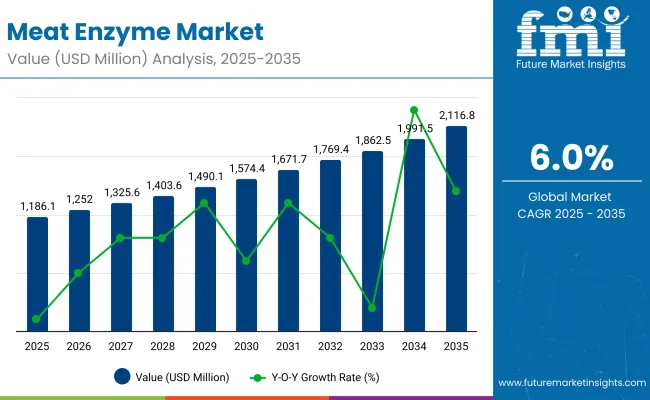

The Meat Enzymes Market is expected to record a valuation of USD 1.19 billion in 2025 and USD 2.12 billion in 2035, with an increase of USD 930.7 million, equal to a 74% expansion over the decade. The overall trajectory reflects a CAGR of 5.12% and a near 1.8X rise in total market size.

Meat Enzyme Market Key Takeaways

| Metric | Value |

|---|---|

| Market Estimated Value (2025E) | USD 1.19 billion |

| Market Forecast Value (2035F) | USD 2.12 billion |

| Forecast CAGR (2025 to 2035) | 5.12% |

Between 2025 and 2030, the market is projected to advance from USD 1.19 billion to USD 1.57 billion, generating an incremental USD 388.3 million and accounting for nearly 42% of decade-long value growth. This early phase of expansion is expected to be supported by rising adoption of enzymes for tenderization, texture optimization, and restructuring in high-volume processing lines. Demand is likely to be further reinforced by increasing regulatory pressure to reduce synthetic additives, with enzymatic alternatives positioned as operationally efficient solutions.

From 2030 to 2035, growth is projected to accelerate, with the market forecast to increase from USD 1.57 billion to USD 2.12 billion, adding USD 542.4 million equivalent to 58% of total growth over the decade. This latter phase is anticipated to be powered by advanced formulations supporting clean-label positioning, shelf-life extension, and improved yield recovery in both red meat and poultry. By 2035, multi-functional enzyme solutions offering measurable ROI in processing efficiency are expected to emerge as key differentiators, aligned with sustainability targets and global protein consumption trends.

From 2020 to 2024, the market expanded steadily as enzymatic tenderization, restructuring, and flavor enhancement gained wider acceptance in industrial meat processing. Competitive positioning during this period was shaped by multinational enzyme manufacturers that emphasized portfolio breadth, application science, and technical service, collectively capturing a significant share of revenue. A preference for powder-based formulations dominated due to extended shelf stability and easier integration into processing systems, while liquid formats remained in nascent adoption stages.

By 2025, market demand has reached USD 1.19 billion, with direct sales into large-scale processors anchoring revenue flows. Going forward, the revenue mix is expected to shift as clean-label formulations, microbial sourcing, and multifunctional enzymes capture higher adoption. By 2035, the market is projected to nearly double in size, with stronger pull from South Asia & Pacific and Europe as cost efficiency, sustainability, and yield optimization are prioritized. Competitive advantage will increasingly be determined by process economics, regulatory alignment, and functional versatility, rather than commodity enzyme sales alone.

Growth in the Meat Enzymes Market is being driven by the rising emphasis on efficiency, sustainability, and clean-label reformulation within global meat processing. Enzymatic solutions are being increasingly adopted as processors seek to enhance tenderness, optimize texture, and extend shelf life while reducing reliance on synthetic additives. Demand is being reinforced by the need for higher yields and consistency across high-volume industrial production, where enzymes are enabling cost savings and improved product uniformity.

Powder formulations are being favored for their operational stability and ease of integration into automated systems, while microbial and plant-derived sources are projected to gain traction due to regulatory alignment and consumer preference for natural solutions. Expansion in South Asia & Pacific and Europe is anticipated to accelerate adoption as meat consumption and packaged convenience products rise. These trends are ensuring that enzymes are positioned as indispensable tools in modern meat processing workflows.

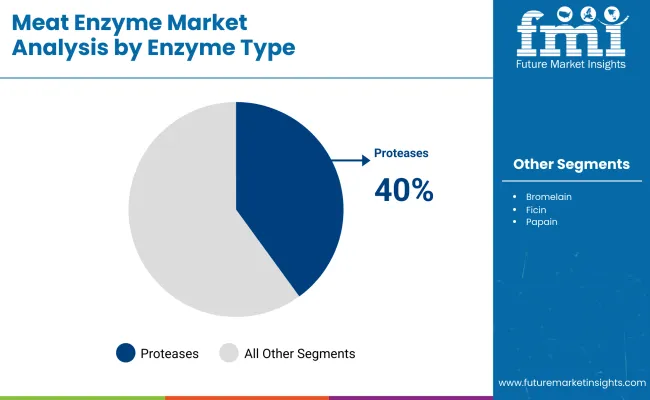

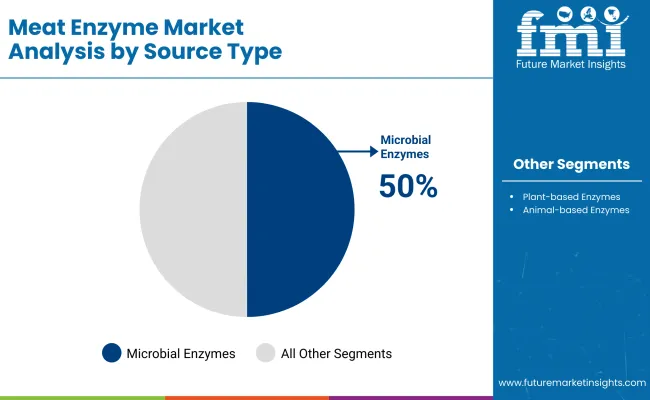

The Meat Enzymes Market has been segmented into Enzyme Type, Source, Functionality, Application, End-use Sector, Form, Sales Channel, and Region. Each category reflects a distinct dimension of demand drivers, operational adoption, and evolving consumer expectations. Enzyme types range from proteases and transglutaminases to lipases and collagenases, offering specialized performance across tenderization, restructuring, and flavor optimization. Sources include plant-based, animal-based, and microbial enzymes, highlighting both traditional extraction and modern fermentation platforms.

Functionality segments capture key processing outcomes, including texture improvement, shelf-life extension, and binding. Applications span across fresh, processed, cured, restructured, and ready-to-eat meat, while end-use industries are anchored by industrial processors, foodservice, and packaged retail. Form and sales channel segmentation further define commercial pathways. Regionally, the market covers North America, Europe, Asia-Pacific, Latin America, and the Middle East & Africa, each demonstrating unique adoption patterns.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Proteases | 40% |

| Transglutaminase | 20% |

| Lipases & Collagenases | 26% |

| Others | 14% |

The Proteases segment is projected to contribute 40% of the Meat Enzyme Market revenue in 2025, maintaining its lead as the dominant component category. Adoption is projected to be reinforced by the growing demand for standardized quality in large-scale meat processing, where papain, bromelain, and microbial proteases are highly effective. Transglutaminase is forecasted to record steady growth as portioning, restructuring, and yield recovery gain traction across processed and restructured meat categories.

Lipases and collagenases are anticipated to expand in niche applications, particularly flavor development and connective tissue breakdown. Market expansion will increasingly be influenced by multifunctional blends combining proteases with binding or flavor-enhancing enzymes, ensuring operational efficiency. Innovation in enzyme formulations with improved stability and pH tolerance is expected to strengthen this segment further, positioning proteases as the backbone of modern Meat Enzyme portfolios.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Plant-based Enzymes | 30% |

| Animal-based Enzymes | 20% |

| Microbial Enzymes | 50% |

Plant- based are anticipated to account for 30% of the Meat Enzyme Market revenue in 2025, sustaining their dominance as the leading component category. Adoption is expected to be reinforced by growing regulatory scrutiny over animal-based additives and rising consumer preference for natural, non-allergenic solutions. Plant-based enzymes are anticipated to witness increasing adoption as sustainability targets drive exploration of alternative sourcing, particularly in regions with strong demand for label-friendly products.

Animal-based enzymes are likely to maintain relevance in traditional applications but face gradual substitution pressure. Across the forecast horizon, microbial fermentation platforms are expected to dominate innovation pipelines, with advancements in strain engineering and process optimization delivering enzymes with superior functionality, stability, and application versatility. This trajectory positions microbial enzymes as the cornerstone of future market expansion.

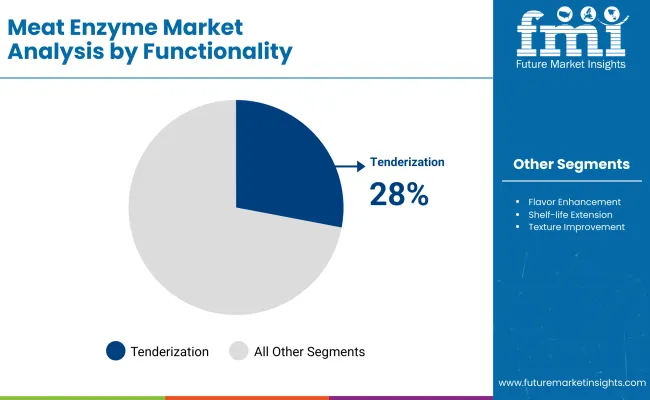

| Component Segment | Market Value Share, 2025 |

|---|---|

| Industrial Meat Processing | 63% |

| Foodservice | 19% |

| Retail / Packaged Meat | 18% |

Industrial meat processing is forecasted to lead the Meat Enzymes Market in 2025, capturing 63% of revenue. Enzyme adoption is being reinforced by the need for higher yields, improved texture uniformity, and reduced wastage at scale. As processors modernize equipment and align with stricter regulatory standards, reliance on enzymes to optimize portioning and shelf-life is expected to grow. Foodservice applications are projected to gain steady traction, driven by the expansion of marinated, pre-cooked, and convenience-based offerings. Retail and packaged meat are also expected to strengthen demand as clean-label reformulation becomes a decisive purchasing factor for end consumers. Over the forecast period, demand will increasingly be tied to enzymes that deliver measurable ROI, ensuring industrial processing retains its position as the backbone of adoption.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Tenderization | 28% |

| Binding & Restructuring | 22% |

| Texture Improvement | 20% |

| Flavor Enhancement | 16% |

| Shelf-life Extension & Protein Hydrolysis | 14% |

The tenderization segment is projected to contribute 28% of the Meat Enzyme Market revenue in 2025, underscoring its critical role in enhancing palatability and standardizing quality across fresh and processed meat categories. Industrial processors are forecasted to prioritize enzymes that ensure consistency in muscle breakdown, particularly for tougher meat cuts. Binding and restructuring functions are projected to expand as transglutaminase adoption grows in processed and restructured formats.

Texture improvement is also anticipated to remain a key area, driven by rising demand for ready-to-cook and premium meat products. Flavor enhancement and shelf-life extension are expected to maintain steady adoption, with innovations in multi-functional formulations supporting value-added meat lines. Enzyme versatility across these functions is forecasted to drive competitive differentiation throughout the forecast horizon.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Processed Meat Products | 33% |

| Fresh Meat Processing | 20% |

| Cured & Smoked Meats | 15% |

| Minced & Restructured Meats | 14% |

| Ready-to-Eat Meat Products | 12% |

| Pet Meat Products | 6% |

Processed meat products are projected to contribute 33% of the Meat Enzyme Market revenue in 2025, driven by their widespread integration of enzymes for yield optimization, texture stability, and portioning consistency. Fresh meat processing is expected to sustain strong adoption as tenderization and flavor optimization remain essential in consumer-facing formats. Cured and smoked categories are forecasted to benefit from enzyme-driven flavor release and shelf-life enhancement.

Minced and restructured meats are anticipated to expand with increased transglutaminase applications in binding. Ready-to-eat meat products are projected to experience rising demand due to convenience and clean-label reformulation trends, while pet meat products will grow steadily with premiumization in animal nutrition. This diverse adoption illustrates the multifunctional importance of enzymes across global meat value chains.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Powder | 52% |

| Liquid | 34% |

| Granules | 14% |

The powder form is projected to contribute 52% of the Meat Enzyme Market revenue in 2025, maintaining its lead due to superior storage stability, convenient dosing, and strong compatibility with automated processing systems. Industrial processors are projected to maintain strong preference for powders due to predictable performance and lower logistics costs. Liquid forms are forecasted to grow steadily, particularly where rapid dispersion and inline blending are required in fast-cycle production systems. Granules are expected to remain niche but relevant in specialized applications where gradual release is preferred. Innovation in carriers and encapsulation technologies is likely to improve liquid and granular adoption, but powders will continue to anchor enzyme delivery formats over the next decade.

| Component Segment | Market Value Share, 2025 |

|---|---|

| Direct Sales (B2B) | 61% |

| Distributors & Wholesalers | 27% |

| Online B2B Platforms | 12% |

Direct sales are projected to contribute 61% of the Meat Enzyme Market revenue in 2025, highlighting their strategic importance in procurement practices among large-scale processors. Major manufacturers are projected to continue offering direct technical support, trial designs, and process validation as value-added components of sales. Distributors and wholesalers are forecasted to sustain relevance in serving mid-sized and regional processors that prioritize availability and cost efficiency. Online B2B platforms are anticipated to record the fastest growth rate, enabled by digital procurement models and the rising penetration of e-commerce in industrial ingredients. Over time, hybrid models combining direct technical service with digital fulfillment are expected to emerge as the dominant sales strategy, ensuring broader access while retaining application-led expertise.

Integration of Enzymes in Yield Optimization and Cost Efficiency

Operational efficiency in meat processing has increasingly been reshaped by enzyme-driven yield optimization. By ensuring higher protein recovery and reducing raw material wastage, enzymes are expected to play a strategic role in margin expansion for large-scale processors. In an environment where input costs for livestock and feed continue to rise, processors are projected to seek enzymatic interventions that enable consistent output without sacrificing product quality.

The ability of enzymes to facilitate binding and restructuring also provides scalability advantages, allowing uniform portioning in processed meat lines. With sustainability becoming a central consideration, cost-efficient enzyme application is anticipated to be prioritized over traditional chemical interventions. This dual benefit of yield maximization and resource conservation positions enzymes as indispensable tools for competitive resilience, particularly in markets where operational margins remain under pressure.

Regulatory Scrutiny and Label Transparency Challenges

Despite favorable adoption prospects, the Meat Enzymes Market is expected to face headwinds from increasing regulatory scrutiny and label transparency demands. In mature regions such as North America and Europe, stricter compliance frameworks regarding enzyme origin, allergenicity, and permissible dosage levels are projected to raise barriers for new entrants. Consumers’ growing sensitivity toward clean-label products has intensified calls for transparency, challenging processors that rely on synthetic or microbial enzyme formulations.

This restraint is particularly significant for producers aiming to supply across multiple jurisdictions with divergent standards, leading to compliance complexity and added certification costs. Furthermore, labeling inconsistencies between functional claims and regulatory classifications are anticipated to constrain marketing strategies. Unless harmonization across global regulatory landscapes is achieved, innovation pipelines could face delays, reducing the pace of enzyme commercialization. This evolving regulatory climate underscores the importance of proactive compliance and transparent labeling frameworks for sustained market penetration.

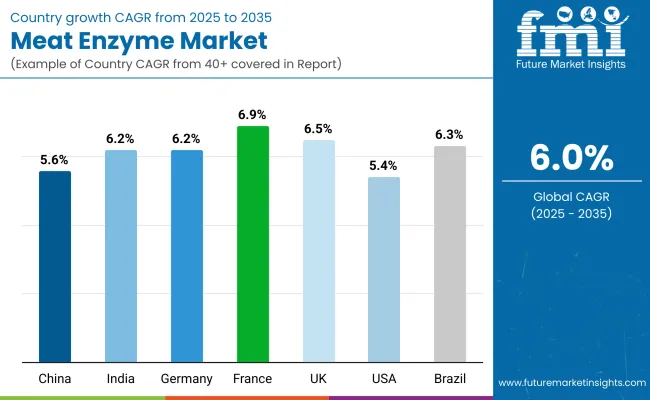

| Countries | CAGR |

|---|---|

| China | 5.63% |

| India | 6.23% |

| Germany | 6.22% |

| France | 6.94% |

| UK | 6.54% |

| USA | 5.41% |

| Brazil | 6.34% |

The global Meat Enzyme Market demonstrates distinct regional variations in growth, largely influenced by dietary shifts, protein consumption trends, and regulatory frameworks. North America is projected to be the fastest-growing region, anchored by Europe at 28% CAGR and India at 6.23% CAGR. Growth in China is expected to be supported by the expansion of large-scale meat processing facilities, alongside government-backed initiatives to modernize food processing infrastructure. Enzymes are anticipated to be deployed extensively to enhance texture, extend shelf life, and improve processing yields in poultry and pork segments. In India, demand is being shaped by the rising penetration of packaged meat, export-oriented production, and cost-focused adoption of enzymatic tenderization, supporting competitiveness in global supply chains.

Europe continues to exhibit a strong adoption profile, led by Germany at 6.22% CAGR, France at 6.94%CAGR, and the UK at 6.54% CAGR. Stringent compliance with food safety regulations, combined with consumer-driven demand for clean-label meat products, is expected to sustain the integration of natural enzymes. Investments in sustainable processing and reduced reliance on synthetic additives are anticipated to reinforce Europe’s leadership.

East Asia reflects moderate expansion, with the China registering a 5.63% CAGR, shaped by its mature meat processing industry and high penetration of automation. Growth is projected to be more innovation-led, with enzymes increasingly utilized in value-added meat products, functional proteins, and customized formulations for quick-service restaurant chains.

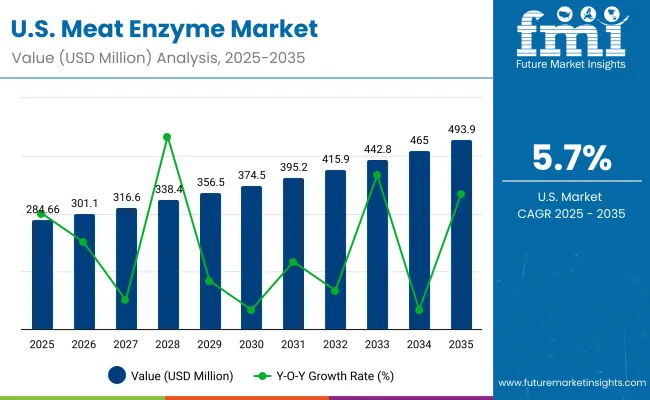

| Year | USA Meat Enzymes Market (USD Billion |

|---|---|

| 2025 | 284.66 |

| 2026 | 301.1 |

| 2027 | 316.6 |

| 2028 | 338.4 |

| 2029 | 356.5 |

| 2030 | 374.5 |

| 2031 | 395.2 |

| 2032 | 415.9 |

| 2033 | 442.8 |

| 2034 | 465.0 |

| 2035 | 493.9 |

The USA Meat Enzyme Market is projected to expand at a CAGR of 5.41% between 2025 and 2035, supported by structural shifts in meat processing, premiumization of protein products, and ongoing investments in sustainable food technologies. Enzyme-driven innovations are being increasingly deployed to improve tenderness, flavor enhancement, and functional protein recovery. The industrial meat sector is expected to witness significant enzyme adoption in poultry and beef segments, as processors aim to reduce waste, optimize yields, and align with clean-label expectations. Enzyme integration is also anticipated to gain ground in alternative protein blends, reflecting consumer preference for hybrid formulations that balance taste, nutrition, and sustainability.

The Meat Enzyme Market in the United Kingdom is projected to expand at a CAGR of 6.54%, supported by innovation in processed meat and sustainable protein applications. Demand is being driven by premiumization trends in ready-to-eat meat and the integration of enzymes for flavor enhancement and shelf-life extension. The UK’s strong regulatory emphasis on clean-label production and sustainable food processing encourages the use of enzymes as substitutes for chemical additives. The rising trend of flexitarian diets is fostering innovation in hybrid meat products, where enzymes are used to balance texture and improve palatability. Academic-industry collaborations are actively shaping R&D pipelines for novel enzyme applications.

The Meat Enzyme Market in India is forecasted to grow at a CAGR of 6.23%, driven by rising meat consumption, modernized processing infrastructure, and regulatory encouragement for efficient protein utilization. The poultry sector is witnessing significant adoption of enzymes to ensure cost-effective yield improvement and texture optimization. Enzymatic solutions are also being applied to regional meat delicacies, reflecting growing alignment with consumer expectations for taste retention. Government-backed initiatives in food processing clusters are providing momentum for enzyme integration into industrial-scale operations. With urbanization driving demand for frozen and ready-to-cook meat, processors are increasingly adopting enzymatic treatments to ensure product consistency and export competitiveness.

The Meat Enzyme Market in China is expected to grow at a CAGR of 5.63%, anchored by high meat consumption and modernization in pork and poultry processing. Government policies encouraging food safety and efficiency in protein utilization are accelerating enzyme use in industrial meat operations. Large-scale pork processors are adopting enzymes to improve yield and minimize waste, while poultry processors are integrating enzymes to enhance tenderness and flavor stability. The hybrid meat and alternative protein space is also emerging, with enzymes used to balance texture and improve nutritional outcomes. Enzyme applications are aligned with national food security goals, reinforcing resource efficiency in protein utilization.

| Countries | 2025 |

|---|---|

| UK | 18.49% |

| Germany | 20.23% |

| Italy | 10.05% |

| France | 13.42% |

| Spain | 11.46% |

| BNELUX | 6.67% |

| Nordic | 5.76% |

| Rest of Europe | 14% |

| Countries | 2035 |

|---|---|

| UK | 19.54% |

| Germany | 20.58% |

| Italy | 10.03% |

| France | 12.93% |

| Spain | 10.46% |

| BNELUX | 5.31% |

| Nordic | 5.88% |

| Rest of Europe | 15% |

The Meat Enzyme Market in Germany is projected to expand at a CAGR of 6.22%, supported by the country’s advanced meat processing ecosystem and strict regulatory focus on quality and sustainability. Enzyme use in premium processed meat and cold cuts is expanding to ensure consistency, yield improvement, and natural preservation. Consumer preference for clean-label products is encouraging the substitution of chemical additives with enzymatic solutions. With Germany being a leading hub for alternative proteins, enzymes are also being explored to optimize taste and texture in plant-meat blends. Strong partnerships between research institutes and processing firms are fostering continuous product innovation, reinforcing Germany’s leadership in sustainable protein processing.

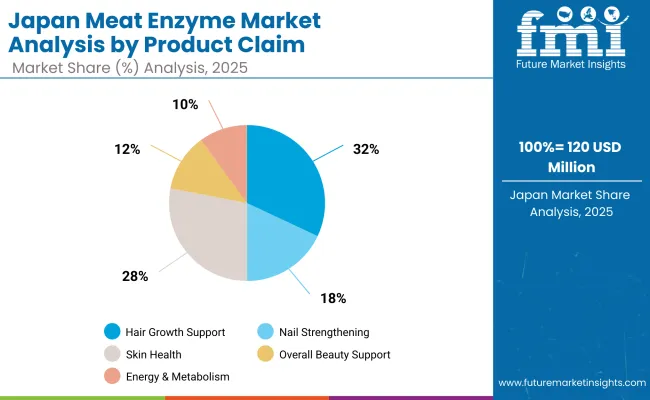

| Product Claim | Share (%) |

|---|---|

| Hair Growth Support | 32% |

| Nail Strengthening | 18% |

| Skin Health | 28% |

| Overall Beauty Support | 12% |

| Energy & Metabolism | 10% |

The Meat Enzyme Market in Japan is projected at USD 0.074 billion in 2025. Processing enzymes contribute 57%, while tenderizing enzymes hold 43%, reflecting the country’s growing reliance on functional solutions that optimize efficiency and align with evolving consumer expectations. This stronger share of processing enzymes is attributed to Japan’s highly mechanized meat processing industry, where yield maximization, flavor stability, and preservation are prioritized to meet both domestic demand and export competitiveness. Tenderizing enzymes, while slightly lower in share, continue to gain ground due to premiumization trends in beef and pork categories, where texture improvement is essential.

Rising adoption of precision fermentation and clean-label solutions is expected to reshape enzyme applications, particularly in hybrid and alternative proteins. Japanese manufacturers are also emphasizing advanced R&D in bio-based enzymes, aligning with national sustainability goals. As consumer preference shifts toward health-focused and natural meat products, enzyme innovation is forecasted to play a pivotal role in shaping future product portfolios.

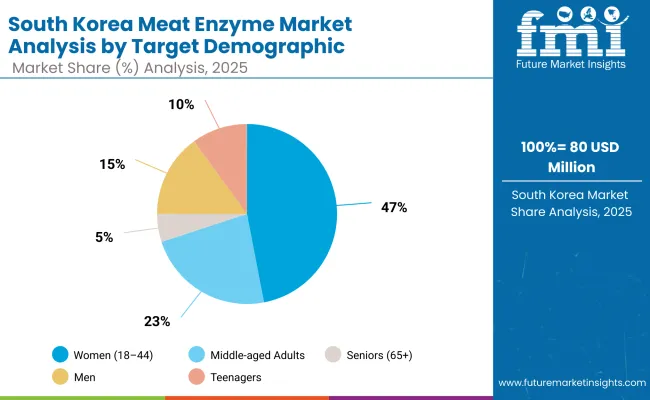

| Demographic | Market Value Share, 2025 |

|---|---|

| Women (18-44) | 47% |

| Middle-aged Adults | 23% |

| Seniors (65+) | 5% |

| Men | 15% |

The Meat Enzyme Market in South Korea is projected at USD 0.08 billion in 2025, accounting for approximately 10% of the regional market. Women aged 18-44 dominate demand with a value of USD37.6 million (47% share), driven by heightened consumption of functional meat products that align with wellness, appearance, and nutritional goals. The higher CAGR of 9.2% within this segment reflects the influence of lifestyle-focused diets and rising preference for clean-label meat solutions enriched with enzyme applications.

Middle-aged adults contribute USD 18.4 million (23% share), supported by steady adoption of protein-enhanced and easy-to-digest meat products. This group shows increasing sensitivity to product quality, pushing enzyme-driven improvements in tenderness, nutrient bioavailability, and preservation. Men account for USD 12.0 million (15% share) with an 8.8% CAGR, signaling rising interest in high-protein meat snacks and fitness-oriented formulations. Teenagers contribute USD 8.0 million (10% share) with an 8.9% CAGR, driven by demand for convenient, affordable, and protein-rich formats that rely on enzymes for taste and texture optimization. Seniors, though smaller at USD 4.0 million (5% share), are expected to benefit from enzyme innovation in digestibility, addressing aging-related dietary needs.

The overall market outlook highlights a shift toward demographic-specific formulations, where enzymes play a pivotal role in balancing health, taste, and convenience. South Korea’s strong urban consumer base and advanced food processing ecosystem are expected to sustain above-average growth in enzyme applications tailored for functional meat categories.

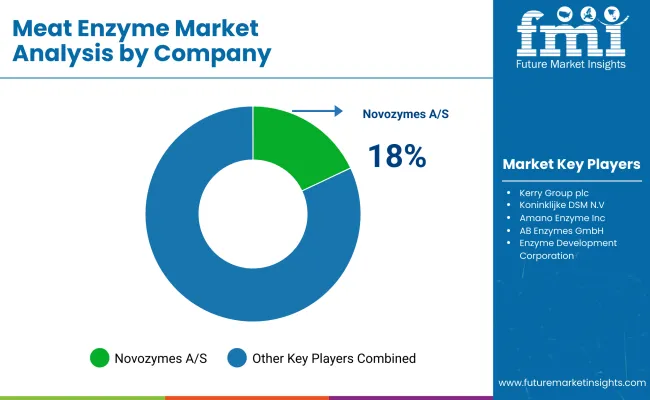

The Meat Enzyme Market in South Korea is moderately fragmented, with global leaders, mid-sized innovators, and niche-focused specialists competing across diverse application areas. Global biotechnology leaders such as Novozymes A/S, Kerry Group, and DSM-Firmenich hold significant market share, supported by extensive portfolios of proteases, tenderizing agents, and preservation enzymes. Their strategies are increasingly focused on precision fermentation, sustainability-driven bio-based innovations, and close partnerships with leading Korean meat processors to optimize yield and improve clean-label adoption.

Established mid-sized players, including AB Enzymes, Amano Enzyme Inc., and Chr. Hansen, are actively addressing the rising demand for application-specific solutions tailored to premium beef, pork, and poultry categories. These companies are accelerating adoption through enzyme blends that enhance flavor retention, texture consistency, and nutritional quality, while maintaining cost efficiency for domestic manufacturers.

Specialized providers such as Nagase Group and regional biotech startups are emphasizing cost-effective, niche enzyme applications, particularly for hybrid meat and plant-based protein categories. Their strength lies in customization and regional adaptability rather than global scale. Competitive differentiation is expected to shift toward integrated ecosystems that combine enzyme innovation with digitalized processing, clean-label certification, and sustainability-driven production models.

Key Developments in Meat Enzyme Market

| Item | Value |

|---|---|

| Quantitative Units | USD 1.19 Billion |

| Component | Processing Enzymes, Tenderizing Enzymes |

| Range | Industrial-scale Enzymes, Mid-scale Applications, Specialty/Small-scale Solutions |

| Technology | Fermentation-based Enzymes, Precision Fermentation, Recombinant Technology, Conventional Extraction |

| Type | Proteases, Collagenases, Papain, Bromelain, Transglutaminases, Lipases |

| End-use Industry | Meat Processing Industry, Foodservice & Catering, Retail Packaged Meat, Hybrid & Alternative Proteins, Nutraceutical Applications |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Novozymes A/S, Kerry Group plc, Koninklijke DSM N.V., Amano Enzyme Inc., AB Enzymes GmbH, Chr. Hansen Holding A/S, Advanced Enzyme Technologies Ltd., Enzyme Development Corporation |

| Additional Attributes | Dollar sales by enzyme type and application segment, rising adoption in processed meat and hybrid proteins, increasing preference for clean-label and bio-based enzymes, premiumization trends in beef and pork, regulatory influences on food enzymes, R&D focus on sustainable enzyme production, and regional demand shifts driven by protein consumption patterns. |

The global Meat Enzyme Market is estimated to be valued at USD 1.19 billion in 2025.

The market size for the Meat Enzyme Market is projected to reach USD 2.12 billion by 2035.

The Meat Enzyme Market is expected to grow at a 5.54% CAGR between 2025 and 2035.

The key product types in the Meat Enzyme Market include proteases, collagenases, papain, bromelain, transglutaminases, and lipases.

In terms of application, the meat processing segment is projected to command 42% share of the Meat Enzyme Market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meat Alternative Market Forecast and Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Meat Tenderizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Meat Based FPP Market Size and Share Forecast Outlook 2025 to 2035

Meat Dicing Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Seasonings Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Packaging Market Trends - Growth & Forecast 2025 to 2035

Meat Emulsions Market Growth - Demand & Industry Insights 2025 to 2035

Analyzing Meat Packaging Market Share & Industry Growth

Market Share Breakdown of Meat, Poultry, and Seafood Packaging Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA