The DNA microarray market is experiencing steady expansion. Rising demand for advanced genetic analysis, increasing adoption of precision medicine, and ongoing genomic research initiatives are driving market growth. The current landscape is defined by technological advancements in hybridization techniques, improved data interpretation tools, and integration of automation for high-throughput applications.

Regulatory support for molecular diagnostics and increased investment in life sciences research are enhancing adoption across clinical and academic sectors. Cost optimization and technological innovation are allowing laboratories to achieve higher efficiency and reproducibility in genetic testing.

The future outlook remains positive, supported by continued emphasis on personalized healthcare, expansion of research in gene expression profiling, and the growing role of DNA microarrays in disease pathway analysis The growth rationale is centered on the segment’s ability to deliver accurate, scalable, and efficient genomic data analysis solutions that support both research and clinical diagnostics, thereby sustaining market momentum and expanding its relevance across multiple end-use domains.

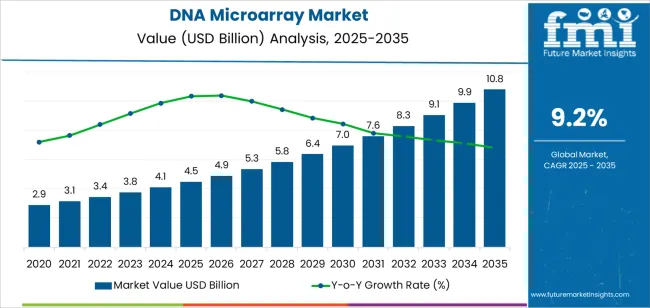

| Metric | Value |

|---|---|

| DNA Microarray Market Estimated Value in (2025 E) | USD 4.5 billion |

| DNA Microarray Market Forecast Value in (2035 F) | USD 10.8 billion |

| Forecast CAGR (2025 to 2035) | 9.2% |

The market is segmented by Component, Type, Application, and End User and region. By Component, the market is divided into Consumables, Instruments, and Software & Services. In terms of Type, the market is classified into Complementary, Oligonucleotide, and Other Types. Based on Application, the market is segmented into Gene Expression Analysis, Genotyping, Transcription Factor Binding Analysis, and Other Applications. By End User, the market is divided into Academic & Research Institute, Pharmaceutical And Biotechnology Companies, Diagnostic Centers, Hospitals and Clinics, and Other End-Users. Regionally, the market is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

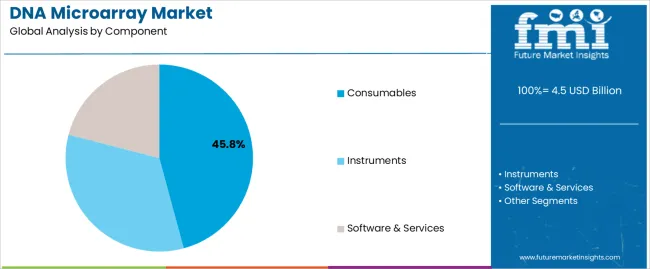

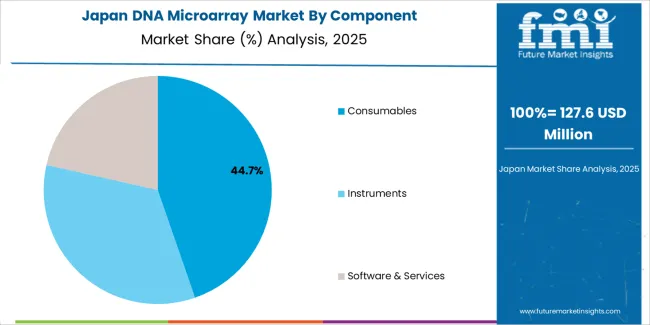

The consumables segment, accounting for 45.80% of the component category, has been leading due to its recurring demand in research and diagnostic laboratories. Consistent utilization of reagents, slides, and assay kits has ensured continuous revenue generation.

Advancements in consumable design and reagent stability have improved data precision and workflow reliability. The segment’s growth has been supported by the increasing volume of genetic testing and rising investments in molecular biology research.

Manufacturers are focusing on improving shelf life, batch consistency, and compatibility with automated platforms The consumables segment is expected to maintain dominance as laboratories expand testing capacity and adopt newer generations of DNA microarray technologies that rely heavily on consistent, high-quality input materials.

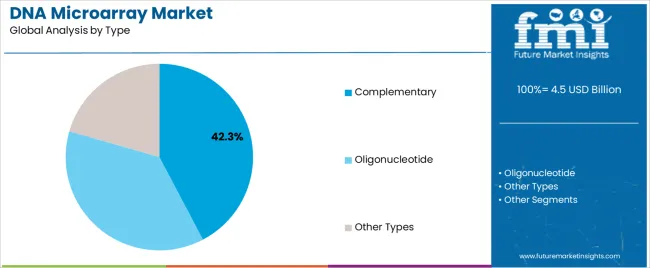

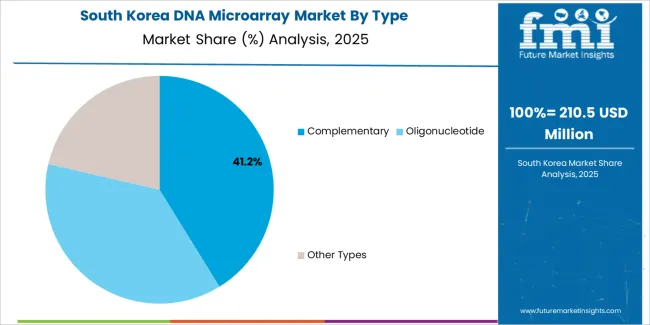

The complementary DNA microarray segment, representing 42.30% of the type category, has maintained its leading position due to its efficiency in detecting gene expression patterns and hybridization accuracy. This segment’s strength lies in its ability to deliver comprehensive data across a wide range of biological samples.

Ongoing enhancements in probe design and data analysis software have reinforced its adoption in both research and clinical settings. The segment’s market share is being supported by rising usage in oncology and pharmacogenomics studies.

Manufacturers are investing in improved signal detection systems and enhanced bioinformatics tools, which are contributing to greater analytical precision These advancements are expected to sustain the segment’s competitiveness and broaden its applications across diagnostic and therapeutic research areas.

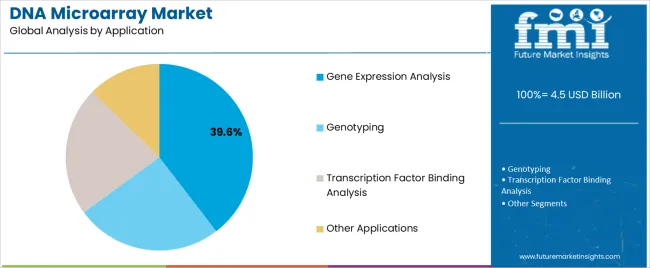

The gene expression analysis segment, holding 39.60% of the application category, has remained dominant due to its critical role in identifying gene activity and understanding disease mechanisms. This segment’s growth is being driven by the increasing focus on personalized medicine and large-scale genomic research projects.

Its adoption has been supported by technological developments that allow simultaneous analysis of thousands of genes, improving research productivity and clinical insights. The ability to correlate gene expression profiles with disease progression and therapeutic response has enhanced its clinical utility.

Expanding use in cancer research, pharmacogenomics, and developmental biology is expected to further strengthen demand Continued innovation in data processing and microarray miniaturization will support sustained market growth and reinforce the prominence of gene expression analysis within the overall DNA microarray landscape.

From 2020 to 2025, the DNA microarray market experienced a CAGR of 11.7%. Gene expression profiling, functional genomics, genome-wide association studies (GWAS), and epigenetics research all extensively use DNA microarrays.

Because of their capacity to scan hundreds of genes at once, researchers can find possible treatment targets, uncover illness biomarkers, and decipher intricate biological processes.

DNA microarrays are essential for molecular diagnostics, genetic testing, cancer profiling, and prenatal screening in clinical diagnostics. Microarray technology's high-throughput capability allows for quick and thorough analysis of patient samples, supporting early illness detection, therapy optimization, and individualized healthcare solutions.

The market is anticipated to develop as long as microarray technology continues to progress. Through the creation of higher-density arrays, better data analysis algorithms, and better probe designs, assay sensitivity, specificity, and throughput have all increased.

Projections indicate that the global DNA microarray market is expected to experience a CAGR of 9.2% from 2025 to 2035.

| Historical CAGR 2020 to 2025 | 11.7% |

|---|---|

| Forecast CAGR 2025 to 2035 | 9.2% |

The table provided highlights the top five countries regarding revenue, with South Korea and Japan leading the list.

Precision medicine, which involves tailoring medical interventions to particular patient characteristics like genetic profiles, is gaining increasing attention from both South Korea and Japan.

DNA microarrays are crucial to precision medicine because they enable the analysis of genetic variants and biomarkers connected to medication metabolism, treatment response, and illness risk. This has encouraged industry growth.

| Countries | Forecast CAGRs from 2025 to 2035 |

|---|---|

| The United States | 9.4% |

| The United Kingdom | 10.3% |

| China | 9.8% |

| Japan | 10.8% |

| South Korea | 11.1% |

The DNA microarray market in the United States is expected to expand with a CAGR of 9.4% from 2025 to 2035. Increasing advancements in microarray technology have led to increased sensitivity, accuracy, and throughput of DNA microarray assays, expanding their applications in research and clinical diagnostics.

Increasing demand in biopharmaceutical research and development for drug discovery, target identification, and biomarker discovery is expected to drive market growth. The healthcare sector is rapidly expanding due to the increasing application of DNA Microarrays in clinical settings for activities like cancer diagnosis, infectious disease detection, and prenatal genetic screening.

The growth of the DNA microarray industry is attributed to extensive, cutting-edge research and development in the United Kingdom. The United Kingdom is expected to expand at a CAGR of 10.3% through 2035. Increasing use of DNA microarrays in clinical diagnostics for applications such as infectious disease detection, cancer profiling, and genetic screening.

Large investment allocations by government and private players contribute to the industry's growth in the United Kingdom. The biotechnology and pharmaceutical industry, which includes established companies and startups focused on DNA microarrays, is present in the country.

China is expected to exhibit significant market growth over the forecast period. The Chinese market for DNA microarray is anticipated to grow at a CAGR of 9.8%.

The growing emphasis on precision medicines and increased demand for personalized medicines in China boosts the market growth. The increasing advances in healthcare and the use of DNA microarray in clinical diagnostics fuel the market growth in China.

China's biotechnology industry has been growing quickly due to investments from the public and commercial sectors. DNA microarrays are in greater demand for use in research, diagnostics, and drug discovery applications due to the expanding emphasis on biopharmaceuticals, agricultural biotechnology, and precision medicine.

The DNA microarray market in Japan is expected to expand with a CAGR of 10.8% from 2025 to 2035. Japan has been at the forefront of DNA microarray research and development, with several leading pharmaceutical and biotech companies investing heavily in the technology.

The Japanese government has also been actively promoting the development of DNA microarray by providing funding support and favorable regulations to researchers and pharmaceutical companies.

The availability of advanced technologies for microarrays, such as higher throughput platforms, improved data analysis tools, and automation, enhances the performance and capabilities of DNA microarrays, making them more attractive for research and clinical applications. This is further propelling the growth of the market in Japan.

The DNA microarray market in South Korea is expected to expand with a CAGR of 11.1% from 2025 to 2035. South Korea boasts a robust biotechnology sector focusing on research and development.

The country is home to leading biotech companies, research institutions, and academic centers that drive innovation in DNA microarray technology and its applications across various fields, including healthcare, agriculture, and environmental science.

The demand for sophisticated diagnostic technologies and personalized treatment solutions is driven by South Korea's high prevalence of chronic diseases and growing aging population. Clinical diagnostics is increasingly using DNA microarrays for tasks including genetic testing, infectious illness diagnosis, and cancer profiling.

The section below shows the leading segment. The consumables segment is set to rise at a CAGR of 9.0% from 2025 to 2035. Based on type, the complementary DNA microarray segment is anticipated to hold a dominant share through 2035. It is set to exhibit a CAGR of 8.8% from 2025 to 2035.

| Category | CAGR from 2025 to 2035 |

|---|---|

| Consumables | 9.0% |

| Complementary DNA Microarray | 8.8% |

Based on components, the consumables segment is anticipated to thrive at a CAGR of 9.0% from 2025 to 2035. Consumables like microarray slides and probes are necessary components for DNA microarray experiments as they play a substantial role. Thus, the reagents are typically only usable once per test or have extremely limited duration to ensure that resampling is needed.

DNA microarray experiments can potentially process many samples simultaneously, often achieved by working with large volumes of consumables. They can supply a high throughput of samples. The rising sample count inevitably entails a proportional increase in the speed of consumables’ use.

Based on the type, the complementary DNA microarray segment is anticipated to thrive at a CAGR of 8.8% from 2025 to 2035. The complementary DNA microarray segment is anticipated to develop at the fastest rate over the projection period.

DNA microarrays are an effective method for examining gene expression in various organisms. The growing number of applications for DNA microarrays, including polymorphism screening, mapping genomic DNA clones, and gene discoveries, is driving the expansion of this market.

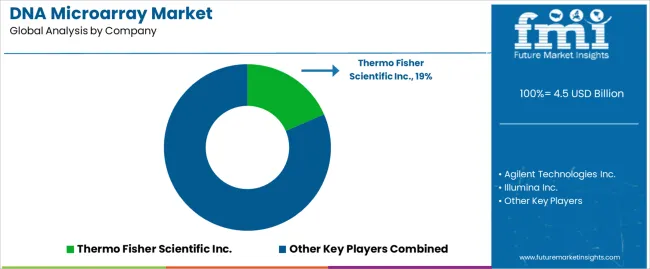

The market is very competitive because many top biotech and pharmaceutical companies are in it. It is distinguished by fierce rivalry, quick technical progress, and significant R&D activity focused on creating cutting-edge DNA microarrays.

The leading players in the market are investing in research and development to enhance their DNA microarray platforms, improve assay sensitivity and specificity, and develop new applications.

| Attributes | Details |

|---|---|

| Estimated Market Size in 2025 | USD 4.1 billion |

| Projected Market Valuation in 2035 | USD 9.9 billion |

| Value-based CAGR 2025 to 2035 | 9.2% |

| Forecast Period | 2025 to 2035 |

| Historical Data Available for | 2020 to 2025 |

| Market Analysis | Value in USD billion |

| Key Regions Covered | North America; Latin America; Western Europe; Eastern Europe; South Asia and Pacific; East Asia; The Middle East and Africa |

| Key Market Segments Covered | Component, Type, Application, End User, Region |

| Key Countries Profiled | The United States, Canada, Brazil, Mexico, Germany, The United Kingdom, France, Spain, Italy, Russia, Poland, Czech Republic, Romania, India, Bangladesh, Australia, New Zealand, China, Japan, South Korea, GCC countries, South Africa, Israel |

| Key Companies Profiled | Thermo Fisher Scientific Inc.; Agilent Technologies Inc.; Illumina Inc.; PerkinElmer Inc.; Bio-Rad Laboratories Inc.; Roche Diagnostics; Qiagen N.V.; Oxford Gene Technology (OGT); Applied Microarrays, Inc.; Eurofins Genomics LLC; LC Sciences |

The global dna microarray market is estimated to be valued at USD 4.5 billion in 2025.

The market size for the dna microarray market is projected to reach USD 10.8 billion by 2035.

The dna microarray market is expected to grow at a 9.2% CAGR between 2025 and 2035.

The key product types in dna microarray market are consumables, instruments and software & services.

In terms of type, complementary segment to command 42.3% share in the dna microarray market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

DNA Methylation Conversion Kit Market Size and Share Forecast Outlook 2025 to 2035

DNA-Modified Plant Extracts Market Analysis - Size and Share Forecast Outlook 2025 to 2035

DNA-Repair Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

DNA Chromatography Chips Market Size and Share Forecast Outlook 2025 to 2035

DNA Methylation Market Size and Share Forecast Outlook 2025 to 2035

DNA Polymerase Market Analysis - Size, Share, and Forecast 2025 to 2035

DNA Sequencing Services Market Trends - Growth & Forecast 2025 to 2035

DNA Synthesis Market Growth - Trends & Forecast 2025 to 2035

DNA-Based Skin Care Market – Trends & Forecast 2025 to 2035

DNA/RNA Extraction Market Growth & Demand 2025 to 2035

DNA Diagnostics Market Growth - Trends & Forecast 2024 to 2034

DNA Sequencing Electrophoresis Systems Market

DNA modifying agents Market

cDNA Synthesis Market

Pet DNA Testing Market Analysis by Animal Type, Sample Type, Test Type, End User and Region: Forecast for 2025 to 2035

Japan DNA Polymerase Market Analysis – Growth, Applications & Outlook 2025-2035

Cosmid DNA Isolation Market

Germany DNA Polymerase Market Trends – Size, Share & Growth 2025-2035

Handheld DNA Reader Market Size and Share Forecast Outlook 2025 to 2035

Enzymatic DNA Synthesis Market Size and Share Forecast Outlook 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA