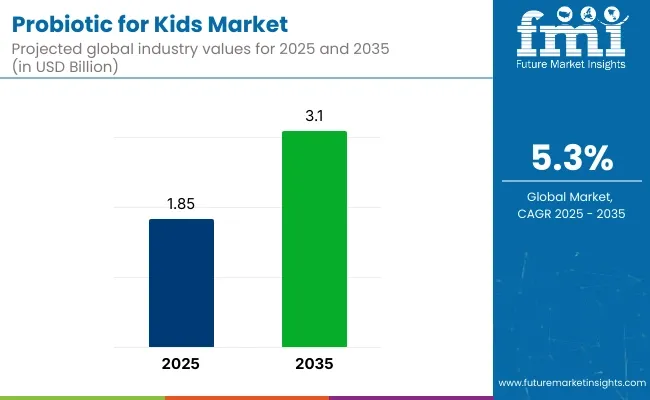

The global probiotic for kids market is projected to grow from USD 1.85 billion in 2025 to USD 3.1 billion by 2035, at a robust CAGR of 5.3% during the forecast period. Increasing cases of gastrointestinal infections, antibiotic misuse, and immune system stress in children are prompting parents to opt for probiotics. Available in chewable tablets, gummies, flavored powder, and liquid yogurts, probiotics are used in managing conditions like diarrhea, constipation, and infantile colic. The market is led by North America, followed by Europe, and is expanding rapidly in Asia-Pacific, especially in India and China.

The global probiotic for kids market is projected to grow at a CAGR of 5.3% from 2025 to 2035, expanding from USD 1.85 billion in 2025 to USD 3.1 billion by 2035. The USA is expected to maintain the largest market share, driven by increasing awareness of gut health and widespread pediatric endorsements.

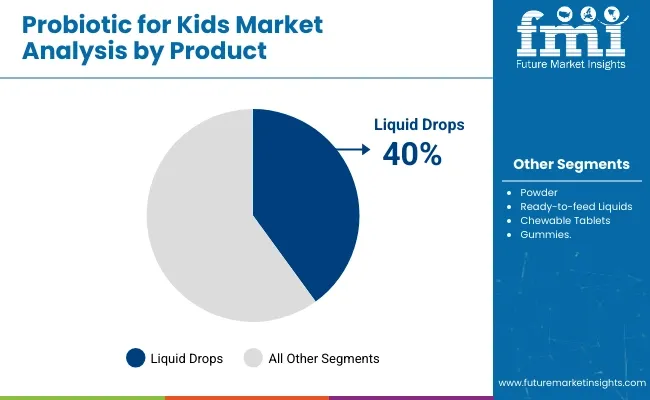

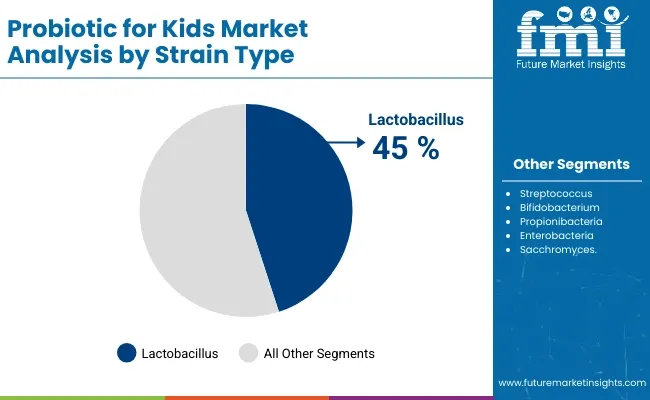

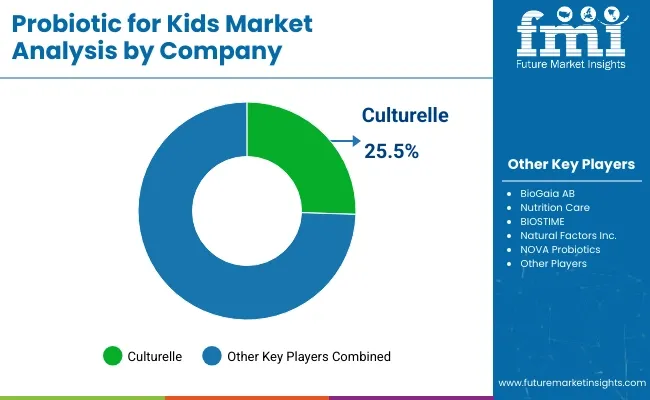

India is poised for the fastest growth, with a CAGR of 8.9%, supported by urbanization and rising health-consciousness among parents. Liquid drops will dominate the product segment, capturing 40% of the market share, while Lactobacillus will lead the strain type segment with a 45% share. Culturelle holds the highest market share at 25.5%.

Leading probiotic brands like Culturelle, BioGaia, Nestlé (Gerber), i-Health Inc., Jarrow Formulas, and NOW Foods are advancing pediatric-specific strains and delivery methods. Cyrill Siewert, CEO of Culturelle, highlighted in 2024, “Culturelle’s use of Lactobacillus GG, supported by over 250 studies, including double-blind trials, provides unmatched scientific evidence, offering the best solution for our retail partners and customers.”

R&D focuses on improving palatability, safety, and strain efficacy, ensuring better compliance across infancy and childhood. Technological innovations in strain formulations and delivery methods are reshaping the pediatric probiotic market, meeting the growing demand for trusted solutions in children’s health.

Liquid drops will dominate the product segment with a 40% market share, while Lactobacillus will lead the strain type segment with a 45% market share in 2025, driven by increasing demand for digestive and immune health support for children.

Liquid drops are expected to dominate the product segment with a 40% market share by 2025.

Lactobacillus is projected to hold a dominant 45% share of the strain type segment by 2025.

eCommerce is projected to lead the sales channel segment, capturing 35% of the market share by 2025.

The global probiotic for kids market is expanding due to rising awareness around digestive and immune health, with strong demand for Lactobacillus-based supplements, convenient formats like liquids and chewables, and increased reliance on eCommerce channels.

Recent Market Trends

Challenges Constraining Market Growth

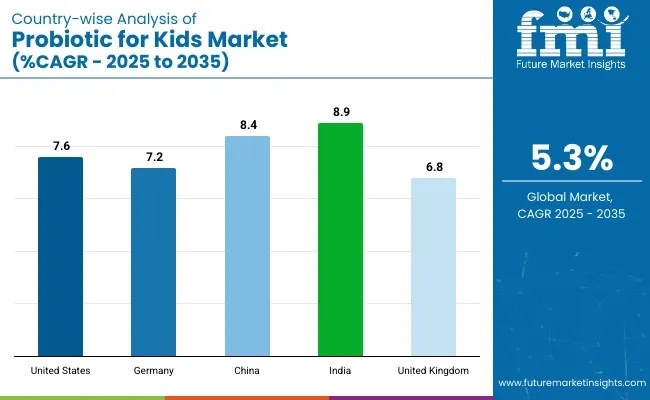

The probiotics for kids market is witnessing rapid global expansion due to rising parental awareness about gut health, immunity, and the preference for preventive wellness solutions. Below is a snapshot of projected CAGR for key countries from 2025 to 2035.

| Countries | Projected CAGR (2025 to 2035) |

|---|---|

| United States | 7.6% |

| Germany | 7.2% |

| China | 8.4% |

| India | 8.9% |

| United Kingdom | 6.8% |

The USA probiotics for kids market is forecast to expand at a 7.6% CAGR from 2025 to 2035, supported by heightened awareness of gut health, widespread pediatric recommendations, and a thriving functional food sector.

India is set to lead in growth with an 8.9% CAGR between 2025 and 2035, driven by urbanization, rising middle-class incomes, and greater health consciousness among parents.

China’s market is projected to grow at an 8.4% CAGR, bolstered by growing pediatric health concerns and parental focus on immunity.

Germany’s market is set to grow at a 7.2% CAGR, backed by strong demand for natural and clinically backed probiotic products.

The UK probiotics for kids market is poised to grow at a 6.8% CAGR from 2025 to 2035, driven by rising demand for immune-boosting supplements post-pandemic.

The probiotics for kids market is moderately fragmented, with a mix of Tier 1, Tier 2, and Tier 3 players employing diverse strategies. Tier 1 leaders like The Clorox Company (Culturelle) and Dr. Willmar Schwabe Group dominate via strong retail distribution, pediatric endorsements, and clinical backing. Culturelle’s chewables with LGG strain exemplify science-led innovation. Tier 2 players such as BioGaia AB, Jarrow Formulas, and Natural Factors Inc. focus on niche, clinically supported strains like L. reuteri.

In May 2024, BioGaia expanded in Asia with its “Protectis Kids Tabs.” Tier 3 players, including NOVA Probiotics, Life-Space, and Nutrition Care, emphasize allergen-free and premium formulations. Barriers to entry include regulatory approvals, access to GRAS-certified strains, and formulation expertise. Though still fragmented, the market shows signs of consolidation, as seen in Clorox’s acquisition of Renew Life. R&D, direct-to-consumer models, and pediatric product line extensions remain key growth strategies across tiers.

Recent Car Probiotic for Kids Industry News

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 1.85 billion |

| Projected Market Size (2035) | USD 3.1 billion |

| CAGR (2025 to 2035) | 5.3% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value |

| Product Segments Analyzed | Liquid Drops, Powder, Ready-to-feed Liquids, Chewable Tablets, Gummies |

| Strain Type Segments Analyzed | Lactobacillus, Streptococcus, Bifidobacterium, Propionibacteria, Enterobacteria, Sacchromyces |

| Sales Channel Segments Analyzed | Hypermarkets/Supermarkets, Specialty Stores, eCommerce, Drug Stores & Pharmacies, Health & Wellness Stores, Convenience Stores, Departmental Stores, Mass Grocery Retailers |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, Spain, China, Japan, South Korea, India, Australia, UAE, South Africa |

| Key Players Influencing the Market | Culturelle, BioGaia AB, Nutrition Care, BIOSTIME, Natural Factors Inc., NOVA Probiotics, Jarrow Formulas, Life-Space, The Clorox Company, Dr. Willmar Schwabe Group |

| Additional Attributes | Dollar sales growth by product type (liquid, powder, gummies), regional demand trends, strain preference, key player market shares, sales channel shifts, consumer preferences, health benefits, and emerging markets |

Liquid Drops, Powder, Ready-to-feed Liquids, Chewable Tablets, Gummies.

Lactobacillus, Streptococcus, Bifidobacterium, Propionibacteria, Enterobacteria, Sacchromyces.

Hypermarkets/Supermarkets, Specialty Stores, eCommerce, Drug Stores & Pharmacies, Health & Wellness Stores, Convenience Stores, Departmental Stores, Mass Grocery Retailers.

North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, Middle East & Africa.

The global probiotic for kids market is expected to grow from USD 1.85 billion in 2025 to USD 3.1 billion by 2035, with a CAGR of 5.3%.

In 2025, the liquid drops segment will dominate the market, holding a 40% share.

Lactobacillus will be the leading strain type in the probiotic for kids market, accounting for 45% of the market share.

India will be the fastest-growing country in the probiotic for kids market.

Culturelle leads the market with the highest share of 25.5%.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Units) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 4: Global Market Volume (Units) Forecast by Product, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Strain Type, 2019 to 2034

Table 6: Global Market Volume (Units) Forecast by Strain Type, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 8: Global Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 12: North America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Strain Type, 2019 to 2034

Table 14: North America Market Volume (Units) Forecast by Strain Type, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 16: North America Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Units) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 20: Latin America Market Volume (Units) Forecast by Product, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Strain Type, 2019 to 2034

Table 22: Latin America Market Volume (Units) Forecast by Strain Type, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 24: Latin America Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 28: Western Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Strain Type, 2019 to 2034

Table 30: Western Europe Market Volume (Units) Forecast by Strain Type, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 32: Western Europe Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Units) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 36: Eastern Europe Market Volume (Units) Forecast by Product, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Strain Type, 2019 to 2034

Table 38: Eastern Europe Market Volume (Units) Forecast by Strain Type, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 40: Eastern Europe Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Units) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Units) Forecast by Product, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Strain Type, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Units) Forecast by Strain Type, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Units) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 52: East Asia Market Volume (Units) Forecast by Product, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Strain Type, 2019 to 2034

Table 54: East Asia Market Volume (Units) Forecast by Strain Type, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 56: East Asia Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Units) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Product, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Units) Forecast by Product, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Strain Type, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Units) Forecast by Strain Type, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channel, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Units) Forecast by Sales Channel, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Product, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Strain Type, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Units) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 10: Global Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Strain Type, 2019 to 2034

Figure 14: Global Market Volume (Units) Analysis by Strain Type, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Strain Type, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Strain Type, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 18: Global Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 21: Global Market Attractiveness by Product, 2024 to 2034

Figure 22: Global Market Attractiveness by Strain Type, 2024 to 2034

Figure 23: Global Market Attractiveness by Sales Channel, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Product, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Strain Type, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 34: North America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Strain Type, 2019 to 2034

Figure 38: North America Market Volume (Units) Analysis by Strain Type, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Strain Type, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Strain Type, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 42: North America Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 45: North America Market Attractiveness by Product, 2024 to 2034

Figure 46: North America Market Attractiveness by Strain Type, 2024 to 2034

Figure 47: North America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Product, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Strain Type, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 58: Latin America Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Strain Type, 2019 to 2034

Figure 62: Latin America Market Volume (Units) Analysis by Strain Type, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Strain Type, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Strain Type, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 66: Latin America Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Product, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Strain Type, 2024 to 2034

Figure 71: Latin America Market Attractiveness by Sales Channel, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Strain Type, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 82: Western Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Strain Type, 2019 to 2034

Figure 86: Western Europe Market Volume (Units) Analysis by Strain Type, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Strain Type, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Strain Type, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 90: Western Europe Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Product, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Strain Type, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Product, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Strain Type, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Strain Type, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Units) Analysis by Strain Type, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Strain Type, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Strain Type, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Product, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Strain Type, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by Sales Channel, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Product, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Strain Type, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Strain Type, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Units) Analysis by Strain Type, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Strain Type, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Strain Type, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Product, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Strain Type, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by Sales Channel, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Product, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Strain Type, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 154: East Asia Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Strain Type, 2019 to 2034

Figure 158: East Asia Market Volume (Units) Analysis by Strain Type, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Strain Type, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Strain Type, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 162: East Asia Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Product, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Strain Type, 2024 to 2034

Figure 167: East Asia Market Attractiveness by Sales Channel, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Product, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Strain Type, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by Sales Channel, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Units) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Product, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Units) Analysis by Product, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Product, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Product, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Strain Type, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Units) Analysis by Strain Type, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Strain Type, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Strain Type, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channel, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Units) Analysis by Sales Channel, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channel, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channel, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Product, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Strain Type, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by Sales Channel, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Probiotic Chewing Gum Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Face Masks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic-Infused Creams Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Wellness Drinks Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Fermentation Skincare Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Skincare Solutions Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Supplements Market Analysis - Size, Share, and Forecast 2025 to 2035

Global Probiotic Serum Market Size and Share Forecast Outlook 2025 to 2035

Probiotic Ingredients Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Yogurt Market Analysis - Size, Share & Forecast 2025 to 2035

Probiotic Beverage Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Drink Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Probiotic Fermented Milk Market Growth & Demand Forecast 2025 to 2035

Probiotic Cheese Market Cheese Type, Bacteria Type, Sales Channel and Others through 2035

Comprehensive Probiotic Strains market analysis and forecast by strain type, application and region.

Probiotic Cosmetics Market Trends - Growth & Forecast 2025 to 2035

Probiotic Supplements Market Share Analysis – Key Trends & Forecast 2025-2035

Market Share Breakdown of Probiotic Ingredients

Probiotics After Antibiotic Recovery Market Analysis by Ingredient and Sales Channel Through 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA