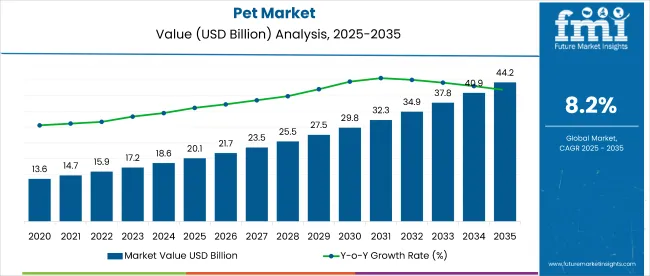

The global pet market is estimated to be valued at USD 20.1 billion in 2025 and is projected to reach USD 44.5 billion by 2035, growing at a robust compound annual growth rate (CAGR) of 8.2%. This impressive growth reflects increasing pet ownership worldwide, rising disposable incomes, and a growing humanization trend, where pets are considered family members and receive premium products and services.

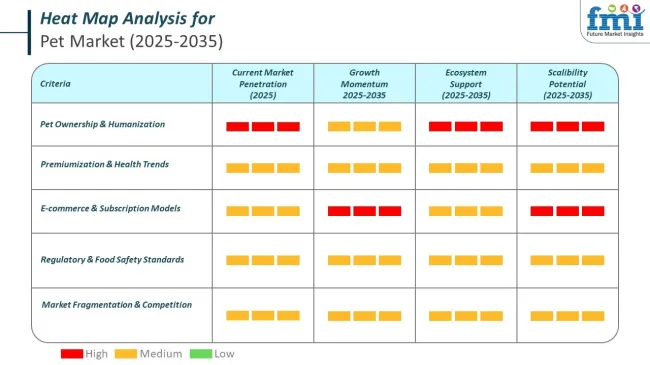

The market encompasses a wide range of segments including pet food, healthcare, grooming products, accessories, and services such as veterinary care and pet insurance. Among these, premium and organic pet food products are experiencing significant demand, driven by pet owners’ heightened awareness of health and nutrition. Additionally, technological advancements such as smart pet devices and telemedicine are transforming the industry, enabling better pet monitoring and care.

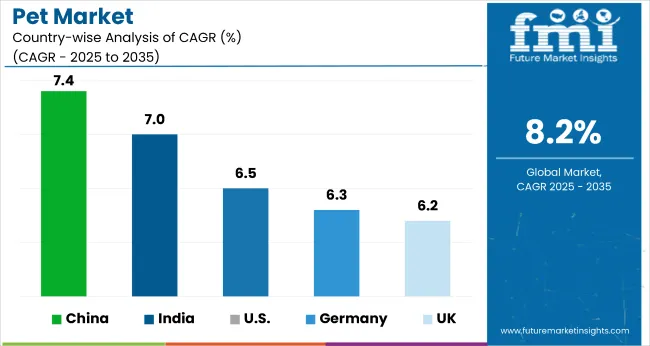

Geographically, North America currently leads the pet market due to its high pet adoption rates and strong consumer spending on pet care. However, the Asia Pacific region is expected to be the fastest-growing market owing to increasing urbanization, changing lifestyles, and a rise in pet adoption in countries like China and India.

In a recent interview with Pet Product News in March 2024, Brendan Keegan, CEO of Petco Health and Wellness Company, emphasized the evolving role of pets in households, stating, “Pets today are an integral part of the family. This drives a demand for innovative products and personalized services that enhance their wellbeing. We are committed to meeting this growing consumer expectation through quality, technology, and education.” His insight highlights the market’s shift towards comprehensive pet care solutions.

With consumers willing to invest more in their pets’ health and happiness, the global pet market is set to maintain a strong growth trajectory, supported by innovation, increasing awareness, and expanding product offerings over the next decade.

Key Industry Attributes

| Attribute | Detail |

|---|---|

| Industry Size (2025) | USD 20.1 billion |

| Industry Size (2035) | USD 44.5 billion |

| CAGR (2025 to 2035) | 8.2% |

The pet market is rapidly evolving with the rise of smart pet devices and telehealth services. Wearables, smart feeding systems, and pet cameras are offering enhanced monitoring and care for pets.

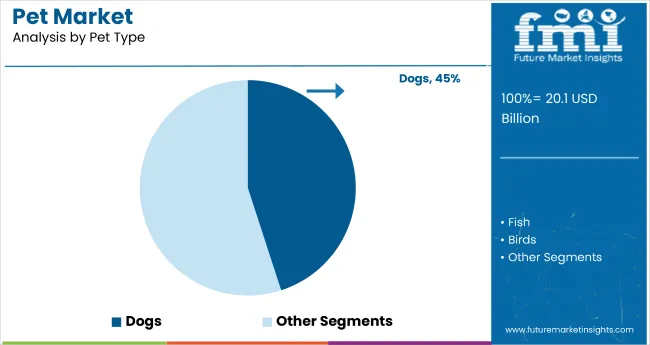

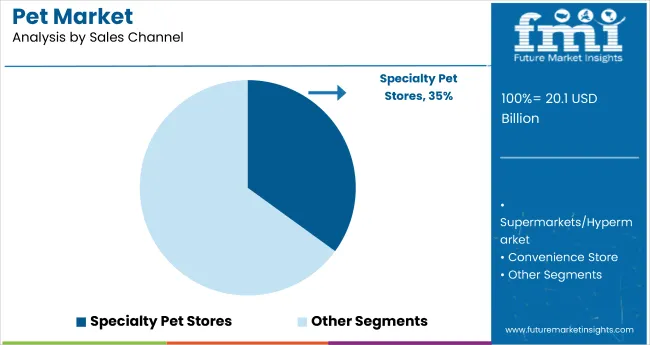

Dogs lead with a 45% market share in 2025 due to growing adoption and humanization of pets. Specialty pet stores dominate the sales channel segment at 35%, offering tailored services, curated products, and a pet-focused retail experience that enhances customer loyalty and supports premium brand growth.

The dog segment accounts for 45% of the global pet market in 2025, fueled by increasing urban pet ownership, emotional companionship demand, and rising expenditure on pet care. Dogs are seen as family members, driving investments in premium nutrition, grooming, health supplements, training, and smart tracking devices.

Large breeds dominate the segment in North America and Europe, while small breeds are preferred in Asia-Pacific due to space constraints. Pet parents are embracing breed-specific diets, organic treats, and advanced veterinary diagnostics, reflecting a surge in the pet humanization trend.

Brands like Nestlé Purina, Mars Petcare, and Hill’s Science Diet capitalize on the canine market through innovations in functional food, personalized health solutions, and digital pet services. The rise of pet insurance and wellness subscriptions further elevates spending per dog, making this the most lucrative segment in the industry.

In 2025, specialty pet stores command a 35% market share, outperforming general retailers by offering a curated, pet-focused shopping experience. These outlets provide tailored product selections including grain-free food, breed-specific grooming kits, orthopedic bedding, and premium toys, which are less commonly found in supermarkets.

Customer trust in in-store staff for dietary and care recommendations strengthens brand loyalty and supports repeat purchases. Specialty pet chains like PetSmart, Petco, and JustDogs have expanded physical footprints while integrating omnichannel strategies-such as click-and-collect and auto-replenishment-enhancing consumer convenience.

These stores often host adoption drives, vaccination camps, and pet training events, building strong community engagement. Furthermore, their partnerships with veterinarians and pet nutritionists attract discerning pet owners who prioritize animal welfare and product quality over price.

As global pet spending shifts from basic care to lifestyle enhancement, specialty pet stores remain the preferred channel for discerning owners seeking premium and specialized offerings.

While demand for high-quality pet food, fixing, and healthcare is increasing, the high cost of decoration pet care products remains a challenge, particularly in developing requests. Pet possessors in price-sensitive regions frequently choose cost-effective preferences, decelerating ultra-expensive request expansion.

The rise of AI-driven pet health monitoring bias, smart affluent, and pet-friendly wearables presents a significant growth occasion. also, the relinquishment of substantiated pet nutrition plans and heartiness programs is shaping the future of pet assiduity. The expansion of online retail and subscription-grounded pet services is further enhancing consumer convenience, creating an economic request for innovative pet care results.

| Country | United States |

|---|---|

| Population (millions) | 345.4 |

| Estimated Per Capita Spending (USD) | 190.50 |

| Country | China |

|---|---|

| Population (millions) | 1,419.3 |

| Estimated Per Capita Spending (USD) | 78.20 |

| Country | Germany |

|---|---|

| Population (millions) | 84.1 |

| Estimated Per Capita Spending (USD) | 152.30 |

| Country | United Kingdom |

|---|---|

| Population (millions) | 68.3 |

| Estimated Per Capita Spending (USD) | 135.10 |

| Country | Japan |

|---|---|

| Population (millions) | 123.2 |

| Estimated Per Capita Spending (USD) | 110.40 |

The USA pet request, valued at USD 65.78 billion, thrives due to high pet power rates and a growing preference for decoration pet food, health supplements, and fixing services. Pet parents laboriously seek organic and tailored products, boosting deals in the assiduity. E-commerce and subscription- grounded pet services continue expanding, feeding to the demand for convenience and technical nutrition.

China's USD 111.02 billion pet request is roaring, driven by rising disposable inflows and civic pet relinquishment trends. Youngish consumers decreasingly humanize faves, investing in high-end nutrition, smart pet widgets, and luxury pet care. Online platforms and influencer-driven pet brands dominate the request, while domestic and transnational players contend for request share in ultra-expensive parts.

Germany’s USD 12.80 billion pet assiduity benefits from strong pet power rates and a preference for sustainable, high-quality pet food. Consumers prioritize grain-free, organic, and veterinarian-recommended diets. The request also sees raised spending on pet insurance, fixing services, and advanced pet health care. E-commerce and specialty pet stores continue driving sector growth.

The UK’s USD 9.22 billion pet request indications as pet possessors invest in high-quality food, veterinary care, and accessories. Sustainability trends impact consumer choices, with eco-friendly pet products gaining traction. Premiumization of pet care services, including heartiness treatments and subscription-grounded pet food deliveries, remains a major request drivers.

Japan USD 13.60 billion pet assiduity thrives as the growing population turns to faves for fellowship. Small canine types dominate, boosting demand for decoration pet food, swish pet accessories, and advanced pet healthcare services. Japanese consumers prefer innovative products similar as smart pet trackers, organic food, and pet-friendly casing results

The pet industry continues to grow with premium pet nutrition, health-oriented options, and online shopping. A survey of 250 USA, UK, EU, Korea, Japan, Southeast Asia, China, ANZ, and Middle East consumers reflects changing consumer attitudes and shopping behavior.

High-end pet food and pet nutrition are major drivers, with 70% of USA and 65% of UK consumers prefer high-protein, grain-free, and organic pet food. Likewise, 58% of EU consumers prefer functional diets for allergy, digestion, and joint health treatment. However, 48% of Southeast Asia and 45% of China consumers prefer low-cost, locally produced pet food, offering room for mid-range players.

Pet health and wellbeing are increasing, with 62% of ANZ and 60% of Japanese consumers placing a high value on probiotics, supplements, and preventative care products. In Korea, 55% of owners spend money on pet insurance and telehealth veterinary care, which is an indication of increased importance being placed on proactive pet health.

Pricing sensitivity also differs across regions, with 52% of USA and 50% of UK consumers being willing to pay USD 50+ per month for premium pet care, but only 35%-40% of Chinese and Southeast Asian consumers choose premium products. Japan (46%) and Korea (43%) are the only two markets where mid-range products find a balance between price and quality.

Pet product retailing is controlled by online retailing with 67% of USA and 65% of China online shoppers buying pet products on Amazon, Shopee, and Tmall for convenience and ease of access. While offline pet stores continue to be strong in Japan (50%) and the Middle East (48%), in both countries customers look for face-to-face pet advice and pet boutique specialist stores.

The pet industry is changing with consumer demand for tailored pet food, holistic wellness options, and tech-enabled pet products. Brands can fuel growth through sustainability, responsible sourcing, and subscription pet service as consumer’s view their pets as family members and shoppers seek out premium, health-oriented products.

The USA pet request is passing strong growth, driven by adding pet power, rising demand for decoration pet food, and a growing focus on pet health and heartiness. Major players include Mars Pet care, Nestlé Purina, and Hill’s Pet Nutrition.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 6.5% |

The UK pet request is expanding due to adding pet humanization, rising demand for sustainable pet products, and growth in pet relinquishment. Leading companies include faves at Home, Lily’s Kitchen, and Royal Canin.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 6.2% |

Germany’s pet request is growing, with consumers prioritizing high-quality pet nutrition, advanced veterinary care, and sustainable pet accessories. crucial players include Fressnapf, Bosch Tiernahrung, and Vitakraft.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| Germany | 6.3% |

India’s pet request is witnessing rapid-fire growth, fueled by adding disposable inflows, rising pet relinquishment rates, and expanding vacuity of decoration pet products. Major brands include Pedigree, Drools, and Himalaya Pet Care.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 7.0% |

China’s pet request is expanding significantly, driven by adding disposable inflows, demand for luxury pet products, and a growing emphasis on pet healthcare. crucial players include Navarch, Bridge PetCare, and Royal Canin.

Market Growth Factors

| Country | CAGR (2025 to 2035) |

|---|---|

| China | 7.4% |

The global pet care request is passing robust growth, driven by adding pet power, the humanization of faves, and a rising focus on pet health and heartiness. This request encompasses a wide range of products and services, including pet food, fixing, veterinary care, and accessories.

Companies are fastening on product invention, premiumization, and expanding their distribution channels to strengthen their request positions. The assiduity features both established transnational pots and arising original players seeking to capture request share through different immolations and targeted marketing strategies.

Mars, Incorporated (23.4%)

Mars leads the global pet care request with a broad diapason of brands feeding to colorful pet needs. The company's commitment to exploration and development, along with strategic accessions, has solidified its request dominance. Mars continues to expand its product lines, fastening on health- acquainted results and substantiated precious care.

Nestlé Purina PetCare (23.1%)

Nestlé Purina maintains a strong request position through nonstop invention and a different product portfolio. The company's emphasis on scientific exploration and quality has fostered trust among pet possessors. Investments in sustainability and digital engagement further enhance its competitive edge.

J.M. Smucker Company

Smucker has established a significant presence in the pet care assiduity by offering a variety of pet foods and treats. The company's focus on expanding its decoration immolations and conforming to consumer trends positions it well for unborn growth.

Hill's Pet Nutrition, Inc.

Hill's Pet Nutrition is famed for its technical diets formulated to manage colorful health conditions in faves . Collaboration with veterinary professionals and a strong emphasis on clinical nutrition bolster the company's character and request share.

Blue Buffalo Co., Ltd.

Blue Buffalo prayers to a niche request member seeking natural and organic pet food options. The company's fidelity to high- quality constituents and translucency resonates with health-conscious consumers, contributing to its growth in the decoration pet food sector.

Other Key Players

The pet care market also includes several other companies contributing to its growth by focusing on niche segments, innovative products, and competitive pricing. Notable brands include:

These companies work their unique strengths and request perceptivity to offer products that feed to specific consumer preferences. Strategies similar as product diversification, concentrate on natural and organic constituents, and expansion into arising requests enhance their competitive positions.

| Report Attributes | Details |

|---|---|

| Market Size (2025) | USD 20.1 billion |

| Projected Market Size (2035) | USD 44.5 billion |

| CAGR (2025 to 2035) | 8.2% |

| Base Year for Estimation | 2024 |

| Historical Period | 2020 to 2024 |

| Projections Period | 2025 to 2035 |

| Quantitative Units | USD billion for value and million units for volume |

| Sales Channels Analyzed (Segment 1) | Supermarkets/Hypermarkets, Specialty Pet Stores, Online, Veterinary Clinics, Others |

| Pet Types Analyzed (Segment 2) | Dogs, Cats, Birds, Fish, Small Mammals, Reptiles |

| Regions Covered | North America; Latin America; Europe; South Asia; East Asia; Oceania; Middle East & Africa |

| Countries Covered | United States, Canada, Brazil, Mexico, Germany, France, United Kingdom, Italy, China, India, Japan, Australia, UAE, South Africa |

| Key Players Influencing the Market | Nestlé Purina PetCare, Mars Petcare Inc., Hill's Pet Nutrition, Blue Buffalo Co., Champion Petfoods LP, Spectrum Brands Holdings, Inc., The J.M. Smucker Company, Colgate-Palmolive (Hill's Pet Nutrition), Unicharm Corporation, Deuerer |

| Additional Attributes | Manufacturers in the pet market would want to know dollar sales, share, fastest-growing pet types, consumer preferences, regional demand shifts, key retail channels, innovation trends, and competitive brand strategies. |

Supermarkets/Hypermarkets, Specialty Pet Stores, Online, Veterinary Clinics, and Others.

Dogs, Cats, Birds, Fish, Small Mammals, and Reptiles.

North America, Latin America, Europe, South Asia, East Asia, Oceania, and the Middle East & Africa (MEA).

The Pet industry is projected to witness a CAGR of 8.2% between 2025 and 2035.

The Pet industry stood at USD 19.2 billion in 2024.

The Pet industry is anticipated to reach USD 44.5 billion by 2035 end.

Asia-Pacific is set to record the highest CAGR of 8.2% in the assessment period.

The key players operating in the Pet industry include Mars Petcare, Nestlé Purina, Hill’s Pet Nutrition, Blue Buffalo, Spectrum Brands, and Central Garden & Pet.

Table 1: Global Market Value (US$ Million) Forecast by Region, 2018 to 2033

Table 2: Global Market Volume (Units) Forecast by Region, 2018 to 2033

Table 3: Global Market Value (US$ Million) Forecast by Pets Type, 2018 to 2033

Table 4: Global Market Volume (Units) Forecast by Pets Type, 2018 to 2033

Table 5: Global Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 6: Global Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 7: Global Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 8: Global Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 9: Global Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 10: Global Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 11: North America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 12: North America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 13: North America Market Value (US$ Million) Forecast by Pets Type, 2018 to 2033

Table 14: North America Market Volume (Units) Forecast by Pets Type, 2018 to 2033

Table 15: North America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 16: North America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 17: North America Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 18: North America Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 19: North America Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 20: North America Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 21: Latin America Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 22: Latin America Market Volume (Units) Forecast by Country, 2018 to 2033

Table 23: Latin America Market Value (US$ Million) Forecast by Pets Type, 2018 to 2033

Table 24: Latin America Market Volume (Units) Forecast by Pets Type, 2018 to 2033

Table 25: Latin America Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 26: Latin America Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 27: Latin America Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 28: Latin America Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 29: Latin America Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 30: Latin America Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 31: Western Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 32: Western Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 33: Western Europe Market Value (US$ Million) Forecast by Pets Type, 2018 to 2033

Table 34: Western Europe Market Volume (Units) Forecast by Pets Type, 2018 to 2033

Table 35: Western Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 36: Western Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 37: Western Europe Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 38: Western Europe Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 39: Western Europe Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 40: Western Europe Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 41: Eastern Europe Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 42: Eastern Europe Market Volume (Units) Forecast by Country, 2018 to 2033

Table 43: Eastern Europe Market Value (US$ Million) Forecast by Pets Type, 2018 to 2033

Table 44: Eastern Europe Market Volume (Units) Forecast by Pets Type, 2018 to 2033

Table 45: Eastern Europe Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 46: Eastern Europe Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 47: Eastern Europe Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 48: Eastern Europe Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 49: Eastern Europe Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 50: Eastern Europe Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 51: South Asia and Pacific Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 52: South Asia and Pacific Market Volume (Units) Forecast by Country, 2018 to 2033

Table 53: South Asia and Pacific Market Value (US$ Million) Forecast by Pets Type, 2018 to 2033

Table 54: South Asia and Pacific Market Volume (Units) Forecast by Pets Type, 2018 to 2033

Table 55: South Asia and Pacific Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 56: South Asia and Pacific Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 57: South Asia and Pacific Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 58: South Asia and Pacific Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 59: South Asia and Pacific Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 60: South Asia and Pacific Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 61: East Asia Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 62: East Asia Market Volume (Units) Forecast by Country, 2018 to 2033

Table 63: East Asia Market Value (US$ Million) Forecast by Pets Type, 2018 to 2033

Table 64: East Asia Market Volume (Units) Forecast by Pets Type, 2018 to 2033

Table 65: East Asia Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 66: East Asia Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 67: East Asia Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 68: East Asia Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 69: East Asia Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 70: East Asia Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Table 71: Middle East and Africa Market Value (US$ Million) Forecast by Country, 2018 to 2033

Table 72: Middle East and Africa Market Volume (Units) Forecast by Country, 2018 to 2033

Table 73: Middle East and Africa Market Value (US$ Million) Forecast by Pets Type, 2018 to 2033

Table 74: Middle East and Africa Market Volume (Units) Forecast by Pets Type, 2018 to 2033

Table 75: Middle East and Africa Market Value (US$ Million) Forecast by Price Range, 2018 to 2033

Table 76: Middle East and Africa Market Volume (Units) Forecast by Price Range, 2018 to 2033

Table 77: Middle East and Africa Market Value (US$ Million) Forecast by Gender, 2018 to 2033

Table 78: Middle East and Africa Market Volume (Units) Forecast by Gender, 2018 to 2033

Table 79: Middle East and Africa Market Value (US$ Million) Forecast by Sales Channels, 2018 to 2033

Table 80: Middle East and Africa Market Volume (Units) Forecast by Sales Channels, 2018 to 2033

Figure 1: Global Market Value (US$ Million) by Pets Type, 2023 to 2033

Figure 2: Global Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 3: Global Market Value (US$ Million) by Gender, 2023 to 2033

Figure 4: Global Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 5: Global Market Value (US$ Million) by Region, 2023 to 2033

Figure 6: Global Market Value (US$ Million) Analysis by Region, 2018 to 2033

Figure 7: Global Market Volume (Units) Analysis by Region, 2018 to 2033

Figure 8: Global Market Value Share (%) and BPS Analysis by Region, 2023 to 2033

Figure 9: Global Market Y-o-Y Growth (%) Projections by Region, 2023 to 2033

Figure 10: Global Market Value (US$ Million) Analysis by Pets Type, 2018 to 2033

Figure 11: Global Market Volume (Units) Analysis by Pets Type, 2018 to 2033

Figure 12: Global Market Value Share (%) and BPS Analysis by Pets Type, 2023 to 2033

Figure 13: Global Market Y-o-Y Growth (%) Projections by Pets Type, 2023 to 2033

Figure 14: Global Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 15: Global Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 16: Global Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 17: Global Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 18: Global Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 19: Global Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 20: Global Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 21: Global Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 22: Global Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 23: Global Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 24: Global Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 25: Global Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 26: Global Market Attractiveness by Pets Type, 2023 to 2033

Figure 27: Global Market Attractiveness by Price Range, 2023 to 2033

Figure 28: Global Market Attractiveness by Gender, 2023 to 2033

Figure 29: Global Market Attractiveness by Sales Channels, 2023 to 2033

Figure 30: Global Market Attractiveness by Region, 2023 to 2033

Figure 31: North America Market Value (US$ Million) by Pets Type, 2023 to 2033

Figure 32: North America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 33: North America Market Value (US$ Million) by Gender, 2023 to 2033

Figure 34: North America Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 35: North America Market Value (US$ Million) by Country, 2023 to 2033

Figure 36: North America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 37: North America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 38: North America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 39: North America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 40: North America Market Value (US$ Million) Analysis by Pets Type, 2018 to 2033

Figure 41: North America Market Volume (Units) Analysis by Pets Type, 2018 to 2033

Figure 42: North America Market Value Share (%) and BPS Analysis by Pets Type, 2023 to 2033

Figure 43: North America Market Y-o-Y Growth (%) Projections by Pets Type, 2023 to 2033

Figure 44: North America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 45: North America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 46: North America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 47: North America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 48: North America Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 49: North America Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 50: North America Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 51: North America Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 52: North America Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 53: North America Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 54: North America Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 55: North America Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 56: North America Market Attractiveness by Pets Type, 2023 to 2033

Figure 57: North America Market Attractiveness by Price Range, 2023 to 2033

Figure 58: North America Market Attractiveness by Gender, 2023 to 2033

Figure 59: North America Market Attractiveness by Sales Channels, 2023 to 2033

Figure 60: North America Market Attractiveness by Country, 2023 to 2033

Figure 61: Latin America Market Value (US$ Million) by Pets Type, 2023 to 2033

Figure 62: Latin America Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 63: Latin America Market Value (US$ Million) by Gender, 2023 to 2033

Figure 64: Latin America Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 65: Latin America Market Value (US$ Million) by Country, 2023 to 2033

Figure 66: Latin America Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 67: Latin America Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 68: Latin America Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 69: Latin America Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 70: Latin America Market Value (US$ Million) Analysis by Pets Type, 2018 to 2033

Figure 71: Latin America Market Volume (Units) Analysis by Pets Type, 2018 to 2033

Figure 72: Latin America Market Value Share (%) and BPS Analysis by Pets Type, 2023 to 2033

Figure 73: Latin America Market Y-o-Y Growth (%) Projections by Pets Type, 2023 to 2033

Figure 74: Latin America Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 75: Latin America Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 76: Latin America Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 77: Latin America Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 78: Latin America Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 79: Latin America Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 80: Latin America Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 81: Latin America Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 82: Latin America Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 83: Latin America Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 84: Latin America Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 85: Latin America Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 86: Latin America Market Attractiveness by Pets Type, 2023 to 2033

Figure 87: Latin America Market Attractiveness by Price Range, 2023 to 2033

Figure 88: Latin America Market Attractiveness by Gender, 2023 to 2033

Figure 89: Latin America Market Attractiveness by Sales Channels, 2023 to 2033

Figure 90: Latin America Market Attractiveness by Country, 2023 to 2033

Figure 91: Western Europe Market Value (US$ Million) by Pets Type, 2023 to 2033

Figure 92: Western Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 93: Western Europe Market Value (US$ Million) by Gender, 2023 to 2033

Figure 94: Western Europe Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 95: Western Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 96: Western Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 97: Western Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 98: Western Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 99: Western Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 100: Western Europe Market Value (US$ Million) Analysis by Pets Type, 2018 to 2033

Figure 101: Western Europe Market Volume (Units) Analysis by Pets Type, 2018 to 2033

Figure 102: Western Europe Market Value Share (%) and BPS Analysis by Pets Type, 2023 to 2033

Figure 103: Western Europe Market Y-o-Y Growth (%) Projections by Pets Type, 2023 to 2033

Figure 104: Western Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 105: Western Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 106: Western Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 107: Western Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 108: Western Europe Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 109: Western Europe Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 110: Western Europe Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 111: Western Europe Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 112: Western Europe Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 113: Western Europe Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 114: Western Europe Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 115: Western Europe Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 116: Western Europe Market Attractiveness by Pets Type, 2023 to 2033

Figure 117: Western Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 118: Western Europe Market Attractiveness by Gender, 2023 to 2033

Figure 119: Western Europe Market Attractiveness by Sales Channels, 2023 to 2033

Figure 120: Western Europe Market Attractiveness by Country, 2023 to 2033

Figure 121: Eastern Europe Market Value (US$ Million) by Pets Type, 2023 to 2033

Figure 122: Eastern Europe Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 123: Eastern Europe Market Value (US$ Million) by Gender, 2023 to 2033

Figure 124: Eastern Europe Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 125: Eastern Europe Market Value (US$ Million) by Country, 2023 to 2033

Figure 126: Eastern Europe Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 127: Eastern Europe Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 128: Eastern Europe Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 129: Eastern Europe Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 130: Eastern Europe Market Value (US$ Million) Analysis by Pets Type, 2018 to 2033

Figure 131: Eastern Europe Market Volume (Units) Analysis by Pets Type, 2018 to 2033

Figure 132: Eastern Europe Market Value Share (%) and BPS Analysis by Pets Type, 2023 to 2033

Figure 133: Eastern Europe Market Y-o-Y Growth (%) Projections by Pets Type, 2023 to 2033

Figure 134: Eastern Europe Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 135: Eastern Europe Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 136: Eastern Europe Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 137: Eastern Europe Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 138: Eastern Europe Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 139: Eastern Europe Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 140: Eastern Europe Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 141: Eastern Europe Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 142: Eastern Europe Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 143: Eastern Europe Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 144: Eastern Europe Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 145: Eastern Europe Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 146: Eastern Europe Market Attractiveness by Pets Type, 2023 to 2033

Figure 147: Eastern Europe Market Attractiveness by Price Range, 2023 to 2033

Figure 148: Eastern Europe Market Attractiveness by Gender, 2023 to 2033

Figure 149: Eastern Europe Market Attractiveness by Sales Channels, 2023 to 2033

Figure 150: Eastern Europe Market Attractiveness by Country, 2023 to 2033

Figure 151: South Asia and Pacific Market Value (US$ Million) by Pets Type, 2023 to 2033

Figure 152: South Asia and Pacific Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 153: South Asia and Pacific Market Value (US$ Million) by Gender, 2023 to 2033

Figure 154: South Asia and Pacific Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 155: South Asia and Pacific Market Value (US$ Million) by Country, 2023 to 2033

Figure 156: South Asia and Pacific Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 157: South Asia and Pacific Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 158: South Asia and Pacific Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 159: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 160: South Asia and Pacific Market Value (US$ Million) Analysis by Pets Type, 2018 to 2033

Figure 161: South Asia and Pacific Market Volume (Units) Analysis by Pets Type, 2018 to 2033

Figure 162: South Asia and Pacific Market Value Share (%) and BPS Analysis by Pets Type, 2023 to 2033

Figure 163: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Pets Type, 2023 to 2033

Figure 164: South Asia and Pacific Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 165: South Asia and Pacific Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 166: South Asia and Pacific Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 167: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 168: South Asia and Pacific Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 169: South Asia and Pacific Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 170: South Asia and Pacific Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 171: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 172: South Asia and Pacific Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 173: South Asia and Pacific Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 174: South Asia and Pacific Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 175: South Asia and Pacific Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 176: South Asia and Pacific Market Attractiveness by Pets Type, 2023 to 2033

Figure 177: South Asia and Pacific Market Attractiveness by Price Range, 2023 to 2033

Figure 178: South Asia and Pacific Market Attractiveness by Gender, 2023 to 2033

Figure 179: South Asia and Pacific Market Attractiveness by Sales Channels, 2023 to 2033

Figure 180: South Asia and Pacific Market Attractiveness by Country, 2023 to 2033

Figure 181: East Asia Market Value (US$ Million) by Pets Type, 2023 to 2033

Figure 182: East Asia Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 183: East Asia Market Value (US$ Million) by Gender, 2023 to 2033

Figure 184: East Asia Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 185: East Asia Market Value (US$ Million) by Country, 2023 to 2033

Figure 186: East Asia Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 187: East Asia Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 188: East Asia Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 189: East Asia Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 190: East Asia Market Value (US$ Million) Analysis by Pets Type, 2018 to 2033

Figure 191: East Asia Market Volume (Units) Analysis by Pets Type, 2018 to 2033

Figure 192: East Asia Market Value Share (%) and BPS Analysis by Pets Type, 2023 to 2033

Figure 193: East Asia Market Y-o-Y Growth (%) Projections by Pets Type, 2023 to 2033

Figure 194: East Asia Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 195: East Asia Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 196: East Asia Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 197: East Asia Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 198: East Asia Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 199: East Asia Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 200: East Asia Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 201: East Asia Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 202: East Asia Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 203: East Asia Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 204: East Asia Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 205: East Asia Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 206: East Asia Market Attractiveness by Pets Type, 2023 to 2033

Figure 207: East Asia Market Attractiveness by Price Range, 2023 to 2033

Figure 208: East Asia Market Attractiveness by Gender, 2023 to 2033

Figure 209: East Asia Market Attractiveness by Sales Channels, 2023 to 2033

Figure 210: East Asia Market Attractiveness by Country, 2023 to 2033

Figure 211: Middle East and Africa Market Value (US$ Million) by Pets Type, 2023 to 2033

Figure 212: Middle East and Africa Market Value (US$ Million) by Price Range, 2023 to 2033

Figure 213: Middle East and Africa Market Value (US$ Million) by Gender, 2023 to 2033

Figure 214: Middle East and Africa Market Value (US$ Million) by Sales Channels, 2023 to 2033

Figure 215: Middle East and Africa Market Value (US$ Million) by Country, 2023 to 2033

Figure 216: Middle East and Africa Market Value (US$ Million) Analysis by Country, 2018 to 2033

Figure 217: Middle East and Africa Market Volume (Units) Analysis by Country, 2018 to 2033

Figure 218: Middle East and Africa Market Value Share (%) and BPS Analysis by Country, 2023 to 2033

Figure 219: Middle East and Africa Market Y-o-Y Growth (%) Projections by Country, 2023 to 2033

Figure 220: Middle East and Africa Market Value (US$ Million) Analysis by Pets Type, 2018 to 2033

Figure 221: Middle East and Africa Market Volume (Units) Analysis by Pets Type, 2018 to 2033

Figure 222: Middle East and Africa Market Value Share (%) and BPS Analysis by Pets Type, 2023 to 2033

Figure 223: Middle East and Africa Market Y-o-Y Growth (%) Projections by Pets Type, 2023 to 2033

Figure 224: Middle East and Africa Market Value (US$ Million) Analysis by Price Range, 2018 to 2033

Figure 225: Middle East and Africa Market Volume (Units) Analysis by Price Range, 2018 to 2033

Figure 226: Middle East and Africa Market Value Share (%) and BPS Analysis by Price Range, 2023 to 2033

Figure 227: Middle East and Africa Market Y-o-Y Growth (%) Projections by Price Range, 2023 to 2033

Figure 228: Middle East and Africa Market Value (US$ Million) Analysis by Gender, 2018 to 2033

Figure 229: Middle East and Africa Market Volume (Units) Analysis by Gender, 2018 to 2033

Figure 230: Middle East and Africa Market Value Share (%) and BPS Analysis by Gender, 2023 to 2033

Figure 231: Middle East and Africa Market Y-o-Y Growth (%) Projections by Gender, 2023 to 2033

Figure 232: Middle East and Africa Market Value (US$ Million) Analysis by Sales Channels, 2018 to 2033

Figure 233: Middle East and Africa Market Volume (Units) Analysis by Sales Channels, 2018 to 2033

Figure 234: Middle East and Africa Market Value Share (%) and BPS Analysis by Sales Channels, 2023 to 2033

Figure 235: Middle East and Africa Market Y-o-Y Growth (%) Projections by Sales Channels, 2023 to 2033

Figure 236: Middle East and Africa Market Attractiveness by Pets Type, 2023 to 2033

Figure 237: Middle East and Africa Market Attractiveness by Price Range, 2023 to 2033

Figure 238: Middle East and Africa Market Attractiveness by Gender, 2023 to 2033

Figure 239: Middle East and Africa Market Attractiveness by Sales Channels, 2023 to 2033

Figure 240: Middle East and Africa Market Attractiveness by Country, 2023 to 2033

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Petroleum Refinery Hydrogen Market Size and Share Forecast Outlook 2025 to 2035

Pet Collagen Treats Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA