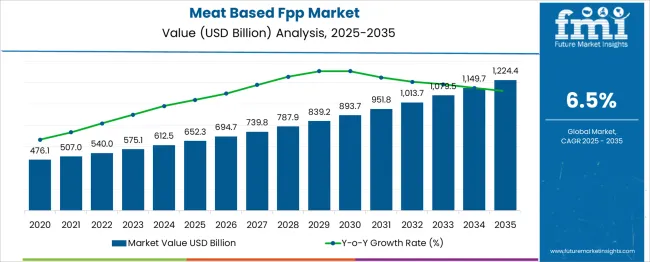

The Meat Based FPP Market is estimated to be valued at USD 652.3 billion in 2025 and is projected to reach USD 1224.4 billion by 2035, registering a compound annual growth rate (CAGR) of 6.5% over the forecast period.

| Metric | Value |

|---|---|

| Meat Based FPP Market Estimated Value in (2025 E) | USD 652.3 billion |

| Meat Based FPP Market Forecast Value in (2035 F) | USD 1224.4 billion |

| Forecast CAGR (2025 to 2035) | 6.5% |

The meat-based further processed products (FPP) market is steadily evolving due to increasing global demand for convenient, ready-to-cook, and ready-to-eat meat solutions. Consumers are showing a strong preference for value-added meat products that offer extended shelf life, enhanced flavor, and easy preparation, which aligns with fast-paced urban lifestyles.

Technological advancements in processing and preservation, along with growing penetration of organized retail, are enabling wider availability and improved product consistency. Health and protein awareness are further driving the consumption of processed meat, particularly in developing regions where disposable incomes are rising.

Future growth is expected to be supported by innovation in flavor profiles, packaging, and healthier reformulations with reduced sodium and fat content. Regulatory improvements and export expansion opportunities are also contributing positively to the market outlook, especially in Asia-Pacific and Latin America.

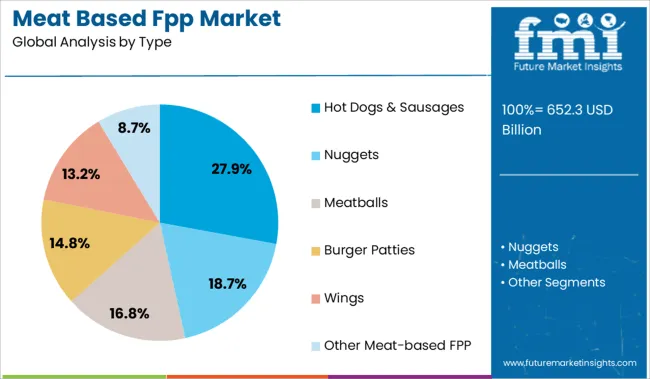

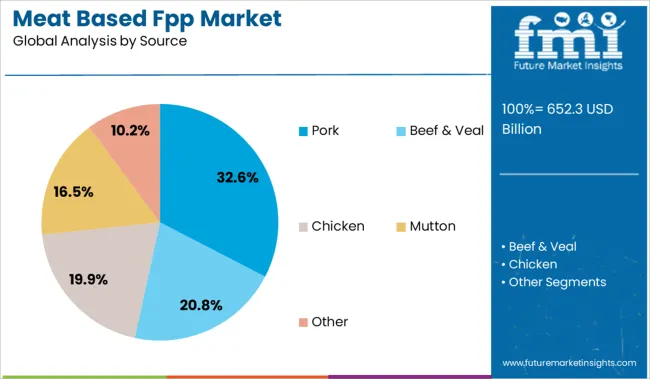

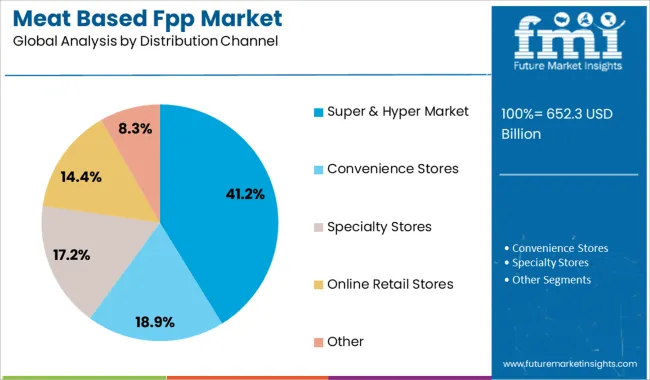

The meat based FPP market is segmented by type, source, and distribution channel and geographic regions. The meat-based fpp market is divided into Hot Dogs & Sausages, Nuggets, Meatballs, Burger Patties, Wings, and Other Meat-based FPP. In terms of the source of the meat, the market is classified into Pork, Beef & Veal, Chicken, Mutton, and Other. Based on the distribution channel, the meat-based FPP market is segmented into Super & Hyper Market, Convenience Stores, Specialty Stores, Online Retail Stores, and Other. Regionally, the meat-based FPP industry is classified into North America, Latin America, Western Europe, Eastern Europe, Balkan & Baltic Countries, Russia & Belarus, Central Asia, East Asia, South Asia & Pacific, and the Middle East & Africa.

The hot dogs and sausages segment accounts for a significant of the meat-based FPP market, owing to its widespread consumption and cultural acceptance across both Western and emerging markets. Its popularity is rooted in convenience, affordability, and variety in taste and size, making it a staple in quick-service restaurants, street food formats, and home consumption.

Manufacturers continue to capitalize on this demand by offering innovative variants including smoked, spiced, organic, and low-fat options. Growth is also being driven by product visibility in frozen aisles and dedicated deli sections in retail outlets, which ensures regular replenishment cycles.

Consumer loyalty and high brand recall further support this segment, with traditional appeal being complemented by expanding interest in protein-enriched snacks. As urban consumption patterns evolve, this segment is expected to remain a key driver of volume sales within the meat-based FPP category.

The pork segment leads the source category with a 32.6% market share, supported by its strong global consumption footprint and versatility in processed meat applications. Pork is preferred in many regional cuisines for its flavor profile, texture, and compatibility with a variety of seasonings and smoking techniques, making it a favored base for sausages, patties, and cured products.

Cost-efficiency in production and high yield from processing have also made pork a reliable choice for manufacturers aiming at volume scalability. In mature markets, pork-based FPPs enjoy consistent demand through retail and foodservice channels, while in developing countries, increasing urbanization and westernization of diets are encouraging uptake.

Continuous improvements in supply chain efficiency and safety standards, along with expansion into premium pork lines such as antibiotic-free and organic offerings, are expected to further solidify this segment’s growth.

The super and hyper market channel dominates the distribution landscape with a 41.2% share, benefiting from high product visibility, wide assortment, and consumer trust in quality assurance. These retail formats serve as the primary point of sale for meat-based FPPs due to their cold chain infrastructure, frequent promotional campaigns, and private label expansions.

Consumers prefer these outlets for their one-stop convenience, access to both domestic and imported brands, and the opportunity to compare multiple product options. Retailers have also enhanced the consumer experience by offering attractive packaging, tasting counters, and loyalty programs that reinforce purchase frequency.

The rise of large-scale retail in urban and semi-urban areas continues to support segment penetration, especially in developing regions. As food safety becomes a decisive purchasing factor, the reliability and hygiene of super and hyper markets are expected to keep this channel in a dominant position within the market.

Market growth is led by rising convenience demand, protein-forward consumption, and faster retail restock cycles. In 2024, approximately 36% of newly launched frozen prepared meals featured meat-based formats. Growth is strongest in North America and Europe, where retail freezer innovation and evolving consumption patterns support innovation, triggering streamlined production systems and fresher SKU cycles.

Processors deploying advanced meat-based frozen formats have cut spoilage and improved supply responsiveness. In North America manufacturers using portion-controlled products reduced freezer inventory cycles by 17 %, and repack suppliers integrated RFID-traceable packs, enabling smaller serialized batch runs. European retailers offering ribeye-based ready meals accelerated turnover by using sealed trays with oxygen-absorbent liners, reducing product write-offs by 14 %. In Asia such formats enabled accelerated rotation of mixed protein boxes, lowering buffer stock by 12 %. These efficiencies supported faster seasonal SKUs deployment, improved cash flow, and tighter laminate pack scheduling across cold-chain distribution hubs.

Despite operational gains, adoption faces hurdles from raw material pricing, multi-layer pack formats, and stringent labeling standards. Meat formulations require commodity contracts that experienced 8–10 % cost spikes during 2024 commodity cycles, reducing pack margin. Flexible multilayer film trays needed thermoform compatibility and barrier certification, delaying launch timelines by 3–5 weeks in regulated markets. Complex ingredient disclosures including allergens, country-of-origin and protein claims added 4–6 days per SKU to design validation. In regions lacking cold-chain inspection norms, inconsistent frozen temperature enforcement caused up to 9 % quality complaints—especially in tropical zones. Packaging mismatch across retail promotions further increased SKU discontinuity, slowing adoption for smaller scale producers.

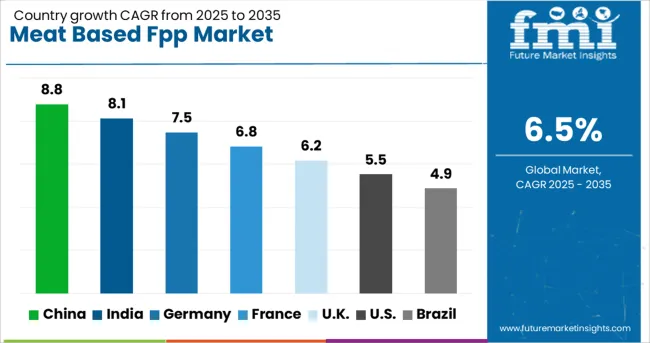

| Country | CAGR |

|---|---|

| China | 8.8% |

| India | 8.1% |

| Germany | 7.5% |

| France | 6.8% |

| UK | 6.2% |

| USA | 5.5% |

| Brazil | 4.9% |

The global meat-based FPP market is projected to expand at a 6.5% CAGR from 2025 to 2035. China is positioned at 8.8%, reflecting a +35% premium over the global average, driven by increased demand for processed meat and protein-enriched ready meals. India follows with 8.1%, up +25%, supported by rising meat consumption among urban consumers. Germany stands at 7.5%, or +15%, with demand from retail and hospitality segments. The UK, at 6.2%, shows growth close to the baseline, while the US, at 5.5%, lags by -15%, reflecting stronger competition from plant-based meat alternatives and regulatory considerations. The report covers detailed analysis of 40+ countries, with the top five countries shared as a reference

Sales of meat-based FPP in China are growing at a CAGR of 8.8%. Pork and poultry remain the dominant raw materials for processed meat snacks, sausages, and shelf-stable meals. Urban supermarkets and e-commerce platforms are driving higher sales of ready-to-eat and vacuum-packed meat products. Shuanghui and Jinluo are expanding automated slicing and marination units in Henan and Shandong. Imports of high-grade beef continue to supplement limited domestic availability, particularly for Western-style processed food brands.

The meat-based FPP market in India is projected to grow at an 8.1% CAGR. Processed chicken products such as nuggets, kebabs, and frankfurters dominate the segment. Growth is concentrated in urban centers, including Delhi NCR, Mumbai, and Bengaluru. Online grocery chains are expanding chilled and frozen meat portfolios. Licious and Zappfresh are focusing on high hygiene packaging lines and portion-controlled SKUs. Infrastructure investment in cold chain nodes near processing clusters is supporting last-mile delivery of perishable products.

Demand for meat based FPP in the UK is expanding at a 6.2% CAGR. Ready meals containing beef and chicken are the primary drivers of volume. Growth is supported by increased adoption of chilled convenience meals among working households. Firms such as Samworth Brothers and Greencore are scaling automated thermoforming and high-pressure processing lines. Pork-based snack foods are gaining share in petrol stations and impulse purchase channels. Post-Brexit regulatory shifts continue to influence sourcing and labeling formats.

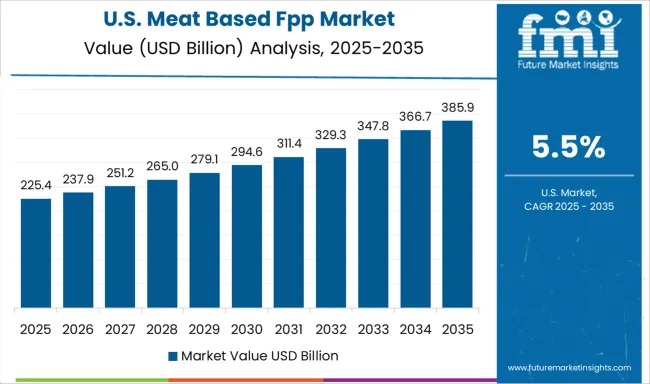

The USA meat based FPP market is projected to grow at a CAGR of 5.5%. Demand is concentrated in bacon, meatballs, deli slices, and frozen poultry-based meals. Companies such as Tyson and Hormel are investing in high-speed dicing and blast-freezing equipment to serve mass retail formats. Supply chain upgrades are focused on extending shelf life of refrigerated products. Growing Hispanic and Asian consumer bases are increasing diversity in flavor profiles and packaging types across regions.

The meat based FPP market in Germany is growing at a CAGR of 7.5%. Sausages, bratwurst, and canned pork products dominate domestic production. Retail sales are stable, but export volumes are rising toward Eastern Europe. Meat processing plants in Lower Saxony and Bavaria are increasing throughput with high-speed vacuum packaging systems. Companies like Tönnies and Westfleisch are integrating energy-efficient steam sterilization to reduce production costs. Rising consumer interest in ready-to-eat pork and poultry dishes continues to expand product variety.

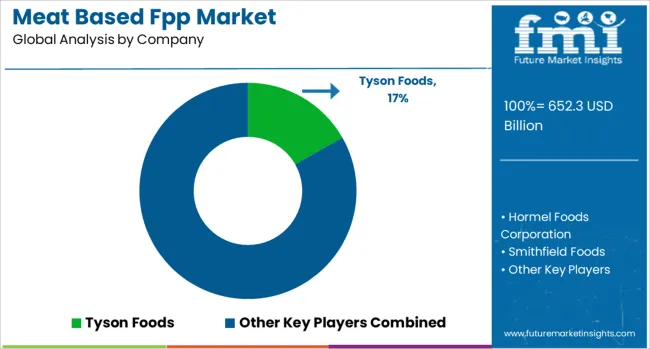

The global meat-based FPP market is led by Tyson Foods (16.8% share), with major competitors including JBS S.A., Smithfield Foods, and Cargill offering comprehensive processing solutions for fresh and packaged meat products. Specialized producers such as Hormel Foods Corporation and ConAgra Brands focus on value-added processed meats, while international players like Danish Crown and NH Foods Ltd. dominate regional markets in Europe and Asia. The industry is adapting to changing consumer preferences, with manufacturers investing in plant-based meat alternatives and clean-label products alongside traditional offerings. Processing technology trends include high-pressure processing for extended shelf life and blockchain integration for supply chain transparency. The market faces challenges from rising input costs and sustainability pressures, but benefits from growing protein demand in emerging economies. BRF S.A. and OSI Group are expanding their global footprints through strategic acquisitions and joint ventures to serve evolving retail and foodservice channels.

| Item | Value |

|---|---|

| Quantitative Units | USD 652.3 Billion |

| Type | Hot Dogs & Sausages, Nuggets, Meatballs, Burger Patties, Wings, and Other Meat-based FPP |

| Source | Pork, Beef & Veal, Chicken, Mutton, and Other |

| Distribution Channel | Super & Hyper Market, Convenience Stores, Specialty Stores, Online Retail Stores, and Other |

| Regions Covered | North America, Europe, Asia-Pacific, Latin America, Middle East & Africa |

| Country Covered | United States, Canada, Germany, France, United Kingdom, China, Japan, India, Brazil, South Africa |

| Key Companies Profiled | Tyson Foods, Hormel Foods Corporation, Smithfield Foods, JBS S.A, Perdue Farms, Cargill, ConAgra Brands, Danish Crown, OSI Group, NH Foods Ltd, and BRF S.A. |

| Additional Attributes | Dollar sales by product type (dry kibble, wet food, treats) and function (digestive health, joint support, skin and coat), demand dynamics across premium dog diets, breed-specific formulations, and senior pet nutrition, regional trends led by North America with Asia‑Pacific expanding domestic brand penetration, innovation in freeze-dried inclusions and species-specific protein blends, and regulatory impact of AAFCO labeling standards, clean label claims, and animal protein traceability. |

The global meat based fpp market is estimated to be valued at USD 652.3 billion in 2025.

The market size for the meat based fpp market is projected to reach USD 1,224.4 billion by 2035.

The meat based fpp market is expected to grow at a 6.5% CAGR between 2025 and 2035.

The key product types in meat based fpp market are hot dogs & sausages, nuggets, meatballs, burger patties, wings and other meat-based fpp.

In terms of source, pork segment to command 32.6% share in the meat based fpp market in 2025.

Full Research Suite comprises of:

Market outlook & trends analysis

Interviews & case studies

Strategic recommendations

Vendor profiles & capabilities analysis

5-year forecasts

8 regions and 60+ country-level data splits

Market segment data splits

12 months of continuous data updates

DELIVERED AS:

PDF EXCEL ONLINE

Meat Alternative Market Forecast and Outlook 2025 to 2035

Meat, Poultry, and Seafood Packaging Market Size and Share Forecast Outlook 2025 to 2035

Meat Extracts Market Size and Share Forecast Outlook 2025 to 2035

Meat Trays Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Interleaving Paper Market Size and Share Forecast Outlook 2025 to 2035

Meat Enzyme Market Analysis - Size and Share Forecast Outlook 2025 to 2035

Meat Mixers Market Size and Share Forecast Outlook 2025 to 2035

Meat Stabilizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Processing Equipment Market Size and Share Forecast Outlook 2025 to 2035

Meat Cutting Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Mincers Market Size and Share Forecast Outlook 2025 to 2035

Meat Tenderizer Market Size and Share Forecast Outlook 2025 to 2035

Meat Starter Cultures Market Size and Share Forecast Outlook 2025 to 2035

Meat Dicing Machine Market Size and Share Forecast Outlook 2025 to 2035

Meat Seasonings Market Size and Share Forecast Outlook 2025 to 2035

Meat Substitutes Market Analysis - Size, Share, & Forecast Outlook 2025 to 2035

Meat Packaging Market Trends - Growth & Forecast 2025 to 2035

Meat Emulsions Market Growth - Demand & Industry Insights 2025 to 2035

Analyzing Meat Packaging Market Share & Industry Growth

Market Share Breakdown of Meat, Poultry, and Seafood Packaging Manufacturers

Thank you!

You will receive an email from our Business Development Manager. Please be sure to check your SPAM/JUNK folder too.

Chat With

MaRIA