In 2024, the European pet food packaging market witnessed a dramatic shift towards convenience formats and eco-friendly substrates. Single-serve and resealable bag demand grew at a high rate, mostly in city locations such as Berlin, Paris, and Amsterdam, where limited living space and increasing solo-household dwellings encouraged more of the small packs of pet food.

Retailers were requesting shelf-ready pack formats to facilitate in-store efficiency, while store brands spent money on eye-catching graphic designs in order to gain shelf space alongside leading-brand labels. Concurrently, inflationary trends pushed producers to optimize supply chains and eliminate waste material.

Analysis by FMI shows that flexible pack formats are increasing their share in total volume due to the lower material weight and cost-effectiveness when compared to traditional rigid food packaging. Despite this, rolling out new packaging formats was delayed due to logistics and scalability issues at the production level.

Through 2025 and onwards, FMI anticipates growth in the industry to continue on the back of sustained pet humanization and enhanced demand for high-end food. Growth in the e-commerce area will also prompt demand for premium, lightweight containers that meet shipment needs without offending brand appearance.

Conformity with the EU Green Deal should propel industry-scale use of reusable materials and closed-loop packaging. Technology breakthroughs in barrier film and digital print are on their way to enhancing packaging functionality, shelf life, and personalization potential in terms of pet food brands.

| Metric | Value |

|---|---|

| Industry Size (2025E) | USD 3,590 Million |

| Industry Value (2035F) | USD 5,520 Million |

| CAGR (2025 to 2035) | 4.4% |

The European packaging industry for pet food is expected to grow consistently to 2035, benefiting from growing ownership of pets, increased demand for high-quality pet food, and regulatory changes in favor of recyclable, convenience-based pack formats.

EU circular economy aims-driven regulation will drive innovation in flexible and recyclable packaging. Sustainability-driven suppliers and pack converters are likely to take industry share, while laggard companies waiting to switch to recyclable formats can expect reduced visibility and competitiveness on shop shelves.

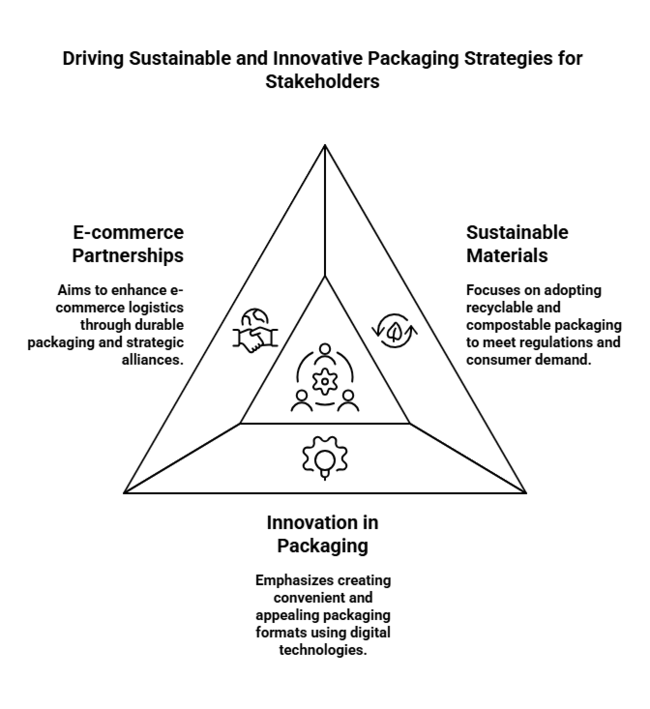

Speed up the use of sustainable materials

Executives must invest in recyclable, compostable, and mono-material packaging options first to meet EU regulation requirements and match the demand for sustainable alternatives from consumers.

Innovate for Convenience and Premium appeals

Develop packaging configurations that support single-serve, resealable, and shelf-ready packaging and extend brand storytelling through digital printing and smart labeling technologies.

Strengthen E-commerce Packaging and Distribution alliances

Enhance capacity for long-term, lightweight packaging designed for direct-to-consumer supply chains, and form strategic alliances with fulfillment platforms to drive delivery optimization and lower damage rates.

| Risk | Probability - Impact |

|---|---|

| Regulatory delays in circular packaging compliance | Medium - High |

| Raw material and resin input cost volatility | High - Medium |

| Below-expected adoption of e-commerce-formatted offerings | Medium - Medium |

| Priority | Immediate Action |

|---|---|

| Assess Bio-Based Packaging Inputs | Conduct a feasibility study in purchasing regionally sourced bio-materials |

| Digital Packaging Innovations | Initiate OEM feedback loop on integration of smart label and QR code. |

| Retail Co-Branding | Initiate pilot program for co-promotions with private-label chains. |

To stay ahead, companies must double down on sustainability-driven innovation and e-commerce agility. This observation predicts a significant trend towards agile, lightweight, and cyclical packaging models that are also EU directive and customer expectation compliant in equal measure.

Leadership groups ought to focus more on R&D in mono-material packaging, spending on digital print for SKU individualization, and investing in capital towards systems based on integrated e-commerce and retail distribution. Strong growth will require agile supply networks and strategic partnerships that can create green regulation compliance while increasing differentiation of brands.

| Country | Policy & Regulatory Impact |

|---|---|

| Germany | Tight enforcement of the German Packaging Act ( VerpackG ) entails recyclability and registration in the Central Packaging Registry (ZSVR). EPR (Extended Producer Responsibility) is tightly enforced. All packaging must be registered on the LUCID database. Strict fines for non-compliance. Eco-modulation in charges incentives recyclable materials. |

| France | Companies are required to provide recyclable, reusable, or compostable packaging by 2025 under Loi AGEC (Anti-Waste Law for a Circular Economy). Laws and waste sorting guidelines require companies to use the Triman logo. Manufacturers are required to pay rising eco-contributions to France's EPR organization, CITEO, for non-sustainable packaging formats. |

| United Kingdom | Post- Brexit regulation divergence has created differentiated rules under the UK Plastics Packaging Tax and Extended Producer Responsibility (EPR) 2024 changes. Companies are taxed if their packaging is less than 30% recycled plastic. UK companies are required to report packaging waste through the National Packaging Waste Database (NPWD) according to mandatory regulations. |

| Italy | Legislative Decree 116/2020 governs this, aligning with EU waste directives. Legislative Decree 116/2020 mandates all packaging to include material codes for sorting and disposal. Italy has also made it mandatory to use compostable material for fresh food packaging in some areas. Manufacturers must comply with the CONAI (National Packaging Consortium) fee system. |

| Spain | Enacted through Royal Decree 1055/2022, Spain has reuse and eco-design obligations for packaging. It is mandatory to join Ecoembes, the national EPR scheme. Spanish legislation mandates that all packaging bear the Green Dot and be certified to UNE 13432 for compostable materials, as relevant. |

The sector expects plastic to be the most remunerative material segment from 2025 to 2035. As consumer demand for functional, rugged, and lightweight packaging that ensures product safety increases, the plastic segment is likely to grow at a CAGR of approximately 4.7% between 2025 to 2035, slightly above the overall industry growth rate of 4.4%.

The adaptability, value, and ongoing research in reusable and degradable plastic alternatives are its primary strengths. Despite plastic waste issues mounting, technological breakthroughs in environmentally friendly plastic production, such as biodegradable plastics and upgraded recycling processes, have supported the plastic sector. They are lightweight, cost-effective, and usually used for various pet food package alternatives.

Bags & pouches will be the most lucrative product type segment within the industry for the period 2025 to 2035. As consumer trends move toward convenience and sustainability, the Bags & Pouches segment is projected to grow at a CAGR of approximately 4.9% from 2025 to 2035, faster than the overall industry growth rate of 4.4%.

The segment is benefiting from increasing demand for convenience packaging, which is conducive to resealability and portion control, both in high demand among consumers. Demand for space-saving, lightweight, and cost-effective substitutes for rigid containers is propelling the use of flexible packaging solutions. Furthermore, innovation in green laminates and recyclable pouches is aligning with sustainability trends.

Dog food is expected to be the highest revenue-generating end-use segment from 2025 to 2035 owing to the growth of premium product offerings and e-commerce. The dog food segment is expected to grow at a CAGR of approximately 4.6% from 2025 to 2035, which is greater than the overall industry growth rate of 4.4%. The industry for premium dog food products such as organic and specialty nutrition formulations is expanding, which is fueling the demand for high-quality and innovative packaging solutions.

Further, driven by the advancement of e-commerce, packaging acts as an imperative element to ensure protection during delivery while enhancing attractiveness to customers. The increased pet humanization of pets, primarily dogs, and the fact that pet owners would pay more to purchase high-class pet food brand names are the key drivers to the growth in this category.

Dry food shall drive the industry's revenue in 2025 to 2035 due to extended shelf life, efficiency in costs, and ease of preference of the consumer. Dry food also shall register a CAGR of about 4.8% during 2025 to 2035 and drive the industry due to higher penetration within the industry and industrial pet food sector.

Dry pet food, the preferred and cheapest for owners, is also gaining an edge through its shelf life and ease of usage. This category is also expanding because of increased pet adoption and the trend toward pet diets based on health. Moreover, innovations in packaging that facilitate better retention of freshness and convenience in handling are driving the growth of this category.

Analysis of Top Countries, Producing, Using, and Distributing Europe Pet Food Packaging Landscape

Germany's pet food packaging industry is expected to develop at a CAGR of 4.5% from 2025 to 2035. Germany is a major driver in the European industry because it has a developed packaging infrastructure and consumer demand for recyclable, regulation-friendly solutions.

German consumers increasingly opt for ecologically friendly and recyclable packaging of pet food because of ecological consciousness as well as strict government regulations like the German Packaging Act (VerpackG). Advanced recycling facilities and emphasis on sustainability in Germany make it a global leader in the industry, presenting opportunities for development in sustainable packaging technologies.

France is expected to witness growth in its pet food packaging sector at a CAGR of 4.2% from 2025 to 2035. France's industry is led by Loi AGEC, which insists on the application of recyclable and compostable packaging materials. This, combined with growing demand for sustainable packaging among consumers, is fueling demand.

France's pet food sector has a strong presence in premium brands, which require advanced packaging to meet aesthetic, functional, and compliance standards. French companies are increasingly embracing sophisticated packaging technologies that meet regulatory needs and respond to both aesthetics and sustainability.

The sales of pet food packaging in the United Kingdom are projected to develop at a 4.3% CAGR during 2025 to 2035. Post-Brexit, tougher legislation in the UK including the UK Plastics Packaging Tax and Extended Producer Responsibility (EPR) is pressuring businesses to innovate recyclable packaging.

Consumer demand for sustainable and convenient packaging solutions is the drive of the industry. The demand for sustainable packaging format will be consistently influenced by the UK drive to reduce plastic waste and encourage recycling initiatives and will hence open up a growth path for the businesses aligned to the said regulations.

The Italian pet food packaging industry is projected to develop at a CAGR of 4.1% during the period 2025 to 2035. Italy's regulations, such as the Legislative Decree 116/2020, go for the circular economy and therefore require its packaging to be recyclable or compostable. Sustainable packaging solutions are in demand amongst Italian consumers actively investing in eco-friendly goods.

Also, packaging solutions are in compliance with waste management and recycling through Italy's involvement in the CONAI (National Packaging Consortium). This trend will continue to drive the growth trajectory of the sector.

Spanish pet food packaging industry is forecasted to develop a CAGR of 4.0% from 2025 to 2035. Spain has established a regulatory environment, with Royal Decree 1055/2022 as the leading force, focused on sustainable packaging and recyclable packaging, thus fostering innovations in pet food packaging.

Consumers in Spain are upgrading sustainability among their concerns, and companies are responding by opting for biodegradable and recyclable materials. The Spanish regulation, in conjunction with the national extended producer responsibility schemes, such as Ecoembes, is now promoting the investment in sustainable innovations and capacities for the pet food packaging domain.

The major players in the industry consolidate their competitive advantages through advanced material innovation, strategic partnerships, and sustainable-focused design integration. The dominant players such as Amcor plc, Mondi Group, and Constantia Flexibles are now putting large investments into recyclable multilayer films, mono-material structures, and compostable packaging to comply with the EU regulatory guidelines pertaining to circularity in packaging and building towards reduction of plastics.

Accessing M&As and regional expansions, these companies are working toward making their industry position stronger and diversify their product offerings. E.g., Mondi has developed its pet food packaging portfolio through the acquisition of local producers and by increasing production capacity in Central and Eastern Europe. Meanwhile, Amcor has taken up innovation toward lighter flexible pouches and packaging that are resalable, taking into account consumer demand for convenience and product freshness.

In Europe, distributors and co-packers are coming in partnership with these manufacturers to jointly develop customized packaging solutions for regional labeling mandates, shelf-life, and sustainability requirements. In turn, regional players have responded with a mix of niche offers targeting local language branding, functional closures, and minimum carbon footprints.

Industry success will depend on integrating sustainability with functional design by 2025. The targets will further lean toward mono-recyclability, resealability, and visual shelf appeal in aindustry that will be shaped by regulations, Premiumization trends, and rising expectations of pet owners in terms of quality and eco-friendliness.

In 2025, the industry is dominated by a leadership group of multinational packaging companies who have consolidated their positions through technological advancements in recyclable materials, targeted acquisitions, and strong partnerships with leading pet food brands. Industry leader Amcor plc controls the industry with an estimated 25% market share, based on its foray into sustainable packaging formats and extensive brand collaborations.

Mondi Group has the leading 20% share, due to its pioneering initiative in recyclable mono-material packs. Constantia Flexibles occupies the second place with 15%, owing to its flexible pack expansions in important European industries.

Huhtamaki Group gains 10% following recent investments in southern Europe that improved regional production capacities. The rest, 30%, is spread over smaller regional operators, indicating a moderately consolidated competition space with some scope for niche innovation.

| Company | Estimated Market Share (2025) |

|---|---|

| Amcor plc | 25% |

| Mondi Group | 20% |

| Constantia Flexibles | 15% |

| Huhtamaki Group | 10% |

| Others | 30% |

the industry is segmented into paper & paperboard, plastic, metals, and others.

the industry is segmented into cans, bags & pouches, folding cartons, tubes, blister pack, plastic bottles & jars, and others.

the industry is segmented into dog food, cat food, fish food, and others.

the industry is segmented into dry food, wet food and frozen food.

the industry is segmented into Germany, France, the United Kingdom, Italy, and Spain.

The growing pet ownership, premiumization of pet food, and heightened sustainability concerns are major growth drivers in pet food packaging.

The industry is forecast to grow significantly through 2035, driven by increased pet adoption, higher spending on pet care, and demand for eco-conscious packaging solutions.

Leading companies in the Europe pet food packaging market, based on product innovation and regional footprint, include Amcor plc, Berry Global, Sealed Air Corporation, Mondi Group, and Huhtamaki Group.

Plastic is the most common pet food packaging material, followed by paper and paperboard, due to its durability and low cost.

Bags & pouches will expand significantly because they are convenient, cost-effective, and flexible for many pet food items.

Table 1: Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 2: Market Volume (Units) Forecast by Country, 2018 to 2033

Table 3: Market Value (US$ Million) Forecast by Material, 2018 to 2033

Table 4: Market Volume (Units) Forecast by Material, 2018 to 2033

Table 5: Market Value (US$ Million) Forecast by Product Type, 2018 to 2033

Table 6: Market Volume (Units) Forecast by Product Type, 2018 to 2033

Table 7: Market Value (US$ Million) Forecast by End-Use, 2018 to 2033

Table 8: Market Volume (Units) Forecast by End-Use, 2018 to 2033

Table 9: Market Value (US$ Million) Forecast by Food Type, 2018 to 2033

Table 10: Market Volume (Units) Forecast by Food Type, 2018 to 2033

Figure 1: Market Value (US$ Million) by Material, 2023 to 2033

Figure 2: Market Value (US$ Million) by Product Type, 2023 to 2033

Figure 3: Market Value (US$ Million) by End-Use, 2023 to 2033

Figure 4: Market Value (US$ Million) by Food Type, 2023 to 2033

Figure 5: Market Value (US$ Million) by Country, 2023 to 2033

Figure 6: Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 7: Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 8: Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 9: Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 10: Market Value (US$ Million) Analysis by Material, 2018 to 2033

Figure 11: Market Volume (Units) Analysis by Material, 2018 to 2033

Figure 12: Market Value Share (%) and BPS Analysis by Material, 2023 to 2033

Figure 13: Market Y-o-Y Growth (%) Projections by Material, 2023 to 2033

Figure 14: Market Value (US$ Million) Analysis by Product Type, 2018 to 2033

Figure 15: Market Volume (Units) Analysis by Product Type, 2018 to 2033

Figure 16: Market Value Share (%) and BPS Analysis by Product Type, 2023 to 2033

Figure 17: Market Y-o-Y Growth (%) Projections by Product Type, 2023 to 2033

Figure 18: Market Value (US$ Million) Analysis by End-Use, 2018 to 2033

Figure 19: Market Volume (Units) Analysis by End-Use, 2018 to 2033

Figure 20: Market Value Share (%) and BPS Analysis by End-Use, 2023 to 2033

Figure 21: Market Y-o-Y Growth (%) Projections by End-Use, 2023 to 2033

Figure 22: Market Value (US$ Million) Analysis by Food Type, 2018 to 2033

Figure 23: Market Volume (Units) Analysis by Food Type, 2018 to 2033

Figure 24: Market Value Share (%) and BPS Analysis by Food Type, 2023 to 2033

Figure 25: Market Y-o-Y Growth (%) Projections by Food Type, 2023 to 2033

Figure 26: Market Attractiveness by Material, 2023 to 2033

Figure 27: Market Attractiveness by Product Type, 2023 to 2033

Figure 28: Market Attractiveness by End-Use, 2023 to 2033

Figure 29: Market Attractiveness by Food Type, 2023 to 2033

Figure 30: Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Pet Cosmetics Market Size and Share Forecast Outlook 2025 to 2035

Pet Herbal Supplements Market Size and Share Forecast Outlook 2025 to 2035

Global Pet Wellness Services Market Analysis Size and Share Forecast Outlook 2025 to 2035

PET Syrup Bottle Market Size and Share Forecast Outlook 2025 to 2035

Pet Fitness Care Market Size and Share Forecast Outlook 2025 to 2035

Pet Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

PET Straps Market Size and Share Forecast Outlook 2025 to 2035

Pet Prebiotics Market Analysis - Size, Growth, and Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA