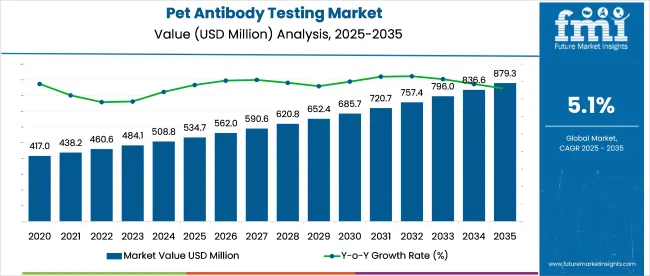

The pet antibody testing market is estimated at USD 534.7 million in 2025 and is projected to exceed USD 879.3 million by 2035, growing at a CAGR of 5.1%.

Demand is being underpinned by rising pet ownership, enhanced zoonotic disease surveillance, and strict vaccination protocols enforced for international pet movement. Rabies-neutralizing antibody assays are being favored as the gold standard, with rapid fluorescent focus inhibition tests (RFFIT) and mouse neutralization tests (MNT) being prioritized across veterinary laboratories.

It is argued that adoption could be accelerated through point-of-care platforms and blockchain-based result tracking, which would enhance traceability and compliance.

In November 2023, Heska, now part of Antech under Mars Petcare, launched its Element i+™ Respiratory Profile to enhance diagnostic capabilities for companion animals. This multiplex panel uses antibody serology to detect prior exposure to pathogens such as heartworm, Lyme disease, and various respiratory viruses.

The tool supports veterinarians in making timely, evidence-based treatment decisions. Emphasizing the significance of this advancement, Kevin Wilson, Chief Commercial Officer at Heska, noted, “Antibody serology remains critical for detecting exposure to pathogens like heartworm, Lyme, and respiratory viruses in pets. Our new multiplex respiratory panel leverages this technology to provide veterinarians with actionable insights for faster, more informed treatment decisions.”

The industry holds a specialized share within its parent markets. In the veterinary diagnostics market, it accounts for approximately 5-7%, as antibody tests are just one aspect of the broader diagnostic tools used for animals. Within the animal health market, its share is around 3-4%, driven by the increasing focus on disease prevention and monitoring in pets.

In the biotechnology market, the share is about 1-2%, as pet antibody testing leverages biotechnological methods but is a niche segment within the broader biotech industry. Within the pharmaceuticals market, its share is approximately 2-3%, due to its role in vaccine development and monitoring immunity. In the pet care market, the share is around 1-2%, as antibody testing is increasingly used for preventive healthcare in pets.

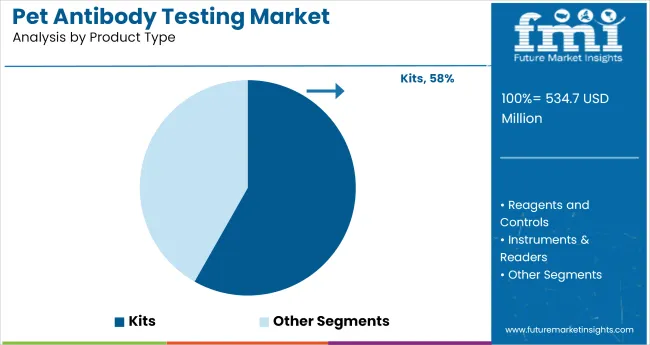

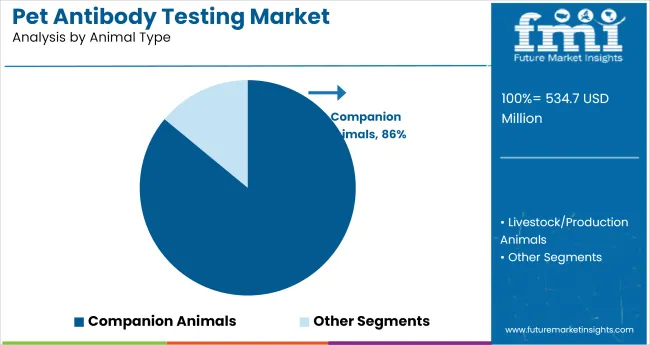

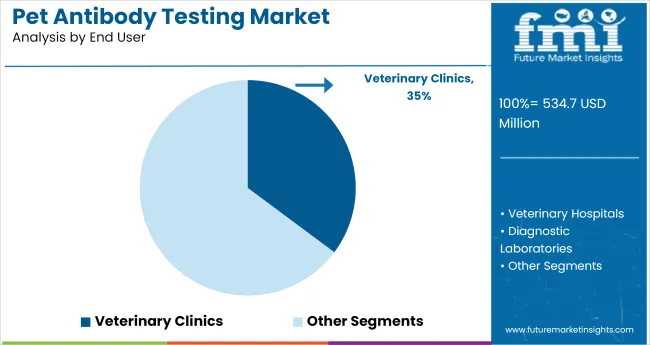

The industry is expected to grow, with kits leading the product type segment at 58.2%. Companion animals will dominate the animal type segment with 86%, chronic conditions will lead the application segment with 55.7%, and veterinary clinics will hold 35.2% of the end-user industry.

Kits are projected to account for 58.2% of the industry share in 2025, with antibody test kits, ELISA kits, immunofluorescence assay (IFA) kits, and at-home kits being the primary drivers. These kits are widely used due to their ease of use, accuracy, and ability to provide quick results. The increasing demand for at-home testing and growing awareness among pet owners are expected to support the continued dominance of kits in the industry.

Companion animals are expected to dominate the animal type segment, capturing 86% of the industry share in 2025. This dominance is driven by the rising pet adoption rates, particularly dogs and cats, and their increasing inclusion in health management and veterinary care.

Pet antibody testing is essential for diagnosing various diseases, including allergies, autoimmune disorders, and chronic conditions, further driving the demand in companion animals. As owners continue to prioritize the health and well-being of pets, the companion animal segment remains the largest industry segment for pet antibody testing.

Chronic conditions are projected to capture 55.7% of the industry in 2025, driven by the need for ongoing diagnostic support and management in pets with long-term health conditions. Conditions like arthritis, diabetes, and kidney disease are common in aging pets, driving the demand for early detection and continuous monitoring through antibody testing.

The growing focus on preventive healthcare and improving the quality of life for aging pets contributes to the dominance of chronic conditions as a key application for pet antibody testing.

Veterinary clinics are expected to hold 35.2% of the industry share in 2025. Veterinary clinics play a key role in diagnosing and managing pet health conditions, including autoimmune disorders, allergies, and chronic conditions, making them a primary end-user for pet antibody tests.

The growing number of pet clinics, coupled with increasing pet healthcare awareness, drives the demand for antibody testing services. With a strong focus on clinical diagnostics, veterinary clinics remain a vital hub for antibody testing, providing accurate and timely results for pet owners and veterinarians alike.

The industry is expanding due to increased pet ownership and a growing focus on animal health. However, challenges such as high testing costs and limited access to veterinary services in certain regions hinder broader adoption.

Rising Pet Ownership and Health Awareness

The surge in pet ownership globally is a significant driver of the industry. As more households adopt pets, particularly in emerging economies, the demand for veterinary services, including diagnostic tests, has increased. This trend is coupled with a heightened awareness among pet owners about the importance of preventive healthcare and early disease detection, further propelling the industry's growth.

High Costs and Limited Access to Veterinary Services

Despite the growing demand, the industry faces challenges related to high costs and limited access to veterinary services. Advanced diagnostic tests can be expensive, making them less accessible to pet owners in lower-income regions. Additionally, in rural or underserved areas, the availability of veterinary clinics equipped to perform such tests is limited, restricting industry growth.

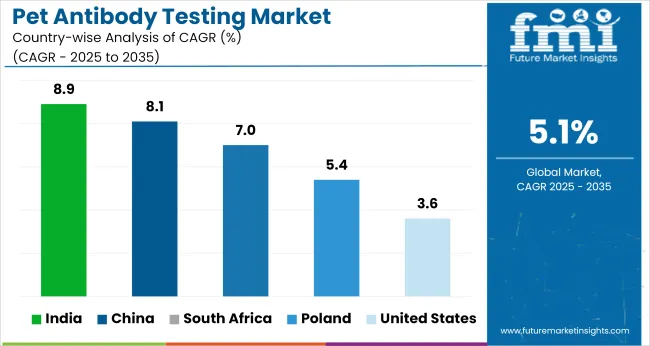

| Countries | CAGR (2025 to 2035) |

|---|---|

| India | 8.9% |

| China | 8.1% |

| South Africa | 7 % |

| Poland | 5.4% |

| United States | 3.6% |

Global industry demand is projected to rise at a 5.1% CAGR from 2025 to 2035. Of the five profiled countries out of 40 covered, India leads at 8.9%, followed by China at 8.1%, and South Africa at 7%, while Poland records 5.4% and the United States posts 3.6%.

These rates translate to a growth premium of +74% for India, +59% for China, and +37% for South Africa versus the baseline, while the United States shows slower growth. Divergence reflects local catalysts: increasing pet ownership and demand for health testing solutions in India and China, while more mature industries like the United States experience slower adoption, and South Africa benefits from rising awareness and veterinary care infrastructure development.

The industry in India is forecast to grow at a CAGR of 8.9% through 2035, driven by expanding companion animal ownership and rising interest in clinical diagnostics across urban veterinary centers. Diagnostic kits for canine parvovirus, distemper, and rabies antibodies are seeing higher adoption in Tier-1 and Tier-2 cities. State veterinary universities have initiated testing centers linked with outreach clinics to improve access.

The industry in China is projected to grow at a CAGR of 8.1% from 2025 to 2035, supported by rising disposable income among pet owners and a growing preference for scientific veterinary care. High-end clinics in Beijing, Shanghai, and Guangzhou are deploying antibody tests for disease screening and vaccine monitoring. Partnerships with diagnostic labs and pet pharma firms are fueling innovation in rapid test formats.

The industry in South Africa is anticipated to grow at a CAGR of 7%. Diagnostic expansion is driven by increased regulation of pet travel, disease surveillance, and proactive pet health management. Veterinary clinics in Johannesburg and Cape Town have upgraded in-clinic testing labs, and wildlife rehabilitation centers are using antibody assays for zoonotic disease monitoring.

The industry in Poland is expected to rise at a CAGR of 5.4% during the forecast period. Growth is being sustained by the rising number of companion animals and mandatory EU travel testing requirements. Veterinary laboratories offer bundled antibody screening panels, and veterinary associations are promoting continuing education in diagnostic practices.

The United States industry is projected to expand at a CAGR of 3.6% from 2025 to 2035. Testing is concentrated in large veterinary hospitals and specialty clinics. Regulatory-compliant testing, such as rabies titers for international travel, and screening for autoimmune conditions drive demand. Preventive care plans in urban clinics now include annual antibody titer tracking.

The global industry is dominated by IDEXX Laboratories, Inc., which holds a significant share through its extensive portfolio of diagnostic tests for companion animals. IDEXX’s products are widely used across veterinary clinics and laboratories, providing reliable and rapid results for diagnosing various conditions.

Competitors like Zoetis, Thermo Fisher Scientific, and Neogen also offer similar diagnostic solutions, but IDEXX’s established distribution network and continuous innovation position it as the leader in the industry, strengthening its industry dominance and contributing to ongoing growth in veterinary diagnostics.

Recent Industry Developments

| Report Attributes | Details |

|---|---|

| Current Industry Size (2025) | USD 534.7 million |

| Projected Industry Size (2035) | USD 879.3 million |

| CAGR (2025 to 2035) | 5.1% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD million for value and million units for volume |

| Product Type Segmentation | Kits (Antibody Test Kits, ELISA Kits, Immunofluorescence Assay (IFA) Kits, At-home Kits), Reagents and Controls, Instruments & Readers |

| Animal Type Segmentation | Companion Animals, Livestock/Production Animals |

| Application Segmentation | Autoimmune Disorders, Allergies & Dermatology, Chronic Conditions |

| End-User Segmentation | Veterinary Hospitals, Veterinary Clinics, Diagnostic Laboratories, Pet Owners / At-Home Testing |

| Regions Covered | North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, Middle East & Africa |

| Countries Covered | United States, Canada, Mexico, Brazil, Argentina, Germany, France, United Kingdom, Italy, Spain, Netherlands, China, India, Japan, South Korea, Australia, New Zealand, GCC Countries, South Africa |

| Key Players Influencing the Industry | Biogal - Galed Laboratories, IDEXX Laboratories, Getein Animal Medical Technology, Guangzhou Wondfo Biotech Co., Ltd., TestLine Clinical Diagnostics, Wuhan J.H. Bio-Tech Co., Ltd., Rohi Biotechnology Co., Ltd., Randox Laboratories, DRG Instruments GmbH, ALPCO |

| Additional Attributes | Dollar sales by product type, animal type, application, and end-user, increasing adoption of antibody testing in veterinary care, growing demand for at-home testing kits, advancements in diagnostics for autoimmune and chronic conditions, regional trends in pet healthcare and diagnostics. |

The segmentation by product type includes Kits, Reagents and Controls, and Instruments & Readers. Kits consist of Antibody Test Kits, ELISA Kits, Immunofluorescence Assay (IFA) Kits, and At-home Kits.

Based on animal type, the industry is divided into companion animals and livestock/production animals.

Applications include autoimmune disorders, allergies & dermatology, and chronic conditions.

End-user categories include veterinary hospitals, veterinary clinics, diagnostic laboratories, and pet owners / at-home testing.

The industry spans North America, Latin America, Western Europe, Eastern Europe, South Asia & Pacific, East Asia, Central Asia, Balkan and Baltic Countries, Russia and Belarus, and The Middle East & Africa.

The projected industry size in 2025 is USD 534.7 million.

The forecasted industry value in 2035 is projected to reach USD 879.3 million, with a CAGR of 5.1%.

Companion animals capture the majority of the animal type segment in the industry with an 86% industry share.

India will lead the industry with an 8.9% CAGR from 2025 to 2035.

IDEXX Laboratories, Inc. is the leading company in the industry with a 30% industry share.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet DNA Testing Market Analysis by Animal Type, Sample Type, Test Type, End User and Region: Forecast for 2025 to 2035

Antibody Specificity Testing Market Size and Share Forecast Outlook 2025 to 2035

Pet Joint Health Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Collagen Market Size, Share, Trends, and Forecast 2025 to 2035

Pet Cognitive Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Pulverizer Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Emulsifier Market Size and Share Forecast Outlook 2025 to 2035

PET Film for Face Shield Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Antibody Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA