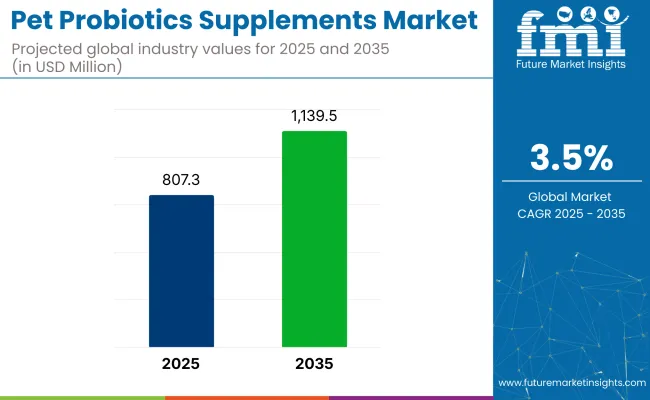

The global pet probiotics supplements market is valued at USD 807.3 million in 2025 and is slated to reach USD 1,139.5 million by 2035, reflecting a CAGR of 3.5%. Growth is being driven by increasing pet ownership, rising health consciousness among pet parents, and continuous product innovations by market leaders. Additionally, the expansion of premium pet food and supplement portfolios, particularly those infused with functional probiotic strains, is contributing to the market’s expansion.

| Metric | Value |

|---|---|

| Market Value (2025) | USD 807.3 million |

| Market Value (2035) | USD 1,139.5 million |

| CAGR (2025 to 2035) | 3.5% |

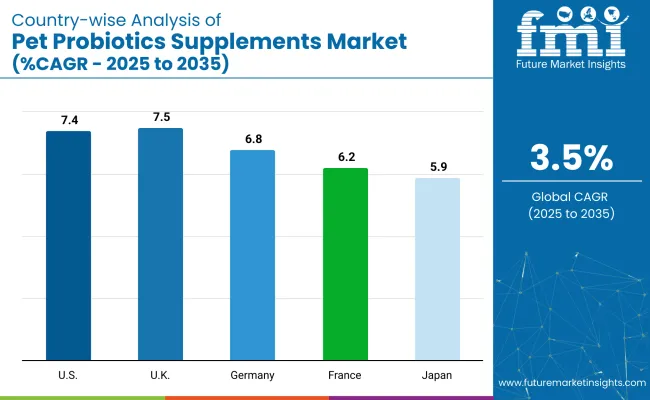

The UK records the highest CAGR of 7.5% from 2025 to 2035, driven by rising demand for premium supplement adoption. USA follows with a CAGR of 7.4%, supported by increasing premium pet supplement adoption, while Germany grows at 6.8% CAGR, driven by increasing awareness of pet health and nutrition.

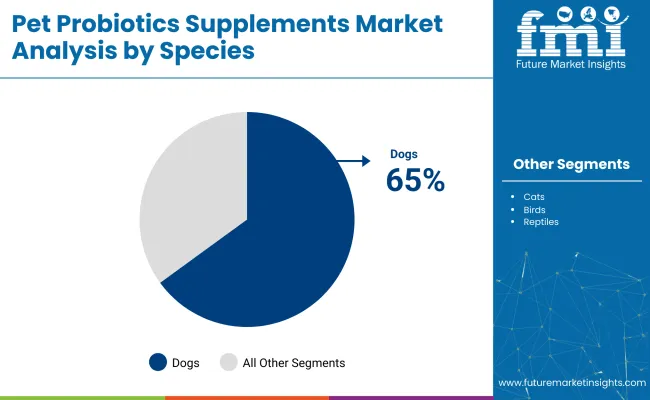

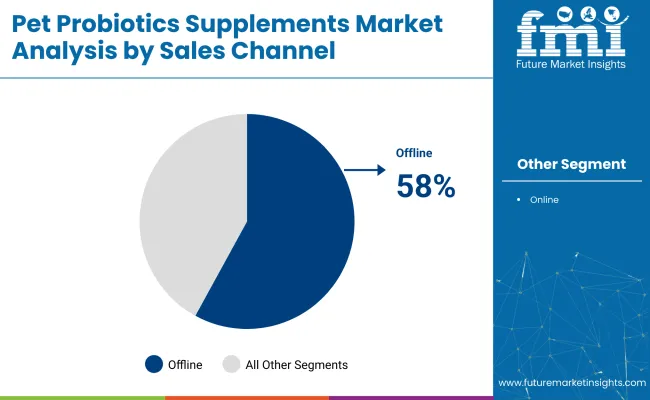

Dogs lead the species segment with a dominant 65% market share, driven by high supplement consumption and targeted formulations. Additionally, the offline sales channel leads sales channel with a 58% market share, supported by the convenience of e-commerce platforms and growing direct-to-consumer subscription models for pet probiotics supplements.

Governments enforce strict regulations to ensure the safety and quality of pet probiotics supplements, with the US FDA and EFSA requiring clear labeling of strains and CFU counts. Companies are adopting advanced microencapsulation techniques to improve probiotic stability and effectiveness.

Manufacturers develop soil-based strains like Bacillus for better viability in dry forms. Brands launch multi-functional products combining probiotics with prebiotics, enzymes, and vitamins. Precision fermentation is used to produce targeted strains with higher CFU counts and longer shelf life, driving market innovation.

The market accounts for a small yet growing share within its parent markets. It holds approximately 2-3% of the overall pet care market and around 4-5% of the pet nutrition market. Within the broader pet food market, its share remains close to 1-2%, as mainstream pet food dominates overall revenues.

In the animal health supplements market, pet probiotics contribute about 6-8% due to their rising popularity for digestive and immunity benefits. Compared to the animal feed additives market, the share is marginal, less than 1%, since that market is driven mainly by livestock feed additives rather than pet supplements.

The pet probiotics supplements market is segmented by form, species, claim, functionality, sales channel, and region. By form, the market includes powder, soft chews, capsules, and liquid. Based on species, it is segmented into dogs, cats, birds, and reptiles.

By claim, the market is categorized into no artificial additives, no artificial flavours, no artificial preservatives, non-GMO, allergen-free, 100% vegan, grain-free, soil-based, and all-natural. Based on functionalities, the market includes gut health, immunity booster, allergy support, digestive health, coat quality, and itching skin.

By sales channel, it is segmented into online (company website, ecommerce, third party websites) and offline (distributors, supermarkets, pet food shops, veterinary clinics). Regionally, the market is segmented into North America, Latin America, Western Europe, Eastern Europe, Balkans & Baltic, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Soft chews hold a 27% market share in 2025, making them the most lucrative segment under form.

Dogs remain the most lucrative species segment, holding a 65% market share in 2025.

The all-natural claim emerges as the most lucrative segment, holding a 22% market share in 2025.

Gut health remains the most lucrative functionality segment, holding a 19.5% market share in 2025.

Offline sales channels account for 58% of the total pet probiotics supplements market share in 2025.

The global pet probiotics supplements market is growing steadily, driven by increasing pet ownership, rising awareness of pet digestive and immune health, and advancements in probiotic strain development and functional supplement formulations.

Recent Trends in the Pet Probiotics Supplements Market

Key Challenges in the Pet Probiotics Supplements Market

Among the top countries, the USA leads with the CAGR of 7.4% from 2025 to 2035, driven by strong demand for digestive and immune health supplements. The UK closely follows with the highest CAGR of 7.5%, supported by premium product adoption and pet humanization trends.

Germany grows at 6.8%, driven by increasing pet health awareness. France records a CAGR of 6.2%, supported by the probiotic powders and chews demand. Japan shows moderate growth with a CAGR of 5.9%, driven by targeted probiotics for small-breed dogs and urban pet owners.

The report covers in-depth analysis of 40+ countries; five top-performing OECD countries are highlighted below.

The USA pet probiotics supplements market is projected to grow at a CAGR of 7.4% from 2025 to 2035, driven by its large pet population and strong focus on pet digestive and immune health.

The UK pet probiotics supplements revenue is projected to grow at a CAGR of 7.5% between 2025 and 2035, supported by rising premium supplement adoption and pet humanization trends.

Sales of pet probiotics supplements in Germany are expected to grow at a CAGR of 6.8% from 2025 to 2035, driven by increasing awareness of pet health and nutrition.

Sales of pet probiotics supplements in France are expected to grow at a CAGR of 6.2% from 2025 to 2035, supported by the rising popularity of probiotic powders and chews.

Japan pet probiotics supplements revenue is projected to grow at a CAGR of 5.9% between 2025 and 2035, driven by rising urban pet ownership and awareness of digestive health.

The pet probiotics supplements market is relatively fragmented, with a mix of global giants and strong regional players competing across segments. Top companies focus on innovation, partnerships, and product diversification to strengthen their positions, while smaller brands target niche categories and local markets.

Chr. Hansen, Nestle Purina, and ADM Protexin dominate the market through investments in probiotic strain development, advanced manufacturing technologies, and strategic acquisitions. Chr. Hansen focuses on natural probiotic solutions tailored for age-specific pet needs, while Nestle Purina leads with strong distribution networks and R&D-backed formulations targeting digestive and immune health.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 807.3 million |

| Projected Market Size (2035) | USD 1,139.5 million |

| CAGR (2025 to 2035) | 3.5% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameters | Revenue in USD million /Volume ( Metric Tons) |

| By Form | Powder, Soft Chews, Capsules, and Liquid |

| By Species | Dogs, Cats, Birds, and Reptiles |

| By Claim | No Artificial Additives, No Artificial Flavours, No Artificial Preservatives, Non-GMO, Allergen Free, 100% Vegan, Grain Free, Soil Based, and All Natural |

| By Functionalities | Gut Health, Immunity Booster, Allergy Support, Digestive Health, Coat Quality, and Itch ing Skin |

| By Sales Channel | Online (Company Website, E-commerce, and Third Party Websites), Offline (Distributor, Supermarket, Pet Food Shops, Veterinary Clinics) |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, East Asia, South Asia & Pacific, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia |

| Key Players | Chr. Hansen, Nestle Purina, ADM Protexin, Bacterfield, Unique Biotech, Nutramax, Mars Petcare Inc., NaturVet, Canine India, Pet360, Probioway, Vital Planet |

| Additional Attributes | Dollar sales by value, market share analysis by region, and country-wise analysis |

As per form, the industry has been categorized into Powders, Soft Chews, Capsules and Liquid.

As per species, the industry has been categorized into Dogs, Cats, Birds and Reptiles.

Based on product claims, the industry has been categorized into No Artificial Additives, No Artificial Flavours, No Artificial Preservatives, Non-GMO, Allergen Free, 100% Vegan, Grain Free, Soil Based and All Natural.

As per product functionalities, the industry has been categorized into Gut Health, Immunity Booster, Allergy Support, Digestive Health, Coat Quality and Itching Skin.

This segment is further categorized into Online (Company Website, Ecommerce and Third Party Websites) and Offline (Distributor, Supermarket, Pet Food Shops and Veterinary Clinics).

Industry analysis has been carried out by Regions which is segmented into North America, Latin America, Europe, East Asia, South Asia, Oceania, and the Middle East & Africa.

The market is valued at USD 807.3 million in 2025.

The market is expected to reach USD 1,139.5 million by 2035.

The market will grow at a CAGR of 3.5% during 2025 to 2035.

Soft chews lead with a 27% market share in 2025.

The UK is the fastest-growing country with a 7.5% CAGR through 2035.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA