume (MT) Analysis by Region, 2018 to 2033

Figure 9: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 10: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 11: Global Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 12: Global Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 13: Global Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 14: Global Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 15: Global Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 16: Global Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 17: Global Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 18: Global Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 19: Global Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 20: Global Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 21: Global Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 22: Global Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 23: Global Market Value (US$ Million) Analysis by Flavour, 2018 to 2033

Figure 24: Global Market Volume (MT) Analysis by Flavour, 2018 to 2033

Figure 25: Global Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 26: Global Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 27: Global Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 28: Global Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 29: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 30: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 31: Global Market Attractiveness by Product Type, 2023 to 2033

Figure 32: Global Market Attractiveness by Source, 2023 to 2033

Figure 33: Global Market Attractiveness by Nature, 2023 to 2033

Figure 34: Global Market Attractiveness by Flavour, 2023 to 2033

Figure 35: Global Market Attractiveness by Sales Channel, 2023 to 2033

Figure 36: Global Market Attractiveness by Region, 2023 to 2033

Figure 37: North America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 38: North America Market Value (US$ Million) by Source, 2023 to 2033

Figure 39: North America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 40: North America Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 41: North America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 42: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 43: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 44: North America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 45: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 46: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 47: North America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 48: North America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 49: North America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 50: North America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 51: North America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 52: North America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 53: North America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 54: North America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 55: North America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 56: North America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 57: North America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 58: North America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 59: North America Market Value (US$ Million) Analysis by Flavour, 2018 to 2033

Figure 60: North America Market Volume (MT) Analysis by Flavour, 2018 to 2033

Figure 61: North America Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 62: North America Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 63: North America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 64: North America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 65: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 66: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 67: North America Market Attractiveness by Product Type, 2023 to 2033

Figure 68: North America Market Attractiveness by Source, 2023 to 2033

Figure 69: North America Market Attractiveness by Nature, 2023 to 2033

Figure 70: North America Market Attractiveness by Flavour, 2023 to 2033

Figure 71: North America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 72: North America Market Attractiveness by Country, 2023 to 2033

Figure 73: Latin America Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) by Source, 2023 to 2033

Figure 75: Latin America Market Value (US$ Million) by Nature, 2023 to 2033

Figure 76: Latin America Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 77: Latin America Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 79: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 80: Latin America Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 81: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 82: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 83: Latin America Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 84: Latin America Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 85: Latin America Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 86: Latin America Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 87: Latin America Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 88: Latin America Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 89: Latin America Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 90: Latin America Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 91: Latin America Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 92: Latin America Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 93: Latin America Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 94: Latin America Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 95: Latin America Market Value (US$ Million) Analysis by Flavour, 2018 to 2033

Figure 96: Latin America Market Volume (MT) Analysis by Flavour, 2018 to 2033

Figure 97: Latin America Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 98: Latin America Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 99: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 100: Latin America Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 101: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 102: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 103: Latin America Market Attractiveness by Product Type, 2023 to 2033

Figure 104: Latin America Market Attractiveness by Source, 2023 to 2033

Figure 105: Latin America Market Attractiveness by Nature, 2023 to 2033

Figure 106: Latin America Market Attractiveness by Flavour, 2023 to 2033

Figure 107: Latin America Market Attractiveness by Sales Channel, 2023 to 2033

Figure 108: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 109: Europe Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 110: Europe Market Value (US$ Million) by Source, 2023 to 2033

Figure 111: Europe Market Value (US$ Million) by Nature, 2023 to 2033

Figure 112: Europe Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 113: Europe Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 114: Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 115: Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 116: Europe Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 117: Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 118: Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 119: Europe Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 120: Europe Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 121: Europe Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 122: Europe Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 123: Europe Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 124: Europe Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 125: Europe Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 126: Europe Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 127: Europe Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 128: Europe Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 129: Europe Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 130: Europe Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 131: Europe Market Value (US$ Million) Analysis by Flavour, 2018 to 2033

Figure 132: Europe Market Volume (MT) Analysis by Flavour, 2018 to 2033

Figure 133: Europe Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 134: Europe Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 135: Europe Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 136: Europe Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 137: Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 138: Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 139: Europe Market Attractiveness by Product Type, 2023 to 2033

Figure 140: Europe Market Attractiveness by Source, 2023 to 2033

Figure 141: Europe Market Attractiveness by Nature, 2023 to 2033

Figure 142: Europe Market Attractiveness by Flavour, 2023 to 2033

Figure 143: Europe Market Attractiveness by Sales Channel, 2023 to 2033

Figure 144: Europe Market Attractiveness by Country, 2023 to 2033

Figure 145: Asia Pacific Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 146: Asia Pacific Market Value (US$ Million) by Source, 2023 to 2033

Figure 147: Asia Pacific Market Value (US$ Million) by Nature, 2023 to 2033

Figure 148: Asia Pacific Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 149: Asia Pacific Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 150: Asia Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 151: Asia Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 152: Asia Pacific Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 153: Asia Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 154: Asia Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 155: Asia Pacific Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 156: Asia Pacific Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 157: Asia Pacific Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 158: Asia Pacific Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 159: Asia Pacific Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 160: Asia Pacific Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 161: Asia Pacific Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 162: Asia Pacific Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 163: Asia Pacific Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 164: Asia Pacific Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 165: Asia Pacific Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 166: Asia Pacific Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 167: Asia Pacific Market Value (US$ Million) Analysis by Flavour, 2018 to 2033

Figure 168: Asia Pacific Market Volume (MT) Analysis by Flavour, 2018 to 2033

Figure 169: Asia Pacific Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 170: Asia Pacific Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 171: Asia Pacific Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 172: Asia Pacific Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 173: Asia Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 174: Asia Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 175: Asia Pacific Market Attractiveness by Product Type, 2023 to 2033

Figure 176: Asia Pacific Market Attractiveness by Source, 2023 to 2033

Figure 177: Asia Pacific Market Attractiveness by Nature, 2023 to 2033

Figure 178: Asia Pacific Market Attractiveness by Flavour, 2023 to 2033

Figure 179: Asia Pacific Market Attractiveness by Sales Channel, 2023 to 2033

Figure 180: Asia Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: MEA Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 182: MEA Market Value (US$ Million) by Source, 2023 to 2033

Figure 183: MEA Market Value (US$ Million) by Nature, 2023 to 2033

Figure 184: MEA Market Value (US$ Million) by Flavour, 2023 to 2033

Figure 185: MEA Market Value (US$ Million) by Sales Channel, 2023 to 2033

Figure 186: MEA Market Value (US$ Million) by Country, 2023 to 2033

Figure 187: MEA Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 188: MEA Market Volume (MT) Analysis by Country, 2018 to 2033

Figure 189: MEA Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 190: MEA Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 191: MEA Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 192: MEA Market Volume (MT) Analysis by Product Type, 2018 to 2033

Figure 193: MEA Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 194: MEA Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 195: MEA Market Value (US$ Million) Analysis by Source, 2018 to 2033

Figure 196: MEA Market Volume (MT) Analysis by Source, 2018 to 2033

Figure 197: MEA Market Value Share (%) and BPS Analysis by Source, 2023 to 2033

Figure 198: MEA Market Y-o-Y Growth (%) Projections by Source, 2023 to 2033

Figure 199: MEA Market Value (US$ Million) Analysis by Nature, 2018 to 2033

Figure 200: MEA Market Volume (MT) Analysis by Nature, 2018 to 2033

Figure 201: MEA Market Value Share (%) and BPS Analysis by Nature, 2023 to 2033

Figure 202: MEA Market Y-o-Y Growth (%) Projections by Nature, 2023 to 2033

Figure 203: MEA Market Value (US$ Million) Analysis by Flavour, 2018 to 2033

Figure 204: MEA Market Volume (MT) Analysis by Flavour, 2018 to 2033

Figure 205: MEA Market Value Share (%) and BPS Analysis by Flavour, 2023 to 2033

Figure 206: MEA Market Y-o-Y Growth (%) Projections by Flavour, 2023 to 2033

Figure 207: MEA Market Value (US$ Million) Analysis by Sales Channel, 2018 to 2033

Figure 208: MEA Market Volume (MT) Analysis by Sales Channel, 2018 to 2033

Figure 209: MEA Market Value Share (%) and BPS Analysis by Sales Channel, 2023 to 2033

Figure 210: MEA Market Y-o-Y Growth (%) Projections by Sales Channel, 2023 to 2033

Figure 211: MEA Market Attractiveness by Product Type, 2023 to 2033

Figure 212: MEA Market Attractiveness by Source, 2023 to 2033

Figure 213: MEA Market Attractiveness by Nature, 2023 to 2033

Figure 214: MEA Market Attractiveness by Flavour, 2023 to 2033

Figure 215: MEA Market Attractiveness by Sales Channel, 2023 to 2033

Figure 216: MEA Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Japan Probiotic Yogurt Market is segmented by product type, source type, nature type, flavor type, fat content, sales channel and key city/province through 2025 to 2035.

Korea Probiotic Yogurt Market Analysis by Product Type, Flavor, Sales Channel, and Region Through 2035

Yogurt And Probiotic Drink Market Analysis by Product Type, Source Type, and Region Through 2035

Lactose-Free Probiotic Yogurt Market Trends - Product Type & Sales Insights

Western Europe Probiotic Yogurt Market Analysis by Product Type, Flavor, Sales Channel, and Countries through 2025 to 2035

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Probiotics For Oral Health Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Fermentation Skincare Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic for Kids Market Analysis - Size, Share, and Forecast 2025 to 2035

Probiotic Fermented Milk Market Growth & Demand Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA