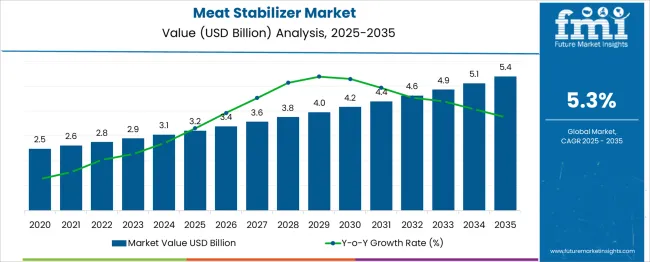

The Meat Stabilizer Market is estimated to be valued at USD 3.2 billion in 2025 and is projected to reach USD 5.4 billion by 2035, registering a compound annual growth rate (CAGR) of 5.3% over the forecast period. From 2020 to 2025, the market is expected to expand from USD 2.5 billion to USD 3.2 billion, generating an absolute dollar opportunity of USD 0.7 billion. This initial growth is driven by the increasing global consumption of processed meat, rising demand for texture-enhancing and shelf-life-extending additives, and the expansion of quick-service restaurants.

Technological advancements in food processing and the adoption of clean-label stabilizers are further supporting steady market penetration in the early years. Between 2025 and 2035, the market is expected to add USD 2.2 billion in absolute dollar opportunity, driven by the rapid expansion of meat processing facilities, the growing popularity of ready-to-eat meat products, and higher demand for consistent quality in both domestic and export markets.

By 2030, the market is forecast to reach USD 4.2 billion, reflecting strong mid-term growth momentum. Over the entire 2020–2035 period, the cumulative absolute dollar opportunity amounts to USD 2.9 billion. This presents significant prospects for manufacturers to innovate with plant-based stabilizer blends, develop cost-efficient formulations, and cater to the rising preference for healthier, additive-optimized meat products worldwide.

| Metric | Value |

|---|---|

| Meat Stabilizer Market Estimated Value in (2025 E) | USD 3.2 billion |

| Meat Stabilizer Market Forecast Value in (2035 F) | USD 5.4 billion |

| Forecast CAGR (2025 to 2035) | 5.3% |

The meat stabilizer market is experiencing accelerated growth due to rising global consumption of processed meat products and the increasing need for shelf-life extension, textural integrity, and emulsification consistency. With consumer preferences shifting toward additive-free, label-transparent, and allergen-free formulations, manufacturers are increasingly adopting natural stabilizers that align with clean-label and sustainability trends. The integration of natural hydrocolloids, proteins, and starches in meat processing is being supported by both regulatory encouragement and retailer-driven product reformulation initiatives.

These shifts are complemented by advancements in food-grade ingredient technologies that enable thermal stability and moisture retention without compromising sensory attributes. Furthermore, as ready-to-eat and convenience meat formats gain popularity across both developed and emerging economies, stabilizer solutions are becoming integral in standardizing quality across mass production.

Future growth is expected to be fueled by R&D innovations focusing on multi-functional blends, as well as the adoption of plant-based stabilizers in hybrid meat formats. The increasing emphasis on product traceability and ingredient origin is also expected to shape purchasing decisions across the value chain.

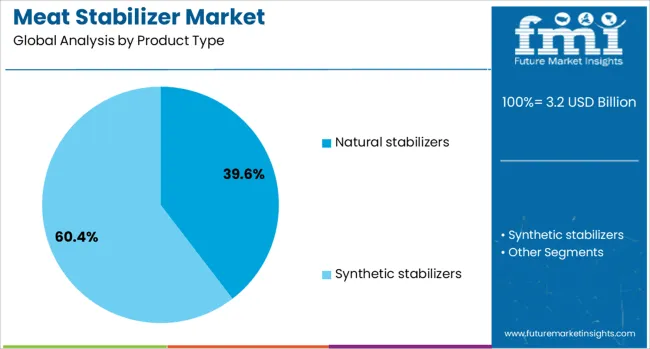

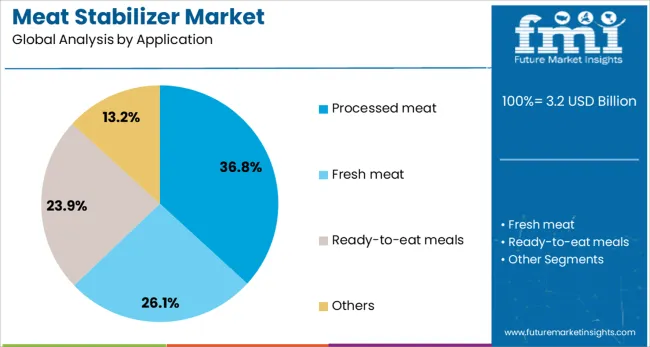

The meat stabilizer market is segmented by product type, application, and geographic regions. By product type, the meat stabilizer market is divided into Natural stabilizers and Synthetic stabilizers. In terms of application, the meat stabilizer market is classified into processed meat, Fresh meat, Ready-to-eat meals, and Others. Regionally, the meat stabilizer industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

Natural stabilizers are expected to account for 39.6% of the total revenue share in the meat stabilizer market by 2025, making it the leading product type. This dominance is being driven by the rising demand for clean-label meat products and the consumer shift away from synthetic additives. Meat processors are increasingly adopting natural stabilizers such as plant-derived gums, starches, and proteins due to their functional ability to enhance water-binding capacity, improve emulsification, and maintain product integrity during thermal processing.

The segment's growth is further supported by the increasing regulatory acceptance of naturally sourced stabilizers, particularly in regions with stringent food labeling laws. Their compatibility with allergen-free and gluten-free formulations has also broadened their applicability across premium meat categories.

Additionally, the growing use of plant-based stabilizers in meat analogs and hybrid meat solutions has further elevated their commercial relevance. As brands prioritize transparency and sustainability in product development, natural stabilizers are expected to remain the preferred choice across both artisanal and industrial meat manufacturing.

The processed meat segment is projected to represent 36.8% of the overall revenue share in the meat stabilizer market by 2025, reflecting its leading role among application segments. This position is reinforced by the widespread use of stabilizers to ensure textural uniformity, extend shelf life, and maintain a consistent mouthfeel in various processed meat formats, including sausages, nuggets, and deli cuts.

The complexity of multi-phase meat formulations and thermal processing steps has increased reliance on stabilizer systems that control water activity, protein gelation, and fat distribution. The segment's growth is also being driven by the rising demand for convenience foods and protein-rich ready-to-eat meat products, which require robust stabilizing systems to maintain product quality during packaging, storage, and transport.

Additionally, stabilizers enable the incorporation of functional additives such as fibers and plant proteins, supporting product innovation in low-fat and high-protein variants. As manufacturers seek to differentiate themselves on quality and shelf performance, stabilizer usage in processed meat is expected to increase across both traditional and reformulated product lines.

The meat stabilizer market is growing steadily as the processed meat industry expands globally to meet rising consumer demand for convenient, high-quality protein products. Meat stabilizers improve texture, moisture retention, and shelf life in products like sausages, patties, and deli meats. Increasing preference for ready-to-eat and frozen meat items supports market growth. Key regions include North America, Europe, and Asia-Pacific, where changing dietary habits and expanding retail networks drive consumption. Manufacturers focus on developing clean-label, natural stabilizer solutions to cater to health-conscious consumers.

Meat stabilizers encompass a variety of ingredients such as phosphates, carrageenan, starches, gums, and proteins. These additives help retain water, prevent fat separation, and improve product binding, resulting in enhanced juiciness and texture. Different stabilizers offer specific benefits, from gel formation to emulsification. Formulation depends on meat type, processing method, and desired product attributes. The trend toward natural and plant-based stabilizers responds to consumer demand for cleaner ingredient lists while maintaining functional performance.

Stabilizers play a crucial role in ensuring product consistency and sensory appeal by reducing cooking losses and maintaining shape during processing. They contribute to extended shelf life by enhancing water retention and inhibiting microbial growth indirectly through moisture control. This improves consumer satisfaction and reduces food waste. Meat processors benefit from reduced production defects and improved manufacturing efficiency. Innovations in stabilizer blends enable tailored solutions for diverse meat products, enhancing competitive advantage.

Stringent food safety regulations govern the use of meat stabilizers, requiring adherence to permissible ingredient types and maximum usage levels. Compliance with labeling standards, including allergen declarations and clean-label claims, influences product formulation. Regional differences in regulatory frameworks necessitate adaptable product development strategies. Transparent sourcing and certification of stabilizer ingredients improve market acceptance. Industry players monitor evolving regulations closely to ensure compliance and avoid market access issues.

The market features global ingredient manufacturers, specialty additive producers, and regional suppliers competing on product innovation, cost, and technical support. Raw material availability and price fluctuations, especially for natural gums and plant proteins, impact production costs. Supply chain disruptions can affect timely delivery, prompting companies to optimize sourcing and inventory management. Collaborations with meat processors and research institutions foster new product development and application support, enhancing customer loyalty in a competitive landscape.

| Country | CAGR |

|---|---|

| China | 7.2% |

| India | 6.6% |

| Germany | 6.1% |

| France | 5.6% |

| UK | 5.0% |

| USA | 4.5% |

| Brazil | 4.0% |

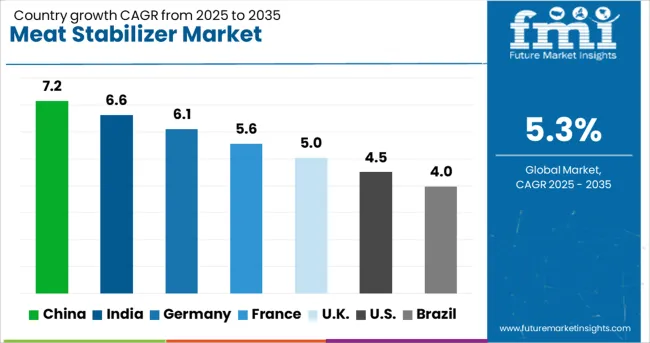

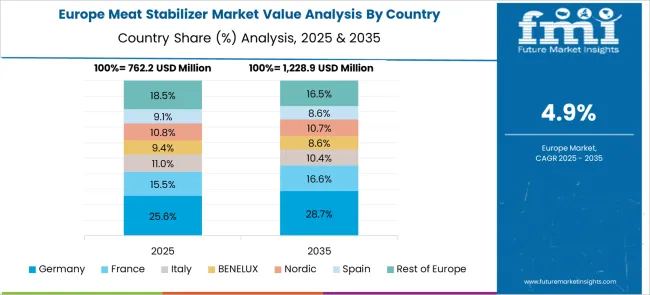

The global meat stabilizer market is expanding at a 5.3% CAGR, supported by growing demand for processed meat products and food safety regulations. Among BRICS nations, China leads with 7.2% growth, driven by large-scale meat processing industries. India follows at 6.6%, fueled by rising consumption and modernization of food production. In the OECD region, Germany records 6.1% growth, reflecting stringent quality controls and advanced food technology. The United Kingdom grows at 5.0%, supported by specialty meat product demand. The United States, a mature market, shows 4.5% growth, shaped by established regulatory frameworks and consumer preferences. These countries collectively influence market dynamics through production scale, regulatory oversight, and market demand. This report includes insights on 40+ countries; the top countries are shown here for reference.

China shows strong progress in the meat stabilizer market with a growth rate of 7.2%. Rising meat consumption in urban and rural areas supports market expansion. Compared to India, China benefits from advanced processing facilities and broader distribution networks. The growing demand for processed meat products in supermarkets and fast-food chains increases stabilizer usage. Producers focus on enhancing product quality, texture, and shelf life to meet consumer expectations. Government regulations on food safety further encourage stabilizer adoption in the meat sector. The expansion of cold storage infrastructure ensures consistent supply to retailers and restaurants.

India experiences notable growth in the meat stabilizer market at 6.6%, supported by increasing urban meat consumption and fast-food chains. Compared to Germany, India is rapidly developing its meat processing industry to meet growing demand. Manufacturers focus on cost-effective stabilizer blends that enhance taste, texture, and product longevity. Seasonal festivals and regional meat delicacies fuel higher consumption, boosting stabilizer sales. Rising retail and online grocery platforms provide wider market access for stabilizer suppliers. Education on processed meat safety encourages adoption in emerging cities. Export opportunities in processed meats also strengthen market prospects.

Germany records steady growth in the meat stabilizer market with a rate of 6.1%. Compared to the United Kingdom, Germany has a more established meat processing infrastructure, ensuring consistent stabilizer demand. Producers emphasize natural and clean-label stabilizers to meet consumer preferences for transparency in ingredients. The rise in ready-to-eat and convenience meat products fuels market expansion. Stringent food safety regulations promote the use of high-quality stabilizers in production. Collaboration between stabilizer manufacturers and meat processors improves innovation and product performance. Export demand for German processed meats strengthens industry prospects.

The United Kingdom meat stabilizer market grows at 5.0%, supported by increased processed meat sales in supermarkets and restaurants. Compared to the United States, the UK market emphasizes quality standards and traceability in meat processing. Demand is rising for stabilizers that improve product texture and extend shelf life. Shifts in consumer dining habits toward convenience foods contribute to steady growth. Manufacturers are introducing innovative stabilizer blends compatible with reduced-sodium and healthier meat options. Food safety certifications remain an important factor influencing buyer decisions in the industry.

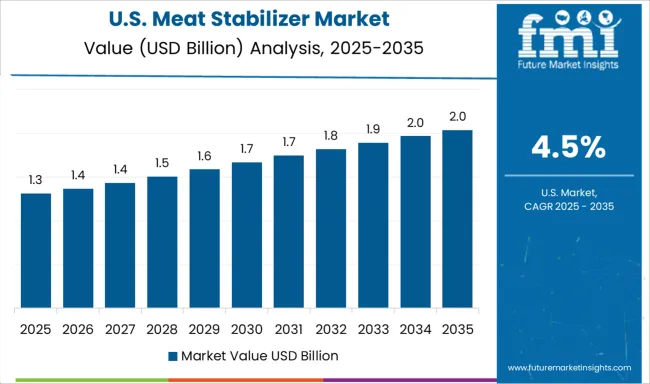

The United States sees moderate growth in the meat stabilizer market at 4.5%. Compared to China, the US market faces competition from alternative preservation methods, but stabilizers remain essential for texture and shelf stability. Fast-food chains, catering services, and supermarkets are key buyers. The growing popularity of pre-packaged meat products increases stabilizer usage in production. Manufacturers invest in blends that withstand frozen storage without compromising quality. Regulations on food labeling influence the adoption of specific stabilizer types. The meat industry’s focus on supply consistency supports the market’s steady performance.

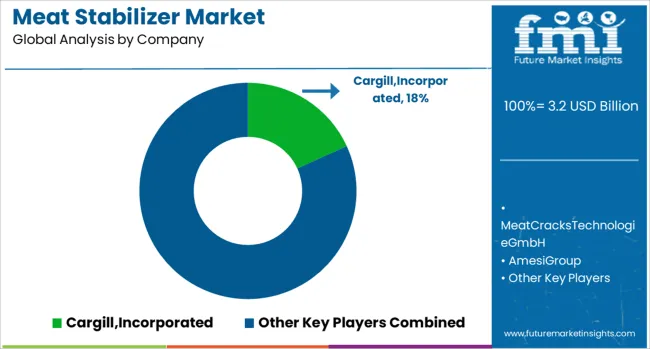

The meat stabilizer market is moderately consolidated, dominated by a handful of global players such as Cargill, Tate & Lyle, Ashland, and Hydrosol, alongside regional specialists like MeatCracks, Amesi, and Caragum. Consolidation is driven by high barriers to entry, including deep R&D requirements for multifunctional formulations, compliance with diverse food regulations, and expertise in application-specific systems across meat processing lines. Smaller players exist primarily in niche segments, focusing on plant-based, clean-label hydrocolloid solutions or specialty applications like cured and fermented meats, which keeps certain pockets of the market fragmented.

Historically, market strategies emphasized broad product portfolios, ingredient diversification, and global distribution networks. Leaders invested heavily in starch-, gum-, and protein-based stabilizers to serve large-scale processed meat manufacturers while complying with regional regulatory standards. Turnkey solutions and functional blends were introduced to reduce formulation complexity for processors.

During the forecast period (2025–2035), strategic focus is expected to shift toward clean-label, reduced-sodium, and plant-based stabilizers, with investment in multifunctional blends that combine water-binding, emulsification, and texture optimization. Companies will increasingly pursue collaborative R&D, application-specific system integration, and digital formulation support to accelerate product launches and maintain competitive differentiation in emerging and mature markets.

| Item | Value |

|---|---|

| Quantitative Units | USD 3.2 Billion |

| Product Type | Natural stabilizers and Synthetic stabilizers |

| Application | Processed meat, Fresh meat, Ready-to-eat meals, and Others |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Cargill,Incorporated, MeatCracksTechnologieGmbH, AmesiGroup, Tate&Lyle, FSL, CaragumInternational, Ingredion, AshlandInc., and HydrosolGmbH&Co.KG |

| Additional Attributes | Dollar sales in the Meat Stabilizer Market vary by product type including carrageenan, xanthan gum, and gelatin, application across processed meat, fresh meat, and poultry, and region covering North America, Europe, and Asia-Pacific. Growth is driven by rising demand for processed meat products, texture enhancement, and extended shelf-life solutions. |

The global meat stabilizer market is estimated to be valued at USD 3.2 billion in 2025.

The market size for the meat stabilizer market is projected to reach USD 5.4 billion by 2035.

The meat stabilizer market is expected to grow at a 5.3% CAGR between 2025 and 2035.

The key product types in meat stabilizer market are natural stabilizers, _plant-based, _animal-based, synthetic stabilizers, _phosphates, _hydrocolloids and _others.

In terms of application, processed meat segment to command 36.8% share in the meat stabilizer market in 2025.

Our Research Products

The "Full Research Suite" delivers actionable market intel, deep dives on markets or technologies, so clients act faster, cut risk, and unlock growth.

The Leaderboard benchmarks and ranks top vendors, classifying them as Established Leaders, Leading Challengers, or Disruptors & Challengers.

Locates where complements amplify value and substitutes erode it, forecasting net impact by horizon

We deliver granular, decision-grade intel: market sizing, 5-year forecasts, pricing, adoption, usage, revenue, and operational KPIs—plus competitor tracking, regulation, and value chains—across 60 countries broadly.

Spot the shifts before they hit your P&L. We track inflection points, adoption curves, pricing moves, and ecosystem plays to show where demand is heading, why it is changing, and what to do next across high-growth markets and disruptive tech

Real-time reads of user behavior. We track shifting priorities, perceptions of today’s and next-gen services, and provider experience, then pace how fast tech moves from trial to adoption, blending buyer, consumer, and channel inputs with social signals (#WhySwitch, #UX).

Partner with our analyst team to build a custom report designed around your business priorities. From analysing market trends to assessing competitors or crafting bespoke datasets, we tailor insights to your needs.

Supplier Intelligence

Discovery & Profiling

Capacity & Footprint

Performance & Risk

Compliance & Governance

Commercial Readiness

Who Supplies Whom

Scorecards & Shortlists

Playbooks & Docs

Category Intelligence

Definition & Scope

Demand & Use Cases

Cost Drivers

Market Structure

Supply Chain Map

Trade & Policy

Operating Norms

Deliverables

Buyer Intelligence

Account Basics

Spend & Scope

Procurement Model

Vendor Requirements

Terms & Policies

Entry Strategy

Pain Points & Triggers

Outputs

Pricing Analysis

Benchmarks

Trends

Should-Cost

Indexation

Landed Cost

Commercial Terms

Deliverables

Brand Analysis

Positioning & Value Prop

Share & Presence

Customer Evidence

Go-to-Market

Digital & Reputation

Compliance & Trust

KPIs & Gaps

Outputs

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meat Stabilizers Blends Market Trends - Source & Function Analysis

Meat Snacks Market Size and Share Forecast Outlook 2025 to 2035

Meat Alternative Market Forecast and Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Meat Tenderizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Meat Based FPP Market Size and Share Forecast Outlook 2025 to 2035

Meat Dicing Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Seasonings Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Packaging Market Trends - Growth & Forecast 2025 to 2035

Meat Emulsions Market Growth - Demand & Industry Insights 2025 to 2035

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA