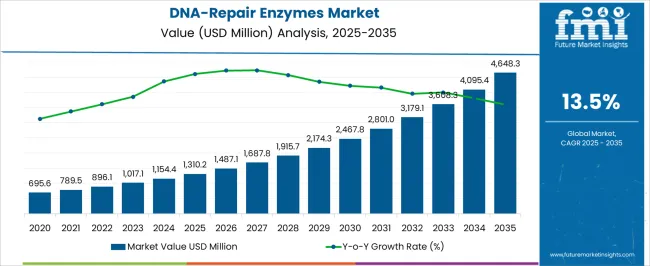

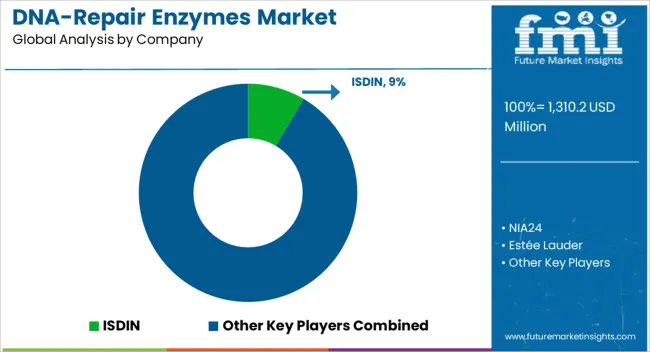

The global DNA-repair enzymes market is projected to grow from USD 1,310.2 million in 2025 to approximately USD 4,648.3 million by 2035, recording an absolute increase of USD 3,342.6 million over the forecast period. This translates into a total growth of 255.2%, with the market forecast to expand at a compound annual growth rate (CAGR) of 13.5% between 2025 and 2035. The overall market size is expected to grow by nearly 3.6X during the same period, supported by the rising awareness of UV-induced skin damage and increasing demand for advanced DNA repair technologies in skincare formulations.

Between 2025 and 2030, the DNA-Repair Enzymes market is projected to expand from USD 1,310.2 million to USD 2,469.0 million, resulting in a value increase of USD 1,158.8 million, which represents 34.7% of the total forecast growth for the decade. This phase of growth will be shaped by rising penetration of DNA repair technologies in premium skincare formulations, increasing consumer awareness about photoaging and UV damage, and growing acceptance of enzyme-based skincare solutions. Manufacturers are expanding their research capabilities to address the growing complexity of DNA repair mechanisms and formulation requirements.

From 2030 to 2035, the market is forecast to grow from USD 2,469.0 million to USD 4,648.3 million, adding another USD 2,183.8 million, which constitutes 65.3% of the overall ten-year expansion. This period is expected to be characterized by advancement of enzyme stabilization technologies, integration of multiple DNA repair enzymes in sophisticated formulations, and development of clinical-grade products across different delivery formats. The growing adoption of preventive skincare and anti-aging treatments will drive demand for more advanced DNA repair enzyme formulations.

Between 2020 and 2025, the DNA-Repair Enzymes market experienced substantial expansion, driven by scientific breakthroughs in understanding DNA repair mechanisms and their application in topical skincare. The market developed as consumers became increasingly aware of the cumulative effects of UV damage and the potential of enzyme-based repair systems to reverse photoaging and prevent skin cancer.

| Metric | Value |

|---|---|

| Estimated Size (2025E) | USD 1,310.2 million |

| Projected Value (2035F) | USD 4,648.3 million |

| CAGR (2025-2035) | 13.5% |

Market expansion is being supported by the increasing prevalence of UV-induced skin damage, rising awareness of photoaging mechanisms, and growing demand for scientifically-proven skincare solutions that can actively repair DNA damage rather than merely providing protection. Modern consumers seek products that offer both preventive and corrective benefits, driving demand for advanced enzyme formulations that can address existing damage while preventing future deterioration.

The growing sophistication of enzyme stabilization technologies and delivery systems is enabling more effective penetration and activity of DNA repair enzymes in skincare products, driving demand for clinical-grade formulations. Beauty brands are increasingly investing in research and development to offer differentiated products that deliver measurable improvements in DNA damage markers and visible skin quality.

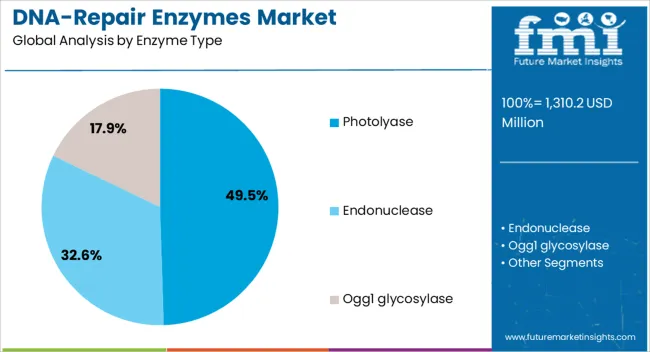

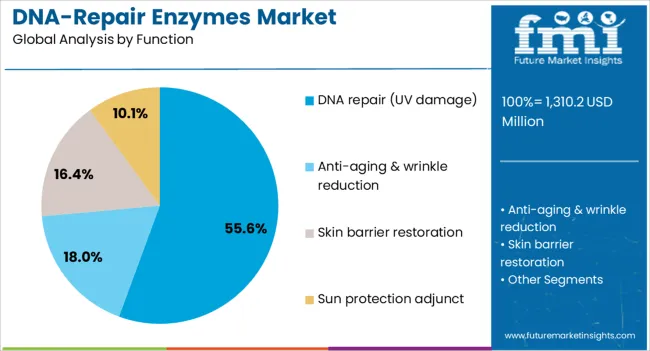

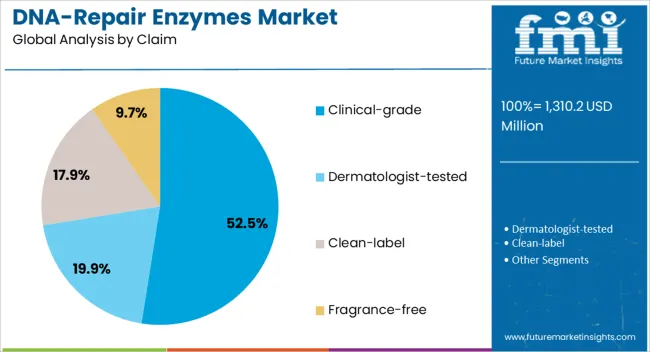

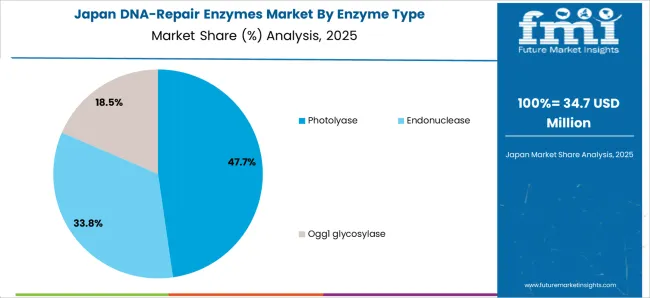

The market is segmented by enzyme type, function, product type, channel, and claim. By enzyme type, the market is divided into photolyase, endonuclease, OGG1 glycosylase, and other repair enzymes. Based on function, the market is categorized into DNA repair (UV damage), anti-aging & wrinkle reduction, skin barrier restoration, and sun protection adjunct. In terms of product type, the market is segmented into serums, creams/lotions, patches, sun-care hybrids, and others. By channel, the market is classified into dermatology clinics, pharmacies, e-commerce, and premium beauty retail. By claim, the market includes clinical-grade, dermatologist-tested, clean-label, and fragrance-free. Regionally, the market is divided into North America, Europe, East Asia, South Asia & Pacific, Latin America, and Middle East & Africa.

Photolyase is projected to account for 49.5% of the DNA-Repair Enzymes market in 2025, valued at USD 643.4 million, establishing its position as the leading enzyme type in the global marketplace. This dominant market share is fundamentally supported by photolyase's unique ability to directly reverse UV-induced DNA damage through photoreactivation, offering the most direct and efficient repair mechanism for cyclobutane pyrimidine dimers (CPDs), the primary DNA lesions caused by UV exposure.

The preference for photolyase stems from its proven efficacy in clinical studies demonstrating significant reduction in UV-induced DNA damage markers and visible improvements in photoaging signs. This enzyme offers superior specificity for UV damage repair compared to other DNA repair enzymes, making it the gold standard for sun damage correction and prevention formulations. The enzyme's ability to harness visible light for activation provides continuous repair activity during daylight hours, enhancing its therapeutic potential.

The market leadership of photolyase is further reinforced by increasing availability of stable formulations that maintain enzyme activity in cosmetic products and growing body of clinical evidence supporting its efficacy. The segment benefits from partnerships between enzyme manufacturers and skincare brands, creating premium products that command higher price points due to their advanced technology and proven results.

DNA repair targeting UV damage is expected to represent 55.6% of the market demand in 2025, valued at USD 722.2 million, establishing its dominance in the global market landscape. This commanding market position reflects the primary concern about cumulative UV damage as the leading cause of premature skin aging and skin cancer risk, driving demand for targeted repair solutions that address the root cause of photodamage.

The DNA repair (UV damage) segment benefits from sophisticated enzyme formulations that can recognize and repair specific UV-induced DNA lesions, including CPDs and 6-4 photoproducts, providing comprehensive protection against the full spectrum of UV damage. Modern DNA repair products feature optimized combinations of repair enzymes, antioxidants, and supporting ingredients that enhance repair efficiency and provide immediate and long-term benefits.

The segment's growth is further supported by increasing awareness of the limitations of traditional sun protection, which only prevents future damage without addressing existing DNA lesions. Clinical studies demonstrating reduction in skin cancer precursors and improvement in photoaging markers drive consumer confidence and professional recommendations for DNA repair products.

Serums represent the primary delivery format for DNA repair enzymes, offering optimal penetration and concentration of active ingredients. The lightweight texture and high concentration of repair enzymes in serum formulations enable effective delivery to deeper skin layers where DNA damage occurs. Advanced formulation technologies protect enzyme stability while ensuring bioavailability upon application.

Creams and lotions provide alternative formats that combine DNA repair enzymes with moisturizing and protective ingredients, appealing to consumers seeking multi-functional products. Patches offer targeted treatment for specific areas of concern, while sun-care hybrids integrate DNA repair enzymes with UV filters for comprehensive photoprotection and repair.

Clinical-grade products are projected to contribute 52.5% of the DNA-repair enzymes market in 2025, valued at USD 682.8 million, representing the preferred positioning for premium DNA repair formulations. This claim category aligns with consumer demand for scientifically-validated, professional-strength products that deliver measurable results comparable to medical treatments.

The competitive advantage of clinical-grade positioning lies in its ability to command premium pricing through association with medical efficacy and professional endorsement. These products typically feature higher concentrations of active enzymes, pharmaceutical-grade ingredients, and extensive clinical testing that supports marketing claims and builds consumer trust.

Clinical-grade products appeal to consumers seeking serious solutions for photodamage and aging concerns, willing to invest in scientifically-proven formulations. The positioning supports distribution through professional channels including dermatology clinics and medical spas, enhancing product credibility and enabling professional recommendation.

The market is advancing rapidly due to scientific innovation in enzyme technology and increasing consumer awareness of DNA damage as a primary cause of skin aging. However, the market faces challenges including high production costs for stable enzyme formulations, need for consumer education about DNA repair mechanisms, and regulatory considerations for enzyme-based cosmetics. Standardization of efficacy testing and stability requirements continue to influence market development patterns.

The growing deployment of sophisticated stabilization technologies including encapsulation, lyophilization, and biomimetic carriers is enabling longer shelf life and enhanced activity of DNA repair enzymes in cosmetic formulations. These technologies protect sensitive enzymes from degradation while ensuring controlled release and optimal activity upon skin application.

Modern formulations are incorporating multiple DNA repair enzymes that target different types of DNA damage through complementary mechanisms. Integration of photolyase, endonucleases, and glycosylases provides comprehensive repair coverage, addressing both direct DNA damage and oxidative lesions for superior anti-aging and protective benefits.

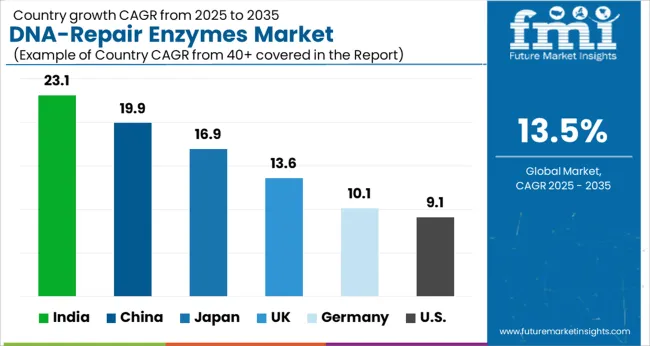

| Country | CAGR (2025 to 2035) |

|---|---|

| India | 23.1% |

| China | 19.9% |

| Japan | 16.9% |

| UK | 13.6% |

| Germany | 10.1% |

| USA | 9.1% |

The DNA-repair enzymes market is growing rapidly across key regions, with India leading at a 23.1% CAGR through 2035, driven by rising sun protection awareness, increasing disposable income, and growing premium skincare adoption. China follows at 19.9%, supported by strong beauty market growth and consumer education about UV damage. Japan grows at 16.9%, emphasizing advanced skincare technology and preventive care. The UK records 13.6% growth with focus on clinical efficacy. Germany shows 10.1% growth driven by scientific approach preferences. The USA demonstrates steady 9.1% growth with established market presence and professional channel distribution.

Revenue from DNA-repair enzymes in India is projected to exhibit the highest growth rate with a CAGR of 23.1% through 2035, driven by increasing awareness of sun damage in tropical climates, rising disposable income, and growing adoption of advanced skincare technologies. The country's high UV exposure levels throughout the year, combined with increasing skin cancer awareness and premature aging concerns, creates strong demand for DNA repair solutions. Major international brands are establishing distribution networks and education programs to serve the growing demand for scientifically-advanced sun protection and repair products.

Revenue from DNA-repair enzymes in China is expanding at a CAGR of 19.9%, supported by rapid beauty market growth, increasing consumer sophistication, and strong adoption of scientifically-advanced skincare solutions. The country's growing middle class and emphasis on skin whitening and anti-aging create favorable conditions for DNA repair products that address both concerns simultaneously. Major beauty conglomerates are developing comprehensive marketing strategies that educate consumers about DNA damage while positioning enzyme products as essential components of modern skincare routines.

Revenue from DNA-repair enzymes in Japan is growing at a CAGR of 16.9%, driven by the country's leadership in skincare innovation, sophisticated consumer base, and cultural emphasis on preventive care and skin perfection. Japanese consumers demonstrate high acceptance of advanced skincare technologies and willingness to invest in scientifically-proven solutions. The market benefits from strong research capabilities, established beauty industry infrastructure, and consumer culture that values long-term skin health over quick fixes.

Demand for DNA-repair enzymes in the UK is projected to grow at a CAGR of 13.6%, supported by strong emphasis on clinical validation, professional recommendation, and evidence-based skincare choices. British consumers demonstrate high interest in scientifically-proven products that offer measurable improvements in skin quality and aging markers. The market is characterized by strong professional channel distribution through dermatology clinics and medical spas that provide expert guidance on DNA repair treatments.

Demand for DNA-repair enzymes in Germany is expanding at a CAGR of 10.1%, driven by consumer preference for scientifically-validated products, rigorous quality standards, and focus on proven efficacy over marketing claims. German consumers value transparency, clinical evidence, and clear mechanisms of action in skincare products, creating demand for DNA repair solutions with comprehensive scientific backing. The market benefits from strong pharmaceutical heritage, advanced research capabilities, and regulatory framework that ensures product quality and safety.

Demand for DNA-repair enzymes in the USA is growing at a CAGR of 9.1%, characterized by diverse market segments, established distribution channels, and steady adoption across professional and consumer markets. The American market demonstrates strong interest in anti-aging innovations while maintaining focus on proven efficacy and value proposition. Market growth is supported by significant investment in biotechnology research, established dermatology sector, and consumer willingness to invest in premium skincare solutions.

The DNA-repair enzymes market is characterized by competition among specialized biotechnology companies, established skincare brands, and pharmaceutical companies leveraging their research capabilities. Companies are investing in enzyme discovery, stabilization technologies, clinical validation, and strategic partnerships to deliver effective DNA repair solutions. Innovation in formulation, clinical evidence generation, and professional endorsement are central to strengthening product portfolios and market presence.

ISDIN leads the market with an 9% global value share in 2025, focusing on scientifically-validated photoprotection and repair solutions with strong clinical backing. The company's Eryfotona line combines DNA repair enzymes with mineral sunscreens for comprehensive photoprotection. NIA24 specializes in Pro-Niacin technology that enhances DNA repair enzyme delivery and efficacy. Estée Lauder leverages its research capabilities to develop premium enzyme formulations for luxury skincare lines.

Shiseido brings Japanese innovation excellence with sophisticated enzyme stabilization technologies and elegant formulations. Neova focuses on professional-grade DNA repair solutions with extensive clinical validation. Murad emphasizes doctor-developed formulations that combine DNA repair enzymes with complementary anti-aging ingredients. SkinCeuticals provides advanced enzyme formulations backed by scientific research and dermatologist recommendation.

| Items | Values |

|---|---|

| Quantitative Units (2025) | USD 1,310.2 million |

| Enzyme Type | Photolyase, Endonuclease, OGG1 glycosylase, Other repair enzymes |

| Function | DNA repair (UV damage), Anti-aging & wrinkle reduction, Skin barrier restoration, Sun protection adjunct |

| Product Type | Serums, Creams/lotions, Patches, Sun-care hybrids, Others |

| Channel | Dermatology clinics, Pharmacies, E-commerce, Premium beauty retail |

| Claim | Clinical-grade, Dermatologist-tested, Clean-label, Fragrance-free |

| Regions Covered | North America, Europe, East Asia, South Asia & Pacific, Latin America, Middle East & Africa |

| Countries Covered | United States, Canada, United Kingdom, Germany, France, China, Japan, South Korea, Brazil, Australia, India and 40+ countries |

| Key Companies Profiled | ISDIN, NIA24, Estée Lauder, Shiseido, Neova, Murad, SkinCeuticals, L'Oréal, EltaMD, and Clinique |

The global dna-repair enzymes market is estimated to be valued at USD 1,310.2 million in 2025.

The market size for the dna-repair enzymes market is projected to reach USD 4,648.3 million by 2035.

The dna-repair enzymes market is expected to grow at a 13.5% CAGR between 2025 and 2035.

The key product types in dna-repair enzymes market are photolyase, endonuclease and ogg1 glycosylase.

In terms of function, dna repair (uv damage) segment to command 55.6% share in the dna-repair enzymes market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Enzymes for Laundry Detergent Market Size and Share Forecast Outlook 2025 to 2035

Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Enzymes for Water Treatment Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Wine Enzymes Market Analysis Size Share and Forecast Outlook 2025 to 2035

Feed Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Dairy Enzymes Market Trends - Innovations & Demand 2025 to 2035

Bakery Enzymes Market Analysis - Size, Share, and Forecast Outlook 2025 to 2035

Marine Enzymes Market Analysis by Product Type, End User and Region through 2035

Brewing Enzymes Market Growth - Fermentation Efficiency & Industry Expansion 2024 to 2034

Biofuel Enzymes Market

Aquafeed Enzyme Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Fish Roe Enzymes and Extracts Market Analysis by Type, Source and Application Through 2035

Technical Enzymes Market Outlook – Growth, Demand & Forecast 2020 to 2030

Industrial Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Drug Discovery Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Tropical Fruit Enzymes Market Size and Share Forecast Outlook 2025 to 2035

Molecular Biology Enzymes, Kits & Reagents Market Trends and Forecast 2025 to 2035

Clinical Chemistry Enzymes Market Report – Trends & Forecast 2023-2033

Bio-Based Detergent Enzymes Market – Trends & Forecast 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA