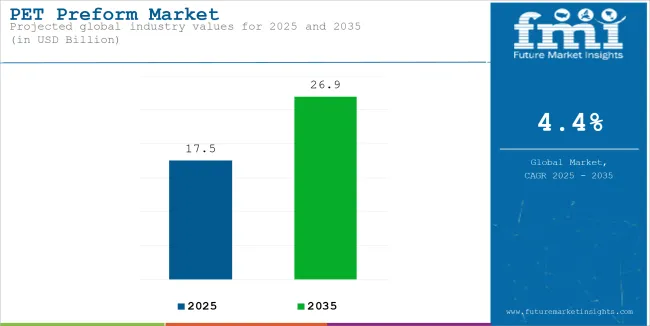

The global PET preform market is valued at USD 17.5 billion in 2025 and is projected to reach USD 26.9 billion by 2035, which shows a CAGR of 4.4%. The market is being driven by rising demand for lightweight, durable, and cost-effective packaging across food & beverages, personal care, household products, and pharmaceuticals.

PET preforms, later converted into bottles and containers, offer excellent strength, clarity, and recyclability qualities that make them the preferred material for rigid packaging applications. The expanding bottled water segment and increasing consumption of carbonated soft drinks, especially in emerging economies, are fueling market growth.

Additionally, the shift toward sustainable packaging and the growing availability of recycled PET (rPET) are further accelerating demand, as brands align with circular economy goals and consumer preferences for environmentally responsible products.

Technological advancements are significantly enhancing product innovation and market competitiveness. Manufacturers are investing in lightweighting techniques and high-speed injection molding to reduce resin consumption, optimize production efficiency, and lower carbon footprint.

The adoption of high-content rPET preforms is increasing, with major packaging companies and beverage brands pursuing ambitious recycled content targets to meet regulatory requirements and sustainability commitments. The market is also witnessing rising demand for specialty preforms designed for hot-fill applications, wide-mouth jars, and personalized packaging formats that enhance shelf appeal and brand differentiation. These innovations are broadening the scope of PET preform applications across diverse packaging segments.

Government regulations are playing a pivotal role in shaping the PET preform market. In Europe, the Single-Use Plastics Directive (SUPD) mandates minimum recycled content requirements, driving demand for rPET preforms. Extended Producer Responsibility (EPR) programs and deposit return systems (DRS) across Europe and North America are further encouraging recyclability and material recovery.

In North America, state-level recycled content laws and voluntary initiatives such as the USA Plastics Pact are influencing material selection and design. Globally, evolving regulations are prompting PET preform manufacturers to adopt advanced recycling technologies, sustainable resin sourcing, and closed-loop production models, positioning PET preforms as a critical component of the sustainable packaging landscape.

Global PET Preform Industry Assessment

| Attributes | Key Insights |

|---|---|

| Historical Size, 2024 | USD 17.1 billion |

| Estimated Size, 2025 | USD 17.5 billion |

| Projected Size, 2035 | USD 26.9 billion |

| Value-based CAGR (2025 to 2035) | 4.4% |

The below table presents the expected CAGR for the global PET preform market over several semi-annual periods spanning from 2025 to 2035. In the first half (H1) of the decade from 2024 to 2034, the business is predicted to surge at a CAGR of 3.2%, followed by a higher slight high growth rate of 5.6% in the second half (H2) of the same decade.

| Particular | Value CAGR |

|---|---|

| H1 (2024 to 2034) | 3.2% |

| H2 (2024 to 2034) | 5.6% |

| H1 (2025 to 2035) | 3.0% |

| H2 (2025 to 2035) | 5.8% |

Moving into the subsequent period, from H1 2024 to H2 2035, the CAGR is projected to decrease to 3.0% in the first half and increase to 5.8% in the second half. In the first half (H1) the market witnessed a decrease of 20 BPS while in the second half (H2), the market witnessed an increase of 20 BPS.

The market is segmented based on capacity, neck type, end use, and region. By capacity, the market is divided into up to 500 ml, 500 ml to 1000 ml, 1000 ml to 2000 ml, and more than 2000 ml. In terms of neck type, it is segmented into ROPP/BPV, PCO/BPF, Alaska/Bericap/Obrist, and others (1810 neck, 1881 neck, 3025 neck, wide mouth neck).

Based on end use, the market is categorized into beverages, food, personal care, pharmaceuticals, and home care. Regionally, the market is classified into North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, and the Middle East & Africa.

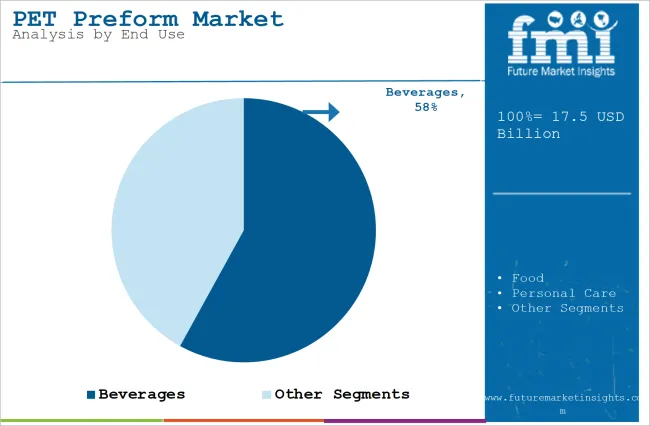

The beverages segment holds 58% market share in 2025, driven by rising demand for lightweight, durable, and recyclable packaging in the bottled water, carbonated soft drinks, juice, and sports beverage markets. PET preforms offer excellent clarity, strength, and barrier properties, making them the preferred choice for beverage packaging worldwide.

The shift toward sustainable packaging is further accelerating adoption of PET preforms in beverages. Lightweighting initiatives, use of recycled PET (rPET), and innovations in neck and preform designs are helping brands reduce carbon footprint while maintaining packaging performance. Emerging markets in Asia Pacific and Africa are driving additional volume growth as bottled beverage consumption increases.

The food segment is experiencing steady demand, with PET preforms used in sauces, edible oils, and ready-to-eat products due to their safety and shelf-life advantages. The personal care segment leverages PET preforms for shampoos, lotions, and cosmetics packaging, with a focus on premium and sustainable formats. Pharmaceuticals use PET for high-barrier, sterile packaging, while the home care segment utilizes PET preforms in household cleaners and detergents. Across all end uses, PET preforms continue to expand as a sustainable, versatile packaging solution.

| End Use | Share (2025) |

|---|---|

| Beverages | 58% |

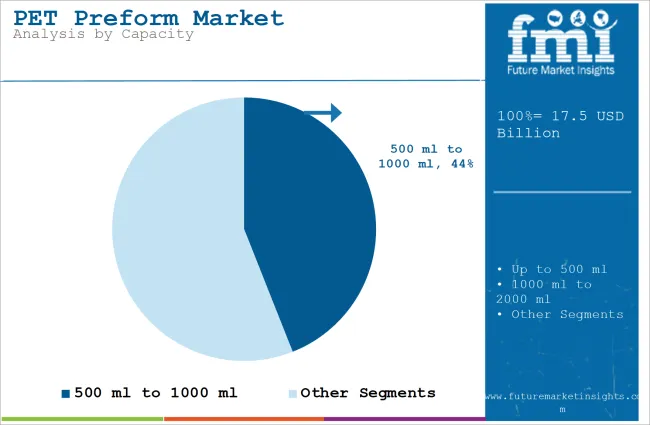

The 500 ml to 1000 ml segment accounts for 44% market share in 2025, supported by its versatility across both single-serve and multi-serve beverage packaging formats. This range is highly preferred for bottled water, carbonated soft drinks, juices, functional beverages, and premium packaging where shelf presence and consumer convenience are key.

Rising health-conscious consumption trends and demand for on-the-go packaging are driving growth in this segment. PET preforms in this size category offer excellent strength-to-weight ratio and clarity, making them ideal for both cold-fill and hot-fill applications. Additionally, innovations in lightweighting and rPET incorporation are enabling sustainable packaging formats in this size range.

Up to 500 ml remains popular for single-serve beverages, particularly in bottled water and flavored water segments. 1000 ml to 2000 ml PET preforms serve family packs and institutional channels. More than 2000 ml PET preforms are primarily used in value packs and bulk packaging for edible oils, water, and home care products. However, as consumer demand shifts toward lifestyle-focused, convenient, and sustainable packaging, the 500 ml to 1000 ml range is expected to drive the majority of new PET preform investments.

| Capacity | Share (2025) |

|---|---|

| 500 ml to 1000 ml | 44% |

The PCO/BPF neck type segment is projected to grow at the highest CAGR of 6.3% from 2025 to 2035, driven by its dominance in the high-volume beverage segment. The PCO (Plastic Closure Only) and BPF (British Plastic Federation) neck types are widely used in carbonated soft drinks, bottled water, and juices due to their compatibility with lightweight closures, tamper-evident features, and efficient capping speeds.

Beverage manufacturers are increasingly adopting PCO/BPF neck types to enhance line efficiency and reduce packaging weight, helping meet both operational and sustainability goals. Continued demand for multi-serve and single-serve beverages further reinforces this segment’s growth.

ROPP/BPV neck types remain vital for edible oil, spirits, and specialty food packaging where roll-on pilfer-proof metal caps or barrier closures are required. Alaska/Bericap/Obrist neck types serve niche applications in premium beverages, specialty closures, and specific brand requirements.

The "others" category including 1810 neck, 1881 neck, 3025 neck, and wide mouth neck supports growing demand in dairy, personal care, and functional food packaging. However, as global beverage packaging continues to scale and evolve, PCO/BPF neck types will remain the workhorse of the PET preform market.

| Neck Type | CAGR (2025 to 2035) |

|---|---|

| PCO/BPF | 6.3% |

Global Beverage Giants Push for Sustainable rPET Packaging Innovations

Major beverage companies in the world- Coca-Cola, PepsiCo and Nestlé-shifting their interests to rPET packaging to embrace sustainability goals along with reducing an environmental footprint from packaging. Examples of this sort are Coca Cola's decision to use half recycled content (50%) in every PET bottle and in every ton of PET film packaging by 2030 through its World Without Waste initiative.

The similar example to it is the 100 percent recyclable, compostable, or biodegradable of PepsiCo by 2025. Until now, one-fifth will be rPET. Therefore, in this regard, sustainable packaging will drive the company to produce PET preforms capable of allowing more recyclates in beverages while saving the strength and transparency of PET while at the same time achieving the barriers of bottles, aseptic jars, and p.a.s. cups.

The onus is on the manufacturers to produce PET preforms that present enhanced compatibility for rPET, which could ensure product integrity, safety, and freshness. This trend supports the corporate sustainability goals and caters to consumer demand for increasing the environmental responsibility of packaging.

Bottled Water Industry Embraces Lightweight PET Preforms for Sustainability

The bottled water industry is shifting toward lightweight PET preforms to lower packaging cost as well as the environmental footprint of the products. Lighter PET bottles will have less material used, meaning reduced production cost as well as transportation carbon footprints. For example, top players such as Nestlé Waters have been moving to lighter PET bottles in a majority of the markets to cut their environmental footprint.

As an example, Nestlé has declined the weight of its bottled water packaging by 20% during the last few years, which in return means lower emissions during transportation and overall material usage. This trend has highly affected demand for specialized lightweight PET preforms that are designed to maintain the strength and robustness of the packaging while using less plastic.

As consumer demand for more sustainable packaging increases, the use of lightweight PET preforms in bottled water continues to grow, thus fitting both the cost-efficiency and environmental goals.

EU Plastic Ban Drives Shift to Bioplastics and Sustainable Packaging

Consumer movements against single-use plastics have gained much momentum, especially in European markets, with increased environmental awareness. Plastic waste and its implications on the environment have been a source of more forceful calls for sustainable alternatives.

Therefore, the European Union imposed a ban on single-use plastics in 2021, directly affecting sectors such as the carbonated soft drink industry, which depends much on PET preforms. The shift in the regulatory environment has forced organizations to look at other options for using different packaging materials and shifting towards greener options, such as bioplastic-based plastics and biodegradable alternatives.

This further resulted in reduced usage of conventional PET preforms, especially in applications where plastic waste is most visible. In light of such concerns, bioplastics and other renewable materials are being explored as a potential alternative to the traditional PET for satisfying the requirements of regulation and consumer choice toward sustainable packaging.

Tier 1 company leaders are characterized by high production technology and a wide product portfolio. These market leaders are distinguished by their extensive expertise in manufacturing and reconditioning across multiple packaging formats and a broad geographical reach, underpinned by a robust consumer base.

They provide a wide range of series including reconditioning, recycling, and manufacturing utilizing the latest technology and meeting the regulatory standards providing the highest quality. Prominent companies within Tier 1 include ALPLA Werke Alwin Lehner GmbH & Co KG, Plastipak Holdings Inc., RETAL Industries Ltd., Indorama Ventures Public Co. Ltd., and Taiwan Hon Chuan Enterprises Co. Ltd.

Tier 2 companies are characterized by a strong presence overseas and strong market knowledge. These market players have good technology and ensure regulatory compliance but may not have advanced technology and wide global reach. Prominent companies in Tier 2 include Resilux NV, Societe Generale Des Techniques (SGT), Zhongfu Enterprise Co Ltd., Manjushree Technopack Limited Co., and Logoplaste UK Ltd.

Tier 3 includes the majority of small-scale companies operating at the local presence and serving niche markets. These companies are notably oriented towards fulfilling local market demands and are consequently classified within the tier 3 share segment. They are small-scale players and have limited geographical reach. Tier 3, within this context, is recognized as an unorganized market, denoting a sector characterized by a lack of extensive structure and formalization when compared to organized competitors.

The section below covers the industry analysis for the PET preform market for different countries. Market demand analysis on key countries in several regions of the globe, including North America, Asia Pacific, Europe, and others, is provided. USA is anticipated to remain at the forefront in North America, with a CAGR of 3.3% through 2035. In South Asia & Pacific market, India is projected to witness a CAGR of 7.1% by 2035.

| Countries | Value CAGR (2025 to 2035) |

|---|---|

| USA | 3.3% |

| Canada | 3.0% |

| Brazil | 4.3% |

| Argentina | 4.0% |

| Germany | 2.6% |

| China | 6.2% |

| India | 7.1% |

The carbonated soft drinks (CSD) segment is a huge driver for the PET preforms market in the USA because consumers continue to seek convenient and robust packaging. PET bottles are the favorite for CSD packaging because they retain carbonation well, have lightweight properties, and can be molded into several shapes for branding purposes.

Innovations in the form of aesthetic PET preforms from leading beverage companies such as PepsiCo and Coca-Cola help create greater appeal at shelf as well as increased functionality. Additionally, adoption of advanced barrier technologies in PET preforms has extended the shelf life for carbonated beverages, with significantly minimized gas permeability.

The trend in this segment is sustainability-related; a brand has set up targets regarding rPET utilization and light weighting bottle design in support of environment-related goals. These factors, coupled with consumer demand for on-the-go beverage solutions, are driving growth and innovation in PET preforms that are tailored to the CSD market.

The pharmaceutical segment is one of the main drivers for the PET preforms market in Germany. Safe, lightweight, and shatterproof packaging solutions are increasing the demand for this industry. Germany has a strong pharmaceutical industry that follows strict quality standards.

Hence, liquid medicines, syrups, and nutraceuticals are mainly packaged in PET bottles. PET preforms deliver the best barrier properties as they shield sensitive formulations from moisture, oxygen and UV light. This helps ensure product stability and efficiency.

The German trend towards home healthcare and self-medication is leading to more demand for convenient and portable packaging, which PET preforms are easily able to offer. Secondly, pharmaceutical companies complying with EU law and using environment-friendly packaging spur the acceptance of rPET for medical grades in the German pharmaceutical market.

In addition, because of safety conditions, manufacturers introduce innovations in child-resistant and tamper-evident designs from PET preform which also positively increases their demands in the market.

Key players operating in the PET preform market are investing in the development of innovative sustainable solutions and also entering into partnerships. Key PET preform providers have also been acquiring smaller players to grow their presence to further penetrate the PET preform market across multiple regions.

Recent Industry Developments in the PET Preform Market

In May 2024, RETAL, a multinational manufacturer of plastic packaging, introduced a new business partner in Central Asia.

| Report Attributes | Details |

|---|---|

| Current Total Market Size (2025) | USD 17.5 billion |

| Projected Market Size (2035) | USD 26.9 billion |

| CAGR (2025 to 2035) | 4.4% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Market Analysis Parameter | Revenue in USD billion/ million tons |

| By Capacity | 500 ml, 500 ml to 1000 ml, 1000 ml to 2000 ml, and more than 2000 ml. |

| By Neck Type | ROPP/BPV, PCO/BPF, Alaska/Bericap/Obrist, and Others. |

| By End Use | Beverages, Food, Personal Care, Pharmaceuticals, Home Care |

| Regions Covered | North America, Latin America, Western Europe, South Asia, East Asia, Eastern Europe, Middle East & Africa |

| Countries Covered | United States, Japan, Germany, India, United Kingdom, France, Italy, Brazil, Canada, South Korea, Australia, Spain, Netherlands, Saudi Arabia, Switzerland |

| Key Players | ALPLA Werke Alwin Lehner GmbH & Co KG, Plastipak Holdings Inc., RETAL Industries Ltd., Resilux NV, Societe Generale Des Techniques (SGT), Taiwan Hon Chuan Enterprises Co. Ltd., Zhongfu Enterprise Co Ltd., Manjushree Technopack Limited Co., Logoplaste UK Ltd., Indorama Ventures Public Co. Ltd. |

| Additional Attributes | Rising demand for cost-effective dairy alternatives, growing infant nutrition sector, expanding bakery industry |

| Customization and Pricing | Available upon request |

In terms of capacity, the industry is divided into up to 500 ml, 500 ml to 1000 ml, 1000 ml to 2000 ml, and more than 2000 ml.

In terms of neck type, the industry is segregated into ROPP/BPV, PCO/BPF, Alaska/Bericap/Obrist, and Others.

The market is classified by end use such as beverage, food, personal care, pharmaceuticals, home care. Beverages are sub categorised as bottled water, carbonated drinks, RTD tea and coffee, juice, sports drinks, other soft drinks, and alcoholic drinks.

Key countries of North America, Latin America, East Asia, South Asia & Pacific, Western Europe, Eastern Europe, and the Middle East & Africa have been covered in the report.

The global PET preform market is expected to reach USD 26.9 billion by 2035, growing from USD 17.5 billion in 2025, at a CAGR of 4.4% during the forecast period.

The 500 ml to 1000 ml capacity segment holds the largest share, accounting for approximately 44% of the market in 2025, due to its versatility across bottled water, carbonated drinks, juices, and functional beverages.

The beverages segment is the largest contributor, holding 58% market share in 2025, driven by the growing demand for lightweight, recyclable packaging in bottled water, soft drinks, and ready-to-drink beverages.

Key drivers include increasing demand for sustainable and lightweight packaging, rising adoption of rPET, expanding bottled water consumption, regulatory pressures on single-use plastics, and innovations in neck designs and lightweighting.

Top companies include ALPLA Werke Alwin Lehner GmbH & Co KG, Plastipak Holdings Inc., RETAL Industries Ltd., Resilux NV, Societe Generale Des Techniques (SGT), Taiwan Hon Chuan Enterprises Co. Ltd., Zhongfu Enterprise Co Ltd., and Manjushree Technopack Limited

Table 1: Global Market Value (US$ Million) Forecast by Region, 2019 to 2034

Table 2: Global Market Volume (Tons) Forecast by Region, 2019 to 2034

Table 3: Global Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 4: Global Market Volume (Tons) Forecast by Material, 2019 to 2034

Table 5: Global Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 6: Global Market Volume (Tons) Forecast by Capacity, 2019 to 2034

Table 7: Global Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 8: Global Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 9: North America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 10: North America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 11: North America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 12: North America Market Volume (Tons) Forecast by Material, 2019 to 2034

Table 13: North America Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 14: North America Market Volume (Tons) Forecast by Capacity, 2019 to 2034

Table 15: North America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 16: North America Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 17: Latin America Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 18: Latin America Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 19: Latin America Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 20: Latin America Market Volume (Tons) Forecast by Material, 2019 to 2034

Table 21: Latin America Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 22: Latin America Market Volume (Tons) Forecast by Capacity, 2019 to 2034

Table 23: Latin America Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 24: Latin America Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 25: Western Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 26: Western Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 27: Western Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 28: Western Europe Market Volume (Tons) Forecast by Material, 2019 to 2034

Table 29: Western Europe Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 30: Western Europe Market Volume (Tons) Forecast by Capacity, 2019 to 2034

Table 31: Western Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 32: Western Europe Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 33: Eastern Europe Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 34: Eastern Europe Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 35: Eastern Europe Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 36: Eastern Europe Market Volume (Tons) Forecast by Material, 2019 to 2034

Table 37: Eastern Europe Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 38: Eastern Europe Market Volume (Tons) Forecast by Capacity, 2019 to 2034

Table 39: Eastern Europe Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 40: Eastern Europe Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 41: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 42: South Asia and Pacific Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 43: South Asia and Pacific Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 44: South Asia and Pacific Market Volume (Tons) Forecast by Material, 2019 to 2034

Table 45: South Asia and Pacific Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 46: South Asia and Pacific Market Volume (Tons) Forecast by Capacity, 2019 to 2034

Table 47: South Asia and Pacific Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 48: South Asia and Pacific Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 49: East Asia Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 50: East Asia Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 51: East Asia Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 52: East Asia Market Volume (Tons) Forecast by Material, 2019 to 2034

Table 53: East Asia Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 54: East Asia Market Volume (Tons) Forecast by Capacity, 2019 to 2034

Table 55: East Asia Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 56: East Asia Market Volume (Tons) Forecast by End Use, 2019 to 2034

Table 57: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2019 to 2034

Table 58: Middle East and Africa Market Volume (Tons) Forecast by Country, 2019 to 2034

Table 59: Middle East and Africa Market Value (US$ Million) Forecast by Material, 2019 to 2034

Table 60: Middle East and Africa Market Volume (Tons) Forecast by Material, 2019 to 2034

Table 61: Middle East and Africa Market Value (US$ Million) Forecast by Capacity, 2019 to 2034

Table 62: Middle East and Africa Market Volume (Tons) Forecast by Capacity, 2019 to 2034

Table 63: Middle East and Africa Market Value (US$ Million) Forecast by End Use, 2019 to 2034

Table 64: Middle East and Africa Market Volume (Tons) Forecast by End Use, 2019 to 2034

Figure 1: Global Market Value (US$ Million) by Material, 2024 to 2034

Figure 2: Global Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 3: Global Market Value (US$ Million) by End Use, 2024 to 2034

Figure 4: Global Market Value (US$ Million) by Region, 2024 to 2034

Figure 5: Global Market Value (US$ Million) Analysis by Region, 2019 to 2034

Figure 6: Global Market Volume (Tons) Analysis by Region, 2019 to 2034

Figure 7: Global Market Value Share (%) and BPS Analysis by Region, 2024 to 2034

Figure 8: Global Market Y-o-Y Growth (%) Projections by Region, 2024 to 2034

Figure 9: Global Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 10: Global Market Volume (Tons) Analysis by Material, 2019 to 2034

Figure 11: Global Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 12: Global Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 13: Global Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 14: Global Market Volume (Tons) Analysis by Capacity, 2019 to 2034

Figure 15: Global Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 16: Global Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 17: Global Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 18: Global Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 19: Global Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 20: Global Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 21: Global Market Attractiveness by Material, 2024 to 2034

Figure 22: Global Market Attractiveness by Capacity, 2024 to 2034

Figure 23: Global Market Attractiveness by End Use, 2024 to 2034

Figure 24: Global Market Attractiveness by Region, 2024 to 2034

Figure 25: North America Market Value (US$ Million) by Material, 2024 to 2034

Figure 26: North America Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 27: North America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 28: North America Market Value (US$ Million) by Country, 2024 to 2034

Figure 29: North America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 30: North America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 31: North America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 32: North America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 33: North America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 34: North America Market Volume (Tons) Analysis by Material, 2019 to 2034

Figure 35: North America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 36: North America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 37: North America Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 38: North America Market Volume (Tons) Analysis by Capacity, 2019 to 2034

Figure 39: North America Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 40: North America Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 41: North America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 42: North America Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 43: North America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 44: North America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 45: North America Market Attractiveness by Material, 2024 to 2034

Figure 46: North America Market Attractiveness by Capacity, 2024 to 2034

Figure 47: North America Market Attractiveness by End Use, 2024 to 2034

Figure 48: North America Market Attractiveness by Country, 2024 to 2034

Figure 49: Latin America Market Value (US$ Million) by Material, 2024 to 2034

Figure 50: Latin America Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 51: Latin America Market Value (US$ Million) by End Use, 2024 to 2034

Figure 52: Latin America Market Value (US$ Million) by Country, 2024 to 2034

Figure 53: Latin America Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 54: Latin America Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 55: Latin America Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 56: Latin America Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 57: Latin America Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 58: Latin America Market Volume (Tons) Analysis by Material, 2019 to 2034

Figure 59: Latin America Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 60: Latin America Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 61: Latin America Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 62: Latin America Market Volume (Tons) Analysis by Capacity, 2019 to 2034

Figure 63: Latin America Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 64: Latin America Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 65: Latin America Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 66: Latin America Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 67: Latin America Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 68: Latin America Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 69: Latin America Market Attractiveness by Material, 2024 to 2034

Figure 70: Latin America Market Attractiveness by Capacity, 2024 to 2034

Figure 71: Latin America Market Attractiveness by End Use, 2024 to 2034

Figure 72: Latin America Market Attractiveness by Country, 2024 to 2034

Figure 73: Western Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 74: Western Europe Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 75: Western Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 76: Western Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 77: Western Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 78: Western Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 79: Western Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 80: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 81: Western Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 82: Western Europe Market Volume (Tons) Analysis by Material, 2019 to 2034

Figure 83: Western Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 84: Western Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 85: Western Europe Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 86: Western Europe Market Volume (Tons) Analysis by Capacity, 2019 to 2034

Figure 87: Western Europe Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 88: Western Europe Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 89: Western Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 90: Western Europe Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 91: Western Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 92: Western Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 93: Western Europe Market Attractiveness by Material, 2024 to 2034

Figure 94: Western Europe Market Attractiveness by Capacity, 2024 to 2034

Figure 95: Western Europe Market Attractiveness by End Use, 2024 to 2034

Figure 96: Western Europe Market Attractiveness by Country, 2024 to 2034

Figure 97: Eastern Europe Market Value (US$ Million) by Material, 2024 to 2034

Figure 98: Eastern Europe Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 99: Eastern Europe Market Value (US$ Million) by End Use, 2024 to 2034

Figure 100: Eastern Europe Market Value (US$ Million) by Country, 2024 to 2034

Figure 101: Eastern Europe Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 102: Eastern Europe Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 103: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 104: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 105: Eastern Europe Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 106: Eastern Europe Market Volume (Tons) Analysis by Material, 2019 to 2034

Figure 107: Eastern Europe Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 108: Eastern Europe Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 109: Eastern Europe Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 110: Eastern Europe Market Volume (Tons) Analysis by Capacity, 2019 to 2034

Figure 111: Eastern Europe Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 112: Eastern Europe Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 113: Eastern Europe Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 114: Eastern Europe Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 115: Eastern Europe Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 116: Eastern Europe Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 117: Eastern Europe Market Attractiveness by Material, 2024 to 2034

Figure 118: Eastern Europe Market Attractiveness by Capacity, 2024 to 2034

Figure 119: Eastern Europe Market Attractiveness by End Use, 2024 to 2034

Figure 120: Eastern Europe Market Attractiveness by Country, 2024 to 2034

Figure 121: South Asia and Pacific Market Value (US$ Million) by Material, 2024 to 2034

Figure 122: South Asia and Pacific Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 123: South Asia and Pacific Market Value (US$ Million) by End Use, 2024 to 2034

Figure 124: South Asia and Pacific Market Value (US$ Million) by Country, 2024 to 2034

Figure 125: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 126: South Asia and Pacific Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 127: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 128: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 129: South Asia and Pacific Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 130: South Asia and Pacific Market Volume (Tons) Analysis by Material, 2019 to 2034

Figure 131: South Asia and Pacific Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 132: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 133: South Asia and Pacific Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 134: South Asia and Pacific Market Volume (Tons) Analysis by Capacity, 2019 to 2034

Figure 135: South Asia and Pacific Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 136: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 137: South Asia and Pacific Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 138: South Asia and Pacific Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 139: South Asia and Pacific Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 140: South Asia and Pacific Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 141: South Asia and Pacific Market Attractiveness by Material, 2024 to 2034

Figure 142: South Asia and Pacific Market Attractiveness by Capacity, 2024 to 2034

Figure 143: South Asia and Pacific Market Attractiveness by End Use, 2024 to 2034

Figure 144: South Asia and Pacific Market Attractiveness by Country, 2024 to 2034

Figure 145: East Asia Market Value (US$ Million) by Material, 2024 to 2034

Figure 146: East Asia Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 147: East Asia Market Value (US$ Million) by End Use, 2024 to 2034

Figure 148: East Asia Market Value (US$ Million) by Country, 2024 to 2034

Figure 149: East Asia Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 150: East Asia Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 151: East Asia Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 152: East Asia Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 153: East Asia Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 154: East Asia Market Volume (Tons) Analysis by Material, 2019 to 2034

Figure 155: East Asia Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 156: East Asia Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 157: East Asia Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 158: East Asia Market Volume (Tons) Analysis by Capacity, 2019 to 2034

Figure 159: East Asia Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 160: East Asia Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 161: East Asia Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 162: East Asia Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 163: East Asia Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 164: East Asia Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 165: East Asia Market Attractiveness by Material, 2024 to 2034

Figure 166: East Asia Market Attractiveness by Capacity, 2024 to 2034

Figure 167: East Asia Market Attractiveness by End Use, 2024 to 2034

Figure 168: East Asia Market Attractiveness by Country, 2024 to 2034

Figure 169: Middle East and Africa Market Value (US$ Million) by Material, 2024 to 2034

Figure 170: Middle East and Africa Market Value (US$ Million) by Capacity, 2024 to 2034

Figure 171: Middle East and Africa Market Value (US$ Million) by End Use, 2024 to 2034

Figure 172: Middle East and Africa Market Value (US$ Million) by Country, 2024 to 2034

Figure 173: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2019 to 2034

Figure 174: Middle East and Africa Market Volume (Tons) Analysis by Country, 2019 to 2034

Figure 175: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2024 to 2034

Figure 176: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2024 to 2034

Figure 177: Middle East and Africa Market Value (US$ Million) Analysis by Material, 2019 to 2034

Figure 178: Middle East and Africa Market Volume (Tons) Analysis by Material, 2019 to 2034

Figure 179: Middle East and Africa Market Value Share (%) and BPS Analysis by Material, 2024 to 2034

Figure 180: Middle East and Africa Market Y-o-Y Growth (%) Projections by Material, 2024 to 2034

Figure 181: Middle East and Africa Market Value (US$ Million) Analysis by Capacity, 2019 to 2034

Figure 182: Middle East and Africa Market Volume (Tons) Analysis by Capacity, 2019 to 2034

Figure 183: Middle East and Africa Market Value Share (%) and BPS Analysis by Capacity, 2024 to 2034

Figure 184: Middle East and Africa Market Y-o-Y Growth (%) Projections by Capacity, 2024 to 2034

Figure 185: Middle East and Africa Market Value (US$ Million) Analysis by End Use, 2019 to 2034

Figure 186: Middle East and Africa Market Volume (Tons) Analysis by End Use, 2019 to 2034

Figure 187: Middle East and Africa Market Value Share (%) and BPS Analysis by End Use, 2024 to 2034

Figure 188: Middle East and Africa Market Y-o-Y Growth (%) Projections by End Use, 2024 to 2034

Figure 189: Middle East and Africa Market Attractiveness by Material, 2024 to 2034

Figure 190: Middle East and Africa Market Attractiveness by Capacity, 2024 to 2034

Figure 191: Middle East and Africa Market Attractiveness by End Use, 2024 to 2034

Figure 192: Middle East and Africa Market Attractiveness by Country, 2024 to 2034

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

PET Preform Machines Market Size and Share Forecast Outlook 2025 to 2035

Market Share Insights of Leading PET Preform Providers

USA PET Preform Market Trends – Growth, Demand & Forecast 2025-2035

ASEAN PET Preform Market Outlook – Share, Growth & Forecast 2025-2035

Japan PET Preform Market Trends – Size, Share & Forecast 2025-2035

Germany PET Preform Market Analysis – Growth, Applications & Outlook 2025-2035

Pet Joint Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Cognitive Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA