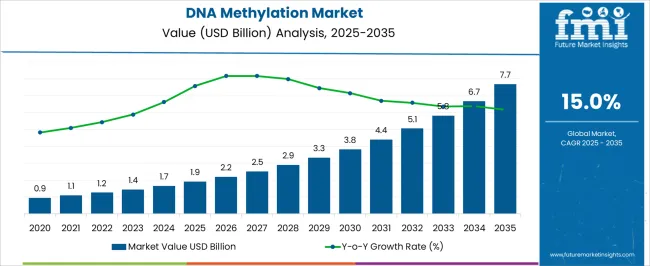

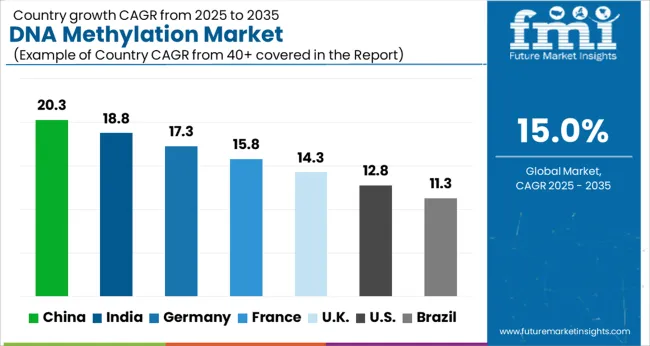

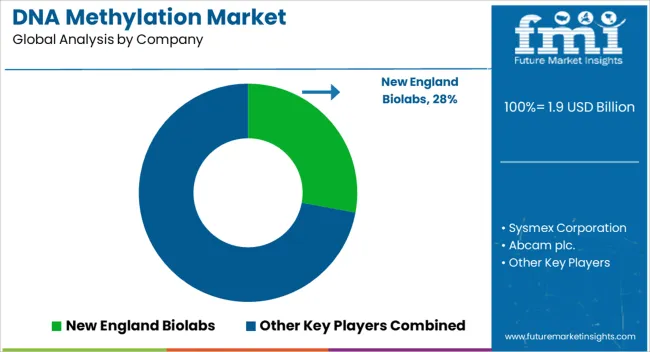

The DNA Methylation Market is estimated to be valued at USD 1.9 billion in 2025 and is projected to reach USD 7.7 billion by 2035, registering a compound annual growth rate (CAGR) of 15.0% over the forecast period.

| Metric | Value |

|---|---|

| DNA Methylation Market Estimated Value in (2025 E) | USD 1.9 billion |

| DNA Methylation Market Forecast Value in (2035 F) | USD 7.7 billion |

| Forecast CAGR (2025 to 2035) | 15.0% |

The DNA methylation market is experiencing strong momentum due to increased focus on epigenetic research, early disease detection, and precision medicine applications. The ability of DNA methylation markers to provide insights into gene expression regulation and disease progression has expanded their utility in clinical and translational research.

Rising cancer prevalence and the development of targeted therapeutics have further elevated the role of DNA methylation profiling in diagnostics and treatment monitoring. Continuous innovation in detection technologies, automation of workflows, and integration with next generation sequencing platforms are enhancing data accuracy and scalability.

Regulatory approvals and expanding applications in oncology, neurology, and developmental biology are contributing to market expansion. The outlook remains optimistic as healthcare institutions and research bodies increase their investment in molecular diagnostics and personalized therapy approaches, making DNA methylation analysis a cornerstone of advanced clinical research.

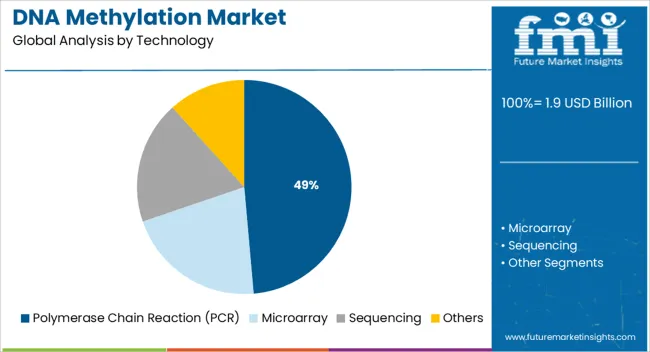

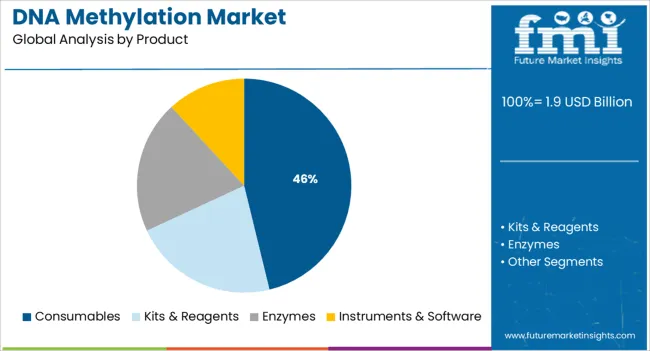

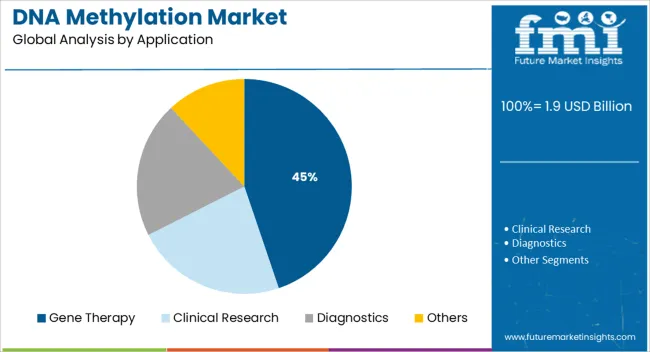

The market is segmented by Technology, Product, Application, and End-use and region. By Technology, the market is divided into Polymerase Chain Reaction (PCR), Microarray, Sequencing, and Others. In terms of Product, the market is classified into Consumables, Kits & Reagents, Enzymes, and Instruments & Software. Based on Application, the market is segmented into Gene Therapy, Clinical Research, Diagnostics, and Others. By End-use, the market is divided into Hospital & Diagnostic Laboratories, Pharmaceutical & Biotechnology Companies, and Research & Academia. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The polymerase chain reaction segment is projected to represent 48.60% of total market revenue by 2025 within the technology category, making it the leading segment. This is due to its widespread availability, high sensitivity, and cost effectiveness in detecting methylation patterns in specific DNA regions.

Its compatibility with clinical and research protocols has led to its dominant use in oncology and biomarker validation. The ability to amplify minute quantities of methylated DNA has made this technology indispensable for early stage disease detection and gene specific methylation analysis.

Moreover, PCR based methods require less complex infrastructure and are easier to implement in laboratories of varying capacities, further contributing to their widespread adoption in both academic and clinical settings.

The consumables segment is expected to hold 46.20% of total market revenue by 2025 in the product category, establishing itself as the most significant contributor. This dominance is driven by the recurring need for reagents, kits, enzymes, and sample preparation materials in both routine diagnostics and large scale research.

High test volumes in clinical labs and academic institutions have sustained demand for reliable and standardized consumables. Furthermore, product innovations that improve workflow efficiency and sensitivity have enhanced the appeal of these materials.

As testing volumes increase and protocols become more specialized, the demand for consistent, high quality consumables is expected to remain strong, reinforcing their position as the foundation of DNA methylation assays.

The gene therapy segment is anticipated to capture 44.80% of total market revenue by 2025 within the application category, positioning it as the top area of use. This leadership is being driven by the growing role of epigenetic modifications in regulating gene expression and their therapeutic relevance in inherited disorders and cancers.

DNA methylation analysis supports the identification of epigenetic biomarkers and assists in evaluating the safety and efficacy of gene based treatments. Advances in gene editing tools such as CRISPR and the development of personalized therapies have increased reliance on DNA methylation profiling as a key component in therapy design.

As gene therapy continues to evolve as a major treatment modality, the integration of methylation insights into therapeutic development is expected to remain a critical enabler, securing this segment’s leading position in the market.

According to market research and competitive intelligence provider Future Market Insights- the market for DNA methylation reflected a value of 9% during the historical period, 2020 to 2024.

DNA methylation remains a promising technique to advance research in core areas of chronic disease treatment. In September 2025, researchers from the University of California published a journal in Nature Communications stating the potential application of cell-free DNA methylation as a promising biomarker for cancer detection at an early stage.

Thus, the market for DNA methylation is expected to register a CAGR of 16.30% in the forecast period 2025 to 2035.

Accessibility to test kits increasing the use of DNA methylation

The COVID-19 outbreak impacted the market negatively due to movement restrictions, which hindered research and testing at research centers and laboratories. However, the post-pandemic, reopening of research institutions resulted in increased usage of DNA methylation. Moreover, the accessibility of a broad range of test kits has further created significant opportunities for market players.

The DNA methylation analysis technique helps scientists gain valuable insights into gene regulation and potential biomarker identification. Abnormal DNA methylation has been associated with several disease processes, such as obesity, cancer, and others.

It also promises potential application in agronomic research to study responses to temperature extremes, drought, and other environmental changes. In June 2025, a research article published in MDPI stated that DNA methylation is mostly studied in epigenetic marks in plants and others. It is considered a sustainable source of variation contributing to crop production and health.

Advanced technology and next-generation technology favoring the growth of the DNA methylation market

Furthermore, various high-throughput technologies such as microarrays and next-generation sequencing (NGS) have facilitated studies related to genome-wide methylation profiling. These technologies offer ways to understand DNA methylation significance, providing insights into the functional effects of variation.

For instance, in February 2024, Twist Bioscience launched the NGS Methylation Detection System, which is to be used for the analysis of liquid biopsy cancer and epigenetic studies. This would further provide insight into disease pathology.

Lack of expertise and unskilled professionals creating obstacles to market growth

A lack of expertise to perform DNA methylation experiments could restrict the growth. DNA methylation holds significant potential in various biotechnology applications, while the relatively low number of skilled professionals remains an obstacle to growth. All these factors may restrict the growth of the DNA methylation market in the forecast period 2025 to 2035.

Investments in research accelerating DNA methylation market growth

North America is expected to account for the largest market share in 2025. This can be attributed to the large network of manufacturing and Research and Development facilities, and the increase in product launches and approvals. Moreover, the growing demand for protein expression systems has also contributed significantly to regional growth.

In May 2025, Twist Bioscience introduced a human methylome panel to allow methylation fractions to be detected in a wide range of applications. This supports the identification of epigenetic targets and the discovery of differentially methylated areas for human development and cancer metastasis research.

North America’s contribution through research and development is creating lucrative opportunities for DNA methylation. Thus, North America is expected to possess a 40% market share in the DNA methylation market in 2025.

Global players penetrating the Asia Pacific market region for wider reach

Asia Pacific is estimated to be the fastest-growing segment over the forecast period due to growing support from the government with several initiatives. Furthermore, the growing focus of global players on emerging markets of Asia Pacific also remains a promising driver of growth.

In September 2024, AnchorDxentered announced the development of a liquid biopsy diagnostic model for breast cancer detection at an early stage. This diagnostic model is focused on circulating cell-free DNA-based methylation patterns. Similarly, in August 2025, Oncgnostics GmbH received authorization from the Chinese government to market its GynTect test to doctors and patients.

This is the first methylation test to be authorized in China for the triage of cervical cancer cases. Thus, Asia Pacific is expected to possess a 38% market share in the DNA methylation market in 2025.

Cost-effective and accurate results favoring the use of sequencing for DNA methylation

The sequencing segment captured the highest market share in 2024 due to the rapid advancement in technologies that offer cost-effective, accurate, and quick results. Bisulfite genomic sequencing is considered a gold-standard technology. Researchers have employed whole-genome bisulfite sequencing to understand the epigenetic landscape of immune-related disorders caused by tobacco use.

Growth of this technology in research studies to understand the adverse effects of smoking and how it relates to diseases promises further growth opportunities in the segment. Thus, sequencing is expected to possess a 35% market share in the DNA methylation market in 2025.

Demand for analyzing DNA making PCR essential for screening in DNA methylation

PCR is anticipated to witness significant growth in the coming years owing to an increase in its use in diagnostics and DNA sequencing procedures. During Covid-19, the demand for PCR technology significantly increased in relevance as a diagnostic procedure. PCR-based methods are primarily used to analyze DNA methylation on a gene-by-gene basis.

In May 2025, Pentabase A/S announced the launch of a qPCR-based assay, EpiDirect, for detecting DNA methylation without pre-treatment. This product aims to create a cancer screening technique that can detect cancers in a cell-free DNA environment.

Wide application in end-user industries making consumables a viable option

The consumables segment is expected to dominate the DNA methylation market in 2025, as it is majorly used in the DNA sequencing procedures and diagnosis process.

Growing demand for quick turnaround times and high throughput results are also strong contributors to the growth. A wide range of consumables is used in the research industry, which includes tubes, vials, microarray panels, dispensers, and pipette tips.

High volume requirements of these consumables continue to boost the overall demand in the market. In April 2025, PacBio announced of expansion of its product offering by adding new DNA methylation consumables. These are made directly available to all its customers using Sequel II and Sequel IIe systems. Thus, consumables are expected to possess a 35% market share in the DNA methylation market in 2025.

Protein-modifying enzymes experiencing lucrative growth for DNA methylation

The enzyme segment is anticipated to witness lucrative growth in the coming years due to the increasing demand for protein-modifying enzymes in the DNA methylation technique. These are widely used in agrigenomic research, genomic research, and genome-wide analysis.

The usage of enzymes in DNA methylation reactions during sequencing analysis, such as Illumina sequencing and pyrosequencing remains prominent. Moreover, the utilization of next-generation sequencing technology has bolstered the demand for enzymes in the biotechnology industry.

Demand for potential biomarkers increasing growth of clinical trials

The clinical research segment is expected to capture the highest market share in 2025, thanks to the increasing number of clinical trials for several diseases globally. Furthermore, increased Research and Development expenditure, and increasing demand for potential biomarkers promise more growth opportunities.

In July 2024, an article published in Springer stated that disease-linked methylation changes could be used as biomarkers at all clinical disease management stages. These various stages include predisposition and risk assessment screening through early diagnostics to the personalized patient care of chronic and relapse disease.

Therefore, disease-related discovery is a promising biomarker and a potential game-changer for precision medicine. Thus, clinical research is expected to possess a 40% market share of the DNA methylation market in 2025.

Accuracy of pathological diagnosis increasing dependency on diagnostic systems

The diagnostic segment is anticipated to witness the fastest growth in the coming years with a CAGR of 16%. DNA methylation profiling is an emerging tool that promises to increase the accuracy of pathological diagnosis.

In January 2025, an article published in PubMed stated that DNA methylation patterns in circulating tumor DNA (ctDNA) offer considerable promise for the categorization and detection of cancer with the least invasive approach. Methylation profiling can be widely used as a cancer diagnostic tool for all tumor types, despite its recent arrival on the scene

High throughput technologies boosting the use of DNA methylation in molecular biology and genomics

The pharmaceutical and biotechnology end-use segment is expected to capture the highest market share in 2025. The increased adoption of DNA methylation in the field of molecular biology and genomics & remains the primary driver of this growth.

Moreover, increasing usage of high throughput technologies such as NGS by key market players also continues to open new opportunities for growth.

In June 2024, Base Genomics announced of leveraging TET-assisted pyridine borane sequencing (TAPS) technology developed by the University of Oxford to find epigenetic signs of cancer in the blood. Thus, the pharmaceutical and biotechnology end-use segment is expected to possess a 42% market share for DNA methylation in 2025.

Research & development activities along with funding from the government contributing to research and academia segment

Research and Academia are anticipated to witness significant growth in the coming years owing to increased Research and Development in the epigenetics sector. This along with increasing government support in terms of funding remains a promising driver of growth.

In July 2025, according to a study published in Genome Biology, DNA methylation in bacteria controls reproduction, gene expression, and pathogenicity. The tissue-specific gene expression that regulates a cell's identity, such as if it’s a brain cell or a skin cell, is regulated by DNA methylation Quality research remains the backbone of growth in the market.

Key players in the DNA methylation market are Base Genomics, EpiQMAx, genknowme, Epify, and EpigenCare

Key players operating in the DNA methylation industry are taking several initiatives such as strategic collaborations, partnerships, and geographical expansion in emerging regions.

Some prominent players in the global DNA methylation market include New England Biolabs, Sysmex Corporation, Abcam plc., F. Hoffmann-La Roche Ltd., Diagenode Diagnostics S.A., Thermo-Fisher Scientific Inc., Agilent Technologies Inc., BioRad Laboratories Inc., Exact Sciences Corporation, QIAGEN N.V., Active Motif, Inc., Illumina Inc., EpiGentek Group Inc., Pacific Biosciences Inc., New England Biolabs Inc., Merck KGaA, Zymo Research Corporation, PerkinElmer Inc.

| Report Attribute | Details |

|---|---|

| Market Value in 2025 | USD 1.9 billion |

| Market Value in 2035 | USD 7.7 billion |

| Growth Rate | CAGR of 15% from 2025 to 2035 |

| Base Year for Estimation | 2025 |

| Historical Data | 2020 to 2025 |

| Forecast Period | 2025 to 2035 |

| Quantitative Units | Revenue in USD Million and CAGR from 2025 to 2035 |

| Report Coverage | Revenue Forecast, Volume Forecast, Company Ranking, Competitive Landscape, Growth Factors, Trends, and Pricing Analysis |

| Segments Covered | Technology, Product Type, Application, End Use, Region |

| Regions Covered | North America; Latin America; Western Europe; Eastern Europe; Asia Pacific Excluding Japan; Japan; Middle East and Africa |

| Key Countries Profiled | USA, Canada, Brazil, Argentina, Germany, United Kingdom, France, Spain, Italy, Nordics, BENELUX, Australia & New Zealand, China, India, ASEAN, GCC Countries, South Africa |

| Key Companies Profiled |

New England Biolabs; Sysmex Corporation; Abcam plc.; F. Hoffmann-La Roche Ltd.; Diagenode Diagnostics S.A.; Thermo-Fisher Scientific Inc.; Agilent Technologies Inc.; BioRad Laboratories Inc.; Exact Sciences Corporation; QIAGEN N.V.; Active Motif, Inc.; Illumina Inc.; EpiGentek Group Inc.; Pacific Biosciences Inc.; New England Biolabs Inc.; Merck KGaA; Zymo Research Corporation; PerkinElmer Inc. |

| Customization | Available Upon Request |

The global dna methylation market is estimated to be valued at USD 1.9 billion in 2025.

The market size for the dna methylation market is projected to reach USD 7.7 billion by 2035.

The dna methylation market is expected to grow at a 15.0% CAGR between 2025 and 2035.

The key product types in dna methylation market are polymerase chain reaction (pcr), microarray, sequencing and others.

In terms of product, consumables segment to command 46.2% share in the dna methylation market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DNA Methylation Conversion Kit Market Size and Share Forecast Outlook 2025 to 2035

DNA Diagnostics Market Size and Share Forecast Outlook 2025 to 2035

DNA Microarray Market Forecast Outlook 2025 to 2035

DNA-Modified Plant Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

DNA Chromatography Chips Market Size and Share Forecast Outlook 2025 to 2035

DNA Polymerase Market Analysis - Size, Share, and Forecast 2025 to 2035

DNA Sequencing Services Market Trends - Growth & Forecast 2025 to 2035

DNA-Based Skin Care Market – Trends & Forecast 2025 to 2035

DNA Synthesis Market Growth - Trends & Forecast 2025 to 2035

DNA/RNA Extraction Market Growth & Demand 2025 to 2035

DNA Sequencing Electrophoresis Systems Market

DNA modifying agents Market

cDNA Synthesis Market

Pet DNA Testing Market Analysis by Animal Type, Sample Type, Test Type, End User and Region: Forecast for 2025 to 2035

Japan DNA Polymerase Market Analysis – Growth, Applications & Outlook 2025-2035

Cosmid DNA Isolation Market

Germany DNA Polymerase Market Trends – Size, Share & Growth 2025-2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Enzymatic DNA Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA