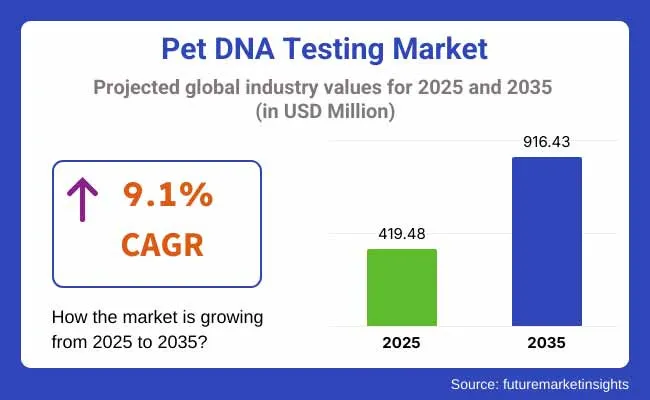

The global pet DNA testing market is estimated to be valued at USD 419.48 million in 2025 and is projected to reach USD 916.43 million by 2035, registering a CAGR of 9.1% over the forecast period.

The developments that were observed in the pet DNA testing Market increased during the year 2024 due to the rising ownership of pets and the growing awareness of consumers about pet genetics and advances in biotechnology. Thus, companies mainly focused on improving test accuracy and increasing breed identification databases to meet the increasing demand for personalized pet healthcare solutions.

Integration of artificial intelligence (AI) in genetic analysis streamlined the tracking of ancestry and the prediction of health predispositions. Furthermore, expansion into DTC testing by important companies has been made possible through various e-commerce channels for improved access.

North America was the industry leader, but the Asia-Pacific region was one of the growth areas experiencing increasing demand through urbanization accompanied by an increase in expenditure on pet care. However, obstacles to some possible regions include regulatory uncertainties and data privacy issues.

Blood Test accounts for a revenue share of 52.7% which reflects the preferred method for obtaining high-quality DNA samples in veterinary genetics. Utilization has been driven by the superior yield and purity of genomic material derived from blood compared to buccal swabs or hair follicles. Veterinarians have favoured blood sampling for comprehensive panels requiring precise analysis of disease mutations and breed markers.

Regulatory standards and clinical protocols have recommended blood-based collection to minimize contamination and improve reproducibility of results. Advances in sample stabilization and logistics have further streamlined laboratory workflows, supporting consistent adoption.

Breed Profile holds a revenue share of 38.7% and is attributed to breed profile testing, highlighting its widespread popularity among pet owners seeking ancestry and breed composition information. Adoption has been driven by the appeal of understanding a pet’s lineage, traits, and potential genetic predispositions.

Breed profile reports have been used to guide health monitoring, behavioral expectations, and lifestyle planning. Direct-to-consumer marketing and user-friendly digital reporting have further supported demand. Veterinary clinics and shelters have integrated breed profiling into wellness programs to support responsible ownership.

Dogs have accounted for 54.1% of market revenue, driven by their status as the most widely owned companion animals globally. The market for Pet DNA testing in canine populations has been supported by the strong cultural emphasis on pet wellness and preventive care. Veterinary professionals have increasingly recommended genetic testing for breed-specific conditions and hereditary diseases that impact dogs more frequently than other species. Advances in breed databases and disease panels tailored to canine genetics have further strengthened clinical relevance.

Marketing efforts have highlighted the benefits of breed confirmation and health screening to support responsible breeding and informed pet care decisions. E-commerce platforms have prioritized dog-specific kits and educational content, improving accessibility and consumer confidence.

As pet humanization rises and demand for personalized healthcare continues to grow along with technological improvements in genetic diagnostics, the pet DNA testing industry will track upward.

Direct-to-consumer testing companies, veterinary partners and research institutions stand to gain, while more traditional pet care providers who are ill-equipped to respond will struggle. As genetic perspectives become a main feature of pet wellness, regulatory specificity and new affordable innovations will dictate the trajectory of the industry in the long term.

Invest in AI-Driven Genetic Insights

Executives should prioritize R&D in AI-enhanced genetic analysis to improve test accuracy and predictive health modeling. By integrating machine learning with DNA databases, companies can provide more precise ancestry tracking and risk assessments, differentiating their offerings in a competitive industry.

Expand Direct-to-Consumer & Veterinary Partnerships

Aligning with shifting consumer behavior, stakeholders must strengthen their e-commerce presence and forge deeper collaborations with veterinary clinics. This will ensure wider adoption through trusted healthcare providers while capitalizing on the growing trend of pet wellness subscriptions and personalized care plans.

Scale Manufacturing & Strengthen Data Security

Companies should invest in scaling production capacity to meet rising demand while ensuring compliance with evolving data privacy regulations. Securing partnerships with logistics providers and refining supply chain strategies will be critical to maintaining service reliability and protecting sensitive pet-owner data.

| Risk | Probability - Impact |

|---|---|

| Regulatory uncertainty around pet genetic data | Medium - High |

| Consumer skepticism about test accuracy | High - Medium |

| Market saturation leading to price competition | Medium - High |

| Priority | Immediate Action |

|---|---|

| Strengthen AI-powered genetic predictions | Expand partnerships with biotech firms and invest in predictive analytics |

| Improve direct-to-consumer engagement | Launch digital industrying initiatives and loyalty-based subscription models |

| Expand international footprint | Conduct feasibility studies for industry entry into Asia-Pacific and Latin America |

The pet DNA testing industry is shifting from a curiosity-driven niche to an essential tool in preventive pet healthcare. To stay ahead, companies must integrate AI for precision testing, deepen veterinarian partnerships, and enhance data security.

A forward-looking roadmap should include scaling global operations, investing in consumer education, and leveraging subscription-based models for recurring revenue. Executives should act decisively to turn pet genetics into a mainstream, indispensable segment of the broader pet wellness ecosystem.

FMI Survey Results: Pet DNA Testing Market Dynamics Based on Stakeholder Perspectives

Surveyed Q4 2024, n=500 stakeholder participants evenly distributed across manufacturers, distributors, veterinarians, pet breeders, and pet owners in the US, Western Europe, Japan, and South Korea

Regional Variance:

High Variance:

Convergent and Divergent Perspectives on ROI:

69% of USA pet owners determined that genetic health screening is "worth the investment," whereas only 35% in Japan saw a strong value proposition.

Consensus:

Saliva: Preferred by 71% of respondents due to non-invasive collection and high consumer accessibility.

Variance:

Shared Challenges:

81% of stakeholders cited the rising costs of genomic sequencing as a barrier to wider adoption.

Regional Differences:

Manufacturers:

Distributors:

End Users (Pet Owners, Breeders, Veterinarians):

Alignment:

76% of global genetic testing companies plan to invest in AI-driven genetic interpretation tools.

Divergence:

High Consensus: Data accuracy, cost pressures, and regulatory uncertainty are critical issues for global stakeholders.

Key Variances:

Strategic Insight:

A standardized approach will not work. Companies must tailor pricing models, technology investments, and compliance strategies based on regional demands to maximize industry penetration.

| Country/Region | Regulatory Impact & Mandatory Certifications |

|---|---|

| United States | The FDA and USDA have started evaluating the need for regulatory oversight of pet genetic testing, particularly for direct-to-consumer (DTC) kits. The Animal and Plant Health Inspection Service (APHIS) requires breeders to comply with genetic health screening for certain conditions. Data privacy laws, such as CCPA (California Consumer Privacy Act), may affect genetic data collection. |

| Western Europe | The General Data Protection Regulation (GDPR) enforces strict guidelines on pet genetic data storage and processing. The European Pet Food Industry Federation (FEDIAF) encourages voluntary compliance with genetic testing standards for breed identification. Veterinary authorities in Germany and France are pushing for mandatory genetic screening of breeding stock to prevent hereditary diseases. |

| United Kingdom | Post-Brexit, the UK has separate regulatory frameworks under the Data Protection Act 2018, which impacts pet genetic data handling. The Kennel Club of the UK has introduced guidelines for breeders to conduct genetic tests before registration. DEFRA (Department for Environment, Food & Rural Affairs) is reviewing potential certification for genetic testing laboratories. |

| Japan | The government does not have strict pet genetic testing regulations, but the Act on the Protection and Management of Animals encourages responsible breeding practices. The Japan Kennel Club (JKC) promotes voluntary genetic health certification for registered breeders. Personal Data Protection Laws may impact how companies collect and store pet genetic information. |

| South Korea | The Korean Animal Protection Act is evolving to include ethical breeding regulations, potentially mandating DNA testing for high-value breeds. The Korean Veterinary Medical Association (KVMA) is working with regulatory bodies to create certification standards for pet genetic laboratories. Genetic data handling must comply with Personal Information Protection Act (PIPA) regulations. |

| China | The China Ministry of Agriculture and Rural Affairs has introduced preliminary guidelines for genetic testing in the livestock sector, but pet DNA testing remains largely unregulated. However, stricter import regulations for genetic testing kits are emerging, affecting foreign companies entering the industry. Data localization laws could require genetic testing companies to store pet genetic data within China. |

| Australia | The Australian Veterinary Association (AVA) is considering standardized DNA testing requirements for registered breeders. The Privacy Act 1988 may impact genetic data storage, particularly for consumer DNA test kits. Some states, like Victoria, have proposed mandatory health screening for dogs used in breeding programs. |

The pet DNA testing industry in the USA is projected to grow at a CAGR of approximately 9.5% from 2025 to 2035, driven by increasing pet humanization and rising interest in genetic health screening. The country has one of the highest pet ownership rates globally, with an expanding population of dog and cat owners seeking DNA testing services.

Major players such as Embark Veterinary and Wisdom Panel dominate the industry, leveraging direct-to-consumer (DTC) sales channels and partnerships with veterinarians. The growing role of genetic testing in preventive pet healthcare is fueling demand, as pet owners become more aware of breed-specific health risks and hereditary diseases.

Additionally, pet insurance companies are increasingly integrating DNA testing into their policies, encouraging early detection of genetic conditions. The regulatory environment in the USA remains relatively open, though potential future concerns around genetic data privacy could influence industry dynamics.

Online retail platforms such as Amazon and Chewy are key sales channels, accounting for a significant portion of revenue. The trend toward at-home testing kits is expected to persist, with advancements in DNA sequencing technology improving test accuracy and affordability. Continued research into pet genetics and personalized wellness solutions will likely drive sustained industry expansion in the coming decade.

The pet DNA testing industry in the UK is expected to register a CAGR of approximately 8.8% from 2025 to 2035, supported by strong animal welfare regulations and a growing focus on responsible breeding practices. The country has a well-established culture of pet care, with pet owners increasingly seeking genetic insights to ensure the long-term health of their animals.

Breed identification and hereditary disease screening are the primary applications driving industry growth, particularly among dog and cat owners. Veterinary clinics and breeders are playing a key role in promoting DNA testing, with many integrating genetic screening into standard health check-ups.

The Kennel Club and other regulatory bodies emphasize ethical breeding, which is increasing the adoption of genetic tests among breeders. Additionally, growing concerns about inbreeding and hereditary disorders in pedigree breeds have heightened demand for comprehensive genetic testing solutions.

E-commerce platforms and pet specialty retailers are expanding their offerings of DNA testing kits, making these services more accessible. The increasing availability of advanced genetic screening, including whole-genome sequencing for pets, is expected to drive further industry adoption. As UK pet owners continue prioritizing their pets' health and longevity, the demand for high-accuracy, user-friendly DNA testing solutions is set to rise.

The pet DNA testing industry in France is projected to grow at a CAGR of approximately 8.5% from 2025 to 2035, driven by rising pet ownership and growing consumer interest in pet health and wellness. France has a strong culture of pet care, with increasing emphasis on preventive healthcare solutions, including genetic testing. Pet owners are becoming more informed about breed-related diseases, which is fueling demand for DNA-based screening services.

Veterinary professionals and pet insurance providers are playing an active role in expanding the industry by recommending DNA tests for early disease detection. French breeders are also adopting genetic testing to ensure healthier breeding practices, particularly for pedigree dogs and cats. However, consumer awareness remains a key challenge, as many pet owners are still unfamiliar with the benefits of DNA testing.

The pet DNA testing industry in Germany is expected to expand at a CAGR of approximately 9.0% from 2025 to 2035, supported by strong consumer awareness, stringent breeding regulations, and technological advancements in genetic testing. Germany has one of the most developed pet care industries in Europe, with a high level of pet ownership and a strong emphasis on animal welfare.

The country's well-established veterinary infrastructure is driving increased adoption of DNA testing, particularly for breed identification and hereditary disease screening. Breeders are actively using genetic tests to minimize the risk of inherited disorders, while pet owners are turning to DNA testing for personalized healthcare insights. Regulatory bodies in Germany promote responsible breeding practices, further fueling demand for genetic testing solutions.

The pet DNA testing industry in Italy is anticipated to grow at a CAGR of approximately 8.3% from 2025 to 2035, driven by increasing pet adoption rates and rising consumer awareness of genetic health testing. Italy has a long-standing tradition of pet care, with an increasing number of pet owners seeking advanced healthcare solutions for their animals.

Breed identification and genetic disease screening are among the primary applications fueling industry demand. Veterinarians are becoming key promoters of genetic testing, encouraging pet owners to use DNA tests for preventive health measures. The rise in pet humanization, where pets are considered family members, has led to increased spending on advanced wellness solutions, including genetic screening.

The pet DNA testing industry in New Zealand is expected to grow at a CAGR of approximately 7.9% from 2025 to 2035, supported by a strong pet ownership culture and increasing demand for pet health insights. New Zealanders have a deep attachment to their pets, leading to a rise in spending on premium pet care services, including DNA testing.

Breeders and veterinarians are adopting genetic testing to ensure responsible breeding practices and early detection of hereditary conditions. Pet owners are increasingly turning to DNA tests to understand their pets' breed history, health risks, and behavioral traits. The industry is still in its early stages compared to North America and Europe, but awareness is growing rapidly.

The pet DNA testing industry in South Korea is projected to expand at a CAGR of approximately 9.2% from 2025 to 2035, driven by a booming pet care industry and rising consumer demand for premium pet healthcare solutions. South Korea has one of the fastest-growing pet ownership rates in Asia, with pet parents increasingly prioritizing their pets' health and well-being.

Veterinary clinics and pet wellness centers are playing a crucial role in expanding genetic testing adoption. Breed identification and health screening tests are gaining popularity among dog and cat owners, particularly in urban areas. The trend toward pet humanization has led to increased spending on high-quality pet products, including DNA testing kits.

The pet DNA testing industry in Japan is projected to grow at a CAGR of approximately 7.6% from 2025 to 2035, supported by the rising pet humanization trend and an aging population that increasingly treats pets as family members. While Japan has a lower pet ownership rate compared to Western industries, the country’s premium pet care segment is expanding, driving demand for advanced healthcare solutions like DNA testing.

Breed identification and hereditary disease screening are key drivers, with small breed dogs being the most common test subjects. Japanese consumers are highly meticulous about their pets' health, and the demand for customized pet nutrition based on genetic insights is growing. However, industry penetration remains lower than in the USA and Europe due to relatively limited awareness of genetic testing benefits.

The pet DNA testing industry in China is anticipated to expand at a CAGR of approximately 10.1% from 2025 to 2035, making it one of the fastest-growing industries globally. The rapid rise in pet ownership, particularly among urban millennials and Gen Z, is a key driver of industry growth. Increasing disposable incomes and a growing willingness to invest in pet healthcare are fueling demand for genetic testing services.

China's industry is dominated by local brands and emerging startups, many of which offer DNA testing as part of broader pet wellness services. The demand for breed verification is particularly high due to concerns over mixed-breed pets being sold as purebred. Additionally, rising awareness of hereditary diseases and customized pet nutrition is further boosting the industry.

The pet DNA testing industry in Australia is expected to grow at a CAGR of approximately 8.7% from 2025 to 2035, driven by high pet ownership rates and strong consumer interest in pet health and well-being. Australia has one of the highest pet ownership rates in the world, with nearly two-thirds of households owning a pet, making it a lucrative industry for DNA testing services.

Breed identification and hereditary disease screening are key market drivers, with veterinarians actively promoting DNA testing as part of routine pet healthcare. Ethical breeding practices are also a major focus, with breeders increasingly using genetic tests to ensure responsible breeding. The Australian government has strict regulations on pet imports, increasing the demand for genetic verification services.

The competitive landscape has been shaped by companies investing in next-generation sequencing capabilities, expanded breed and disease panels, and consumer-friendly reporting platforms. Leading providers have prioritized partnerships with veterinary networks to strengthen credibility and streamline sample collection. Strategic acquisitions have been pursued to access proprietary databases and bioinformatics expertise.

Key Development:

The increasing awareness among pet owners about genetic health risks, rising demand for personalized pet care, and advancements in DNA testing technology are major factors contributing to the expansion of pet DNA testing services.

Veterinarians use DNA tests to diagnose genetic diseases early, allowing for proactive health management, while breeders rely on them to ensure responsible breeding practices and prevent hereditary disorders.

The most popular tests include breed identification, genetic disease screening, and health & wellness assessments, all of which provide insights into a pet’s ancestry and potential health risks.

Yes, North America and Europe have the highest adoption rates due to advanced veterinary infrastructure and high pet ownership rates, while Asia-Pacific is emerging as a fast-growing region due to increasing pet humanization trends.

Accuracy of results, affordability, ease of sample collection, and the depth of genetic information provided are among the top considerations for pet owners when choosing a DNA test for their pets.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Pet Shampoo Market Size and Share Forecast Outlook 2025 to 2035

Pet Perfume Market Size and Share Forecast Outlook 2025 to 2035

Pet Tick and Flea Prevention Market Forecast and Outlook 2025 to 2035

Pet Hotel Market Forecast and Outlook 2025 to 2035

PET Vascular Prosthesis Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Preservative Market Forecast and Outlook 2025 to 2035

Petroleum Liquid Feedstock Market Size and Share Forecast Outlook 2025 to 2035

Pet Food Ingredients Market Size and Share Forecast Outlook 2025 to 2035

PET Stretch Blow Molding Machines Market Size and Share Forecast Outlook 2025 to 2035

PET Injectors Market Size and Share Forecast Outlook 2025 to 2035

PET Material Packaging Market Size and Share Forecast Outlook 2025 to 2035

Petri Dishes Market Size and Share Forecast Outlook 2025 to 2035

Petroleum And Fuel Dyes and Markers Market Size and Share Forecast Outlook 2025 to 2035

Petrochemical Pumps Market Size and Share Forecast Outlook 2025 to 2035

PET Dome Lids Market Size and Share Forecast Outlook 2025 to 2035

Pet Dietary Supplement Market Size and Share Forecast Outlook 2025 to 2035

PET Imaging Workflow Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Petroleum Refinery Merchant Hydrogen Generation Market Size and Share Forecast Outlook 2025 to 2035

Pet Bird Health Market Size and Share Forecast Outlook 2025 to 2035

PET Film Coated Steel Coil Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA