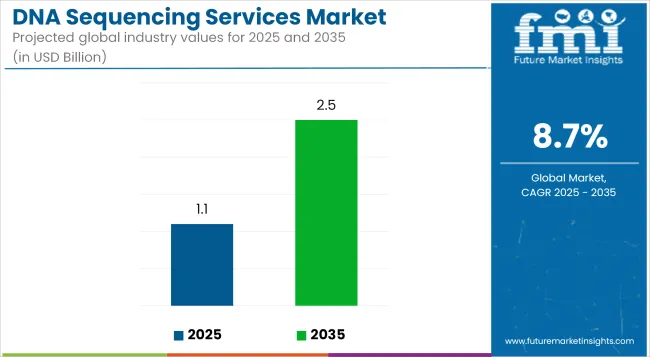

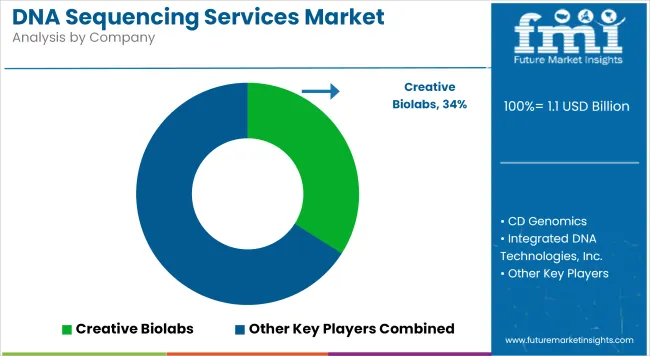

The global DNA Sequencing Services Market is estimated to be valued at USD 1.1 billion in 2025 and is projected to reach USD 2.5 billion by 2035, registering a compound annual growth rate of 8.7% over the forecast period.

| Metric | Value |

|---|---|

| Market Size (2025E) | USD 1.1 Billion |

| Market Value (2035F) | USD 2.5 Billion |

| CAGR (2025 to 2035) | 8.7% |

The DNA Sequencing Services Market is evolving rapidly, driven by technological innovations with wider clinical adoption and a push toward personalized medicine. Integration of next-generation sequencing (NGS) into healthcare systems, such as national genomic initiatives, is broadening its diagnostic and preventive potential.

Rising incidence of genetic disorders and cancer is creating strong demand for precise, genome-based diagnostics. Companies are expanding applications into pediatrics, agriculture, and forensic science, diversifying revenue streams. While ethical and regulatory challenges persist especially around data privacy ongoing advancements in sequencing platforms, favorable policy developments, and rising healthcare investments are reinforcing long-term growth prospects. The market’s future will be shaped by its ability to scale precision diagnostics while ensuring equitable access and robust data governance frameworks.

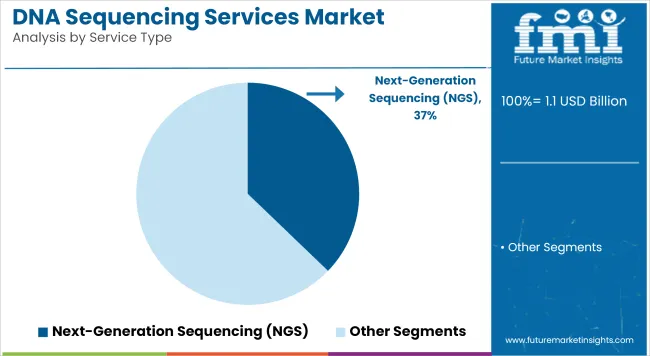

Next-Generation Sequencing (NGS) is expected to hold a leading 37.20% revenue share in 2025, owing to its versatility, accuracy, and declining cost per sample. This segment has been favored due to its scalability in processing large volumes of genomic data, which has enabled wide adoption across clinical diagnostics, oncology panels, pathogen surveillance, and genetic disease screening.

Growth in this segment has been fueled by enhanced automation, improved library preparation kits, and faster turnaround times, allowing laboratories to scale efficiently. The clinical utility of NGS has been extended beyond rare disease diagnosis to include pharmacogenomics and hereditary cancer risk profiling.

It has also been preferred in liquid biopsy services and prenatal diagnostics due to its sensitivity and ability to detect low-frequency variants. Additionally, reimbursement improvements and regulatory endorsements in key markets have increased trust and integration of NGS services into standard care protocols. As sequencing moves further into routine clinical workflows, the value derived from NGS platforms is expected to remain unmatched, securing its leadership in the service-type segment.

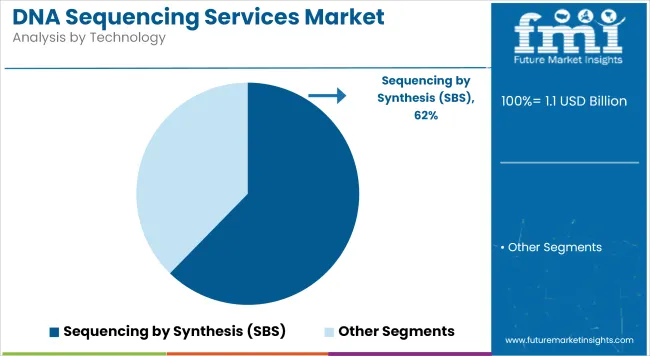

Sequencing by Synthesis (SBS) is projected to contribute 62.3% of market revenue in 2025, making it the most adopted sequencing technology globally. This dominance has been driven by its exceptional accuracy, read depth consistency, and proven utility across a wide range of applications, including whole-genome, exome, and targeted sequencing.

It has been widely implemented in both clinical and research environments due to streamlined workflows and mature bioinformatics support systems. The sustained trust in SBS platforms has been supported by continuous platform upgrades, resulting in faster cycle times and reduced sequencing costs.

Widespread compatibility with automated sample prep and analytics tools has enabled broader deployment across hospitals, academic cores, and biotech labs. In addition, the scalability of SBS has allowed it to power national genome programs and personalized medicine initiatives with high sample throughput. As the preferred backbone for many commercial sequencing service providers, SBS is likely to maintain its market leadership due to consistent innovation, reliable data quality, and enterprise-level support infrastructure.

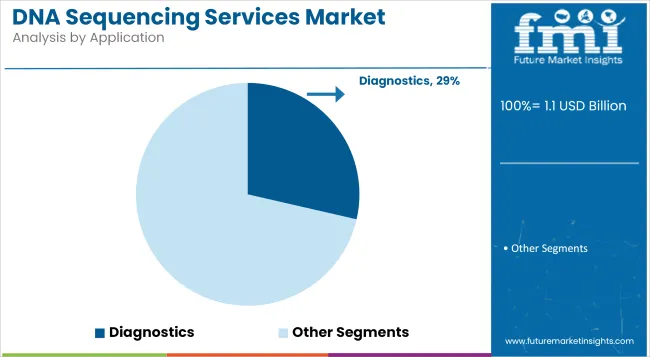

The diagnostics segment is expected to account for 28.60% of the global revenue share in 2025, positioning it as the most dominant application in the DNA sequencing services market. This growth has been largely supported by the shift toward precision medicine and the increasing need for early and accurate disease detection.

Sequencing services have been routinely adopted in cancer diagnostics, rare genetic disease screening, and infectious disease identification, reinforcing their clinical relevance. The expansion of reimbursement policies and approvals for sequencing-based companion diagnostics has contributed to increased clinical adoption. In oncology, tumor profiling using NGS has been endorsed in several guidelines, allowing clinicians to match patients with targeted therapies.

Moreover, sequencing has become vital for neonatal and reproductive health diagnostics, supported by its ability to detect chromosomal and monogenic disorders. The utility of sequencing in pandemic response and antimicrobial resistance surveillance has also elevated its significance in public health frameworks. As diagnostic ecosystems continue to evolve toward genomic integration, this segment is poised to expand further across clinical disciplines.

High Costs and Data Management

High costs for whole-genome sequencing services, particularly in developing regions, are continuing hurdles to market growth despite advancements in sequencing technology. In addition, DNA sequencing produces large volumes of data that necessitate complex data management and analysis that put technical burdens on other providers and users. Data privacy and security are great challenges, particularly in the clinical environment.

Advancements in Sequencing Technologies and Increasing Demand for Personalized Medicine

Fast developments in technology for sequencing, particularly with having next-generation sequencing (NGS) platforms, are expected to bring a reduction in prices and improved access to DNA sequencing services.

Personalized medicine therapies are one of the strongest promises for a market based on differences in genetics. The potential applications of these services are also expected to include agriculture, environmental science, and forensic applications, as the DNA sequencing applications keep growing.

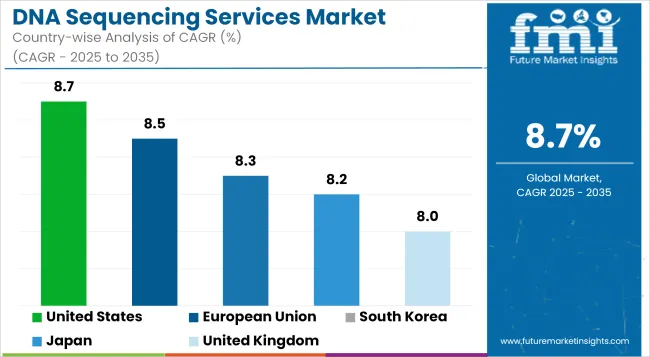

The DNA sequencing services marketin the United States is fast getting big because the country leads in the study of genes, better ways to work with life's build, and more use of personalizedmedicine. With a key jump in gene studies, like looking into cancer, finding out about genetic disorder, and drug-DNA activity, the need for DNA sequencing services is going up. The USA also has some of the biggest bio-research projects that are pushing new stuff in DNA sequencing tech, including next-generation sequencing (NGS).

| Country | CAGR (2025 to 2035) |

|---|---|

| United States | 8.7% |

In the UK, the market for DNA sequencing services is growing well, mostly because the government is putting money into studies on genes and better ways in precision medicine. The UK's work in large-scale geneprojects, like the 100,000 Genomes Project, has really pushed the need for DNA tests. The National Health Service (NHS) is using DNA tests more and more in day-to-day health care, which helps the market grow even more.

| Country | CAGR (2025 to 2035) |

|---|---|

| United Kingdom | 8.0% |

The DNA sequencing services marketin the European Union has been steadily growing, considering major investments in genomic research and precision medicine among EU countries. Germany, France, and Sweden are among the key players in advancing research and healthcare with a corresponding increase in demand for DNA sequencing services. The building of a centralized healthcare data infrastructure and improving access to genomic medicine is the class contributing to promoting the market in Europe.

| Country | CAGR (2025 to 2035) |

|---|---|

| European Union | 8.5% |

The Japan DNA sequencing services marketis on a stable rise due to hefty investments in health and biotechnology research. The continued endeavors to popularize precision medicine and genomic therapies manifests into a strong demand for advanced DNA sequencing technologies. Also, Japan's pioneering spirit in genomic research, particularly with regard to aging and rare genetic diseases, drives market growth.

| Country | CAGR (2025 to 2035) |

|---|---|

| Japan | 8.2% |

Highly diving growth has been observed in the DNA sequencing services marketof South Korea, primarily because of the strong commitment of the country to genomics and precision medicine. Government support for biotechnology health innovation together with growing concern and application in genomic oncology and inherited disease is part of the increasing demand for DNA sequencing services.

| Country | CAGR (2025 to 2035) |

|---|---|

| South Korea | 8.3% |

The DNA sequencing services market is witnessing intensifying competition, shaped by rapid technological innovation, expanding clinical applications, and global infrastructure scaling. Market players are increasingly focusing on developing faster, more cost-efficient sequencing platforms while offering integrated services that include sample preparation, data interpretation, and cloud-based analytics.

Competitive advantage is being pursued through long-term academic and pharmaceutical partnerships, enabling access to large-scale genomic datasets and real-world clinical applications. Additionally, strategic acquisitions and collaborations with AI-driven bioinformatics firms are enhancing the value proposition of sequencing services. Service providers are also differentiating themselves by offering regulatory-compliant solutions tailored for clinical diagnostics, particularly in oncology and rare genetic disorders.

Key Development

The overall market size for the DNA sequencing services market was USD 1.1 billion in 2025.

The market is expected to reach USD 2.5 billion in 2035.

Demand for DNA sequencing services will be driven by advances in genomics research, increasing adoption of precision medicine.

The top 5 contributing countries are the United States, China, Germany, the United Kingdom, and Japan.

The next-generation sequencing (NGS) services segment is expected to lead the market due to its high throughput, accuracy, and cost-effectiveness.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DNA Microarray Market Forecast Outlook 2025 to 2035

DNA Methylation Conversion Kit Market Size and Share Forecast Outlook 2025 to 2035

DNA-Modified Plant Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

DNA Chromatography Chips Market Size and Share Forecast Outlook 2025 to 2035

DNA Methylation Market Size and Share Forecast Outlook 2025 to 2035

DNA Polymerase Market Analysis - Size, Share, and Forecast 2025 to 2035

DNA Synthesis Market Growth - Trends & Forecast 2025 to 2035

DNA-Based Skin Care Market – Trends & Forecast 2025 to 2035

DNA/RNA Extraction Market Growth & Demand 2025 to 2035

DNA Diagnostics Market Growth - Trends & Forecast 2024 to 2034

DNA modifying agents Market

DNA Sequencing Electrophoresis Systems Market

cDNA Synthesis Market

Pet DNA Testing Market Analysis by Animal Type, Sample Type, Test Type, End User and Region: Forecast for 2025 to 2035

Japan DNA Polymerase Market Analysis – Growth, Applications & Outlook 2025-2035

Cosmid DNA Isolation Market

Germany DNA Polymerase Market Trends – Size, Share & Growth 2025-2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Enzymatic DNA Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA